Xm broker sign up

If you are based in south africa, or any other country outside the european economic area, the registration process at XM.Com is a bit different, so we will cover it here too.

Real forex bonuses

5# step – voila, you have successfully registered a new account at XM.Com

XM.Com sign up guide – how to register a new account

XM.Com is a popular CFD and forex trading broker. Today, we will provide you with 2 step-by-step guides on how to sign up at XM.Com (depending on whether you are from the EU or not). So let’s get right into finding out how to register a new XM.Com account.

How to sign up at XM.Com *

*for traders from the european economic area*

1# step – visit the official website of the broker XM.Com

74–89% of retail investor accounts lose money.

2# step – on the homepage of the broker click either open a demo account or open an account (a real one)

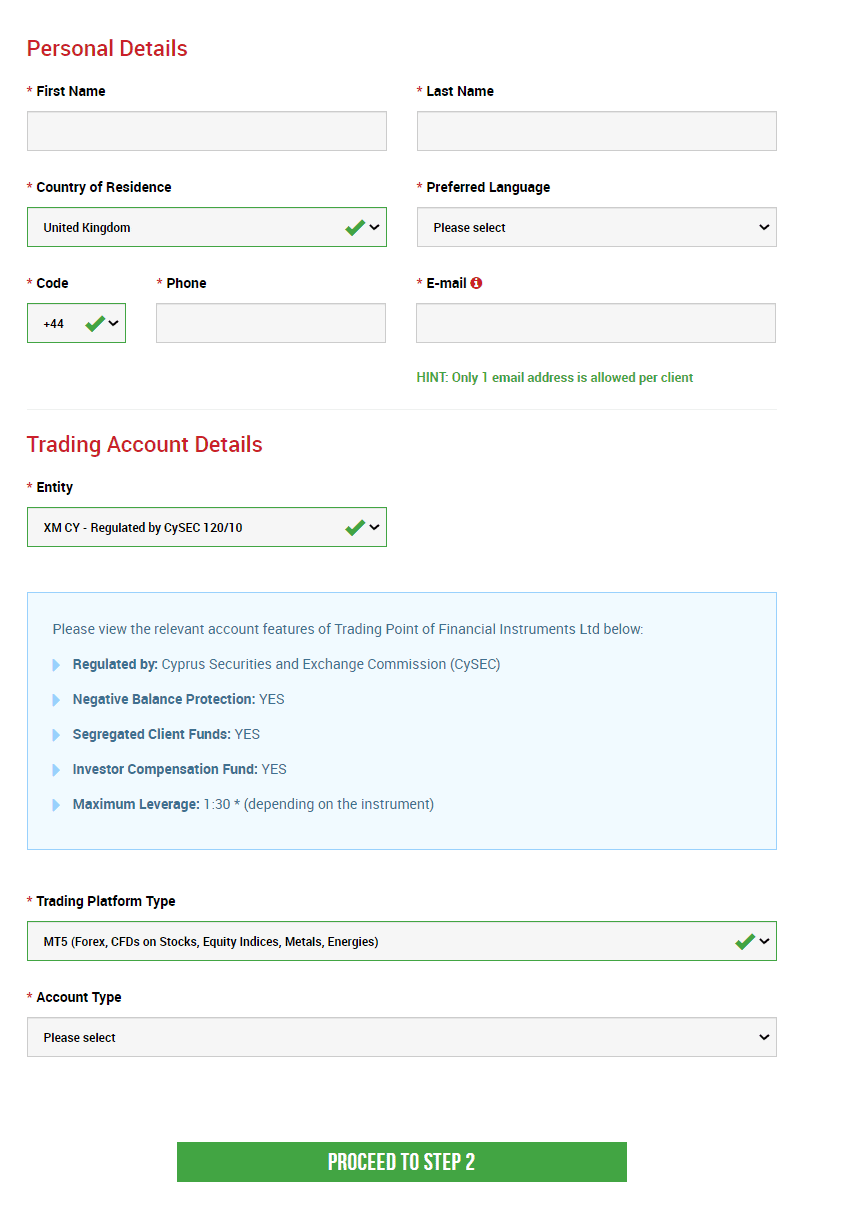

3# step – once you do that a new page with a form will open, looking similar to this one (if you too clicked on opening a real account).

Here, you have to fill in your personal details (like your fist and nast name, phone number etc.). Remember that you have to fill in the correct information, otherwise, you might get into some unnecessary troubles when deposit and withdrawing funds later on. Once you fill in your personal details, you can choose with what entity you want to trade with. XM.Com operates with two entities, one is regulated by the cysec (a financial regulator in cyprus, europe) and the other one by IFSC (a regulator in belize).

The cysec regulated entity features an investor compensation fund which provides extra protection to all european traders. However, because the cysec regulated entity has to follow the european ESMA laws, you can trade with only up to 1:30 leverage. The other entity (XM global limited), does not feature any investor compensation fund, but the maximum leverage you can use is 1:888.

Both entities feature negative balance protection and segregation of clients funds from their own. With that being said, I would opt for the cysec regulated option to get the extra protection of a european regulator.

Once you chose the entity, decide on what trading platform you want to trade. XM.Com features two: MT4 and MT5. If you don’t know them, either google them or take a look at their features right on the XM.Com website. Generally speaking, despite the fact that MT5 is more modern, MT4 is still more popular amongst traders due to its advanced functionality. In this step, you also decide with what account type you want to trade. If you are unsure how they differ, open a new tab and go again to the XM.Com homepage, click in the top menu on trading > trading account types.

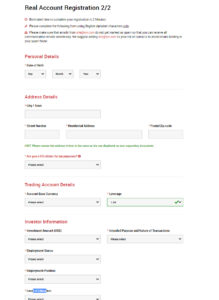

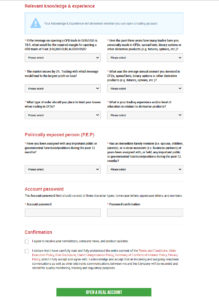

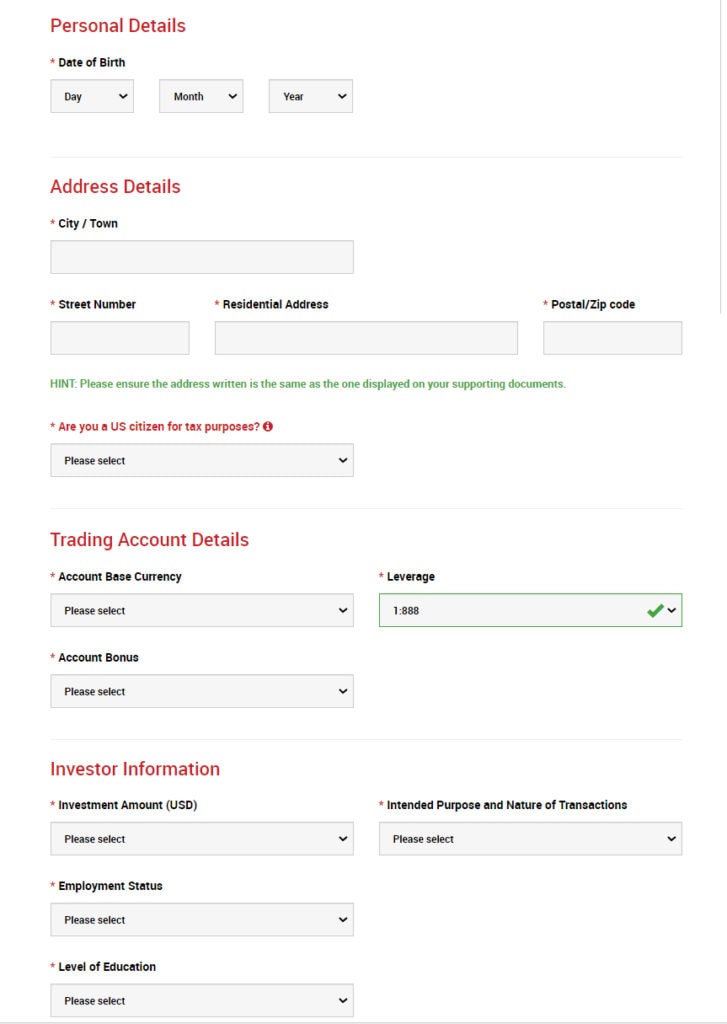

4# step – once you fill in the most basic information about yourself and the trading account details, click on “proceed to step 2”, as soon as you do that, a similar form will appear.

