Fund my trading account

In the past, currency trading was limited to certain individuals and institutions. That's because the funds required to play were significantly higher than for any other investment instrument. However, with the development of electronic trading networks and margin accounts, requirements have changed. Although nearly 75% of forex trading is still done by large banks and financial institutions, individuals are now able to invest in forex with as little as $1,000—thanks in large part to the use of leverage. Despite these changes, making high returns on highly-leveraged currency trades can be difficult, and will require a good amount of patience and skill. Forex traders are usually given several options when deciding how they will deposit funds into trading accounts. Credit card deposits have by far become the easiest way. Since the development of online payment services, digital credit card payouts have become increasingly efficient and secure. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day.

How do you fund a forex account?

The forex (FX) market is where currencies from around the world are traded. A foreign exchange account is typically what is used to trade and hold foreign currencies online. Using these accounts is easier than it has ever been in the past. Typically, you will just need to open a new account, deposit the amount of money you choose in your country’s currency, and then you are free to sell and buy currency pairs as you see fit.

Key takeaways

- Forex accounts are used to hold and trade foreign currencies.

- It is easier than ever for individuals to participate in forex trading, due to the development of margin accounts and electronic trading.

- You can invest in forex with as little as $1,000.

- The biggest difference between trading equities and trading on forex is the amount of leverage required.

- Forex accounts can be funded by credit card, wire transfer, personal check, or bank check.

In the past, currency trading was limited to certain individuals and institutions. That's because the funds required to play were significantly higher than for any other investment instrument. However, with the development of electronic trading networks and margin accounts, requirements have changed. Although nearly 75% of forex trading is still done by large banks and financial institutions, individuals are now able to invest in forex with as little as $1,000—thanks in large part to the use of leverage. Despite these changes, making high returns on highly-leveraged currency trades can be difficult, and will require a good amount of patience and skill.

How forex trading works

By using a margin account, investors essentially borrow money from their brokers. Of course, margin accounts can also be used by investors to trade in equity securities. The main difference between trading equities and trading forex on margin is the degree of leverage that is provided.

For equity securities, brokers usually offer a 2:1 leverage to investors. On the other hand, forex traders are offered between 50:1 and 200:1 leverage. This means that traders need to deposit between $250 and $2,000 to trade positions of $50,000 to $100,000.

Learning the ins and outs of investing in a market that contains foreign currencies can be a useful skill to develop in today’s hyper-connected world.

How to fund a forex account

Forex traders are usually given several options when deciding how they will deposit funds into trading accounts. Credit card deposits have by far become the easiest way. Since the development of online payment services, digital credit card payouts have become increasingly efficient and secure. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day.

Investors can also transfer funds into their trading accounts from an existing bank account or send the funds through a wire transfer or online check. When choosing to perform a wire transfer, keep in mind that most banks will charge about $30 per wire, and there may be a delay of two to three days before the amount will show in the recipient’s account for the first transfer performed.

Traders are also usually able to write a personal check or a bank check directly to their forex brokers. The only problem with using these other methods is the amount of time that is needed to process the payments. For example, paper checks can be held for up to 10 business days (depending on the individual’s bank and the state) before being added to a trading account.

Transfer of funds to your trading account

Very common question when opening such account is, whether one should fund it from his own account? The answer is definitely yes.

Regulations you need to adhere to dictate that any funds invested need to come directly from your name and your name only, into an account that is set up in your name and your name only. You cannot use a check from a friend or family member to fund your account.

The best way to fund your account is via a bank wire or credit card directly from your checking or savings account.

A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Wire transfers are fast and highly secure.

Sending money to a trading account via credit card or debit card is easy, secure and the fastest way to fund your trading account and start to trade.

FAQ

What is the fastest way to fund my trading account?

Most of traders fund their trading accounts with a credit card. It`s the fastest way. Almost immediately you will see your money on your trading account. It`s cheaper than classic bank wire transfer. Online brokers do not charge any commission on your deposits.

Can I later send more funds to my trading account?

Yes, you can. In case that traders are satisfied with the services of the chosen online broker they fund their accounts over again.

