Xm regulated

XM uses cookies to ensure that we provide you with the best experience while visiting our website.

Real forex bonuses

Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time. Trading point of financial instruments ltd is licensed by cysec under license number 120/10.

Regulation

XM group licenses

International financial services commission

XM global limited is licensed by IFSC under license number 000261/106

Cysec

Cyprus securities and exchange commission

Trading point of financial instruments ltd is licensed by cysec under license number 120/10.

Australian securities and investments commission

Trading point of financial instruments pty ltd has been issued an australian financial services license by ASIC (number 443670)

Dubai financial services authority

Trading point MENA limited is licensed and regulated by the dubai financial services authority (reference no. F003484)

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number 000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

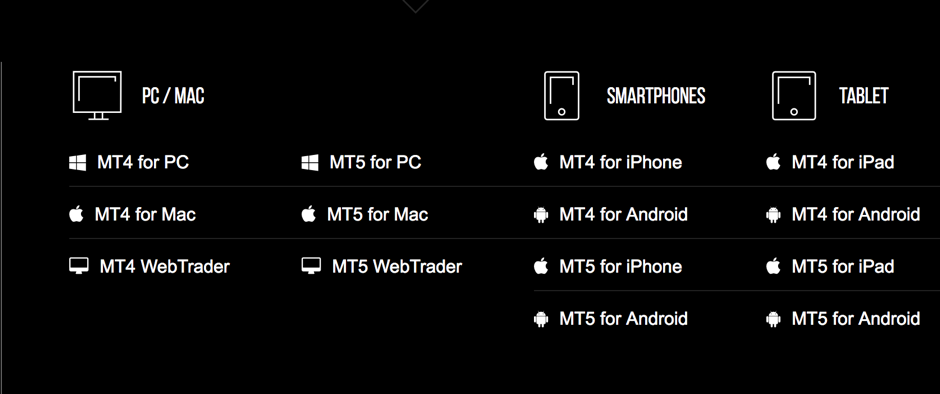

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

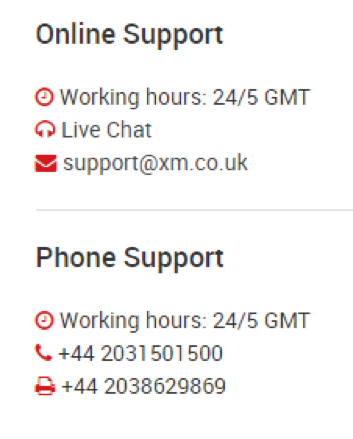

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM group forex broker review

A decent and detailed review of a forex broker will give you the necessary information about it in brief. Such an action and filtering of all the available foreign currency exchange platforms is superb way for both – high punters and beginners – to find the best broker for their trading experience. And since we are here to give you the best and most optimal assistance into forex market, we are full of detailed reviews about the most popular and renewable brokers. Check out now our XM group review and find out if it is suitable for your preferences and needs in trading.

XM group overview and specifics

XM group is a group of online regulated brokers. Trading point of financial instruments ltd was established in 2009 with headquarters in limassol, cyprus and is regulated by cysec with license number 120/10. Trading point of financial instruments pty ltd was established in 2015 with headquarters sydney, australia and is regulated by ASIC with license number 443670. XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (000261/106).

All countries that are in eurozone or in EU are provided with special regulation measures for both – gambling and trading websites. So when it comes to the safety for the customer`s personal data and money, XM group is the right and one of the most recommended websites. But this is not the only great and interesting thing about the XM group platform. The website has also a superb customer support. The services are provided 24/5 and on 17 multiple languages, which makes it easy for any client regardless he is beginner or high punter to make an inquiry at almost any time and to receive a respond to his question or requirement. Also, the XM group website has numerous trading options – including with foreign currenciest, commodity, stocks, precious materials and etc. 99,35% of the orders for trading are usually executed in less than one single second. Moreover, the leverage here is also ok – 1:30 and the XM group provides more than 100 financial instruments. Be aware that the currency options are also numerous on the website – USD, EUR, GBP, JPY, CHF, AUD and etc.

XM group forex broker has more than 60 currency pairs to trade with, while the minimum deposit is only 5 $, which makes it quite suitable for beginners in trading, who do not want to risk lots of money for their first steps on the market. XM group offers 4 type of accounts: micro, standard, zero and ultra low.” please include the following note regarding the XM ultra low account type: XM ultra low account is not applicable to all entities of the group. Account availability depends on the clients’ country of residence. Demo account is also available for people, who are not sure whether to remain on the website before testing its platform. There are no commissions or hidden fees in trading activity on the XM group broker, while the deposit and withdrawal payment methods are the general standard methods such as debit/credit card, neteller, skrill, bank wire transfer, etc.

XM group bonus system and types

Learning information about a broker is an entire process you need to consider every time before signing in a particular website. And part of this process is to see if the available bonuses are ok for you. Thankfully, XM group offers numerous promotions and special extras you should definitely check out now.

