Jp market withdrawal time

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

Real forex bonuses

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

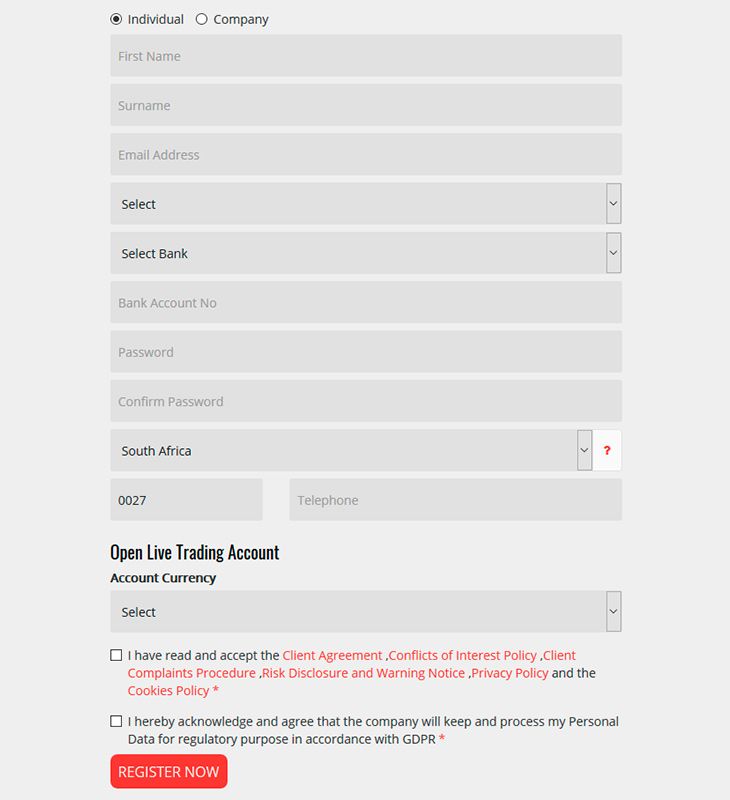

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

JP markets review

JP markets is among the many forex markets that are increasing in popularity. It gives its clients a single type of account with variable spreads, as well as additional benefits. However, the site does not allow the use of (EA) automated strategies, scalping and hedging.

Who is behind JP markets?

Established in 2016, JP markets is a forex broker that has its base in south africa, and happens to be the leading african and south african forex broker, with services expanding into other countries such as bangladesh, swaziland, kenya and pakistan.

The company operates under approval from the financial services board (FSB), south africa, FSP 46855. This gives the technology and platform allowing african-based clients to trade successfully in forex markets around the world.

JP markets focuses on assisting clients at a localized level through customer service as well as tools that can assist in succeeding on that front. The company prides itself on being the only brokerage worldwide that gives interest on trading accounts (this is subject to a specific minimum balance), as well as other industry firsts and benefits to various clients.

The founder is a south african entrepreneur, justin paulsen. He has extensive knowledge on the financial sector, having obtained a degree in economics and finance from the university of cape town. He has also worked with several brokers and forex agencies before setting up the company.

Trading services offered

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform.

You may wonder why the base is in south africa. One reason is that many investors view south africa as a country with great potential, since it is among the most developed countries on the continent. The regulator, FSA, has enforcing powers that allow it to deal with breaches in forex brokerage, while it also runs the office of the omud for financial services providers, which is a customer complaints service.

Regulation within the country is not among the best in the world, though there is some level of reliability in the sector. If you are a local broker with a trading license, you need to keep all your client funds in recognized banks in the country within segregated accounts.

Advantages of MT4 trade platform

As the industry standard platform, MT4 lends itself to various traders as an easier alternative, thanks to the richness of its features. It places itself among the leading platform in online trading due to its foreign exchange agency model implementation, unconventional organization of trading, as well as competitive assessments.

You can use algorithmic traders as well as expert advisors (eas), which automate your exchange and make the process easier for you. MT4 allows you to see the marketplace you are dealing with, all within real time, highly accurate and impeccably judge all your exits and entrances.

Accounts available on the platform

Clients have a single account type to choose, and this account comes with no commission fees imposition, fixed spreads, STP (straight through processing) market execution and leverage that reaches a maximum of 1:500. You can get PAMM services as well.

Straight through processing

This service means that the forex broker will send the customer’s order directly to larger brokers or banks without the order passing through a dealing desk. That implies that there are no delays in the process and the processing of transactions is faster.

It has several advantages, which include:

STP brokers make their money through addition of small commissions, which are markups to the spreads

The losses of the client are not the profits of the broker

When the trader loses or wins, the exact markup will go to the broker, so this eliminates conflict of interest

A related aspect to STP is NDD (no dealing desk), which gives brokers access to the inter-bank forex markets. In addition, this eliminates conflict of interest, filling orders and re-quotes.

Deposit and withdrawal options

The platform does not offer a wide range of deposit options. The bank option is ned bank, with the deposit details. Keep in mind that the south african reserve bank (SARB) will always convert international payments to their base rate. Other options include bitcoin, credit and debit cards, neteller and skrill.

You need an initial deposit minimum of R3500, and this is a reasonable amount especially when you compare it to other south african brokers. In addition, allocations of payments can take a maximum of 24 hours on business days (from monday to friday).

