Tickmill sign up

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225).

Real forex bonuses

Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270. The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

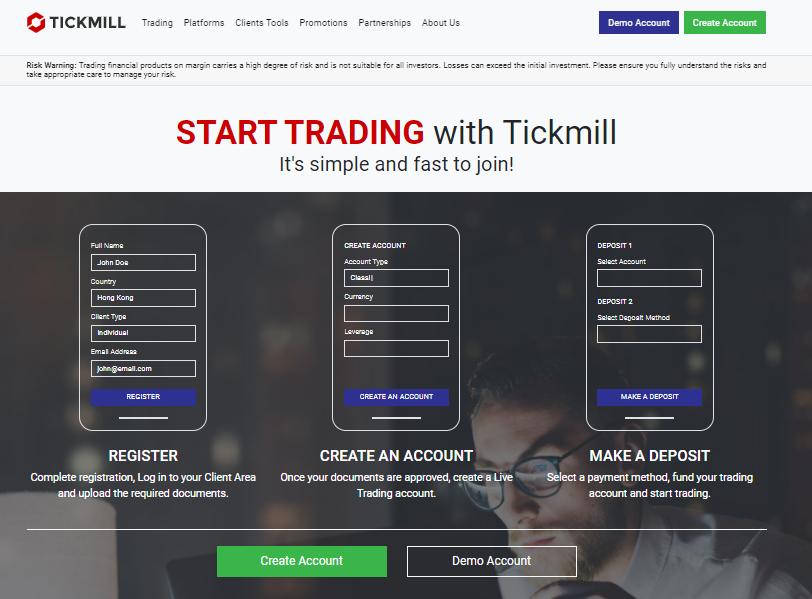

Tickmill sign up

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill $30 no deposit bonus

Tickmill is giving away 30 USD for free to all new MT4 traders!

Experience one of the best trading environments in the industry risk-free with the $30 welcome account.

Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30 welcome account

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and conditions

Tickmill $30 welcome account

Tickmill offers free 30 USD to start trading forex online.

30 USD is available in the “welcome account” which each eligible client can open only one time.

No risks, costs or hidden commissions are involved to the promotion.

Here is how the promotion works for new investors.

- Open tickmill’s welcome account.

- Receive login credentials and login to the MT4 account.

- Start trading forex without risking your own funds.

- Withdraw profit (from $30 to $100) by meeting the criteria.

$30 welcome account is available for all new traders of tickmill!

Tickmill 30 USD no deposit bonus promotion

Here are the main information of tickmill’s $30 no deposit bonus promotion.

| Promotion type | no deposit bonus |

|---|---|

| cost for participation | zero |

| requirement | only account opening |

| trading platform | MT4 (metatrader4) |

| account type | pro |

| bonus withdrawal | not available |

| profit withdrawal | from $30 to $100 can be withdrawn |

Participating in the promotion and getting 30 USD in tickmill’s welcome account costs nothing.

All you need is internet connection and a desktop or mobile phone to trade forex online.

How to get tickmill’s $30 no deposit bonus?

To participate in the promotion and get 30 USD no deposit bonus from tickmill, follow the steps below.

1. Go to the promotion page

Go to tickmill official website and proceed to the main promotion page.

Then proceed to “FSA SC”, “promotions” and “$30 welcome account” as shown in the screenshot below.

2. Fill in the application form

Then fill in the application form available in the page.

3. Receive login credentials

Once your application has been approved, $30 welcome account will be created and login credentials will be sent to your registered email address.

4. Start trading in $30 welcome account

Download MT4 (metatrader4) or access to the web-based platform in tickmill official website.

You can also download mobile applications for android and ios devices.

When trading in $30 welcome account of tickmill, please note the following 4 important rules.

- Use of eas (expert advisers) is prohibited in $30 welcome account

- Arbitrage trading strategy is prohibited.

- The “arbitrage” trading strategy includes hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- $30 welcome account is available for trading for 90 days from the account opening date.

- Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

Fund withdrawal conditions of tickmill $30 welcome account

30 USD no deposit bonus amount itself cannot be withdrawn, but it is available only for trading purpose.

If you have made profits in $30 welcome account, you have an opportunity to transfer the profits to your other MT4 live accounts.

The available amount for profit transfer is from 30 USD to 100 USD.

The requirements for profit transfer are the followings:

- Registration to the client area

- Account verification

you must submit copies of ID and proof of address to complete your verification. - Live account opening

this can be done for free in tickmill’s client area. - $100 minimum deposit

After a deposit is made to a live MT4 account, the client should contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

After the transfer of profit is completed, you can use the amount for both trading and fund withdrawal as you want.

