Online cryptocurrency broker

Not a single party can alter your transactions and this is why it can offer you more transparent transactions than the conventional fiat currencies.

Real forex bonuses

However, one basic difference between the two is that any person from any place in the world can take part in the ICO.

Top cryptocurrency brokers for 2021

We found 11 online brokers that are appropriate for trading cryptocurrency.

Best cryptocurrency brokers guide

Are you interested in investing in cryptocurrency?

If the answer to this is a yes, then you will need to find the right cryptocurrencies brokers whocan accommodate you with the best facilities to trade on the cryptocurrency markets.

Before proceeding, lets cover the real definition of cryptocurrency.

Defining cryptocurrencies

In short, cryptocurrencies are digital or virtual currencies.

These currencies are reliant on cryptography to ensure the security and verification of each digital transaction.

Cryptography can control the number of units and prevent the change of code of the cryptocurrency unless some conditions are met.

The important characteristics of the cryptocurrencies

For some people, cryptocurrencies are the savior of the economy. This is because these can give the perks that not all banks or other financial institutions can provide.

Here are the unique characteristics of the cryptocurrencies which you cannot find in the conventional means of transactions.

No third party involved

There will not be third parties like financial institutions, governments, or any other third party organizations which govern the transactions between you and your recipients, and vice versa.

There is no third party that will intervene in your transaction. And it is a win-win solution with the P2P or peer to peer network. You can send cryptocurrencies through the P2P network and the other users will also be able to do the same for you.

Cryptocurrencies have more transparency

The problem with the conventional transactions is that one can ask for a refund and this will procure such unfortunate things to only one party.

As an example if your buyer has sent you a payment and you have delivered the goods but before the goods reach their destination, your buyer reverses the transaction your result could be that you will not receive the money you are owed and your buyer may have lead you.

You can avoid this issue with the cryptocurrencies transactions as these transactions are irreversible.

Not a single party can alter your transactions and this is why it can offer you more transparent transactions than the conventional fiat currencies.

Decentralized

There is no centralized place to transact at all so you can eliminate the high rates of fees when transferring money.

The cryptocurrency is maintained through the ledger technology called the blockchain. The blockchain prevents all other entities from tarnishing the data. Not a single person can alter the system so that your transactions will be safe and sound. We will discuss blockchain next.

Blockchain definition

Blockchain is bitcoin technology comes in the list of recorded data blocks, which are gathered by cryptography.

The recorded data in the blockchain is referred to as ledger. When there is a new data exchange, usually a transaction, a new block is added to the ledger or the blockchain.

In summary, the blockchain or ledger contains important information.

Cryptocurrency brokers

The era of virtual coin is upon us and is paving a golden path for traders. When trading cryptocurrency it is important to trade through reputable cryptocurrency brokers.

We list some notable cryptocurrency brokers below:

Etoro - being one of the top-rated cryptocurrency brokers it offers several currencies including ethereum, ripple, bitcoin and dash.

XTB - XTB too has a good name among traders and offers a wide range of such virtual currencies including litcoin, ethereum and bitcoin. It is placed as one of the top 5 cryptocurrency brokers in the industry.

Plus500 - it offers crypto throughout the day and night with good leverage for the most popular currencies like litecoin, ripple, neo, ethereum and bitcoin.

What is cryptocurrency?

Cryptocurrency is a virtual coin and is traded on cryptocurrency exchanges through cryptocurrency brokers.

Lately, cryptocurrency has continued to gain popularity. This has opened up lots of new trading tools and ways to trade including contracts for difference (CFD). They earn from the difference between the cost of an asset at the present time and what value it could become in the future.

Cryptocurrency wallets

Similar to other wallets this too facilitates storing, sending and receiving the currency. We explain the three types of cryptocurrency wallet below:

The hardware wallet

The hardware wallet is the most secure crypto wallet as all the data is stored offline. A few of the good examples are trezor, keepkey and ledger nano S.

The paper wallet

A paper cryptocurrency wallet is popular and it is secure. However, it is not as convenient as the hardware wallet.

The software wallet

The software wallet is the most conveniant among the three and can be managed from a desktop or mobile phone device. Some of the cryptocurrency wallets of note are exodus, jaxx and electrum.

Cryptocurrency exchanges

A cryptocurrency exchange is a place where buyers and sellers meet for the purpose of buying, selling or trading the virtual coins with the help of couple of cryptocurrency brokers.

Binance exchange is the most famous cryptocurrency exchange in the world and it offers crypto to crypto trading.

Combase is popular too and it offers trading on 100s and 1,000s of virtual currencies like litecoin, ethereum classic and bitcoin.

Localbitcoins, on the other hand, offers over-the- counter trading of virtual coins. Traders can post a currency for sale on its websites mentioning the rate and payment methods.

ICO and token

Abbreviated for initial coin offering the ICO is a kind of fundraising for a start-up. It is done by selling underlying tokens against ethereum or bitcoin.

ICO is similar to IPO in which traders buy company shares. Investors take an entry at early stage of the project and so are capable of making a profit with the success of the company.

However, one basic difference between the two is that any person from any place in the world can take part in the ICO.

Token meanwhile is a kind of cryptocurrency too but represents a specific asset. It is sometimes used as loyalty points that can be redeemed against discounts. It can also represent something uncommon like one token is 5 bitcoins.

The cryptocurrency mining

Just a little different with the fiat currencies, the cryptocurrencies are usually mined by miners. So, there is a phrase to describe the activity as the cryptocurrency mining.

To define it, it is a process in which the miners use powerful resources, in this case computers and adequate hardware to solve mathematical problems. These complicated problems need to be solved in order to attain the rewards.

To make it more challenging, these mathematical problems have cryptographic hash functions which are linked to the block which contains the information of the transaction.

These mathematical problems are tempted to solve with multiple miners.

So, when figuring out solutions for the problems, miners are competing with other cryptocurrency miners. It is about winning and losing. The winners will get small amounts of cryptocurrency.

The reward comes from the transaction fees the users pay. At least that is how major cryptocurrencies conduct and the other factor which also gives the rewards to the miner is the release of new cryptocurrency.

Cryptocurrency wallet

The cryptocurrency wallet is a digital wallet which the users use to deposit, store, hold, send, and receive digital currency or cryptocurrency.

