Best leverage for 100usd

You buy 2 mini lots of EUR/USD. Your true leverage is about 63:1. You’ll be broke faster than mike tyson can chew your ear off.

Real forex bonuses

Low leverage allows new forex traders to survive

As a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage.

Using a ratio of 100:1 as an example means that it is possible to enter into a trade for up to $100 for every $1 in your account.

This gives you the potential to earn profits on the equivalent of a $100,000 trade!

It’s like a super scrawny dude who has a super long forearm entering an arm-wrestling match.

If he knows what he’s doing, it doesn’t matter if his opponent is arnold schwarzenegger, due to the leverage that his forearm can generate, he’ll usually come out on top.

When leverage works, it magnifies your gains substantially. Your head gets BIG and you think you’re the greatest trader that has ever lived.

But leverage can also work against you.

You’ll be broke faster than mike tyson can chew your ear off.

Here’s a chart of how much your account balance changes if prices move depending on your leverage.

| Leverage | % change in currency pair | % change in account |

|---|---|---|

| 100:1 | 1% | 100% |

| 50:1 | 1% | 50% |

| 33:1 | 1% | 33% |

| 20:1 | 1% | 20% |

| 10:1 | 1% | 10% |

| 5:1 | 1% | 5% |

| 3:1 | 1% | 3% |

| 1:1 | 1% | 1% |

Let’s say you bought USD/JPY and it goes up by 1% from 120.00 to 121.20.

If you trade one standard 100k lot, here is how leverage would affect your return:

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | +100% |

| 50:1 | $2,000 | +50% |

| 33:1 | $3,000 | +33% |

| 20:1 | $5,000 | +20% |

| 10:1 | $10,000 | +10% |

| 5:1 | $20,000 | +5% |

| 3:1 | $33,000 | +3% |

| 1:1 | $100,000 | +1% |

Let’s say you bought USD/JPY and it goes down by 1% from 120.00 to 118.80.

If you trade one standard 100k lot, here is how leverage would affect your return (or loss):

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | -100% |

| 50:1 | $2,000 | -50% |

| 33:1 | $3,000 | -33% |

| 20:1 | $5,000 | -20% |

| 10:1 | $10,000 | -10% |

| 5:1 | $20,000 | -5% |

| 3:1 | $33,000 | -3% |

| 1:1 | $100,000 | -1% |

The more leverage you use, the less “breathing room” you have for the market to move before a margin call.

You’re probably thinking, “I’m a day trader, I don’t need no stinkin’ breathing room. I only use 20-30 pip stop losses.”

Example #1

You open a mini account with $500 which trades 10k mini lots and only requires .5% margin.

You buy 2 mini lots of EUR/USD.

Your true leverage is 40:1 ($20,000 / $500).

You place a 30-pip stop loss and it gets triggered. Your loss is $60 ($1/pip x 2 lots).

You’ve just lost 12% of your account ($60 loss / $500 account).

Your account balance is now $440.

You believe you just had a bad day. The next day, you’re feeling good and want to recoup yesterday losses, so you decide to double up and you buy 4 mini lots of EUR/USD.

Your true leverage is about 90:1 ($40,000 / $440).

You set your usual 30-pip stop loss and your trade losses.

Your loss is $120 ($1/pip x 4 lots).

You’ve just lost 27% of your account ($120 loss/ $440 account).

Your account balance is now $320.

You believe the tide will turn so you trade again.

You buy 2 mini lots of EUR/USD. Your true leverage is about 63:1.

You’ve just lost almost 19% of your account ($60 loss / $320 account). Your account balance is now $260.

You’re getting frustrated. You try to think about what you’re doing wrong. You think you’re setting your stops too tight.

The next day you buy 3 mini lots of EUR/USD.

Your true leverage is 115:1 ($30,000 / $260).

You loosen your stop loss to 50 pips. The trade starts going against you and it looks like you’re about to get stopped out yet again!

But what happens next is even worse!

You get a margin call!

Since you opened 3 lots with a $260 account, your used margin was $150 so your usable margin was a measly $110.

The trade went against you 37 pips and because you had 3 lots opened, you get a margin call. Your position has been liquidated at market price.

The only money you have left in your account is $150, the used margin that was returned to you after the margin call.

After four total trades, your trading account has gone from $500 to $150.

Congratulations, it won’t be very long until you lose the rest.

| Trade # | starting account balance | # lots of used | stop loss (pips) | trade result | ending account balance |

|---|---|---|---|---|---|

| 1 | $500 | 2 | 30 | -$60 | $440 |

| 2 | $440 | 4 | 30 | -$120 | $320 |

| 3 | $320 | 2 | 30 | -$60 | $260 |

| 4 | $260 | 3 | 50 | margin call | $150 |

A four-trade losing streak is not uncommon. Experienced traders have similar or even longer streaks.

The reason they’re successful is that they use low leverage.

Most cap their leverage at 5:1 but rarely go that high and stay around 3:1.

The other reason experienced traders succeed is that their accounts are properly capitalized!