- No deposit bonus – the bets forex bonus ever – the no deposit bonus – is still part of the bonus system that XM group website provides to all of its clients. To be more specific only newly registered clients can actually benefit of it. The no deposit bonus here is 30 $ and you can use it only if you are new on the website and have just made your registration with a validated account to trade from.

- Welcome bonus – another welcome bonus for all the newly registered clients on the XM group website gives you up to 100% with a maximum reward of 5000 $ of your initial deposit. Unlike the previous bonus, you must make a deposit in advance and then to receive the bonus. So if you deposit 200 $ you can have in your wallet 400 $.

- Loyal bonuses and programs – become a regular customer on XM group at some point and you will be able to apply for a loyalty program. This program gives you several extras and special promotions and to reach it you will need to collect a particular amount of points, which are given during your experience on XM group platform.

- Special seasonal bonuses – do not forget to check out for special seasonal bonuses on XM group. This forex platform has a tradition to update its bonus system all the time, so you can receive an additional offer throughout your experience here.

- Trading bonus and loyalty program are not eligible for clients registered under trading point of financial instruments ltd.

XM broker review

XM brokerage company was created as a coproduct of trading point financial instruments ltd., which has a reputation of one of the world's largest providers of internet trading services. Forex broker XM started its activity in 2009. The company was founded in cyprus, called initially xemarkets, but after rebranding its name was shortened to XM.

XM in 2020 is a significant and globally recognized investment company with a leading position in the industry. The broker has the knowledge and resources to allow traders with any experience and from any country in the world to implement their investment plans successfully. And by tracking the latest trends in the industry and incorporating the latest technologies into its operations, the company is continuously improving to meet the growing and more sophisticated needs of its clients.

The results of the company's work for ten years: 2 500 000+ clients; traders from 196 countries; support of 30+ languages; 25+ payment systems; 16 multifunctional trading platforms; 450+ specialists with rich experience in finance.

Regulation

The british regulation of the FCA (trading point of financial instruments UK limited) is the most powerful advantage of a broker. It means that the company's activity meets all the regulatory rules and regulations. A licensed broker is a reliable broker, and if he has a license from the most significant regulated body, the integrity of his work is beyond doubt.

Also, XM group is licensed by ASIC in australia (trading point of financial instruments pty limited) and cysec in cyprus (trading point of financial instruments ltd).

Feedback

One of the most important indicators of the broker's work is the feedback of traders who already have experience working with the platform and are ready to share it. Reading the feedback from XM clients, you realize that a broker tries to work for a client, always goes to a meeting, providing high-quality services and excellent service. Traders are happy to work with a broker and do not need to use other similar services, the reliability of most of which is in considerable doubt. They highly appreciate XM and leave a lot of positive feedback.

First of all, users are impressed by the principles on which the work of the broker XM is built. Excellent, attentive attitude to the client and his needs, quick problem solving, favourable conditions for profitable trading and all this is accompanied by the highest service.

Among the advantages of the service, clients note a modern multi-language interface, stable operation of the software, timely payments, fast registration and simple verification, a large number of instruments for trading, low spread, fast order execution, frequent bonuses, reliability, competent support service.

"I like this broker, and I have been working closely with him for a long time. Always payments are timely, and I am satisfied with them. You can count on it, and what else do you need?"

"thank you, XM for its quality service! One of the few companies that warn about trade risks."

"quite a good broker with excellent, just great execution. Of course, the spreads are a bit large, but due to the excellent execution of trades, this is not felt. The website has a great bonus program and loyalty program".

“positive broker, the main advantage of technical support of the client on the questions, timely, accurately, withdrawal of money on the day of the order on the conclusion that pleases, not everyone has it: traditional trading conditions, plus bonuses. I continue to trade with XM”.

As for negative reviews, of course, they also exist, but they are rare. The deal was cancelled, long waiting for withdrawal of funds, too secure password, etc.

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Advantages and disadvantages

International focus: 2.5 million clients from 196 countries;

Licensed and regulated broker: FCA (UK), ASIC (australia), cysec (cyprus);

Intuitive and straightforward interface, characterized by the smooth operation;

Multilingualism: customer service in more than 30 languages;

Seven asset classes: trading currencies in forex, stock indices, commodities, stocks, metals and energy;

Three types of accounts with different trading conditions, as well as the possibility to open a demo account;

The minimum deposit to open an account is $5;

100% order execution and 99.35% of transactions are opened within 1 second;

100% order execution and 99.35% of transactions will be unlocked within 1 second;

Fast implementation of orders on cent accounts;

Narrow spreads: from 0.6 pips for all trading accounts;

55+ popular currency pairs;

300+ cfds on shares, indices, commodities, metals, energy;

Zero commissions for input and output;

Personal account managers;

Free daily technical analysis of the forex market;

A huge amount of training materials, free webinars;

Issue of mastercard bank cards with your logo and the ability to withdraw funds to them without commission pay for goods and services on the internet;

Fast and qualified technical support;

Bonuses: welcome bonus (up to 5000$), a loyalty program.