Do not mistake it with concepts like paypal, payza, or various other digital currency systems. The crypto wallets do not serve as the storage of the cryptocurrency. The wallets only store the information in the form of public and private keys.

Meanwhile, the crypto itself is inside the blockchain. The users do not necessarily store their cryptocurrencies in their wallet. In summary, the cryptocurrencies wallet stores the important information which you can use to access your crypto assets.

Cryptocurrency exchange

When you have the cryptocurrencies assets, you may want to sell it to other users or, you could want to trade the cryptocurrencies. Here is where you will need to use a cryptocurrency exchange.

The cryptocurrency exchange is a platform which allows the users to buy, sell, or trade the cryptocurrencies.

Some exchanges only provide crypto-to-crypto trades, but some also allow the crossover currencies so that you can trade from crypto to fiat or fiat to crypto.

There are many cryptocurrencies exchanges that you can find on the internet. Some of them offer the trades for common cryptos such as BTC, ETH, BNB, USDT, and so on. But some also offer more wider array of currencies exchange.

Cryptocurrency brokers verdict

In current times, it is not exaggerating to say that cryptocurrency is the most volatile asset class that you can find.

It is due to the fact that it comes with the high speculative market not to mention that it currently disrupts the conventional economy so that many established players don�t see it to have inherent value.

Therefore, it is still safe to use the cryptocurrencies but in addition to fiat currencies.

We've collected thousands of datapoints and written a guide to help you find the best cryptocurrency brokers for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best cryptocurrency brokers below. You can go straight to the broker list here.

Reputable cryptocurrency brokers checklist

There are a number of important factors to consider when picking an online cryptocurrency trading brokerage.

- Check your cryptocurrency broker has a history of at least 2 years.

- Check your cryptocurrency broker has a reasonable sized customer support of at least 15.

- Does the cryptocurrency broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your cryptocurrency broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your cryptocurrency broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your cryptocurrency can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering cryptocurrency brokers.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below cryptocurrency brokers.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 cryptocurrency brokers of 2021 compared

Here are the top cryptocurrency brokers.

Compare cryptocurrency brokers min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are cryptocurrency brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more cryptocurrency brokers that accept cryptocurrency clients

Top 10 online cryptocurrency trading brokers

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

Pepperstone has won numerous industry awards for innovation and excellence in CFD brokerage. Pepperstone is an australian-based online ECN forex broker with some of the industries lowest spreads.

- Award winning CFD broker

- No deposit or withdrawal fees

- Fee-free funding options

- Razor spreads from 0.0 pips

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Pepperstone has won numerous industry awards for innovation and excellence in CFD brokerage. Pepperstone is an australian-based online ECN forex broker with some of the industries lowest spreads.

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

How to get started in cryptocurrency trading

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

What is cryptocurrency?

Today, the most famous cryptocurrency is bitcoin. Its inventor attempted to build a “peer-to-peer electronic cash system”. Many have tried this system many times before. However, the main difference between bitcoin and the previous efforts, like digicash, was that it was to be entirely decentralized. Since no overarching entity is controlling the currency, the notion of “trust” would be eliminated from the system.

To combat “double spending”, the major problem in all the digital cash systems at that point, satoshi nakamoto, bitcoin’s inventor, proposed the blockchain technology. The blockchain technology is a revolutionary technology that records all the transactions made with this currency.

For any single balance, transaction, or change to the network to take place, there needs to be a consensus amongst those who validate the network – the miners. Since the invention of bitcoin, many programmers have attempted to use the model and change it to provide what they consider a more functional form of digital cash.

The other kinds of cryptocurrencies include monero, new economy movement, litecoin, and ether. Many of these cryptocurrency efforts tailor their currency for an individual and particular purpose. Some of the most common purposes are speed, privacy, and price.

What are cryptocurrencies used for?

Since cryptocurrency is such a new technology, it may be that people have not used it yet for its eventual use. Still, today people utilize it for many various purposes. These purposes include, but aren’t limited to the following: trading, remittances, payment for goods and services, investment, gambling, private monetary transactions, and as a hedge against national currencies which are suffering from rapid devaluation (greece, venezuela for example).

As the whole cryptocurrency space begins to expand, it’s likely that we will see some additional applications joining the list of purposes for the crypto currency. There are already young services such as steemit, which aims to revolutionize the way people pay for content on social media, in addition to services like musicoin which attempts to find a more equitable way to pay artists without the need for a middleman.

What is the difference between bitcoin and ethereum?

All cryptocurrencies have their own characteristics. However, recently one coin has come to challenge bitcoin more than ever before. Ethereum is the new player on the market. The reasons that it is a challenge to bitcoin are easy to understand.

Ethereum emerged as an effort to try to correct some of the main criticisms made towards bitcoin – especially regarding security.

What ethereum has accomplished to do was to provide transactions that are safer, more flexible contracts that are compatible with any wallet, with short block times for negotiating (where the confirmations are easier). Also, ethereum is available more than bitcoin. Whereas more than two-thirds of bitcoin has already been mined, access to ethereum is still widely available. Another main difference between these two cryptocurrencies is that ethereum allows for different developers to raise funds for their projects. It can, therefore, be in itself a kickstarter for some projects.

One of the main advantages to ethereum is that it’s a more secure, easy to use, flexible, and transact coin. In addition to this advantage, it has brought innovations in terms of entrepreneurship and investment. And this is posing a serious challenge to bitcoin’s market cap.

What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

You can invest in cryptocurrency in two ways. First, cryptocurrency can be bought and sold at a cryptocurrency exchange and stored in a digital wallet. The second method would be to invest in crypto as a CFD with regulated cryptocurrency brokers. With CFD cryptocurrency trading, the digital currency is treated as a speculative investment and traded as a contract for difference (or CFD), through brokers.

Platforms that allow traders to buy and sell cryptocurrencies are cryptocurrency exchanges. Dues to the fact that it is a very recent – and booming – market, the majority of these platforms are relatively new. But, of course, one of the essential questions that people ask is how to know if a particular platform is safe or not.

The only way that you can find out is to check if the exchange provides transparent data of the coins that are in cold storage. What this means is, whether it has the reserves that it requires to provide liquidity to its activities. You can find check this easily by checking whether an exchange is regulated or not.