While learning technical analysis, fundamental analysis, sentiment analysis, building a system, trading psychology are important, we believe the biggest factor on whether you succeed as a forex trader is making sure you capitalize your account sufficiently and trade that capital with smart leverage.

Your chances of becoming successful are greatly reduced below a minimum starting capital. It becomes impossible to mitigate the effects of leverage on too small an account.

Low leverage with proper capitalization allows you to realize losses that are very small which not only lets you sleep at night, but allows you to trade another day.

Example #2

Bill opens a $5,000 account trading 100k lots. He is trading with 20:1 leverage.

The currency pairs that he normally trades move anywhere from 70 to 200 pips on a daily basis. In order to protect himself, he uses tight 30 pip stops.

If prices go 30 pips against him, he will be stopped out for a loss of $300.00. Bill feels that 30 pips are reasonable but he underestimates how volatile the market is and finds himself being stopped out frequently.

After being stopped out four times, bill has had enough. He decides to give himself a little more room, handle the swings, and increases his stop to 100 pips.

Bill’s leverage is no longer 20:1. His account is down to $3,800 (because of his four losses at $300 each) and he’s still trading one 100k lot.

He decides to tighten his stops to 50 pips. He opens another trade using two lots and two hours later his 50 pip stop loss is hit and he losses $1,000.

He now has $2,800 in his account. His leverage is over 35:1.

He tries again with two lots. This time the market goes up 10 pips. He cashes out with a $200 profit. His account grows slightly to $3,000.

He opens another position with two lots. The market drops 50 points and he gets out. Now he has $2,000 left.

He thinks “what the hell?!” and opens another position!

The market proceeds to drop another 100 pips.

Because he has $1,000 locked up as margin deposit, he only has $1,000 margin available, so he receives a margin call and his position is instantly liquidated!

He now has $1,000 left which is not even enough to open a new position.

He lost $4,000 or 80% of his account with a total of 8 trades and the market has only moved 280 pips. 280 pips! The market moves 280 pips pretty darn easy.

Are you starting to see why leverage is the top killer of forex traders?

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Or to be really safe, 1:1. Trading with too high a leverage ratio is one of the most common errors made by new forex traders. Until you become more experienced, we strongly recommend that you trade with a lower ratio.

How much leverage is right for you in forex trades

Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics, and the impact of volatility on specific markets. But the truth is, it isn’t usually economics or global finance that trip up first-time forex traders. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses.

Data disclosed by the largest foreign-exchange brokerages as part of the dodd-frank wall street reform and consumer protection act indicates that a majority of retail forex customers lose money. The misuse of leverage is often viewed as the reason for these losses. this article explains the risks of high leverage in the forex markets, outlines ways to offset risky leverage levels, and educates readers on ways to pick the right level of exposure for their comfort.

Key takeaways

- Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone.

- Forex traders often use leverage to profit from relatively small price changes in currency pairs.

- Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

- Leverage in the forex markets can be 50:1 to 100:1 or more, which is significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market.

The risks of high leverage

Leverage is a process in which an investor borrows money in order to invest in or purchase something. In forex trading, capital is typically acquired from a broker. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades.

In the past, many brokers had the ability to offer significant leverage ratios as high as 400:1. This means, that with only a $250 deposit, a trader could control roughly $100,000 in currency on the global forex markets. However, financial regulations in 2010 limited the leverage ratio that brokers could offer to U.S.-based traders to 50:1 (still a rather large amount). this means that with the same $250 deposit, traders can control $12,500 in currency.

So, should a new currency trader select a low level of leverage such as 5:1 or roll the dice and ratchet the ratio up to 50:1? Before answering, it’s important to take a look at examples showing the amount of money that can be gained or lost with various levels of leverage.

Example using maximum leverage

Imagine trader A has an account with $10,000 cash. He decides to use the 50:1 leverage, which means that he can trade up to $500,000. In the world of forex, this represents five standard lots. There are three basic trade sizes in forex: a standard lot (100,000 units of quote currency), a mini lot (10,000 units of the base currency), and a micro lot (1,000 units of quote currency). Movements are measured in pips. Each one-pip movement in a standard lot is a 10 unit change.

Because the trader purchased five standard lots, each one-pip movement will cost $50 ($10 change / standard lot x 5 standard lots). If the trade goes against the investor by 50 pips, the investor would lose 50 pips x $50 = $2,500. This is 25% of the total $10,000 trading account.

Example using less leverage

Let’s move on to trader B. Instead of maxing out leverage at 50:1, she chooses a more conservative leverage of 5:1. If trader B has an account with $10,000 cash, she will be able to trade $50,000 of currency. Each mini-lot would cost $10,000. In a mini lot, each pip is a $1 change. Since trader B has 5 mini lots, each pip is a $5 change.

Should the investment fall that same amount, by 50 pips, then the trader would lose 50 pips x $5 = $250. This is just 2.5% of the total position.

How to pick the right leverage level

There are widely accepted rules that investors should review before selecting a leverage level. The easiest three rules of leverage are as follows:

- Maintain low levels of leverage.

- Use trailing stops to reduce downside and protect capital.

- Limit capital to 1% to 2% of total trading capital on each position taken.

