Tickmill deposit malaysia

Syarikat tersebut mempunyai pengetahuan industri yang meluas dan mempunyai pemahaman yang mendalam tentang keperluan pedagang-pedagang, dan menyediakan syarat-syarat sesuai untuk mereka menjadi cemerlang.

Real forex bonuses

Tickmill menawarkan spread yang sangat rendah daripada 0 pip, leverage setinggi 1:500, pelaksanaan dagangan yang sangat cepat daripada 0.1 saat dan salah satu komisen terendah untuk dagangan ($2 untuk setiap lot) sambil membenarkan semua strategi-strategi dagangan. Tickmill malaysia ialah satu broker forex dan CFD antarabangsa yang dilesenkan dan dikawal selia oleh pihak berkuasa perkhidmatan kewangan seychelles (FSA), cyprus serta suruhanjaya sekuriti dan bursa (cysec) dan juga pihak berkuasa kelakuan kewangan UK (FCA).

Tickmill malaysia - tickmill broker review

Tickmill malaysia ialah satu broker forex dan CFD antarabangsa yang dilesenkan dan dikawal selia oleh pihak berkuasa perkhidmatan kewangan seychelles (FSA), cyprus serta suruhanjaya sekuriti dan bursa (cysec) dan juga pihak berkuasa kelakuan kewangan UK (FCA).

Pelanggan-pelanggan tickmill boleh mendapat akses kepada satu pasaran dan menjalankan dagangan forex, logam, tenaga dan komoditi. Selaku seorang broker yang memenangi anugerah, tickmill bertungkus lumus untuk memberikan pengalaman dagangan yang luar biasa kepada pelanggannya dari malaysia melalui syarat-syarat dagangan yang unggul, pelaksanaan kelajuan sangat tinggi dan sokongan pelanggan malaysia yang memberangsangkan.

Syarikat tersebut mempunyai pengetahuan industri yang meluas dan mempunyai pemahaman yang mendalam tentang keperluan pedagang-pedagang, dan menyediakan syarat-syarat sesuai untuk mereka menjadi cemerlang. Tickmill menawarkan spread yang sangat rendah daripada 0 pip, leverage setinggi 1:500, pelaksanaan dagangan yang sangat cepat daripada 0.1 saat dan salah satu komisen terendah untuk dagangan ($2 untuk setiap lot) sambil membenarkan semua strategi-strategi dagangan.

Pelanggan-pelanggan tickmill dari malaysia boleh membiayai akaun mereka secara serta-merta dengan cara pembayaran atas talian terkenal dan juga deposit bank tempatan di malaysia, serta mengeluarkan wang atau keuntungan mereka dalam masa satu hari bekerja. Sebagai seorang broker antarabangsa dengan pendekatan rantau, broker tickmill kerap menjadi tuan rumah seminar pendidikan di seluruh dunia, termasuk malaysia dan seminar laman web forex sambil menyediakan sokongan pelanggan yang disediakan khas dalam pelbagai bahasa melalui sembang langsung, emel atau telefon.

Tickmill malaysia menawarkan welcome bonus $30 dalam satu akaun langsung untuk memulakan dagangan forex bagi semua pelanggan baru dari malaysia, selain daripada hadiah bulanan $1000 untuk pedagang bulanan terbaik dalam pertandingan dagangan bulanan bagi akaun langsung.

Tickmill broker review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Tickmill offers very low spreads and commission, a 30 USD welcome bonus for all new traders, fast market execution on the MT4 platform and has an excellent reputation in the industry.

All accounts can be converted to islamic accounts and all clients have access to free autochartist and copy trading (via myfxbook) вђ“ great tools for traders of all experience levels. A regular winner of trade execution and trading conditions awards, tickmill has the reputation, and the performance, traders should look for in a broker.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Founded in 2014 by the former head of brokerage for admiral markets, tickmill is a relatively young broker, but it has expanded very quickly to become one of the more popular brokers in many global markets.В

The company is split into three divisions:

- Tickmill ltd, which is regulated by the seychelles FSA (license: SD 008)

- Tickmill UK ltd, which has been regulated by the UK FCA (license: 717270) since 2016

- Tickmill europe ltd, which has been regulated by cysec (license: 278/15) since 2015

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex execution broker 2018 (UK forex awards) andв best forex trading conditions 2017 (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker in europe 2017 (global brands magazine) for its focus on competitive pricing and maintaining a fair and transparent trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in an average of 0.15 seconds on 62 currency pairs; in addition to forex, other tradeable assets include cfds, stock indices, metals, and bonds. All trades at tickmill are completed using a fully automated no dealing desk (NDD) execution model, providing liquidity from global, top-tier banks and hedge funds with no requotes.В

The margin call and stop-out percentage differ for the retail and professional versions of the accounts, the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30% вђ“ but all accounts benefit from having up to 1:500 leverage.