Faqs of tickmill $30 welcome account

Do you have any other questions to ask before participating?

Visit tickmill official website and contact multilingual support available for 24/5.

Tickmill $30 welcome account – terms and conditions

Here are the terms and conditions of the promotion “tickmill $30 welcome account”.

Make sure to read and understand the rules of the promotion before participating.

- The promotion is run by tickmill ltd licensed by FSA SC.

- Tickmill brand is owned and used by multiple companies. If your account is not registered with tickmill ltd, then you may not be able to participate in the promotion.

- The promotion is available for all new traders of tickmill ltd with restrictions of the following countries: algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- Investors residing in european union cannot participate in the promotion.

- Use of expert advisors (eas) in $30 welcome account is prohibited.

- The promotion is available only one time per person.

- $30 welcome account has the same trading conditions as pro account type. For more information about pro account type, please visit the page here.

- $30 welcome account is available for trading for 90 days from the date of account opening.

- $30 welcome account will be disabled after 90 days, but will be still accessible only for profit withdrawal for an additional 30 days.

- $30 welcome account has USD as the base currency.

- Once an eligible client register for the promotion, login credentials of his/her $30 welcome account will be sent to the registered email address.

- Registration and account opening of $30 welcome account does not give the eligible client access to the client portal.

- The profit amount you can transfer from $30 welcome account is limited from $30 to $100.

- Profit withdrawal from $30 welcome account can be done only one time.

- In order to withdraw profits from $30 welcome account, you must register your client profile with tickmill and deposit at least $100.

- Once profit is withdrawn from $30 welcome account, the account will be fully disabled.

- Any profits transferred to live MT4 trading accounts of tickmill can be withdrawn at anytime without limitation.

- You cannot make deposits to $30 welcome account.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