Trade cryptocurrency online using CFD services

If you are interested in trading because of the opportunity to profit from the incredible volatility of cryptocurrency, your best option is to use an online trading platform that allows CFD services. Currently, there are very few CFD platforms that allow this kind of trade, so to see available options refer to our recommendations above.

CFD brokers are a great option if you want to trade cryptocurrencies with the option to accept multiple forms of payment. If you want to buy cryptocurrency with paypal, you can, and these forums also accept major credit cards and wire transfers as well. Furthermore, if you choose to trade through a forex or CFD platform, you will pay the lowest commissions possible. That is in comparison to other investment alternatives. CFD and forex companies use an exchange rate that is an aggregate of different crypto exchanges.

Trading cryptocurrencies – getting started with cfds (contracts for differences)

Cryptocurrency cfds allow you to trade digital coins without actually owning any. Crypto cfds were generated to give traders exposure to the cryptocurrency market without the need for ownership.

Contracts for differences, also known as “cfds,” represent a contract between trader and exchange. Cfds declare that the difference between the price on entry and the price on exit will be a trader’s profit or loss. Basically, cfds are an agreement held between two parties that simulate an actual asset.

How to make money trading crypto

There are several ways to make money cryptocurrency trading. The most popular is trading bitcoin against the US dollar, known in market terms as the BTC/USD pair. The first method is to find a top cryptocurrency broker and to invest in a digital currency in the same way that you would do with a physical currency – by buying low and selling high. Since cryptocurrency is highly volatile, you should be able to identify the dip with studying and market research.

Read on to learn how to find the best cryptocurrency brokers. Be sure to review the platforms we suggest above, all are fully-registered and come highly recommended. For additional information regarding trading cryptocurrency as a CFD, check out our guide on “the basics of cfds“. It’s important that you remember that leverage works both ways and it will magnify the gains and losses.

How to choose the best cryptocurrency trading broker online

Because there’s so much competition in the market as well as having countless cryptocurrency brokers to choose from, it can be difficult to know which option will be best for you. Here are a few key points we suggest keeping in mind when deciding how to best invest:

Regulation

Each country has its own regulatory body. The regulatory body develops rules, services and programs to protect the integrity of the market. The regulators protect traders, and investors as well as the cryptocurrency brokers themselves. Their main obligation is to help members meet regulatory responsibilities. Due to potential safety concerns regarding deposit, you should exclusively open accounts with regulated firms.

Customer service

Cryptocurrency trading takes place 24 hrs a day, so customer support should be available at all times. Ideally, you will want to speak with a live support person rather than a time-consuming auto-attendant. Give a call to the customer service centre to get an idea of the type of customer service provided. Check on wait times and find out the representative’s ability to answer questions regarding spreads and leverage, trade volume, and company details.

Account types

Your ideal cryptocurrency trading broker should be able to offer either multiple account options or an element of customizability. Look for cryptocurrency brokers that offer competitive spreads and easy deposits/withdrawals.

Currency pairs

Cryptocurrency brokers can provide a selection of cryptocurrency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

Platform type

The trading platform is the investor’s portal to the markets. With that in mind, look for a platform that’s easy to use, straightforward and offers an advanced collection of analytical and technical and tools. These features will help to enhance your trading experience.

Here at topbrokers.Trade, we take pride in providing the best possible trading brokers comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrencies, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Bitcoin brokers: top 5 cryptocurrency brokers 2020

If you want to buy bitcoin with a debit card online, you will need to use a cryptocurrency or bitcoin broker. The process is super-easy, and merely requires 10 minutes of your time. Simply open your bitcoin account with your chosen bitcoin broker, deposit funds, and that’s it.

With that said, knowing which cryptocurrency broker to sign up with is no easy feat, as there are now hundreds to choose from. In this article, we explore the best five brokers to buy bitcoin in 2020. We explain key metrics such as the broker’s regulatory status, supported payment methods, tradable coins, and minimum deposit.

On this page:

Our recommended bitcoin broker for 2020

If you don’t have time to read through our top five picks, we would suggest opting for etoro. The regulated platform allows you to buy bitcoin with paypal and other methods, such as a debit/credit card, paypal, skrill, or a local bank transfer. Fees are also competitive, as the broker does not charge any trading commissions.

Etoro : best bitcoin broker for 2020

- Cysec, FCA and ASIC regulated

- Paypal accepted

- Buy 15+ coins outright or trade crypto cfds

- US-friendly

Top 5 cryptocurrency brokers 2020

So now that you know what to look out for when choosing a bitcoin broker, you’ll be sure to find a platform that best meets your long-term investing goals. However, if you don’t have time to perform your own research, why not consider the merits of the recommended brokers listed below? Each broker meets our strict set of requirements, such as holding at least one tier-one regulatory license, low fees and commissions, high trading volumes, and heaps of everyday payment methods.

1. Etoro - best overall bitcoin broker

Our top-rated bitcoin broker is etoro. First and foremost, the platform is ideal if you're buying cryptocurrencies for the very first time. This is because the broker is easy to use, and it takes minutes to open an account. Moreover, the platform supports heaps of everyday payment methods - such as a debit card, credit card, bank transfer, paypal, skrill, and neteller. If you check out our etoro review you'll see it is also strong in the fee department. For example, you won't need to pay any trading commissions, so it's just the spread that you need to look out for. You can also deposit funds for free, although withdrawals come at a small cost of $5 per transaction. On top of bitcoin, etoro supports lots of other cryptocurrencies.

This covers both fiat-to-crypto (like BTC/USD) and crypto-to-crypto (like BTC/ETH) pairs. We also list etoro as our number one cryptocurrency broker because of its copy trading feature.

This allows you to mirror the trades of other users, proportionate to the amount that you wish to invest. Most importantly, etoro is heavily regulated. This includes licenses with the FCA, ASIC, and cysec. This ensures that your money is held in segregated bank accounts.