Don`t I have to worry about entering a credit card number and a CVV code?

You don`t have to worry about the safety. All online brokers have completely safe online payment methods. It cannot be misused and it`s completely safe and most common way of funding accounts.

What if I enter the credit card information, click on deposit and I don`t see the money on my trading account?

Most likely you don`t have allowed payments over the internet. You have to request your bank to allow the internet payments. Don`t worry about abuse. The money stayed in your bank account.

How to withdraw my money?

Most online brokers have an easy way how trader can withdrawal their money. You have just to fill an easy withdrawal form and your money will be send to your bank account back.

Deposit and withdrawal of your invested money is safe in case you choose licensed and regulated broker. Your money is safe.

Help fund my trading account

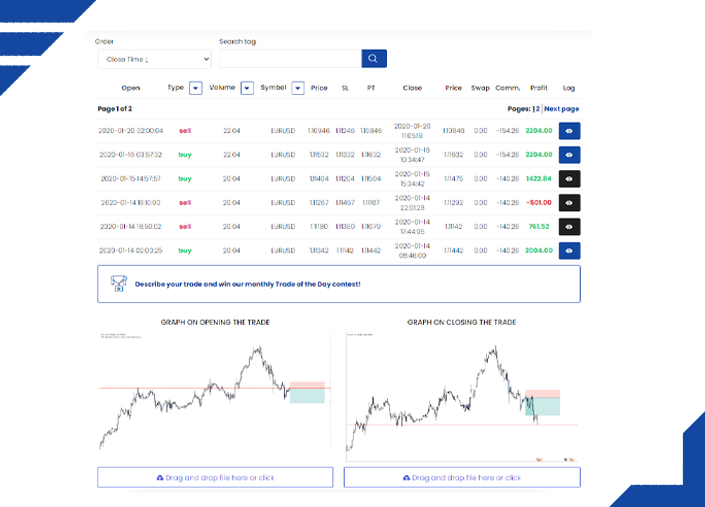

Greetings to you all, I trust that you are well. My name is dion hwehwe, I am a finance graduate of the university of pretoria and I am kindly asking you to help me fund my forex trading account.

I was introduced to forex trading in may 2015, I was 20 years old doing my final year at that time. I did my research on the forex industry and career path, and decided I would work towards becoming a forex trader.

Over the next 2 and a half years I put in the hours, reading books and eventually practicing on a demo account, and somehow the hard-work manifested into a passion. The person who introduced to forex trading played the role of a mentor, nudging and guiding me in the right direction.

I started applying for jobs so that I could be financially independent and raise capital for trading, however it has been very difficult to find a job. Despite the failure to find a job I have always maintained high hopes believing that recruiters will give me chance to prove myself, however lately I have been experiencing an emotional rollercoaster as I've seen companies retrench or close down because of the covid-19 outbreak.

I have had the privilege of mentoring someone for a few weeks and it was a great experience. I learnt that fear not only holds us back from fulfilling our potential but also creates psychological barriers. I learnt that confidence can make up for a lack of experience.

I advise those who are new trading, answering their questions, suggesting books that would help them and letting them know that it's not a walk in the park but a full time career. I do this because I am passionate about forex trading.

That is my story, interested parties are welcome to message me to discuss more. I am willing to share screenshots of some of the trades I have executed. Any donations of any amount will be highly appreciated. Thank you very much for your support and taking the time to read my message. God bless you all.

Learn crypto and blockchain

Real forex bonuses

How do I fund my contract trading accounts?

Phemex offers you both BTC and USD trading accounts which can be funded by either your BTC or USDT wallet. To fund either account, please perform the following steps:

BTC trading account

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the BTC trade account section, click the fund BTC trade account button.

- Enter your desired amount and click confirm.

NOTE: to withdraw, simply click the withdraw to wallet button and follow the same steps.

To initiate a withdrawal for the first time: learn how to make a withdrawal?

USD trading account

Funding with BTC

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the USD trade account section, click the fund USD trade account button.

- Select BTC wallet from the left-side drop-down menu.

