What is fbs pakistan

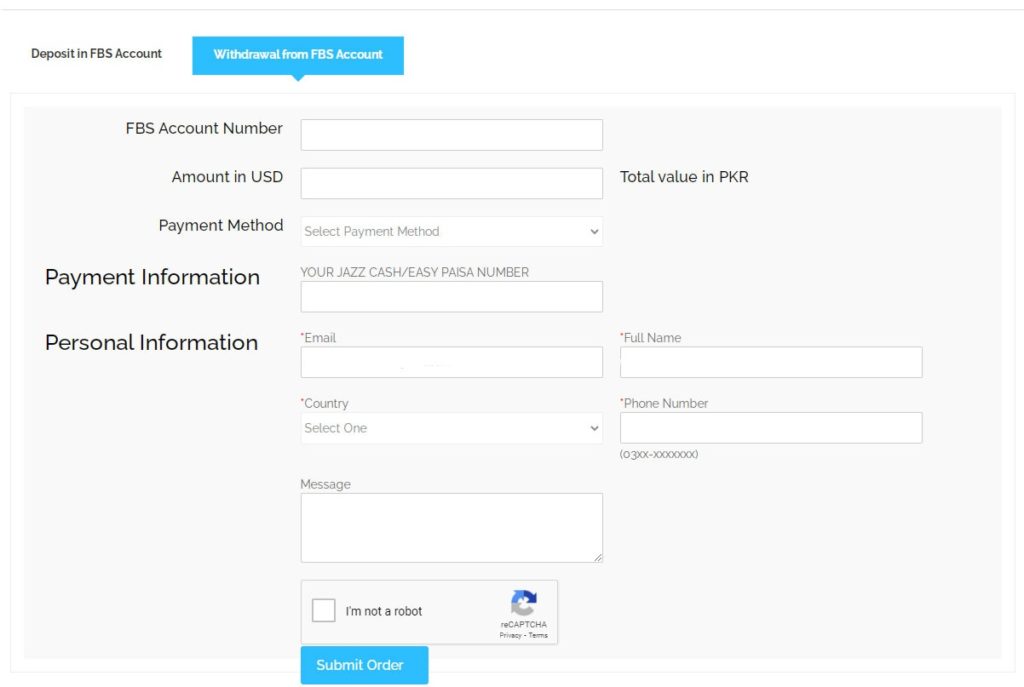

Now you need to “place new oder” in order to withdraw your earnings from FBS account (image below).

Real forex bonuses

- The cent (the common mini account) with a minimum deposit of $1

- Micro account with minimum deposit of $5

- The zero spread (for fast trading) with minimum deposit of $500

- Standard account for the experienced traders with the minimum deposit of $100

- The ECN account (full power of trading with ECN technologies) by depositing $1000.

How to start forex trading on FBS in pakistan?

If you are looking to start the forex trading on FBS in pakistan you are right here. FBS in pakistan is highly acclaimed forex broker for doing online trading across the world.

FBS is a well-recognized international online forex broker that holds the cysec license and also the official trading partner of FC barcelona.

FBS is serving its clients in the regions of asia, latin america, europe, and MENA, etc and is trading with the commodities and other financial products for currency, metals, and indexes trading for clients with diverse targets and backgrounds.

It comprises a low barrier to entry and top-ranking apps including metatrader4 and metatrader5. Over 11 years in the field, the FBS broker won 50 international awards, including best international forex broker, best forex brand, and most progressive forex broker europe.

FBS is the trouble-free and most suitable forex trading platform in pakistan allows the customers to trade in currency pairs, cfds, stocks and metals. It is one of the leading and renowned forex trading platforms globally, operating in more than 190 countries and also in pakistan with its full-fledge online website that is rendering its services in urdu language.

Although the forex trading is associated with real currencies and regulated by the rules and regulations. Traders can also make trading in stock, index, treasury, sector, commodity and cfds.

As a resident of pakistan you are allowed to do forex trading because the economy of pakistan keeps on growing and people are more interested to invest in forex market.

FBS in pakistan is doing trading and a large number of traders are associated with this platform. Trading with FBS in pakistan is extremely simple and a convenient way to earn handsome profit as it provides the trustworthy services of earning through forex trading.

FBS allows the customers and forex traders to register themselves on its platform by choosing any of the four accounts that are as follows:

- The cent (the common mini account) with a minimum deposit of $1

- Micro account with minimum deposit of $5

- The zero spread (for fast trading) with minimum deposit of $500

- Standard account for the experienced traders with the minimum deposit of $100

- The ECN account (full power of trading with ECN technologies) by depositing $1000.

FBS allows you to open the account with in two common types of currency such as USD and EUR. The forex traders in pakistan can join the FBS by depositing just $10 and after the deposit customers get 100% of their invested money amount.

So, you want to become a forex trader and interested to start trading with FBS in pakistan below we have compiled several steps that you need to follow to start trading.

First of all make yourself register by creating an account with FBS in pakistan here.

Now you need to select the account type on FBS that suits your needs.

Upon registration you will get a personal area where you need to provide all your details accurately and then verify your profile including your phone number, email ID and identity, etc. Successful verification will allow you to withdraw your profit instantly.

Now you need to make the deposit by selecting the number of payment options available at FBS like USD and EUR.

At the FBS platform you will find the list of a number of authorized local exchangers as well (digitalpaisa.Pk also one of them).

You also need to download the FBS trading software (trader app) available in both ios and android options. Just download it and login. You will get connected to the forex market.

For the ease of the new users FBS has “analytics and education” section, where you will find a number of articles, video tutorials, and webinars on all-things-trading, so you can better understand how to start trading with FBS in pakistan.

If you go through these above mentioned steps, you will have a great start in forex trading. You can also took the help of the authorized and steadfast e-currency exchanger in pakistan such as digitalpaisa.Pk which is the official partner of FBS and lets you directly draw your payments and earning by just clicking on its logo present on FBS platform.

Digitalpaisa is facilitating a large number of forex traders in pakistan who are trading with FBS to make deposit, withdraw and exchange their profits in convenient, safe and transparent manner.

You can have the services of the digitalpaisa.Pk directly from FBS platform and have your earnings directly into your local accounts such as jazzcash, easypaisa, UBL omini, bank transfers, western union, etc. You can have the service of digitalpaisa for depositing your money into the FBS account as well.

At our end, digitalpaisa is always ready to provide the necessary support to its customers with its dedicated customer care team servicing you through live chat.

Here is a complete detail on how you can deposit and withdraw from FBS in pakistan with the digitalpaisa.Pk platform:

How to deposit in FBS account?

