How to join forex trading without money

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself?

Real forex bonuses

Will you get any significant benefit from it? The answer to that question is subjective, some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

Forex trading without deposit | no deposit bonus explained

It’s generally known that in order to get started in forex, you need to put a lot of resources into it. And while these resources can be your time and energy, the most straightforward one is, of course, your money.

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

10 ways to avoid losing money in forex

The global forex market is the largest financial market in the world and the potential to reap profits in the arena entices foreign-exchange traders of all levels: from greenhorns just learning about financial markets to well-seasoned professionals with years of trading experience. Because access to the market is easy—with round-the-clock sessions, significant leverage, and relatively low costs—many forex traders quickly enter the market, but then quickly exit after experiencing losses and setbacks. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading.

Do your homework

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Learning about forex is integral to a trader’s success. While the majority of trading knowledge comes from live trading and experience, a trader should learn everything about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies.

Key takeaways

- In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker.

- Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective.

- It's important to use proper money management techniques and to start small when you go live.

- Control the amount of leverage and keep a trading journal.

- Be sure to understand the tax implications and treat your trading as a business.

Homework is an ongoing effort as traders need to be prepared to adapt to changing market conditions, regulations, and world events. Part of this research process involves developing a trading plan—a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives.

How do you make money trading money?

Find a reputable broker

The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker. Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the national futures association (NFA) and is registered with the commodity futures trading commission (CFTC) as a futures commission merchant. each country outside the united states has its own regulatory body with which legitimate forex brokers should be registered.

Traders should also research each broker’s account offerings, including leverage amounts, commissions and spreads, initial deposits, and account funding and withdrawal policies. A helpful customer service representative should have the information and will be able to answer any questions regarding the firm’s services and policies.

Use a practice account

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Few things are as damaging to a trading account (and a trader’s confidence) as pushing the wrong button when opening or exiting a position. It is not uncommon, for example, for a new trader to accidentally add to a losing position instead of closing the trade. Multiple errors in order entry can lead to large, unprotected losing trades. Aside from the devastating financial implications, making trading mistakes is incredibly stressful. Practice makes perfect. Experiment with order entries before placing real money on the line.

$5 trillion

The average daily amount of trading in the global forex market.

Keep charts clean

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. This should be avoided.

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace. The chosen colors, fonts, and types of price bars (line, candle bar, range bar, etc.) should create an easy-to-read-and-interpret chart, allowing the trader to respond more effectively to changing market conditions.

Protect your trading account

While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of the process. Many veteran traders would agree that one can enter a position at any price and still make money—it’s how one gets out of the trade that matters.

Part of this is knowing when to accept your losses and move on. Always using a protective stop loss—a strategy designed to protect existing gains or thwart further losses by means of a stop-loss order or limit order—is an effective way to make sure that losses remain reasonable. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session.

While traders should have plans to limit losses, it is equally essential to protect profits. Money management techniques such as utilizing trailing stops (a stop order that can be set at a defined percentage away from a security’s current market price) can help preserve winnings while still giving a trade room to grow.

Start small when going live

Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. As such, it is vital to start small when going live.

Factors like emotions and slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process.

Use reasonable leverage

Forex trading is unique in the amount of leverage that is afforded to its participants. One reason forex appeals to active traders is the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth. But leverage can just as easily amplify losses.

A trader can control the amount of leverage used by basing position size on the account balance. For example, if a trader has $10,000 in a forex account, a $100,000 position (one standard lot) would utilize 10:1 leverage. While the trader could open a much larger position if they were to maximize leverage, a smaller position will limit risk.

Keep good records

A trading journal is an effective way to learn from both losses and successes in forex trading. Keeping a record of trading activity containing dates, instruments, profits, losses, and, perhaps most important, the trader’s own performance and emotions can be incredibly beneficial to growing as a successful trader. When periodically reviewed, a trading journal provides important feedback that makes learning possible. Einstein once said that “insanity is doing the same thing over and over and expecting different results.” without a trading journal and good record keeping, traders are likely to continue making the same mistakes, minimizing their chances of becoming profitable and successful traders.

Know tax impact and treatment

It is important to understand the tax implications and treatment of forex trading activity in order to be prepared at tax time. Consulting with a qualified accountant or tax specialist can help avoid any surprises and can help individuals take advantage of various tax laws, such as marked-to-market accounting (recording the value of an asset to reflect its current market levels).

Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters.

Treat trading as a business

It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

As with any business, forex trading incurs expenses, losses, taxes, risk and uncertainty. Also, just as small businesses rarely become successful overnight, neither do most forex traders. Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

The bottom line

The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. When approached as a business, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. Traders can improve their odds by taking steps to avoid losses: doing research, not over-leveraging positions, using sound money management techniques, and approaching forex trading as a business.

How to make money in forex without actually trading

There is only one sure thing in forex trading. Loss. It is the only sure thing that every open position will eventually be closed with a loss. So how to make money in forex without actually trading it? You definitely can earn a lot of money in forex trading without opening any single position. Here are just two examples of how to make money in forex without actually trading. Every beginner with a goal to trade forex successfully needs to read the below.

1. Be a forex broker

To be a forex broker means that you earn money by connecting sellers and buyers. In the old days, when computers were just in star trek, brokers needed only a pencil, paper, and phone.

Brokers called from early morning till late afternoon to dealers in banks, trying to find just two with opposite ideas and wishes. And there is hidden the forex broker profit.