Clients can choose from three wallet currencies вђ“ USD, EUR and GBP.

Account types

Tickmill offers three different live accounts in addition to the demo account and all accounts are available with a swap-free islamic option. The main differentiating factor between the accounts is that the pro and VIP accounts are commission-based accounts with much tighter spreads, whereas the classic account is commission-free, but the brokerвђ™s fee is incorporated into a wider spread.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days and you can change the balance on your demo account whenever you want by writing to the tickmill support team. You can keep your demo account open once you open a live account by installing your MT4 live account and MT4 demo account in different folders on your computer.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. Spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for more advanced traders. Tighter spreads are available in exchange for a commission of 2 USD per side per lot (100,000) traded, so 4 USD round turn. This commission pricing and structure is an industry-standard and is on the cheaper end of what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum balance. The commission is reduced to 1 USD per side per lot traded, making trading even more profitable. This is a very competitive professional account which offers excellent trading conditions and one of the lowest commissions in the world.

Spreads and commissions

As explained above, spreads and commission change between accounts:

- Classic account: the minimum spread is 1.6 pips with no commission charged.

- Pro account: the minimum spread is 0.0 pips with a commission of 2 USD per side per standard lot traded

- VIP account: the minimum spread is 0.0 pips with a commission of 1 USD per side per standard lot traded

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD for any deposit over 5000 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited.В

Tickmill for beginners

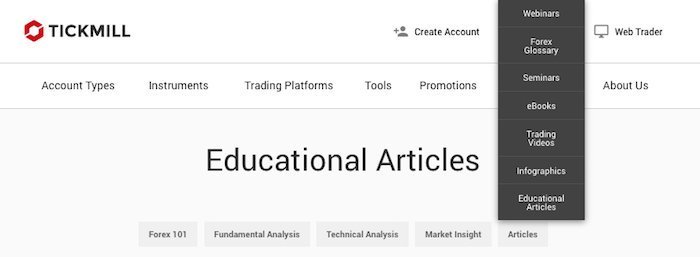

Tickmill does not have a traditional forex trading course, but it does hold frequent webinars in a range of languages and hosts seminars all over the world for traders of all experience levels. It has also published a detailed ebook which new traders will find useful and maintains a video library of tutorials, again in a number of languages.

Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer valuable learning experiences for traders вђ“ beginners will also find the weekly market outlook helpful when thinking about how to develop a trading strategy.

Educational material

For new traders, tickmillвђ™s main resource is its ebook, but the beginners will also find the webinars and seminars of great benefit.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well presented and will be a viable trading course replacement for those who enjoy reading. The ebook covers subjects such as the forex trading basics, how forex trading works, the major currency pairs, common trading strategies and the methodology behind forex analysis. The ebook ends with a selection of tips designed to give new traders more confidence in their decision-making.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from basic concepts like news trading strategies to more complex technical analysis and chart theories.

Tickmill also has a schedule of free seminars around the world, many of which will be helpful for more experienced traders вђ“ these are also presented in a number of languages, depending on location.В

The education section is rounded off by a decent glossary of forex terms that will be a useful reference for new traders.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unusual for broker analysts, who typically shy away from direct contact with traders, especially when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

