How to request ewallet pin

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#.

Real forex bonuses

The new PIN that will be sent to you will enable you to withdraw funds from your account without fail. When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

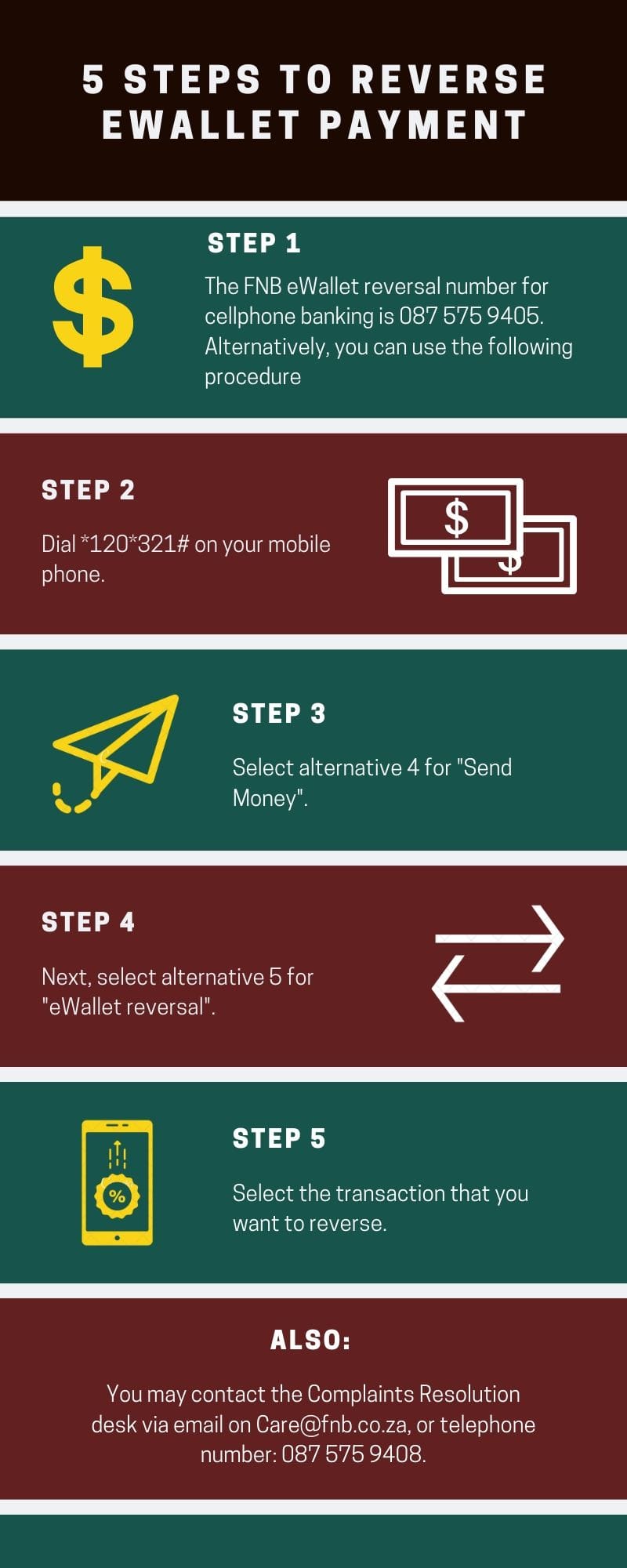

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How to request ewallet pin

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

Is using FNB ewallet safe?

FNB ewallet is a safe and secure way to send money. The FNB ewallet can hold up to R5000, which can be drawn at any FNB ATM or selected retailers.

There are four options for sending money:

- Cellphone banking

- Online banking

- Banking app

- FNB ATM

You can use any of the channels to send money to anyone with a valid south african cellphone number.

Is using FNB ewallet safe?

There have been a few reported incidents of customers not receiving their pins to be able to withdraw from an FNB ATM. The temporary ATM PIN refers to the 5 digit one time PIN that gives the recipient access to withdraw funds from the ewallet at FNB atms and FNB atms with automated deposits, without needing a bank card.

FNB emphasises that it’s important to ensure that the correct cellphone number is used. Customers should also keep their pins safe before drawing the ewallet money.

Since its launch in 2009, more than 700 000 ewallets have been created, with 50 000 new ewallets created on a monthly basis.

The popularity of the money transfer service makes it a potential target for scammers. This is why it’s important for customers to be vigilant when using online banking as well as atms.

One of the ways that scammers are using to steal customer information at atms is through thermal technology.

Thermal technology:

Using a smartphone and thermal technology (an imaging attachment), criminals can easily steal your PIN. The way this works is that your thermal signature is left behind when you press buttons, so criminals can use a smartphone with a FLIR ONE thermal imaging attachment to figure out your PIN. A way to avoid this is by lightly touching some other keys on the keypad.