The small fraction of trade amount, but without any risk (of course, if we ignore counterparty risk) would be the broker’s fee.

Counterparty risk means, that you still risk that your counterparty will not pay your fees. However, if you work with regulated banks, your risk is pretty low.

Volatility is a friend of every broker

The only thing you need as a broker is volatility. You will praise volatility, you will enjoy any unexpected event which will move markets up or down.

You will not care about direction market moves, and you will care just about if the move is large enough. More volatility, more happy and wealthy you will be.

You will hate holidays and low liquidity. You will hate non-eventful days, stable markets, and peace in the world.

Your day will be much nicer when FED unexpectedly raises rates or decreases them. No matter what FED does, it will definitely help that it surprises forex markets.

What you need as a broker

You needed just a pen, pencil and phone long ago. Nowadays you will need probably a robust IT system and a lot of money.

The competition between brokers is pretty strong. All of them invest a lot in IT infrastructure and marketing.

Fees are going down, and you need more significant amounts to earn the same money as year or two ago. However, still, you do not have any open positions.

You can sleep peacefully. There is no possibility that you come to the office in the morning and all your positions will be in a deep loss.

2. Be a consultant

You do not want to trade your own money, do you? Trading other people’s money can be more pleasant in case you lose them. Be a consultant means that you just give advice and take your fees before anything goes wrong.

You will not risk your money. Great, isn’t it?

What do you need as a consultant?

The primary thing in the consultancy business is reputation. Without a reputation, nobody will hire you.

To earn a reputation is not easy. Basically, you can be a trader who finished his career and your trade log speaks for itself.

The second possible way is to make yourself visible. You have to comment in discussions about forex, write articles about it, do not be afraid telling others what they should do last week.

And you will see that some fool will like your advice and hires you. You know that prediction of future on forex is impossible, so let your partners pay your fees before any of your opinions materialize.

Is it possible to make money in forex without actually trading?

Yes, it is possible to make money in forex without actually trading. We showed you two possible ways how you can win at the forex every time.

We are sure there are other ways we did not mention. But even as a consultant or a broker, you will have to work hard to earn anything.

How to trade forex without money? (free credits and money)

A lot of people want to start investing but just don’t have the money to do so but want to get involved anyway. Anything that deals with investing whether it be stocks or forex comes with its risks. Of course is it much better to get involved without having to use your hard earned money.

So how is it possible to trade forex without actual money? Most all brokers will allow you to setup a demo account fore 100% absolutely free so you can get the full effect of trading without losing actual money. There are also brokers that allow you to open a no deposit account which is where you trade with live money of theirs but you can’t actually withdraw that money until you make money off of it.

There are 4 main ways to get involved with forex without having money of your own to invest:

- Demo

- Through A broker

- Contests

- Affiliate

Demo – we went over this briefly above but you should always demo to at least initially learn how to trade before moving forward to a live account anyway. Most all brokers allow you to use a demo account for free and there literally is no difference between demo and live besides the fact that you connect to a different server for the data feed which I will get into at a later time. The brokers I have used (live in U.S.) are finpro, FX choice, JAFX, and traders way. If you live outside the U.S. You have many more options usually.

Through A broker – there are brokers out there that will allow you to trade a small amount of their money live. I have never personally done this because I haven’t heard anything good about it. But what happens in they give you a no deposit account where you trade their money you can’t take that money out until you actually make money with it. The bad thing I have heard is that they make excuses as to why you can’t withdraw the money or it takes a long time to actually withdraw the winnings then it ends up being the wrong amount. So if you go this route make sure you go with somebody reputable.

Contests – okay now this can be fun because they are almost always a public contest where results are shown so the broker has to be honest and is held accountable for these. JAFX actually had one awhile ago (I was nowhere close to winning) that you were given a demo account and I believe it was a month to make the most money trading by any means and I believe the person who won it traded bitcoin (BTCUSD) exclusively and kicked butt. The prize for this was $10k USD that was deposited to their account of live money! Again you will probably want to look to demo safely first but if something like this pops up just go for it because there is no risk involved.

You may ask well why do brokers do this but it is for the publicity and the spread of their business they reel in many new long term customers by doing this. There are other contests like I believe at the time of this writing there is a scalping contest coming up I think this is it right here: https://www.Mexgroup.Com/demo_competition

Affiliate – let’s say you start demoing with a broker and you like their platform, feed seems to be right on, and their spreads and fees are very low. Well why not tell your friends, family and anyone else about them? Most brokers also have an affiliate program that gives you a percentage of what people trade live (included in brokers fees). So why not sign up and spread the word on a great broker that you are using.

The only thing you really can’t promote on is a deposit and withdrawal since you haven’t actually done this yourself but that is okay because most people looking to get into forex look at spreads mostly especially scalpers.

The bonus methods of making money in forex without having money:

- Start A blog (like this) – yes that’s right write as you learn to trade and let google make money for you. The chance is pretty good you either found this article by searching google or through one of my social media posts. I do actually make money by ads along with people signing up to my email list or affiliate offers. It is not that hard to do and I will actually be doing a free post on how to do this. Just don’t expect to make money on it overnight but it is like keeping a running journal of your journey to becoming a professional trader or at least that is how I look at it.