A form that will appear if you chose in the previous step an entity regulated in cyprus by the cysec

A form that will appear if you chose in the previous step XM global limited, an entity regulated in belize

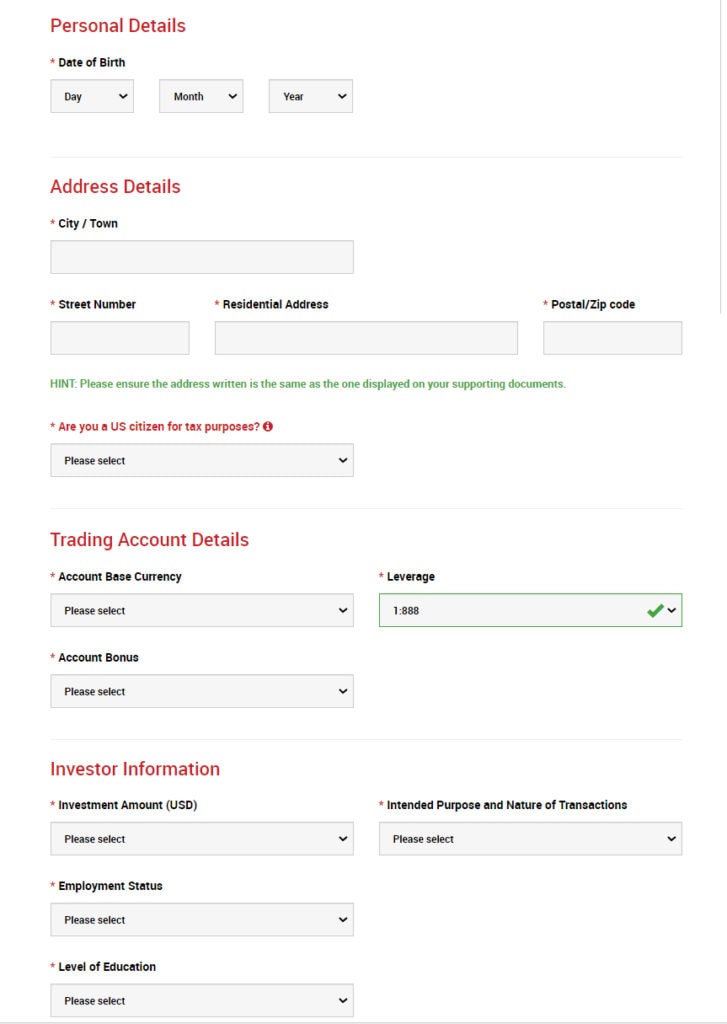

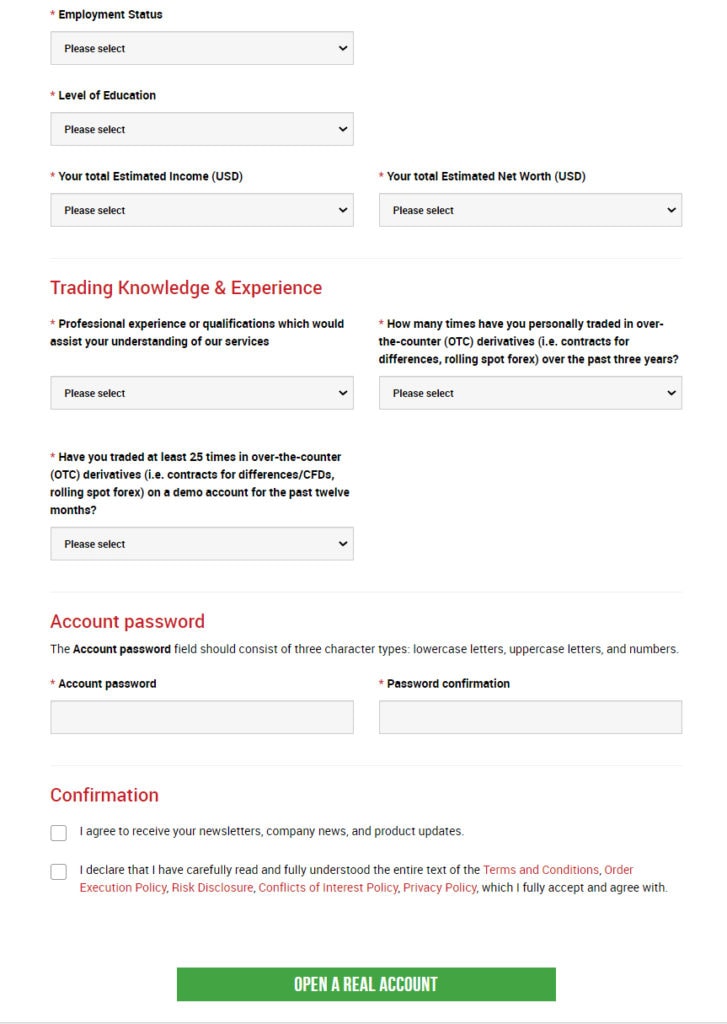

All the information broker requires in this step is pretty straightforward, if you are unsure about a certain question, feel free to drop a comment here and I will help you further. Once you fill in everything, click on open a real account.

5# step – voila, you have successfully registered a new account at XM.Com

After these 5 steps, the broker will provide you with information about how to log into the trading platform and how to make the first deposit to start trading.

How to register an XM.Com account *

*for traders outside the european economic area

If you are based in south africa, or any other country outside the european economic area, the registration process at XM.Com is a bit different, so we will cover it here too.

1# step – visit the official website of the broker XM.Com

2# step – on the homepage of the broker click either open a demo account or open a live account (and get 30 free dollars to start with)

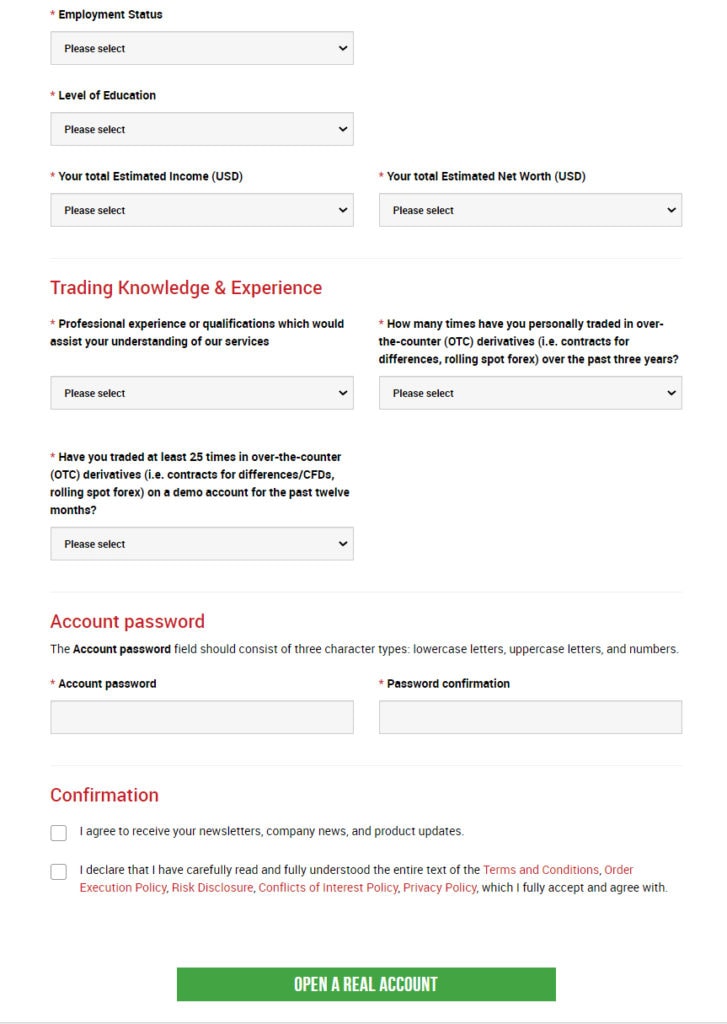

3# step – once you do that a new page with a new form will open, looking similar to this one (if you too clicked on opening a live account).