- Enter your desired BTC amount and click get quotation. This will calculate and display the final USD amount to be deposited into your account.

- Click confirm.

Funding with USDT

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the USD trade account section, click the fund USD trade account button.

- Select USDT wallet from the left-side drop-down menu.

- Enter your desired USDT amount and click get quotation. This will calculate and display the final USD amount to be deposited into your account.

- Click confirm.

NOTE: quotations will expire after 15 seconds.

NOTE: to withdraw, simply click the withdraw to wallet button and follow the same steps.

For any inquiries contact us at support@phemex.Com.

Follow our official twitter account to stay updated on the latest news.

Join our community on telegram to interact with us and other phemex traders.

Fund my trading account

Trade our company's capital .

Receive 70% of profits,

we cover the losses.

Trade for proprietary trading firm

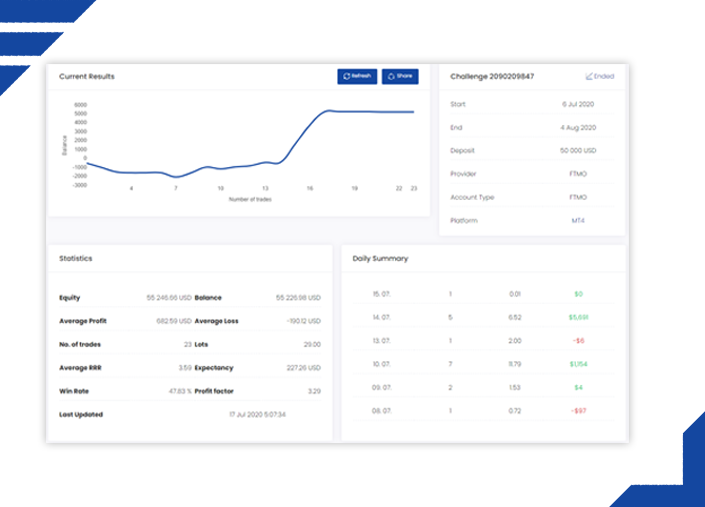

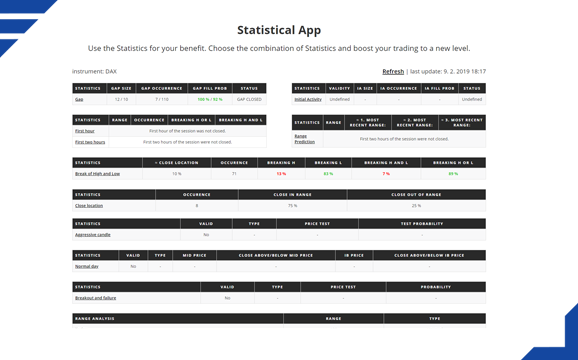

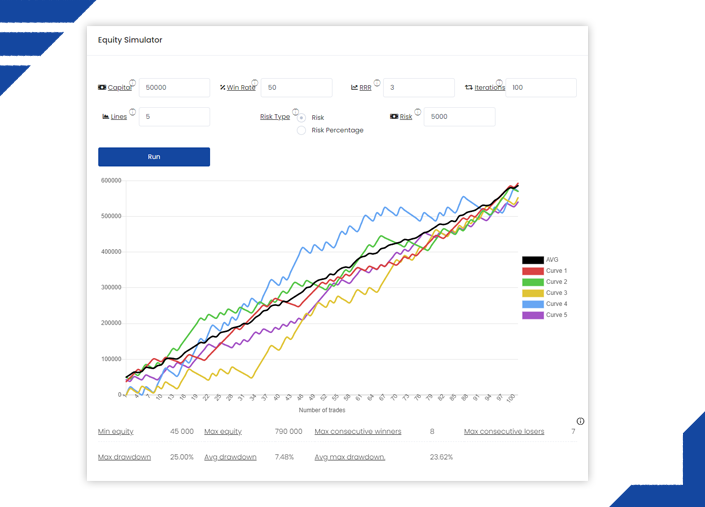

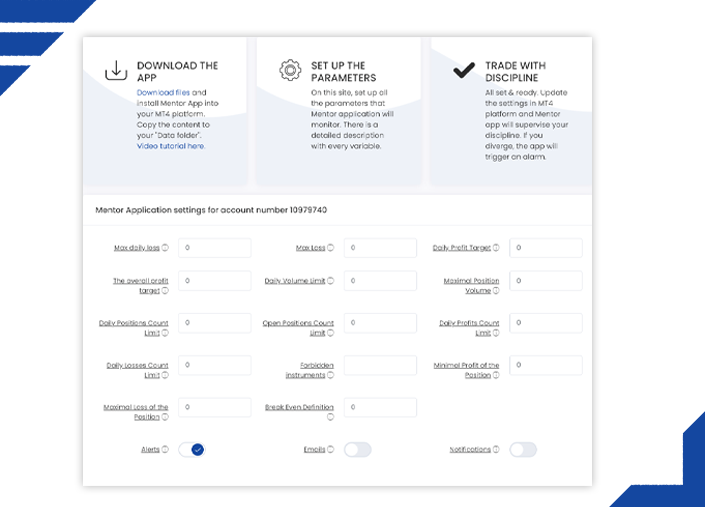

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the evaluation course, you are offered a placement in the FTMO proprietary trading firm where you can remotely manage the FTMO account with a balance of up to 100,000 USD . Your journey to get there might be challenging, but our educational applications, account analysis and performance coach are here to help you on the endeavour to financial independence.

We fund good traders

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the trading course, you are guaranteed a placement in the FTMO proprietary trading firm where you can remotely manage funded account of up to 100,000 USD. Your journey to get there might be challenging, but our educational applications, account analysis and performance psychologist are here to guide you on the endeavour to financial independence.

Evaluation process

FTMO challenge

Verification

FTMO trader

Know your trading objectives

Before we allow you to trade for our proprietary trading firm, we need to be sure that you can manage risk. For this reason, we developed trading objectives. By meeting the trading objectives, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you; we don’t set any limits on instruments or position size you trade.

| Step 1 FTMO challenge | step 2 verification | step 3 FTMO trader | |

|---|---|---|---|

| trading period | 30 days | 60 days | indefinite |

| the FTMO challenge duration is 30 calendar days; the verification duration is 60 calendar days. |

If you manage to pass the trading objectives sooner, you do not need to wait for the remaining duration days.