- Affiliate offers – there are many paid forex educational platforms that some are great, some are mediocre, and others are outright scams. If you learn to trade from one of these paid educational platforms and make money why not share it with people. I myself started getting serious about forex trading after joining IML (imarketslive). This is an educational platform that has a lot more to offer by learning from many years of experience of forex traders along with crypto gurus. The one main reason I stay active with them is because of the new paradigm guru who is named steve gregor he has been a trader for over 15 years as of this writing and I have learned most everything I know from him. There are others out there and you have some people that over hype things (IML included) that make it look scammy that is why you need to look for a mentor that is honest and been around for a long time (not me). I have only been trading for going on 2 years at the time of this article.

Related questions from our readers:

How to make money in forex without actually trading?

You can make money the 4 ways we described above which include: broker affiliate, broker demo contests, no deposit broker, blogging about forex, and becoming an IBO for an affiliate forex educational platform.

How much money do you need to start trading forex?

You need absolutely no money to get started in forex you can demo as long as you like now you will need access to a computer and the internet however.

Can you get rich by trading forex?

Yes of course but it isn’t as easy as a lot of people say. Once you get a strategy down by doing volumes of trades it does get much easier and steer clear of the news.

Can forex trading be profitable?

Forex trading can be very profitable but you also need to focus on being patient and proper risk management.

Can I do forex trading without A broker?

Yes you can but I do think it would be a big mistake to start forex trading this way unless you are already a millionaire of course. One of the biggest cons of this is you will have no leverage.

Hello I am tab winner welcome to my forex blog. I have been trading forex for over 2 years now and a stay at home dad for about the same amount of time.

Head and shoulder patterns are fun to trade and can make for some major pips if you get in just right on the reversal pattern. You will mostly see reversal patterns on uptrends. Also known as.

Drawing support and resistance can be the backbone to any trading style. Luckily in tradingview their drawing tools are amazing and continue to improve as they come out with constant updates.

About me

Hello I am tab winner welcome to my forex blog.

My site is called stayathometrader.Com for 2 main reasons:

1. I am a stay at home father have been for over 4 years now. This blog will be documenting my journey and daily struggles of raising a daughter (3 years old now) and also trying to become a professional trader at the same time.

2. I trade from home. I do two things for work SEO and trading forex. Both I think of in terms of compounding for myself and families future. I will be trying to post at least 1-2 times a week as I work on my education and daily trades during the week.

Some other quick things about me:

– I live in the middle of nowhere and own a small old

family farm

– we also have horses, dogs, cats, and fish

– I do not consider myself a professional trader even

though I do make a living from it I am continually

learning from my mentor steve gregor who has over

16 years of experience

How to start forex trading for beginners

If you have decided to, or are still considering whether to become a professional forex trader, you are probably wondering things such as 'how do you start forex trading' or 'how much money do you need to start forex trading?'.

This article will address such questions, and more, by providing you with a step by step guide on how to start forex trading online today. We will look at things such as, which types of accounts you should consider, how these accounts differ, and then of course, how much money a beginner needs to trade forex.

How to start forex trading

There are a dizzying array of questions and variables to consider when you begin trading. Will you trade using fundamental or technical analysis? Or perhaps, a combination of both? Do you want to start day trading forex or will you be taking a longer-term approach? Will you trade rigidly based on the rules of a particular forex system? Will you take a more discretionary approach? The questions are endless, but ultimately they determine what you will achieve in the market, and how you do it. You can also break these questions down into even more specific directions.

Let's first look at how much money you need to start trading forex. The answer may be smaller than you think – it's actually zero. A demo trading account allows you to start trading forex without an initial investment and experience the live forex markets, without risk, by trading with virtual currency. Admiral markets offers clients the ability to trade virtual funds of up to $10,000 in their forex demo account.

With a demo account, you can even access our expert trading platform, mettrader supreme edition. By mixing the use of a demo account and a live account, you can test your strategies within a risk free environment first, before you move onto the live markets. If you are a beginner, a demo account is the perfect way to start forex trading and get a feel of what the live markets are like.

After all, part of learning is making mistakes – but you with a demo account, you will not have to lose capital by doing so. Another important thing to consider when you start trading is how to implement risk management into your trading. Doing so will enable you to manage the risks effectively, so you are aware of them, and you know how to reduce your exposure to these risks.

Learn to trade forex with admiral markets

If you are wondering what the best way to learn forex trading is, look no further than our forex 101 trading course. This online course is the perfect place for beginner traders to learn the intricacies of the forex market. And best of all its FREE! Click the banner below to sign up to this course today:

The forex market: A market for everyone

Let's consider the forex market for a moment. Much is made of the vast size of the FX market, but its egalitarian accessibility is often overlooked. Small players happily play alongside the largest participants. There is a place at the table for everyone because of the surprisingly low barriers to entry. High levels of leverage allow small deposits to command sizeable positions.

In short, this means you can make trades without tying up a lot of your cash. Obviously, you should never trade beyond your means, but leverage offers a very convenient way of trading.

How much money do I need to open A forex account?

It really depends on the type of account. Because different account types offer a variety of services and generally require different starting deposits. But for the most part, you can open an account with a relatively small deposit.

For example, with admiral markets, you can open a trade.MT5 or a zero.MT5 account with a minimum deposit of $100 (or a similar amount in other currencies). The trade.MT5 account offers low spreads and highly competitive leverage, whereas the zero.MT5 offers ultra-low spreads and institutional-grade speed of execution which is well suited for high frequency traders.