An interesting aspect to JP markets is the allowance for sending withdrawal requests through whatsapp, which is unseen on other platforms. The withdrawals are easy and fast to process (the process takes about 24 hours), and you can do the process on official working days from 9am to 5pm.

The platform uses secure and safe ways to send you your money, while all transactions undergo rigorous processing to ensure your money stays safe.

The option is through local bank transfer, as the site does not allow e-wallets or any other mediums of withdrawal. The time it takes to receive funds depends on the bank you use. For instance, standard bank, ABSA, nedbank and FNB allow you to get your money within the same day, while other banks could take up to two days.

As with any other withdrawal process, you need to have proof of documentation before you submit your withdrawal request. This includes scanned copies of your ID, bank statements and proof of address, all confirming your details as per regulations from the FSB.

Keep in mind that all withdrawals that you make through credit cards have an extra fee of R50. For the case of bank transfers, there are no charges for withdrawals, but you are liable for any fees that the individual bank charges in the transaction, including the use of intermediaries.

Commissions, leverages and spreads

The maximum amount of leverage you can get is 1:500, which many investors consider high, even with other brokers offering higher or similar rates.

Note that with higher leverage comes higher risks of losses, and this is the reason many jurisdictions set caps on leverage rates.

Any promotional bonuses?

There are a few promotions that the company offers, which include:

30% welcome on deposit bonus, and this is valid for 60 days

Currently, the minimum amount that qualifies you for any bonus is R3000. There is also not much information regarding bonuses.

The platform does not charge you extra commission fees, which may be a good thing. However, we do not like the spreads, as we find them too wide to be competitive – they are 2.4 pips on average for USD/EUR.

Even though fixed spreads are wider than floating ones generally, many other brokers will offer you a better deal.

Pros of the JP markets platform

The FSB regulates its activities

MT4 is available on the site

Same day deposits and withdrawals are possible

You can trade in rand, other than USD or EUR

There is a limited choice of trading platforms

The spreads are too wide

You cannot use eas, hedging or scalping techniques on the platform

Final thoughts

JP markets is a CFD south african broker and forex company that the FSA regulates actively. They support the MT4 platform, making them easy to use for many traders. However, the spreads are higher than the average, and this unfortunately places many restrictions on trade.

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

JP markets review

Jpmarkets is a forex broker. JP markets offers the metatrader 4 and mobile forex trading top platform. Jpmarkets.Co.Za offers over 25 forex currency pairs, cfds, stocks, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options.

2020-06-19: the south african FSCA has privisionally suspended the license of JP markets. This was done because "there is reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services."

CLICK HERE to verify.

Broker details

Live discussion

Join live discussion of jpmarkets.Co.Za on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Not able to withdraw

Length of use: 6-12 months

Due to the numerous complaints from clients failing to withdraw their funds, the FSCA (financial sector conduct authority) has provisionally suspended JP market's license pending a full investigation. As from the 19th of june 2020 they are no longer allowed to take any new business or clients. I'm not surprised coz when i used them back in 2016 i couldn't even make a deposit to fund my account. Had to do an EFT and then call their office to let them know so they could check with the bank. Very poor service indeed. Anyway you can read the story of their suspension below:

Length of use: over 1 year

Length of use: over 1 year

This is the worst broker in the world, I made withdrawals amounting to R1.5 million in a he past weeks and they started asking me to submit my fica and bank cards of which I did. Only today they told me I won’t be getting my withdrawals since their system says I used different accounts to fund my account of which I didn’t. I don’t even know the people they talked about.

Stay away from this broker. I just can’t wait for this lock down to be over so I can visit their offices

Length of use: over 1 year

Jp markets should be challenged and charged for market and accounts manipulation. This is wrong and we will expose them.

Our funds and pending orders just disappeared and when we tried to contact someone no one answered.

This broker will not last long with the kind of service it provides.

Frequently asked questions

What is the minimum deposit for JP markets?

JP markets does not have a strict minimum deposit. Traders can invest whatever they are comfortable with. However JP markets recommends starting with around ZAR3,000.

Is JP markets a good broker?

Unbiased traders reviews on forexpeacearmy is the best way to answer if JP markets is a good broker. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we'd recommend to check recent JP markets community discussions: https://www.Forexpeacearmy.Com/community/tags/jpmarkets/

Is JP markets safe?

To define whether a company is safe or not, you'd better get to know about this company, the unbiased traders reviews on forexpeacearmy is the best resources to grant you such knowledge. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

JP markets at least is regulated with south africa financial services board under license 46855. Being regulated gives you a chance to complain to the authority if it comes down to it.

What is JP markets?

JP markets is an online forex retail broker. JP markets offers a number of assets to be traded on metatrader 4 and JP mobile app.

- Forex currency pairs

- Cryptocurrencies

- Stock indices

- Precious metals

- Commodities

Jp market withdrawal time

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

Jp market withdrawal time

As part of our retirement insights program, the guide to retirement serves as a valuable source of information on retirement topics and provides a strong backdrop for planning discussions.

Updated annually, the award-winning* guide to retirement provides an effective framework for supporting your retirement planning conversations with clients. It includes charts and graphs to help you explain complex issues in a clear and concise manner. A description and audio commentary are available for every slide.

*the guide to retirement won the 2012 RIIA retirement income communications award, the 2014 MFEA STAR award for retail education and the 2015 wealthmanagement.Com industry award for thought leadership – investing. In addition, in 2018 it won “highly commended” in the "best pensions paper 2018 (north america)" category: https://www.Savvyinvestor.Net/blog/awards-best-pensions-white-paper-north-america-2018, and most recently won the investment management education alliance (IMEA) star awards for “retirement ongoing education”.