Trading platforms

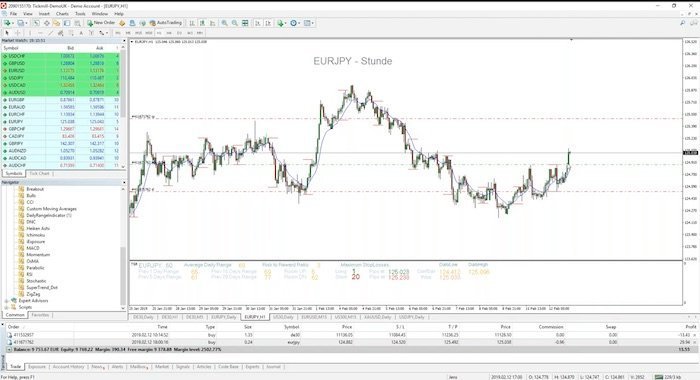

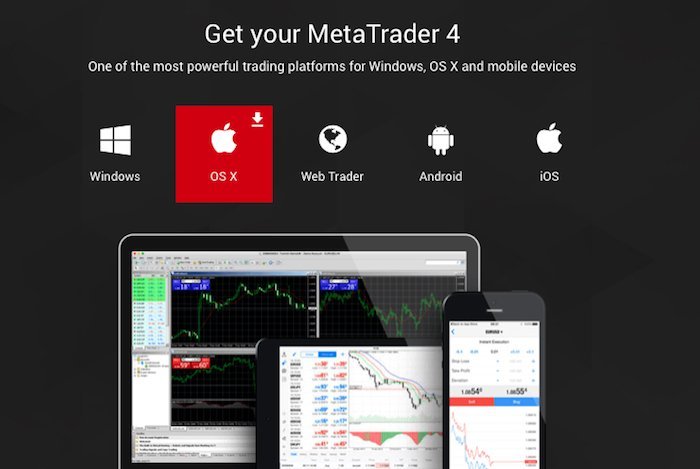

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications.В

MT4 is the industry leader and the most common trading platform for forex CFD traders even though its successor, metatrader 5, has been available for some time. Metatrader 4 has been the industry standard for CFD trading since 2005 and most brokers will still support it.

The advantages of using MT4 are numerous but most centre around the community support and the number of users that the platform boasts. Support is available for MT4 from tickmill customer support and you will also find a wealth of guidance online.

The main advantages of MT4 include:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Trading tools

Tickmill also provides a number of useful trading tools.

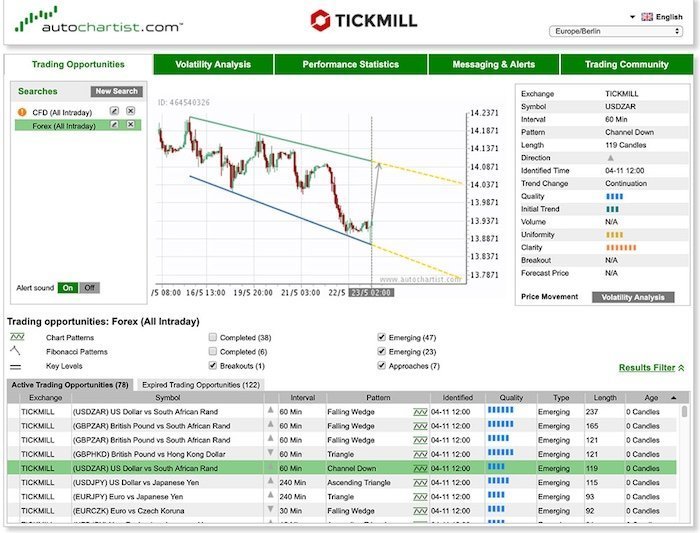

Autochartist

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. It integrates very well into MT4, with information available from inside the chart view without detracting from the other important aspects of the platform. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online and new traders will be able to start using it almost immediately. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available through tickmill is the myfxbook autotrader вђ“ a cross-broker social trading platform that allows new traders to follow and copy more experienced, successful, traders without the need for additional software. As an investor, you are able to look at the performance of a variety of trading systems that have been created by other successful traders. Youвђ™re given the choice between a diverse range of trader systems and can choose a system to follow based on your own trading style.

One click trading

The one click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

VPS service

Tickmill VPS has partnered with beeksfx to provide a discounted VPS service to clients. As one of the largest forex VPS providers, beeksfx gives users access to very low latency networks, where expert advisors can still be easily used.В

Tickmill clients are entitled to the following exclusive benefits with beeksfx:

- 20% discount on all packages.

- Quick setup and a 24/7 live chat and email support.

- Negligible latency due to VPS serversвђ™ adjacent location to tickmill.

- 100% uptime guarantee.