Be risk-aware

Depicted: admiral markets metatrader 5 - EURGBP daily chart. Disclaimer: charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by admiral markets (cfds, etfs, shares). Past performance is not necessarily an indication of future performance.

You should never trade more than you can afford to lose. When considering how much to start forex trading with, it is very much an issue of your own personal finances, and your own attitude to risk. Trading can often be a nerve-wracking and pressure-filled experience. One simple way to ease this is to trade conservatively. This will help you cope with these conditions.

Let's look at an example to get a feel for how much we are talking about. A sensible rule of thumb is that you shouldn't be risking more than 1% or 2% of your capital per trade. For the sake of convenience, let's use 1%.

The minimum trade size with the trade.MT5 account is 0.01 lots. A lot is a standard transaction size for each currency pair and equates to 100,000 units of the base currency. Let's say you decide to buy 0.01 lots of EURUSD. This is a position that means you make or lose 0.1 USD for every pip movement. The margin for a position this small would be covered by your minimum deposit.

How do you quantify risk?

Here's the kicker – quantifying the risk attached to an individual trade is a tricky business. We can broadly say that the risk is the amount of loss you would be willing to withstand before closing the position. However, this likely underestimates the risk because you may subsequently change your mind and tolerate a greater loss. There may also be times when a market moves faster than you can react.

One way to try to draw a line under the position and quantify the risk is to use a stop-loss. But be aware that a conventional stop order is not guaranteed. A stop order becomes an order to deal on the market once its level has been hit. However, in the event of a fast-moving or gapping market, your stop-loss may not be executed, due to slippage.

In short, stops do not mean any maximum loss is set in stone, but they do give you a rough and useful idea of your risk for normal conditions. Let's say you placed your stop 80 pips away. For our rough estimation, we could say that the theoretical risk is 80 pips x 0.1 USD per pip = $8.

If we are assigning a theoretical risk of $8 to this trade, and we are also saying one trade is 1% of our total risk capital, then the total risk capital must be $8 x 100 = $800. These are just some sample numbers, of course.

If you worked with tighter stops, your risk capital would be even smaller. If you worked with wider stops and/or a larger transaction size, you would need more risk capital. Here's another way of considering the question – successful trading is about winning in the long run. To win in the long run, you must not have your capital wiped out in the short run.

Still want to know how much money you need for forex trading? Put simply, you need enough to avoid blowing up. Look at price catastrophes that have occurred historically in your chosen currency pair. Think about what such movements would mean to you with your average trading size. Make sure that your risk capital is large enough to withstand such price shocks.

Once you're up and running, and in a position to make steady returns, you might start to consider how much money you need to start forex trading like a full-time business. If you are trying to find out what realistic monthly returns for a trader are, you are going to be trading in sizes that are much larger than usual minimums. Therefore, your risk capital will have to be larger as well.

Final thoughts

If you start conservatively and use sensible money management, you do not need a large amount of money to trade forex. It is possible to start trading with only a few hundred dollars, provided your trading sizes are small. If you are willing to put in the preparatory leg work, you should be able to discover a trading approach that works for you.

There's one more thing to consider – people who succeed at trading forex, work hard at it. The more effort you put in, the more likely you are to succeed. So, when facing a new, challenging venture, the only correct option is to learn more about what you are getting into. If you would like to learn more about forex, or trading in general, why not check out range of articles and tutorials?

Trade forex & cfds with admiral markets

Professional trading has never been more accessible than right now! Admiral markets offers professional traders the ability to trade on the forex market directly and via cfds with 80+ currencies, including forex majors, forex minors, exotic pairs and more! Open your live trading account today by clicking the banner below!

About admiral markets

Admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

How to make money in forex without actually trading

Looking for ways to extract money from the markets and thinking that the forex or the stock market is too complicated? In today’s article, I’m going to introduce to you a fairly new concept called social trading platforms.

With these platforms, you can make money without the hassle of having to trade by yourself – you can just copy others who know what they’re doing.

What are social trading platforms?

Source: pixabay

You may be familiar with social networks but never heard of social trading platforms before. Social trading platform/network is similar to the social network. Instead of seeing someone sharing photos, you see them share their trading results.

The most important feature of a social trading platform is the ability to copy other traders.

If you think a trader is successful and has the same investment style as you, then you can choose to copy that person. It means all his open transactions will be automatically copied

into your account.

Several social trading platforms also equipped with chat or comment features. It opens the possibility to learn and discuss the market in real-time – another feature similar to social networks.

You don’t need to give out your personal information or access to your account, as the “copy” feature is automatically done by the system.

The social trading concept also gives benefit to professional traders. These are traders who are usually being copied by beginners. They receiving a small fee to motivate them, and they earn an additional income as money managers.

The reason social trading platforms are growing exponentially is the combination of professional traders’ skill and beginner traders’ capital.

Since the professional traders will receive a fee from their followers, and beginners can make money by copying, it’s a win-win solution for both types of traders.

Benefits of social trading

There are several benefits of social trading, such as:

- Open concept – all gains or losses from a trader will be disclosed automatically to their followers.

- Passive income for beginners who copy successful traders

- Additional income for professional traders

- Opportunity to discuss and learn more about the markets and about the strategies of the pros.

While having several strong benefits, social trading platforms also have their disadvantages.

For example, the professional traders are not selected by risks or experience. Usually, they are people with skill and luck until they passed the minimum trading criteria to be considered as a professional. Followers need to learn about risks on their own and decide carefully whom to copy.