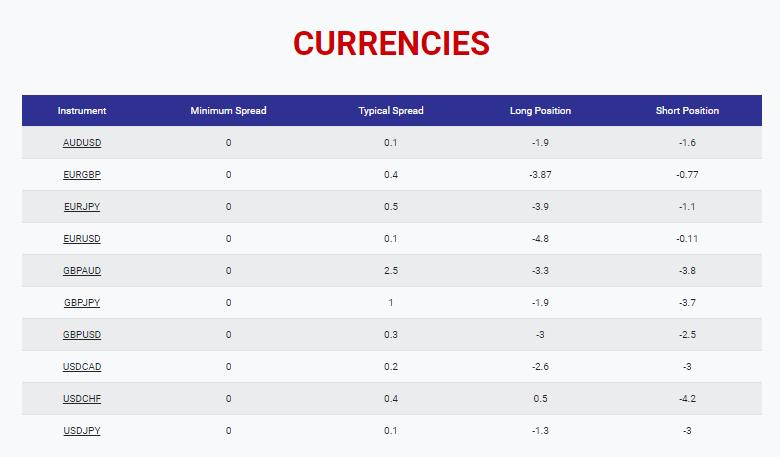

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

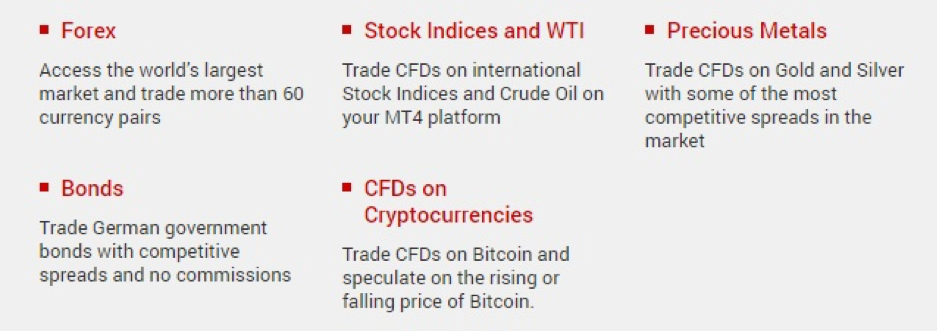

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

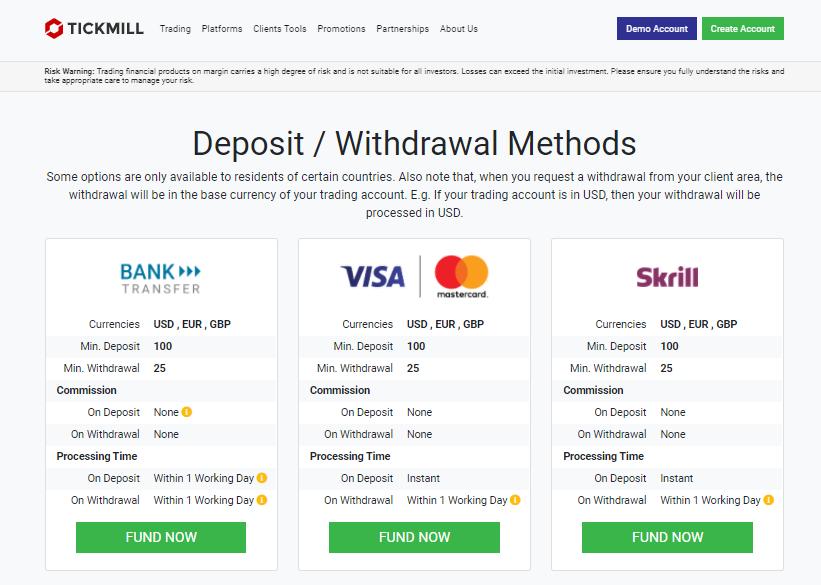

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

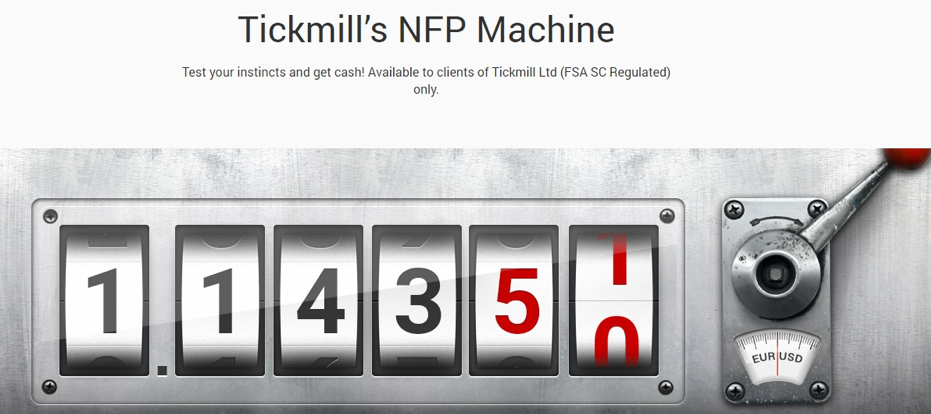

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

No deposit bonus, withdraw profits – tickmill

Make your perfect risk-free start with $30 forex no-deposit welcome bonus presented by tickmill. Feel the superior execution quality and the perfect trading environment with no-deposit bonus where no investment involves trading live forex. Besides, withdraw all profit earned traded by non-deposit welcome bonus, with a single condition given below. Each client can open only one account for this welcome no-deposit promotion.

€£$ TICKMILL 30 forex no-deposit welcome bonus

Joining link: get-bonus

Ending date: december 31, 2021

Offer is applicable: new traders with a live account

How to apply:

- Register a client account

- Make a live account under client profile

- Bonus is added after complete the registration.`

Cash out: only profits can be withdrawn as below

- Verify the profile by uploading the required documents.

- Trade 5 lots to withdraw all profits.

- At least a 100 deposit must be made to another live trading account.

Terms – tickmill NO deposit bonus

The bonus is not available for the client of algeria, armenia, australia, azerbaijan, belarus, bulgaria, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

Bonus need to claim within 14 business days from the date of registration.

This forex bonus is available to one per client.

Profit and rebate

Bedanya, sekarang trading dapat profit dan rebate.

CARA DAPAT REBATE?

Ketika anda membuka akun perdagangan forex anda (atau menghubungkan akun yang sudah ada) melalui kami, broker anda membayar kami rebate untuk setiap perdagangan. Kemudian kami membayarkan sebagian besar rebate ini kepada anda yang dapat anda tarik setiap saat.

Mulai dapatkan rebate untuk setiap trade hari ini.

Daftar OKEFX gratis

Berapa banyak rebate saya?

Rebate sangat tergantung dari broker yang anda pilih, jenis akun dan jumlah lot dalam trading. Gunakan kalkulator rebate di samping untuk mengetahui estimasi pendapatan rebate anda.

Sebagai contoh: hanya dengan 20 kali trade perhari (0.1 lot) dan rate rebate 7.5 usd per lot. Anda dapat rebate sebesar $15 perhari, atau $300 per bulan! Bahkan $3,600 per tahun

Rebate calculator

1 open A live account with tickmill

Open live tickmill

jika sudah punya MT4 dibawah IB lain, silahkan buat MT4 baru di dalam cabinet tickmill kemudian pilih "new introducing broker" lalu isi kan kode IB :

IB51463415

2 tambahkan MT4 yang baru dibuat di OKEFX

Login | klik tambah akun

status pending MT4 menjadi under ib, di update otomatis pada maintenance mingguan.