- No shared resources, and increased control.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: trading financial products on margin carries a high degree of risk and is not suitable for all investors. Losses can exceed the initial investment. Please ensure you fully understand the risks and take appropriate care to manage your risk.

Overview

Tickmill is an award-winning and trustworthy non-dealing desk broker with a strong focus on transparency, quality and fast execution. With a good education section, additional premium tools offered to traders for no extra cost, and some of the best trading conditions in the world, tickmill should be a tempting choice for all traders considering a new broker.

Tickmill malaysia

Memberi maklumat tentang forex broker, tickmill yang berlesen dengan FCA UK

Maklumat tentang tickmill, forex broker yang regulated dengan FCA UK

PENGUMUMAN: signal & bimbingan forex (jika anda ZERO dalam forex) – jemputan untuk join group telegram. Klik di sini

Adakah anda tercari-cari info tentang tickmill dan samada tickmill mempunyai operasi di malaysia?

Jangan risau. Laman sesawang ini akan memberi penerangan lengkap tentang forex broker, tickmill dan bagaimana nak mula trade forex dengan mereka.

- Anda masih ragu-ragu nak trade dengan tickmill? Ok, baca review tentang tickmill di sini sebelum anda buat keputusan!

- Jenis-jenis akaun forex yang anda boleh buka dengan tickmill.

- Bagaimana nak buat deposit dan withdrawal.

- Usaha sama tickmill dengan myfxbook autotrade.

- Sepuluh sebab UTAMA kenapa anda harus trade dengan tickmill.

- Anda ada pertanyaan? Sila hubungi kami di sini.

Apakah komen orang tentang tickmill?

(komen-komen ini diambil dari forex peace army. Harap maklum)

Jika anda nak tahu lanjut tentang tickmill, anda boleh klik di sini untuk melawat laman rasmi tickmill.

Tickmill deposit malaysia

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Ulasan terhadap broker tickmill

Ringkasan

Tickmill menawarkan spread dan komisyen yang sangat rendah, 30 USD bonus aluan kepada pedagang baru, pelaksanaan pasaran yang pantas pada platform MT4 dan mempunyai reputasi cemerlang dalam industri.

Semua akaun boleh ditukarkan kepada akaun islamik dan semua pelanggan mempunyai akses kepada autochartist percuma dan salinan dagangan (melalui myfxbook) вђ“ alatan yang hebat untuk pedagang tidak kira tahap pengalamannya. Kerap memenangi anugerah pelaksanaan dagangan danв persekitaran dagangan, tickmill mempunyai reputasi dan prestasi yang dicari oleh pedagang pada broker.

Ulasan

Maklumat akaun

Keadaan dagangan

Butiran syarikat

Cara simpanan & pengeluaran

Platform yang disokong untuk tickmill

Adakah tickmill selamat?

Ditubuhkan pada 2014 oleh bekas ketua brokeraj admiral markets, tickmill secara relatif masih baru, namun telah berkembang dengan cepat untuk menjadi salah satu daripada broker popular dalam banyak pasaran global.

Syarikat ini terbahagi kepada tiga divisyen:

- Tickmill ltd, yang dikawal selia oleh seychelles FSA (lesen: SD 008)

- Tickmill UK ltd, yang telah dikawal selia oleh UK FCA (lesen:В 717270) sejak tahun 2016

- Tickmill europe ltd, yang telah dikawal selia oleh cysec (lesen:В 278/15) sejak tahun 2015

Kualiti dan populariti tickmill dikalangan pedagang mendapat perhatian dan anugerah daripada rakan se-industri; dalam tahun terdekat ini syarikat telah memenangi anugerah untuk broker CFD asia terbaik 2019 (majalah international business), broker pelaksana forex terbaik 2018 (anugerah forex UK) dan persekitaran dagangan forex terbaik 2017 (anugerah forex UK).

Lebih penting lagi untuk pelanggan berpotensi, tickmill adalah penerima untuk broker paling dipercayai eropah 2017 (majalah global brands) untuk fokusnya pada harga yang kompetetif dan berterusan mengekalkan persekitaran dagangan yang adil dan telus.В

Persekitaran dagangan

Semua akaun di tickmill menawarkan pelaksanaan perdagangan pasaran dengan pemprosesan terus (STP) dalam purata 0.15 saat pada 62 pasangan mata wang; selain dari forex, juga pada aset dagangan lain termasuk CFD, index stok, logam, dan bon. Semua dagangan di tickmill dilengkapkan menggunakan model pelaksana tanpa pihak ketiga (NDD) yang sepenuhnya automatik, yang memberikan kecairan dari bank dan dana lindung nilai peneraju tanpa pengubahan semula sebut harga.