Regulation: ASIC, FCA, cysec

Special features: copy trading feature allows you to copy the trades of other investors

Demo account: yes

Educational material: lots of educational guides for newbie traders

Fees: no trading commissions, average spreads

Minimum deposit: $200

Volume: high trading volumes

Deposit and withdrawal conditions: minimum withdrawal of $50

Payment methods: credit/debit card, paypal, sofort, rapid transfer, skrill, wire transfer, neteller, webmoney, unionpay

Best online brokers for buying and selling cryptocurrency in february 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Cryptocurrency, especially bitcoin, has proven to be a popular trading vehicle, even if legendary investors such as warren buffett think it’s as good as worthless. Part of cryptocurrency’s popularity is due to its volatility, since these swings allow traders to make money on the price moves.

For example, at the start of 2017, the price of bitcoin broke through the $1,000 barrier. By the end of the year, the digital currency had reached nearly $20,000. Almost a year later, bitcoin was hovering around $3,200. But it sprung back to life in 2019, rising to more than $10,000 and has continued significantly higher since then — briefly crossing the $40,000 level in early 2021.

It’s this kind of price movement that has attracted traders looking to ride the waves to profit. While some traders like to own the currency directly, others turn to the futures market. Futures may be an even more attractive way to play the volatility of digital currencies such as bitcoin, because they allow traders to use leverage to magnify their gains (but also magnify losses).

Where can you buy and sell cryptocurrencies?

Traditional brokers have the advantage of offering a wide selection of investible securities, though typically you can’t trade bitcoin directly, only futures. Meanwhile, crypto exchanges are limited to digital currencies, though you can own the currencies directly and can often buy several, rather than simply bitcoin or bitcoin futures, as you would with a general broker. And paypal has also gotten in on the act, allowing U.S. Users to buy and sell cryptocurrencies.

Here are the best brokers for cryptocurrency trading, including traditional online brokers, as well as a new specialized cryptocurrency exchange. You might also want to check out which brokers offer the best bonuses for opening an account to determine where you can get a little extra.

Overview: best brokers for cryptocurrency trading

Robinhood

Robinhood is a great option for buying cryptocurrency directly, although the online broker hasn’t had the smoothest of starts this year. You’ll also get to take advantage of robinhood’s wildly popular trading commissions: $0 per trade, or commission-free. And if you’re into more than just cryptocurrency, you can stick around for stock and ETF trades for the same low price. Robinhood’s slick app makes trading so easy, though those looking for a full-featured trading experience will be disappointed.

Commission: $0

Account minimum: $0

TD ameritrade

TD ameritrade is one of the top full-service brokers on the market, and not only does it offer access to traditional products such as stocks and bonds, but it’s expanded its offering to include bitcoin futures. However, TD ameritrade does not allow trading directly in the digital currency. You’ll need to meet the account minimum to get started with bitcoin futures. (charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Commission: $2.25 per contract

Account minimum: $25,000 for futures

Interactive brokers

Interactive brokers allows you to buy bitcoin futures rather than owning the currency directly. And in this broker’s case, you can actually buy futures on the chicago mercantile exchange, with all-in contracts costing $15.01 with five bitcoins per contract. In addition, interactive brokers brings its full suite of investment offerings, so you can buy almost anything that trades on an exchange.

Commission: $15.01 per contract

Account minimum: $0

Charles schwab

Charles schwab is routinely one of bankrate’s picks for top broker, and this investor-friendly company offers trading in bitcoin futures. Schwab also has no account minimum, but any futures contracts you trade will require some minimum margin to hold them open. Schwab offers an attractive commission of $1.50 per contract, and if you’re able to bring big money to the table, you’ll receive a welcome bonus, too.

Commission: $1.50 per contract

Account minimum: $0, futures margin depends on contract

Tradestation

Traders have a couple options at this broker, which has rolled out direct currency trading via tradestation crypto, with commission-based pricing for traders. Pricing is based on your account balance with the broker and whether your order is directly marketable. Normally pricing ranges from 0.25 percent of your order to 1 percent. Traders can also buy and sell bitcoin futures as well as take advantage of substantial volume trading discounts.

Commission: 0.25-1 percent

Account minimum: $0, but futures margin depends on contract

Coinbase

Coinbase is a specialized cryptocurrency-focused platform that allows you to trade digital currencies directly, including bitcoin, ethereum, litecoin and bitcoin cash. In total, you’ll have access to more than three dozen cryptocurrencies. You’ll also be able to store your coins in a vault with time-delayed withdrawals for additional protection. The exchange’s commission structure is steep. It charges a spread markup of about 0.5 percent and adds a transaction fee depending on the size of the transaction and the funding source.

Commission: at least 1.99 percent of the transaction value

Account minimum: $0

Bottom line

Whenever you’re selecting a broker, it’s important to consider all of your needs. And for new traders in cryptocurrency, you’ll want to figure out whether you want to own the virtual currency directly or whether you want to trade futures, which offer higher reward, but also higher risk.

You’ll also need to consider whether you want to trade more than bitcoin, which is what the majority of traditional brokers restrict you to. If not, you may want to turn to a cryptocurrency exchange, since they offer more choice of tradable cryptocurrency.

Compare cryptocurrency brokers

For our trading cryptos comparison, we found 13 brokers that are suitable and accept traders from ukraine. Disclaimer: availability subject to regulations.

We found 13 broker accounts (out of 147) that are suitable for trading cryptos.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Plus500

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About plus500

Platforms

Funding methods

76.4% of retail CFD accounts lose money

Etoro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About etoro

Platforms

Funding methods

71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Easymarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About easymarkets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider.

Spreadex

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About spreadex

Platforms

Funding methods

67% of retail investors lose money when trading spread bets and cfds with this provider.

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Trade.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About trade.Com

Platforms

Funding methods

71.36% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

What are cryptocurrencies?

The word “cryptocurrency” is thrown around a lot these days, but what is it really? Some say it’s the greatest technological breakthrough of our time, while some say it’s the biggest scam of our time. But few people can actually explain what it is. In this article, we help shed light on the topic of cryptocurrencies.

Cryptocurrencies are digital or virtual currencies that use cryptography to secure and verify transactions so that they work as a medium of exchange. Cryptography is also used to control the number of units and prevent changes to the cryptocurrency’s code unless certain conditions are fulfilled.

As well, cryptocurrencies have three characteristics that they all share in common.

They are trustless. Meaning no third party is involved by replacing trust verification with a peer to peer network. Individuals can directly send cryptocurrencies to one another without permission or control from corporate institutions or governments.