Login | klik arsip rebate

rebate update setiap seminggu sekali dan di bayarkan hari senin-rabu maksimal jumat.

FITUR OKEFX

Lihat rebate anda secara real-time.

Kami membayar dengan rate rebate yang besar tiap lot nya

Ada pertanyaan ? Support kami siap membantu anda

OKEFX

Platform rebate untuk trader online.

Lebih mudah dan nyaman untuk deposit, withdrawal dan notif rebate.

BROKER

Tickmill

Rebate akun klasik 9 usd per lot

rebate akun pro 1.6 usd per lot

rebate akun vip 1.6 usd per lot

Tentang OKEFX

Kami senang mencoba kesempatan baru.

Rekomendasikan kepada kami broker anda.

Tentang tickmill

General information

| broker name | tickmill |

| broker type | |

| country | united kingdom |

| operating since year | 2014 |

| number of employees | 100 |

| international offices | cyprus , seychelles , united kingdom |

| regulation | FCA, FSA |

| address | 1 fore street london EC2Y 9DT united kingdom |

| broker status | broker |

| accepting US clients? | No |

Account options

| account currency | USD, GBP, EUR, PLN |

| funding/withdrawal methods | wire transfer, credit card, debit card, webmoney, neteller, unionpay, skrill, fasapay |

| swap free accounts | yes |

| segregated accounts | yes |

| interest on margin | no |

| managed accounts | no |

| accounts for money managers (MAM, PAMM) | yes |

Customer service

| phone | +44 203 608 6100 |

| fax | |

| support@tickmill.Co.Uk | |

| languages | english, spanish, german, portuguese, japanese, italian, russian, chinese, polish, indonesian, malay, thai, arabic, vietnamese, korean |

| availability | phone, chat, email, skype |

Trading

| trading platforms | metatrader 4, web platform, mobile platform, autotrade |

| trading platform(s) timezone | (GMT +2:00) south africa, jerusalem |

| demo account | yes |

| mobile trading | yes |

| web based trading | yes |

| API | yes |

| OCO orders | no |

| trading over the phone | yes |

| hedging allowed | yes |

| trailing stops | yes |

| one click trading | yes |

| bonuses | yes |

| contests | yes |

| other trading instruments | indices, commodities, cfds, cryptocurrency |

Account

| minimum deposit($) | 100.0 $€£25 for classic and pro accounts; $€£50,000 for VIP account |

| maximal leverage(1:?) | 500 |

| minimum lot size | 0.01 |

| maximum lot size | 100.0 |

| commission | 0.0 0.0 per side per lot on classic account; 2 per side per lot on pro account; 1.6 per side per lot on VIP account |

| spread | variable |

| decimals | 5 decimals |

| scalping allowed | yes |

General information about tickmill

Tickmill is a trading name of tickmill ltd. Registered and head office: trop-X securities exchange building, 3 F28-F29 eden plaza, eden island, mahe, republic of seychelles. Tickmill ltd is a company registered in the republic of seychelles, number: 8414279-1. Authorised and regulated by the financial services authority. FSA license number: SD008.

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure. Card processing services for tickmill ltd are provided by procard global ltd, (a company registered in england and wales under number 9369927). Registered office: nwms center, 31 southampton row, office 3.11, 3rd floor, WC1B 5HJ london, united kingdom.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Honest tickmill forex broker review – scam or not?

| Review: | regulation: | min. Deposit: | forex pairs: | spreads: |

|---|---|---|---|---|

| (5 / 5) | FCA (UK), cysec (EU), FSA (SE) | 100$ | 50+ | 0.0 pips + 1$ commission per 1 lot |

Are you looking for real experiences and a critical test to the tickmill broker? – then you are exactly right on this page. As traders with more than 7 years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it really worth it to invest in forex broker tickmill money or not? – inform yourself in detail now.

Official website of tickmill

What is tickmill? – the company presented

Tickmill is an international broker for trading derivatives financial forex and cfds. The main headquarters are located in london: 1 fore street, london EC2Y 9DT, united kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. Also, there are branches in cyprus and seychelles.

According to the website, tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Facts about tickmill:

- Forex broker from great britain (london)

- Made by traders for traders

- Specialized in forex trading with special conditions and lowest spreads

- Worldwide branches in different countries

- 114 billion average trading volume per month

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Is tickmill a regulated forex broker?