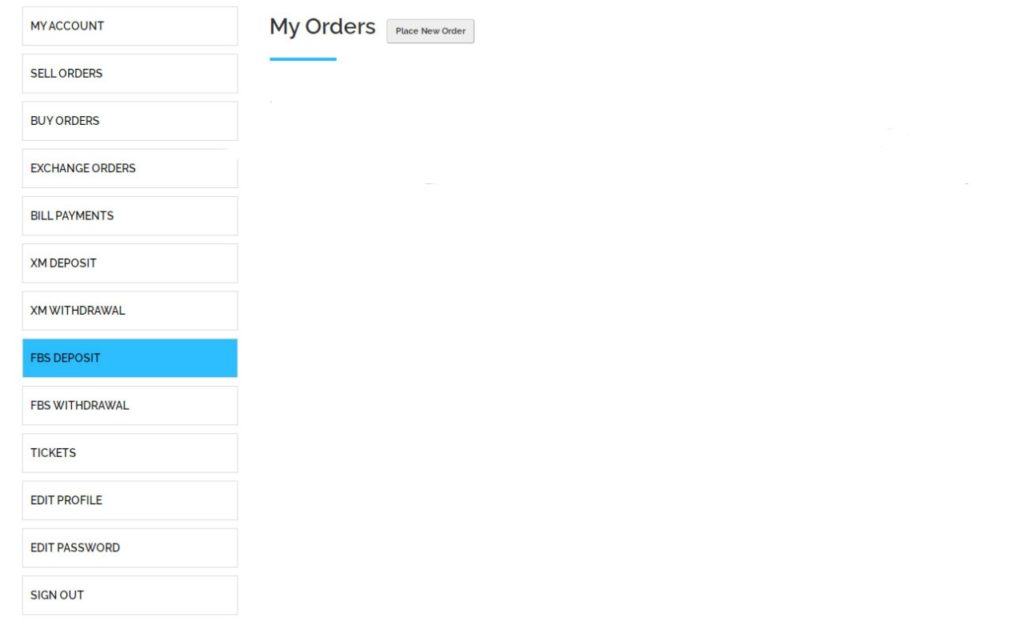

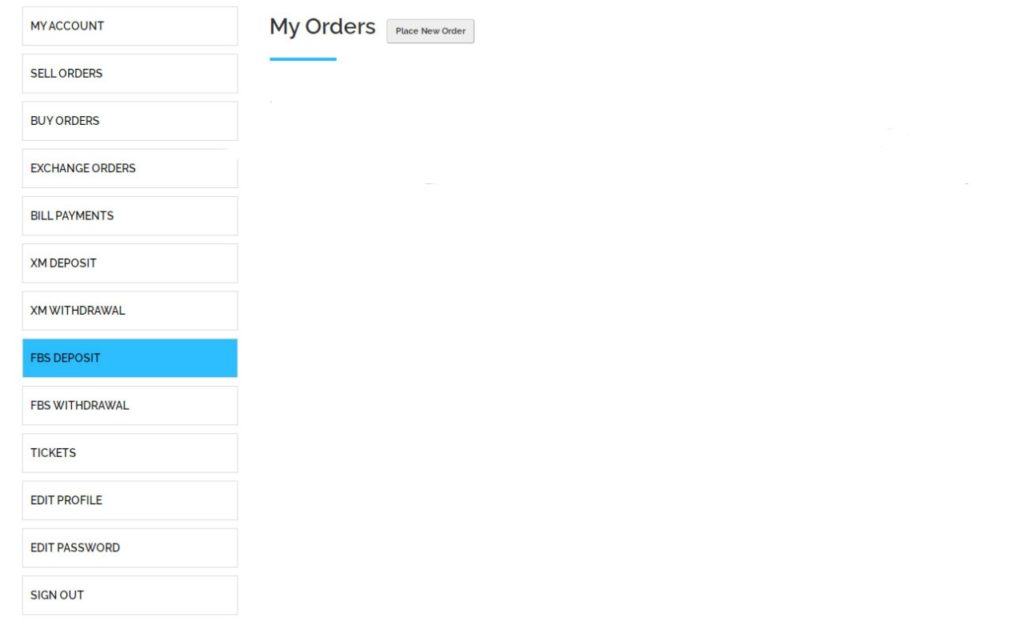

First of all you need to make yourself registered at digitalpaisa.Pk by providing your details. After the account verification you need to login you account and click on the “FBS deposit” (image below).

Now you need to click on the “place new oder” in order to deposit your money in FBS account.

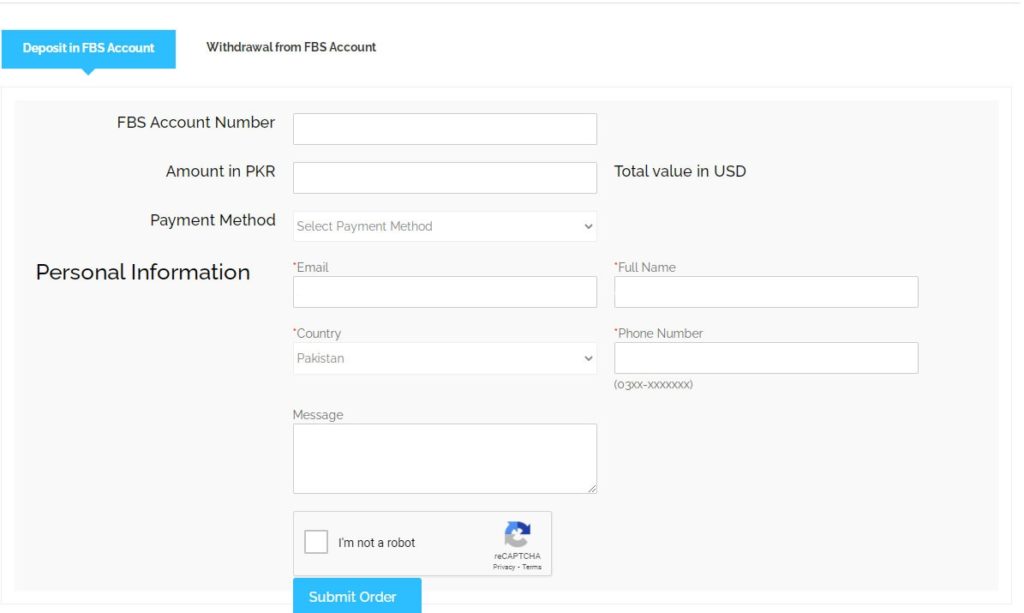

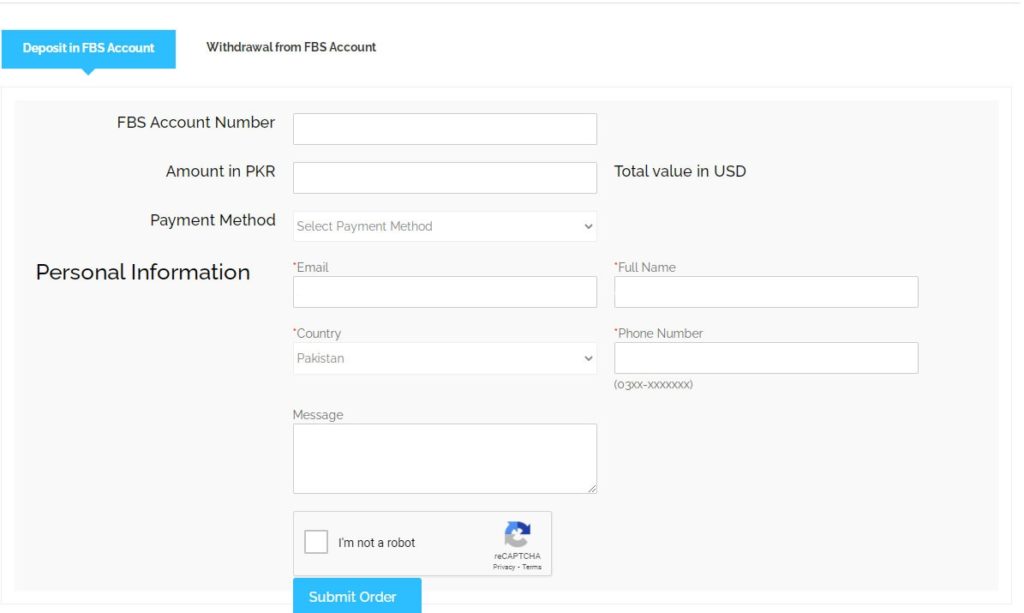

Another window will open in front of you (image below).