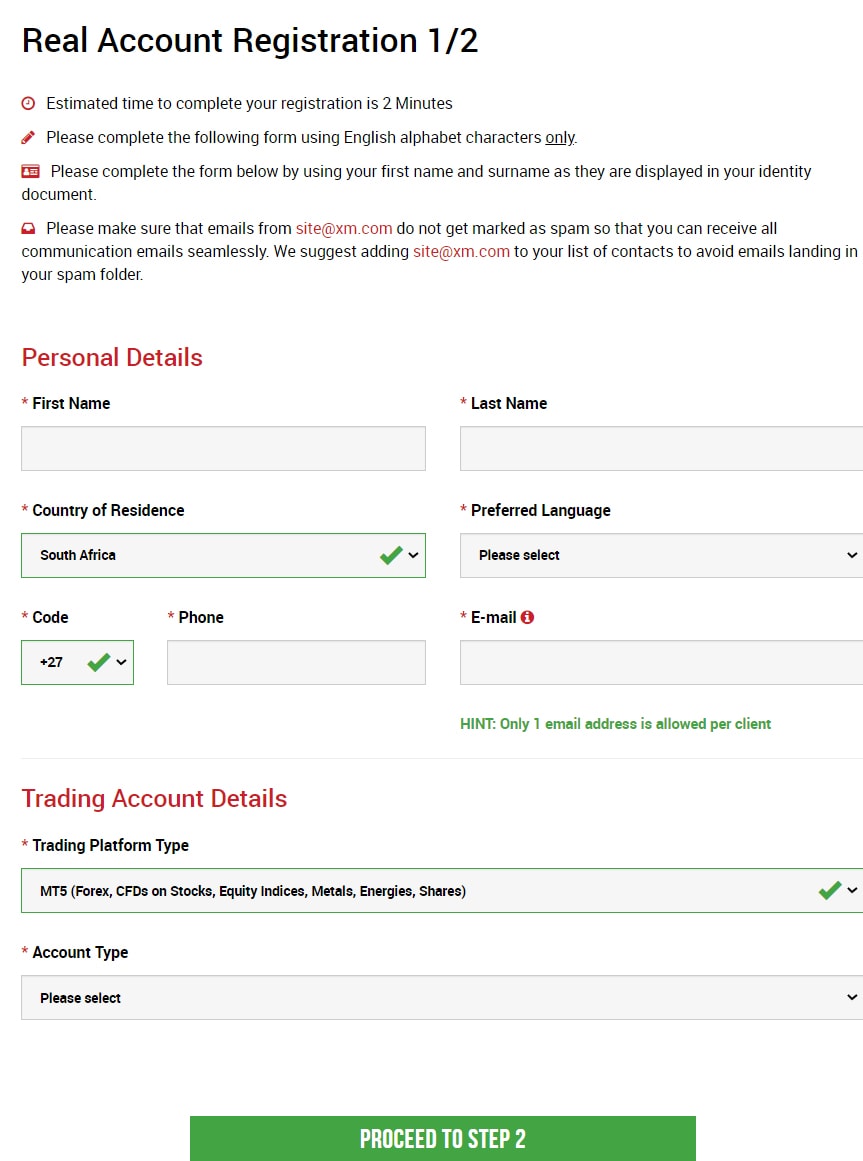

4# step – once you fill in the most basic information about yourself and the trading account details, click on “proceed to step 2”, as soon as you do that, a similar form will appear.

5# step – voila, you have successfully registered a new account at XM.Com

74–89% of retail investor accounts lose money.

Members area access

Use your MT4/MT5 real account number and password to log in to the members area.

New to XM?

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number 000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

We are using cookies to give you the best experience on our website. Read more or change your cookie settings.

Risk warning: your capital is at risk. Leveraged products may not be suitable for everyone. Please consider our risk disclosure.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Change settings

Please select which types of cookies you want to be stored on your device.

XM sign up bonus

A XM sign up bonus of US dollar 30 is offered by XM.

Traders who register a real account with XM are offered first time sign up bonus which is equivalent to that of a no deposit bonus as well as a welcome bonus for first time registration as no initial bonus is required to earn this bonus amount.

The US dollar 30, or currency equivalent, bonus is automatically credited to the trader’s account and it is non-withdrawable. Only profits earned can be withdrawn.

This offer is only available to new traders who register a real account, demo account users are not considered eligible.

In addition, XM also provides traders with a 100% deposit bonus of up to US dollar 500 along with an additional 20% deposit bonus, with a cumulative amount of maximum US dollar 4,500 or currency equivalent.

This offer is not available to demo account holders or XM ultra low account holders.

Brokers often offer these broker bonusses to new traders in an effort to draw in more customers in addition to encouraging trading activities. These bonuses are some of the best ways in which to assure traders that they will receive some cash back.

Referral bonus

XM does not currently offer referral bonuses to new or existing traders who make use of the products and services offered by XM.

Referral bonuses are offered by brokers to traders in an attempt to draw in new clients and expand their customer base.

Often these types of bonuses have strict criteria that will have to be fulfilled before the trader can benefit from referring a friend or family member.

Some of the criteria includes, but is not limited to:

- The referral has to register a real account with the broker using a unique referral link so that the registration can be traced back to the trader.

- The referral bonus is only applicable should referrals register a real account as these bonuses are not available when using a demo account.

- A certain minimum deposit amount has to be made by the referral.

- The referral may be required to execute a certain number of trades on the new account before the trader becomes eligible to receive the referral bonus

Referral bonuses may also have a limited time in which they can be utilized by traders, perhaps in a given month that brokers see a decrease in activity and attempts to counter it by providing such bonuses.

Additional bonuses, promotions and rewards

XM offers trading bonuses to active traders and loyal customers through the XM loyalty program where traders are rewarded with special seasonal bonuses during specific calendar events and occasions.

In addition, XM provides traders with an additional 10-year anniversary promotion to the value of US dollar 1,000,000 where a random account will be chosen every month, providing traders with the chance of winning various prizes until 31 august 2021.

Pros and cons

| PROS | CONS |

| 1. First time sign up bonus provided which serves as a welcome bonus and no deposit bonus | 1. No referral bonus offered |

| 2. Trading bonuses offered through XM loyalty program for active traders and loyal customers |

Conclusion

XM caters extensively and comprehensively for new traders who register a real account, existing traders, and loyal customers through its array of bonuses and rewards in addition with its competitive trading conditions.

XM broker

XM broker review explained by professional forex trading experts, all you need to know about XM broker login, for more information about XM.Com broker you can also visit XM review by forexsq.Com currency trading website, the top forex broker ratings fx brokers website and the fxstay.Com online investing company and get all information you need to know about XM trading forex broker.

XM broker review

XM broker‘s trading platforms is too diversify, maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. XM,com provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM broker account types

There are 4 types of XM.Com broker trading account types:

XM.Com broker zero account

XM zero accounts provide spreads as little as 0 on 56 currency pairs, silver and gold and the leverage up to 500:1.

XM broker micro trading account

This kind of account is suitable for those who need to accept a low risk approach near investing. This trading account essentials a really low minimum initial deposit of just 5 dollars.

XM.Com broker standard trading account

The standard trading account is more suitable for the expert and more skilled traders. Though the profits are the similar as micro trading accounts, traders with standard trading accounts can trade with greater contract size.

XM.Com broker managed forex accounts

Customers who don’t have the involvements or time to trade for they can also trust on the extra services provided by XM through the method of managed accounts. An expert account manager will help customers’ with their trades and also assistance to manage their assets for them.

XM broker islamic account

Knowing that the forex market is a universal marketplace, it also make payments for those traders who request to trade in accord with their spiritual belief. The islamic trading permits traders to bearing trades based on sharia ideologies.

XM broker demo account

Through the XM forex trading demo account, traders can trial out their trading approaches without having to risk real money. Every demo account is providing with 100,000 dollars in virtual money so traders can attempt to simulate real trading situations.

XM broker deposit and withdrawal methods

They take the most normally used banking approaches today comprising electronic payments, credit cards, local bank transfers, bank wire transfers, western union and moneygram. Their coverage is fairly extensive and enhances more suppleness on adding assets into the account.