Regulations and licenses are important for traders and brokers so that a trusting relationship can be created. When a broker applies for a license, certain criteria and requirements must be met. A violation of the policy means in most cases a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). It gives us a positive direct impression. European traders have to trade with the english license (FCA) or cysec license, which brings further benefits. On the other side, international traders have to choose the FSA license.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes handle money incorrectly. In order to avoid such a fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the barclays bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of tickmill with the financial services compensation scheme (FSCS) of up to £ 75,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, cysec, and FSA

- Customer funds are managed by barclays bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Review of the tickmill conditions for traders

Tickmill is a true NDD broker (non-dealing desk) with well-known liquidity providers. It is traded herewith excluded conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

There are more than 84 instruments available on the market. The broker is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. The offer is quite manageable and the tickmill tries to specialize with its offer on currencies (forex). Cfds (contracts for difference) are also available for commodities, government bonds or stock indices. Individual shares cannot be traded on this broker, so here’s a small smear in the rating that must be made.

Tickmill is characterized by its extremely tight spreads and low commission. We have compared many providers in recent years and tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true forex broker. This means you will always be able to open and close a position for the next best price in the market. The liquidity is always given by the various liquidity providers and the slippage is also very low on business news.

The best conditions:

- Very low spreads starting at 0.0 pips

- The extreme low commission in pro and VIP account is a huge advantage

- Pay only 2$ (pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 forex pairs

- Max. Leverage of 1:500

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Tickmill trading platform test

As a trading platform, the metatrader 4 is offered to you. This is a proven and worldwide trading platform for private and professional traders. The platform is available for the browser (web), desktop (download), android (app) and ios (app). With the metatrader, you can easily and flexibly access the markets of tickmill from anywhere in the world.

The metatrader is perfect for any trader who wants to earn sustainable money in the markets. Even with small capital can be traded, because there are micro lots available. In addition, there is always a guaranteed execution at tickmill and no partial execution.

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

Available for any device

In addition, tickmill offers education material and webinars for its clients.

Trading tutorial: how do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs. Including many currencies from emerging markets. This is a huge advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

Cfds are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with cfds on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation is sometimes confusing, tickmill offers a forex calculator. With this calculator, you can determine your risk and the position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in london I have a latency of under 30 ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Use a VPS-server for the best connection

The provider allows any strategies and automatic programs. Expert advisors (eas) can run 24 hours a day automatically through a VPS server at tickmill. The latency is very low and the price from $ 22 a month too.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill automated trading is possible

Tickmill allows every strategy and also automated programs. As mentioned above you can rent a VPS server very cheap. In connection with the metatrader 4 it works without problems and the setup is very simple. Program automatic programs for your trading or use provided trading systems. Today, more than 50% of the order executions are made automatically in the forex market.

Here you can see again that tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

VPS-server allows you trading 24/7 on tickmill.

How to open your free tickmill account:

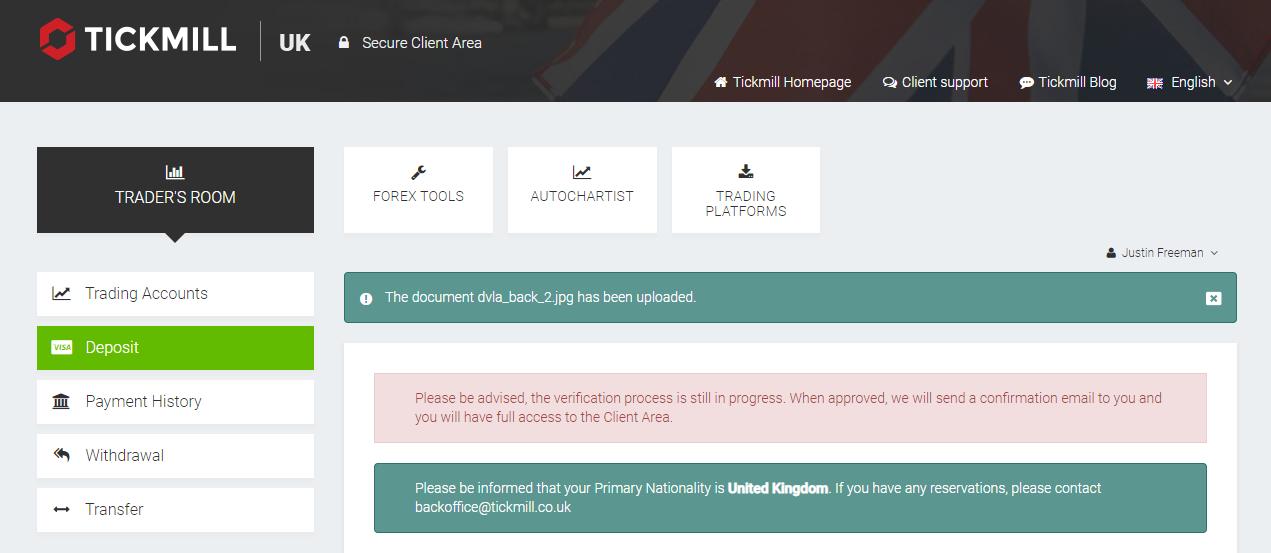

Another plus point for tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can not tell you whether a deposit without verification is possible.