Forex traders should choose the level of leverage that makes them most comfortable. If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

The bottom line

Selecting the right forex leverage level depends on a trader’s experience, risk tolerance, and comfort when operating in the global currency markets. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. Using trailing stops, keeping positions small, and limiting the amount of capital for each position is a good start to learning the proper way to manage leverage.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

See how leverage can quickly wipe out your account

Hopefully, we’ve done our job and you now have a better understanding of what “margin” is.

If you don’t know what margin is, or think it’s an alternative form of butter, please read our previous lessons.

Now we want to take a harder look at “leverage” and show you how it regularly wipes out unsuspecting or overzealous traders.

We’ve all seen or heard online forex brokers advertising how they offer 200:1 leverage or 400:1 leverage.

We just want to be clear that what they are really talking about is the maximum leverage you can trade with.

There is maximum leverage. And then there is your true leverage.

True leverage

True leverage is the full amount of your position divided by the amount of money deposited in your trading account.

Let us illustrate with an example:

You deposit $10,000 in your trading account. You buy 1 standard 100K of EUR/USD at a rate of $1.0000. The full value of your position is $100,000 and your account balance is $10,000.

Your true leverage is 10:1 ($100,000 / $10,000)

Let’s say you buy another standard lot of EUR/USD at the same price. The full amount of your position is now $200,000, but your account balance is still $10,000.

Your true leverage is now 20:1 ($200,000 / $10,000)

You’re feeling good so you buy three more standard lots of EUR/USD, again at the same rate. The full amount of your position is now $500,000 and your account balance is still $10,000.

Your true leverage is now 50:1 ($500,000 / $10,000).

Assume the broker requires 1% margin.

If you do the math, your account balance and equity are both $10,000, the used margin is $5,000, and the usable margin is $5,000. For one standard lot, each pip is worth $10.

In order to receive a margin call, price would have to move 100 pips ($5,000 usable margin divided by $50/pip).

This would mean the price of EUR/USD would have to move from 1.0000 to .9900 – a price change of 1%.

After the margin call, your account balance would be $5,000.

You lost $5,000 or 50% and the price only moved 1%.

Now let’s pretend you ordered coffee at a mcdonald’s drive-thru, then spilled your coffee on your lap while you were driving, and then proceeded to sue and win against mcdonald’s because your legs got burned and you didn’t know the coffee was hot.

To make a long story short, you deposit $100,000 in your trading account instead of $10,000.

You buy just 1 standard lot of EUR/USD – at a rate of 1.0000. The full amount of your position is $100,000 and your account balance is $100,000. Your true leverage is 1:1.

Here’s how it looks in your trading account:

In this example, in order to receive a margin call, price would have to move 9,900 pips ($99,000 usable margin divided by $10/pip).

This means the price of EUR/USD would have to move from 1.0000 to .0100! This is a price change of 99% or basically 100%!

Let’s say you buy 19 more standard lots, again at the same rate as the first trade.

The full amount of your position is $2,000,000 and your account balance is $100,000. Your true leverage is 20:1.

In order to be “margin called”, the price would have to move 400 pips ($80,000 usable margin divided by ($10/pip X 20 lots)).

That means the price of EUR/USD would have to move from $1.0000 to $0.9600 – a price change of 4%.

If you did get margin called and your trade exited at the margin call price, this is how your account would look like:

An $80,000 loss!

You would’ve wiped out 80% of your account and the price only moved 4%!

And you would probably look like something like this.

Do you now see the effects of leverage?!

Leverage amplifies the movement in the relative prices of a currency pair by the factor of the leverage in your account.

Do you feel overwhelmed by all this margin jargon? Check out our lessons on margin in our margin 101 course that breaks it all done nice and gently for you.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

