Jp market deposit bonus

For a very limited time we will be offering 100% bonus on ALL deposits, even ones below R3’000!

Real forex bonuses

Please note that this is a very limited time, so get in quick! When this expires, the minimum will be R3’000 and up. Just a massive 100% bonus on ALL deposits over R3’000 up to a whopping R140’000 or USD equivalent! The bonus only applies for deposits made through the mobile app or the online portal.

JP markets 100% deposit bonus

Just a massive 100% bonus on ALL deposits over R3’000 up to a whopping R140’000 or USD equivalent! The bonus only applies for deposits made through the mobile app or the online portal.

For a very limited time we will be offering 100% bonus on ALL deposits, even ones below R3’000! Please note that this is a very limited time, so get in quick! When this expires, the minimum will be R3’000 and up.

- Make a deposit of at least R3’000 and you will automatically be given the same value in additional credit.

- The bonus will stay in your account for 90 days, and withdrawals will only effect your bonus as a percentage instead of removing the whole thing.

- The bonus will be running until the end of june 2019 so get your deposit in before then.

- By continuing to participate in the bonus promotions you agree to the terms and conditions both as listed below and on our website.

- For the duration of this promotion, a 100% deposit bonus will be applied to all deposits of R3 000 and above, up to a cumulative maximum of $10 000 or equivalent per trading account.

- Due to the nature of the MAM system, no MAM clients will qualify for any bonus.

- The bonus is directly linked to the qualifying deposit – the bonus will be transferred proportionally in the event of any inter-account transfers, and any withdrawals will result in the bonus being reduced by an amount equal to the withdrawal. Your bonus will be reduced with any withdrawal, irrespective of whether this is a profit or capital withdrawal.

- This bonus is intended as a trading credit only and may not be withdrawn. Equally, should your balance drop below the bonus amount, the bonus will be adjusted accordingly.

- Bonus expires 90 days after date of issue therefore the company has the right to amend, alter or terminate this bonus scheme at its sole discretion, and at any time without notice.

- Should your account be stopped out, the negative balance protection feature will be applied and any bonus removed, resulting in a zero balance / equity

- The company accepts no liability whatsoever for any loss resulting from the stop out of open positions where the company has removed the bonus scheme. Please make careful note of any expiry dates and ensure you have sufficient equity to maintain any open positions should the bonus be withdrawn.

JP markets 100% deposit bonus

Just a massive 100% bonus on ALL deposits over R3’000 up to a whopping R140’000 or USD equivalent! The bonus only applies for deposits made through the mobile app or the online portal.

For a very limited time we will be offering 100% bonus on ALL deposits, even ones below R3’000! Please note that this is a very limited time, so get in quick! When this expires, the minimum will be R3’000 and up.

- Make a deposit of at least R3’000 and you will automatically be given the same value in additional credit.

- The bonus will stay in your account for 90 days, and withdrawals will only effect your bonus as a percentage instead of removing the whole thing.

- The bonus will be running until the end of june 2019 so get your deposit in before then.

- By continuing to participate in the bonus promotions you agree to the terms and conditions both as listed below and on our website.

- For the duration of this promotion, a 100% deposit bonus will be applied to all deposits of R3 000 and above, up to a cumulative maximum of $10 000 or equivalent per trading account.

- Due to the nature of the MAM system, no MAM clients will qualify for any bonus.

- The bonus is directly linked to the qualifying deposit – the bonus will be transferred proportionally in the event of any inter-account transfers, and any withdrawals will result in the bonus being reduced by an amount equal to the withdrawal. Your bonus will be reduced with any withdrawal, irrespective of whether this is a profit or capital withdrawal.

- This bonus is intended as a trading credit only and may not be withdrawn. Equally, should your balance drop below the bonus amount, the bonus will be adjusted accordingly.

- Bonus expires 90 days after date of issue therefore the company has the right to amend, alter or terminate this bonus scheme at its sole discretion, and at any time without notice.

- Should your account be stopped out, the negative balance protection feature will be applied and any bonus removed, resulting in a zero balance / equity

- The company accepts no liability whatsoever for any loss resulting from the stop out of open positions where the company has removed the bonus scheme. Please make careful note of any expiry dates and ensure you have sufficient equity to maintain any open positions should the bonus be withdrawn.

$25 NO-deposit trading credit – markets.Com

Takes nothing to start live trading with $25 NO-deposit credit offered by markets.Com for FREE trading. Let’s trade cfds with this non-deposit promo without any finance from your own. All its require to open a real account and get $25 trading-credit for FREE – where no deposit required! After, complete the registration procedure money will be added to the account and available for live trading. NOTE – this NO deposit offer is not available for the countries listed below in the details section. Also, it requires some deposit to withdraw both credit and profits.

Get $25 NO-deposit for risk-FREE trading*

Joining link: non-deposit

Ending date: december 31, 2017

Offer is applicable: new client

How to apply:

- Register an account

- Verify phone no.

Withdrawal: need further deposit in order to withdraw to credit, and it’s profits.

More details – markets.COM NO deposit promotion

Get some extra offers like personal 1-on-1 training, 12 educational online video sessions.

Also, get an ebook for trading.

The promotion can be terminated anytime without such notice.

This promotion is not available for the traders of the countries bellow.