XM broker login

To do XM broker login you can visit the broker website and after sign up with the broker you can check your email and do XM broker login.

XM broker review conclusion

However the XM.Com broker is regulated but invest the amount you can afford to lose it as online trading contains risk of losing your money.

By this XM forex review now you know all about XM trading platform, there is other XM broker review on the internet to know about XM MT4, XM login and XM download, if you like this XM forex broker review then share it please and help other currency traders to know about this XM trading review.

XM review

Regulation and security

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments ltd was established in 2009 and it is regulated by the cyprus securities and exchange commission (cysec 120/10), trading point of financial instruments pty ltd was established in 2015 and it is regulated by the australian securities and investments commission (ASIC 443670) and XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (000261/106).

XM’s regulation in cyprus provides its clients there with a degree of investor protection, as cysec maintains an investor compensation fund which is empowered to award depositors who lose their accounts due to failure of a regulated firm an amount up to €20,000.

XM has been in operation as a brokerage since 2009, giving it a relatively long track record. Typically, it can be said that the longer a broker has been in business, the more reputable the broker should be held to be. This means that XM can be said to have a substantial track record and an established reputation of safety as a brand which it will wish to protect.

Like all forex / CFD brokerages regulated in member states of the european union like cyprus, all clients of XM enjoy negative balance protection. This means that it is impossible for any client to lose more than the amount they have deposited with XM. The “tail risk” of an extremely large and sudden market movement, amplified by any leverage used, is borne fully by XM under this european union regulation.

| ��️ headquarter | cyprus, belize, australia |

| ⚖️ regulations | cysec, ASIC, IFSC |

| �� type of broker | market maker |

| �� minimum deposit | $5 |

| �� maximum leverage | 1:888 *the maximum leverage foe clients registered under the EU regulated entity of the group is 30:1 |

| �� type of platform | metatrader 4, metatrader 5, web-based |

| �� deposit with credit card | yes |

| �� depositing with wire transfer | yes |

| �� demo account provided | yes |

| ��️ instruments traded | forex cfds, commodities cfds, equity indices cfds, precious metals cfds, energies cfds |

The question of fees charged by a brokerage should always be paramount in the mind of anyone searching for the right forex / CFD broker. In considering the question, all costs of doing business must be considered carefully. We can break the entirety of fees and costs into two separate sub-categories: fees which are incurred through opening and closing trades, such as spreads, commissions, and overnight financing; and incidental fees, such as charges imposed by the brokerage due to account inactivity, or transaction fees applied to deposits or withdrawals. The trading fee element is going to be most important by far so this should be examined first.

Looking at trading fees first, we begin with spreads and commissions, which should be lumped together as an all-in “round trip” cost covering the opening and closing of a trade. As XM offer a few different account types which charge slightly different fees, we will judge the trading fees of its most common account type, the standard account.

The average round trip cost of trading the benchmark EUR/USD forex currency pair is 1.7 pips. However, this falls to only 0.8 pips in the XM zero account.

The average round trip costs of trading individual stocks, soft commodities, and equity indices are average for the industry.

Finally, data on the average round trip cost of trading the precious metals gold and silver shows that it is never below 30 cents for gold and 3 cents for silver.

It can be said that these levels of spreads and commissions are competitive for depositors of relatively low amounts. The minimum deposit required to open a standard account is only $5, so for traders depositing only a few hundred dollars or less, these fees will certainly be competitive. However, traders with considerably larger sums to deposit such as a few thousand dollars would be able to find more competitive alternative brokerage options within the industry, unless they wish to open an XM zero account which has extremely competitive fees.

The next thing to consider as part of the fee structure is overnight financing, which is usually a net charge applied to every trade daily which is open at 5pm new york time, although it can sometimes be a payment. These fees are, at least theoretically, based upon tom/next fees applied in the intrabank market, but retail brokerages tend to offer relatively unfavorable rates which can make swing or position trading expensive, especially when buying into currencies with very low or negative interest rates. XM are open and transparent about their overnight financing rates, which is a good sign. XM state that their rates are based upon the bank market’s tom/next rates plus the XM mark-up. Comparing the rates offered at the time of review to the industry average, their overnight financing rates are relatively competitive, meaning that XM may be a good choice for traders who wish to hold positions open for periods longer than a day or two.

We end this section on fees by looking at incidental transaction fees, occurring through non-trading processes.

XM charges an account inactivity fee of $5 per month after 90 days. XM charges no additional fees on deposits or withdrawals except where an amount of less than $200 is moved by wire transfer. Overall, this is not a bad deal, unless you are making a very low deposit and will want to make no trades at all for a period which may be longer than one month.

Our conclusion on fees: XM’s fees are competitive for traders making deposits under $1,000 across all account types, while the XM zero account is competitive at any deposit level.

What can I trade

After regulation, safety, and the fee structure, the next most important element to consider when choosing a forex / CFD brokerage is what is offered for trading on the broker’s menu. Some traders will be seeking exposure only to one asset class, such as forex, or cfds on individual stocks and shares, while others will be looking for diversification.

XM offer the following instruments for trading:

Forex – more than 55 currency pairs and crosses, including exotic currencies, as listed below.

Stocks – an extremely wide selection of individual stocks are offered for trading, with more than 1,200 different equities currently listed by XM. This is a very impressive, wide range of choice offered as an access to global equities. Stocks are offered from seventeen different national equity markets, including of course the major markets such as the U.S.A., the U.K., germany, switzerland, and australia, but also russia. Otherwise, the geographical markets are entirely european. Traders interested in trading individual major market stocks should give XM serious consideration as a broker of choice.

Commodities - a decent selection of 8 soft commodities are offered, which is more than most brokerages run to. They are listed below.

Five energies, including natural gas, are available to trade.

The final element of XM’s commodities offering are precious metals, namely, gold and silver. More exotic precious metals such as platinum and palladium are not available.

Equity indices – 18 major equity indices are on the menu, which is a decently wide-ranging selection for choice. The full list of equity indices is set out below.

Our conclusion regarding XM’s offering of tradable assets is favorable, with a wide range of asset classes offered that should satisfy most traders. The offering is especially impressive concerning global equities, with an unusually large amount (over 1,200) on the menu at the time this review was published. We expect there is a sufficiently wide range here for those traders who are not particularly interested in individual stocks and shares, but who want to be reasonably diversified across major markets.

Account types

XM group offers its clients 4 types of account: MICRO, STANDARD, ZERO and ULTRA LOW with low spreads. The MICRO account allows you to operate with micro lots, lower level of risk and it has minimum initial deposit of $5. The STANDARD account allows you to operate with standard lots and it has minimum initial deposit of $5. The XM ZERO* account allows you to operate with standard lots, lower spreads starting at 0 pips and it has minimum initial deposit of $100. XM ZERO account has a $3.5 commission per $100,000 traded. Finally, the XM ULTRA LOW* account allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50.

All account types allow hedging, scalping, and automated trading via expert advisers.

We think that the range of account types offered are realistic, easy to use and understand, and good value. Too often in the retail forex / CFD industry, account type classifications are made unnecessarily complex for marketing purposes. It is admirable that XM seem to have refrained from doing this and are instead looking simply to give their clients what they want and need.

Trading platforms

XM offers all its trader clients a choice between the use of the two most popular retail forex / CFD trading platforms globally. Clients with any account type may choose to use either metatrader 4 or metatrader 5. Both platforms are well-known, intuitive, and easy to understand, and have been around for many years. Both platforms are also very popular with the retail trading community. Some traders may wish for a deeper choice of platform that is given here, yet a big majority of traders who find themselves considering becoming customers of XM will find the choice on offer adequate.

XM offers a range of MT4 and MT5 platforms for both windows and mac operating systems which gives traders unrestricted access to all platforms.

In addition, a range of MT4 and MT5 mobile applications for both apple and android operating systems seamlessly allow access to an account with full account functionality from a smartphone or tablet.

XM pioneered the offering of an MT4 platform with trading execution quality in mind. It offers the following benefits: over 100 instruments including forex, cfds and futures, 1 login access to 8 platforms, spreads as low as 1 pip, full EA (expert advisor) functionality, 1 click trading, technical analysis tools with 50 indicators and charting tools and 3 different chart types.