Download the guide to retirement PPT

Access the guide to retirement powerpoint presentation.

Retirement principles

The principles of a successful retirement presentation uses select slides in the award-winning guide to retirement to help you simplify the complex for your clients and help them make informed decisions.

On the bench

Need more guide to the retirement? Access an additional collection of guide to the retirement slides, updated on a yearly basis.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

Same bed different dream composition of IPO shares and withdrawal decisions in weak market conditions

Abstract

The aim of this paper is to investigate the relationship between the IPO withdrawal decision and the number of secondary shares during the weak stock market conditions. Our results suggest that the withdrawal decision is determined by who plans to sell their shares at the IPO. The findings are as follows. The secondary shares of vcs are positively correlated with an IPO withdrawal decision. The secondary shares of ceos are only correlated when the ceos retained ownership is low, and not when ceos retained ownership is high. These results imply that the VC profit maximization behavior is a key variable in determining IPO withdrawal.

This is a preview of subscription content, access via your institution.

Access options

Buy single article

Instant access to the full article PDF.

Tax calculation will be finalised during checkout.

Subscribe to journal

Immediate online access to all issues from 2019. Subscription will auto renew annually.

Tax calculation will be finalised during checkout.

Notes

Approximately 20% of firms in the USA withdraw their ipos after registration (dunbar and foerster 2008; hao 2011).

Beyond meat, a plant-based burger manufacturer, postponed its going public from late december 2018 to early january 2019, due to the instable market condition in december 2018 (“U.S. Government shutdown freezes IPO market, imperiling expectations for 2019” wall street journal, january 10, 2019).

In an earlier version of this paper, we also examine the impact of other pre-IPO owners (e.G., parent companies). However, their average ownership ratio is tremendously lower than that of the ceos and VC; impacts on the withdrawal decisions were not well observed.

See smith and smith (2003) for more detail.

This paper considers the largest shareholders at the pre-IPO stage to be insiders, because these pre-IPO shareholders potentially have a conflict of interest with the IPO investors. This causes moral hazard and agency problems.

In the USA, market timing is not the only reason for withdrawal. Firms in the USA also postpone or decline ipos because of both the litigation risk related to IPO share pricing (hughes and thakor 1992; lowry and shu 2002; hao 2011) and opinion shopping (lian and wang 2012).

In our sample, 37.4% of vcs and 47.5% of ceos sell their shares at the ipos.

The minimum review period by stock exchanges is at least 3 months for ipos on the tokyo stock exchanges and 2 months for ipos on MOTHERS and JASDAQ, the stock markets for start-ups.

This is different from the US setting, where the offering price is not necessarily in the price range.

This subsection is based on the tokyo stock exchange (http://www.Jpx.Co.Jp/listing/stocks/new/) website.

Ljungqvist and wilhelm (2003) find spikes in IPO withdrawals in 1998, during the long-term capital management crisis, and in 2000, during the IT bubble. In addition, hao (2011) reports that 90% of ipos ended in withdrawals in 2008, during the global financial crisis.

In the management field, bruton et al. (2010) investigates what effect private equity investors with different investment horizons have on the performance of IPO firms.

It is uncommon to replace ceos in japan after going public.

Booth and chua (1996) and brennan and franks (1997) analyze the distribution of block and minority shareholders and the impact of stock liquidity after ipos.

Only one company withdrew twice during the sample period; we deleted the second-time withdrawal (ticker code 5220).

We check the number of primary and secondary shares and the top 10 shareholders for withdrawn ipos. There are 12 s-time ipos, of which 10 report the same number of primary shares and 9 report the same number of secondary shares for the first and second times, respectively.

Nikkei 225 and TOPIX are the well-known market indexes of japanese stock markets, which are the weighted stock market returns of the 225 companies selected by nikkei and the weighted average of the first section of the tokyo stock exchange, respectively. They tend to cover large listed firms, and therefore, fewer IPO firms.

Unreported results show that our conclusions remain unchanged, even though year dummies are included (see internet appendix table B for a review).

In japan, firms that issue equity are required to report the planned use of proceeds. Please see the discussion of seasoned equity offerings in suzuki and yamada (2012).

The arguments pastor and veronesi (2009) and chemmanur and he (2011) assume that the IPO bubble period is led by highly productive firms.

We also divide the shares by the total number of IPO shares, which is the sum of primary and secondary shares. We calculate the fraction of secondary proceeds offered by ceos and vcs as a percentage of the total pre-IPO assets. The results are similar to those found when dividing by the total shares outstanding before the IPO (see internet appendix table A).

See internet appendix table C.

We only use BHR − 1 to 0 month for the first-stage estimation. Similar results are obtained. Only the secondary shares by vcs in the withdrawn subsample are higher than those of the matching sample, with statistical significance (t-statistic = 2.05). See internet appendix table D for a review.

The unreported analysis, where the withdrawn dummy is the dependent variable, illustrates that ceos’ tenure has a coefficient of − 0.044 (p = 0.013) and the dummy variable for work experience in the financial sector has a coefficient of − 0.023 (p = 0.928).

The unreported analysis, where the dependent variable is a withdrawn dummy, shows that the VC selling 3 months before the IPO has a coefficient of − 0.157 (p = 0.502).