Panggilan margin dan peratusan henti-keluar berbeza untuk versi akaun runcitan dan profesional, panggilan margin dan henti-keluar untuk pelanggan runcit adalah 100% ke 50%, manakala profesional adalah 100% ke 30% вђ“ namun semua akaun mendapat kelebihan leveraj sehingga 1:500.

Pelanggan boleh memilih dari tiga dompet mata wang вђ“ USD, EUR dan GBP.

Jenis akaun

Tickmill menawarkan tiga akaun langsung berbeza selain akaun demo, dan semua akaun tersedia dengan pilihan bebas-tukar islamik. Perbezaan utama antara akaun-akaun adalah akaun pro dan VIP adalah berasaskan komisyen dengan spread yang lebih sempit, manakala akaun klasik adalah bebas komisyen, namun yuran broker dialihkan kepada spread yang lebih lebar.В

Akaun demo вђ“ akaun demo tersedia untuk pedagang baru dan akan sentiasa dibuka sehingga tiada lagi log masuk dalam tujuh hari berturutan dan anda boleh menukar baki dalam akaun demo bila-bila masa yang anda inginkan dengan menulis pada pasukan sokongan tickmill. Anda masih boleh menggunakan akaun demo sebaik membuka akaun langsung dengan memasang akaun langsung MT4 dan akaun demo MT4 dalam folder berbeza pada computer anda.

Akaun klasik вђ“ akaun tahap-pemula ini memerlukan deposit minima 100 USD, dan, seperti semua akaun tickmill lain, ini juga menawarkan pilihan akaun bebas-tukar islamik. Spread bermula pada 1.6 pips dan leveraj maksima adalah 1:500 вђ“ ambil perhatian bahawa ini adalah satu-satunya akaun dengan spread lebar daripada mengenakan komisyen pada setiap dagangan.

Akaun pro вђ“ akaun ini juga dengan pilihan bebas-tukar islamik, memerlukan deposit minima 100 USD dan ia adalah akaun-pemula untuk pedagang yang lebih berpengalaman. Spread lebih sempit tersedia dengan tukaran kepada komisyen 2 USD setiap belah setiap lot (100,000) yang didagangkan, jadi 4 USD setiap satu pusingan. Struktur harga dan komisyen ini adalah standard industri dan terletak dalam lingkungan murah berbanding tawaran broker STP lain dengan perkhidmatan yang sama.

Akaun VIP вђ“ akaun ini, dengan pilihan bebeas-tukar islamik juga, adalah untuk pedagang profesional dengan perdagangan berskala besar dan memerlukan baki minima 50,000 USD. Komisyen direndahkan kepada 1 USD setiap belah setiap lot didagangkan, membuatkan dagangan lebih menguntungkan. Ini adalah akaun profesional yang sangat kompetetif yang menawarkan persekitaran dagangan yang terbaik dan salah satu komisyen terendah di dunia.

Spread dan komisyen

Seperti yang dijelaskan diatas, spread dan komisyen akan bergantung kepada akaun:

- Akaun klasik: spread minimum adalah 1.6 pip dan tiada komisyen yang dikenakan.

- Akaun pro: spread minimum adalah 0.0 pip dengan komisyen 2 USD setiap belah setiap lot biasa yang didagangkan

- Akaun VIP: spread minimum adalah 0.0 pim dengan komisyen 1 USD setiap belah setiap lot biasa yang didagangkan

Yuran deposit dan pengeluaran wang

Tickmill menerima deposit melalui berbagai kaedah global dan tempatan, dibawah polisi tiada yuran. Ianya merangkumi:

- Visa/mastercard

- Pindahan bank

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Vn

- QIWI

- Webmoney

Polisi tiada yuran bermakna tickmill membayar balik pedagang untuk sebarang yuran dikenakan sehingga 100 USD untuk sebarang kemasukan wang melebihi 5000 USD. Jika anda dicaj, hantar salinan penyata bank yang menunjukkan caj tersebut, dan wang anda akan dikembalikan.