Weak password protection for your account: you cannot use special characters when compiling a password;

Lack of two-factor authentication;

Not regulated by the central bank of russia;

No ECN-accounts (electronic communication network).

XM group review

XM group is a multi-award winning globally established and regulated online trading broker with over 2.5m clients from 196 countries offering no-requotes, low spreads, fast execution and negative balance protection.

XM group review, pros & cons

- Strict regulation

- Negative balance protection

- Multiple awards

- Low spreads, low commissions & fast trade execution speeds

- Hedging & scalping allowed

In this detailed XM group review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

XM group is ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers and best online brokers categories. You can use our free broker comparison tool to compare online brokers including XM group.

XM group review: summary

XM group was founded in 2009 and has since grown into a large globally established trading broker with over 2,500,000 clients from 196 countries.

XM group is based in cyprus, australia and belize, with over 450 employees who have many years of combined experience in the financial industry. This experience combined with strict regulation and customer service in over 30 languages make them one of the most popular brokers for traders from all different backgrounds and levels of experience.

XM group offers an impressive 25+ secure payment methods, 16 trading platforms and 24/5 customer service. They take great pride in being a fair and reputable broker with all clients receiving the same trading conditions regardless of their investment size or trading experience.

XM group offers a no re-quote and no rejections policy with 99.35% of trades being executed within 1 second. Their business model is built around the belief that execution is everything when trading.

XM group clients have negative balance protection which means that traders are not at risk of losing more than the account balance. They provide multiple different trading platforms and flexible conditions to suit individual client needs.

XM group management team have hosted hundreds of seminars in over 120 cities to educate traders. They are a human company who put client satisfaction first which explains why they have such a high level of client retention and loyal user base. They have won numerous awards for their services including best FX broker, best forex customer service, best forex broker and best forex execution broker.

XM group monitors the latest industry trends to keep up to date with the latest innovative technologies and to be able to adapt to clients ever changing and demanding needs. They do not compromise on trading performance which ensures they offer some of the lowest spreads and fastest execution speeds whilst remaining versatile.

XM group offer a wide range of trading instruments for traders to choose from including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies & cfds. All instruments are available to trade from the same trading account on 16 trading platforms which makes trading easier and more efficient.

XM group is operated with client requirements at the forefront of everything that they do. This is not just for the best possible trading conditions but also the simplicity of opening an account to making deposits / withdrawals, contacting support and trading.

XM group review: regulation

XM group is authorised and regulated by the australian securities and investment commission (ASIC) and cyprus securities and exchange commission (cysec). This helps to ensure safety of client funds and that they abide by strict regulatory standards with the most sought-after regulators. They are also regulated with the international financial services commission of belize (IFSC).

XM group have partnered with regulated entities for the withdrawal and deposit process for extra client protection. Client funds are kept segregated from the company funds in tier 1 banks to ensure that they cannot be used by XM group or the liquidity providers under no circumstance. Client accounts also have negative balance protection.

XM group is a member of the investor compensation fund and stick to the investor protection principles outlined by the markets in financial instruments directive (mifid).

XM group have a best execution policy to provide the most favourable trading conditions to traders. Collaboration with a range of liquidity providers mean that they can offer some of the lowest spreads with plenty of liquidity at all times.

These factors combined with a no-requotes and no extra commissions policy ensures that XM group are amongst one of the best trading brokers.

XM group review: countries

XM group accepts clients from all over the world, excluding USA, canada, israel and iran. Some XM group broker features and products mentioned within this XM group review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

XM group review: trading platforms

XM group review: trading platforms

XM group offer clients the option to choose from 16 variations of the popular metatrader 4/5 trading platforms for desktop (PC / MAC), web trading directly in your browser without needing to download or install any additional software and metatrader for mobile devices running on ios or android. The mobile trading apps are especially useful if you need to access your trading account whilst on the go from anywhere in the world provided that you have an internet connection.

Metatrader 4 (MT4)

XM group review: metatrader 4 (MT4) platform

MT4 still has long been the platform of choose from all types of trades across the globe. It is well known for its user-friendly interface and abundance of built in trading tools for conducting detailed chart analysis and trading efficiently. XM pioneered offering an MT4 platform with trading execution quality in mind. XM clients can trade on MT4 with no re-quotes, no rejection of orders and with flexible leverage. Whatever your trading style or experience level, MT4 is considered as on of the go to platforms for online trading. XM have a good selection of trading platform video tutorials on their website to help familiarise yourself with MT4. Some of the main MT4 features include:

- Over 1000 instruments including forex, cfds and futures

- 1 single login access to 8 platforms

- Spreads as low as 0 pips

- Full EA (expert advisor) functionality

- 1 click trading

- Technical analysis tools with 50 indicators and charting tools

- 3 chart types

- Alert notifications (email, SMS & pup-ups)

- Micro lot accounts (optional)

- Hedging allowed

- VPS functionality

- Freely available on desktop, web & mobile devices

Metatrader 5 (MT5)

XM group review: metatrader 5 (MT5) platform

The XM MT5 offers all of the same powerful features that the XM MT4 has to offer, along with more trading tools and advanced capabilities. It has an additional 1000 CFDS on stocks (shares), which makes it the ideal multi-asset platform. You can trade forex and cfds on stocks, gold, oil and equity indices from 1 platform with no rejections, no re-quotes and flexible leverage.