We only use BHR − 1 to 0 month during the first-stage estimation. We find a positive relationship between secondary shares by vcs and the withdrawal decision (t-statistic = 2.54). These results are not reported due to space limitations (see internet appendix table E for a review).

References

Aggarwal, R. K., krigman, L., & womack, K. L. (2002). Strategic IPO underpricing, information momentum, and lockup expiration selling. Journal of financial economics, 66(1), 105–137. Https://doi.Org/10.1016/S0304-405X(02)00152-6.

Allen, F., & faulhaber, G. R. (1989). Signalling by underpricing in the IPO market. Journal of financial economics, 23(2), 303–323. Https://doi.Org/10.1016/0304-405X(89)90060-3.

Arthurs, J. D., hoskisson, R. E., busenitz, L. W., & johnson, R. A. (2008). Managerial agents watching other agents: multiple agency conflicts regarding underpricing in IPO firms. Academy of management journal, 51(2), 277–294. Https://doi.Org/10.5465/amj.2008.31767256.

Banerjee, S., güçbilmez, U., & pawlina, G. (2016). Leaders and followers in hot IPO markets. Journal of corporate finance, 37, 309–334. Https://doi.Org/10.1016/j.Jcorpfin.2016.01.004.

Benninga, S., helmantel, M., & sarig, O. (2005). The timing of initial public offerings. Journal of financial economics, 75(1), 115–132. Https://doi.Org/10.1016/j.Jfineco.2003.04.002.

Bodnaruk, A., kandel, E., massa, M., & simonov, A. (2007). Shareholder diversification and the decision to go public. Review of financial studies, 21(6), 2779–2824. Https://doi.Org/10.1093/rfs/hhm036.

Boeh, K. K., & southam, C. (2011). Impact of initial public offering coalition on deal completion. Venture capital, 13(4), 313–336. Https://doi.Org/10.1080/13691066.2011.642148.

Booth, J. R., & chua, L. (1996). Ownership dispersion, costly information, and IPO underpricing. Journal of financial economics, 41(2), 291–310. Https://doi.Org/10.1016/0304-405X(95)00862-9.

Booth, J. R., & smith, R. L. (1986). Capital raising, underwriting and the certification hypothesis. Journal of financial economics, 15(1), 261–281. Https://doi.Org/10.1016/0304-405X(86)90057-7.

Brau, J. C., li, M., & shi, J. (2007). Do secondary shares in the IPO process have a negative effect on aftermarket performance? Journal of banking & finance, 31(9), 2612–2631. Https://doi.Org/10.1016/j.Jbankfin.2006.09.016.

Brennan, M. J., & franks, J. (1997). Underpricing, ownership and control in initial public offerings of equity securities in the UK. Journal of financial economics, 45(3), 391–413. Https://doi.Org/10.1016/S0304-405X(97)00022-6.

Brettel, M., mauer, R., & appelhoff, D. (2013). The entrepreneur's perception in the entrepreneur–VCF relationship: the impact of conflict types on investor value. Venture capital, 15(3), 173–197. Https://doi.Org/10.1080/13691066.2013.782625.

Bruton, G. D., filatotchev, I., chahine, S., & wright, M. (2010). Governance, ownership structure, and performance of IPO firms: the impact of different types of private equity investors and institutional environments. Strategic management journal, 31(5), 491–509. Https://doi.Org/10.1002/smj.822.

Busaba, W. Y., benveniste, L. M., & guo, R.-J. (2001). The option to withdraw ipos during the premarket: empirical analysis. Journal of financial economics, 60(1), 73–102. Https://doi.Org/10.1016/S0304-405X(01)00040-X.

Chambers, D., & dimson, E. (2009). IPO underpricing over the very long run. Journal of finance, 1407–1443. Https://doi.Org/10.1111/j.1540-6261.2009.01468.X.

Chemmanur, T. J., & he, J. (2011). IPO waves, product market competition, and the going public decision: theory and evidence. Journal of financial economics, 101(2), 382–412. Https://doi.Org/10.1016/j.Jfineco.2011.03.009.

Cochrane, J. H. (2005). The risk and return of venture capital. Journal of financial economics, 75(1), 3–52. Https://doi.Org/10.1016/j.Jfineco.2004.03.006.

Collewaert, V., & fassin, Y. (2013). Conflicts between entrepreneurs and investors: the impact of perceived unethical behavior. Small business economics, 40(3), 635–649. Https://doi.Org/10.1007/s11187-011-9379-7.

Collewaert, V., & sapienza, H. J. (2016). How does angel investor–entrepreneur conflict affect venture innovation? It depends. Entrepreneurship theory and practice, 40(3), 573–597. Https://doi.Org/10.1111/etap.12131.

Cornelli, F., goldreich, D., & ljungqvist, A. (2006). Investor sentiment and pre-IPO markets. Journal of finance, 61(3), 1187–1216. Https://doi.Org/10.1111/j.1540-6261.2006.00870.X.

Cumming, D. (2008). Contracts and exits in venture capital finance. Review of financial studies, 21(5), 1947–1982. Https://doi.Org/10.1093/rfs/hhn072.

Cumming, D., & dai, N. (2010). Local bias in venture capital investments. Journal of empirical finance, 17(3), 362–380. Https://doi.Org/10.1016/j.Jempfin.2009.11.001.