Tickmill untuk pemula

Tickmill tidak mempunyai kursus perdagangan forex tradisional, namun kerap mengadakan webinar dalam beberapa julat bahasa dan menghoskan seminar di serata dunia untuk pedagang di semua peringkat pengalaman. Ia juga telah menerbitkan e-buku terperinci yang sangat membantu pedagang pemula dan juga menyimpan pustaka video tutorial yang juga dalam pelbagai bahasa.

Tambahan lagi, sementara blog analisis tidak menerangkan asas perdagangan, ia menawarkan ilmu berguna kepada pedagang вђ“ pemula juga akan mendapati bahawa tinjauan pasaran mingguan sangat membantu apabila hendak merancang strategi perdagangan.

Bahan pendidikan

Untuk pedagang pemula, sumber utama tickmill adalah dari e-buku, namun pemula juga akan mendapati bahawa webinar dan seminar mereka juga sangat bermanfaat.

E-buku dengan 46 halaman, berjudul the majors вђ“ insights & strategies, diolah dengan baik dan akan menjadi alternatif kursus perdagangan berdaya maju untuk yang gemar membaca. E-buku tersebut melitupi subjek seperti asas perdagangan forex, bagaimana perdangangan forex berjalan, pasangan mata wang major, strategi perdagangan biasa dan kaedah dalam analisa forex. E-buku ini berakhir dengan tips pilihan dirancang untuk membuatkan pedagang baru lebih yakin dalam pembuatan keputusan mereka.

Webinar diadakan dalam berbagai bahasa, dan semua webinar terdahulu boleh didapati di arkib youtube. Subjek webinar berbeza daripada konsep asas seperti strategi perdagangan berita kepada analisa teknikal dan teori carta yang lebih kompleks.

Tickmill juga mempunyai jadual untuk seminar percuma di serata dunia, yang kebanyakannya akan membantu untuk pedagang yang lebih berpengalaman вђ“ ini semua disampaikan dalam berbagai bahasa, bergantung kepada lokasi.

Bahagian pendidikan disimpulkan dengan glosari sesuai untuk jargon forex yang akan membantu sebagai rujukan pedagang pemula.

Bahan analisis

Pasukan penyelidikan tickmill menyiarkan blog yang meliputi topik berkaitan dengan analisa fundamental dan teknikal. Penyelidikan selalunya meliputi pasangan mata wang berbeza dan menggalakkan pedagang untuk mempelajari tentang acara yang berimplikasi kepada pasaran diluar sumber berita biasa.

Blog ini terbuka untuk semua pembaca dan tickmill membenarkan pedagang untuk menghubungi penulis dengan soalan tentang artikel. Ini adalah sesuatu diluar kebiasaan juruanalisis broker, yang biasanya mengelak dari dihubungi pedagang, terutamanya apabila untuk membincangkan pelaburan spesifik.

Platform dagangan

Tickmill menyokong metatrader4 (MT4) dan web dan aplikasi mudah alih berkaitan.В

MT4 adalah peneraju industri dan platform dagangan yang paling popular untuk pedagang forex CFD walaupun penggantinya, metatrader 5, telah dilancarkan buat beberapa ketika. Metatrader 4 telah menjadi piawaian industri sejak 2005 dan hamper kesemua broker masih menyokongnya.

Terdapat banyak kelebihan dari menggunakan MT4 namun yang paling dilihat adalah sokongan komuniti dan bilangan pengguna yang menjadi kemegahan platform. Sokongan tersedia untuk MT4 dari sokongan pelanggan tickmill dan anda juga akan menjumpai banyak bimbingan dalam talian.

Kelebihan utama MT4 termasuk:

- Komuniti MT4 adalah luas, dan juga bilangan sumber teks dan video untuk membantu pedagang baru dan berpengalaman.

- Komuniti pembangun MT4 EA (penasihat pakar) adalah aktif, menjadikan urusan sewaan atau pembelian algoritma perisian perdangan adalah mudah.

- MT4 mempunyai keperluan sistem yang rendah, jadi peranti atau computer baru tidak perlu untuk dimulakan.

Metatrader4 (MT4) juga boleh didapati pada telefon dan tablet mudah alih ios, android dan windows. Apl akan bersambung dengan akaun sama seperti perisian atas meja, menjadikan pengalaman berdagang berselaras, dan berdagang mudah alih.