For verification, it is sufficient to upload your ID and proof of address. The broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at tickmill

The free demo account of tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

3 different account types – which one you should choose?

Tickmill offers 3 types of accounts for traders. Interesting for us is only the pro and VIP account. From our experience, it is not worth the classic account to open, because the fees are accordingly higher than in the pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The pro accounts commission is only $2. So you pay only a fee of $4 per completed trade. When you open a VIP account, you save another 50%, because you only pay $2 for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by european servers. Upon request, an islamic account without swaps (interest) can be created.

| Classic | pro | VIP | |

|---|---|---|---|

| min. Deposit: | 100$ | 100$ | 50.000$ |

| spreads: | 1.6 pips | 0.0 pips | 0.0 pips |

| leverage: | max. 1:500 | max. 1:500 | max. 1:500 |

| commission: | 0$ | 2$ per 1 lot traded | 1$ per 1 lot traded |

Info: tickmill also offers its european customers to sign up as a professional trader and keep the high leverage of 1: 500.

The VIP account is the best choice for high volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of 50,000$, you have even cheaper fees. You then only pay $ 1 per traded lot. This makes $ 2 per completed trader. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, tickmill account types offer a great opportunity for every trader. The terms are very good and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, tickmill is the right decision for beginners or advanced traders.

Compare the terms between tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my forex broker comparison. With no other broker, you get so cheap trading fees without conflict of interest.

Review of the deposit and withdrawal of tickmill

At tickmill you can deposit and withdraw using the same methods. Bank transfer, credit card, skrill and neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are very fast and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a very small position size and the risk is in most cases only a few cents high. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Tickmill deposit and withdrawal methods

Questions and tips for your transactions:

- Open your free account at tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – this is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with tickmill safe? – yes, tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: now use sofortüberweisung (klarna) or paysafecard to capitalize your account even faster.

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At tickmill there is no additional funding and you are thus protected against a negative balance.

With tickmill you cannot lose more money than your deposit.

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than 10 different languages (also africa, asia, india, thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, 7 days a week. The support is provided by chat, phone or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example at the world of trading in frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders and tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are giovanni cicivelli or mike seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from tickmill is very good and professional. Our personal concerns were always resolved very quickly and we can make a clear recommendation here. Overall, the overall package is rounded off with a great service.

| Support: | available: | phone number: | special: |

|---|---|---|---|

| phone, chat, email | 24/5 | +44 (0)20 3608 6100 | webinars, 1 to 1 support, events |

Conclusion of my review: tickmill is one of the best forex brokers

My experience and tests show on this page that tickmill is a very good broker. He gets from us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

With the world’s cheapest fees, the broker is currently topping any competitor. The trading experience is unique with this broker and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK regulation and high customer safety

- The cheapest forex broker of the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for forex traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Tickmill is the best forex broker in the world because of the cheap trading fees and good execution. (5 / 5)

Read our other articles about tickmill:

Tickmill minimum deposit and fees overview

If you’re making a short-list of brokers to choose from, there are a lot of factors to consider. Do they cover the markets you want to trade, what are the fees and commissions, is the customer service high-grade?

One feature that sometimes flies below the radar is the minimum deposit requirement. This is the amount of funds you need to wire to a broker to open an account.

It might appear to be low down on the list of priorities, but there are two reasons to keep it in mind. The first is that some potential clients have a limited amount of free funds. The other is that trading in small size can be beneficial to your P&L.

When starting out, having positions that are of an uncomfortable size can be hair-raising. Using small trades and taking the emotion out of trading can actually allow you to stick with your strategy, rather than panic and close out a position early instead of waiting for it to become profitable.

Before we get started, let’s take a look at our other guides:

- An in-depth reviewof tickmill

- The top forex brokersin 2021

- Expert guidesto trading forex

Below is a summary of why tickmill should be top of the short-list of candidate brokers.

- Low minimum deposit

- User-friendly registration process

- Low-cost trading

- Superior trading infrastructure

- No deposit or withdrawal fees

Tickmill minimum deposit

The minimum deposit for all account types is $100. If you want to step up to the VIP account, you have to hold a minimum balance of $50,000.

The tickmill minimum deposit is a realistic amount of cash to facilitate you getting started trading the markets. You need a certain amount of capital to put trades on and hold positions if price goes against you.