- Over 1000 instruments, including stock cfds, stock indices cfds, forex, cfds on precious metals and cfds on energies.

- 1 single login to 7 platforms

- Spreads as low as 0 pips

- Full EA functionality

- One click trading

- All order types supported

- Over 80 technical analysis objects

- Market depth of latest price quotes

- Hedging allowed

- Freely available on desktop, web & mobile devices

XM group review: trading tools

XM group provide clients with very good proprietary trading tools for the metatrader 4/5 trading platforms. These tools are fully automated and can perform technical analysis across multiple instruments and charts, in order to identify potential trading opportunities. This makes it quick and easy to identify trading signals without needing to constantly stare at your charts all day and night.

Ribbon indicator

- Follow the prevailing trend

- Identify areas of consolidation

- Predict impending reversals

- Know the best time to trade

River indicator

- All-in-one trend indicator

- Know which markets are trending

- Identify strength and direction

- Learn how the market is moving

Ichimoku indicator

- Identify support and resistance levels

- Recognise strong market trends

- Know when is best to enter a trend

- Learn where prices might go next

Bollinger bands indicator

- Learn to trade market volatility

- Identify entry points in ranging markets

- Recognise extreme price levels

- Know when price movements will occur

ADX & PSAR indicator

- Recognise a market in consolidation

- Identify the start of new trends

- Learn the best time to place a trade

- Know when trends reach extreme conditions

Analyser indicator

- Analyse in seconds instead of hours

- Map the market direction in real time

- Quickly identify the best instruments to trade in

You can automate your analysis and gain access to the proprietary indicators by contacting your personal account manager at XM group who will be happy to get you started and provide you with assistance.

XM group review: education

XM group review: overview

XM group has a vast range of educational materials within the research and education center. This includes daily market updates, economic events, tutorial videos, webinars, seminars and more. This section is frequently updated by 20 multilingual market professionals providing a diverse library of knowledge to assist traders of all levels, from the novice to more advanced trader. The video library covers a range of topics including:

- Introduction to the markets

- Trading essentials

- Fundamental analysis

- Technical analysis

- Money management

- Trading psychology

- Trading strategies

They also offer live trading education with a basic and advanced online educational room for learning the fundamentals of trading from XM groups expert instructors, as they cover strategies for the various trading sessions and answer your questions in real time.

XM group review: live education

XM group review: trading instruments

XM group offer a wide range of trading instruments to traders including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies & cfds.

XM group review: trading instruments

XM group review: trading accounts & fees

XM group offer 3 different account types that provide flexible trading conditions to meet the needs of both beginner and advanced traders. Minimum deposit required is just $5 whilst you can choose between no commission accounts with marked up spreads or pay a $3.5 commission charge to get variable spreads starting from 0 pips. Leverage depends on the financial instrument traded and on client’s country of residence.

- Micro account: $0 commission, variable spreads from 1.0 pips

- Standard account: $0 commission, variable spreads from 1.0 pips

- XM zero account: $3.5 commission, variable spreads from 0.0 pips

XM group review: account conditions

As broker fees can vary and change, there may be additional fees that are not listed in this XM group review. It is imperative to ensure that you check and understand all of the latest information before you open a XM group broker account for online trading.

XM group review: customer service

XM group has over 450 employees with customer service in over 30 languages available 24/5. Support is available 24/5 in 14 languages via phone, chat and email.

XM group review: deposit & withdrawal

XM group have a variety of fast and convenient deposit and withdrawal options. Providing options such as skrill allows for faster transfers to and from trading accounts.

Fees may be charged when using certain payment methods. Bank transfers can take a few business days to clear. Accounts can be opened in USD, GBP, EUR, CHF, JPY, PLN, SGD, ZAR, AUD, HUF & RUB. The various different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

XM group review: account opening

XM group estimate the account opening process to take an impressive 2 minutes to complete. You simply fill out the brief online registration form, verify your email and upload your identification. Once your account has been verified, you are then free to fund it using any of the multiple deposit options and start trading. XM group support is on hand to guide you through the process if need be.

XM group review: account opening

XM group review: conclusion

XM group understands that clients want fair and transparent trading conditions with the lowest possible spreads and fastest possible execution. The model that they incorporate ensures that they are one of the industry leaders when it comes to favourable trading conditions for clients of all levels. This combined with strong regulation and a human approach, makes XM group one of the best trading brokers available to traders worldwide.

