How to turn demo money to real money

Remember to take all of your trades into account across the course of the day rather than focusing on a single trade.

Real forex bonuses

If you are maintaining a risk reward of 1:2 or greater, you are being successful. Objective thinking is very important, and it is vital not to let emotions get in the way. A clear head is the best way to successful forex trading, so developing a defined trading strategy and plan before leaping in is the best way to avoid spectacular losses. Limiting early trades to small values and only opening a micro account that allows low deposits is the best way to start. Wise investors will use a demo account for around three months to hone their strategies before moving onto a live account. This is an adequate amount of time to see consistent virtual profit and to develop all of the necessary skills that will be so vital to a trader’s success in the real-world markets. Here are some key points to remember when transitioning:

How to transfer from a demo account to a live one

Most of the best forex brokers on the market offer potential investors the option of opening a demo account in order to try out their trading platform and features before taking the final step of opening a live account and depositing funds. While a demonstration account is a great way to get a taster of the experience of choosing a specific broker, there are some downsides to using one. In this article, we look at the advantages and disadvantages of opening a forex demo account and outline how best to make the transition from a demonstration account to a live trading account.

What are the advantages and disadvantages of using a demo forex account?

For novice traders, a demo trading account can supply a valuable insight into the world of forex trading and can give beginners the confidence that they need to start trading for real. When used correctly, a demo account can be a useful training tool that will give them the necessary basic knowledge and skills that they need to get up and running. A demonstration account can be set up free of charge and only requires the potential investor to enter a few basic personal details. Access to this account enables the trader to get to grips with the trading platform without putting any of their finances at risk and allows the investor to see how to trade in real time, viewing the impact of fluctuations in price upon their account. Even more experienced traders can benefit from using a demo account as they offer a great opportunity to try out a new trading strategy in real time in a genuine trading environment and actual market conditions without taking any financial risk.

Nevertheless, there are some disadvantages to using a demo account. One of the major issues with demonstration accounts is that they cannot train an investor in the best way to manage their money. Most practice accounts come pre-filled with up to $100,000 of virtual money and this is hardly a realistic basis on which to begin. Most novices begin their foray into real-world forex trading with a micro or mini account which will involve depositing much smaller sums of money than this. These enormous virtual sums encourage investors to try their hand at much riskier trades than they should and this can become a habit that is hard to break after transferring to a live account and which can cost the novice investor dearly. The use of virtual money also protects the investor from the knowledge that they are risking their own hard-earned money when they make a trading decision. Therefore, a demo account cannot ever recreate the pressure of real-life forex trades and actually impairs the novice’s understanding of underlying risks.

How to transition to a live account

Transitioning from a demo account to a live trading account can be a steep learning curve, and a novice trader cannot expect to be incredibly successful immediately. It is not unusual for potential investors to have great success when using their demo account only to fail to make a profit as soon as they transition to a live account, and this is because the pressure has increased with real money on the line. One of the keys to transitioning successfully from a demonstration to a live account is to resist the urge to trade quickly and to take your time. Money management is essential at this stage, and every investor should set a maximum daily trading amount for themselves in order to not overstretch their finances.

Objective thinking is very important, and it is vital not to let emotions get in the way. A clear head is the best way to successful forex trading, so developing a defined trading strategy and plan before leaping in is the best way to avoid spectacular losses. Limiting early trades to small values and only opening a micro account that allows low deposits is the best way to start. Wise investors will use a demo account for around three months to hone their strategies before moving onto a live account. This is an adequate amount of time to see consistent virtual profit and to develop all of the necessary skills that will be so vital to a trader’s success in the real-world markets. Here are some key points to remember when transitioning:

Accept that losses are inevitable at some point – use losses as a learning curve.

Never risk money that you cannot afford.

Remember to take all of your trades into account across the course of the day rather than focusing on a single trade. If you are maintaining a risk reward of 1:2 or greater, you are being successful.

Spend enough time practising with your demo account to develop clear strategies before committing any funds to your live account.

Pre-plan your strategy to avoid making emotional decisions.

If you follow these guidelines, you will find the transition from a demo account to a live one less stressful and more profitable.

Post by konstantin rabin of top rated forex brokers

About author

Konstantin has been in the FX industry since 2008. Until early 2015 he was working in marketing for one of the leading brokers and after that, moved into developing his own site dedicated to promotions in the retail FX sector - forexbonuslab. Currently konstantin focuses on writing the reviews about traders' education, platforms and brokers.

How to seamlessly transition from demo trading to real money

- By justin bennett

- / march 24, 2017

This week’s question comes from cooper, who asks:

I like to maintain a demo account as well as my live account. When I can’t pull the trigger on a trade, I go to my demo and enter it there. Gets it out of my system and I can watch it (and hopefully learn from it). However, my demo account is growing, and my live account is dropping… FAST! I did have my first profitable month (month to month) in february, and that was after switching to 4h and daily time frames and focusing on price action/support & resistance. I just can’t seem to make sense of how the trades that I’m entering are different. Obviously, I should be taking the trades I’m sending to the demo, but I just can’t get my brain to let me enter those trades. How would you recommend making that connection?

Usually, I like to keep the questions in these Q&A segments concise. But because today’s topic is a bit more complex than usual, I thought it appropriate to share the full story.

I also believe the situation above is something we’ve all dealt with at one time or another. Making the switch from demo trading to a real money account is a big step and is often not without challenges.

One of two dilemmas tends to arise when making the transition from a demo account to a real money account.

- You did well on demo but as soon as you switched to a real money account your performance suffered

- You run both demo and live accounts, but only your demo account is growing

Both situations tell me the same thing…

Get instant access to the same "new york close" forex charts used by justin bennett!