Cumming, D., & macintosh, J. G. (2003). A cross-country comparison of full and partial venture capital exits. Journal of banking & finance, 27(3), 511–548. Https://doi.Org/10.1016/S0378-4266(02)00389-8.

Cumming, D., & sofia johan, S. A. (2008). Preplanned exit strategies in venture capital. European economic review, 52(7), 1209–1241. Https://doi.Org/10.1016/j.Euroecorev.2008.01.001.

Dorn, D. (2009). Does sentiment drive the retail demand for ipos? Journal of financial and quantitative analysis, 44(1), 85–108. Https://doi.Org/10.1017/S0022109009090024.

Dunbar, C. G., & foerster, S. R. (2008). Second time lucky? Withdrawn ipos that return to the market. Journal of financial economics, 87(3), 610–635. Https://doi.Org/10.1016/j.Jfineco.2006.08.007.

Forbes, D. P., korsgaard, M. A., & sapienza, H. J. (2010). Financing decisions as a source of conflict in venture boards. Journal of business venturing, 25(6), 579–592. Https://doi.Org/10.1016/j.Jbusvent.2009.03.001.

Gong, J. J., & wu, S. Y. (2011). CEO turnover in private equity sponsored leveraged buyouts. Corporate governance: an international review, 19(3), 195–209. Https://doi.Org/10.1111/j.1467-8683.2010.00834.X.

Hall, R. E., & woodward, S. E. (2010). The burden of the nondiversifiable risk of entrepreneurship. American economic review, 100(3), 1163–1194. Https://doi.Org/10.1257/aer.100.3.1163.

Hao, Q. (2011). Securities litigation, withdrawal risk and initial public offerings. Journal of corporate finance, 17(3), 438–456. Https://doi.Org/10.1016/j.Jcorpfin.2010.12.005.

Helbing, P. (2018). A review on IPO withdrawal. International review of financial analysis. Https://doi.Org/10.1016/j.Irfa.2018.09.001.

Hellmann, T. (2002). A theory of strategic venture investing. Journal of financial economics, 64, 285–314. Https://doi.Org/10.1016/S0304-405X(02)00078-8.

Higashide, H., & birley, S. (2002). The consequences of conflict between the venture capitalist and the entrepreneurial team in the united kingdom from the perspective of the venture capitalist. Journal of business venturing, 17(1), 59–81. Https://doi.Org/10.1016/S0883-9026(00)00057-4.

Hughes, P. J., & thakor, A. V. (1992). Litigation risk, intermediation, and the underpricing of initial public offerings. Review of financial studies, 5(4), 709–742. Https://doi.Org/10.1093/rfs/5.4.709.

Jensen, M. C., & meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305–360. Https://doi.Org/10.1016/0304-405X(76)90026-X.

Johan, S. A. (2010). Listing standards as a signal of IPO preparedness and quality. International review of law and economics, 30(2), 128–144. Https://doi.Org/10.1016/j.Irle.2009.12.001.

Kanniainen, V., & keuschnigg, C. (2003). The optimal portfolio of start-up firms in venture capital finance. Journal of corporate finance, 9(5), 521–534. Https://doi.Org/10.1016/S0929-1199(02)00021-4.

Khanin, D., & turel, O. (2015). Conflicts and regrets in the venture capitalist–entrepreneur relationship. Journal of small business management, 53(4), 949–969. Https://doi.Org/10.1111/jsbm.12114.

Kutsuna, K., smith, J. K., & smith, R. L. (2009). Public information, IPO price formation, and long-run returns: japanese evidence. Journal of finance, 64(1), 505–546. Https://doi.Org/10.1111/j.1540-6261.2008.01440.X.

Leland, H. E., & pyle, D. H. (1977). Informational asymmetries, financial structure, and financial intermediation. Journal of finance, 32(2), 371–387. Https://doi.Org/10.1111/j.1540-6261.1977.Tb03277.X.

Lian, Q., & wang, Q. (2012). Acquisition valuations of withdrawn ipos: when IPO plans turn into mergers. Journal of banking & finance, 36(5), 1424–1436. Https://doi.Org/10.1016/j.Jbankfin.2011.12.008.

Lin, T. H., & smith, R. L. (1998). Insider reputation and selling decisions: the unwinding of venture capital investments during equity ipos. Journal of corporate finance, 4(3), 241–263. Https://doi.Org/10.1016/S0929-1199(98)00005-4.

Ljungqvist, A., & wilhelm, W. J. (2003). IPO pricing in the dot-com bubble. Journal of finance, 58(2), 723–752. Https://doi.Org/10.1111/1540-6261.00543.

Lowry, M., & shu, S. (2002). Litigation risk and IPO underpricing. Journal of financial economics, 65(3), 309–335. Https://doi.Org/10.1016/S0304-405X(02)00144-7.

Muscarella, C. J., & vetsuypens, M. R. (1989). A simple test of baron’s model of IPO underpricing. Journal of financial economics, 24(1), 125–135. Https://doi.Org/10.1016/0304-405X(89)90074-3.

Norton, E., & tenenbaum, B. H. (1993). Specialization versus diversification as a venture capital investment strategy. Journal of business venturing, 8(5), 431–442. Https://doi.Org/10.1016/0883-9026(93)90023-X.

Pastor, L., & veronesi, P. (2009). Learning in financial markets. Annual review of financial economics, 1(1), 361–381. Https://doi.Org/10.1146/annurev.Financial.050808.114428.