Fogot ewallet pin nsfas

Gotech MFI pro manual

. (16 pin plug, pin 3) single coil . Pin 3 - positive VW golf mp9 pin 4 . The air temperature sensor is supplied with the gotech wiring harness as seen in fig 1.3.

- Filesize: 1,018 KB

- Language: english

- Published: december 6, 2015

- Viewed: 1,907 times

SECTION K NSFAS loan application form - unisa online

My choice @ unisa 2011 loan application form SECTION K NSFAS loan application form . Send your complete NSFAS application form

- Filesize: 354 KB

- Language: english

- Published: november 25, 2015

- Viewed: 7,707 times

Sbux merchant guide - NSFAS > NSFAS home

Sbux merchant (faqs) no questions answers about sbux 1 what is sbux? Sbux is the new cellphone payment system which NSFAS uses to pay your allowances.

- Filesize: 814 KB

- Language: english

- Published: november 27, 2015

- Viewed: 3,852 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in

- Filesize: 570 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,944 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in 2014 please note the following very .

- Filesize: 570 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,899 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO WISH TO .

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in 2014 please note

- Filesize: 570 KB

- Language: english

- Published: november 30, 2015

- Viewed: 3,767 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO WISH

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in

- Filesize: 570 KB

- Language: english

- Published: december 11, 2015

- Viewed: 2,653 times

WIRING INSTRUCTIONS REF. DIAGRAM no. 1. 5002/3 .

Ref.: diagram no. 3 8 GREEN-BROWN you connect on the door pin switches, it door pin switches connect the GREEN-BROWN wire on to the courtesy light pin switch circuit.

- Filesize: 377 KB

- Language: english

- Published: november 24, 2015

- Viewed: 1,376 times

PIC18F2455/2550/4455/4550 data sheet

PIC18F2455/2550/4455/4550 DS39632C-page 2 preliminary 2006 microchip technology inc. Pin diagrams 40-pin PDIP PIC18F2455 28-pin PDIP, SOIC

- Filesize: 7,298 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,048 times

EGS1 0 (pdf) - G-tech/pro support

Jul 9, 2008 . BLACK (THIN) is the shield wire for the cable and it should be connected to ground. 12 CADILLAC CTS 2004 5.7L green connector, white wire pin 10 @ ECU . CHEVY CAVALIER 1996-1998 2.4L white wire pin 10 @ ECU blue . DODGE DAKOTA 1995 3.9L gray wire with light blue stripe, pin 43 .

- Filesize: 2,747 KB

- Language: english

- Published: december 6, 2015

- Viewed: 1,273 times

Suggested document

Random document

If you don't see any interesting for you, use our search form below:

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How to request ewallet pin

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

FNB ewallet code – ultimate guide to FNB bank south africa ewallet USSD code

With the FNB ewallet code, you can make money transfers in and outside south africa. With a valid south african cellphone number, you can transfer funds to anyone in the country.

The FNB ewallet USSD code does not require internet access, and it allows you to send money to other family and friends.

You can also use the FNB ewallet service to withdraw funds from your first national bank ATM, buy electricity units, and top up prepaid airtime.

Use the list of table of contents below to jump to any section of the guide you may want to read:

The FNB ewallet USSD codes for sending and withdrawing funds are *120*277# and *130*277#.

What is the USSD code to access FNB bank south africa ewallet without airtime?

If you do not have airtime/credit on your cellphone, then dial *120*277#.

After dialing that code, you will then be able to buy airtime.

Next, you can continue with the ewallet transaction.

FNB ewallet code to withdraw money from ATM

If you want to withdraw cash from your FNB south africa bank account at the ATM using the ewallet service, the code to dial is *120*277* and press option 1 to withdraw cash.

After that, type 1 again to get your ATM PIN.

You can also dial this USSD code *120*277*1*1# to withdraw the money at the FNB south africa ATM.

Transfer code to access the mobile banking service at retail stores in south africa

You can make withdrawals at retail stores in all the provinces of south africa using your ewallet account.

The FNB ewallet USSD code to withdraw cash at retail stores is *120*277*4#.

Press the send button after dialing this USSD code.

After dialing the code, press 1 to get your retail PIN for the cash withdrawal.

Code to reverse wrong ewallet transfer

For most south africans, the main challenge is how to reverse FNB ewallet payment.

As soon as you realized that you have made a wrong ewallet transaction, follow these steps to reverse or cancel the money transfer:

- Dial this USSD code *120*321# to reverse the transaction.

- Enter option four (4) and press send.

- Select 5 for ewallet reversal.

- Finally, choose the ewallet transaction you want to cancel or reverse.

That is how to reverse a wrong ewallet money transfer.

Recommended reading : how to use FCMB USSD code.

How do I get my FNB e-wallet PIN

How to find your first national bank personal identification number (PIN) is pretty straightforward.

To get your FNB ewallet PIN, follow the steps below:

- Dial *120*277*1# on your cellphone.

- Press 1 to request your ewallet PIN.

- FNB will send you a message containing your ewallet 4-digit PIN.