Here you need to provide the following details:

- FBS account number

- Amount in PKR (pakistani rupees)

- Payment method (jazzcash, easypaisa, bank transfer)

- Your personal details like name, email ID, phone number, etc

The calculation details of your added amount will be given to you along with the service fee. Now you need to “submit order”.

Now you need to transfer the payment to digitalpaisa prescribed account (will be given in post reply section of your order) against the FBS deposit.

You also need to upload the proof of your payment in digitalpaisa account in the post reply section.

Wait until the verification of your payments.

After the verification of your payment digitalpaisa will transfer the amount into your given FBS account.

This is how your FBS deposit order will be completed and you will be notified through SMS or email.

How to withdraw from FBS account?

To withdraw from FBS you need to login your FBS account and at withdrawal arena you need to click the digitalpaisa logo and then withdraw your payments.

Now you need to submit the FBS withdrawal order with digital paisa.

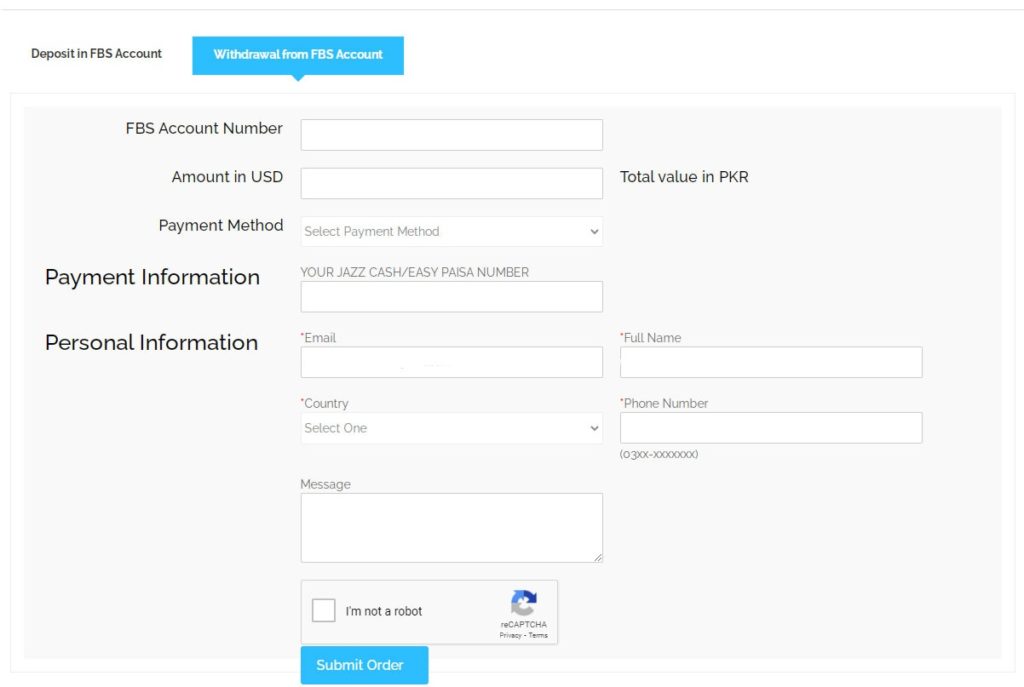

Click on the “FBS withdraw” (image below).

Now you need to “place new oder” in order to withdraw your earnings from FBS account (image below).

You need to provide the following details:

- FBS account number

- Amount in USD

- Payment method (jazzcash, bank transfer)

- Payment information (jazzcash, bank transfer, or easypaisa account number)

- Your personal details like name, phone number, email ID , etc

You will also get the complete calculation details of your amount next to your withdrawal order page.

After providing the complete information click on “submit order”.

You also need to upload the proof of your payment in the post reply section.

Wait until digitalpaisa will verify your payments.

After the verification of your payments will be transferred into your jazzcash, easypaisa and bank account.

Digitalpaisa will notify you through SMS and email regarding the order completion and close your order.

Important note:

The bonus you get at FBS platform can be utilized only for the trading at the platform. You can’t withdraw that bonus amount through digitalpaisa.Pk.

So customer, these are the complete details on how to start trading with FBS and in pakistan and how you can easily deposit and withdraw your payments with digitalpaisa.Pk. Hope this information will be beneficial for you, keep inform us through your precious comments.

Disclaimer:

This article is for the informative purpose only. We don’t endorse and do forex trading through this platform. It’s only the e-currency exchanging gateway that serves its customers to buy/sell, deposit/withdraw, exchange and make transaction of the digital currencies including webmoney, perfect money, skrill, neteller, advcash, etc.

Forex trading is always linked with the risk so when selecting the broker to invest into in FX market keep in mind that your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

It’s totally up to you whether you can afford the high risk of losing your money or not.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

What to know about fasting blood sugar?

We include products we think are useful for our readers. If you buy through links on this page, we may earn a small commission. Here’s our process.

Fasting blood sugar levels give vital clues about how a person’s body is managing blood sugar. Blood sugar tends to peak about an hour after eating and declines after that.

High fasting blood sugar levels point to insulin resistance or diabetes, while abnormally low fasting blood sugar could be due to diabetes medications.

Knowing when to test and what to look for can help keep people stay healthy, especially if they have diabetes or are at risk of developing the condition.

Share on pinterest A healthcare professional may recommend using a glucometer to test daily levels of fasting blood sugar.

The body needs glucose for energy, and glucose comes from the food we eat. However, the body does not use all of this energy at once. Insulin makes it possible to store and release it as necessary.

Following a meal, blood sugar levels rise, usually peaking about an hour after eating.

How high blood sugar rises, and the precise timing of the peak depends on the person’s diet.

Factors relating to food that can trigger significant rises include:

- Eating large meals

- Consuming sugary foods and drinks

- Eating foods with simple carbohydrates, or carbs, such as bread and sweet snacks

As blood sugar rises, the pancreas releases insulin. Insulin lowers blood sugar, breaking it down so that the body can use it for energy or store it for later.

However, people who have diabetes have difficulties with insulin in one of two ways:

1. Those with type 1 diabetes do not produce enough insulin because their body attacks its insulin-producing cells.

2. Those with type 2 diabetes do not respond well to insulin in their body and, later, may not make enough insulin.

In both cases, the result is the same, with people experiencing high blood sugar levels and difficulty using glucose, or blood sugar.

This means that fasting blood sugar depends on three factors:

- The contents of a person’s last meal

- The size of their previous meal

- Their body’s ability to produce and respond to insulin

Blood sugar levels between meals offer a window into how the body manages sugar. High levels of fasting blood sugar suggest that the body has been unable to lower the levels of sugar in the blood.

This points to either insulin resistance or inadequate insulin production and, in some cases, both.

When blood sugar is very low, diabetes medications may be lowering blood sugar too much.