Pollock, T. G., fund, B. R., & baker, T. (2009). Dance with the one that brought you? Venture capital firms and the retention of founder-ceos. Strategic entrepreneurship journal, 3(3), 199–217. Https://doi.Org/10.1002/sej.71.

Renneboog, L., simons, T., & wright, M. (2007). Why do public firms go private in the UK? The impact of private equity investors, incentive realignment and undervaluation. Journal of corporate finance, 13(4), 591–628. Https://doi.Org/10.1016/j.Jcorpfin.2007.04.005.

Ritter, J. R., & welch, I. (2002). A review of IPO activity, pricing, and allocations. Journal of finance, 57(4), 1795–1828. Https://doi.Org/10.1111/1540-6261.00478.

Smith, R. L., & smith, J. K. (2003). Entrepreneurial finance. New york: wiley.

Suzuki, K., & yamada, K. (2012). Do the use of proceeds disclosure and bank characteristics affect bank underwriters’ certification roles? Journal of business finance & accounting, 39(7–8), 1102–1130. Https://doi.Org/10.1111/j.1468-5957.2012.02296.X.

Takahashi, H. (2015). Dynamics of bank relationships in entrepreneurial finance. Journal of corporate finance, 34, 23–31. Https://doi.Org/10.1016/j.Jcorpfin.2015.07.006.

Yitshaki, R. (2008). Venture capitalist-entrepreneur conflicts: an exploratory study of determinants and possible resolutions. International journal of conflict management, 19(3), 262–292. Https://doi.Org/10.1108/10444060810875813.

Yung, C., çolak, G., & wang, W. (2008). Cycles in the IPO market. Journal of financial economics, 89(1), 192–208. Https://doi.Org/10.1016/j.Jfineco.2007.06.007.

Zacharakis, A., erikson, T., & george, B. (2010). Conflict between the VC and entrepreneur: the entrepreneur's perspective. Venture capital, 12(2), 109–112. Https://doi.Org/10.1080/13691061003771663.

Acknowledgements

We thank the two anonymous referees, naoshi ikeda, kenneth lehn, hidenori takahashi, konari uchida, and yupana wiwattanakantang for their valuable comments. We also thank the seminar participants at nagasaki university and finance camp kagoshima.

Funding

This research is supported by JSPS grant numbers 25780256, 16H05952, 16H02027, and 17H02525.

Author information

Affiliations

College of international management, ritsumeikan asia pacific university, 1-1 jyumonjihara, beppu, oita, 874-8577, japan

Faculty of economics, nagasaki university, 4-2-1 katafuchi, nagasaki, 850-8506, japan

You can also search for this author in pubmed google scholar

You can also search for this author in pubmed google scholar

PF withdrawal amid COVID-19 crisis: how much can you withdraw from your EPF account?

All EPFO employees will be eligible for the benefits of non-refundable advance. This means, the employee will not have to put the money back into the provident fund (PF) account, as this is an advance.

" data-medium-file="https://images.Financialexpress.Com/2020/04/pf-1-1-300x194.Jpg" data-large-file="https://images.Financialexpress.Com/2020/04/pf-1-1-620x413.Jpg" src="https://www.Financialexpress.Com/wp-content/plugins/a3-lazy-load/assets/images/lazy_placeholder.Gif" data-lazy-type="image" data-src="https://images.Financialexpress.Com/2020/04/pf-1-1-620x413.Jpg" alt="EPFO, covid19, EPFO interest rate, partial withdrawal from pf, epf partial withdrawal, public provident fund, kisan vikas patra, national savings certificate, exchange traded funds, pensions schemes, finance ministry" width="620" height="413" srcset="" data-srcset="https://images.Financialexpress.Com/2020/04/pf-1-1-620x413.Jpg 620w, https://images.Financialexpress.Com/2020/04/pf-1-1-300x200.Jpg 300w, https://images.Financialexpress.Com/2020/04/pf-1-1-401x267.Jpg 401w, https://images.Financialexpress.Com/2020/04/pf-1-1.Jpg 660w" sizes="(max-width: 620px) 100vw, 620px" /> before applying for PF withdrawal, it’s important to know how much you will be able to withdrawn.

EPFO has been sending customers SMS, saying “settlement of covid-19 advance claims are being given high priority by EPFO and, for faster relief, you can apply even if you have already made any other claim. We are processing other claims too, but disposal is affected due to lockdown.”

To help account holders withdraw money due to this pandemic, EPFO has recently released a set of faqs, especially for those who want to make PF withdrawals. Additionally, as people are facing difficulties due to the lockdown because of the COVID-19, the government had earlier relaxed the EPFO rules regarding the withdrawal of PF money.

The new PF advance/withdrawal rule will apply to all employees working in establishments and factories across india, who are members of the EPF scheme, 1952. All such employees will be eligible for the benefits of non-refundable advance. This means, the employee will not have to put the money back into the provident fund (PF) account, as this is an advance.

However, before applying for PF withdrawal, it’s important to know how much you will be able to withdrawn.

As per the EPFO notification, an employee will be permitted to make PF withdrawal of up to 75 per cent of the amount standing to the member’s credit in the EPF account or up to the amount of basic wages and dearness allowance for 3 months, whichever is less. Along with the employees, employers also match the PF contribution every month. The PF balance includes both the employee and the employer’s contribution along with the interest earned on their contributions.