Your emotions are getting in the way. There’s something about the loss of real money that’s tripping you up, which is why your demo account is doing better than your live account.

The good news is there are a few potential solutions. None of the topics we’re about to discuss are quick fixes, but with the right amount of discipline, your dilemma can be resolved.

By the way, throughout this post, you will see me use “live” and “real money” interchangeably. Both refer to the use of your money versus trading fake money in a demo account.

1. You aren't using risk capital

First things first, if you aren’t using risk capital, your trading is going to suffer. There’s no way around this one.

Put simply, it’s money you can afford to lose. It’s money you set aside that isn’t needed to pay for living costs.

So if you plan on trading your rent money, you may want to rethink your approach. The same goes for any money you need for food, utilities or any other costs required to live your life.

Also included in this list is cash from credit cards. I realize some cards let you take out cash advances. And although U.S. Brokers are now prohibited from allowing credit card funded accounts, I know it’s still available in other countries.

All of the above leads to one inevitable outcome…

Your emotions are likely to get the best of you. You can’t possibly risk money in the forex market that you need for rent or food and not feel the pressure from it.

Trading forex successfully is hard enough as it is. By adding the stress of risking money you can’t afford to lose, you’re making it even harder.

2. The amount at risk is above your comfort level

How much can you risk on one trade without getting anxious or frustrated?

That’s a question you need to answer before every trade. And responding with a fixed percentage such as 2% of your account balance isn’t going to cut it.

As I’ve mentioned in previous posts, you need to know how much money is at risk, not just a percentage.

But more than that, you need to be 100% comfortable with losing every penny of that amount.

After all, it’s usually the money that triggers the emotional reaction. A percentage such as 2% has no meaning without placing a dollar amount next to it.

Here’s a little trick that could help…

Before taking your next trade, try writing the amount you plan on risking. So if you’re risking 2% of your account and that happens to be $50, write the following on a piece of paper, a whiteboard, an ipad or anywhere that’s clearly visible.

I am prepared to lose $50 or 2% of my account to see if this idea has merit.

Now, think about the statement you just wrote. Read it out loud if you have to. Do whatever you need to do for this amount to sink in both consciously and subconsciously.

While you read it, convince yourself that you stand to lose the entire $50.

After about 20 to 30 seconds, you’ll know if you’re risking too much. If you are, that $50 is going to look and sound like far too much money to risk on the next trade idea.

If that happens, try cutting the amount in half to $25. Keep cutting by half until you get to a figure that doesn’t intimidate you.

That’s when you’ll know you’ve found an acceptable level of risk.

By the way, the trick of cutting your risk in half also works wonders if you’re suffering from a losing streak.

Just keep cutting your risk in half until you get your confidence back. Once you get it back, you can begin to normalize your risk per trade.

3. You aren't planning your trades

There’s a difference between a trading plan and a trade plan.

As I mentioned in a past Q&A post, think of your trading plan as a way to win the war. Your trade plan, on the other hand, is how you intend to win the battle.

Your trading plan should include things like the strategies you utilize, the time frames you trade and your minimum risk to reward ratio, among other things.

Your trade plan will be specific to the setup at hand. It should include things like your stop loss and take profit values as well as other key levels that could become a factor.

It all goes back to money and emotions. If you don’t have a well thought out plan before putting money at risk, you’re more likely to be influenced by emotions.

We all know the forex market (or any market for that matter) doesn’t always behave. So you have to account for every possible outcome.

For instance, the questions below are just a few you should be asking.

- What’s my reason for entering? (strategy, momentum, risk to reward, etc.)

- What are my stop loss and take profit levels?

- How much am I risking and am I comfortable losing the entire amount?

- Is there any news coming up that could affect my trade?

These are all things you need to account for before you put money at risk. Because once money is on the line, it becomes much harder to differentiate the facts from your emotions.

4. Your demo account balance is unrealistic

This one is tricky. You see, many traders think that the balance of a demo account is inconsequential.

After all, it’s just fake money, right?

Plus it’s fun to experiment with a $50,000 account or maybe even a $100,000 account.

But if you plan on opening a live account with $500 or perhaps already have one with that amount, you’re doing yourself a disservice.

Let’s say you have a real account with $500. You also have a demo account with $50,000.

You did fairly well on demo, but you just can’t figure out why your live account isn’t growing.

One thought is that the profit from your $50,000 demo account is more meaningful to you than your live account.

What does that have to do with performance?

If you’re risking 2% of the account balance on each trade, the profit from the larger account is $2,000 for a 2R trade.

Compare that to your $500 account where a 2R trade is just $20.

Which outcome is more likely to persuade you to relax a bit and not overtrade or over leverage your account?

I think we can all agree it’s the $2,000 profit.

You’re at a far greater risk of overtrading and overleveraging a small account than you are a larger one.

If this sounds familiar then you have two options:

- Save up until you have the funds to put on meaningful trades

- Convince yourself that learning the process of good trading is more important than the profits

You may want to consider doing both. But I will say that number two above is paramount.

Too many traders come into this business obsessed over making a lot of money. The problem is they ignore learning the process first. That process involves things like learning support and resistance, trend analysis, favorable risk to reward ratios, etc.

A lawyer doesn’t get to make a lot of money without first going to law school.

The same concept applies to trading forex or any other market.

Overtrading and overleveraging are perhaps the two greatest sins in the forex market. They’re also the least forgiving.

You do either one, and you’re likely to struggle. You do both, and I can all but guarantee that you’ll end up with a blown account.

It's all about the money

The only thing that separates a demo account from a live account is the money. That’s it. Everything else is the same.

And what does money tend to do?