There are also complains about copied trades having high slippage. This may happen as a result of poor internet connection. Many social trading platforms have eliminated this risks by letting traders set a maximum acceptable slippage. It means if the actual slippage exceeds your parameter, the trade won’t be copied.

What kind of trader are you?

Source: pixabay

We already mentioned above that beginners need to understand the risks and their own investment style before copying others. Ask yourself these questions to understand which traders you should copy:

- Do you want to make short-term profits or long-term growth?

- Can you deal with negative results for weeks or do you want instant profits?

- How much risk are you willing to take?

There are usually 2 main types of traders on the social trading platforms – day traders and long-term traders.

Day traders are those who are after short-term profits, and will open and close their positions during the same day.

You are less likely to suffer massive losses by copying these traders.

On the other hand, long-term traders will use their own strategy to read the market and leaves position open overnight. This kind of traders are thinking that the forex market fluctuates and won’t continue in the same direction all the time.

If you copy the long-term traders, you may get higher profits than the day traders do. However, keep in mind that you may experience bigger losses too.

Overview of the 2 biggest platforms

Now that you know what a social trading platform is, let’s take a look at 2 of the biggest platforms out there.

Etoro

Source: etoro homepage

Etoro was founded in 2007 and currently served as a leading social trading platform with over 5 million traders globally.

This site is for entry to medium level traders, just because the platform is so easy to use.

The web or mobile interface is clean and easy to understand. You can make your own trades or copy others. You can easily copy which traders to follow based on their trading style, performance, risk score, etc.

These traders will receive a small fee, to motivate them that someone like you is copying them. Do not worry about this fee as they are low and won’t affect your account much. Consider it like this: if the traders are good, they should earn you bigger money than the fees.

Other than the ability to copy others, etoro also implements social sentiment. You can see what other traders are thinking about each stock or currency. They also provide an abundance of free trading education, just spend a little bit of your time to watch their educational videos.

Tutorial on using etoro

Now, etoro may not be the cheapest broker, since they required you to deposit a minimum of $200. However, if you aim to copy other traders and learn from them, then this platform is right for you.

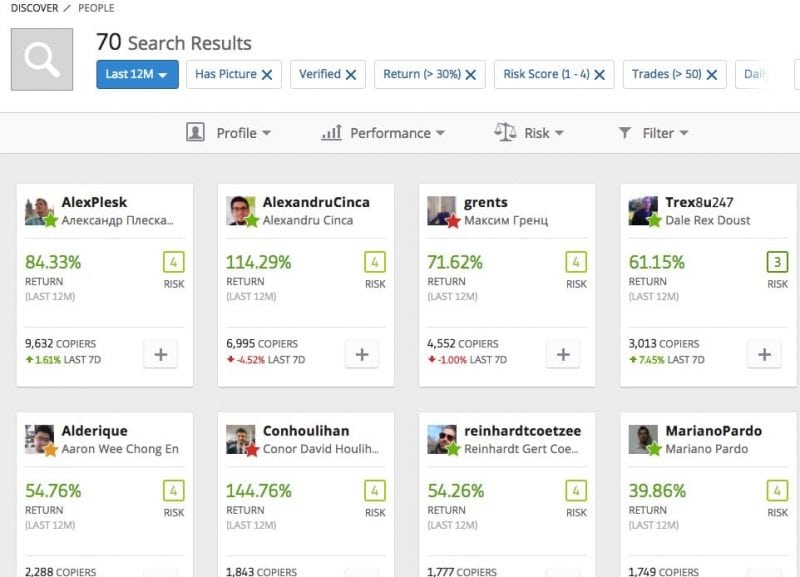

Source: etoro

Here is a tutorial and tips to copy others on etoro:

#1: invest time to find the traders that have the highest return while keeping a good risk score.

#2: use filters to your advantage – filter them by time, profile, social, and most importantly, by performance.

In the performance filter section, choose the return for 30 % (since there are fees involved in copying others, it is better to look for traders with a minimum 30% return).

While in the profitable months’ section, choose 70%. Profitable months means the number of months in a year the trader had profit. Every trader will have losing trades or losing months. By setting it to 70% then you will find the cream of the top.

Next filter you want to set is the risk filter. Set the numbers from 1-6 in the risk score part, so that the result will cover riskier traders. Set 5% in the daily drawdrown to keep your risk under control.

Daily drawdrown helps you set the maximum percentage of money the trader lost per day. So, by setting it to 5%, the result will include riskier trader with5% risk per day. Remember, the higher the risk, the bigger the rewards.

#3: sort them based on “return” – although technically all the people pop up here are those who fit your criteria and you could pick any of them.

By sorting based on return, you can check which one of them have the most return in the past months. Don’t be lazy to click on the profile and check them out.

Check out his past performance, risk score (remember the higher the number means riskier trader). Also, check the copiers part of the trader profile. It lets you know how many people are copying this trader, and the amount of money they put on him.

Next is to check their max drawdrown to analyze their risk and return ratio. The smaller the number on this and the bigger number on a return is what we want.

Last, check his trading stats, which shows how much transactions this trader had in the past months. We want an active trader with more than 75% success.

Also, be aware if a trader only trades in one instrument. There are cases that traders made their own copier accounts – meaning he copy himself. It might look good on the profile but usually, this kind of trader only deal with one kind of instrument.