Anguilla, azerbaijan, bahamas, bangladesh, bermuda, bhutan, bolivia, british indian ocean territory, brunei darussalam, burundi, cambodia, cameroon, central african republic, chad, colombia, comoros, cyprus, djibouti, dominica, dominican republic, egypt, equatorial guinea, ethiopia, faroe island, gabon, gambia, ghana, grenada, guinea, guinea-bissau, india, indonesia, jersey, kenya, korea democratic people of, korea republic of, kyrgyzstan, lao people democratic republic, lebanon, lesotho, liberia, libya, madagascar, malawi, marshall islands, mayotte, mongolia, morocco, mozambique, namibia, niger, nigeria, pakistan, philippines, russian federation, rwanda, saint kitts and nevis, saint lucia, samoa, sao tome and principe, seychelles, sierra leone, somalia, south sudan, sudan, suriname, tajikistan, united republic of tanzania, togo, trinidad and tobago, tunisia, turkey, turkmenistan, ukraine, uzbekistan, vietnam, zambia, zimbabwe.

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

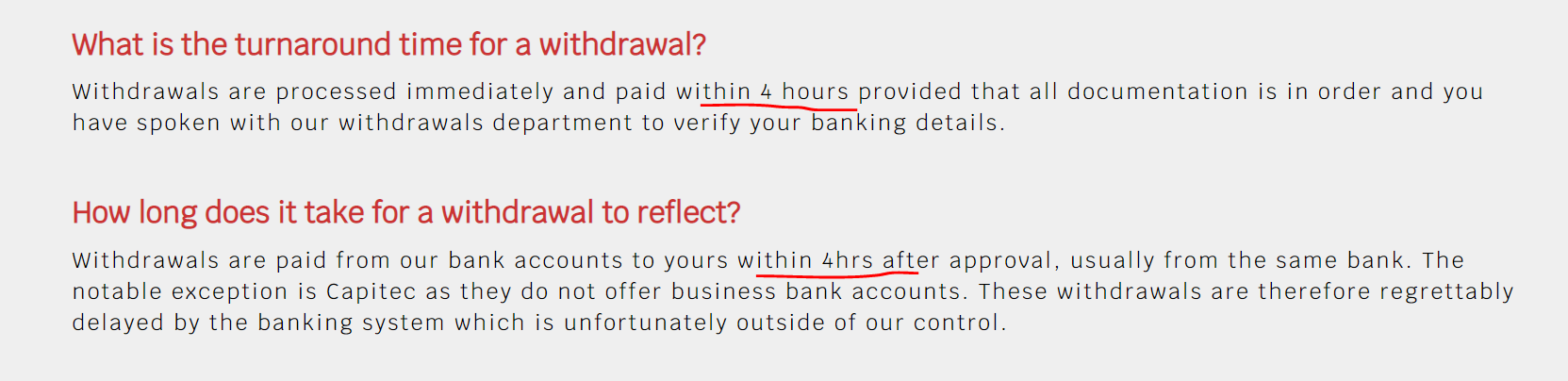

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Jp market deposit bonus

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

JP markets review

JP markets is among the many forex markets that are increasing in popularity. It gives its clients a single type of account with variable spreads, as well as additional benefits. However, the site does not allow the use of (EA) automated strategies, scalping and hedging.

Who is behind JP markets?

Established in 2016, JP markets is a forex broker that has its base in south africa, and happens to be the leading african and south african forex broker, with services expanding into other countries such as bangladesh, swaziland, kenya and pakistan.

The company operates under approval from the financial services board (FSB), south africa, FSP 46855. This gives the technology and platform allowing african-based clients to trade successfully in forex markets around the world.

JP markets focuses on assisting clients at a localized level through customer service as well as tools that can assist in succeeding on that front. The company prides itself on being the only brokerage worldwide that gives interest on trading accounts (this is subject to a specific minimum balance), as well as other industry firsts and benefits to various clients.

The founder is a south african entrepreneur, justin paulsen. He has extensive knowledge on the financial sector, having obtained a degree in economics and finance from the university of cape town. He has also worked with several brokers and forex agencies before setting up the company.

Trading services offered

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform.

You may wonder why the base is in south africa. One reason is that many investors view south africa as a country with great potential, since it is among the most developed countries on the continent. The regulator, FSA, has enforcing powers that allow it to deal with breaches in forex brokerage, while it also runs the office of the omud for financial services providers, which is a customer complaints service.

Regulation within the country is not among the best in the world, though there is some level of reliability in the sector. If you are a local broker with a trading license, you need to keep all your client funds in recognized banks in the country within segregated accounts.

Advantages of MT4 trade platform

As the industry standard platform, MT4 lends itself to various traders as an easier alternative, thanks to the richness of its features. It places itself among the leading platform in online trading due to its foreign exchange agency model implementation, unconventional organization of trading, as well as competitive assessments.

You can use algorithmic traders as well as expert advisors (eas), which automate your exchange and make the process easier for you. MT4 allows you to see the marketplace you are dealing with, all within real time, highly accurate and impeccably judge all your exits and entrances.

Accounts available on the platform

Clients have a single account type to choose, and this account comes with no commission fees imposition, fixed spreads, STP (straight through processing) market execution and leverage that reaches a maximum of 1:500. You can get PAMM services as well.

Straight through processing

This service means that the forex broker will send the customer’s order directly to larger brokers or banks without the order passing through a dealing desk. That implies that there are no delays in the process and the processing of transactions is faster.

It has several advantages, which include:

STP brokers make their money through addition of small commissions, which are markups to the spreads

The losses of the client are not the profits of the broker

When the trader loses or wins, the exact markup will go to the broker, so this eliminates conflict of interest

A related aspect to STP is NDD (no dealing desk), which gives brokers access to the inter-bank forex markets. In addition, this eliminates conflict of interest, filling orders and re-quotes.