For example, if your EPF balance on march 31, 2020 is rs 8 lakh and your basic salary is rs 45,000 per month, you will be able to withdraw rs 1.35 lakh only. However, if the balance in your PF account is rs 2 lakh and basic monthly salary amounts to rs 52,000, you can withdraw only rs 1.5 lakh.

In general, your basic wage/salary/basic pay consists of basic salary along with dearness allowance (DA), if any. To find out the actual amount, check your salary slip. To apply for PF withdrawal/advance, employees can either log in to the EPF india website or access the unified portal from his/her phone.

Chase ATM withdrawal limit guide: (resets and increases) [2020]

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Uponarriving has partnered with cardratings for our coverage of credit card products. Uponarriving and cardratings may receive a commission from card issuers.

Atms are extremely convenient and allow you to withdraw cash as well as make deposits with both cash and checks. But banks set certain limits for your withdrawals and chase is no different. In this article, I’ll tell you everything you need to know about chase ATM withdrawal limits, including when they reset, how to get increases, and how to avoid certain fees. I’ll also cover making ATM deposits as well.

What is the chase ATM withdrawal limit?

For many chase checking accounts your withdrawal limit will be $500 to $1,000 per day and your purchase limit will be $3,000 to $7,500 per day. However, you can take advantage of higher withdrawal limits by going in-branch during business hours.

If you actually go to a chase branch while it’s open during business hours you can usually withdraw much higher limits from the atms. In my case, my usual $500 daily limit goes all the way up to $3,000 so the limit can be substantially higher.

Tip: check out the free app walletflo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

The in-branch limit is separate from the non-branch atms. So you should be able to withdraw $3,000 from inside a branch and then head over to a chase ATM machine (not located at a branch) and withdraw another $500 since the limits are separate.

However, the in-branch limit applies across all of your chase debit cards so it wouldn’t be possible for you to withdraw $3,000 with one debit card in-branch and then to go back to chase and attempt to withdraw $3,000 in-branch with debit card #2 on the same day.

Also, keep in mind that the chase ATM withdrawal limit varies based on the type of chase checking account that you have and possibly on the state that you opened up your account in. For thef most accurate information, simply call the number on the back of your debit card for more information. But if you’d like to see what the limits are for some chase checking accounts keep reading.

When does the chase ATM withdrawal limit reset?

The chase ATM withdrawal limit will be reset every 24 hours so you’ll be able to withdraw $500 or $1,000 on consecutive days if you’d like. The exact time that the reset takes place is at midnight eastern standard time (EST) so plan your withdraws accordingly.

I have heard of people successfully double dipping on an ATM withdrawal by waiting for the clock to turn midnight and then making a withdrawal shortly after.

Tip: consider maximizing your cash back with one of the best cash back credit cards available: the chase freedom flex. You can get $200 cash back after spending $500 in the first three months!

What is the international withdrawal limit?

The the international withdrawal limit should be the same as the limit you have at home. But keep in mind that you’ll be charged fees for the foreign transaction unless you have a certain type of account like chase private client or sapphire banking.

If you are traveling out of state like from california to new york, you should also have the same withdrawal limits for atms. In some cases, you might be limited to lower limits at non-chase atms. For example, you could be limited to $500 for non-chase atms if your limits would otherwise be at $1,000. So once again, it’s a good idea to call the number on the back of your debit card for more details.

Chase withdrawal limit increase

It is possible for you to get a withdrawal limit increase with chase. These can happen in two different types of ways.

The first is that you are given a temporary increase. These are handy when you only need to pull out more for a big event or some other type of spending need. Getting a temporary increase usually isn’t that difficult, especially if you can provide chase with a specific reason for why you need it.

The second type of increase is a permanent increase. In order to get a permanent increase you’ll likely need to keep a certain amount of funds in your bank account (such as $1,000 every day). Thus, these type of increases will be a little tougher to get.

The amount that you can get increased to varies by customer. In some cases you might be able to increase your daily limit from $500 to $1,000 but in other cases it might be a smaller or larger amount.

If you’re able to sign-up for a chase sapphire banking account or chase private client account you can also get higher limits for your withdrawals. For example, with chase private client you might be able to pull out up to $2,000 or even $3,000 depending on the location. Also, your daily purchase limit will likely be higher at around $7,500.

Other options with higher limits include the premium platinum debit card with limits of $3,000 at chase atms.

If you’d like to request a higher limit simply call the chase customer service phone number at: 1-800-935-9935.

Similar to getting a credit limit increase, it will help if you can explain to the agent why you need an increased limit.

Student card ATM withdrawal limits

If you have one of the student cards issued by chase like a high school debit card your limits may be much lower. For example, your withdrawal limit might be capped at $500 and your purchase limit might be even lower. Some cards for students are strictly ATM cards and can’t be used on purchases at all so keep that in mind.

Non-ATM (teller) withdrawals

Remember that you can always go in-branch to a teller in order to pull more funds out of your bank account. If you bypass the atms and deal directly with a teller, you should not have any limits on the amount that you can withdraw.

And if you can’t make it to a bank, consider going into a place like a grocery store to pull out cash back after your purchase. Many people but something like a drink or pack of gum and then request cash back. Just be aware that you’ll be limited by how much cash back you can get.

Chase withdrawal ATM fees

If you have a standard chase total checking account you’ll have to pay fees for non-chase atms. These are atms that do not have chase branded on them and belong to other banks. However, you can avoid some of these fees with other account types and you can read more about those below.