There are two methods that individuals or healthcare professionals use for assessing fasting blood sugar levels:

1. A conventional blood sugar test

2. A glycosylated hemoglobin (hba1c) test

The hba1c test

The hba1c test measures how the body is managing blood sugar over time, usually the last 2–3 months.

The person will undertake this test at the doctor’s office or in a lab. If levels are very high, the individual may need a second test. The results show as a percentage.

Hba1c is the main test that doctors use to manage diabetes.

Blood sugar testing at home

A person can test their blood sugar levels at home.

In most cases, doctors ask people to measure fasting blood sugar immediately upon waking and before they have anything to eat or drink. It may also be appropriate to test blood sugar before eating or sometimes 2 hours after a meal when blood sugar has returned to normal levels.

The right time to test is dependant on treatment goals and other factors. For example, most people with diabetes do not need to test between meals unless they are using a diabetes drug that can lower blood sugar. Other people may test between meals if they feel their sugar levels may be low.

Since they do not make any insulin, some people with type 1 diabetes need to test several times a day. They do this because they need to check their levels regularly in order to adjust their insulin dose at that time.

To do the blood sugar test, a person will:

- Prepare the testing strip and glucose monitor to be ready for the blood sample.

- Clean the testing area, usually the side of a fingertip, using an alcohol swab.

- Lance the testing area. Bracing against a firm surface can help with the impulse to pull away.

- Squeeze the testing area around the wound to maximize blood flow.

- Squeeze a drop of blood onto the test strip.

- Put the strip into the monitor.

- Record the time, blood sugar reading, and recent food intake in a log.

Find out more here about blood sugar testing at home.

Blood glucose monitoring kits for use at home are available for purchase online.

Continuous glucose monitoring

Another option for daily use is continuous glucose monitoring (CGM).

For CGM, a person wears a monitor 24 hours a day. The monitor records their blood glucose levels on an ongoing basis.

CGM can give a more accurate picture of a person’s levels and fluctuations throughout the day. However, this type of kit is more expensive to buy.

There are also non-fasting blood tests.

Random plasma glucose (RPG): the doctor does a conventional blood sugar test when the person is not fasting. Find out more here.

Oral glucose tolerance test (OGTT): A healthcare provider takes samples of a person’s blood several times. The analysis begins with a fasting blood test. The individual with diabetes then drinks a liquid containing glucose, and the healthcare provider draws their blood every hour, three times. Learn more here about the glucose tolerance test.

Blood sugar levels vary throughout the day and with food intake, so no single blood sugar reading can reveal how well or not someone is processing sugar.

Hba1c results

According to the american diabetes association (ADA), the results of an hba1c test will be one of the following:

- Normal: less than 5.7 percent

- Prediabetes: between 5.7 and 6.4 percent

- Diabetes: 6.5 and over

Prediabetes is when blood sugar is high but not as high as in diabetes. People can take measures that may reverse it and stop diabetes from developing. Find out more here.

Home testing

Target blood sugar numbers are as follows, in milligrams per deciliter (mg/dl):

- Fasting (morning testing before food or water): 80–130 mg/dl

- Two hours after starting a meal: under 180 mg/dl

However, the target numbers will vary between individuals. A healthcare professional will help a person identify their own target levels.

It is vital to follow a healthful diet to keep fasting blood sugar from rising too high. Strategies include:

- Limiting the intake of sugar and salt.

- Choosing whole-grain bread and pasta instead of white bread and pasta.

- Eating foods that are rich in fiber to help the body lower blood glucose levels.

- Eating high-protein foods to support feelings of fullness.

- Choosing non-starchy vegetables that are less likely to trigger blood glucose spikes.

People who are taking diabetes drugs and who are at risk of dangerous blood sugar dips should follow a similar diet. They also need to take proactive steps to prevent blood sugar from dropping. Those include:

- Eating regular meals throughout the day.

- Increasing food intake and snacking frequency during intense physical activity.

- Avoiding or limiting alcohol beverages.

- Consulting a doctor if vomiting or diarrhea make it difficult to manage blood sugar.

People are likely to experience symptoms if their blood sugar levels are too low or too high.

Low blood sugar levels

Blood sugar that is too low can cause symptoms such as:

- Shaking and sweating

- Feeling jittery

- Difficulty concentrating

- Lack of energy

- Pale skin

- Fatigue or tiredness

- Headaches or muscle aches

- Fast or irregular heartbeat

- Weakness

- Lack of coordination

In extreme cases, low blood sugar can trigger seizures, loss of consciousness, confusion, and the inability to drink or eat.

Very high blood sugar, or hyperglycemia, can cause the following symptoms:

- Increased hunger or thirst

- Excessive urination

- Blurred vision

- Headache

- Tiredness

As with low blood sugar, high blood sugar may cause loss of consciousness or seizures if people leave them untreated. Persistent high levels can increase the risk of serious complications that doctors relate to diabetes, such as cardiovascular disease.

If a person’s blood sugar levels are high more than three times in a 2-week period without an apparent reason, the national institute for diabetes and digestive and kidney diseases (NIDDK) recommend that they seek medical help.

Any significant change in blood sugar patterns warrants a visit to a doctor. People with diabetes and those at risk of diabetes should also consult a doctor if:

- Blood sugar levels become unusually high or low

- Well-managed blood sugar levels are suddenly start fluctuating

- People have new or worsening symptoms of diabetes

- They change their medication or stop using it

- They experience abnormally high blood pressure

- They develop an infection or sore that will not heal

Diabetes needs ongoing monitoring, and the treatment can change over time. Information about diet and exercise is vital to enable a doctor to outline a proper treatment plan for each person individually.

People with diabetes can assist their doctor by keeping detailed logs and being transparent and accurate about dietary or lifestyle changes.

Financial accounting & budgeting system

Office of the controller general of accounts, government of pakistan

Reforming today for a better tomorrow

FABS represents one of the largest SAP-based public sector implementation of an integrated MIS in the world. The budgets and financial reports of federal, provincial and district tiers of the government are processed through the FABS. Monthly salaries, GP fund payments and pensions of nearly 3 million public sector employees and thousands of daily contingent payments and receipts of government entities are also processed.

News flash

Anticipatory pension payment- new pension payment introduced for pensioners.

Another flagship initiative by the government of pakistan has been initiated for its valued pensioners - the anticipatory pension. The anticipatory pension will commence once the employee reaches 60 years of age, the retiree will get 65% of basic pay for one year as anticipatory pension even if the pension case is not submitted. However, upon submission of the retirement case, the anticipatory pension will be adjusted. The pensioners will have the benefit of accessing pension funds directly from their ATM under direct credit scheme and will receive a monthly pension slip on the registered email address for their reference and record keeping. For more information, please visit your nearest accounts office.

Dashboard for finance division has been developed & deployed

FABS has developed and activated a comprehensive dashboard for the secretary finance division. The dashboard yields daily, cumulative of month and cumulative of the year information on government’s expenditures, tax and non-tax receipts, domestic debt and external debt transactions, as well as the daily cash balances from the state bank of pakistan (SBP).

The dashboard is fed information from SAP and non-SAP sources through interfaces and linkages with institutions like federal board of revenue, central directorate of national savings (CDNS), economic affairs division, and self-accounting entities (pak PWD, NHA, mofa etc.), SBP/NBP. The real-time expenditure data of centralized accounting entities is captured through the SAP-based IFMIS.