- Visit the nearest ATM and use your PIN for withdrawal.

- Please note the PIN expires within sixteen (16) hours.

- The code to dial for retail stores is *120*277*4*1#, then press 1 to get your FNB ewallet PIN.

That is all you need to know about the FNB bank south africa ewallet code for transactions.

This simple and easy guide was last updated on 15th january 2021 by thetransfercode

Please you need to visit this post “https://thetransfercode.Com/fnb-ewallet-code/” peroidically for updates and any changes that we may make to this guide.

In the year 2021, we bring you the best of banking and money transfer experience. Just stay tuned for more articles.

Here is the list of our latest guides, check them:

Fogot ewallet pin nsfas

Gotech MFI pro manual

. (16 pin plug, pin 3) single coil . Pin 3 - positive VW golf mp9 pin 4 . The air temperature sensor is supplied with the gotech wiring harness as seen in fig 1.3.

- Filesize: 1,018 KB

- Language: english

- Published: december 6, 2015

- Viewed: 1,907 times

SECTION K NSFAS loan application form - unisa online

My choice @ unisa 2011 loan application form SECTION K NSFAS loan application form . Send your complete NSFAS application form

- Filesize: 354 KB

- Language: english

- Published: november 25, 2015

- Viewed: 7,707 times

Sbux merchant guide - NSFAS > NSFAS home

Sbux merchant (faqs) no questions answers about sbux 1 what is sbux? Sbux is the new cellphone payment system which NSFAS uses to pay your allowances.

- Filesize: 814 KB

- Language: english

- Published: november 27, 2015

- Viewed: 3,852 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in

- Filesize: 570 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,944 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in 2014 please note the following very .

- Filesize: 570 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,899 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO WISH TO .

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in 2014 please note

- Filesize: 570 KB

- Language: english

- Published: november 30, 2015

- Viewed: 3,767 times

NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO WISH

Nsfas applications for 2014 to all students who wish to apply for national student financial aid scheme (nsfas) funding in

- Filesize: 570 KB

- Language: english

- Published: december 11, 2015

- Viewed: 2,653 times

WIRING INSTRUCTIONS REF. DIAGRAM no. 1. 5002/3 .

Ref.: diagram no. 3 8 GREEN-BROWN you connect on the door pin switches, it door pin switches connect the GREEN-BROWN wire on to the courtesy light pin switch circuit.

- Filesize: 377 KB

- Language: english

- Published: november 24, 2015

- Viewed: 1,376 times

PIC18F2455/2550/4455/4550 data sheet

PIC18F2455/2550/4455/4550 DS39632C-page 2 preliminary 2006 microchip technology inc. Pin diagrams 40-pin PDIP PIC18F2455 28-pin PDIP, SOIC

- Filesize: 7,298 KB

- Language: english

- Published: november 29, 2015

- Viewed: 1,048 times

EGS1 0 (pdf) - G-tech/pro support

Jul 9, 2008 . BLACK (THIN) is the shield wire for the cable and it should be connected to ground. 12 CADILLAC CTS 2004 5.7L green connector, white wire pin 10 @ ECU . CHEVY CAVALIER 1996-1998 2.4L white wire pin 10 @ ECU blue . DODGE DAKOTA 1995 3.9L gray wire with light blue stripe, pin 43 .

- Filesize: 2,747 KB

- Language: english

- Published: december 6, 2015

- Viewed: 1,273 times

Suggested document

Random document

If you don't see any interesting for you, use our search form below:

so, let's see, what was the most valuable thing of this article: south africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips. what is ewallet? Ewallet is a prepaid account that allows y at how to request ewallet pin

Contents of the article

- Real forex bonuses

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How to request ewallet pin

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- Is using FNB ewallet safe?

- Fogot ewallet pin nsfas

- Gotech MFI pro manual

- SECTION K NSFAS loan application form - unisa...

- Sbux merchant guide - NSFAS > NSFAS home

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO...

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO...

- WIRING INSTRUCTIONS REF. DIAGRAM no. 1. 5002/3 .

- PIC18F2455/2550/4455/4550 data sheet

- EGS1 0 (pdf) - G-tech/pro support

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to request ewallet pin

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- FNB ewallet code – ultimate guide to FNB bank...

- What is the USSD code to access FNB bank south...

- FNB ewallet code to withdraw money from ATM

- Transfer code to access the mobile banking...

- Code to reverse wrong ewallet transfer

- How do I get my FNB e-wallet PIN

- Fogot ewallet pin nsfas

- Gotech MFI pro manual

- SECTION K NSFAS loan application form - unisa...

- Sbux merchant guide - NSFAS > NSFAS home

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO...

- NSFAS APPLICATIONS FOR 2014 TO ALL STUDENTS WHO...

- WIRING INSTRUCTIONS REF. DIAGRAM no. 1. 5002/3 .

- PIC18F2455/2550/4455/4550 data sheet

- EGS1 0 (pdf) - G-tech/pro support

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.