Deposit and withdrawal options

The platform does not offer a wide range of deposit options. The bank option is ned bank, with the deposit details. Keep in mind that the south african reserve bank (SARB) will always convert international payments to their base rate. Other options include bitcoin, credit and debit cards, neteller and skrill.

You need an initial deposit minimum of R3500, and this is a reasonable amount especially when you compare it to other south african brokers. In addition, allocations of payments can take a maximum of 24 hours on business days (from monday to friday).

An interesting aspect to JP markets is the allowance for sending withdrawal requests through whatsapp, which is unseen on other platforms. The withdrawals are easy and fast to process (the process takes about 24 hours), and you can do the process on official working days from 9am to 5pm.

The platform uses secure and safe ways to send you your money, while all transactions undergo rigorous processing to ensure your money stays safe.

The option is through local bank transfer, as the site does not allow e-wallets or any other mediums of withdrawal. The time it takes to receive funds depends on the bank you use. For instance, standard bank, ABSA, nedbank and FNB allow you to get your money within the same day, while other banks could take up to two days.

As with any other withdrawal process, you need to have proof of documentation before you submit your withdrawal request. This includes scanned copies of your ID, bank statements and proof of address, all confirming your details as per regulations from the FSB.

Keep in mind that all withdrawals that you make through credit cards have an extra fee of R50. For the case of bank transfers, there are no charges for withdrawals, but you are liable for any fees that the individual bank charges in the transaction, including the use of intermediaries.

Commissions, leverages and spreads

The maximum amount of leverage you can get is 1:500, which many investors consider high, even with other brokers offering higher or similar rates.

Note that with higher leverage comes higher risks of losses, and this is the reason many jurisdictions set caps on leverage rates.

Any promotional bonuses?

There are a few promotions that the company offers, which include:

30% welcome on deposit bonus, and this is valid for 60 days

Currently, the minimum amount that qualifies you for any bonus is R3000. There is also not much information regarding bonuses.

The platform does not charge you extra commission fees, which may be a good thing. However, we do not like the spreads, as we find them too wide to be competitive – they are 2.4 pips on average for USD/EUR.

Even though fixed spreads are wider than floating ones generally, many other brokers will offer you a better deal.

Pros of the JP markets platform

The FSB regulates its activities

MT4 is available on the site

Same day deposits and withdrawals are possible

You can trade in rand, other than USD or EUR

There is a limited choice of trading platforms

The spreads are too wide

You cannot use eas, hedging or scalping techniques on the platform

Final thoughts

JP markets is a CFD south african broker and forex company that the FSA regulates actively. They support the MT4 platform, making them easy to use for many traders. However, the spreads are higher than the average, and this unfortunately places many restrictions on trade.

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

Money crashers

What do you want to

do with your money?

- Make money

- Careers

- College & education

- Small business

- Extra income

- Manage money

- Banking

- Budgeting

- Taxes

- Giving

- Save money

- Frugality

- Shopping

- Deals

- Borrow money

- Get out of debt

- Credit cards

- Bankruptcy

- Mortgage

- Loans

- Protect money

- Estate planning

- Insurance

- Legal

- Scam alert

- Invest money

- Bonds

- Retirement

- Real estate

About money crashers

- Credit cards

- Cash back

- Low APR interest

- Travel rewards

- Hotel rewards

- Gas rewards

- Student

- Business

- Secured

- Banking

- New bank account promotions

- Best online banks

- Free checking accounts

- High-yield checking accounts

- Rewards checking accounts

- High-yield savings accounts

- Best money market accounts

- Highest-interest CD rates

- Best business checking accounts

- Free business checking accounts

- College student checking accounts

- Bank accounts for kids

- Loans

- Mortgage

- Personal loans

- Family & home

- Kids & parenting

- Home improvement

- Relationships

- Estate planning

- Investing

- New brokerage account promotions

- Best online stock brokers

- IRA accounts

- Stock brokers for beginners

- Free stock trading

- Stock screeners

- Fractional shares of stock

- Stock picking services

- Micro-investing apps

- Robo advisors

- Options trading platforms

- Small business

Recent stories

13 best personal loan companies of 2021

8 best stock brokers that allow you to invest in fractional shares

15 best rewards checking accounts of 2021

Advertiser disclosure: the credit card and banking offers that appear on this site are from credit card companies and banks from which moneycrashers.Com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Moneycrashers.Com does not include all banks, credit card companies or all available credit card offers, although best efforts are made to include a comprehensive list of offers regardless of compensation. Advertiser partners include american express, chase, U.S. Bank, and barclaycard, among others.

Explore

Featured content

14 best cash-back credit cards – reviews & comparison

Featured content

14 best cash-back credit cards – reviews & comparison

Featured content

9 best low APR interest credit cards – reviews & comparison

Featured content

18 best travel rewards credit cards – reviews & comparison

Featured content

15 best hotel rewards credit cards – reviews & comparison

Featured content

11 best gas credit cards – reviews & comparison

Featured content

12 best credit cards for college students – reviews & comparison

Featured content

26 best small business credit cards – reviews & comparison

Featured content

10 best secured credit cards to rebuild credit – reviews & comparison

Share this article

Dig deeper

Follow @moneycrashers

Trending articles

Why gas prices are rising so high – reasons for fluctuations

26 best new bank account promotions & offers – february 2021

13 best stock market investment news, analysis & research sites

13 best paycheck advance apps to help you make it to payday

7 best stock picking services of 2021

Become a money crasher!