It triggers emotional responses.

Learn to troubleshoot this problem like you would any other dilemma. Eliminate the irrelevant and think through the problem.

One way to do this is to ask yourself the question “why?” up to five times. The idea is that by the time you get to the fifth why you’ll find the root cause.

I trade well on demo, but my performance suffers as soon as I switch to real money. (the problem)

- Why? I cut profitable trades too early and let losses run in my live account.

- Why? I’m afraid of taking too many losses, and I don’t want to give profits back.

- Why? I can’t afford to lose the money in my account.

- Why? I’m in a financial situation that requires the money in my account.

The method above is called the 5 whys. It’s an interrogative technique used to explore cause-and-effect relationships.

Note that it only took four series of asking why to get to the root cause above. That’s okay as long as you get there.

The idea is that by the time you’ve asked why up to five times, you’ll arrive at the root cause.

Once you have this information, you can address the problem head on.

Final words

If you find that your demo trading is more successful than your real money account, be sure you’re only using risk capital. If the money in your account isn’t disposable income, you shouldn’t be placing at risk in the forex market.

Are you 100% comfortable with the amount of money you’re risking per trade?

If not, you should take a step back and reevaluate your risk threshold. Because if you go over this amount and the market moves against you in the slightest way, you’re going to be tempted to close the trade prematurely.

Plan your trade and trade your plan. It’s sage advice from some of the best traders out there.

To trade based on logic rather than emotions, you need to have a plan before risking any capital. If you don’t have a plan of attack before jumping into the market, your emotions will eat you alive.

The best defense against emotional trading is to keep risk small and always have a plan.

Send me weekly updates about daily price action's Q&A

Your turn: ask justin anything

I’d love for this new weekly Q&A to be successful and provide an invaluable repository of answers to common forex questions.

To do that, I need your help.

Here’s what you can do to get involved and have your question answered in next week’s post:

- Ask questions. Post them in the comments below or tweet them to me @justinbennettfx

- Help me answer questions. If I missed something or if you have something to add, don’t hesitate to leave a comment below.

Leave a comment:

19 comments

If you are scared of losing real money, start with a $50.00 account and start the gearing at .01 and gradually increase it as your confidence increases.

Nice suggestion, andre. Thanks for sharing.

You talk like you live in my account , mentor .

I love your post.

My question is how do I stop letting my losing trades run-I can be positive in 15-20 trades and then I get a big loss and give back everything.

Second I am afraid to let my winning trades run. I trade in small lots 0.02. Usually on 15min. TF.- hour TF. Please help.

Fay, trading from the higher time frames (4-hour and daily) usually helps most traders. I’d start there if I were you.

Hi justin, your comments are always welcome. Most the time they hit the nail on the head. In this case, I would say the key word is discipline. Having a trading plan is easy; executing it, is a different story and there is where discipline comes in. One must resist the urge to put on a trade that does not fit the trading plan, otherwise you end up with a loss. I have been there. Also, you suggestion of risking 2% of capital per trade is a good one and I am trying to stick to it. Thanks for your blog/comments

You’re welcome, fabio. Discipline is certainly key as you say. All of the planning in the world won’t do you any good without having the discipline to stick to it.

Thanks justin. Great lesson. I’m new to daily price action & I’m getting a lot out of it. Trading profitably has been so very difficult. It’s really hard work (mentally I mean). Cheers.

That’s great to hear, graeme. Becoming a profitable trader is one of the toughest journeys in life. But that’s also what makes it so rewarding.

Fantastic article justin, thanks! Discipline is the key.

You’re welcome, cooper. Let me know how things work out for you. Cheers.

Sound and proper advise, all the above will be applied in full. Thank you

You’re welcome, thami. Pleased to hear that.

I have a problem about where to place a stop loss order. What is the best position to place a stop loss order in order to prevent stop outs.

Hello justin, how do i manage to handle a winning trade by not being paranoid on taking profits too soon. I see charts going towards the direction as analysed but i take profits too soon before reaching predicted target.

Hi. Am new here. Fantastic insights. My issue is that I start the day gaining on trades only to loose them back before the end of the day resulting in overall huge losses. How can I stop that? Glad for your advise. Thanks

Welcome! Great to have you. The simple answer is to stop overtrading and use the daily time frame.

What is your daily time frame sir

Disclaimer: any advice or information on this website is general advice only - it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by daily price action, its employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, cfd's, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How to cash out bitcoin: how to do it easily

Want to learn how to cash out bitcoin? Find out right here!

Last updated: january 05, 2021

Bitdegree.Org fact-checking standards

To ensure the highest level of accuracy & most up-to-date information, bitdegree.Org is regularly audited & fact-checked by following strict editorial guidelines. Clear linking rules are abided to meet reference reputability standards.

All the content on bitdegree.Org meets these criteria:

1. Only authoritative sources like academic associations or journals are used for research references while creating the content.

2. The real context behind every covered topic must always be revealed to the reader.

3. If there's a disagreement of interest behind a referenced study, the reader must always be informed.

Feel free to contact us if you believe that content is outdated, incomplete, or questionable.

So, you’ve made your millions, and now you want to know how to cash out bitcoin? Well, this guide will tell you everything you need to know!

This guide will include methods of how to turn bitcoin into cash such as bank transfer, paypal and even through cash deposit! I will show you how to withdraw bitcoins to cash using a broker (namely, coinbase) and through a peer-to-peer exchange. And to make it easier for you, I will also include some helpful images.

By the end of this guide, you will be able to decide which method is best for you.

Cool fact: did you know that more than $2 billion worth of bitcoin transactions happen every day?!