Alatan perdagangan

Tickmill juga membekalkan beraneka alatan dagangan.

Autochartist

Autochartist adalah alat menganilis carta automatik pihak ketiga yang mengimbas pasaran untuk ketidakstabilan dan memberitahu pedagang peluang perdagangan yang sesuai. Ia mampu berintegrasi sangat baik dengan MT4, dengan maklumat tersedia dari penglihatan dalaman carta tanpa mengurangkan aspek penting lain platform. Autochartist adalah alat analisa teknikal yang biasa digunakan di kalangan pedagang, jadi video latihan mudah untuk didapati dalam talian dan pedagang baru boleh mula menggunakannya hamper dengan serta merta. Tickmill menawarkan autochartist secara percuma kepada semua akaun langsung dan akaun demo pada tangguhan lima kaki lilin.

Myfxbook

Alatan perdagangan biasa lain yang terdapat melalui tickmill adalah myfxbook autotrader вђ“ sebuah platform perdagangan social rentas-broker yang membolehkan pedagang baru untuk mengikuti dan menyalin pedagang yang lebih berkemahiran dan berjaya, tanpa perlu perisian tambahan. Sebagai pelabur, anda berupaya melihat prestasi berbagai sistem perdagangan yang telah dicipta oleh pedagang berjaya lain. Anda diberikan pilihan dari berbagai sistem pedagang dan boleh memlilih sistem untuk diikuti bergantung kepada gaya dagangan peribadi anda.

One click trading

Penasihat pakar one click trading MT4 (EA) direka bentuk untuk membina mekanisma perdagangan biasa lebih mudah diakses, yang membantu perdagangan dan menyingkirkan navigasi antara tetingkap dan carta yang melecehkan. EA tidak terlebih dalam meringkaskan MT4, namun ia menjadikan perdagangan pada platform lebih mudah.

VPS service

Tickmill VPS bersekutu dengan beeksfx untuk memberikan perkhidmatan VPS pada kadar diskaun kepada pelanggan. Sebagai salah satu pembekal VPS forex terbesar, beeksfx memberikan pengguna akses kepada rangkaian dengan kependaman rangkaian yang rendah, dimana penasihat pakar masih boleh digunakan dengan mudah.

Pelanggan tickmill berhak mendapat kelebihan eksklusif dari beeksfx berikut:

- 20% diskaun untuk semua pakej.

- Pemasangan segera dan sokongan 24/7 chat dan e-mel langsung.

- Kependaman yang sangat rendah memandangkan pelayan VPS adalah bersebelahan lokasi tickmill.

- 100% masa hidup dijamin.

- Tiada sumber yang dikongsi, dan peningkatan kawalan.

Kaedah penilaian

Kami menghargai ketelusan dan keterbukaan dalam cara kami menilai rakan usaha sama. Untuk meletakkan ketelusan di muka hadapan, kami telah menerbitkanв proses penilaian kamiв yang merangkumi pecahan terperinci tentang tawaran tickmill. Berpusat pada proses tersebut adalah penilaian tentang kebolehpercayaan broker, tawaran platform dari broker dan persekitaran dagangan yang ditawarkan kepada pelanggan, yang diringkaskan dalam ulasan ini. Setiap darinya digred, dan skor keseluruhan dikira dan diberikan kepada broker.

Penyata risiko tickmill

Perdagangan forex adalah berisiko, dan setiap broker dikehendaki untuk memperincikan risiko perdagangan CFD forex kepada pelanggan. Tickmill ingin anda mengetahui bahawa: perdagangan produk kewangan pada margin membawa darjah risiko yang tinggi dan tidak sesuai untuk semua pelabur. Kerugian boleh melebihi pelaburan awal. Sila pastikan anda betul-betul faham tentang risikonya dan mengambil langkah berjaga untuk menguruskan risiko anda.

Gambaran keseluruhan

Tickmill adalah broker meja tidak-berunding penerima-anugerah dan boleh dipercayai dengan fokus utama pada ketelusan, kualiti dan pelaksanaan pantas. Dengan bahagian pendidikan yang baik, alatan premium tambahan ditawarkan kepada pedagang tanpa kos tambahan, dan juga dengan persekitaran perdagangan terbaik dunia, tickmill seharusnya menjadi pilihan yang menarik untuk semua pedagang yang mencari broker baru.