Trades can trade with the MT4 platform on their mac as well as on mobile devices such as androids and iphones, ipads and tablets.

XM webtrader 4

XM webtrader 4 is accessible for PC’s and mac’s without downloading. Traders can choose from over 100 instruments including forex, CFD’s and futures, 1 single login access to 8 platforms, spreads as low as 1 pip, 1 click trading and built in news functionality.

XM MT4 multiterminal

The XM MT4 multiterminal platform is the ideal tool for traders wanting to handle multiple MT4 account from 1 single terminal with ease with 1 master login and password.

It supports up to 128 trading accounts, has multiple order types, three allocation methods and provides management and execution in real time.

Metatrader 5 offers a range of extra features that analyze the market and help traders trade in any style they want.

In addition to all the features of the MT4 platform, the MT5 platform also offers different order types such as 'fill or kill' and 'immediate or cancel' as well as technical and fundamental analysis using over 79 analytical tools.

Unique features

The standout features of XM are twofold: first, its strong regulatory regime in two major industry centers (australia and cyprus, the latter of which gives passporting into E.U. Regulation throughout the union); secondly, its very extensive offering of individual equities listed in european countries and other major developed nations.

XM’s zero account also has an extremely competitive fee structure at a very low minimum required deposit.

XM is proud of its history and its accomplishments. Its milestones in our corporate history chart goes back to 2011 and points to a background of trustworthiness and corporate involvement.

The XM management has visited over 120 cities around the world to connect with their clients and partners in order to interact with them on a face to face basis. They have hosted more than 100 seminars to educate traders, enabling them to make better trading decisions. These activities have helped XM reach the highest levels of client retention of any forex broker, anywhere.

In fact, XM prides itself on having over 300,000 real accounts opened to date from 196 countries and over 150,000,000 trades executed with zero re-quotes or rejections, ever.

XM withdrawal problems

XM is one of the biggest retail brokers operational with more than 3,500,000 traders from 196 countries. It provides traders with more than 25 payment options and given the size of this broker and broad international reach. Therefore, it is not surprising for a few clients to claim XM withdrawal problems. XM maintains a clean track record with five regulators, making isolated stories of issues related to a withdrawal dubious. Those claims are often made in online forums with the well-document malicious intent to extract payments from brokers to avoid tarnishing their reputation. All known claims were related to traders violating the terms and conditions. One trader claims he deposited his friend’s skrill account into his XM trading account. The case dates back to 2013 and violated anti-money laundering (AML) regulations. While they were not as detailed as today, at that time, some brokers did not check the source of deposits, while withdrawals faced strict scrutiny. The trader provided no supporting evidence and stopped responding to the thread he started, suggesting it was nothing more than a malicious attempt, potentially sponsored by a competitor, a common practice in the industry, or by a disgruntled trader who faced losses.

XM also offers generous bonuses, however, clients registered under the EU regulated entity of the group are not eligible for the bonus (ESMA regulations). XM remains a legit, trustworthy, and honest broker that offers bonuses. Traders should consider the source of any claims of XM withdrawal problems and the lack of evidence before trusting misleading smear campaigns.

Research and education

The XM research & education offering is impressive. It should be said that a forex / CFD brokerage can offer an excellent service without providing any education or research offering at all. Brokers primarily exist to execute trades and safeguard deposits efficiently, and these core functions are what customers need and want.

All too often, substandard brokers throw together a hastily assembled collection of low-quality educational material, simply for the sake of trying to put across a good appearance. Happily, in the case of XM, the educational and research offering is there because it is worthwhile.

Research is offered as news and analysis on key markets and relevant geopolitical developments, including technical analysis performed on selected price charts. Forex, commodities, and stocks are covered.

In the XM learning center, subsections are divided into live education, educational videos, forex webinars, platform tutorials, and forex seminars.

The educational rooms are live trading rooms which clients may enter and participate in and see live markets traded in real time. Most of them are open for eight hours continuously on weekdays, which is extremely impressive. Seven educational videos on a range of common forex trading topics are also present in their relevant subsection.

Account holders can benefit from weekly webinars in 13 different languages including arabic, bengali, indonesian, polish and others given by 18 expert instructors whose pictures are presented on the site.

The list of video tutorials seems endless and cover topics as basic as how to open a forex account to how to use a MT4 droid pad on the mobile trader app.

Upcoming XM workshops and seminars are listed as are ones that have already taken place.

In addition, their economic calendar posts any upcoming events taking place in markets throughout the world.

There are market reviews, a forex news report and technical analysis that appear daily.

A selection of trading tools are also offered, in addition to free forex signals and forex calculators.

Customer support

Most traders will never use their broker’s customer support service beyond the occasional query for clarification of the trading terms offered. Still, its good to know that if you do need the help desk, you will be dealt with promptly and helpfully.

XM’s customer support has a good reputation, partly because it is offered in a wide variety of languages with dedicated native speakers offering support to clients in their own language.

The XM customer support desk is available 24 hours a day, from monday to friday – the same time period over which the markets are open. Representatives speak english, greek, japanese, chinese, bahasa malay, bahasa indonesia, hungarian, russian, french, spanish, italian, german, polish, hindi, arabic, korean, portuguese, czech, slovakian, bulgarian, romanian and dutch.

Traders can contact a rep at different departments in several international locations via email of telephone. Live chat is also available.

Bonuses and promotions

- Free VPS for clients who maintain a balance (equity-credit) USD 5,000 or currency equivalent.

- $30 non-deposit trading bonus for new clients only.

- The two-tier deposit bonus offers 50% deposit bonus up to $500 and 20% deposit bonus up to $5,000.

- The XM loyalty program offers the clients XM points (XMP) per lot traded. These XMP can be redeemed at any time for credit bonus which can be used for trading purposes only.

*trading bonuses and loyalty program are not eligible for clients registered under the EU regulated entity of the group

Opening an account

The account opening process with XM is relatively quick and painless. You can expect to get your account open and ready on the same day that you begin the account opening process. Clients only need to navigate through a couple of web screens where they submit a few details and choose the type of account they want to sign up for.

It is worth noting that residents of the U.S.A. And a few other extremely regulated jurisdictions are not accepted as new clients by XM.

In addition to providing personal and account details, new clients are required to verify their ID and proof of residency by way of utility bills or bank statements. Proof of ID may be verified by providing an official national identity card, passport, or driver license. Images can be uploaded for verification and response times are very quick.

Deposits and withdrawals

At XM there is no minimum deposit required. However, system restrictions limit the minimum deposit amount to $5 for electronic funding such as moneybookers, skrill and neteller as well as credit cards and bank wire transfers. Moneygrams and western union payments are also accepted.

Withdrawals can be made using the same methods. In fact, the deposit and withdrawal options are listed side by side on the website and a trader needs only click on “make a deposit” or “request a withdrawal” in order to make a transaction.

Withdrawals via bank-wire of amounts under $200 are subject to a $15 administration fee. While this is not completely uncommon, it is a little unusual and smaller depositors should consider whether they will be able to plan to sit tight and hope to grow their account to a level where this fee would not apply to any likely amount the client will wish to withdraw.

XM broker

XM broker review explained by professional forex trading experts, all you need to know about XM broker login, for more information about XM.Com broker you can also visit XM review by forexsq.Com currency trading website, the top forex broker ratings fx brokers website and the fxstay.Com online investing company and get all information you need to know about XM trading forex broker.

XM broker review

XM broker‘s trading platforms is too diversify, maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. XM,com provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM broker account types

There are 4 types of XM.Com broker trading account types:

XM.Com broker zero account

XM zero accounts provide spreads as little as 0 on 56 currency pairs, silver and gold and the leverage up to 500:1.

XM broker micro trading account

This kind of account is suitable for those who need to accept a low risk approach near investing. This trading account essentials a really low minimum initial deposit of just 5 dollars.

XM.Com broker standard trading account

The standard trading account is more suitable for the expert and more skilled traders. Though the profits are the similar as micro trading accounts, traders with standard trading accounts can trade with greater contract size.

XM.Com broker managed forex accounts

Customers who don’t have the involvements or time to trade for they can also trust on the extra services provided by XM through the method of managed accounts. An expert account manager will help customers’ with their trades and also assistance to manage their assets for them.