Table of contents

Different cash out methods

There are many things to consider when cashing out bitcoin. Here are a few:

Latest coinbase coupon found:

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

Your discount is activated!

- Do you want the easiest method, or the cheapest method?

- Do you want the money deposited into your bank account or paypal?

- How long do you want to wait to receive your cash?

- Which currency do you need to change your bitcoin in to?

These are some of the questions that you will need to ask yourself. So, read through the following methods on how to cash out bitcoin and then decide which is best for you.

Third-party broker exchanges

A third-party broker is just another name for an exchange. Most cryptocurrency exchanges do not allow you to deposit funds using fiat money - however, some do.

This is how it works: you deposit your bitcoin into the exchange, then, once the exchange has received your bitcoin, you can request a fiat currency withdrawal. The most common way to do this via a bank (wire) transfer.

To make sure brokers do not break money laundering laws, you will need to withdraw to the same bank account that you deposited with. If you have never deposited fiat on to a broker exchange, then you will more than likely need to make (at least) one deposit first.

This can be annoying, I know… but that’s the way it goes.

If you decide to cash out your bitcoin using a broker exchange (such as coinbase), then it will normally take about 1-5 days for the money to reach your account. For EU customers, payments are made via SEPA (withdrawals paid in euros). However, if you want to sell bitcoin for USD, brokers normally use the SWIFT payment method.

And that’s how to cash out bitcoin using a broker exchange — skip the next section to follow instructions on how to do this.

However, if you’d prefer the more anonymous & less time-consuming approach, let’s look at how to sell bitcoin for cash using a peer-to-peer platform!

Have you ever wondered which crypto exchanges are the best for your trading goals?

- Can be managed from mobile device

- Very secure

- Supports more than 1,100 cryptocurrencies

- Super secure

- Protection against physical damage

- Supports more than 1500 coins and tokens

Peer-to-peer

If you don’t like the thought of having to wait three days for cashing out bitcoin, you should consider using a peer-to-peer selling platform like localbitcoins.

When selling bitcoins to other people on localbitcoins, you can decide which payment method you want the buyers to use. These include:

- Cash deposit: you can ask the buyer to deposit cash into your bank account. However, you should always ask them for proof of ID and proof of payment before releasing your bitcoins to them.

- Bank transfer: you can ask the buyer to send you a bank transfer payment. Before trying this method on how to cash out bitcoin, be sure to always request proof of ID from the buyer before going ahead. Once you have received the money, you can release the bitcoins to them.

- Meet in person for cash: you can arrange to meet up with a buyer who is local to you, and they will pay you in cash for your bitcoins.

P2P selling is safe if you know what you’re doing. However, it’s important to be aware of fraudsters. Localbitcoins offer a good level of safety because of their escrow service. This keeps your bitcoins locked until you confirm the payment has been received from the buyer.

I bet you’re still a little confused as to what an escrow is, so let’s use an example:

- John wants to buy 1 bitcoin. As he is from the UK, he searches for sellers in his country.

- John sees that mike is selling 1 bitcoin at a good price, and he also accepts bank transfer as a payment option.

- John sends his request for 1 bitcoin to mike, and mike accepts.

- Mike puts his 1 bitcoin into the escrow. This holds the bitcoin until john transfers the money to mike.

- John transfers the agreed amount into mike’s bank account.

- When mike has received the payment, he releases the bitcoins from the escrow, which is then sent to john’s account.

That’s it! Now you know how to sell bitcoin for cash using a P2P exchange!

How to cash out bitcoin using a broker exchange

So, now that you know the difference between the two favored methods, I will now show you how to withdraw bitcoins to cash using broker exchanges!

Coinbase is the most popular broker exchange for buying and selling bitcoin. They process more bitcoin transactions than any other broker and have a massive customer base of 13 million.

- Withdrawal methods: coinbase lets you sell bitcoins for cash, which you can then withdraw into your bank account. You can only cash out your bitcoin into a bank account that you have already used to buy cryptocurrency on coinbase. So, if you haven’t done this yet, I recommend purchasing a small amount of cryptocurrency first.

- Fees: the fees depend on the country that your bank is located in. For example, if you want to sell bitcoin for USD, a wire transfer is $25. If you are located in the EU and have SEPA, then this costs just $0.15!

- Cash-out times: withdrawal times also depend on the country that your bank is located. US withdrawals normally take between 4-6 working days, while EU withdrawals take 1-3 working days.

The most liked findings

Looking for more in-depth information on related topics? We have gathered similar articles for you to spare your time. Take a look!

Ripple price prediction: will it rise or crash?

Ripple price prediction 2021: will ripple rise or will ripple crash? Find out i the complete ripple price prediction guide.

Monero price prediction: what's the future of monero?

Monero price prediction: what's the future of monero? What are monero predictions 2021? Read the monero price prediction guide and find out.

Buy dogecoin: where and how to buy dogecoin

Learn where and how to buy dogecoin with different payment means: buy dogecoin with credit card vs buy dogecoin with paypal vs buy dogecoin with USD

Turn bitcoin into cash using coinbase

To make things a little easier for you, I will now show you how to cash out bitcoin at coinbase.

1. First, you will need to open an account with coinbase, link your bank account, and make a deposit. If you need help on how to do this, view our guide here. If you have already done this, proceed to step 2!

2. Once you have set up your account, you will need to send your bitcoin to your coinbase bitcoin address! To do this, click on the accounts tab, open your bitcoin wallet, and click “receive”. You will then be shown your bitcoin coinbase wallet address. This is the address you need to send your bitcoin to.