Choose at least 10 traders to minimize your risk. Remember the old saying “never put your eggs in one basket” rings true in any kind of investment. By diversifying your capital to 10 traders, it will minimize your overall losses.

Etoro is a very good platform for beginners. However, for advanced traders, there are better platforms out there for pure trading purposes.

Zulutrade

Source: zulutrade homepage

Zulutrade was founded in 2007 and considered as forex auto trading platform. The main uniqueness of zulutrade is that it enables traders to share their knowledge with beginners who are interested in learning to trade. Traders can leave comments and also see live feeds of others.

Similar to etoro, zulutrade is also a social trading platform where you can either trade or copy other traders to make money in forex. It is meant for beginner traders or people who don’t have time to do the trading. However, zulutrade has a slightly higher deposit than etoro, $300.

Not just copying other traders, zulutrade also gives the ability for you to trade on your own. The platform is easy to use, and you may feel like playing a game with real money.

Tutorial on using zulutrade

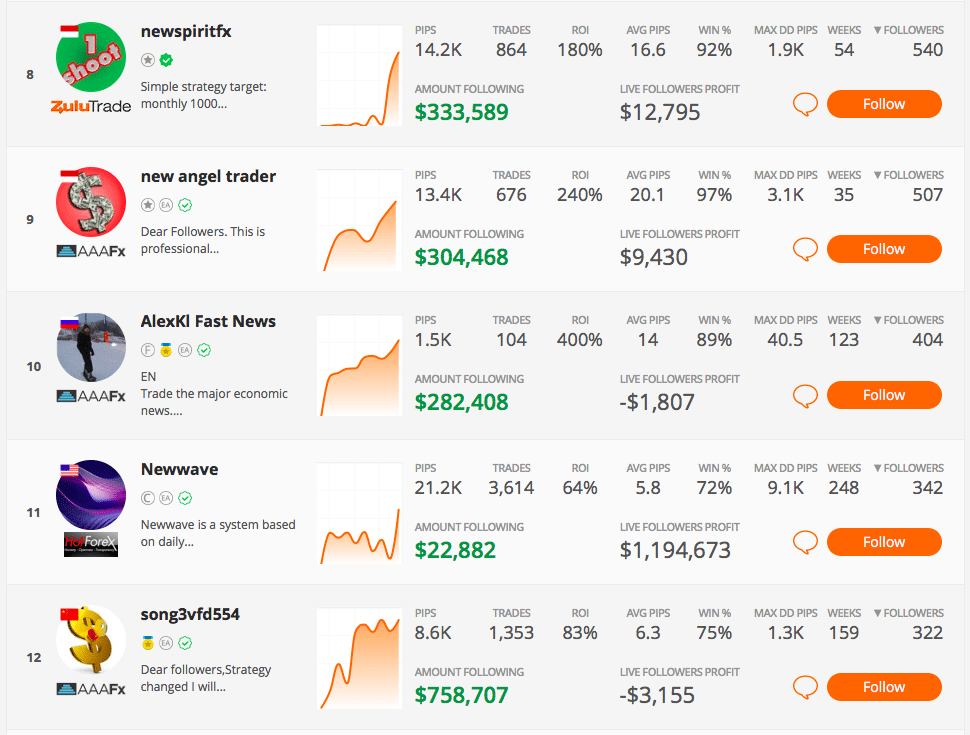

By using a social trading platform such as zulutrade, you can locate the top 5 traders who are able to make profits out of their trading venture.

Here are the tutorial and tips to copy others in zulutrade;

#1: search the top traders – traders are ranked based on the total amount of money others put to copy them. Just check the top 5.

#2: click on each profile – you need to learn the trader’s stats, choose traders who have minimum 75% winning ratio. After checking and confirming everything is okay, just click the orange “follow” button.

#3: define the zuluguard – there is a pop-up box that appears everytime you hit that follow button, and you need to define some values.

Choose the amount you want to use for copying the trader – this is based on your available funds. Just fill with a percentage (75% is the maximum percentage). Remember to spread your funds to different traders.

Choose the number of lots you want to be executed in your account. Generally, it means how much size to use for each trade that is copied. Usually, people just fill with 0.1 lots.

After that, you are all set. Since there are many profitable traders in zulutrade platform, you can choose whoever suits your risk preference.

Overall, zulutrade is great for beginners who want to copy the success of professional traders. You also can learn their strategies by asking questions to these professionals or even try to play on your own.

Finding professional traders

Source: zulutrade

Here are some tips on searching the professional traders to copy;

- Look at their winning percentage. A high number of winning percentage may look good, but the high numbers can also come from the traders who keep on losing until they eventually succeed.

- Observe their performance in the longest time possible. Choose traders with the most consecutive profitable months.

- Look at the comments the traders leave. Logically, if a professional trader often comments and discuss their market views, it’s possible they are following the market closely. You may want to follow this type of guy.

- Also, look at how the followers leave their ratings and comments. Since the social trading platform is very vocal, they will leave a comment or give a rating for someone deemed as professional– or whether the traders change their strategy resulting in massive losses.

- In zulutrade, look at the“profit made from following this trader” table, located on the left side under the statistics. This table shows the real money that other followers have made with this trader so far. Any amount above $5,000 means that a trader has gained people’s trust. Also, try to avoid traders with profits below $500.

Conclusion

Whether you are a beginner or a more experienced trader, it’s wise to consider utilizing social trading platforms to your advantage.