XM broker islamic account

Knowing that the forex market is a universal marketplace, it also make payments for those traders who request to trade in accord with their spiritual belief. The islamic trading permits traders to bearing trades based on sharia ideologies.

XM broker demo account

Through the XM forex trading demo account, traders can trial out their trading approaches without having to risk real money. Every demo account is providing with 100,000 dollars in virtual money so traders can attempt to simulate real trading situations.

XM broker deposit and withdrawal methods

They take the most normally used banking approaches today comprising electronic payments, credit cards, local bank transfers, bank wire transfers, western union and moneygram. Their coverage is fairly extensive and enhances more suppleness on adding assets into the account.

XM broker login

To do XM broker login you can visit the broker website and after sign up with the broker you can check your email and do XM broker login.

XM broker review conclusion

However the XM.Com broker is regulated but invest the amount you can afford to lose it as online trading contains risk of losing your money.

By this XM forex review now you know all about XM trading platform, there is other XM broker review on the internet to know about XM MT4, XM login and XM download, if you like this XM forex broker review then share it please and help other currency traders to know about this XM trading review.

XM forex broker $30 no deposit bonus how to trade & withdraw?

XM global limited is one of the oldest broker with over 196 countries access to their financial services. XM is recognized by cyprus, EU, and australian securities commission firms for regulation formalities.

On december 01, 2020, the XM forex broker introduces a great promotional program for the newbie’s registrars not just they can test their system in real market order execution, they can also avail the opportunity of earning money by testing their trading skills in the real market experience. Let’s explore the specifications of this bonus program terms and conditions and how the users can be eligible to successfully avail the funds and trade so that they can withdraw the profit amount.

XM broker forex $30 no-deposit bonus overview

The ongoing no-deposit bonus requires your attention to claim it if you are the newly introduced user of XM forex broker and want to test and trade the real market on the XM broker system setups. You have a total of 25 days in the month of december after the account registration and completing the mandatory steps which are mentioned below.

XM forex broker $30 no-deposit bonus terms & conditions to withdraw profit amount

There are some important conditions to meet if you really want to take benefit from this no-deposit bonus opportunity. Here are the following terms and conditions settled by the XM global broker administration to combat the fraud and regulate the activity of the bonus program.

- You must be a fresh user of XM broker at the time of bonus claim.

- The IP address must be unique, having zero histories of XM broker account usage.

- You must have to verify the account fully along with KYC verification to avail withdrawal opportunity.

- You must have to trade 10 micro-lots of bonus amount so then you will able to withdraw your profited amount.

- The bonus amount of $30 cannot withdrawable but you can withdraw the above amount of $30, whatever you profit made by trading your bonus amount.

- When you withdraw your profit equivalent percentage of the bonus amount will also deduct from your bonus account i.E you made a $100 profit and withdraw $50 from your profit that is 50% so that percentage of 50% will deduct from the bonus amount which will be half of $30 and remaining bonus $15 you have remaining for trading.

- The XM broker terms & conditions also identify that hedging will not allowable in this program.

- Shares trading is not allowed or irrelevant to this bonus account.

- The company reserve the rights whenever they want to change the policy of the bonus program by informing the users, as well as they, can nullify the eligibility of any user who notices as an activity violator of the system without their consent.

How to claim XM $30 no-deposit bonus

- To claim the no-deposit bonus amount first of all you have to sign up for your account at XM broker member area click here to claim $30 bonus amount directly.

- After successfully confirm your email and then move ahead and complete your ID verification process to gain the privilege of depositing and withdrawing quickly.

- After completing the KYC process you can now able to claim your $30 bonus amount from the promotional tab or either through the claim button below given after the OTP verification.

- Now you are able to trade your credited equity and make a profit out of it and make withdrawals.

- Currently, XM is providing skrill, neteller, VISA, MASTER card, webmoney & local banks transfer payment channels after KYC verification

Thoughts on $30 bonus program

This opportunity is especially seemingly for those who want to avail this to trade in the real market with the real equity to get monetary benefit out of it. This program will end on until 31st of december 2020 so it’s great to offer for the XM new users who are ready to avail of it before the new year beginning. You can trade it properly with money management to avoid any chance of losing equity and chance of getting profitable withdrawal out of it. Suggestively on the equity of $30, 1 micro lot is only sufficient to trade on per definite major entry of great probabilities.

Xm broker sign up

This XM review was conducted by the team of our professional forex experts for those who want to invest with XM.Com broker.Formerly founded in 2009 as trading point of financial instruments ltd, it is a regulated forex broker in the republic of cyprus. The company was originally established by a group of interbank traders who required to recover the level of services in the forex trading communal. Through XM, traders now have access to the cfds, commodities and forex marketplaces.

Featured site

One of the foremost advantages of trade with XM is the information that the company is founded in cyprus, a member nation of the eurozone. This mean it meets the lowest fiduciary standard essential of a financial service provider working in the eurozone. By the way, it is also registered with the UK’s financial services authority (FSA) and federal financial supervisory authority of germany (bafin) thus giving extra protection to traders.

XM forex trading platforms

Maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. It provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM MT4 download

This is XM’s version of the commerce-leading mt4 platform. It is extremely configurable and effortlessly suited to both novice and expert traders alike. It provides a live news feed and a wide technical analysis abilities. The MT4 platform also joins one click trading along with their manual trading feature, and even permits you to setup eas to mechanically place trades for you. Actually, there are a sum of add-ons and applications that will assistance you trade and progress your approaches. Trade cfds, futures and forex with no requotes and no refusals on this platform.

MT4 multiterminal

The multiterminal platform is mainly intended for money managers or traders who use manifold accounts and perform multiple order types instantaneously. Several of the features of MT4 are presented, but eas are not permissible as the terminal is planned for managing numerous accounts simply. Multiterminal doesn’t offer tech study either, but it does provide financial news and system signals in real-time, accompanied by numerous execution models intended to meet the necessities of those who essential to manage numerous accounts.

Mac MT4

This is a mac friendly version of the extremely popular metatrader4 platform. This version of the platform comprises all of the functionality and features defined above, but permits traders to usage the platform on apple computers without the essential to run a parallel windows emulator or windows desktop.

XM.Com MAM

As revealed previous, it look like to be the “one broker for all” as they offer a huge number of explanations. If you are an account or portfolio manager, or you are attentive in managing numerous accounts with the comprehensive features of metatrader4, this is the platform for you. Unlike MT4 multiterminal, XM MAM permits automated trading with eas and offer the technical analysis and charts you’d expect from metatrader4. There is so much more to this platform as it even permits numerous account pockets to manage numerous MT4 trading accounts through one main account. If this sounds right to your necessities, we endorse you speak with the support team to completely understand the functionality and features available here.

Webtrader

This is online trading platform. It is well-matched with mac, PC and any other apparatus accomplished of running a browser. No download is essential. Just open the platform from XM.Com in your browser and increase complete access to your trading accounts instantly. Traders can take benefit of a number of tools to increase their trading skills and trade with no rejections and no requotes. Like the metatrader4 platform, the webtrader 4 platform offers one-click trading, market analysis, an economic calendar and streaming news. It’s influential, capable and flexible. It comes extremely optional.

Ipad trader

XM brings MT4 to all ipad users by their ipad trader platform. It offers admittance to your metatrader4 account and presents actual interactive charts with scroll and zoom functionality. It also delivers real-time estimates of financial instruments, a complete set of trading tools and a comprehensive trading history, confirming that traders can examine their progress precisely. Unlike certain apps, this is far from an extra and really does provide an imaginary remote trading knowledge.

Iphone trader (IOS), mobile trader (windows mobile), droid trader (android) – mobile operators are not left imperfect as XM provide a mobile solution for all main smartphones. Their mobile platforms provide exceptional trading suppleness by bringing you a mounted down version of MT4 to your fingertips. They all provide direct access to your account and offer actual quotes of financial tools. The platforms also offer a complete set of trade orders comprising pending orders, 30 technical indicators, trade history, and the aptitude to trade straight from charts.

XM review

Regulation and security

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments ltd was established in 2009 and it is regulated by the cyprus securities and exchange commission (cysec 120/10), trading point of financial instruments pty ltd was established in 2015 and it is regulated by the australian securities and investments commission (ASIC 443670) and XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (000261/106).