Join our community.

11 best new brokerage account promotions & bonus offers – february 2021

Share this article

As a savvy investor, you’re no doubt aware dozens of banks and credit unions entice new business with account-opening promotions. Some reward first-time customers with bonuses worth hundreds of dollars just for opening an account and making qualifying deposits. The best land on our regularly updated roundup of the top new bank account promotions.

You’ve probably seen credit card issuers get in on the action too. Many of the best cash-back credit cards and travel rewards credit cards come with irresistible welcome offers, the best of which rival the most generous new bank account promotions.

If it’s been years since you switched brokerage firms or you’re entirely new to investing, you might be unaware america’s top self-directed and managed investment platforms also offer impressive new-account bonuses. Top-tier new brokerage account promotions dwarf the leading bank and credit card promotions — promising thousands to new customers bringing substantial assets to the table.

Best new brokerage account promotions (february 2021)

These are the best new brokerage account promotions from north america’s top online stock brokers for this month. All are subject to change, so check back often for updates.

Whichever you choose, pair your new brokerage account with a subscription to trade ideas, the most powerful paper trading and market research subscription around.

1. Acorns — $10 bonus

Open a new acorns account using the link below to earn a $10 credit. It’s that simple — no minimum deposit or balance required. You’ll receive the credit after completing your account registration.

Moving forward, acorns offers three attractively priced plans that support everyday money management, longer-term saving, and market investing:

- Lite. For just $1 per month, take advantage of a powerful investing platform (invest) that allows you to invest spare change left over from everyday purchases (round-ups) and earn bonus investments from more than 350 found money partners.

- Personal. For just $3 per month, acorns adds a tax-advantaged retirement account that updates regularly to match your goals and a checking account with 55,000+ fee-free atms worldwide and up to 10% bonus investments.

- Family. For just $5 per month, you’ll get everything included in the lower-priced plans, plus early, a kid-friendly investment account featuring automatic recurring investments, exclusive bonus investments, family-centered financial advice, and potential tax savings.

2. Robinhood — up to $200 (or more) in free stock

Open a new robinhood account and to get up to $200 (or more) in free stock. Here’s how it works:

- Apply for a new robinhood brokerage account and get approved.

- Robinhood adds 1 free share of stock worth between $2.50 and $200 (or more) per share, chosen randomly from its inventory of settled shares.

- You can hold the share indefinitely or sell it after 2 trading days.

Bear in mind that you may not receive the same stock as other applicants and your share’s value may fluctuate with market movements. Once open, use your account to trade stocks, etfs, and other market-traded instruments.

3. Webull — free stocks up to $3,700 total value & 3 months free level 2 advance (nasdaq totalview) subscription

Open and fund a new webull account with at least $100 to get up to four free stocks worth up to $3,700 in total. Participating stocks include google, facebook, procter & gamble, starbucks, kraft heinz, and snap.

Plus, sign up to receive a three-month level 2 advance (nasdaq totalview) subscription for free. Here’s how these promotions work:

Account opening bonus (2 free stocks)

Simply sign up and open a qualifying webull account to receive two free stocks valued between $2.50 and $250. You must complete the account opening process by the stated offer end date at the time you apply. This date is subject to change at webull’s discretion.

Deposit bonus (2 free stocks)

Make an initial deposit of $100 or more to your new account by the end of the offer period to claim two free stocks valued between $8 and $1,600 each per share.

Account opening bonus (nasdaq totalview subscription)

Sign up and open your account to receive a three-month level 2 advance (nasdaq totalview) subscription for free. After the promotional period ends, the standard subscription fee applies.

These offers apply only to webull cash and margin accounts.

4. Blockfi — up to $250 BTC bonus

Open and fund a blockfi interest account (BIA) for the first time and make qualifying deposits within the first 30 days of opening. In return, you could earn a special one-time bonus worth up to $250 BTC. The payout tiers work as follows:

- $15 BTC: deposit $25 to $249

- $20 BTC: deposit $250 to $999

- $40 BTC: deposit $1,000 to $4,999

- $75 BTC: deposit $5,000 to $9,999

- $150 BTC: deposit $10,000 to $19,999

- $250 BTC: deposit $20,000 or more

To ensure that you receive the bonus, you must maintain a crypto balance of $25 or greater through the 14th of the month two and a half months from your eligibility month (account opening month). Eligible payouts occur on a rolling basis on or about the 15th of every month.

5. Ally invest — up to $3,500 cash bonus

Open a new self-directed account with ally invest by march 31, 2021, and make a qualifying deposit of new money or assets to earn up to $3,500 bonus cash. The bonus thresholds are:

- $50: deposit $10,000 to $24,999 in new funds or assets.

- $200: deposit $25,000 to $99,999 in new funds or assets.

- $300: deposit $100,000 to $249,999 in new funds or assets.

- $600: deposit $250,000 to $499,999 in new funds or assets.

- $1,200: deposit $500,000 to $999,999 in new funds or assets.

- $2,500: deposit $1,000,000 to $1,999,999 in new funds or assets.

- $3,500: deposit $2,000,000 or more in new funds or assets.

To qualify for the bonus, you must fund the account within 60 days of opening. Once ally invest credits the bonus to the account, the combined bonus and qualifying deposit (less any trading losses) must remain in the account for 300 days. Otherwise, ally invest reserves the right to revoke the bonus.

Deposited funds must come from accounts that aren’t ally or ally subsidiary accounts. You must fund the new account with a minimum qualifying deposit of $10,000 or more to qualify for the minimum cash bonus.