The dashboard will help government in better financial planning and management with a timelier picture of its budget utilization, deficit and financing information.

Automated deduction of sales tax on services implemented in sindh & balochistan

FABS directorate in consultation with revenue authorities and ags of balochistan and sindh developed SAP based program for mandatory deduction of sales tax on services for payments processed by ags/ daos in sindh and baluchistan. Through this program SAP system automatically syncs its data with PRAL’s data and collects information of vendor status and then calculates the applicable amount of tax to be deducted. This system prevents valuable government receipt from being miscalculated or misclassified. The system was launched in sindh during october 2018 and in balochistan during march 2019. S.R.B has recognized the efforts made by FABS for making this system successful and reported 80% increase in tax collection for period october 2018 to june 2019.

Dashboard for ministry of climate change has been implemented

FABS in coordination with UNDP, has developed a dashboard for ministry of climate change which yields cost-center-wise information on ministry-wise and function-wise expenditure of federal government on climate-change related areas under the categories of mitigation, adaptation and support.

FABS contributes to increased revenues through automated deduction of sales tax

Solution for automated deduction of sales tax through the system activated across all the ags/daos with potential for substantively improving withholding sales tax collection through accounting offices. The FABS system accesses FBR database through optical fiber link on a daily basis to verify the status of sales tax registration of vendors/suppliers. The system ensures that the correct amount of sales tax at applicable rates is withheld from the bills processed at ags\daos the next day.

FABS online salary slip solution users exceed 1.3 million

More than 1.3 million government employees are receiving their salary slips through email every month. The measure is expected to contribute towards curbing the increasing cost incurred on the purchase of paper stationery and the repair and maintenance of printers at government offices.

System based tracking of pension cases launched at AGPR

Pension case tracking system has been developed for the pension cases processed at AGPR islamabad. The pensioners can view the status of their cases online which would facilitate the pensioners thereby marking a major improvement in terms of service delivery, transparency and accessibility. The same facility will also be developed for all the accounting offices across the country.

AGPR goes live with loan and advances module

A solution has been successfully implemented for AGPR islamabad under which processing of house building, motor car, motor cycle and cycle advances for government employees under ambit of the AGPR main office in islamabad, has been automated. The solution ensures that the employees get the advances according to the order in which they have applied for the same. It also tracks repayment of advances and makes sure that next advance is only allowed to an employee once he has paid back the required number of instalments of the previous advance as per the applicable rules. Furthermore, rules are enforced by the system through which an employee is barred from getting a particular advance more than twice during the length of her/his service. Activation of the solution has already led to filtering out of hundreds of applications for advances that were against the rules, thereby improving service delivery to the deserving applicants, as well as saving the exchequer from undue burden of advances to those employees who have not repaid due instalments on previous advances. The solution is planned to be replicated in all AGPR-suboffices in respective provinces.

FABS implements organizational management(OM) module in KP

The OM module has been successfully implemented in khyber pukhtunkhwa province. Data cleaning work is already under way to enable roll-out of OM module in balochistan. The module shall subsequently be replicated in all provinces as well as at the federal government level. FABS is also working on developing OM module-based dashboards which will provide regular update on sanctioned, vacant and filled posts in various government departments, districts across the respective provinces, at the click of a button, thereby enabling better rationalization of human resource across the federal and provincial governments.

About FABS

The office of the director general MIS/FABS, working under the controller general of accounts(CGA), is responsible for smooth functioning of the SAP-based financial accounting & budgeting system(FABS), which is an integrated financial management information system(IFMIS) being run at government offices at federal, provincial and district level. FABS was initiated and established under government of pakistan and world bank-funded project to improve financial reporting & auditing(PIFRA). PIFRA was implemented at federal, provincial and district levels of the government in three phases between 1996-2014. After closure of PIFRA on 31.12.2014, its FABS component was mainstreamed into the o/o DG MIS/FABS on 01.01.2015.

Essentially, FABS comprises of the new accounting model(NAM), and a SAP-ERP-based information technology platform. The new accounting model(NAM) was introduced in year 2000, through approval by the auditor general of pakistan, to improve the traditional government accounting system by bringing-in a shift towards modified cash-basis of accounting, double-entry book-keeping, commitment accounting, fixed asset accounting and a new multi-dimensional chart of accounts. A key objective of FABS (i.E. NAM, along with the SAP-based IT platform) was to help produce timely, relevant, accurate, reliable and comprehensive financial reports for the decision makers to enable effective accountability and better financial governance. Objectives of FABS include effective budgetary management, financial control, cash forecasting, trend analyses, fiscal administration and debt management.

The SAP-ERP based system is being run at more than 500 sites across the country at federal, provincial and district level. They include self-accounting entities like pak PWD, pakistan mint, geological survey of pakistan and directorate of postal accounts. The district accounts offices(daos) and other district level offices, and provincial line departments are linked through wide area network(WAN) to servers at accountant general office and the finance department of the respective province. All provincial servers are linked through WAN to the federal server lying at the office of the accountant general pakistan revenues(AGPR) in islamabad, thereby creating a seam-less and integrated system capable of providing real-time information on financial transactions taking place on the system across the country at national and sub-national level. Among other things, the FABS is being used to process (a) monthly pay of more than 2.5 million government employees at federal, provincial and district levels (b) monthly pension of more than 0.5 million government employees (c) general provident fund payments of government employees (d) thousands of payment claims of government departments across the country on a daily basis (e) monthly and annual accounts of federal, provincial and district governments (f) budgets of federal and provincial governments.

New services are being initiated which aim to utilize the system for providing useful information to decision-makers in the government through dashboard reports. Horizontal expansion of the system is also being undertaken through interfaces with relevant government entities to capture comprehensive information related to receipts, expenditures, domestic debt and external debt transactions of the government.

FABS ensures proper functioning of the SAP-based financial accounting, budgeting, pre-audit, payroll, GPF and pension processing system of federal and sub-national governments through:

- Technical support to SAP end-users in accounting and budgeting offices and line departments/ministries

- Development of new SAP-based solutions for better public financial management

- Ensuring proper functioning of the SAP hardware and networking infrastructure across the country

FABS comprises of the following teams under their respective team leads:

- Human resource team (HR team)

- Financial team (FI team)

- BASIS team

- LAN/WAN team

- ABAP team

- Information security team

FBS forex pakistan

FBS pakistan is a popular forex broker in pakistan. They have proved themselves as a truly global forex broker. FBS pakistan has a dedicated website for pakistan forex traders. As a special offer for pakistan forex traders, they offer a no deposit bonus of $50 to start with. FBS complies with the standards set by IFSC and accepts traders from all over the world including pakistan. You can trade with confidence in a safe and transparent trading environment with FBS pakistan.

FBS offers MT4 and MT5 forex trading platforms with built-in indicators. All these professional analysis tools and indicators are accessible to FBS forex traders on multiple devices and on the web browsers. FBS pakistan also supports the traders with market alerts, forex news, daily, and weekly analysis. While trading with FBS forex you can trade forex pairs, commodity CFD and cryptocurrency CFD with the most competitive spread. The fund deposit and withdrawals to and from FBS account are quite simple and quick. These all features make FBS forex broker the preferred forex broker in pakistan.