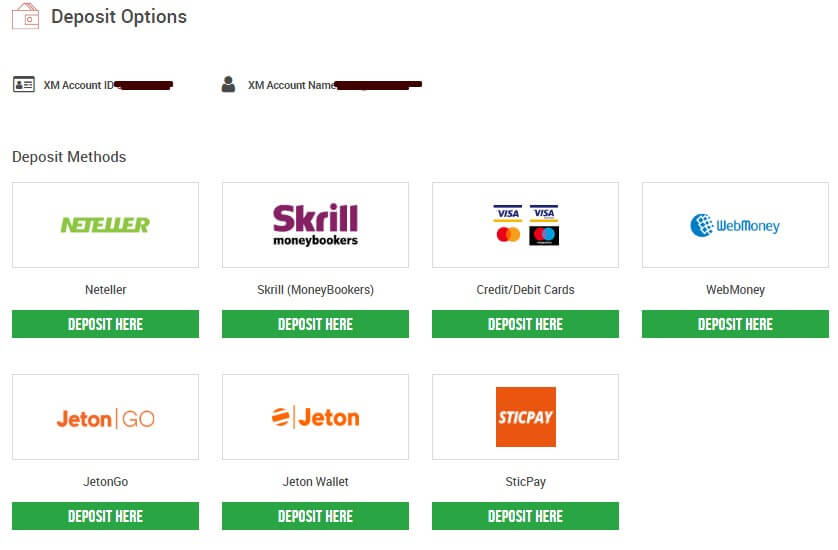

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

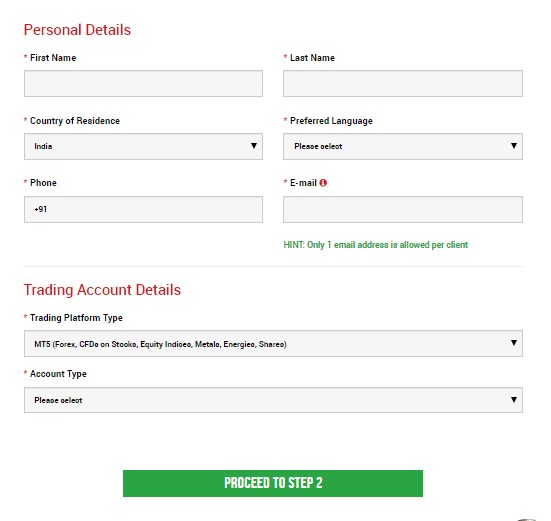

Step 2: filling the personal details

Fill all the box with accurate details

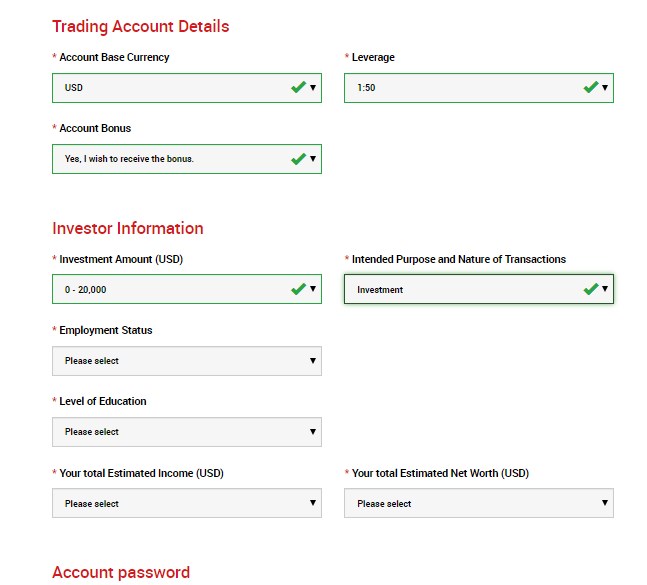

Step 3: investor information & trading account details

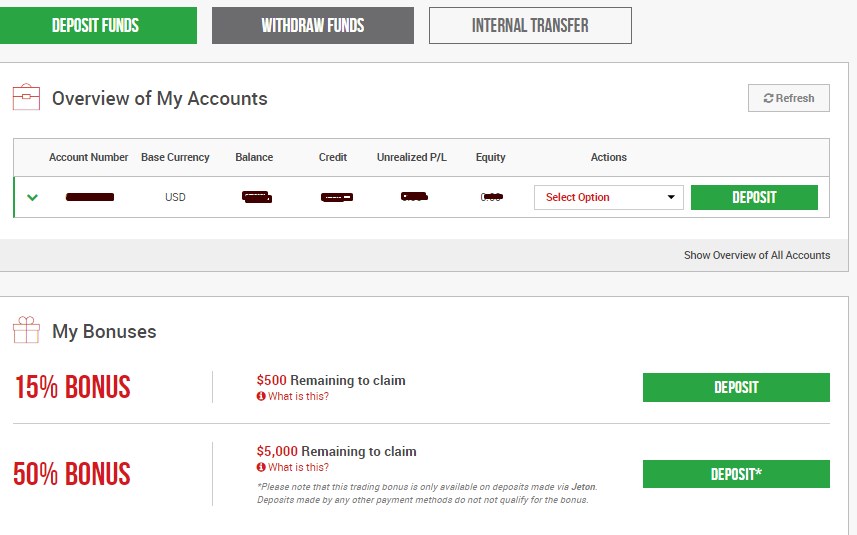

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

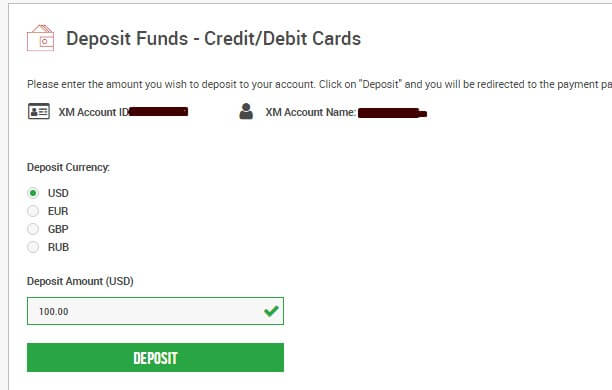

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

See how leverage can quickly wipe out your account

Hopefully, we’ve done our job and you now have a better understanding of what “margin” is.

If you don’t know what margin is, or think it’s an alternative form of butter, please read our previous lessons.