3. Once you are all set up, click on buy/sell at the top of the page.

4. Next, click on sell.

5. The next step on how to cash out bitcoin is in the wallet. Assuming you have now sent your bitcoin to your coinbase wallet, you should see your bitcoin wallet and your default fiat currency here. In the example image below, I opened an account from the EU, so my deposit wallet is in euros (EUR).

This will change depending on where you are located. For example, U.S customers have the option to withdraw to USD, and japanese users can withdraw to JPY.

You will also see your withdrawal limit. If you have already verified your account, your limits will be quite high. However, if you need to increase this, click on see limits and follow the additional verification instructions!

6. Before you can withdraw, you need to exchange your bitcoin to your local currency. In my example, I am exchanging bitcoin to euro (EUR). Enter the amount of bitcoin that you wish to sell, and the fiat currency equivalent will update.

7. Once you click on sell bitcoin instantly, your funds will now be in your fiat currency wallet.

8. Ok, so we are at the final step on how to cash out bitcoin to your bank account. Click on your fiat currency wallet (for example, EUR/USD/YEN), and click on withdraw. Your bank account details will already be saved from when you set it up earlier.

Congratulations! You now know how to turn bitcoin into USD, EUR, and other fiat currencies using coinbase! Don’t forget, there are many other brokers that you can use. Another popular choice for bitcoin sellers is kraken!

Kraken is another popular exchange that allows fiat currency deposits and withdrawals. It has been around since 2011, and processes the most bitcoin to euro transactions. However, they also support other major currencies like USD, CAD, and JPY!

- Withdrawal methods: if you want to turn your bitcoin into cash with kraken, you can withdraw to your local bank account.

- Fees: the withdrawal fees at kraken are very low. For example, a SEPA cash out is only €0.09! And if you want to sell bitcoin for USD using a local US bank, it’s just $5.00!

- Cash-out times: it takes between 1-5 working days for kraken withdrawals to reach your bank account.

Turn bitcoin into cash using a peer-to-peer exchange

Now that you know how to cash out bitcoin using a broker, let me show you how to do it using a peer-to-peer exchange. There are a few to choose from, however, the one I most recommend is local bitcoins.

Localbitcoins was created in 2012 and now supports almost every country in the world. So, no matter where you are from, you should be able to find buyers to sell your bitcoin to.

The great thing about P2P is that you can request any payment method you want. Here are some examples of the different payment methods available on localbitcoins:

- Local bank transfer

- International bank wire

- Paypal

- Skrill

- Payoneer

- Western union

- Gift vouchers

- Web money

- Bank cash deposit

- Neteller

Sellers who know how to cash out bitcoin can also choose the price they would like to sell their bitcoin for. You can do this by creating an advertisement, which will charge you a fee of 1% of the total sale.

However, if you sell to a buyer that has listed the price they want to pay, there are no fees.

There is also a rating system like ebay, where you can leave feedback for the buyer or seller. This helps you to remain safe when choosing a buyer. If you are a beginner, I only recommend selling to buyers who have 100% positive feedback.

Local bitcoins allows you to stay anonymous, too (when choosing such payment methods as web money or gift vouchers), especially if you also use a reliable and safe VPN to secure your connection. However, some sellers decide to ask new buyers (those who have no feedback) to supply identification.

Here’s a step-by-step guide on how to turn bitcoin into cash using a peer-to-peer exchange:

How to cash out bitcoin using localbitcoins

1. First, you will need to open an account at local bitcoins. You can do this by clicking here.

2. Choose a username and a strong password. You also need to enter and confirm your email address.

3. Once you are logged in, click on sell bitcoins at the top of the page.

4. Then you need to choose the country where your ideal buyers are located. I recommend using your own country (of course), however, this is up to you. In this example, I have selected the UK. You also need to enter the amount of bitcoin you wish to sell.

5. As you will see below, there are many different ways to cash out your bitcoin.

6. In this example, I will show you how to cash out bitcoin using paypal. As you can see, the buyer has a 100% feedback rating, and has completed more than 1000 trades! This is a sign of a serious, legitimate buyer.

7. Confirm the amount of bitcoin you want to sell and enter your paypal email address. Then click on send trade request.

8. Your buyer will then receive a notification to say that you would like to sell your bitcoins to them. Once they accept, you will then send your bitcoins to the localbitcoins escrow (I explained an escrow earlier, remember?). So, the buyer will not receive your bitcoins until they have paid you, and you confirm they have done so.

9. The buyer should contact you to let you know that the funds have been sent. Check that the funds have arrived in your paypal, then click on payment received, and you're finished.

Congratulations! You now know how to cash out bitcoin using a P2P exchange.

Once you become more experienced with local bitcoins, you can practice selling using different payment methods. The good thing is, some payment methods allow you to sell your bitcoins at a higher price — so it’s worth getting used to.

It is also a good idea to set up an advertisement. Even though it will cost you 1% in fees, you can set up your own price and choose your own payment method. In this case, you will receive a notification from buyers when they want to buy from you.

Localbitcoins is just one of the P2P exchanges that allow you to cash out your bitcoin — there are many others. The important thing to remember is that the exchange has an escrow, and NEVER send your bitcoin to a buyer before they have paid!

The most trending findings

Browse our collection of the most thorough crypto exchange related articles, guides & tutorials. Always be in the know & make informed decisions!

Bitcoin mining hardware: how to choose the best one

Best bitcoin mining hardware: your top choices for choosing the best bitcoin mining hardware for building the ultimate bitcoin mining machine.

Monero mining: full guide on how to mine monero

Learn how to mine monero, in this full monero mining guide.

What is segwit and how it works explained

Wondering what is segwit and how does it work? Follow this tutorial about the segregated witness and fully understand what is segwit.