Keep in mind that just because you are not charged a fee from chase, that doesn’t mean you’re off the hook. The ATM owner may still impose a fee on you (although again you can get this refunded with certain types of accounts like sapphire and private client).

Tip: consider maximizing your cash back with one of the best cash back credit cards available: the chase freedom flex. You can get $200 cash back after spending $500 in the first three months!

Chase total checking

- $2.50 for any inquiries, transfers or withdrawals while using a non-chase ATM in the U.S., puerto rico and the U.S. Virgin islands. Fees from the ATM owner still apply.

- $5 per withdrawal and $2.50 for any transfers or inquiries at atms outside the U.S., puerto rico and the U.S. Virgin islands.

Chase premier checking

- $0 for the first four inquiries, transfers or withdrawals each statement period at a non-chase ATM. Fees from the ATM owner still apply. A foreign exchange rate adjustment fee from chase will apply for ATM withdrawals in a currency other than U.S. Dollars.

- $2.50 for any additional inquiries, transfers or withdrawals over four while using a non-chase ATM in the U.S., puerto rico and the U.S. Virgin islands. Fees from the ATM owner still apply.

- $5 per withdrawal and $2.50 for any transfers or inquiries at atms outside the U.S., puerto rico and the U.S. Virgin islands (the $5 withdrawal or $2.50 transfer or inquiry fee can be waived as part of the first four inquiries, transfers or withdrawals). Fees from the ATM owner still apply.

Chase sapphire and private client

Find a chase ATM

If you’re looking for a chase ATM you can find one near you here. Some atms might be cardless which means that you can use a mobile wallet like apple pay, samsung pay, or google pay to make transactions at chase atms. Look for the cardless logo to see where these are located.

In addition to withdrawing funds, you can also deposit checks and cash at chase atms. Many of the atms are open 24 hours a day so this is a great way to deposit your funds at all hours (though remember that you can use the chase mobile app to make deposits as well).

You can also make transfers, view your balances, see your recent transactions and in the future you will be able to make payments to your credit card.

Chase ATM deposit limits

The limits for depositing at atms are as follows: you can deposit up to 30 checks and 50 bills at a time at select atms. If you need to order chase checks or find out more about ordering those checks you can click here. Also, if you need to find out more about how to make transfers with chase quick pay read on here.

Keep in mind that if you make a deposit with a check, you may only have limited access to your funds the next day. For example, you might only have access to $200 the next day until your check clears.

Chase ATM withdrawal limit FAQ

The standard withdrawal limit for chase atms is $500 to $1,000 per day.

However, if you have a premium bank account you might be able to withdraw higher amounts ranging from $2,000 to $3,000.

By going inside a chase branch during business hours you can typically withdraw much more than your daily limit from an ATM.

You can also call chase and request a temporary increase in your ATM withdrawal limit.

Because different accounts have different limits, the best way to find out your withdrawal limit is to call the number on the back of your debit card.

The withdrawal limit will reset at midnight eastern standard time.

The limit for international ATM withdrawals will likely be the same as the limit in the US.

If you are withdrawing funds from a bank teller at a chase branch then you should not have any limit on the amount you can withdraw.

The fees will depend on the type of bank account you have opened.

Certain types of accounts such as chase sapphire and private client will not charge you ATM fees for using non-chase atms.

But for a standard account, you will be charged $2.50.

Final word

Chase has some pretty standard limits for ATM withdrawals. But if you’d like to up your limits you can also make a special request to a customer service agent and possibly get your limits increased from $500 to $1,000. Also, some chase accounts allow you to have higher withdraw limits and also come with lower fees, so check those out.

Uponarriving has partnered with cardratings for our coverage of credit card products. Uponarriving and cardratings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

So, let's see, what was the most valuable thing of this article: is JP markets reliable forex broker? Is JP regulated in south africa and other african countries? Complete guide & review with screenshots, videos & testimonials. Updated. At jp market withdrawal time

Contents of the article

- Real forex bonuses

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- JP markets review

- Who is behind JP markets?

- Trading services offered

- Accounts available on the platform

- Deposit and withdrawal options

- Commissions, leverages and spreads

- Pros of the JP markets platform

- Final thoughts

- Leave a reply cancel reply

- ������top broker 2020 SA������

- JP markets review

- Broker details

- Live discussion

- Video

- Traders reviews

- Not able to withdraw

- Frequently asked questions

- What is the minimum deposit for JP markets?

- Is JP markets a good broker?

- Is JP markets safe?

- What is JP markets?

- Jp market withdrawal time

- Jp market withdrawal time

- Download the guide to retirement PPT

- Retirement principles

- On the bench

- Same bed different dream composition of IPO...

- Abstract

- Access options

- Notes

- References

- Acknowledgements

- Funding

- Author information

- PF withdrawal amid COVID-19 crisis: how much can...

- All EPFO employees will be eligible for the...

- Chase ATM withdrawal limit guide: (resets and...

- What is the chase ATM withdrawal limit?

- When does the chase ATM withdrawal limit reset?

- What is the international withdrawal limit?

- Chase withdrawal limit increase

- Student card ATM withdrawal limits

- Non-ATM (teller) withdrawals

- Chase withdrawal ATM fees

- Find a chase ATM

- Chase ATM deposit limits

- Chase ATM withdrawal limit FAQ

- Final word

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.