71.61% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Min $5 deposit

XM group is a multi-award winning globally established and regulated trading broker with over 2.5m clients from 196 countries offering no-requotes, low spreads, fast execution and negative balance protection.

Fxdailyreport.Com

If you are a forex trader that has decided to work with a forex broker who will execute your trades, it is important that you keep in mind a few criteria to work with the right kind of broker. In the first place, you should examine carefully the regulatory status of the broker that you want to work with. Trading with a regulated forex broker is important if you want to have the least amount of risk when you are trading and you want to keep your capital investment safe. The forex broker that the trader chooses can be an individual broker, an association of individuals, or a brokerage company.

Top recommended regulated forex brokers

| Broker | min deposit | spread | leverage | regulation | open account |

|---|---|---|---|---|---|

| $5 | from 0.2 pips | 500:1 | FSA (saint vincent and the grenadines), cysec | visit broker | |

| $1 | from 0 pips | 3000:1 | cysec, IFSC | visit broker | |

| $5 | from 0 pips | 888:1 “*this leverage does not apply to all the entities of XM group.” | ASIC, cysec, IFSC belize | visit broker | |

| $1 | from 0 pips | 2000:1 | FCA UK, cysec, FSP, bafin, CRFIN | visit broker | |

| $100 | starting 0 pips | up to 400:1 | FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| $300 | floating, from 0 pips | 500:1 | FCA UK reference number 579202 | visit broker | |

| $200 | starting 0 pips | 500:1 | ASIC australia, FCA UK | visit broker | |

| no minimum deposit | 1.2 pips | 50:1 | CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| $10 | cysec | visit broker | |||

| $200 | from 3 pips | 400:1 | NFA, FCA, cysec | visit broker | |

| $100 | starting 0 pips | up to 500:1 | FCA UK, ASIC australia, MAS singapore | visit broker |

Why you must trade with regulated forex brokers

Starting to trade in forex these days is much easier than it was in the past. A trader can trade from anywhere in the world, even in the comfort of his/her own home. All you need to have is a computer, a reliable internet connection and help from a reliable forex broker who is regulated and offers a convenient and easy-to-use trading platform.

Regulation – what is it

Many major financial institutions around the globe comply with financial regulations. This compliance sets them apart as having a genuine purpose in running the organization and their willingness to follow rules and standards. In the case of a forex broker, it is necessary that they sign a code of conduct to run their businesses in different jurisdictions. The code of conduct is constituted by the local financial regulator. The code of conduct supplies a set of regulatory guidelines that the forex broker is expected to follow. It specifies as to how they should run their business. The guidelines also provide a framework on what behavioral and financial ethics the forex brokers are expected to follow.

On the financial front, regulated forex brokers will be expected to submit copies of financial reports to the regulatory authorities at specified intervals. Examples are operational accounts of the company that will be subject to audits by qualified personnel. Regulated forex brokers are also expected to work with an adequate amount of capital reserve and liquidity to ensure reliable and uninterrupted operations on their part.

The best regulated forex brokers will see to it that they comply with all the operational procedures and standards set by the authorities. Any failures on the part of the brokers to follow the guidelines that are specified are punishable and penalties will be charged. In the worst cases of non-compliance with rules, the broker’s regulatory status may be lost or their operations may be closed forcefully. In the interest of furthering their businesses, it is best for the forex brokers to comply with regulations.

Importance of working with regulated forex brokers

The forex broker is the connection between the seller and the purchaser of the currencies that are exchanged in the market. It is, therefore, important that the brokers that the traders want to work with have appropriately planned businesses and a good standing reputation.

There are many reasons why forex traders should seek to work with regulated forex brokers. First and foremost, working with a regulated forex broker means that it provides a safety net for their investments. The trader is assured of the fact that their trading operations are being overseen by an official body. Any point of contention between the broker and the trader is resolved by the higher body. The guidelines that are put in place by the regulatory authorities control the different functional areas of the brokers’ operations. These are mainly in the areas of monitoring the brokers’ accounts and use of the clients’ data. They are designed to combat fraud on the part of the broker and also set benchmarks for customer service and support that is to be provided by the brokers.

The single most important aspect of regulation for the broker is dealing with the requirement of holding the clients’ funds in segregated accounts. This arrangement is in place to protect the users’ funds if the broker runs into financial trouble. This money may not be used by the brokers to settle their debts as it is ‘protected’. If this kind of a scenario happens, this money is to be returned to the client.

How to ascertain if A broker is regulated

Though a good number of forex brokers claim that they are regulated it is a good idea to ascertain the same before parting with any money or transferring funds to their account. Some forex brokers that operate in different parts of the globe are members of more than one regulatory body. This is good because there is additional scrutiny of their operations. This provides additional protection against fraud and malpractices. Though it is not an absolute requirement that a trader should associate with a forex broker in their own country, most traders prefer to utilize the services provided by a local forex broker because of the convenience of communicating in the language they are most comfortable with.