XM’s regulation in cyprus provides its clients there with a degree of investor protection, as cysec maintains an investor compensation fund which is empowered to award depositors who lose their accounts due to failure of a regulated firm an amount up to €20,000.

XM has been in operation as a brokerage since 2009, giving it a relatively long track record. Typically, it can be said that the longer a broker has been in business, the more reputable the broker should be held to be. This means that XM can be said to have a substantial track record and an established reputation of safety as a brand which it will wish to protect.

Like all forex / CFD brokerages regulated in member states of the european union like cyprus, all clients of XM enjoy negative balance protection. This means that it is impossible for any client to lose more than the amount they have deposited with XM. The “tail risk” of an extremely large and sudden market movement, amplified by any leverage used, is borne fully by XM under this european union regulation.

| ��️ headquarter | cyprus, belize, australia |

| ⚖️ regulations | cysec, ASIC, IFSC |

| �� type of broker | market maker |

| �� minimum deposit | $5 |

| �� maximum leverage | 1:888 *the maximum leverage foe clients registered under the EU regulated entity of the group is 30:1 |

| �� type of platform | metatrader 4, metatrader 5, web-based |

| �� deposit with credit card | yes |

| �� depositing with wire transfer | yes |

| �� demo account provided | yes |

| ��️ instruments traded | forex cfds, commodities cfds, equity indices cfds, precious metals cfds, energies cfds |

The question of fees charged by a brokerage should always be paramount in the mind of anyone searching for the right forex / CFD broker. In considering the question, all costs of doing business must be considered carefully. We can break the entirety of fees and costs into two separate sub-categories: fees which are incurred through opening and closing trades, such as spreads, commissions, and overnight financing; and incidental fees, such as charges imposed by the brokerage due to account inactivity, or transaction fees applied to deposits or withdrawals. The trading fee element is going to be most important by far so this should be examined first.

Looking at trading fees first, we begin with spreads and commissions, which should be lumped together as an all-in “round trip” cost covering the opening and closing of a trade. As XM offer a few different account types which charge slightly different fees, we will judge the trading fees of its most common account type, the standard account.

The average round trip cost of trading the benchmark EUR/USD forex currency pair is 1.7 pips. However, this falls to only 0.8 pips in the XM zero account.

The average round trip costs of trading individual stocks, soft commodities, and equity indices are average for the industry.

Finally, data on the average round trip cost of trading the precious metals gold and silver shows that it is never below 30 cents for gold and 3 cents for silver.

It can be said that these levels of spreads and commissions are competitive for depositors of relatively low amounts. The minimum deposit required to open a standard account is only $5, so for traders depositing only a few hundred dollars or less, these fees will certainly be competitive. However, traders with considerably larger sums to deposit such as a few thousand dollars would be able to find more competitive alternative brokerage options within the industry, unless they wish to open an XM zero account which has extremely competitive fees.

The next thing to consider as part of the fee structure is overnight financing, which is usually a net charge applied to every trade daily which is open at 5pm new york time, although it can sometimes be a payment. These fees are, at least theoretically, based upon tom/next fees applied in the intrabank market, but retail brokerages tend to offer relatively unfavorable rates which can make swing or position trading expensive, especially when buying into currencies with very low or negative interest rates. XM are open and transparent about their overnight financing rates, which is a good sign. XM state that their rates are based upon the bank market’s tom/next rates plus the XM mark-up. Comparing the rates offered at the time of review to the industry average, their overnight financing rates are relatively competitive, meaning that XM may be a good choice for traders who wish to hold positions open for periods longer than a day or two.

We end this section on fees by looking at incidental transaction fees, occurring through non-trading processes.

XM charges an account inactivity fee of $5 per month after 90 days. XM charges no additional fees on deposits or withdrawals except where an amount of less than $200 is moved by wire transfer. Overall, this is not a bad deal, unless you are making a very low deposit and will want to make no trades at all for a period which may be longer than one month.

Our conclusion on fees: XM’s fees are competitive for traders making deposits under $1,000 across all account types, while the XM zero account is competitive at any deposit level.

What can I trade

After regulation, safety, and the fee structure, the next most important element to consider when choosing a forex / CFD brokerage is what is offered for trading on the broker’s menu. Some traders will be seeking exposure only to one asset class, such as forex, or cfds on individual stocks and shares, while others will be looking for diversification.

XM offer the following instruments for trading:

Forex – more than 55 currency pairs and crosses, including exotic currencies, as listed below.

Stocks – an extremely wide selection of individual stocks are offered for trading, with more than 1,200 different equities currently listed by XM. This is a very impressive, wide range of choice offered as an access to global equities. Stocks are offered from seventeen different national equity markets, including of course the major markets such as the U.S.A., the U.K., germany, switzerland, and australia, but also russia. Otherwise, the geographical markets are entirely european. Traders interested in trading individual major market stocks should give XM serious consideration as a broker of choice.

Commodities - a decent selection of 8 soft commodities are offered, which is more than most brokerages run to. They are listed below.

Five energies, including natural gas, are available to trade.

The final element of XM’s commodities offering are precious metals, namely, gold and silver. More exotic precious metals such as platinum and palladium are not available.

Equity indices – 18 major equity indices are on the menu, which is a decently wide-ranging selection for choice. The full list of equity indices is set out below.

Our conclusion regarding XM’s offering of tradable assets is favorable, with a wide range of asset classes offered that should satisfy most traders. The offering is especially impressive concerning global equities, with an unusually large amount (over 1,200) on the menu at the time this review was published. We expect there is a sufficiently wide range here for those traders who are not particularly interested in individual stocks and shares, but who want to be reasonably diversified across major markets.

Account types

XM group offers its clients 4 types of account: MICRO, STANDARD, ZERO and ULTRA LOW with low spreads. The MICRO account allows you to operate with micro lots, lower level of risk and it has minimum initial deposit of $5. The STANDARD account allows you to operate with standard lots and it has minimum initial deposit of $5. The XM ZERO* account allows you to operate with standard lots, lower spreads starting at 0 pips and it has minimum initial deposit of $100. XM ZERO account has a $3.5 commission per $100,000 traded. Finally, the XM ULTRA LOW* account allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50.

All account types allow hedging, scalping, and automated trading via expert advisers.

We think that the range of account types offered are realistic, easy to use and understand, and good value. Too often in the retail forex / CFD industry, account type classifications are made unnecessarily complex for marketing purposes. It is admirable that XM seem to have refrained from doing this and are instead looking simply to give their clients what they want and need.

Trading platforms

XM offers all its trader clients a choice between the use of the two most popular retail forex / CFD trading platforms globally. Clients with any account type may choose to use either metatrader 4 or metatrader 5. Both platforms are well-known, intuitive, and easy to understand, and have been around for many years. Both platforms are also very popular with the retail trading community. Some traders may wish for a deeper choice of platform that is given here, yet a big majority of traders who find themselves considering becoming customers of XM will find the choice on offer adequate.

XM offers a range of MT4 and MT5 platforms for both windows and mac operating systems which gives traders unrestricted access to all platforms.

In addition, a range of MT4 and MT5 mobile applications for both apple and android operating systems seamlessly allow access to an account with full account functionality from a smartphone or tablet.

XM pioneered the offering of an MT4 platform with trading execution quality in mind. It offers the following benefits: over 100 instruments including forex, cfds and futures, 1 login access to 8 platforms, spreads as low as 1 pip, full EA (expert advisor) functionality, 1 click trading, technical analysis tools with 50 indicators and charting tools and 3 different chart types.

Trades can trade with the MT4 platform on their mac as well as on mobile devices such as androids and iphones, ipads and tablets.

XM webtrader 4

XM webtrader 4 is accessible for PC’s and mac’s without downloading. Traders can choose from over 100 instruments including forex, CFD’s and futures, 1 single login access to 8 platforms, spreads as low as 1 pip, 1 click trading and built in news functionality.

XM MT4 multiterminal

The XM MT4 multiterminal platform is the ideal tool for traders wanting to handle multiple MT4 account from 1 single terminal with ease with 1 master login and password.

It supports up to 128 trading accounts, has multiple order types, three allocation methods and provides management and execution in real time.

Metatrader 5 offers a range of extra features that analyze the market and help traders trade in any style they want.