They are a great tool to diversify your portfolio with a good risk/reward instrument. Always remember though that never put your eggs in one basket – the more you diversify, the less risk you will have.

10 ways to avoid losing money in forex

The global forex market is the largest financial market in the world and the potential to reap profits in the arena entices foreign-exchange traders of all levels: from greenhorns just learning about financial markets to well-seasoned professionals with years of trading experience. Because access to the market is easy—with round-the-clock sessions, significant leverage, and relatively low costs—many forex traders quickly enter the market, but then quickly exit after experiencing losses and setbacks. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading.

Do your homework

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Learning about forex is integral to a trader’s success. While the majority of trading knowledge comes from live trading and experience, a trader should learn everything about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies.

Key takeaways

- In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker.

- Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective.

- It's important to use proper money management techniques and to start small when you go live.

- Control the amount of leverage and keep a trading journal.

- Be sure to understand the tax implications and treat your trading as a business.

Homework is an ongoing effort as traders need to be prepared to adapt to changing market conditions, regulations, and world events. Part of this research process involves developing a trading plan—a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives.

How do you make money trading money?

Find a reputable broker

The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker. Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the national futures association (NFA) and is registered with the commodity futures trading commission (CFTC) as a futures commission merchant. each country outside the united states has its own regulatory body with which legitimate forex brokers should be registered.

Traders should also research each broker’s account offerings, including leverage amounts, commissions and spreads, initial deposits, and account funding and withdrawal policies. A helpful customer service representative should have the information and will be able to answer any questions regarding the firm’s services and policies.

Use a practice account

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Few things are as damaging to a trading account (and a trader’s confidence) as pushing the wrong button when opening or exiting a position. It is not uncommon, for example, for a new trader to accidentally add to a losing position instead of closing the trade. Multiple errors in order entry can lead to large, unprotected losing trades. Aside from the devastating financial implications, making trading mistakes is incredibly stressful. Practice makes perfect. Experiment with order entries before placing real money on the line.

$5 trillion

The average daily amount of trading in the global forex market.

Keep charts clean

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. This should be avoided.

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace. The chosen colors, fonts, and types of price bars (line, candle bar, range bar, etc.) should create an easy-to-read-and-interpret chart, allowing the trader to respond more effectively to changing market conditions.

Protect your trading account

While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of the process. Many veteran traders would agree that one can enter a position at any price and still make money—it’s how one gets out of the trade that matters.

Part of this is knowing when to accept your losses and move on. Always using a protective stop loss—a strategy designed to protect existing gains or thwart further losses by means of a stop-loss order or limit order—is an effective way to make sure that losses remain reasonable. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session.

While traders should have plans to limit losses, it is equally essential to protect profits. Money management techniques such as utilizing trailing stops (a stop order that can be set at a defined percentage away from a security’s current market price) can help preserve winnings while still giving a trade room to grow.

Start small when going live

Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. As such, it is vital to start small when going live.

Factors like emotions and slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process.

Use reasonable leverage

Forex trading is unique in the amount of leverage that is afforded to its participants. One reason forex appeals to active traders is the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth. But leverage can just as easily amplify losses.

A trader can control the amount of leverage used by basing position size on the account balance. For example, if a trader has $10,000 in a forex account, a $100,000 position (one standard lot) would utilize 10:1 leverage. While the trader could open a much larger position if they were to maximize leverage, a smaller position will limit risk.

Keep good records

A trading journal is an effective way to learn from both losses and successes in forex trading. Keeping a record of trading activity containing dates, instruments, profits, losses, and, perhaps most important, the trader’s own performance and emotions can be incredibly beneficial to growing as a successful trader. When periodically reviewed, a trading journal provides important feedback that makes learning possible. Einstein once said that “insanity is doing the same thing over and over and expecting different results.” without a trading journal and good record keeping, traders are likely to continue making the same mistakes, minimizing their chances of becoming profitable and successful traders.

Know tax impact and treatment

It is important to understand the tax implications and treatment of forex trading activity in order to be prepared at tax time. Consulting with a qualified accountant or tax specialist can help avoid any surprises and can help individuals take advantage of various tax laws, such as marked-to-market accounting (recording the value of an asset to reflect its current market levels).

Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters.

Treat trading as a business

It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

As with any business, forex trading incurs expenses, losses, taxes, risk and uncertainty. Also, just as small businesses rarely become successful overnight, neither do most forex traders. Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

The bottom line

The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. When approached as a business, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. Traders can improve their odds by taking steps to avoid losses: doing research, not over-leveraging positions, using sound money management techniques, and approaching forex trading as a business.

Opening a trading account

How do I open an account with FOREX.Com?

You can apply for an account with FOREX.Com online. Start your application now.

What information do I need when opening an account?

We will need you to provide us with your name, address and tax ID number to establish your identity. Typically, we can verify your identity instantly. For more information, see our account documents faqs.

Why do I need to provide my financial information?

FOREX.Com requests personal information, including financial and tax identification information, in order to comply with U.S. Government laws and CFTC rules. We’ll request personal information from both new customers and existing customers. FOREX.Com complies with a CFTC customer identification rule of the USA patriot act of 2001. This rule requires FOREX.Com to put procedures in place to verify the identity of any person seeking to open an account and to maintain records of their information. Therefore, we may request you to provide a bank statement or card account statement.

How much money do I need to open an account?