The main regulator for traders in the UK is the financial conduct authority (FCA) and for those in the US is national futures association (NFA). Regulators in europe include mifid and cysec. In the united states, a forex broker of repute is a member of the NFA and is also registered with the US commodity futures trading commission (CFTC) as a futures commission merchant and a retail foreign exchange dealer. This means that the broker is compliant with all the rules and programs that are laid out to protect the market and the traders from manipulation, fraud, and other abusive practices. It also means that these regulated forex brokers support open, competitive futures and options markets that are financially sound.

Having a well-designed and flashy website alone does not guarantee that the forex broker is a member of a regulatory body. A forex broker that is a member of regulatory bodies usually displays the fact on their websites. Typically, the member/registration numbers are displayed in the ‘about us’ section of the websites. Like the US, each country has its own regulatory bodies.

Forex regulatory bodies in the world

Forex is a decentralized market, so you should pay close attention to the broker’s regulatory status. This brings us to the question, what is forex regulation? It’s all about customer protection. These are rules set by bodies or authorities to protect traders and investors. The regulatory agencies audit licensed brokers to ensure they meet the industry standards. Here are the best forex regulatory bodies to help with your investment decision.

- Commodities futures trade commission (CFTC)

This regulatory body protects individuals and investors in commodity, futures, and forex trading. Since it was established in 1974, CFTC has been at the forefront of creating a level playing field for investors. The mission of commodities futures trade commission is to be competitive and financially sound. To ensure transparency, CFTC receives data from reporting firms every month. The body has five committees who represent the interest of traders, commodity exchanges, and futures exchanges.

CFTC guarantee investors that the price of commodity futures is fair. Without regulation, sellers could have control of the current and future prices. This means that there would be unfair commodity prices in the market. CFTC has invested heavily in research and development.

- National futures association (NFA)

NFA began its regulatory operations in 1982 and is one of the top forex regulatory bodies in the US. The national futures association protects market participants and monitor industry integrity. Their members include commodity pool operators, commodity trading advisers, introducing brokers, and futures commission merchants. Once you register as a member, NFA must perform a background check before you’re allowed to conduct business in public.

Because the members are required to pay membership fees, NFA remains completely independent. The body takes disciplinary measures to members who violate the rules. And before you make the investment decision, NFA provides investor education. Also, traders are given a lot of resources to help them make an investment decision. Any entity or person conducting business in the futures exchange market should register with the body. Furthermore, the regulator offers new programs to ensure the members stay up-to-date with the current changes. If a member is being investigated, NFA works together with the FBI to ensure the prosecution is successful.

- Financial conduct authority (FCA)

FCA regulates over 59,000 financial firms in the UK. It ensures individual investors and businesses get a fair deal when they trade in the financial markets. Whether you’re a novice or an advanced trader, the body will ensure there are no malpractices when conducting online business. And because this is an independent public body, it’s accountable to the treasury. Just like other financial regulatory bodies, FCA works with trade associations and stakeholders.

Once you become a member, you can find lots of information regarding mortgages, insurance, and any other financial advice. And if you’re unhappy with the services of the forex broker, you simply report and claim compensation. According to financial services and reporting act of 2000, any firm that carries financial activity must be regulated by FCA. Brokers must adhere to the regulatory system and meet the set standards. As an investor, you should sign up for a monthly newsletter that shows all the regulated firms. You can also access a wide range of publications regarding your broker.

- Cyprus securities exchange commission (cysec)

Cysec was established in 2001 and is part of european mifid regulation. Because cyprus is one of the top destinations for forex brokers, cysec serves as a gateway to europe. The commission is tasked to oversight the performance of brokers. Forex brokerages regulated by cysec must provide financial services according to the rules set by the body. Also, the operations must comply with the european commission (mifid). If you’re using a broker under cysec regulation, you don’t have to worry about the safety of your funds.

Cyprus securities exchange commission grants operating license to investment firms, forex brokers, and brokers for binary options. Other than that, it imposes disciplinary penalties to firms that fall under stock market legislation. Due to the high reputation of the regulator, brokerage firms use the body to gain investor confidence. If you’re an investor within eurozone and you’re not sure whether the broker is regulated, you can ask for information at customer support. Unlike most regulatory bodies, cysec imposes higher fines and penalties to forex brokers who go against the set rules.

- The swiss financial market regulatory authority (FINMA)

This is one of the most trusted and safest regulatory bodies in switzerland. It works closely with other banks to monitor the operations of forex brokers. FINMA was established in 2007. It has authority over financial institutions and investment schemes. And because it’s an independent body, the regulator reports to the swiss federal department of finance. Each year, FINMA audits the financial institutions to ensure all measures are in place. Besides that, the regulator represents the global stage and fights terrorist financing activities.

- The canadian security administrators

These are provincial security regulators whose goal is to regulate forex brokers in canada. They strive to cultivate policies impacting the investment landscape. Beyond regulated-related functions, the body educates the public on all aspects of the financial market. All brokers in canada are required to register with the body.