Trading with the minimum would require you to trade in small size, but that’s not a bad idea for newbies.

How to make a deposit

First of all, you need to open an account. This process is done online and involves setting up a password — which only you will know. There is also a requirement to submit personal information and proof of address.

Completing this know your client (KYC) process is actually a good sign as regulated brokers ask clients to tick boxes so that compliance with the financial regulator is assured. Tickmill, as a regulated broker, is also required to keep a log of your tax ID details in case you make substantial profits and your local tax authority wants to apply the appropriate charges.

If you have all the information to hand, then the registration process can take as little as a matter of minutes. There is a requirement on tickmill to verify the KYC docs you upload and this part of the process may be the one which takes the longest time.

Once your account is validated, you can pay funds into it using the desktop or mobile app platform.

- Log in to your tickmill account client area

- Click ‘deposit’ in the left-hand sidebar

- Enter the deposit amount and select your base currency

- Select your payment method

- Click ‘submit' to confirm your deposit

When depositing funds into your tickmill account, there are more than 10 different payment providers to choose from. The list includes:

- Bank transfer

- Visa

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Vn

- Qiwi

- Webmoney

All of the above payment methods, apart from bank transfer and unionpay, allow for instant deposits of funds.

You might also notice that tickmill fees are reported with great transparency. The broker does not charge any commissions on deposits or withdrawals.

Part of tickmill’s eagerness to share that information is that this is a big plus point for it. There are a lot of brokers that charge commissions, particularly on withdrawals, and trading is risky enough without surrendering cash to admin charges.

Full disclosure does require mention of the fact that some clients may choose a payment option that incurs charges from a third-party. Giving the subject of which payment processor to use can save money.

If you choose one of the faster payment systems, then the process of depositing funds can take moments to complete.

All deposits starting from $5,000 USD or equivalent and processed in one transaction by bank transfer, are included in the zero fees policy. Smaller bank transfer amounts may be liable to charges.

Tickmill deposit currencies

Currencies that can be wired include:

- USD

- EUR

- GBP

- PLN

Take this quick quiz to help us find the best path for you

User-friendly registration process

One of the positive features of the tickmill platform is the straight-forward onboarding process. The list of questions that has to be worked through is set by the regulator. Tickmill makes the process as painless as possible and its list of drop-down prompts helps guide users.

It’s important to remember that there aren’t any right or wrong answers to some of the questions. Tickmill just needs to know more about you so it can gauge your competency. Answering as accurately as possible is important as the broker will grade the degree of customer care they need to apply.

Low-cost trading

Tickmill fees are some of the lowest in the market. It’s not a no-frills broker. In fact, it provides clients with dedicated a premium-grade trading experience. There are a whole range of additional services such as autochartist, but when it comes to fees, tickmill is market-leading.

This approach might stem from the fact that the founders of tickmill themselves come from a trading background. They have first-hand experience of how hard it can be to make a profit in the markets and giving it up on administrative costs is a painful experience.

The broker operates a variable spread tariff. At times of strong market liquidity, the spreads on 10 major currency pairs, such as EURUSD, can be as tight at 0.0 pips. It’s hard to compete with zero.

The aggressive policy towards trader expenses is long-established and can be expected to remain in place — it’s part of the tickmill brand DNA.

Superior trading infrastructure

The behind-the-scenes infrastructure of a broker is sometimes overlooked. It’s, in some ways, unglamorous, but is incredibly important.

The feeling that tickmill has been built by traders, for traders is demonstrated by the platform operating on state-of-the-art technological infrastructure.

Tickmill’s set up means that not only does it offer low-cost trading, but it is reliable as well.

- It has one of the industry’s fastest execution times — 0.20s on average.

- Its no requotes policy means that when you execute a trade, you can have confidence of it being filled.

- This policy runs across the 80+ markets on offer on the platform.

- Trading strategies such as expert advisors (eas), hedging and scalping, which are not available or permitted at other brokers, can all be conducted on the tickmill platform.

- Virtual private servers (VPS) are available 24/7 and come with a 100% uptime guarantee.

- The VPS servers are located close to the exchanges to ensure lower latency — which means better quality and lower cost trading.

- One-click trading — including ‘go to zero’ functionality so you can close all your positions with just one click.

Tickmill is safe

Everybody wants their trader to be ‘safe’ and tickmill has gone to great lengths to give its clients a sense of security.

Applying for licences at regulators and complying with all the reporting standards costs money and takes time. Tickmill’s approach to take on licences with five different regulators therefore needs applauding.

By operating under license in five distinct regions of the world, tickmill gives its clients coverage from a regulator geographically close to them.

- Tickmill UK ltd is authorised and regulated by the financial conduct authority (FCA). FCA register number: 717270.

- Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA). FSA licence number: SD008.

- Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company. Cysec licence number: 278/15.

- Tickmill asia ltd is authorised and regulated by the labuan financial services authority (labuan FSA). Licence number: MB/18/0028.

- Tickmill south africa (pty) ltd is authorised and regulated by the financial sector conduct authority (FSCA). FSCA licence number: FSP 49464.

A client’s location and domicile status will determine which regulator’s protective umbrella they come under. Not all of the below features will apply to all accounts, but some of the protective to look out for includes:

- Negative balance protection — NBP stipulates that you can’t lose more money than you put into an account. If you invest $100 in tickmill and get things horribly wrong then the most you can lose is. $100.

- Segregation of funds — some regulators require brokers to hold client funds at an independent bank. If segregation applies then tickmill’s own accounts, which pay staff wages and other costs, will be separate from client trading accounts. This means that if a broker fails, your funds are safe.

- Anti-money laundering – AML protocols at the FCA and cysec, for example, require any funds paid into a tickmill account to only be returned to the account from which it initially came. This is to prevent cash being laundered through brokers, but adds up to extra security for clients as their cash can’t be forwarded on to a rogue account.

Ease of access

Once you’ve set up your account and wired funds, you want the platform to work for you, not vice versa. The tickmill trading infrastructure may be extremely high-tech, but the user-interface has an intuitive feel.

The desktop version of the trading platform has functionality that has been tested and enhanced for more than 15 years. It’s very much a finished product with the input of millions of individual traders going in to shaping how it works.

The mobile trading experience is also high-quality. Given how powerful some of the metatrader analysis tools are, it’s quite an achievement to have so many available on the smaller screen. The app is free to download and compatible with ios and android devices. Setting it up takes moments, and once completed, you’re in position to trade at your desktop, or on the go.

Further reading:

Is tickmill trustworthy?

Tickmill is a safe broker. One of the ways it’s gone on to establish a reputation for being trustworthy is by gaining regulatory approval from five different regulators. Tickmill holds licenses with the following regulators — FCA in the UK, cysec in cyprus / EU, the FSCA in south africa, and the FSA in seychelles and the labuan financial services authority in asia.

This means tickmill has to comply with the rules and regulations stipulated by those organisations, which means client protection is a priority.

How can I contact tickmill?

Tickmill actually has bricks and mortar offices in a range of global locations. Its customer service team are contactable during business hours via telephone or email.

How to sign up for a tickmill account?

Signing up for a tickmill account is super-easy. The process is all online and takes minutes to work through. Once you’ve funded your account, you’ll be ready to trade the markets.

Be sure to make sure you reach the right place (not a scammer) by following this link to the tickmill website and registration page.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

So, let's see, what was the most valuable thing of this article: tickmill sign up estimated time to complete your registration is 3 minutes please complete the following form using latin letters only tickmill is a trading name of tickmill UK ltd (a at tickmill sign up

Contents of the article

- Real forex bonuses

- Tickmill sign up

- Tickmill $30 no deposit bonus

- Tickmill is giving away 30 USD for free to all...

- Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30...

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and...

- Tickmill 30$ welcome bonus (no deposit required)

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- No deposit bonus, withdraw profits – tickmill

- €£$ TICKMILL 30 forex no-deposit welcome bonus

- Profit and rebate

- CARA DAPAT REBATE?

- FITUR OKEFX

- OKEFX

- BROKER

- Tentang OKEFX

- Tentang tickmill

- General information

- Account options

- Customer service

- Trading

- Account

- General information about tickmill

- Honest tickmill forex broker review – scam or not?

- What is tickmill? – the company presented

- Is tickmill a regulated forex broker?

- The safety of customer funds

- Review of the tickmill conditions for traders

- Tickmill trading platform test

- Professional charting and analysis

- Trading tutorial: how do forex and CFD trading...

- Tickmill offers fast order execution and high...

- Use a VPS-server for the best connection

- Tickmill automated trading is possible

- How to open your free tickmill account:

- Unlimited demo account for beginners at tickmill

- 3 different account types – which one you should...

- The VIP account is the best choice for high...

- Review of the deposit and withdrawal of tickmill

- How high is the minimum deposit? – trading with a...

- Is there negative balance protection?

- Tickmill service and support for traders

- Conclusion of my review: tickmill is one of the...

- Tickmill minimum deposit and fees overview

- Tickmill minimum deposit

- How to make a deposit

- Tickmill deposit currencies

- Take this quick quiz to help us find the best...

- User-friendly registration process

- Low-cost trading

- Superior trading infrastructure

- Tickmill is safe

- Ease of access

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.