The minimum initial deposit required is at least 100 of your selected base currency. However, we recommend you deposit at least 2,500 to allow you more flexibility and better risk management when trading your account.

How do I know if my account has been opened?

We will email you as soon as your application has been approved. Alternatively, you can always log in to myaccount to check on the status of your account application.

How do I open an additional account?

You may request an additional account by logging in to myaccount, going to your account settings and selecting add new account.

Does FOREX.Com offer iras?

FOREX.Com offers US individual customers the ability to trade forex by setting up an individual account with us and an IRA through one of our three partner custodians with whom we have established relationships. Visit our IRA page to learn more about the process.

Does FOREX.Com offer swap-free accounts?

Yes, FOREX.Com offers swap-free accounts in certain circumstances. For more information, please contact us.

What types of documents do you accept for identity verification?

Acceptable documents for identity verification include but are not limited to:

- Valid, current passports

- Valid, current driver licenses

- Valid national ids

Other types of ID may be acceptable on a case-by-case basis after review.

What types of documents do you accept as address verification?

To be accepted as a verification of address, a document must show both your name and address as indicated on your application.

Acceptable forms of proof of residence include but are not limited to:

- Government-issued photo identification

- Utility bills

- Bank or credit card statements

Utility bills and statements must be dated within the last six months. Confidential information such as account numbers may be removed at your discretion.

My proof of identification also has my address on it. Can I use it for both ID and proof of residence?

Yes, if your proof of identification document has your address on it, it can usually be used for both address and identity verification. However, please be aware that there are exceptions when we do need to request two separate forms of identity.

How can I send my documentation to FOREX.Com?

The fastest way to provide us with supporting documentation is via myaccount. Simply log in and follow the instructions to upload your documents.

You can also email or mail us your documentation:

FOREX.Com

attn: new accounts

bedminster one 135 US highway 202/206, suite 11

bedminster, NJ 07921 USA

Fax: +1.908.731.0777

My documents are not in english. Will this be a problem?

FOREX.Com has staff available to translate documents from many languages.

Whose name and address should be on the confirmation documents for a corporate account application?

The address verification document for a corporate account application should display the entity’s name and primary business address.

What are articles of incorporation in regards to a corporate account?

Articles of incorporation state the purpose for which the company was formed, indicate the members of the company, and sets forth its purpose according to the laws of the state in which it is established. These documents are sometimes referred to as articles of association and memorandum of association and should also include a breakdown of the shares of the company. If any shareholder owns more than 10% of the company, we will require ID verification for that shareholder.

How can I provide the breakdown of shares/share registry for my corporate account?

The corporate breakdown of shares or share registry should be within the official articles of incorporation. If the details are not within the corporate documentation, please contact FOREX.Com at your earliest convenience.

What is a certification of incorporation in regards to a corporate account?

A certificate of incorporation is a statement which confirms that a new company has fulfilled the necessary legal requirements for incorporation and is duly incorporated according to the local government or other regulatory agency.

For a joint account, do I need documentation for both account holders?

Yes, both account holders must provide a government-issued photo ID when we aren't able to electronically verify their ID. Documentation for proof of address also must be verified for both applicants.

So, let's see, what was the most valuable thing of this article: do you want to start your FX trading with no deposit bonus and become successful trader? We show you how to trade forex without investments in this article! At how to join forex trading without money

Contents of the article

- Real forex bonuses

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- 10 ways to avoid losing money in forex

- Do your homework

- Find a reputable broker

- Use a practice account

- Keep charts clean

- Protect your trading account

- Start small when going live

- Use reasonable leverage

- Keep good records

- Know tax impact and treatment

- Treat trading as a business

- The bottom line

- How to make money in forex without actually...

- 1. Be a forex broker

- 2. Be a consultant

- Is it possible to make money in forex...

- How to trade forex without money? (free credits...

- Related questions from our readers:

- How to make money in forex without actually...

- How much money do you need to start trading forex?

- Can you get rich by trading forex?

- Can forex trading be profitable?

- Can I do forex trading without A broker?

- About me

- How to start forex trading for beginners

- How to start forex trading

- The forex market: A market for everyone

- How much money do I need to open A forex account?

- Be risk-aware

- Final thoughts

- How to make money in forex without actually...

- What are social trading platforms?

- Benefits of social trading

- What kind of trader are you?

- Overview of the 2 biggest...

- Finding professional traders

- Conclusion

- 10 ways to avoid losing money in forex

- Do your homework

- Find a reputable broker

- Use a practice account

- Keep charts clean

- Protect your trading account

- Start small when going live

- Use reasonable leverage

- Keep good records

- Know tax impact and treatment

- Treat trading as a business

- The bottom line

- Opening a trading account

- How do I open an account with FOREX.Com?

- What information do I need when opening an...

- Why do I need to provide my financial information?

- How much money do I need to open an account?

- How do I know if my account has been opened?

- How do I open an additional account?

- Does FOREX.Com offer iras?

- Does FOREX.Com offer swap-free accounts?

- What types of documents do you accept for...

- What types of documents do you accept as address...

- My proof of identification also has my address on...

- How can I send my documentation to FOREX.Com?

- My documents are not in english. Will this be a...

- Whose name and address should be on the...

- What are articles of incorporation in regards to...

- How can I provide the breakdown of shares/share...

- What is a certification of incorporation in...

- For a joint account, do I need documentation for...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.