- Australian securities and investment commission (ASIC)

ASIC regulates the financial markets in australia and surrounding regions. It was established in 2001 and strives to ensure the forex markets are transparent. Under the ASIC act, brokers are required to store and process the information quickly. They should also improve financial system performance to boost investor confidence. Also, the body educates investors on prudent financial investment. And based on consumer behavior, they hold gatekeepers into account. ASIC also regulates organizations such as mortgage brokers, finance companies, and credit unions. This regulatory body takes financial fraud very seriously.

- Federal financial markets service

This is an executive body that controls the financial markets. Since it was established in 2004, it took over the role of federal executive branch agencies. The main goals of the regulatory body are consumer protection and financial accountability. It works closely with government agencies and banks to ensure the safety of the trader’s funds. Also, they have strict laws that prevent market manipulation and insider trading. If you want to file an official complaint with your broker, you should make an official report on the customer’s section.

Since there’s no centralized market to control forex exchange activities, you should ensure your broker is regulated. The idea of forex regulation is to boost investor confidence and maintain sanctity in the financial market. Ideally, the above forex regulators ensure traders are not subjected to conditions that tilt the market against them.

DFSA regulated forex brokers in 2021

If you are thinking about signing up with one of the DFSA regulated forex brokers, then you might be facing yourself with a rather unique situation. Dubai is indeed one of the most populated cities in the united arab emirates – and is actually one of the seven emirates that make the country. It is understandable why this place is also the home of the world’s richest retail traders.

List of DFSA regulated forex brokers

Orient financial brokers

However, considering that it is an islamic city, there are several laws and religious customs that you have to be followed. Forex brokers, in particular, have to respect the sharia law that was made to satisfy various islamic beliefs.

In a city where most of the profits usually came from oil reserves, tourism, real estate, and aviation, financial services in dubai are also beginning to take flight. One particular area in dubai, referred to as the dubai international finacial center (DIFC) is where things take a different route compared to the rest of dubai – and all the other emirates as well.

What does the DIFC entail?

The DIFC is a federal area that is financially-free – and is also one that occupies around 110 acres of the city of dubai. It features its own legal system and courts, and it is completely separated from the rest of the country.

It also maintains its own jurisdiction over the corporate, commercial, civil, trust, employment, and security law matters. At the head of the organization is the DFSA – or the dubai financial services authority.

It is this exact organization that deals with the regulation for the dubai forex companies – even if it is just a small part. The DFSA oversees the financial activity in that free zone, aiming to provide international standard services. The body that is responsible for the financial markets that are outside the DIFC is called the UAE federal securities and services.

DFSA and DFSA-regulated brokers

When the DIFC was first created, a regulatory body also came into existence and that is the DFSA. This independent regulator of financial services oversees all the relevant services that take place in the free zone. These services may include:

- Securities

- Commodities futures trading

- Insurance

- Credit and banking services

- Islamic finances

- International equities exchange

- Trust and custody services

- Asset management

- Collective investment companies

- International commodities derivatives exchange

Other responsibilities may include enforcing anti-money-laundering and counter-terrorism. The DFSA can also conduct investigations of regulated entities – DFSA regulated forex companies included.

How the DFSA helps with forex trading

The DFSA may help you with your forex trading in several ways. The most obvious ways in which it can prove helpful are the following:

- Giving the latest regulatory news to the consumer

- Helping the consumers in avoiding scams

- Allowing the investors to understand the basic rules

- Offering advice on how to solve various disputes and complaints

- Offering certain details about regulated firms

So, yes, there are various brokerages in the emirate of dubai – but most of the time, the advice is to go for DFSA-regulated brokerages.

Fxdailyreport.Com

Countless brokers are mushrooming in the forex landscape. You have to conduct your due diligence before making a choice one way or the other. What better way to make an informed decision than to prepare a list of their features?

We bring you a systematic comparison of the cyprus-based forex broker XM and the forextime (FXTM). The comparison is aimed at bringing out the differences in currency and commodity offerings, trading, account types, leverages, and customer care. Let us look at who fared better in XM vs. FXTM debate.

General overview – XM vs. FXTM

XM is a group of online regulated brokers headquartered in limassol, cyprus. Since its inception in 2009, it has emerged as one of the best forex trading websites when it comes to customer’s data and money. The XM group is regulated by the australian securities and investments commission (ASIC) with license number 443670; belize international financial services commission (IFSC) with license number (000261/106); and cyprus securities and exchange commission (cysec), with license number 120/10.

FXTM headquartered in the same country, cyprus is managed by cyprus securities and exchange commission (cysec) under license number 185/12. Although founded two years later in 2011, the broker has grown to be recognized as one of the leading forex brokers in the EU.