Now we want to take a harder look at “leverage” and show you how it regularly wipes out unsuspecting or overzealous traders.

We’ve all seen or heard online forex brokers advertising how they offer 200:1 leverage or 400:1 leverage.

We just want to be clear that what they are really talking about is the maximum leverage you can trade with.

There is maximum leverage. And then there is your true leverage.

True leverage

True leverage is the full amount of your position divided by the amount of money deposited in your trading account.

Let us illustrate with an example:

You deposit $10,000 in your trading account. You buy 1 standard 100K of EUR/USD at a rate of $1.0000. The full value of your position is $100,000 and your account balance is $10,000.

Your true leverage is 10:1 ($100,000 / $10,000)

Let’s say you buy another standard lot of EUR/USD at the same price. The full amount of your position is now $200,000, but your account balance is still $10,000.

Your true leverage is now 20:1 ($200,000 / $10,000)

You’re feeling good so you buy three more standard lots of EUR/USD, again at the same rate. The full amount of your position is now $500,000 and your account balance is still $10,000.

Your true leverage is now 50:1 ($500,000 / $10,000).

Assume the broker requires 1% margin.

If you do the math, your account balance and equity are both $10,000, the used margin is $5,000, and the usable margin is $5,000. For one standard lot, each pip is worth $10.

In order to receive a margin call, price would have to move 100 pips ($5,000 usable margin divided by $50/pip).

This would mean the price of EUR/USD would have to move from 1.0000 to .9900 – a price change of 1%.

After the margin call, your account balance would be $5,000.

You lost $5,000 or 50% and the price only moved 1%.

Now let’s pretend you ordered coffee at a mcdonald’s drive-thru, then spilled your coffee on your lap while you were driving, and then proceeded to sue and win against mcdonald’s because your legs got burned and you didn’t know the coffee was hot.

To make a long story short, you deposit $100,000 in your trading account instead of $10,000.

You buy just 1 standard lot of EUR/USD – at a rate of 1.0000. The full amount of your position is $100,000 and your account balance is $100,000. Your true leverage is 1:1.

Here’s how it looks in your trading account:

In this example, in order to receive a margin call, price would have to move 9,900 pips ($99,000 usable margin divided by $10/pip).

This means the price of EUR/USD would have to move from 1.0000 to .0100! This is a price change of 99% or basically 100%!

Let’s say you buy 19 more standard lots, again at the same rate as the first trade.

The full amount of your position is $2,000,000 and your account balance is $100,000. Your true leverage is 20:1.

In order to be “margin called”, the price would have to move 400 pips ($80,000 usable margin divided by ($10/pip X 20 lots)).

That means the price of EUR/USD would have to move from $1.0000 to $0.9600 – a price change of 4%.

If you did get margin called and your trade exited at the margin call price, this is how your account would look like:

An $80,000 loss!

You would’ve wiped out 80% of your account and the price only moved 4%!

And you would probably look like something like this.

Do you now see the effects of leverage?!

Leverage amplifies the movement in the relative prices of a currency pair by the factor of the leverage in your account.

Do you feel overwhelmed by all this margin jargon? Check out our lessons on margin in our margin 101 course that breaks it all done nice and gently for you.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

The 5 best forex broker with high leverage – real comparison

The best forex brokers with high leverage are regulated, operate transparent trading conditions, and utilize the latest fintech.

But finding the forex broker that’s right for you and your trading experience can be somewhat of a daunting task. With leverage ranging from less than 1:500 up to 1:2000, it is vital that you know as much about forex trading as possible before you get your feet wet.

To help navigate the world of high leverage forex brokers, we have chosen our top five picks and reviewed them for you. We look at the top 5 forex dealers to see what each has to offer. Please read on to find out which brokerage fits your needs, whether you be a complete novice or a veteran forex trader.

The following FX brokers which we reviewed:

- Bdswiss – swiss financial know-how

- Roboforex – great offers and promotions

- Blackbull markets – kiwi company with an excellent track record

- IC markets – one of the biggest forex traders around

- Vantagefx – trusted ECN broker

| broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

| 1. Bdswiss | (5 / 5) ➜ read the review | starting 0.0 pips + $ 2 – $ 5 commission per 1 lot (negotiable) | cysec (EU), FSC (MAU) | + maximal leverage 1:500 + individual offers + trading signals + raw spreads | $ 100 minimum deposit |

What is high leverage forex trading?

Before we dive straight into the review, let’s take a few seconds to consider what we mean by high leverage. This phrase means the trader can use their funds plus ‘borrow’ capital to increase potential gains. The result is that even the smallest of traders to trade currency pairs at larger volumes.

However, while making possible far greater returns, the gearing effect also significantly increases the risks of losses. For example, you want to trade with a leverage of 1:1000. That means you only need $1 of capital to trade the amount of $1,000. The leverage will increase your position size. But in the end, you can always varify the size of the position.

1. Bdswiss

Bdswiss was formed in 2012 and is jointly headquartered in zurich, switzerland, and cyprus, the latter of which is an EU member state. It’s also overseen and regulated by the financial authorities in the USA, seychelles, and mauritius.