A trading day is defined as a day when at least one trade is executed.

If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

Current daily loss = results of closed positions of this day + result of open positions.

For example, in a case of the FTMO challenge with the initial account balance of €40000, the max daily loss limit is €2000. If you happen to lose €1000 in your closed trades, your account must not decline more than €1000 this day. It must also not go -€1000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit €2000 in one day, then you can afford to lose €4000, but not more than that. Once again, be reminded that your maximum daily loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of €1000 and then you open a new trade that goes into a floating loss of some -€1200 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -€2200 on the equity, which is more than the permitted loss of €2000.

Be careful as the maximum daily loss resets at midnight CE(S)T! Let’s say that one day you had a profit of €600. On the same day, you have an open position with a currently floating loss of €2500. On this day, the maximum daily loss is not violated. The current daily loss is €1900. ( €600 closed profit – €2500 open position). However, if you hold this position with the open loss of €2500 after midnight, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of €2500 exceeds the max daily permitted loss of €2000.

The size of the maximum daily loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why maximum daily loss limit includes your possible floating losses.

You can get more insight into why this rule is in place in this article.

10% of the initial account balance gives trader enough space to prove that his/her account is suitable for the investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% (80% in case of aggressive version) of its value under any circumstance.

For example: if you trade challenge with $100,000 account balance, your profit target is $10,000 in the FTMO challenge and then $5,000 in the verification.

Note that we will provide you with a new free challenge every time you meet all the trading objectives (regardless of whether that is challenge or verification) except for the profit target. To receive the new FTMO challenge for free, your account profit must be positive at the end of the duration with all positions being closed.

Deposits and withdrawals

It is simple to deposit and withdraw funds to and from your trading account. You can deposit, withdraw and transfer funds between your OANDA sub-accounts from your ‘my funds’ page. Log in to your account and click ‘manage funds’ to view your ‘my funds’ page.