XM vs. FXTM fees

- Charges 0% deposit fees

- Offers commission-free micro-account and standard account

- Allows minimum withdrawal of $5 without charging fees

- Accepts a minimum deposit of $5 for micro and standard accounts

- Charges $7 per lot round turn while opening trade (XM zero account)

- Offers as low as 0.01 LOT min trade

- Offers as high as 50 LOT max trade

- An inactivity fee of $5 per month after 90 days is applicable

- Charges 0% deposit fees

- Accepts minimum deposit of $100 for standard MT4 and MT5 accounts

- Accepts minimum deposit of $25000 for FXTM pro

- A fee is applicable on ECN MT4 and ECN MT5 accounts.

- Does not charge a commission for any account except ECN MT4 and ECN MT5

- Charges $4 per one lot trading

- An inactivity fee of $5 per month after 180 days is applicable

Currency and commodity offerings

XM group provides access to over 57 FX pairs and cfds on indices, precious metals, energies, stocks, and commodities on MT4 and MT5. In the commodities market, you trade on cocoa, corn, copper, cotton, soybean, sugar, and wheat.

On the other hand, FXTM offers over 59 currency pairs and crosses, which include exotic currencies as well. Trading cfds on commodities is more suited to customer convenience. And with this idea, it opens access to trade on US brent oil, US crude oil and US natural gas.

Trading platform

- Desktop/laptop platform (windows)

- Web interface

- Social trading

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mac platform

- Mobile/tablet apps (android & ios)

- Proprietary platform

- Desktop/laptop platform (windows)

- Web interface

- Copy trading

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- MAC

- Mobile/tablet apps (android & ios)

Account types

- Demo account

- Micro account

- Standard account

- Ultra-low account “*XM zero and XM ultra low accounts are not available to all the entities”

- Zero account “*XM zero and XM ultra low accounts are not available to all the entities”

- Shares account

- Islamic account

- Demo account

- Standard account

- Cent account

- Shares account

- ECN account

- ECN zero account

- FXTM pro account

- NGN account (only available in nigeria)

Spreads

With commission-free accounts, XM offers variable spreads that amount to 1.7 pips on EUR/USD. The zero spread account holders get an average of 0.1 pips on EUR.USD. Also, the ultra-low account offers spread that comes down to 0.8 pips.

If you have a standard MT4 trading account, your spreads start from as low as 1.6 pips. And on the ECN MT4 and ECN MT5 accounts, the spread provided is 0.1 pips.

Leverage

With XM, you can enjoy flexible leverage that ranges between 1:1 and 888:1 “ *this leverage does not apply to all the entities of XM group. The maximum leverage for clients registered under the EU regulated entity of the group is 30:1 ”. The higher the leverage, the higher is the potential of profit with borrowed trading capital. However, there is also room for loss at the same time, as the rule normally follows.

FXTM offers higher leverage ratios than XM. The broker is one of the highest providers of leverage, with the ratio reaching 1:1000. That said, you need to keep a note that the leverage they offer is floating. In other words, as the notional value (size of position) increases, the leverage decreases.

Verdict

Towards the conclusion, we uncover the features exclusive to both brokers. XM group is secured with 2 global tier-1 licenses. It has an excellent customer support service that helps new customers start afresh confidently. Putting all together, it owns a trust score of 81.00

FXTM has no tier-1 license, but it has 1 global tier-2 license, same as XM group. The broker has a trust score of 70.00. As one of the award-winning brokers, it offers customers an almost all-inclusive assortment of instruments, platforms, account types, and resources. This opens doors to flexible, efficient, and convenient trading experience.

So, as you’ve had a close look at all the features, it’s up to you to decide for yourself who wins the XM vs. FXTM battle.

So, let's see, what was the most valuable thing of this article: as a regulated broker, XM secures clients' funds in segregated accounts with tier 1 investment grade banking institutions. At xm regulated

Contents of the article

- Real forex bonuses

- Regulation

- XM group licenses

- International financial services commission

- Cysec

- Cyprus securities and exchange commission

- Australian securities and investments commission

- Dubai financial services authority

- This website uses cookies

- This website uses cookies

- Your cookie settings

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM group forex broker review

- XM group overview and specifics

- XM broker review

- Regulation

- Feedback

- Advantages and disadvantages

- XM group review

- XM group review: summary

- XM group review: regulation

- XM group review: countries

- XM group review: trading platforms

- XM group review: trading tools

- Ribbon indicator

- River indicator

- Ichimoku indicator

- Bollinger bands indicator

- ADX & PSAR indicator

- Analyser indicator

- XM group review: education

- XM group review: trading instruments

- XM group review: trading accounts & fees

- XM group review: customer service

- XM group review: deposit & withdrawal

- XM group review: account opening

- XM group review: conclusion

- Fxdailyreport.Com

- Top recommended regulated forex...

- DFSA regulated forex brokers in 2021

- List of DFSA regulated forex brokers

- What does the DIFC entail?

- DFSA and DFSA-regulated brokers

- How the DFSA helps with forex trading

- Fxdailyreport.Com

- General overview – XM vs. FXTM

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.