The bonus is available to U.S. Residents, excluding current ally invest account holders, and ally invest account holders who closed their accounts within 90 days of applying.

Account transfer fee credit

Separately, ally invest credits up to $150 in transfer fees charged by other brokerages when you complete a first-time account transfer totaling $2,500 or more. That credit hits your account within 30 days of the transfer.

For more information about ally invest’s taxable brokerage accounts and iras with commission-free trades, read our ally invest review. To learn more about ally bank, ally invest’s parent institution, check out our ally bank review.

6. Citi wealth management — up to $3,500 cash bonus

Open a new eligible citi personal wealth management account by june 30, 2021, and make a qualifying deposit of new money or assets to earn a cash bonus up to $3,500. The bonus thresholds are as follows:

- $500: deposit $50,000 to $199,999 in new funds or securities.

- $1,000: deposit $200,000 to $499,999 in new funds or securities.

- $1,500: deposit $500,000 to $999,999 in new funds or securities.

- $2,500: deposit $1,000,000 to $1,999,999 in new funds or securities.

- $3,500: deposit $2,000,000 or more in new funds or securities.

To earn this bonus, you must do the following:

- Open and enroll your new citi private wealth management account

- Make the qualifying new money deposit within 2 months of account opening

- Enroll the account into e-delivery of statements within 2 months of account opening.

- Maintain the new funding at least through the end of the third month (statement cycle) after account opening.

Eligible funds must be new to citibank and can’t come from or be combined with funds from any other citi accounts. This offer is available to new citi private wealth management clients only.

7. M1 finance — up to $2,500 transfer bonus

Open a new M1 finance account and initiate an account transfer within 60 days of sign-up to earn a transfer bonus of up to $3,500.

The bonus thresholds for the cash bonus are:

- $40 bonus: transfer an account worth $10,000 to $19,999.99.

- $75 bonus: transfer an account worth $20,000 to $49,999.99.

- $150 bonus: transfer an account worth $50,000 to $99,999.99.

- $250 bonus: transfer an account worth $100,000 to $249,999.99.

- $500 bonus: transfer an account worth $250,000 to $499,999.99.

- $1,000 bonus: transfer an account worth $500,000 to $999,999.99.

- $2,500 bonus: transfer an account worth $1,000,000 to $1,999,999.99.

- $3,500 bonus: transfer an account worth $2,000,000 or more.

Your new M1 finance account type must match your old account type. The offer isn’t valid on ACH deposits, wire transfers or direct 401k rollovers. Once the transfer is received, you’ll receive payment within 90 days.

8. Betterment — up to 1 year managed free

Get up to one year managed free when you open a betterment robo-advisor account and make a qualifying deposit within 45 days. Bonus thresholds are:

- 1 month free: fund your account with $15,000 to $99,999 within the qualification period.

- 6 months free: fund your account with $100,000 to $249,999 within the qualification period.

- 12 months free: fund your account with $250,000 or more within the qualification period.

You can’t combine this offer with any other promotions, and it’s available to U.S. Residents only.

For more about betterment’s benefits, check out our lists of the best high-yield savings accounts and cash management accounts on the market today.

9. Sofi invest — win up to $1,000 in free stock

For a limited time, download the sofi invest app and open a new sofi active invest account for the chance to win up to $1,000 in free stock. Moving forward, enjoy commission-free stock trades and access to fractional shares in select securities with no account minimums.

Terms and conditions apply. See offer for details.

10. Charles schwab — up to $500 cash referral bonus

Open a new qualifying charles schwab account with a qualifying referral from an existing schwab client to earn a cash bonus of up to $500.

To qualify, ask a friend or family member with a schwab account to send you their unique referral code. Then use the code to open a new schwab account with an initial deposit or deposits totaling at least $1,000. Make one or more qualifying deposits within 45 days of your account opening date, and you’ll receive your cash bonus about a week later.

Your bonus amount depends on how much you deposit during the 45-day qualifying period:

- $100: deposit $1,000 to $24,999 in new money or assets.

- $200: deposit $25,000 to $49,999 in new money or assets.

- $300: deposit 50,000 to $99,999 in new money or assets.

- $500: deposit 100,000 and above in new money or assets.

Once your account is open, monthly fees may apply. Multiple members of the same household may qualify for bonuses individually, as long as they open separate schwab accounts.

11. Nvstr — up to $1,000 cash

Open a new nvstr account using this link to earn up to $1,000 in cash. There’s no minimum funding threshold or other hoops to jump through — just open your account, and nvstr rewards you with $10 to $1,000 cash.

There is one catch: nvstr chooses your reward amount at random, and it’s impossible to predict how much you stand to receive. Once the bonus is in your account, you must make at least one trade within three months and keep the bonus funds on deposit for a full year.

The cash offer is available to new nvstr users on live trading accounts only. Simulated trading accounts aren’t eligible.

Final word

If you’re a satisfied investor, you’d be forgiven for feeling no urgency to switch brokerages. Why fix something that’s not broken?

But the prospect of earning hundreds or thousands of dollars in brokerage bonuses is often reason enough.

Most of these brokerages take pains to ensure their new-account bonuses qualify as easy money. In many cases, moving assets to a newly opened account requires little more than completing an account application and authorizing an electronic funds transfer or asset rollover, a process that’s quick and painless enough to complete in a spare 15 minutes.

Even if you’re not ready to take advantage of these brokerage account bonuses, it still pays to add a review of the top brokerage promotions to your due-diligence to-do list for whenever you’re ready to start investing on a new trading platform.