FBS forex trading with $100 bonus

FBS regulations and compliance

FBS is a legitimate broker with registered address as no.1 orchid garden street, belmopan, belize, C.A.

It complies with the international financial services commission (IFSC) with license number IFSC/60/230/TS/18. Although FBS claims to have clients from over 190 countries, it has not obtained a license in the majority of the countries. However, IFSC protects clients internationally and gives decision in a professional and neutral way.

FBS doesn’t accept traders from japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran. If you are not from these countries, you can trade with FBS without any issue.

FBS review - FBS forex broker pakistan

How to deposit into FBS forex trading account?

FBS accept multiple fund deposit and withdrawal methods, which include credit card, debit card, skrill, and neteller. However, some customers complaint about transaction failure while depositing with credit and debit cards. Such transaction failures may happen due to restrictions from the bank on international transactions. But no need to worry. There are alternate safe and secure payment methods available with FBS forex pakistan. You can sign up for a skrill or neteller account, and get it verified by submitting your identification documents. After that, you can fund your skrill or neteller wallet. And deposit and withdraw funds from your skrill or neteller wallet.

Is FBS forex legal in pakistan?

Yes, forex trading with FBS is legal in pakistan. There are thousands of traders from pakistan using FBS trading platform for forex trading. FBS offers MT4 and MT5 platform to traders in pakistan. You are free to choose from several account types including swap free islamic account.

Why to choose FBS pakistan? The specialties of FBS pakistan as a forex broker.

Pros and cons.

- MT4 and MT5 platform on robust servers.

- A dedicated website with support in urdu.

- Quick deposit and withdrawal processing while accepting deposits via money exchange companies.

- Complies with IFSC vide license IFSC/60/230/TS/18;

- No deposit BONUS of $50.

- Free demo trading account with complete access to all features on the trading platform.

- Excellent support and personalized account manager with local language support.

FBS is one of the trusted brokers for forex trading in pakistan. They provide forex CFD, commodity CFD and cryptocurrency CFD trading in one single account. You can also avail free bonus of $50 and start trading in real market conditions. FBS has got the best in the industry customer service. FBS offers quicker fund deposit and withdrawal processing for clients.

Binaryoptions4me@gmail.Com

+919999970928

Risk disclaimer: trading foreign exchange (“forex”), commodity futures, options and cfds on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange (“forex”), commodity futures, options, or cfds, you should carefully consider your monetary objectives, level of experience, and risk appetite. The possibility exists that you may sustain a loss of some or all of your deposited funds and therefore you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, commodity futures, options, cfds and spreadbetting trading, and seek advice from an independent advisor if you have any doubts. Past returns are not indicative of future results.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. The broker/dealer and the referring broker will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Forex trading in pakistan – is forex trading legal?

Forex brokers in pakistan – is forex trading legal?

The forex traders in pakistan are doing remarkably well in forex trading. Online “forex trading in pakistan” has become very popular among the young traders with higher risk capacity. That is the reason that many forex brokers have now registered and started providing forex trading to pakistan traders. Another reason for the popularity of forex trading is the success rate of pakistan investors. It is a well-known fact in the financial industry that forex traders from pakistan do well compared to any other country. The serious trading attitude and excellent analytical skills of pakistan forex traders bring them more success. A successful forex trader in pakistan also helps earn foreign currencies for the country as most of the profits are paid in USD $.

Interestingly, a large number of investors are making more profit from the forex market than equity markets in pakistan. The key to succeeding in forex trading lies in interpreting the currency price actions. The currency price (EUR/USD) keeps changing along with global financial news and political developments. The forex traders must monitor the events that affect currency valuation and economic data releases from different central banks affecting the currency price. One thing is clear, many pakistan forex traders have multiplied their investments of $100 into thousands of dollars, and they earn tens of thousand US dollars every month. So, forex trading is undoubtedly something that can not be ignored by serious traders.

But the new entrants to the forex market in pakistan face difficulties in understanding the terminology, options, platforms, so here’s a quick explanation to help you understand forex trading.

Open free demo account

Forex brokers in pakistan

Few forex brokers are offering exclusive forex trading services in pakistan. FBS pakistan is one such financial company having a dedicated website for pakistan forex traders. Additionally, the site offers its content in the urdu language, which help traders to understand forex trading in urdu. Pakistan forex traders have the freedom the choose from several brokers available in the industry. However, you must check the broker’s reputation, funding methods, and regulations before trading with them.

Best forex brokers in pakistan 2020

The following forex brokers are preferred in pakistan. These brokers have more than ten years of well-established trust in the market. If you are looking for the best forex brokers in pakistan in 2020, this list of brokers may help. You can also do research online to find the best forex broker in pakistan.

- Arabic language support

- Low spread and leverages to suit your trading style

- Copy trading through zulutrade

- MT4 and MT5 trading platform

- Islamic account – yes

- A minimum deposit of $1

- Maximum leverage 1:1000

- Five different accounts types

- ECN account – low spreads

- Bonus deposit – yes

- Islamic account – yes

- MT4 platform

- $100 minimum deposit

- Web and MT4

- VIP account

- 37 international awards

- Free market analysis

- Islamic account – yes

- Fixed spreads – fairly low

- Minimum deposit of $1

- Leverage of up to 1:3000

- Five different types of accounts

- Low spread

- MT4 & MT5 trading platform

- Islamic account – yes

Frequently asked questions on forex trading in pakistan

Who’s trading forex in pakistan?

Many traders are currently trading forex in pakistan. Not only that, most of them are trading forex successfully to make money. Forex trading is also known as foreign exchange trading. Forex market is the world’s biggest financial market with a turnover of trillions of dollars every day. According to estimations, there’s an average turnover above US$6 trillion dollars every single day.

People from different backgrounds are trading forex, from large companies to part-time small traders operating from their home. In pakistan, it has got accessible to many traders from remote areas with the proliferation of the internet. Now, many traders trade from the comfort of their home and make some additional income. Forex trading in karachi and islamabad has become quite popular among today’s smart traders. Hence, online trading brokers are opening their regional offices to cater to forex traders in pakistan. When we talk about forex trading – maximum traders are from karachi and islamabad. Karachi being the capital and financial hub, forex trading in karachi has become an attraction among traders.

Is forex trading legal in pakistan?

“is forex trading legal”, is one of the frequently asked questions by the traders in pakistan. Every trader wants to know about the legal aspect of forex trading. “is forex trading legal?” the answer is – yes, it is legal to trade forex in pakistan.” however, you must take care of your tax liabilities. Several forex trading companies have offices in karachi and operate while complying with pakistan regulators. Since the government’s rules keep changing, you should consult a local financial advisor for detailed advice on the legal aspects of trading forex in pakistan. The forex brokers accepting pakistan traders are hotforex, FBS, and IQ option. Sign up with any of these brokers to start trading forex in pakistan.

Is forex trading halal in pakistan?

Yes, forex trading is halal in pakistan, forex brokers are offering islamic forex trading account to pakistan traders. These are special forex trading accounts that do not charge any interest or ribba and comply with islamic principles. It is also known as swap-free forex accounts. You can ask your account manager or support team to offer you a halal forex account or islamic forex account.

What causes currency movements?

As you know that the values of currencies keep changing, so the exchange rates vary. The changes in those rates are determined by thousands of traders buying currencies with other currencies. It determines what each currency is worth in relation to the other.