In less than a decade, bdswiss has grown rapidly, and today boasts over a million and a half registered accounts from clients in more than 180 countries. Bdswiss is now arguably one of the most prominent international forex trading groups in the world. The award-winning forex broker has grown its customer base through numerous branch offices, both in europe and the US. Though it does have offshore registrations in the seychelles and mauritius, bdswiss is generally considered a safe broker. It also has to comply with the european union’s strict financial regulatory framework and that of the united states.

Bdswiss, then, can be considered a safe harbor for your trading cash. And with leverage of up to 1:500 available, the trading group is one of the best forex brokers with high leverage. However, it is always strongly recommended you carry out your due diligence and fully understand the implications of such high leverage. Always check the bdswiss site to verify its allowance structure and check each instrument individually as there is variation here too.

Trading fees are competitive but vary depending on the type of account you open. Be sure when registering to select your base currency – either euros, US dollars, or the GB pound – and you can dodge currency conversion fees. Currently, there are three types of accounts – classic, VIP, and raw, which offer spreads from 0.0 pips (subject to a $5 commission) to 1.5.

The classic and VIP accounts are not charged for forex, commodity, or crypto pairs. However, they are charged a fixed commission for everything else, including shares and indices.

Bdswiss has combined the renowned swiss financial prowess with a powerful and easy to use trading platform. It’s little surprise their expansion has been so rapid as it rests on sound foundations. Given the number of awards it has won and the solid reputation it has earned, bdswiss looks well placed for even more significant growth.

Bdswiss advantages:

- Permitted leverage of up to 1:500 subject to criteria

- European traders can use high leverage with the mauritius regulator

- A low minimum deposit of $100 USD

- Robust foundations

- Global coverage

- Ability to trade forex and a range of CFD instruments

- Opening an account is fast and easy

- Free demo accounts

- Customer support monday to friday

- Forex educational resources, webinars, and courses

- Trading signals

- Base currencies are USD, EUR, and GBP

- Metatrader 4/5, web-trader, app

(risk warning: your capital can be at risk)

2. Roboforex

Belize-based roboforex is probably best known outside of the trading world as the sponsorship partners of BMW M motorsport. The company was formed in 2009 and is IFSC (international financial services commission) of belize regulated. This accreditation provides for segregated trading accounts and negative balance protection. Roboforex is signed up to the financial commission’s compensation fund and provides execution quality certificates via verify my trade.

Since its inception, roboforex has been solidly focussed on using cutting edge technology to leverage its years of trading experience.

It operates globally and offers eight asset classes, leverage of up to 1:2000 regardless of account type, and more than 50 forex currency pairs.

Roboforex offers a range of five different account types with varying initial deposits ranging from $10 to $100 and varying degrees of leverage from 1:300 to 1:2000. So there’s a good chance you can track down an account that suits you. There are also ‘swap-free’ islamic and demo accounts available.

Trading is via the industry-standard metatrader, metatrader 4 and 5, ctrader, and the broker’s in-house R trader platform.

Because roboforex is overseas-based and regulated, they can offer an array of attractive bonuses and promotional offers. These offers vary from time to time. However, at the time of writing, their flagship offer was a prize giveaway with a total pot of a million dollars. The giveaway is to mark roboforex’s tenth year of trading. In addition to monthly prizes worth $100,000, in may 2021, there is to be a ‘grand prix giveaway’ which is worth an accumulated $300,000.

At the moment, there are these types of bonuses:

- A $30 welcome bonus once your account has been verified

- A 60% profit share bonus

- A 120% bonus of your deposited amount.

Check the website for the terms and conditions.

As well as the attractive benefits above, roboforex scores as one of the best forex brokers with high leverage thanks to its commission structure. They charge zero commission on client trading accounts. As well as that, roboforex offers over 20 different ways to deposit funds, so you are unlikely to be stuck for a payment provider.

Withdrawals are easy too. Their system for withdrawals is automatic and can take as little as one minute to transfer, depending on your payment method. Varying withdrawal fees apply.

Roboforex advantages:

- Tight spreads from 0.0 pips

- High leverage for every customer

- Fast order execution and ECN accounts

- Four account currencies available

- Micro accounts

- Eight asset classes including forex, indices, stocks, cryptocurrencies, energy, metals, etfs, and soft commodities

- Access to over 12,000 markets

- Negative balance protection

- 24/7 multi-language customer support

- Dedicated analytics app

- Learning videos

- Metatrader 4/5, ctrader, rtrader

(risk warning: your capital can be at risk)

3. Blackbull markets

Based in new zealand, hence the nice wordplay of blackbull, this international brokerage is a real electronic communication network (ECN). Founded in the year 2014, blackbull markets has dual accreditation. It’s licensed both by its domestic regulatory body, the new zealand financial markets authority, and in seychelles by their financial services authority.

Blackbull is headquartered in new zealand’s largest city, auckland, and has a support office in the malaysian capital city, kuala lumpur. Blackbull markets trades its more than 300 tradable instruments on the award-winning and industry-standard metatrader 4 and 5 platforms and web trader.