Deposits

You can fund your account using a number of different methods:

Credit and debit card

We accept payments from credit and debit cards provided by mastercard and visa. Deposits made using a credit or debit card will typically be visible on your account within one business day.

Paypal

You can fund your account using your own personal paypal account. It usually takes up to one business day for funds deposited via paypal to be visible on your account.

Bank wire and electronic bank transfer

We accept payments via a range of different bank wire and bank transfer options, for example: faster payment, bacs, CHAPS and SEPA. The processing times for these methods vary.

For more information about depositing funds into your account and the various funding methods we accept, visit our deposit funds FAQ page.

Withdrawals

You can withdraw funds from your account via a number of different payment methods.

- We return all funds to source. If, for instance, you deposited using a credit card, you would need to withdraw funds back to that same card.

- All withdrawals are subject to our hierarchy rules. If you have deposited funds using multiple methods, you must withdraw the total sum deposited by each means in a set order, for example: first by debit cards, then credit cards, then paypal and finally bank wire transfer. Find out more about how you can withdraw funds from your account.

Credit and debit card

We process withdrawals to credit and debit cards provided by mastercard and visa.

Paypal

We process withdrawals to paypal accounts. Withdrawals to paypal accounts are usually processed within one business day.

Bank wire transfer

You can withdraw funds straight to your bank account via bank transfer.

For more information about withdrawing funds from your trading account, visit our withdraw funds FAQ page.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Take a position with OANDA trade

OANDA trade can be accessed from your web-browser, desktop, tablet and mobile device.

What are financing costs?

Financing costs can affect your cost of trading, so it's important to understand how financing works.

How to fund your account

Before you start trading, you first need to fund your account. You can find out more about the various funding methods available below.

Debit card

Execution time: instant deposit, via my IG within the trading platform.

Cost: free for visa and mastercard.

Credit card

Execution time: instant deposit, via my IG within the trading platform.

Cost: 1% charge for visa and 0.5% charge for mastercard.

HKD FPS

Execution time: up to three business days

Cost: free

NB: please quote your five-digit IG account number as a reference.

Transfer to our HK based HSBC account

Execution time: up to three business days.

Cost: free.

Please use the following details to make a transfer into IG's account:

IG international ltd – client trust account

The hongkong and shanghai banking corporation limited

1 queen's road central, hong kong

Additional bank details by currency:

NB: to ensure your funds are credited in a timely manner, please quote your five-digit IG account number as a reference. Your account number can be found in the web-based trading platform under 'my IG' > 'manage accounts' or in the email that we sent you upon activation of your account.

Please send a copy of your payment receipt to helpdesk.En@ig.Com

Important information

Please note that for security reasons payments must be made directly by the named IG account holder, and not by any third parties. The minimum funding amount for card payments is $300 USD, but there is no obligation to trade. There is no minimum funding amount for bank transfers. If your account is inactive for two years, an inactivity fee will apply.

We cannot accept cash, cheques, ATM and teller payments, commercial credit cards, or business credit cards.

Debit card and credit card payments can only be used for personal accounts.

All payments are subject to security checks and we may request more information from you before returning your funds, such as a screenshot of your bank statement or proof of identity.

We'll normally remit money in the same method and to the same place from which it was received. However, we may consider a suitable alternative at our absolute discretion.

Contact us

Questions about opening an account:

Existing client questions:

We're here 24hrs a day from 8am saturday to 10pm friday (UK time).

Markets

Trading platforms

Learn to trade

About

Contact us

The risks of loss from investing in cfds can be substantial and the value of your investments may fluctuate. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

CFD accounts provided by IG international limited. IG international limited is licensed to conduct investment business and digital asset business by the bermuda monetary authority and is registered in bermuda under no. 54814.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG international limited is part of the IG group and its ultimate parent company is IG group holdings plc. IG international limited receives services from other members of the IG group including IG markets limited.

Fund your account

Select the FCM for funding instructions.

Contact us for a consultation.