They are immutable. Cryptocurrency transactions cannot be undone, reversed, double spent, or altered. Therefore, cryptocurrencies are far more transparent and effective than traditional fiat currencies.

They are decentralized. A cryptocurrency is controlled via its distributed ledger technology, known as the blockchain. The creation of new units is coded into the system and no one entity controls it.

What is blockchain?

Blockchain is the underlying technology of bitcoin and most other cryptocurrencies.

In its essence, it is a growing list of recorded data, called blocks, which are linked together using cryptography. All of the recorded data is referred to as a “ledger”, and every time there is a data exchange, a “transaction”, a new block is added to the ledger or “blockchain”.

Therefore, the blockchain or ledger can have information added onto it, but it is always added on in the form of a new block. Previous blocks in the blockchain can never be changed, edited, or adjusted.

Another important aspect of blockchain is that they are consensus driven. Meaning a large number of computers in a distributed system are needed to verify each transaction. This is also known as a peer-to-peer network of nodes.

What is mining?

Cryptocurrency mining is a process in which miners use powerful computers and hard drives to solve complicated mathematical problems. These mathematical problems have cryptographic hash functions which are associated with a block containing transactional data. While solving these problems, the miner is competing against other cryptocurrency miners and the first one to solve the mathematical problem is rewarded with small amounts of cryptocurrency.

The reward is too incentivise miners to continue mining and thus securing the network. The mining award comes from the transaction fees users pay as well as newly released crypto.

What is a cryptocurrency wallet?

A cryptocurrency wallet is a digital wallet used to store, send, and receive cryptocurrency. A big misconception of crypto wallets is that the cryptocurrency is stored within the wallet’s software or hardware. However, this is not the case. Crypto wallets simply store a cryptocurrency’s public and private keys, while the crypto itself remains on the blockchain. So essentially, a crypto wallet stores the information in which gives you access to your crypto assets.

There are 3 different types of cryptocurrency wallets you can use.

- The most secure being a hardware wallet such as a ledger nano S, keepkey, or trezor (all data is kept safely offline)

- Another secure wallet but quite inconvenient is a paper wallet.

- A wallet more focused on convenience is a software wallet that sits on your desktop computer’s hard drive or in your smartphone, examples are jaxx, exodus, and electrum. (these are also known as hot wallets where your cryptos are not kept in cold storage eg. Are kept online.)

What is an ICO?

An ICO (initial coin offering) is a method of fundraising that new cryptocurrency projects use to build start-up capital. They work by selling their underlying crypto tokens in exchange for bitcoin or ethereum. Investors buy these crypto tokens during the projects ICO if they think the project will succeed.

An ICO is similar to an IPO (initial public offering) in which investors purchase shares of a company when they go public. Both icos and ipos allow investors to get in at an early stage and make a profit if the company succeeds.

The biggest difference between an ICO and an IPO is that anyone from anywhere in the world can participate in an ICO. This has led to an explosion of icos with over $6 billion being raised in 2017 and over $7 billion so far in 2018.

What is a token?

The term “token” has taken on a few different meanings in the cryptocurrency space. Tokens are a kind of cryptocurrency that represent an asset or a utility. While cryptocurrencies are primarily used as a means of exchange like a currency, crypto tokens actually represent a specific asset or are actually meant to be used for something.

The topic of crypto tokens is a deep one, but we will give some examples here.

- A crypto token can be used as customer loyalty points in which they can be redeemed to receive a discount on a product, or even used to pay for the product.

- A crypto token can be used to represent something. For instance, a token could be used to represent 5 bitcoins per token.

- A crypto token might be used in order to watch a video on a tokenised video streaming service.

The examples go on and on and they are always up for debate as the concept of crypto tokens is still very new.

What is a smart contract?

A smart contract is a self executing contract that’s built using a computer protocol running on top of a blockchain. The contract itself is built into the code along with the terms of the agreement between two parties. The smart contract code can facilitate, verify, and enforce the terms of an agreement or transaction. Essentially, smart contracts are the simplest form of decentralised automation.

The idea behind smart contracts is to provide a superior contract to traditional contract law by increasing security and lowering expenses involved in a contract. Smart contracts can facilitate trusted transactions and agreements between dishonest and anonymous parties without the need for external enforcement such as legal systems, central authorities, etc.

What is a cryptocurrency exchange?

A cryptocurrency exchange is a business that allows customers to buy, sell, or trade cryptocurrencies. Some exchanges only allow crypto to crypto trading while others allow crypto to fiat and vise versa.

The largest and most popular crypto exchange in the world in terms of daily trading volume is the binance exchange. Binance only facilitates crypto to crypto trading with no support for fiat currencies. Traders on binance can trade various cryptos against bitcoin (BTC), ethereum (ETH), binance coin (BNB), or tether (USDT).

Another popular exchange is coinbase. Coinbase differs from binance because they accept the on and off boarding of fiat currencies. Currently, users can trade bitcoin (BTC), bitcoin cash (BCH), ethereum (ETH), ethereum classic (ETC), litecoin (LTC), 0x (ZRX) and basic attention token (BAT). Coinbase has plans to add hundreds if not thousands more cryptocurrencies in the near future. The fiat currencies accepted at coinbase include USD, EUR, and GBP.

A cryptocurrency exchange that differs from the ones already mentioned is localbitcoins. This exchange facilities over-the-counter trading of local currency for bitcoin. Users post their bitcoin for sale on the website along with their exchange rate and payment methods.

The volatility of cryptocurrency

Cryptocurrency is the most volatile asset class of our time. It’s not uncommon to see price swings 50%+ in any direction within a given day. The volatility is largely due to the highly speculative market of cryptocurrencies. As well, cryptocurrencies do not follow any regulatory oversight, have thin order books, lack institutional capital, and currently have no intrinsic value.