As arguably one of the best forex brokers with high leverage, the award-winning blackbull markets team gains this accolade thanks to a combined decade of experience in institutional forex trading. And this is reflected in the institution-class fintech service it offers its retail clients.

The minimum deposit to get started trading with blackbull markets is from $200, with leverage of 1:500, fast order execution, and customer support 24/5.

The lowest spreads available are from 0.1 pips but typically are in the region of 0.8 pips in their ECN standard type of account. Live spreads for the EUR/USD pair begin at 0.2 pips.

There are several account types available. Each is tailor-made to suit every forex trader, from complete beginners to veteran forex traders. Standard accounts accept deposits as low as $200, are commission-free, and give access to all of blackbull markets tradable instruments with low spreads.

Prime accounts, meanwhile, require a minimum initial deposit of $2,000 but offer a commission of $6 per lot on every $100,000 traded. Spreads start at 0.2 pips. It should be noted that blackbull markets charge overnight swap fees to keep positions open. For those of the muslim faith, there are swap-free islamic accounts. If you wish to test the water first, you can open a 30-day demo account simulator that’s pre-loaded with $100,000 of virtual cash for you to trade risk-free.

For their live accounts, you have the choice of depositing in nine currencies, including USD, EUR, AUD, and GBP. All payment methods are instantly processed, apart from bank transfers, which take between one to three days. You can only make a withdrawal via the method you used to pay initially. Withdrawal fees apply.

Advantages of blackbull markets:

- More than 300 tradable instruments

- Gold standard award-winning trading platforms

- Extra tools such as zulutrade and myfxbook

- Zero pip spreads available

- Offers more than 60 forex pairs

- Commission-free trading on some accounts

- Maximum leverage of 1:500

- Metatrader 4 and 5, plus a mobile app

- Deposits accepted in nine currencies

- Trading academy

- Cross-platform trading

(risk warning: your capital can be at risk)

4. IC markets

Founded in 2007 in australia, IC markets is regulated by the ASIC (australian securities and investments commission). It also has overseas branches and is subject to regulation by the cysec (cyprus securities and exchange commission), and in seychelles by the financial supervisory authority (FSA).

Opening an IC markets account is fast and easy. You only need $200 as a minimum deposit. And you will also love those deposits, withdrawals, and inactivity incur no fees.

However, there is a $20 AUD charge for international bank transfers. Otherwise, moving your money in or out is free with most of the payment methods on offer. Getting an account approved typically only takes 24 hours on a business day. You will also be asked about your trading experience during the account setup process. There is also the option of opening a demo account to try out the platform.

There are three account types – raw spread (based on ctrader); raw spread (based on metatrader); and standard, which is also traded on metatrader.

The standard account comes with zero commission and spreads from 1.0. Both raw spread accounts offer pips of 0.0 but charge commission. The ctrader account charges $3 per $100,000 USD, while the metatrader version is subject to a commission of $3.50 (per lot per side).

Trading fees charged by IC markets are broadly speaking low and align closely to their main competitors.

What also sets IC markets apart as one of the best forex brokers with high leverage is the number of base currencies they can offer to clients. These are USD, GBP, EUR, AUD, NZD, JPY, CAD, HKD, SGD, and CHF. This is extremely useful if you have a multi-currency bank account with an internet bank. Or, if you wish to avoid conversion fees by funding your account in the currency of your existing bank account or trading assets in the currency you selected as your account’s base currency.

IC markets’ portfolio and fee reports are straightforward and transparent. It’s easy to view your profit and loss balance as well as the commission fees incurred.

Advantages of IC markets:

- Low forex trading fees

- Free deposit and withdrawal

- ECN broker

- Minimum $200 deposit

- No inactivity fee

- Supports ten base currencies

- Three account types

- Fast execution of orders

- Offers sub-accounts in different base currencies

- Uses metatrader 4 and 5, plus ctrader

- Forex spreads starting from 0.0 pips

(risk warning: your capital can be at risk)

5. Vantage FX

Vantagefx was founded in australia in 2009 and said theirs is a dedicated ECN trading platform. It also offers online trading via metatrader, a mobile trading app, and social trading.

The vantage FX team, drawn from forex, finance, and technology backgrounds, are regulated by the australian securities and investments commission (ASIC). Their various branches around the world are regulated by financial regulatory bodies in the cayman islands, the UK, and vanuatu. The company uses a segregated bank account with tier-1 bank, national bank of australia, to hold client payments.

Vantage FX can lay claim to being among the best forex brokers with high leverage because of their background. They say it is because of their strong and diverse experience that they can offer class-leading access to global forex markets. They say retail and pro traders will notice a distinction when comparing vantage FX to other brokers they may have used in the past.

Vantage FX pitches three client account flavors suitable for all levels of trading experience. All are based on metatrader 4 and 5, offer 44 currency pairs, leverage up to 1:500, and nine base currencies.

The standard STP account is aimed at novice traders who want direct market access with zero commission and a low $200 minimum deposit. The minimum lot of trade size is 0.01, while the spreads start at 1.4.