Haven’t selected a clearing firm? For a consultation with a daniels trading representative, call us toll-free at +1.800.800.3840, or contact us using the form below. After a consultation, you should have a clear understanding of which clearing firm will best meet your needs.

Please complete the form below. The fields marked with an (*) are required.

Your privacy is important to us.

Please review our privacy policy.

Footer

Site navigation

Contact us

Connect with us

Copyright © 2021 · daniels trading. All rights reserved.

THIS MATERIAL IS CONVEYED AS A SOLICITATION FOR ENTERING INTO A DERIVATIVES TRANSACTION.

THIS MATERIAL HAS BEEN PREPARED BY A DANIELS TRADING BROKER WHO PROVIDES RESEARCH MARKET COMMENTARY AND TRADE RECOMMENDATIONS AS PART OF HIS OR HER SOLICITATION FOR ACCOUNTS AND SOLICITATION FOR TRADES; HOWEVER, DANIELS TRADING DOES NOT MAINTAIN A RESEARCH DEPARTMENT AS DEFINED IN CFTC RULE 1.71. DANIELS TRADING, ITS PRINCIPALS, BROKERS AND EMPLOYEES MAY TRADE IN DERIVATIVES FOR THEIR OWN ACCOUNTS OR FOR THE ACCOUNTS OF OTHERS. DUE TO VARIOUS FACTORS (SUCH AS RISK TOLERANCE, MARGIN REQUIREMENTS, TRADING OBJECTIVES, SHORT TERM VS. LONG TERM STRATEGIES, TECHNICAL VS. FUNDAMENTAL MARKET ANALYSIS, AND OTHER FACTORS) SUCH TRADING MAY RESULT IN THE INITIATION OR LIQUIDATION OF POSITIONS THAT ARE DIFFERENT FROM OR CONTRARY TO THE OPINIONS AND RECOMMENDATIONS CONTAINED THEREIN.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE PERFORMANCE. THE RISK OF LOSS IN TRADING FUTURES CONTRACTS OR COMMODITY OPTIONS CAN BE SUBSTANTIAL, AND THEREFORE INVESTORS SHOULD UNDERSTAND THE RISKS INVOLVED IN TAKING LEVERAGED POSITIONS AND MUST ASSUME RESPONSIBILITY FOR THE RISKS ASSOCIATED WITH SUCH INVESTMENTS AND FOR THEIR RESULTS.

TRADE RECOMMENDATIONS AND PROFIT/LOSS CALCULATIONS MAY NOT INCLUDE COMMISSIONS AND FEES. PLEASE CONSULT YOUR BROKER FOR DETAILS BASED ON YOUR TRADING ARRANGEMENT AND COMMISSION SETUP.

YOU SHOULD CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR CIRCUMSTANCES AND FINANCIAL RESOURCES. YOU SHOULD READ THE "RISK DISCLOSURE" WEBPAGE ACCESSED AT WWW.DANIELSTRADING.COM AT THE BOTTOM OF THE HOMEPAGE. DANIELS TRADING IS NOT AFFILIATED WITH NOR DOES IT ENDORSE ANY TRADING SYSTEM, NEWSLETTER OR OTHER SIMILAR SERVICE. DANIELS TRADING DOES NOT GUARANTEE OR VERIFY ANY PERFORMANCE CLAIMS MADE BY SUCH SYSTEMS OR SERVICE.

GLOBAL ASSET ADVISORS, LLC (“GAA”) (DBA: DANIELS TRADING, TOP THIRD AG MARKETING AND FUTURES ONLINE) IS AN INTRODUCING BROKER TO GAIN CAPITAL GROUP, LLC (GCG) A FUTURES COMMISSION MERCHANT AND RETAIL FOREIGN EXCHANGE DEALER. GAA AND GCG ARE WHOLLY OWNED SUBSIDIARIES OF STONEX GROUP INC. (NASDAQ:SNEX) THE ULTIMATE PARENT COMPANY.

How do I fund my trading account?

Please be aware that saxo markets australia pty ltd (SCM australia) is unable to accept funds before account opening due diligence is completed and you have received your account details. Any funds received before this process has been completed, will be returned to your sending account, less bank charges (if any).