Conclusions

If you have read this guide from start to finish, you should now know how to cash out bitcoin! We have shown you two different methods — the broker exchange way (coinbase), and also the peer-to-peer way.

They both have their advantages and disadvantages. Coinbase can be more convenient and safe for beginners, whilst localbitcoins allows you to remain anonymous and sell at a higher price.

So, which did you prefer? Are you going to use a broker for cashing out bitcoin, or a P2P exchange?

Leave your honest feedback

Leave your genuine opinion & help thousands of people to choose the best crypto exchange. All feedback, either positive or negative, are accepted as long as they’re honest. We do not publish biased feedback or spam. So if you want to share your experience, opinion or give advice - the scene is yours!

Where and how do I convert bitcoin into real money?

Surely if you have ever talked to a family member or friend about investing in bitcoin or cryptocurrencies, the first thing they asked you is what they are, and then … how can I convert bitcoins into real money?

It is the first question that comes to mind when we want to invest in bitcoin or other cryptocurrencies and we must know the answers.

Where and how can I convert [BTC] bitcoin into real money?

There are several options to convert bitcoins into real money, such as bitcoin atms, exchanges, bitcoin buying and selling platforms, debit cards, peer to peer sales … etc., today we will show you how to do it, where and what precautions should be taken.

Exchange currency exchange:

Using exchanges is one of the most common ways to convert bitcoin into real money, for this, the most important point that must be taken into account is that the exchange where you want to exchange bitcoin or other cryptocurrency for fiduciary money, has the cripto / fiat pair that you want to convert.

This means that if our goal is to change bitcoin to euros, the exchange must have that option, because otherwise, it will be impossible to make the change. Bitcoin’s most common par (fiat) is the dollar (USD), which is usually available in almost all exchanges.

Be careful not to confuse the USD pair with the USDT (tether), the tether is a cryptocurrency with a value equivalent to the dollar, but it is still a cryptocurrency, therefore if you want to exchange to real money it should be exchanged to USD or EURO.

The second point to consider is whether the platform will allow sending those funds in fiat money directly to our bank account or if they only allow us to send that money to another wallet.

Exchanges with the BTC/euro pair

The most known platforms that allow this change are: kraken, bitstamp, GDAX and bitfinex.

Exchanges with the BTC/USD pair

The most known platforms that allow this change are: bitfinex, bitstamp, GDAX, gemini, kraken, CEX.IO.

Once the change has been made and the euros, dollars or fiduciary currency that we want in the withdrawal section of the chosen platform appear, we must transfer the money to our bank account.

In order to carry out this change to fiat money, the exchanges usually request a prior verification of data, such as the telephone, address and a picture of the passport or id. Once the data has been verified (this process usually lasts several days until they verify that the data is real) you can send the money to the bank account and convert the bitcoins to real money.

Peer to peer platforms

As for P2P platforms to convert bitcoin to euros, localbitcoins is the best known. This platform allows you to buy and sell bitcoin to other people, either through bank transfer, in person, by hal-cash or paypal, among other options.

It is a worldwide platform, where you only have to search if,0 in the place where you want to make the exchange, there is someone interested in selling or buying bitcoin. Localbitcoins will then indicate the closest people both for the purchase and for the sale of cryptocurrencies.

To convert bitcoin into real money, you just have to register on the page and put the offer with the price that you want to sell the cryptocurrencies with and the payment methods that you accept.

The biggest drawback of this page is that the price of the cryptocurrency sales is usually more expensive than in the market since here the sellers are the ones who mark the price, although if your interest is to sell, a greater benefit will be obtained.

Halcash

Halcash is a company of spanish origin, which since 2004 offers an electronic payment system where they can send money both domestically and internationally.

This platform has more than 12,000 atms around the world and with the association of 16 banking entities, in spain, poland and they are expanding their borders to the united states and mexico.

Among its associates, it has: bankinter, abanca, evo, ING direct, santander group, laboral kutxa, cajamar group, mbank, WBK, euronet wordwide, payment alliance international, pademobile, among others.

How do I change bitcoin to real money with halcash?

Halcash as such does not allow directly changing bitcoin into real money, this is why they are associated with other companies in the sector that can make the process of changing from crypto to fiat, such as bit2me, localbitcoins or chip-chap.

To use halcash you do not need to have a bank account, you only need a phone number since the withdrawal codes are sent via SMS.

Uphold platform

Uphold is a financial services platform based on the cloud, which can be accessed from 184 countries and gives the possibility to exchange with more than 30 currencies, fiduciary, cryptographic or precious metals.

Uphold services

- Add funds to a portfolio through a transfer, debit card or bitcoin wallet.

- Save funds securely (protected by reservations all around the world)

- Move and convert your money instantly and for free.

- Total control of funds in real time.

The platform was launched in 2015 and already moves more than 3 billion dollars in transactions.

Bitcoin buying / selling platforms.

There are platforms in which you can buy and sell bitcoin, the biggest drawback of these platforms are the commissions and the price difference with the market, since because they have to obtain a benefit from each transaction, these platforms usually buys more expensive and is sold cheaper than at the market price.

As a point in favor, it can be said that they provide security, since these platforms have been offering these services for years.

Coinbase

Coinbase is one of the best known platforms both for buying and selling bitcoin, to exchange bitcoins for euros on this platform the following steps should be done:

- Have bitcoin in the wallet

- Sell bitcoins to fiat money.

- Make a withdrawal of the fiduciary money to a bank account by a transfer.

Bit2me

In bit2me it is possible to buy and sell bitcoin, regarding the sale it can be made through SEPA bank transfer (to europe), SWIFT bank transfer (international) or from halcash.