The ECN-based accounts, raw ECN and pro ECN allow for 0.0 pips. The most popular of the two is raw ECN, as it requires only a minimum deposit of $500 to get started trading. The commission is charged from $3 per lot per side.

Meanwhile, the pro ECN account is firmly designed for high volume trade professionals and money managers. The minimum deposit is $20,000, with the commission payable being from $2 per lot per side.

Vantage FX offers a range of international and australia-only payment methods, including visa, JCB, china union pay, neteller, skrill, and fasapay. Most options involve no fees.

Their transparent forex market access and solid financial set up has understandably led to vantage FX being hailed as a secure and safe forex broker.

Advantages of vantagefx

- 50% welcome bonus on initial deposits up to $500

- A minimum deposit of $200

- 0.0 spreads

- Leverage up to 1:500

- Free forex signals

- Fast execution

- Award-winning customer support

- Negative balance protection

- Spot FX and forex cfds

- Volume commission rebates

(risk warning: your capital can be at risk)

What are high leverage forex brokers?

These brokers specialize in foreign exchange trades and use a system of leverage using borrowed money to bet on the direction of travel between currency pairs. For example, the USD against the euro. Or the GB pound against the japanese yen. The gearing effect that’s possible, generally 1:500, makes significant gains possible if the exchange rate moves in the predicted direction. If not, the losses can be substantial. However, almost all high leverage forex trading platforms have negative balance protection. So you won’t lose any more than the deposit you hold in your account.

What is 1:500 leverage?

Leverage is essentially a line of credit to trade on the foreign exchange markets. If a broker is offering leverage of 1:500, it means you can multiply your capital by 500. In other words, for every dollar of your trading capital, it is matched by $500 from the broker.

What is the best leverage ratio for novice traders?

As a novice trader, you should not be trading at more than 10:1 or 5:1. To be ultra-cautious, it’s better to stick with the leverage of 1:1 at the beginning. The most common rookie mistake of a new forex trader is to go too high with leverage. Play it safe until you have a comprehensive grasp of the subject and never trade with cash you can’t afford to lose.

Is high leverage forex trading risky?

The general consensus is that high leverage foreign exchange market trading is riskier. However, the potential rewards – and losses – are significantly more significant due to the multiplying effect. Some traders contend that by using only a level of leverage you are comfortable with, this form of trading can carry no more risk than other types. But, more importantly, it magnifies potential gains. It’s the classic half-full, half-empty argument.

Which are the best high leverage forex brokers?

The best ones are those that are regulated by a recognized financial regulatory body. They should also offer negative balance protection and be transparent about their commission fees and trading and non-trading charges. If you would like to get a proper handle on a particular platform, consider opening a demo account first. This will enable you to get some hands-on experience with virtual trading capital before committing yourself.

Final review of the best forex brokers with high leverage:

High leverage forex trading can be a success if you go about it the right way. As you can see from our review of the best forex brokers with high leverage, finding the right broker to suit should be easier than you imagine.

The top 5 forex brokers we highlight all share a strong commitment to helping their clients achieve their foreign exchange trading goals. These five are well-regulated and widely considered to be a safe harbor for trading.

There is much emphasis, too, on the fintech that underlies their platforms. There is a reliance on the industry-standard software metatrader 4 and 5, along with mobile apps and integration with social copy trading apps such as zulutrade and myfxbook, among others.

There is much evidence to conclude that the five forex brokers we have reviewed here are not prepared to rest on their laurels. There is a commitment to continue introducing the latest technology to execute orders as fast as possible and make their platforms intuitive and user-friendly.

As we have spotlighted, there is recognition of the need to cater to the diversity of traders, from beginners to seasoned veterans of forex trading. This is reflected not only in their tailor-made accounts with specific types of traders in mind but also in their desire to educate. Brokers like those we have reviewed spend much time, effort, and money on their educational resources. Not only is it in their interests to have an informed customer base, but it is also an acknowledgment that no matter how little or how much forex trading experience you have, there is always something new to learn.

With high leverage, you can use a bigger position sizes and suitable trading strategies.

So, let's see, what was the most valuable thing of this article: low leverage allows new forex traders to survive as a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage. Using a ratio of 100:1 as an at best leverage for 100usd

Contents of the article

- Real forex bonuses

- Low leverage allows new forex traders to survive

- Example #1

- Example #2

- How much leverage is right for you in forex trades

- The risks of high leverage

- Example using maximum leverage

- Example using less leverage

- How to pick the right leverage level

- The bottom line

- Fxdailyreport.Com

- How to start forex trading with $100

- See how leverage can quickly wipe out your account

- True leverage

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- See how leverage can quickly wipe out your account

- True leverage

- Fxdailyreport.Com

- How to start forex trading with $100

- The 5 best forex broker with high leverage – real...

- What is high leverage forex trading?

- 1. Bdswiss

- 2. Roboforex

- 3. Blackbull markets

- 4. IC markets

- 5. Vantage FX

- What are high leverage forex brokers?

- What is 1:500 leverage?

- What is the best leverage ratio for novice...

- Is high leverage forex trading risky?

- Which are the best high leverage forex brokers?

- Final review of the best forex brokers with high...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.