Best no deposit bonus forex brokers 2021

The brokers below represent the best no deposit bonus forex brokers.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Cysec, FCA, FSA(SC), FSCA, labuan-fsa

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Ctrader, MT4, MT5, proprietary

Dealing desk, ECN, market maker, no dealing desk, STP

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Note: not all forex brokers accept US clients. For your convenience we specified those that accept US forex traders as clients.

Tickmill

Regulated by: cysec, FCA, FSA(SC), FSCA, labuan-fsa

Headquarters : 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill was founded in 2014 and is regulated by the UK financial conduct authority (FCA), the cyprus securities and exchange commission (cysec) and the seychelles financial services authority (FSA).

The broker provides more than 80+ CFD instruments to trade on covering forex, indices, commodities and bonds through three core trading accounts called the pro account, classic account and VIP account. They also offer a demo trading account and islamic swap-free account.

GO markets

Headquarters : level 22, 600 bourke street, melbourne, VIC 3000, australia

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Australian brokers are definitely making a name for themselves in the trading arena as some of the most reliable, intuitive and forward thinking firms around. This broker is no different with a wide variety of tools, assets and reasonable trading conditions.

GO markets pty ltd an ASIC regulated broker has been in operation since 2006. The head office is located in melbourne, australia. With over a decade of experience, GO markets has grown to become a leading broker with a huge client base from over 150 countries. GO markets offers forex, share cfds, indices, metals and commodities for trading on the MT4 and MT5 trading platforms.

Roboforex

Headquarters : 2118 guava street, belama phase 1, belize city, belize

The roboforex brand is operated by the roboforex group, and is located in belize. Roboforex began operations in 2009 and has grown in size and capacity. The brand offers over multiple trading instruments which include forex, stocks, indices, etfs, commodities, energies, metals and cryptocurrencies.

They also offer cutting edge platforms. Roboforex boasts of over 800,000 clients from 169 countries. They are both a dealing desk and non dealing desk broker offering ECN and STP trading accounts through their platforms. This means a different payment model to you the trader eg. Lower spreads for ECN accounts with some commissions to pay.

*leverage depends on the financial instrument traded and on the client’s country of residence.

Axiory

Headquarters : no.1 corner of hutson street and marine parade belize city, belize

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Axiory was founded in 2012 and is a trading name of axiory global ltd which is authorised and regulated by the international financial services commission (IFSC) of belize. The broker segregates client funds from their own and offers negative balance protection. The company is also audited by pricewaterhousecoopers and is a member of the financial commission.

Users can choose from three types of trading accounts called nano, standard and max to trade on 80 different markets covering forex and cfds on indices, energies, stocks and metals. Axiory offers maximum leverage of up to 1:500 and also provides access to islamic swap-free accounts and a demo trading account. Users can also access data regarding execution times and slippage distribution for even more transparency.

What is a no deposit forex bonus?

A no deposit forex bonus is a cash award that is deposited by the broker into the forex trader’s account, without requiring an initial deposit into the trading account by the trader.

Just like the deposit bonuses in forex (which require you to deposit first), the no-deposit bonus is used strictly for trading purposes and can only be withdrawn from the account on fulfillment of the broker’s trade volume requirements.

Typically, the no-deposit forex bonuses are not as large as the deposit bonuses. They range from between $10 and $200, depending on the broker. They are actually meant to introduce new traders into the world of real money trading and are not meant to be used for profit-oriented trading. Think of it as a form of live, real money practice account where you keep all the gains. If you lose money, you have lost nothing.

What should I do to get my bonus?

Most of the no-deposit forex bonuses in the market can be obtained as exclusive offers through affiliate partners of the forex brokers that offer them. The forex brokers who award the no-deposit forex bonuses directly are typically in the minority.

What is the difference between no deposit bonuses and deposit bonuses?

No-deposit forex bonuses do not require an initial deposit into the trading account before they are awarded. This factor distinguishes the no-deposit forex bonus from deposit bonus, which like the name implies, requires a deposit from the trader before it is awarded.

No-deposit forex bonuses are smaller in size as they mostly serve for live account practice.

What other bonus and promotion types do brokers offer?

Other bonuses and promotions may be given out by brokers occasionally.

- The cashback is the commonest bonus which a trader can get. Although this requires that some previous deposit would have been made by the trader, cashbacks are a good way to earn back any money that has been lost in previous trades. These are provided by brokers automatically without requiring further deposits.

- Trade contest awards do not require a previous deposit. You can participate in various trade contests on broker platforms for a share of the prizes. Cash prizes are usually awarded to traders as a no-deposit bonus. All you need is to ensure your account KYC documents are in place and you can claim your award if you win.

- Some brokers provide traders with tools they need to trade with on fulfillment of certain conditions such as attaining certain trade volumes within a specified time frame.

Conclusion

Are you looking for the best no deposit bonus forex brokers for 2017? Here we show a list of these brokers which we have compiled after careful evaluation of various candidates. Ensure you use the no-deposit forex bonus wisely and use it to enhance your live account trading experience.