Currency prices can sometimes change very fast in response to news and global events. Forex traders look at some essential factors like – political and economic stability, monetary policy, currency intervention, major political events, and natural disasters. Forex traders in pakistan take advantage of these factors, and trade currencies to make money.

Forex trading pakistan – how does forex trading work?

While trading forex, you buy in pairs like EURUSD. The trader predicts how the exchange rate between the two currencies will change. So, if the trader believes that the EURO (EURO) will strengthen against the USD (US dollar), then they buy EURO, which means they are also ditching their dollars. If they are right then the value of their currency increases and they can sell it for a profit. If their decision was wrong, then they lose.

For example, the EUR/USD rate shows the number of dollars one euro can buy. If a trader believes the euro will increase in value against the dollar, then they use dollars to buy euros. If the exchange rate rises, then they can sell the euros back for a profit. One of the reasons forex trading is so popular with hobbyist investors is that the markets are open pretty much 24 hours a day, following the different countries’ time zones.

Will I make any money?

That’s a tricky question now! Forex trading is highly risky. It’s so risky that many experts believe that there is a significant possibility for amateur traders to lose their capital. It is tough for individual traders to understand and determine the direction of the currency market with his limited understanding and knowledge of the forex market. The idea that an individual can reliably predict the movements of currencies is quite rare. Hence, individual traders need proper education and training in the forex market.

There are many trading platforms and guides and books and investment tutorials available to help new traders learn. The brokers in pakistan also provide webinars and one to one training to their clients. The brokers in pakistan who care for their clients to learn, provide free demo trading account to get some hands-on practice without risking any real money. If you are not sure of your knowledge level and trading skills, you must practice a lot in the demo trading account. You can learn forex trading with a free demo trading account with FBS and make use of their useful training resources.

Hence, would-be traders must understand the risks involved in forex trading. It’s essential that would-be traders should not invest money they can’t afford to lose.

What next? Can I start trading forex in pakistan?

By now, you must have understood that forex trading is full of risk and a complex area to master. But it is not impossible to learn and make a profit from trading. Hence you must get extensive training and acquire some hands-on experience in a demo account. Interestingly, many traders from pakistan are good at forex trading because of their analytical skills.

You must discuss with your online broker and financial advisers to understand the degrees of risk. The individual traders usually get to know more by trading in demo accounts and getting more and more studies. Before undertaking any online trading, it’s a good idea to spend time reading more and talking to other investors.

Conclusion

Finally, forex trading in pakistan is not a get rich quickly type of thing. You can not get rich overnight by trading forex. If you trade with the right knowledge and discipline and stay profitable, you will become rich by trading forex. Don’t just jump in and start trading, rather jump in and start learning first. After you learn, you must trade forex in a demo account for a few months. Then, you may switch to a real forex trading account if you feel confident of trading with real money.

You should start trading in a real account with real money only after getting enough experience in the demo account.

How to deposit or withdraw from FBS account in pakistan

FBS is a broker and CFD including MT4 and MT5 trading website that works almost in every country including pakistan so you can trade on FBS while living in pakistan. FBS company first established in 2009 and now it is one of the best broker websites in the world to trade different assets. Millions of user’s worldwide daily trades on this broker website so if you are interested then you can join now.

FBS broker is regulated with CYSEC and IFSC and as a starter, you can open their demo account to start learning about trading. Mine suggestion for you is to first practice on a demo account and once you master everything then you should deposit real money there. FBS team members put up all their assets in a separate bank account to save all their investors’ money.

The following are the deposit methods available on their platform:

- VISA

- SKRILL

- NETELLER

- Perfect money (recommended)

If you are looking for the best e-wallet to deposit /withdraw your money while living in pakistan then you should read this post. Visa cards usually do not work in pakistan so you need an alternative solution to deposit/withdraw your money from forex broker websites. Skrill and neteller have a lot of issues like verification and strong policies which create hurdles for users to deposit/withdraw money easily. If you are using skrill or nettler then your money is at risk because your account can be blocked and skrill did the same with me and charge me 150$ fine.

Perfect money (recommended)

Perfect money is an alternative best solution for you to deposit/money into FBS because you do not any kind of verification to use the perfect money account. Also, their fees are lower than skrill and almost all exchangers worldwide support perfect money platform. I am using the perfect money account for the last three years and I have not found any single issue with their platform. Almost all online exchangers support the perfect money system because their policies are not as strict.

How to deposit or withdraw from perfect money in pakistan

You can use kukichanger to instantly buy/sell perfect money dollars in pakistan which is a trusted e currency exchange in pakistan. For any kind of information related to e currency, you can open up livechat available on our website.

FBS pakistan

Currently our best forex broker in pakistan is: hot forex. If you are searching for an alternative to FBS you should start there. To see all of the best brokers available for you, see our list: forex trading pakistan. If you'd like to visit FBS anyway, www.Fbs.Com is their website.

Best alternative in pakistan for FBS

- Over 350,000 accounts open since 2010, 140 employees globally

- Winner of 18 industry awards

- Free monthly contests to enter and win cash prizes

- 4-tier loyalty program

#2 rated best pakistan broker

- Start with 20 free trades (zero commissions)

- Over 150 trading instruments available

- Extremely fast execution speed at under 30ms

- Trade with up to 500:1 leverage

#3 rated best pakistan broker

- Excellent cash-back program: get up to $5 per lot (T&C apply)

- Trade with MT4 or MT5 via webtrader, mobile (android/apple) or desktop

- Copytrader service and free trading signals for all users

- Deposit by credit card, skrill, neteller, OK pay, webmoney, and more..

Is forex trading in pakistan legal?

Copyright В©2020 forexagentreviews.Com all rights reserved

Disclaimer: reproduction in whole or in part in any form or medium without express written permission of is prohibited. This website is a promotional feature and the site has been paid for to list the following positive review about these trading platforms - these reviews are not provided by an independent consumer. This comparison site is supported by payment from operators who are ranked on the site and the payment impacts the ranking of the sites listed. General risk warning: the financial services reviewed here carry a high level of risk and can result in the loss of all your funds.

How to start forex trading on FBS in pakistan?

If you are looking to start the forex trading on FBS in pakistan you are right here. FBS in pakistan is highly acclaimed forex broker for doing online trading across the world.

FBS is a well-recognized international online forex broker that holds the cysec license and also the official trading partner of FC barcelona.

FBS is serving its clients in the regions of asia, latin america, europe, and MENA, etc and is trading with the commodities and other financial products for currency, metals, and indexes trading for clients with diverse targets and backgrounds.

It comprises a low barrier to entry and top-ranking apps including metatrader4 and metatrader5. Over 11 years in the field, the FBS broker won 50 international awards, including best international forex broker, best forex brand, and most progressive forex broker europe.

FBS is the trouble-free and most suitable forex trading platform in pakistan allows the customers to trade in currency pairs, cfds, stocks and metals. It is one of the leading and renowned forex trading platforms globally, operating in more than 190 countries and also in pakistan with its full-fledge online website that is rendering its services in urdu language.

Although the forex trading is associated with real currencies and regulated by the rules and regulations. Traders can also make trading in stock, index, treasury, sector, commodity and cfds.

As a resident of pakistan you are allowed to do forex trading because the economy of pakistan keeps on growing and people are more interested to invest in forex market.