Cex.Io

Cex.Io has been offering services related to bitcoin since 2013, this platform also allows the purchase and sale of bitcoins, the withdrawal of cash can be made through visa, mastercard or cryptocapital (a private fiat banking platform built to support any cryptocurrency blockchain)

Platforms that offer debit cards

Debit cards are a fast and convenient way to convert bitcoin into real money, you just have to recharge the debit card with bitcoin or another cryptocurrency that they accept and it will automatically convert the balance to fiduciary money to make a payment at any place that allows payments with debit card.

The most known platforms that offer these services are: wirex, shift card or bitpay.

Through bitcoin atms

More and more bitcoin buying / selling atms are being installed around the world. It has reached more than 3000 units and will undoubtedly continue to grow.

The united states is the country with the most bitcoin atms surpassing 1000 units, followed by canada, austria, the united kingdom and spain.

To change bitcoins to real money through a selling cashier / bitcoin, you only have to send bitcoin to the address indicated and when the transaction is verified the cashier will deliver the corresponding cash.

After converting bitcoin into real money, how do we receive its payment?

Depending on how and where we exchanged bitcoin to fiat money, we can receive our money one way or another.

In cash:

To receive cash, you must exchange bitcoins at a bitcoin purchase / sale cashier or make a peer to peer sale through a platform such as localbitcoin.

In an account:

To receive money in a bank account, you can make the change through an exchange, a bitcoin buying platform such as coinbase or a platform that allows this type of deposit, localbitcoin in addition to cash also allows this type of exchange.

Debit cards:

It will be necessary to register in one of the platforms that offer this service, send the bitcoin that you want to sell to the wallet you specified and wait for the cripto / fiat conversion to be done so you are able to buy with the debit card anywhere.

If you liked our article and you are interested in knowing more about the world of cryptocurrencies, do not hesitate to contact us, we will be happy to assist you.

How to make real money playing video games

It’s every little kid’s dream: getting someone to pay you to play the games you already enjoy. And like most dreams, the reality is somewhat underwhelming. A career as a game tester boils down to being an elaborate quality control worker. But there are other ways you can make extra money by gaming at home. Here are a few.

Trade in-game items for cash

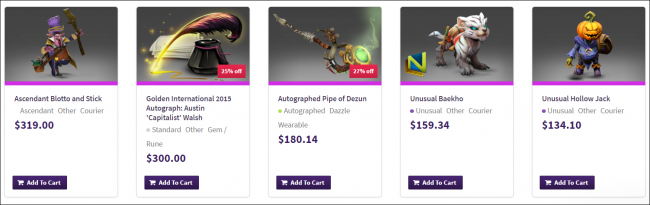

In just about any multiplayer online game, the best gear and weaponry is also the hardest to obtain. And while you might have the kind of disposable time it takes to sink 200 hours into dungeon crawling, raiding, or randomized loot drops, not everyone does. That’s why some of the rarest items in games like counter-strike: global offensive sell for real money on third-party marketplaces. (they’re sold in-game for steam wallet credit, too, but those funds can’t be exchanged for real-world cash.)

CS:GO skins are probably the most lucrative item market in the world at the moment, at lest among games that explicitly allow and enable their in-game loot to be sold outside the game interface. DOTA 2, another game that relies on steam’s item trading system, has a similar economy. Players can link their digital inventories with an online sale site like loot market, post a price for their item just like it was a real object, and get paid in real-world credit via paypal, bitcoin, steam wallet credit, or even real bank transfers. Everquest 2, a long-running MMO, allows buying and selling of in-game items for real money in select areas only, with a cut of each transaction going to the developer.

It’s important to note that while selling your steam items through one of these third-party markets is permissible, it’s rather easy to get scammed, since valve takes no responsibility at all for transactions that happen outside of its system. Most other online games explicitly ban any kind of trading for real-world money (though of course it happens on the sly more or less all the time—see below). The few mainstream games that have tried to have an easy in-and-out relationship with real money have had serious issues with their economies, like diablo III’s now-shuttered auction house. For this reason, it’s unwise to invest too much time and effort into a high-value item with an intent to sell, when an unscrupulous vendor or player could leave you high and dry. Do your research before trying to sell player-to-player or on a third-party market.

Trade in-game money for real money

Other games allow you to cut out the middleman and exchange the in-game currency directly for real money. Most mmos and free-to-play games have some mechanism for exchanging real currency for digital coins or credit, but in the perennial life simulator second life, players can turn the “linden dollars” they’ve earned in-game back into real money via bank transfer or paypal (at an exchange rate of more than 200 to one, if you’re wondering).

Entropia universe, a space-themed MMO, allows players to buy in-game items for real money with an exchange rate of $1USD to 10PED. That currency can be transferred back out with a stable exchange rate at any time. The developer is so protective of its “real cash economy” that some players use physical one time PIN systems to log in.

Other, smaller games have attempted to create real cash economy systems, with varying degrees of success—many quickly folded or never got out of development. It’s an interesting aspect of the evolving world of gaming, and one that can be expected to grow in unpredictable ways.

Create items of your own

One of second life‘s most lucrative enterprises is creating digital furniture and other accessories to sell to other players. In a case of life imitating art, you can do the same thing for some of valve’s most popular games. Most of the cosmetic items that appear in the shooter team fortress 2 and the multiplayer strategy game DOTA 2 were created by players, submitted to the developer, and then approved for sale. Each time other players spend real money on those items, the creator gets a small cut, like an author receiving royalties from a book sale.

Of course, there are significant barriers to entry here. Anyone submitting items for valve needs to have some basic 3D modelling skills, and a bit of animation experience doesn’t hurt. Once you’ve created the item it needs to be voted on by the community and selected by valve…so there’s definitely an element of skill and creativity here.