You find your personal funding account number information directly from our platform(s):

Go to menu> deposit and transfer > funding instructions

Electronic funds transfer & telegraphic transfer

AUD bank account details:

bank: HSBC

account name: saxo capital markets (australia) pty ltd

BSB: 342 011

account number: 451747163

reference: * your saxo client ID (e.G. 1357683)

FX currency bank account details:

bank: HSBC bank australia limited

address: 28 bridge street sydney, NSW 2000

account name: saxo capital markets (australia) pty ltd

SWIFT: HKBAAU2S

account number: see below for currency account number

reference: *your saxo client ID (e.G. 1357683)

Bank address

HSBC bank australia limited

28 bridge street

sydney NSW 2000

australia

| FX currency | account number |

|---|---|

| CAD | 011-451747-905 |

| CHF | 011-451747-923 |

| CNH | 011-451747-160 |

| EUR | 011-451747-908 |

| GBP | 011-451747-904 |

| HKD | 011-451747-159 |

| JPY | 011-451747-914 |

| NZD | 011-451747-917 |

| SGD | 011-451747-911 |

| USD | 011-451747-902 |

Please ensure that you have read the below general section on important information relating to funding your account.

Before you fund your trading account with SCM, please ensure that your existing bank account has been opened under the same name (in the exact order, sequence and form) as the name which has been used to open your SCM trading account. You can only withdraw funds from your trading account to a bank account held under your name . Please instruct your bank to include your saxo client ID and name in your transfer instructions.

Card funding

Instant transfer via card funding module:

On saxotradergo: select account > deposit and transfer

On saxotraderpro: select ADD MODULE > deposit and transfer

Please refer to our credit and debit card payment factsheet

Merchant transaction fees are charged by the payment service provider.

Saxo does not charge any fees relating to credit card payments.

Third party funding is not accepted

SCM does not accept incoming funds from any third party. SCM will only accept funds originating from a bank account held in the same name registered with SCM. This rule applies to both individual accounts as well as corporate accounts.

Funds received from any third party accounts will be returned (less bank charges) to the sender. The funds should typically reach the sender’s account within 5 to 10 working days, however, there may sometimes be a delay depending on the banks involved.

Unaccepted forms of payment

SCM does not accept banker’s drafts, cash deposits and remittances from exchange houses/money changers. Funds received from any or all of these payment channels will be rejected and returned to the sender (less bank charges, if any).

Currency conversions:

If you transfer funds that are in a different currency than the currency of our HSBC account, your funds will be accepted and automatically be converted to the appropriate currency by HSBC who will charge a non-refundable currency conversion fee. For example, if you send USD to our AUD account 011-451747-163 at HSBC, HSBC will convert your USD to AUD and credit our account.

If your funds are subsequently rejected by us (for example, for third party funding or remittances from exchange houses/money changers), any currency conversion already carried out on your funds will not be reversed.

If you do not have a SCM account denominated in the same currency as our HSBC account that your funds have been transferred to, we will convert the funds to the appropriate currency when crediting your SCM account, and you will be charged a non-refundable currency conversion fee as described in our commissions, charges and margin schedule. For example, if you send AUD to our AUD account 011-451747-163 at HSBC, and you only have a USD-denominated SCM account, we will convert your AUD to USD and credit your SCM account.

Remittance charges:

SCM can and will only credit your account with the actual monies received on your behalf.

Remittance charges should be fully covered by the sender.

Rejected funds due to remittance received before the due diligence has been completed and you have received your account details or remittance received from exchange houses/money changers or any third party (including family members) will be returned to the sender less bank charges (if any).

Request for proof of remittance:

Please note that we are required under the anti-money laundering rules and regulations to request for and verify proof of remittance from our clients. Although such request may not be made immediately upon making the bank transfer or credit/debit card payment, saxo capital markets reserves the right to request for such proof at a later date. If the client is unable to furnish such proof of remittance within a reasonable period of time, we are entitled to limit or restrict

Related articles

Browse all topics

Can't find what you are looking for?