In addition to all the features of the MT4 platform, the MT5 platform also offers different order types such as 'fill or kill' and 'immediate or cancel' as well as technical and fundamental analysis using over 79 analytical tools.

Unique features

The standout features of XM are twofold: first, its strong regulatory regime in two major industry centers (australia and cyprus, the latter of which gives passporting into E.U. Regulation throughout the union); secondly, its very extensive offering of individual equities listed in european countries and other major developed nations.

XM’s zero account also has an extremely competitive fee structure at a very low minimum required deposit.

XM is proud of its history and its accomplishments. Its milestones in our corporate history chart goes back to 2011 and points to a background of trustworthiness and corporate involvement.

The XM management has visited over 120 cities around the world to connect with their clients and partners in order to interact with them on a face to face basis. They have hosted more than 100 seminars to educate traders, enabling them to make better trading decisions. These activities have helped XM reach the highest levels of client retention of any forex broker, anywhere.

In fact, XM prides itself on having over 300,000 real accounts opened to date from 196 countries and over 150,000,000 trades executed with zero re-quotes or rejections, ever.

XM withdrawal problems

XM is one of the biggest retail brokers operational with more than 3,500,000 traders from 196 countries. It provides traders with more than 25 payment options and given the size of this broker and broad international reach. Therefore, it is not surprising for a few clients to claim XM withdrawal problems. XM maintains a clean track record with five regulators, making isolated stories of issues related to a withdrawal dubious. Those claims are often made in online forums with the well-document malicious intent to extract payments from brokers to avoid tarnishing their reputation. All known claims were related to traders violating the terms and conditions. One trader claims he deposited his friend’s skrill account into his XM trading account. The case dates back to 2013 and violated anti-money laundering (AML) regulations. While they were not as detailed as today, at that time, some brokers did not check the source of deposits, while withdrawals faced strict scrutiny. The trader provided no supporting evidence and stopped responding to the thread he started, suggesting it was nothing more than a malicious attempt, potentially sponsored by a competitor, a common practice in the industry, or by a disgruntled trader who faced losses.

XM also offers generous bonuses, however, clients registered under the EU regulated entity of the group are not eligible for the bonus (ESMA regulations). XM remains a legit, trustworthy, and honest broker that offers bonuses. Traders should consider the source of any claims of XM withdrawal problems and the lack of evidence before trusting misleading smear campaigns.

Research and education

The XM research & education offering is impressive. It should be said that a forex / CFD brokerage can offer an excellent service without providing any education or research offering at all. Brokers primarily exist to execute trades and safeguard deposits efficiently, and these core functions are what customers need and want.

All too often, substandard brokers throw together a hastily assembled collection of low-quality educational material, simply for the sake of trying to put across a good appearance. Happily, in the case of XM, the educational and research offering is there because it is worthwhile.

Research is offered as news and analysis on key markets and relevant geopolitical developments, including technical analysis performed on selected price charts. Forex, commodities, and stocks are covered.

In the XM learning center, subsections are divided into live education, educational videos, forex webinars, platform tutorials, and forex seminars.

The educational rooms are live trading rooms which clients may enter and participate in and see live markets traded in real time. Most of them are open for eight hours continuously on weekdays, which is extremely impressive. Seven educational videos on a range of common forex trading topics are also present in their relevant subsection.

Account holders can benefit from weekly webinars in 13 different languages including arabic, bengali, indonesian, polish and others given by 18 expert instructors whose pictures are presented on the site.

The list of video tutorials seems endless and cover topics as basic as how to open a forex account to how to use a MT4 droid pad on the mobile trader app.

Upcoming XM workshops and seminars are listed as are ones that have already taken place.

In addition, their economic calendar posts any upcoming events taking place in markets throughout the world.

There are market reviews, a forex news report and technical analysis that appear daily.

A selection of trading tools are also offered, in addition to free forex signals and forex calculators.

Customer support

Most traders will never use their broker’s customer support service beyond the occasional query for clarification of the trading terms offered. Still, its good to know that if you do need the help desk, you will be dealt with promptly and helpfully.

XM’s customer support has a good reputation, partly because it is offered in a wide variety of languages with dedicated native speakers offering support to clients in their own language.

The XM customer support desk is available 24 hours a day, from monday to friday – the same time period over which the markets are open. Representatives speak english, greek, japanese, chinese, bahasa malay, bahasa indonesia, hungarian, russian, french, spanish, italian, german, polish, hindi, arabic, korean, portuguese, czech, slovakian, bulgarian, romanian and dutch.

Traders can contact a rep at different departments in several international locations via email of telephone. Live chat is also available.

Bonuses and promotions

- Free VPS for clients who maintain a balance (equity-credit) USD 5,000 or currency equivalent.

- $30 non-deposit trading bonus for new clients only.

- The two-tier deposit bonus offers 50% deposit bonus up to $500 and 20% deposit bonus up to $5,000.

- The XM loyalty program offers the clients XM points (XMP) per lot traded. These XMP can be redeemed at any time for credit bonus which can be used for trading purposes only.

*trading bonuses and loyalty program are not eligible for clients registered under the EU regulated entity of the group

Opening an account

The account opening process with XM is relatively quick and painless. You can expect to get your account open and ready on the same day that you begin the account opening process. Clients only need to navigate through a couple of web screens where they submit a few details and choose the type of account they want to sign up for.

It is worth noting that residents of the U.S.A. And a few other extremely regulated jurisdictions are not accepted as new clients by XM.

In addition to providing personal and account details, new clients are required to verify their ID and proof of residency by way of utility bills or bank statements. Proof of ID may be verified by providing an official national identity card, passport, or driver license. Images can be uploaded for verification and response times are very quick.

Deposits and withdrawals

At XM there is no minimum deposit required. However, system restrictions limit the minimum deposit amount to $5 for electronic funding such as moneybookers, skrill and neteller as well as credit cards and bank wire transfers. Moneygrams and western union payments are also accepted.

Withdrawals can be made using the same methods. In fact, the deposit and withdrawal options are listed side by side on the website and a trader needs only click on “make a deposit” or “request a withdrawal” in order to make a transaction.

Withdrawals via bank-wire of amounts under $200 are subject to a $15 administration fee. While this is not completely uncommon, it is a little unusual and smaller depositors should consider whether they will be able to plan to sit tight and hope to grow their account to a level where this fee would not apply to any likely amount the client will wish to withdraw.

So, let's see, what was the most valuable thing of this article: find out in our step by step guide, how to sign up at XM.Com and how to register a new trading account (either real or demo). At xm broker sign up

Contents of the article

- Real forex bonuses

- XM.Com sign up guide – how to register a new...

- How to sign up at XM.Com *

- How to register an XM.Com account *

- Members area access

- New to XM?

- XM sign up bonus

- Referral bonus

- Additional bonuses, promotions and rewards

- Pros and cons

- Conclusion

- XM broker

- XM broker review

- XM broker account types

- XM.Com broker zero account

- XM broker micro trading account

- XM.Com broker standard trading account

- XM.Com broker managed forex accounts

- XM broker islamic account

- XM broker demo account

- XM broker deposit and withdrawal methods

- XM broker login

- XM review

- Regulation and security

- What can I trade

- Account types

- Trading platforms

- Unique features

- Research and education

- Customer support

- Bonuses and promotions

- Opening an account

- Deposits and withdrawals

- XM broker

- XM broker review

- XM broker account types

- XM.Com broker zero account

- XM broker micro trading account

- XM.Com broker standard trading account

- XM.Com broker managed forex accounts

- XM broker islamic account

- XM broker demo account

- XM broker deposit and withdrawal methods

- XM broker login

- XM forex broker $30 no deposit bonus how to trade...

- XM broker forex $30 no-deposit bonus overview

- XM forex broker $30 no-deposit bonus terms &...

- How to claim XM $30 no-deposit bonus

- Thoughts on $30 bonus program

- Xm broker sign up

- Featured site

- XM forex trading platforms

- XM MT4 download

- XM.Com MAM

- Webtrader

- XM review

- Regulation and security

- What can I trade

- Account types

- Trading platforms

- Unique features

- Research and education

- Customer support

- Bonuses and promotions

- Opening an account

- Deposits and withdrawals

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.