�� forex no-deposit bonuses 2021

| nodeposit bonus | bonus | valid till |

|---|---|---|

| 7bforex | no-deposit bonus | $25 | dec/31/2021 |

| AGEA | $5 no-deposit bonus | $5 | dec/31/2021 |

| almahfaza | phone verification bonus (in arabian) | $50 | dec/31/2021 |

| arum trade | “first investment” no-deposit bonus | $30 | dec/31/2021 |

| atlasforex | $50 USD no-deposit bonus (in japanese) | $50 | jan/31/2021 |

| bityard | beginner rewards | 4 USDT | dec/31/2021 |

| bullseye markets | $25 USD no-deposit bonus | $25 | dec/31/2021 |

| bybit | $10 registration bonus | $10 | dec/31/2021 |

| bybit | social media bonus | $5 | dec/31/2021 |

| bybit | survey bonus | $5 | dec/31/2021 |

| cfmerchants | $50 welcome no deposit bonus | $50 | dec/31/2021 |

| corsa capital | $100 no-deposit fixed welcome bonus | $100 | dec/31/2021 |

| cube global | $20 no-deposit bonus | $20 | dec/31/2021 |

| CWG | hi account! $50 USD no-deposit bonus | $50 | dec/31/2021 |

| elite fin FX | free $20 no-deposit bonus | $20 | dec/31/2021 |

| emporio trading | $30 USD no-deposit bonus | $30 | dec/31/2021 |

| FBS | level up bonus FREE $140 | $140 | dec/31/2021 |

| FBS | no-deposit "trade 100 bonus" | $100 | dec/31/2021 |

| FBS | quick start $100 no-deposit bonus | $100 | dec/31/2021 |

| forex.Ee | 15 USD welcome no deposit bonus | $15 | dec/31/2021 |

| forexchief | no deposit bonus $50 (in indonesian) | $50 | dec/31/2021 |

| fortfs | $35 USD no-deposit welcome bonus | $35 | dec/31/2021 |

| freshcent | 300 cent bonus "start working with a gift!" | $3 | jan/31/2021 |

| freshforex | no deposit bonus $2021 | $2020 | feb/28/2021 |

| FX TRB | $50 no deposit welcome bonus (in thai) | $50 | dec/31/2021 |

| fxcess | $10 no-deposit email verification bonus | $10 | dec/31/2021 |

| fxcess | $15 no-deposit phone verification bonus | $15 | dec/31/2021 |

| fxgiants | email verification bonus | $30 | dec/31/2021 |

| fxgiants | phone verification bonus | $15 | dec/31/2021 |

| fxopen | $1 no deposit bonus for micro accounts | $1 | dec/31/2021 |

| fxopen | $10 no-deposit bonus | $10 | dec/31/2021 |

| fxoptexgroups | $30 USD free account | $30 | dec/31/2021 |

| fxplayer | $100 no-deposit bonus | $100 | dec/31/2021 |

| fxprivate | $10 "only for friends" no-deposit bonus | $10 | dec/31/2021 |

| fxprocent | $300 cents no deposit bonus | $3 | dec/31/2021 |

| FXQM | $30 USD welcome bonus | $30 | dec/31/2021 |

| gannmarkets | $30 welcome bonus | $30 | dec/31/2021 |

| GICM | $25 no deposit bonus | $10 | dec/31/2021 |

| global crypto exchange | subscribe for your 1000 FREE tokens | $100 | mar/20/2021 |

| GNT capital | $50 USD trading bonus | $50 | dec/31/2021 |

| GOFX | $30 free trading bonus (in thai) | $30 | dec/31/2021 |

| heart forex | $100 welcome bonus | $100 | dec/31/2021 |

| hexta prime | $30 USD no-deposit bonus | $30 | dec/31/2021 |

| instaforex | $3,500 startup no-deposit bonus | $3500 | dec/31/2021 |

| IUX market | account open bonus $30 | $30 | dec/31/2021 |

| kaje forex | $50 USD welcome no-deposit bonus | $50 | dec/31/2021 |

| meefx | welcome no-deposit bonus $5 USD | $5 | dec/31/2021 |

| mitrade | 50 USD trial bonus | $50 | dec/31/2021 |

| noble sky | USD 500 reward for login | $500 | dec/31/2021 |

| noble sky | welcome new year gift of USD 1000 | $1000 | mar/05/2021 |

| PPM PRIME | $40 free to trade no deposit bonus | $40 | dec/31/2021 |

| redstonefx | $88 no-deposit bonus | $88 | dec/31/2021 |

| roboforex | $30 welcome bonus | $30 | dec/31/2021 |

| seven capitals | new year´s exclusive real $100 account | $100 | jan/31/2021 |

| SFEX | $50 no-deposit welcome bonus | $50 | dec/31/2021 |

| sinosoft FX | trade free with $20 no-deposit bonus | $20 | dec/31/2021 |

| superforex | $50 no-deposit bonus | $50 | dec/31/2021 |

| templerfx | no deposit bonus 30$ | $30 | dec/31/2021 |

| tiomarkets | $25 USD no-deposit bonus | $25 | mar/31/2021 |

| tradehall | $50 welcome no-deposit bonus | $50 | dec/31/2021 |

| tradeland | $50 welcome no-deposit bonus | $50 | dec/31/2021 |

| traders trust | $100 USD no-deposit bonus | $100 | dec/31/2021 |

| unicorn brokers | $50 free bonus for afghanian customers | $50 | dec/31/2021 |

| upforex | $100 no-deposit welcome bonus | $100 | dec/31/2021 |

| velocity trades | $25 no deposit bonus | $25 | dec/31/2021 |

| windsor brokers | free account $30 | $30 | dec/31/2021 |

| world forex | $10 or $20 USD bonus | $20 | dec/31/2021 |

| world trade investment | $50 no-deposit bonus | $50 | dec/31/2021 |

| XM group | $30 no-deposit bonus | $30 | dec/31/2021 |

| xtreamforex | $25 no deposit bonus | $25 | dec/31/2021 |

Latest promotions:

Extra promotions:

Trader

Fxtm 50 doller bonus

http://www.Forextime.Com/refer-a-friend

Trader

Global crypto trading exchange

A safe, secure, regulated and complete cryptocurrency exchange

Subscribe for your 1000 FREE tokens ($100 value)

Bestforexbonus

FXTRB doesn't seem to have an english website version, or promotion tos for u to translate it.