We'll show you how to contact us.

Saxo services & products

Losses can exceed deposits on margin products. Please ensure you understand the risks.

Saxo capital markets (australia) limited ABN 32 110 128 286 AFSL 280372 (‘saxo’ or ‘saxo capital markets’) is a wholly owned subsidiary of saxo bank A/S, headquartered in denmark. Please refer to our general business terms & combined financial services guide & product disclosure statement to consider whether acquiring or continuing to hold financial products is suitable for you, prior to opening an account and investing in a financial product.

Trading in financial instruments carries various risks, and is not suitable for all investors. Please seek expert advice, and always ensure that you fully understand these risks before trading. Trading in leveraged products such as cfds and margin FX products may result in your losses surpassing your initial deposits. Saxo capital markets does not provide ‘personal’ financial product advice, any information available on this website is ‘general’ in nature and for informational purposes only. Saxo capital markets does not take into account an individual’s needs, objectives or financial situation.

The saxo trading platform has received numerous awards and recognition. For details of these awards and information on awards visit www.Home.Saxo/en-au/about-us/awards.

The tradingfloor.Com website is the property of saxo bank A/S as an affiliate of saxo bank, and is a part of saxo bank group, saxo capital markets has entered into an arrangement with tradingfloor.Com to allow clients of saxo capital markets upon their consent to access information on tradingfloor.Com and use their saxo trading account to enter into transactions through tradingfloor.Com. Any materials or other social trading features available on the tradingfloor.Com website are provided by saxo bank A/S and saxo capital markets does not accept any responsibility or liability for the contents or services made accessible through tradingfloor.Com. For the avoidance of doubt, should clients decide to enter into any transaction through tradingfloor.Com saxo capital markets will be the counterparty to any transaction entered into by clients and not saxo bank.

Social trading involves risks, even when following and/or replicating other profiled traders. Past performance of a trader indicated on tradingfloor.Com is not indicative of future results. When reviewing the portfolio or financial performance information, opinions or views of a profiled trader, you should not assume that the profiled trader is unbiased, experienced, professional, independent or qualified to provide financial information or advice. Tradingfloor.Com does not contain (and should not be construed as containing) financial, investment, tax, trading advice and should not be construed as an offer or solicitation for the subscription, sale or purchase in any financial instrument. Saxo bank A/S or its affiliates will not be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available as part of tradingfloor.Com or as a result of the use of tradingfloor.Com.

Apple, ipad and iphone are trademarks of apple inc., registered in the US and other countries. Appstore is a service mark of apple inc.

The information or the products and services referred to on this website may be accessed worldwide, however is only intended for distribution to and use by recipients located in countries where such use does not constitute a violation of applicable legislation or regulations. Products and services offered on this website is not intended for residents of the united states and japan.

Please click here to view our full disclaimer.

So, let's see, what was the most valuable thing of this article: forex traders are usually given several options when deciding how to deposit funds into trading accounts, from credit cards to wire transfers. At fund my trading account

Contents of the article

- How do you fund a forex account?

- How forex trading works

- How to fund a forex account

- Transfer of funds to your trading account

- Help fund my trading account

- Learn crypto and blockchain

- Real forex bonuses

- How do I fund my contract trading accounts?

- BTC trading account

- USD trading account

- Fund my trading account

- Trade for proprietary trading firm

- We fund good traders

- Evaluation process

- FTMO challenge

- Verification

- FTMO trader

- Know your trading objectives

- Deposits and withdrawals

- Deposits

- Withdrawals

- Ready to start trading? Open an account in minutes

- How to fund your account

- Debit card

- Credit card

- HKD FPS

- Transfer to our HK based HSBC account

- Fund your account

- Select the FCM for funding instructions.

- Contact us for a consultation.

- Footer

- How do I fund my trading account?

- Electronic funds transfer & telegraphic...

- Card funding

- Third party funding is not accepted

- Unaccepted forms of payment

- Currency conversions:

- Remittance charges:

- Request for proof of remittance:

- Related articles

- Browse all topics

- Can't find what you are looking for?

- Saxo services & products

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.