FBS in pakistan is doing trading and a large number of traders are associated with this platform. Trading with FBS in pakistan is extremely simple and a convenient way to earn handsome profit as it provides the trustworthy services of earning through forex trading.

FBS allows the customers and forex traders to register themselves on its platform by choosing any of the four accounts that are as follows:

- The cent (the common mini account) with a minimum deposit of $1

- Micro account with minimum deposit of $5

- The zero spread (for fast trading) with minimum deposit of $500

- Standard account for the experienced traders with the minimum deposit of $100

- The ECN account (full power of trading with ECN technologies) by depositing $1000.

FBS allows you to open the account with in two common types of currency such as USD and EUR. The forex traders in pakistan can join the FBS by depositing just $10 and after the deposit customers get 100% of their invested money amount.

So, you want to become a forex trader and interested to start trading with FBS in pakistan below we have compiled several steps that you need to follow to start trading.

First of all make yourself register by creating an account with FBS in pakistan here.

Now you need to select the account type on FBS that suits your needs.

Upon registration you will get a personal area where you need to provide all your details accurately and then verify your profile including your phone number, email ID and identity, etc. Successful verification will allow you to withdraw your profit instantly.

Now you need to make the deposit by selecting the number of payment options available at FBS like USD and EUR.

At the FBS platform you will find the list of a number of authorized local exchangers as well (digitalpaisa.Pk also one of them).

You also need to download the FBS trading software (trader app) available in both ios and android options. Just download it and login. You will get connected to the forex market.

For the ease of the new users FBS has “analytics and education” section, where you will find a number of articles, video tutorials, and webinars on all-things-trading, so you can better understand how to start trading with FBS in pakistan.

If you go through these above mentioned steps, you will have a great start in forex trading. You can also took the help of the authorized and steadfast e-currency exchanger in pakistan such as digitalpaisa.Pk which is the official partner of FBS and lets you directly draw your payments and earning by just clicking on its logo present on FBS platform.

Digitalpaisa is facilitating a large number of forex traders in pakistan who are trading with FBS to make deposit, withdraw and exchange their profits in convenient, safe and transparent manner.

You can have the services of the digitalpaisa.Pk directly from FBS platform and have your earnings directly into your local accounts such as jazzcash, easypaisa, UBL omini, bank transfers, western union, etc. You can have the service of digitalpaisa for depositing your money into the FBS account as well.

At our end, digitalpaisa is always ready to provide the necessary support to its customers with its dedicated customer care team servicing you through live chat.

Here is a complete detail on how you can deposit and withdraw from FBS in pakistan with the digitalpaisa.Pk platform:

How to deposit in FBS account?

First of all you need to make yourself registered at digitalpaisa.Pk by providing your details. After the account verification you need to login you account and click on the “FBS deposit” (image below).

Now you need to click on the “place new oder” in order to deposit your money in FBS account.

Another window will open in front of you (image below).

Here you need to provide the following details:

- FBS account number

- Amount in PKR (pakistani rupees)

- Payment method (jazzcash, easypaisa, bank transfer)

- Your personal details like name, email ID, phone number, etc

The calculation details of your added amount will be given to you along with the service fee. Now you need to “submit order”.

Now you need to transfer the payment to digitalpaisa prescribed account (will be given in post reply section of your order) against the FBS deposit.

You also need to upload the proof of your payment in digitalpaisa account in the post reply section.

Wait until the verification of your payments.

After the verification of your payment digitalpaisa will transfer the amount into your given FBS account.

This is how your FBS deposit order will be completed and you will be notified through SMS or email.

How to withdraw from FBS account?

To withdraw from FBS you need to login your FBS account and at withdrawal arena you need to click the digitalpaisa logo and then withdraw your payments.

Now you need to submit the FBS withdrawal order with digital paisa.

Click on the “FBS withdraw” (image below).

Now you need to “place new oder” in order to withdraw your earnings from FBS account (image below).

You need to provide the following details:

- FBS account number

- Amount in USD

- Payment method (jazzcash, bank transfer)

- Payment information (jazzcash, bank transfer, or easypaisa account number)

- Your personal details like name, phone number, email ID , etc

You will also get the complete calculation details of your amount next to your withdrawal order page.

After providing the complete information click on “submit order”.

You also need to upload the proof of your payment in the post reply section.

Wait until digitalpaisa will verify your payments.

After the verification of your payments will be transferred into your jazzcash, easypaisa and bank account.

Digitalpaisa will notify you through SMS and email regarding the order completion and close your order.

Important note:

The bonus you get at FBS platform can be utilized only for the trading at the platform. You can’t withdraw that bonus amount through digitalpaisa.Pk.

So customer, these are the complete details on how to start trading with FBS and in pakistan and how you can easily deposit and withdraw your payments with digitalpaisa.Pk. Hope this information will be beneficial for you, keep inform us through your precious comments.

Disclaimer:

This article is for the informative purpose only. We don’t endorse and do forex trading through this platform. It’s only the e-currency exchanging gateway that serves its customers to buy/sell, deposit/withdraw, exchange and make transaction of the digital currencies including webmoney, perfect money, skrill, neteller, advcash, etc.

Forex trading is always linked with the risk so when selecting the broker to invest into in FX market keep in mind that your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

It’s totally up to you whether you can afford the high risk of losing your money or not.

So, let's see, what was the most valuable thing of this article: digitalpaisa.Pk is providing skrill, webmoney , paypal dollars buy sell and exchange services in pakistan. At what is fbs pakistan

Contents of the article

- Real forex bonuses

- How to start forex trading on FBS in pakistan?

- How to deposit in FBS account?

- How to withdraw from FBS account?

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- What to know about fasting blood sugar?

- The hba1c test

- Blood sugar testing at home

- Continuous glucose monitoring

- Hba1c results

- Home testing

- Low blood sugar levels

- Financial accounting & budgeting system

- Office of the controller general of accounts,...

- Reforming today for a better tomorrow

- News flash

- Anticipatory pension payment- new pension payment...

- Dashboard for finance division has been developed...

- Dashboard for ministry of climate change has been...

- FABS contributes to increased revenues through...

- FABS online salary slip solution users exceed 1.3...

- System based tracking of pension cases launched...

- AGPR goes live with loan and advances module

- FABS implements organizational management(OM)...

- About FABS

- FBS forex pakistan

- FBS review - FBS forex broker pakistan

- How to deposit into FBS forex trading account?

- Why to choose FBS pakistan? The specialties of...

- Pros and cons.

- Forex trading in pakistan – is forex trading...

- Forex brokers in pakistan – is forex trading...

- Open free demo account

- Forex brokers in pakistan

- Best forex brokers in pakistan 2020

- Frequently asked questions on forex trading in...

- Who’s trading forex in pakistan?

- Is forex trading legal in pakistan?

- Is forex trading halal in pakistan?

- What causes currency movements?

- Forex trading pakistan – how does forex trading...

- Will I make any money?

- What next? Can I start trading forex in...

- Conclusion

- How to deposit or withdraw from FBS account in...

- FBS pakistan

- Best alternative in pakistan for FBS

- #2 rated best pakistan broker

- #3 rated best pakistan broker

- Is forex trading in pakistan legal?

- How to start forex trading on FBS in pakistan?

- How to deposit in FBS account?

- How to withdraw from FBS account?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.