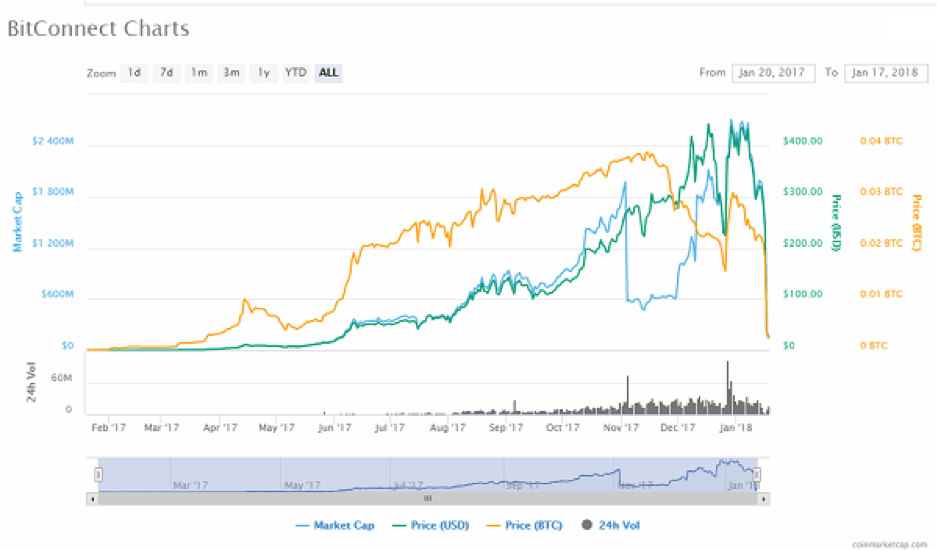

To give an example of the volatility apparent in cryptos, look at the graph below of the most popular cryptocurrency, bitcoin.

As you can see in the price chart above, the price of bitcoin went from $6300 in november to $20,000 in december. That’s a price rise of over 68% in the span of a month, and at the of this writing, roughly 10 months from its high, the price is back to where it was a year ago.

Img source: https://coinmarketcap.Com/currencies/bitconnect/

An example of a crypto that went to zero and is no longer available is bitconnect.

As you can see in the chart above, when people finally realized bitconnect was a ponzi scheme, it dropped from a price of over $400 to 0 in a matter of days. Therefore, it is important to understand the project you buy into as there are many scams in crypto with false promises.

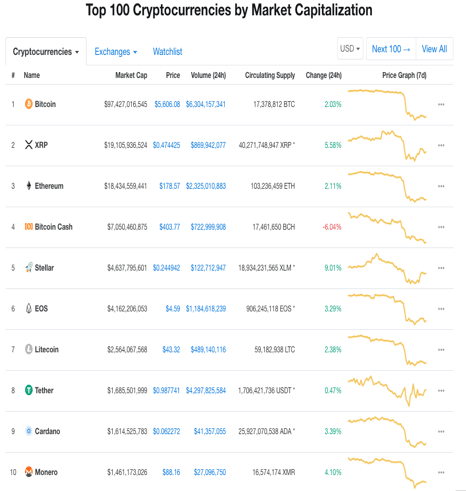

What are the top cryptocurrencies for traders

The top cryptocurrencies for traders are generally the ones with the highest market cap. For example, several brokers regulated by the financial conduct authority in the UK like city index, IG, etoro and XTB all offer the cryptocurrencies bitcoin, bitcoin cash, ethereum, ripple and lite coin for traders.

All five of these coins are in the top 10 cryptocurrencies based on market cap according to coinmarketcap as of the 16th of november:

1. Bitcoin (BTC) is by far the most popular cryptocurrency for traders as it has the largest market cap, was the first successful cryptocurrency, is available on nearly every exchange, and has the most liquidity.

2. Ripple (XRP), known for its relationship with the banking industry and speculation for potential.

3. Ethereum (ETH). A popular cryptocurrency that is widely available across exchanges, and it is also highly speculative.

4. Bitcoin cash (BCH), bitcoin cash was created to all an increase the block size to 32MB from the original bitcoin in an attempt to improve the usability of the cryptocurrency.

5. Litecoin (LTC), is a cryptocurrency that provides instant and low-cost payments globally.

Differences between trading cryptocurrencies as a CFD and through an exchange

When trading cryptocurrencies on an exchange, the trader is actually buying and selling the crypto asset. When a trader places a buy order and it’s fulfilled, they actually gain possession of the crypto asset and can send it to their personal wallet, spend it, transact it, etc.

When trading cryptocurrencies by using contracts for difference (cfds), the trader is simply speculating on the price movements. They do not actually buy or sell the crypto asset itself, but rather a contract on the price of the crypto asset.

For example, when trading with XBT, a CFD broker, buying 1 bitcoin would require the nominal value of 1 lot with 1:2 (50%) leverage. Essentially, the trader only has to put down a fraction of what 1 bitcoin costs in order to speculate on its price.

While buying 1 bitcoin on a cryptocurrency exchange, they would require the full price amount of 1 bitcoin, say $6500. Upon buying this bitcoin, it will be transferred to the trader’s exchange wallet. The trader can then choose to trade it again or send it to their own personal wallet.

Also, if the price of bitcoin went up 10% when trading a bitcoin CFD on leverage, the trader would receive a larger profit on their money than a trader who actually bought the bitcoin on an exchange. However, the same is true if the price of bitcoin drops 10%, the CFD trader can lose more money than the exchange trader because they are using leverage to trade.

Why choose IG

for trading cryptos?

IG scored best in our review of the top brokers for trading cryptos, which takes into account 120+ factors across eight categories. Here are some areas where IG scored highly in:

- 44+ years in business

- Offers 10,000+ instruments

- A range of platform inc. MT4, mac, web trader, L2 dealer, tablet & mobile apps

IG offers four ways to tradeforex, cfds, spread betting, share dealing. If you wanted to trade BITCOIN

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

IG have a AAA trust score. This is largely down to them being regulated by financial conduct authority and ASIC, segregating client funds, being segregating client funds, being established for over 44

Trust score comparison

| IG | XTB | avatrade | |

|---|---|---|---|

| trust score | AAA | AAA | AAA |

| established in | 1974 | 2002 | 2006 |

| regulated by | financial conduct authority and ASIC | financial conduct authority | central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of IG vs. XTB vs. Avatrade

Want to see how IG stacks up against XTB and avatrade? We’ve compared their spreads, features, and key information below.

Best bitcoin brokers 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Now over twelve years old, bitcoin continues to grow and mature as an alternative asset. After peaking at over $18,000 per coin in late 2017, bitcoin retreated in price, then surged back to claim record price highs above $28,000 in late december 2020. As of publishing, the total value of all bitcoin is nearly $500 billion.