Valve briefly experimented with paid mods for popular games like the elder scrolls V: skyrim. But due to the nebulous nature of attribution in the mod market, the scheme fell apart rather quickly. We may see something similar come back in the future.

Legitimate alternatives…

Of course there are other methods for playing games and making money that don’t directly affect in-game economies. But these generally involve combining a passion for video games with real-world skills and talent. Youtube users who record their play sessions and upload it with commentary, collectively known as “let’s play” makers or just “let’s players,” can make enough money to be considered professional content producers. A variation of this technique is to stream video of your current play session live to an online audience with twitch and similar services, earning money on advertising and donations.

Professional gamers, those who compete in nation- and world-wide tournaments, can make tens of thousands of dollars for winning a single event. The most popular games are the most lucrative, but game tournaments are now so diverse that most competitive genres are covered, including older real-time strategy games like starcraft, newfangled mobas like league of legends and DOTA, shooters like counter-strike and overwatch, and traditional fighting games like street fighter and super smash bros. (starcraft has been jokingly called the “national sport of korea” for the enormous pro circuit in south korea alone.) the market is so big now that gaming leagues and teams are attracting corporate sponsors, just like real sports, allowing the most successful players to depend on competition as a full-time income.

If you’re not a particularly “epic” player and you lack the natural showmanship necessary to appeal to a live audience, there’s a huge and growing market for game journalism. Game journalists working for traditional publications and online blogs have to keep abreast of the latest releases and trends, but in a very real sense they get paid to play and review video games… so long as they’re also fairly decent writers as well. If current news coverage or long-form reviews don’t appeal to you, some writers make lucrative incomes creating game guides and selling them on digital book markets like amazon kindle.

Of course, all of these avenues for gaming wealth come with a big drawback: you need real talent and dedication to turn them into what’s basically a full-time job. Let’s players and streamers have to create a stable and loyal following, pro gamers have to practice for hours a day to stay competitive, and game journalists often have to spend years working for practically nothing to build up a resume before they’re hired at a legitimate site or publisher. All of these careers are extremely competitive because, well, people like to play video games. While you work on becoming the next twitch star or respected reviewer, remember the traditional comedian’s advice: don’t quit your day job.

…and less legitimate options

Just because a game doesn’t have an official cash economy doesn’t mean that it has no economy at all. In pretty much every multiplayer game, there’s at least someone who’s willing to pay real money for in-game gold, gear, or even characters. There are entire sites setup to facilitate moving real money around between players who have in-game goods and other players who are willing to pay for them. Players have even been known to sell their steam accounts, including access to all the games purchased within, for thousands of dollars.

The problem is that, with the exception of the games listed above, most multiplayer games list transactions outside of the game itself as a violation of its terms of service. Paying real money for those super-shiny pants in league of legends or that fully-leveled character in world of warcraft isn’t illegal—which is to say, there’s no way doing so can actually land either party in jail. But if the administrators of the game find out you’ve been “gold farming” or brokering high-value items for cash, they can boot both you and your customers out of the game for violating the terms of service.

This “grey market” fringe status tends to attract a lot of less salubrious elements to the out-of-game gold and item markets. Scams and fraud are rampant, even on sites that insist they’re completely safe. The takeaway here is that, unless you have that rare item or account worth thousands of real-world dollars, and you don’t mind risking it to turn a quick buck, trying to make real money off of markets that are against game rules isn’t a winning proposition in the long run. At the end of the day, it’s probably best to let games be what they are: fun.

Michael crider

michael crider is a veteran technology journalist with a decade of experience. He spent five years writing for android police and his work has appeared on digital trends and lifehacker. He’s covered industry events like the consumer electronics show (CES) and mobile world congress in person.

Read full bio »

so, let's see, what was the most valuable thing of this article: traders find it difficult to start trading on a live account successfully. This article explains the best practices when moving to real money trading. At how to turn demo money to real money

Contents of the article

- Real forex bonuses

- How to transfer from a demo account to a live one

- What are the advantages and disadvantages...

- How to transition to a live...

- How to seamlessly transition from demo trading to...

- 1. You aren't using risk capital

- 2. The amount at risk is above your comfort level

- 3. You aren't planning your trades

- 4. Your demo account balance is unrealistic

- It's all about the money

- Final words

- Send me weekly updates about daily...

- Your turn: ask justin anything

- How to cash out bitcoin: how to do it easily

- Different cash out methods

- GET UP TO $132

- By learning - coinbase holiday deal

- GET UP TO $132

- Your discount is activated!

- Third-party broker exchanges

- Peer-to-peer

- How to cash out bitcoin using a broker exchange

- The most liked findings

- Ripple price prediction: will it rise or crash?

- Monero price prediction: what's the future of...

- Buy dogecoin: where and how to buy dogecoin

- Turn bitcoin into cash using coinbase

- Turn bitcoin into cash using a peer-to-peer...

- How to cash out bitcoin using localbitcoins

- The most trending findings

- Bitcoin mining hardware: how to choose the best...

- Monero mining: full guide on how to mine monero

- What is segwit and how it works explained

- Conclusions

- Where and how do I convert bitcoin into real...

- Where and how can I convert [BTC] bitcoin...

- Exchange currency exchange:

- Peer to peer platforms

- Halcash

- Uphold platform

- Bitcoin buying / selling...

- Platforms that offer debit cards

- Through bitcoin atms

- Exchange currency exchange:

- After converting bitcoin into real money,...

- How to make real money playing video games

- Trade in-game items for cash

- Trade in-game money for real money

- Create items of your own

- Legitimate alternatives…

- …and less legitimate options

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.