Regretfully we're unable to find out about exact terms and conditions for this bonus.

Trader

FXTRB - $50 no deposit bonus

New clients only thailand ;

https://fxtrb.Com/promotions-2/

Trader

SFEX - $50 welcome no deposit bonus

When register using a partner’s link ;

https://www.Sfexvip.Com/activity/partner/language/en-us

Trader

Topfx - $50 no deposit bonus scheme

Trader

40 usd no deposit bonus ! Https://panel.Coinofa.Com/

Trader

Atlasforex - $50 no deposit bonus

Trader

Looking for powefull platform and leveraged crypto trading ? Https://www.Binance.Com/en/register?Ref=*****

use this refferal link, and get 10% kick back.

Trader

Hello everyone , I try this company bonus and make many withdrawal from it trader

Profitto ltd - $30 USD no deposit bonus

Malaysia and indonesia only ;

bonus end date/time 29th january 2021 11:59:59 GMT +8 ;

https://www.Profittoltd.Com/no-deposit-bonus/

Trader

GEMFOREX - 30,000 JPY no deposit bonus

Trader

Templerfx - no deposit bonus 30$!

Trader

Xm babbling broker. Big scammer rejected my withdrawal 27.90$

Trader

Cooin.Io - $20 crypto no deposit bonus

Trader

Ronex - $20 crypto no deposit bonus

Trader

Gannmarkets - welcome bonus 30 USD

Trader

Https://lirunex.Com/promotion/#iphone

Trader

Milton markets - welcome bonus $50

Withdrawal conditions: 10lots of transactions completed after deposit ;

https://miltonmarkets.Com/promotion/

Trader

Instaforex - $2000 startup no-deposit bonus

Trader

Freshforex - 300 USC no deposit bonus

The promotion is valid from december 11, 2020 to january 31, 2021 ;

https://freshforex.Com/company/news/news_35202.Html

Trader

Xtreamforex | $25 no deposit bonus

Getting ready to start your trading without committing an investment. No deposit bonus for newbies to try out services to start earning profit without risking any of their funds.

Bonus available for philippines clients:- no deposit bonus of amount $25 is available for philippines clients with live trading account with verified status. No need to deposit to claim the bonus.

Easy to claim:- register the live account, verify the trading account. Get the bonus by registering the live trading account.

Start your trading:- after getting the bonus you will able to start your trading to earn more profits with zero investment.

Start date to registration:- no deposit bonus account will start on 7th december 2020 for a limited time.

Maximum leverage is 1:400.

Trading account credited with $25 no deposit bonus is not eligible for commissions and ibrebates.

So, let's see, what was the most valuable thing of this article: just a massive 100% bonus on ALL deposits over R3’000 up to a whopping R140’000 or USD equivalent! The bonus only applies for deposits made through the mobile at jp market deposit bonus

Contents of the article

- Real forex bonuses

- JP markets 100% deposit bonus

- JP markets 100% deposit bonus

- $25 NO-deposit trading credit – markets.Com

- Get $25 NO-deposit for risk-FREE trading*

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Jp market deposit bonus

- JP markets review

- Who is behind JP markets?

- Trading services offered

- Accounts available on the platform

- Deposit and withdrawal options

- Commissions, leverages and spreads

- Pros of the JP markets platform

- Final thoughts

- Leave a reply cancel reply

- ������top broker 2020 SA������

- Money crashers

- Recent stories

- 13 best personal loan companies of 2021

- 8 best stock brokers that allow you to invest in...

- 15 best rewards checking accounts of 2021

- Explore

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Follow @moneycrashers

- Trending articles

- Why gas prices are rising so high – reasons for...

- 26 best new bank account promotions & offers –...

- 13 best stock market investment news, analysis &...

- 13 best paycheck advance apps to help you make it...

- 7 best stock picking services of 2021

- Become a money crasher! Join our community.

- 11 best new brokerage account promotions & bonus...

- Best new brokerage account promotions (february...

- 1. Acorns — $10 bonus

- 2. Robinhood — up to $200 (or more) in free stock

- 3. Webull — free stocks up to $3,700 total value...

- Account opening bonus (2 free stocks)

- Deposit bonus (2 free stocks)

- Account opening bonus (nasdaq totalview...

- 4. Blockfi — up to $250 BTC bonus

- 5. Ally invest — up to $3,500 cash bonus

- 6. Citi wealth management — up to $3,500 cash...

- 7. M1 finance — up to $2,500 transfer bonus

- 8. Betterment — up to 1 year managed free

- 9. Sofi invest — win up to $1,000 in free stock

- 10. Charles schwab — up to $500 cash referral...

- 11. Nvstr — up to $1,000 cash

- Final word

- Best no deposit bonus forex brokers 2021

- Tickmill

- GO markets

- Roboforex

- Axiory

- What is a no deposit forex bonus?

- What should I do to get my bonus?

- What is the difference between no deposit bonuses...

- What other bonus and promotion types do brokers...

- Conclusion

- �� forex no-deposit bonuses 2021

- Latest promotions:

- Extra promotions:

- Trader

- Trader

- Bestforexbonus

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

- Trader

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.