This guide explains what bitcoin is, how to buy bitcoin, and summarizes the best cryptocurrency brokers to trade bitcoin cfds.

What is bitcoin?

Bitcoin is a form of public internet money or electronic cash, known as cryptocurrency. It was first launched on january 3rd, 2009 after its design was published in a white paper. Bitcoin’s supply is limited, and every bitcoin comes into existence through mining, where anyone from the public can verify transactions to help secure the network.

Thanks to its use of blockchain technology, all transactions are public. Furthermore, bitcoin is highly-resistant to any form of censorship, and forged transactions are impossible.

Best bitcoin brokers for 2021

Based on over 105 different variables, here are the best forex brokers to buy cryptocurrency, such as bitcoin.

- Etoro - best overall for crypto trading

- Swissquote - trusted global brand, diverse offering

- IG - excellent offering, most trusted

- City index - great all-round offering

- Avatrade - multiple trading platform options

- XTB - best customer service, great platform

- HYCM - over 60 crypto cfds offered

Best overall for crypto trading - visit site

Etoro is excellent for cryptocurrency trading and copy trading and is our top pick for both categories in 2021. Furthermore, etoro offers a user-friendly web platform and mobile app that is great for casual investors, including beginners. (75% of retail investor accounts lose money) read full review

Trusted global brand, diverse offering

Traders willing to pay a premium to have their brokerage account held with a swiss bank choose swissquote for its competitive, multi-asset offering. Swissquote's cryptocurrency trading and wallet service are available from its etrading account, but is segmented away from its forex and CFD trading offering. (79% of retail investor accounts lose money) read full review

Excellent offering, most trusted - visit site

IG is the ultimate forex broker, finishing 1st overall in our 2021 ranking. Alongside finishing third for platforms & tools and second for research, IG finished best in class (top 7) for cryptocurrency trading, offering of investments (19,000+ tradeable instruments), commissions & fees, education, mobile trading, and professional trading. (75% of retail investor accounts lose money) read full review

Great all-round offering - visit site

Backed by GAIN capital, city index is a trusted brand that traders choose for its advanced trading platforms, excellent mobile app, diverse market research, education, and extensive range of markets. (73% of retail investor accounts lose money) read full review

Multiple trading platform options - visit site

Avatrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found avatrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. (73% of retail investor accounts lose money) read full review

Best customer service, great platform - visit site

As a trusted multi-asset broker, XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the xstation 5 trading platform. 25 cryptocurrencies are offered. (82% of retail investor accounts lose money) read full review

Over 60 crypto cfds offered - visit site

While its storied history is impressive, when it comes to trading forex and cfds across its global brands, HYCM fails to impress. Effective spreads are high across all account options, and research and education are sub-par. That said, HYCM offers over sixty cryptocurrency CFD pairs. (71% of retail investor accounts lose money) read full review

How do you buy bitcoin?

There are three primary ways to buy and sell cryptocurrencies like bitcoin:

- 1. Buy bitcoin (the underlying asset) - the most common way to buy bitcoin is to buy physical bitcoin from an online bitcoin exchange such as etoro. Your bitcoin is then held and secured in a digital wallet provided by the broker.

- 2. Buy a bitcoin CFD (contract for difference) - another popular way to trade bitcoin is to use cfds. With a CFD, you do not own the underlying bitcoin. Instead, you are betting on the direction that bitcoin’s price will go, either up or down, and profiting when you are right.

- 3. Buy an exchange-traded note (ETN) - while far less common and not available in many countries, exchange-traded notes (etns) are very slowly growing in popularity. Etns are similar to exchange traded funds (etfs), meaning they trade like stocks on a formal stock exchange. Like etfs, etns aim to mirror the price of the underlying asset they track. For more on bitcoin etns, including pros and cons, see this guide from xena exchange and this guide from ETF.Com.

How much does it cost to trade bitcoin?

Fees for buying bitcoin can become quite high across many websites and un-regulated exchanges, which is why we only suggest using a regulated broker. While fees may vary to buy bitcoin, the costs will consist of any per-trade commission, along with the difference between the bid/ask price, known as the spread.

The fees to trade bitcoin generally start at anywhere from 0.002% to as much as 2% of the trade value, depending on where you trade and the trade size.

Brokers that charge a commission will usually have lower spreads, while commission-free brokers will have higher spreads to make up for the difference. For example, if you buy $25,000 worth of a bitcoin CFD, with a spread of $50, that would be commission equivalent 0.002% of the trade value. In other words, whether via spread or commission, bitcoin involves trading costs.

What does a bitcoin broker do?

Bitcoin brokers enable you to buy or sell cryptocurrency. Without a broker, you cannot safely trade cryptocurrencies like bitcoin. To avoid scams, using a trusted broker is crucial when you are trading bitcoin.

What is the best forex broker to trade bitcoin?

For bitcoin CFD trading, including the ability to go long or short, we recommend forex brokers such as IG or city index due to their competitive pricing. Conversely, traders who wish to purchase the underlying physical bitcoin will find that etoro is a great option, followed by swissquote bank.

Which forex broker offers the most cryptocurrencies to trade?

Our research found that etoro offers the most cryptocurrency pairs to trade. With etoro, investors can buy and sell bitcoin (underlying asset), trade crypto cfds, and even copy trade other investors. Behind etoro, other crypto brokers that offer dozens of cryptocurrency cfds to choose from include XTB and HYCM.

Which crypto exchange is the safest?

Among brokers offering bitcoin underlying, swissquote, regulated as a swiss bank, is the safest broker. Founded in 1996, swissquote is publicly-traded (SIX: SQN) and regulated in four tier-1 jurisdictions. Behind swissquote, IG is another safe broker for bitcoin trading. While not a regulated swiss bank, IG is publicly traded (LON: IGG) and regulated in six tier-1 jurisdictions.

How much is one bitcoin worth?

Powered by blockchain technology, the price of one bitcoin reached a new all-time high above $28,000 in december 2020. The price gains were mostly attributed to new institutional investors entering the market and buying bitcoin.

I first wrote about cryptocurrencies in 2013 when bitcoin was still a novelty. Yet, as I’m writing this, the combined market cap of cryptocurrencies is over $600 billion, with bitcoin accounting for over 70%. According to data from coinmarketcap, the price of bitcoin fluctuates widely across various trading venues.

Is buying bitcoin risky?

Despite the potential for large gains, buying bitcoin remains risky. The main risk is significant volatility (price swings). For example, if you buy bitcoin and the price drops by a lot, it can create a substantial loss of your money. Adding any leverage (trading with borrowed money) will only further increase the risk when buying bitcoin.

Also, bitcoin remains a complex financial product. Many investors have lost money by losing their private keys, whether through exchange hacks or not securing them properly in self-hosted wallets. Using a regulated, reputable broker is essential for safely trading bitcoin.

How do I know if a crypto broker is regulated?

To avoid scams, you should only use regulated bitcoin brokers. To verify a broker's regulatory status, first, determine the broker's legal name and country, then find the appropriate regulator website to look them up. For example, a broker in the UK must be authorized and regulated by the financial conduct authority (FCA). Here on forexbrokers.Com, we track, rate, and rank brokers across 20 international regulators.

How do you sell bitcoin short?

To speculate that bitcoin's price will fall, you must open a forex brokerage account with a broker that offers bitcoin cfds. Using a contract for difference (CFD), you can open a sell order (bet the price will go down) and then place your trade. To make a profit, the price of bitcoin must fall. If bitcoin rises in price, you will lose money.

If cfds are not available, using a futures or options contract can be an alternative way to bet against bitcoin. However, bitcoin futures and options are very complex instruments, not widely available, and should only be traded by professionals.

Should I buy physical bitcoin or use cfds to trade bitcoin?

If you are a long-term cryptocurrency investor, buying the underlying physical bitcoin is the safest and lowest-cost way to invest in bitcoin. For more active, short term trading, contracts for difference (cfds) can be suitable. Just remember, cfds are not ideal for holding long-term positions (months or years) because the financing charges add up.

Is trading cryptocurrency legal?

In some jurisdictions, cryptocurrency is banned or illegal to purchase, trade, or own. Meanwhile, in other countries, it is perfectly legal. For example, in the united states (US) and united kingdom (UK), it is legal to buy cryptocurrency from regulated brokers. However, cfds are illegal to trade in both countries. The UK ban on bitcoin cfds went into effect on january 6th, 2021.

How do you safely store bitcoin?

If you do not want to keep your bitcoin with your online broker, you need to store it safely. To secure your bitcoin, you must choose a hot (online) or cold self-hosted (offline) wallet.

Personally, for a hot wallet (online, internet-connected), I use blockchain.Com, which provides a mobile and web-based version. For cold storage, I use ledger, a hardware device that allows you to keep the bitcoin private key offline (including creating a backup recovery phrase in written format).

Do I need a broker to buy bitcoin?

Yes, always use a regulated bitcoin broker to buy bitcoin. Using a regulated broker, you will protect yourself from scams, and your bitcoin will be secure. To avoid scams, never buy bitcoin from someone directly on a third-party website or marketplace.

Summary

Here's a summary of the best forex brokers for crypto trading.

Read next

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

So, let's see, what was the most valuable thing of this article: compare the best cryptocurrency brokers for 2021. Read our cryptocurrency brokers guide. Our pros compare and list the top trading cryptocurrency brokers. At online cryptocurrency broker

Contents of the article

- Real forex bonuses

- Top cryptocurrency brokers for 2021

- Best cryptocurrency brokers guide

- Are you interested in investing in cryptocurrency?

- Defining cryptocurrencies

- The important characteristics of the...

- No third party involved

- Cryptocurrencies have more transparency

- Decentralized

- Blockchain definition

- Cryptocurrency brokers

- What is cryptocurrency?

- Cryptocurrency wallets

- Cryptocurrency exchanges

- The cryptocurrency mining

- Cryptocurrency wallet

- Cryptocurrency exchange

- Cryptocurrency brokers verdict

- Reputable cryptocurrency brokers checklist

- Top 15 cryptocurrency brokers of 2021 compared

- Top 10 online cryptocurrency trading brokers

- How to get started in cryptocurrency trading

- What is cryptocurrency?

- What are cryptocurrencies used for?

- What is the difference between bitcoin and...

- What is the difference between a cryptocurrency...

- Trade cryptocurrency online using CFD services

- Trading cryptocurrencies – getting started with...

- How to make money trading crypto

- How to choose the best cryptocurrency trading...

- Bitcoin brokers: top 5 cryptocurrency brokers 2020

- On this page:

- Our recommended bitcoin broker for 2020

- Top 5 cryptocurrency brokers 2020

- Best online brokers for buying and selling...

- Advertiser disclosure

- How we make money.

- Editorial disclosure.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Where can you buy and sell cryptocurrencies?

- Overview: best brokers for cryptocurrency trading

- Bottom line

- Compare cryptocurrency brokers

- We found 13 broker accounts (out of 147)...

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Avatrade

- Plus500

- Etoro

- City index

- Easymarkets

- Spreadex

- Admiral markets

- Trade.Com

- What are cryptocurrencies?

- What is blockchain?

- What is mining?

- What is a cryptocurrency wallet?

- What is an ICO?

- What is a token?

- What is a smart contract?

- What is a cryptocurrency exchange?

- The volatility of cryptocurrency

- What are the top cryptocurrencies for traders

- Differences between trading cryptocurrencies as a...

- Why choose IG for trading cryptos?

- A comparison of IG vs. XTB vs. Avatrade

- Best bitcoin brokers 2021

- What is bitcoin?

- Best bitcoin brokers for 2021

- How do you buy bitcoin?

- How much does it cost to trade bitcoin?

- What does a bitcoin broker do?

- What is the best forex broker to trade bitcoin?

- Which forex broker offers the most...

- Which crypto exchange is the safest?

- How much is one bitcoin worth?

- Is buying bitcoin risky?

- How do I know if a crypto broker is regulated?

- How do you sell bitcoin short?

- Should I buy physical bitcoin or use cfds to...

- Is trading cryptocurrency legal?

- How do you safely store bitcoin?

- Do I need a broker to buy bitcoin?

- Summary

- Read next

- Methodology

- Forex risk disclaimer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.