Tickmill review

Our tickmill review found this forex broker has a choice of 2 accounts and 1 forex trading platform with metatrader 4. While they have over 60 currency pairs, the range of markets is limited with 2 metals, 4 bonds, 14 indices but no crypto or shares

| ��️ regulation | UK, europe, south africa, malaysia |

| �� trading fees | low spreads |

| �� trading platforms | MT4 |

| �� minimum deposit | $100 |

| �� deposit/withdrawal fee | $0 |

| ��️ instruments offered | forex, cfds, bonds |

| �� credit card deposit | yes |

Tickmill account types

Tickmill offers you the choice of three account types for trading forex and cfds using a no dealing desk model with ECN style pricing. These include the pro account, the classic account, and the VIP account. Each of these account types will suit a different level of trading experience.

- When trading with tickmill, all accounts include the following features:

- Minimum lot size of 0.01 (micro-lots)

- Available base currencies: USD, EUR, GBP

- Hedging, scalping, arbitrage, expert advisors permitted

- Swap-free islamic account options

Pro account

You can get started with a pro account with a minimum deposit of $100. The pro account offers low spreads from 0.0 pips EURUSD and charges commission fees of $2.00 per side ($4 round-turn) per lot. This account offers the best pricing for retail traders, as it has ECN pricing.

This account is the most popular among traders because of the low commission rate and tight spreads.

Classic account

The classic account is the same as the standard account that many brokers offer. This means you will not pay commission fees. To open a classic account, you will require a minimum deposit of $100. Spreads start from 1.6 pips. The classic account is more suitable for beginner traders with little experience.

VIP account

There is no minimum deposit required for the VIP account, however, you will require a minimum account balance of $50,000 to trade. This makes this trading account more suitable for experienced traders. Spreads start from 0.0 pips, and the commission fees are only $1.00 per side.

Islamic account

Tickmill also offers islamic accounts for traders of the muslim faith. You can select from a pro account, classic account, or VIP account and convert it to an islamic account. Trading conditions remain the same as with the other trading accounts, along with compliance with the sharia law.

Our rating

The overall rating is based on review by our experts

Spreads

Tickmill offers competitive spreads across a range of 62 currency pairs, stock indices, oil, metals, and bonds. The classic account offers slightly higher average spreads on the range of currency pairs. Typical spread data from the pro account and VIP account shows an offering of 0.10 pips on the EUR/USD pair.

Commission spreads

The following table compares the average spreads across a range of commission-based account types, including the pro account and VIP account from tickmill.

Data taken from broker website. Accurate as at 05/01/2021

Non-commission spreads

The following table displays average spreads from non-commission accounts with the classic account from tickmill and others.

Leverage

What is leverage?

Price movements in the forex market can be small. Leverage is a tool that allows you to access borrowed equity to trade with higher without investing an exorbitant amount of using your own funds. For example, trading with 1:100 leverage will allow you to trade up to $100,000 with only $1,000 in your account. Remember that this invokes a high risk as price movements can turn unfavourably in certain trading environments.

What determines leverage?

The maximum leverage that a CFD broker can offer depends on what the regulator of the country you are trading from will permit. Tickmill uses the following regulators: FCA, cysec for clients in the UK and europe, FSCA for clients in south africa, LFSA for malaysia clients and FSA for clients in other regions.

Retail investor accounts (for clients in the UK and europe):

- Up to 1:30 on forex in the UK and europe

- Up to 1:20 on stocks indices and oil

- Up to 1:20 on metals

- Up to 1:5 on bonds

FCA and cysec regulations are tighter than most regulators in other countries require. However, if you are in the UK or europe, you may be eligible for a professional account which will allow you to access leverage in line with tickmill clients in other regions.

Professional investor accounts (UK and europe clients) and retail investors accounts (outside the UK and europe):

- Up to 1:500 on forex

- Up to 1:100 on stocks indices and oil

- Up to 1:500 on metals

- Up to 1:100 on bonds

Trading platforms

Tickmill only allows you to trade using the most popular trading platform: metatrader 4. Despite the minimal selection of trading platforms, metatrader 4 is the most commonly used system and provides a range of features to help you trade the financial markets.

Metatrader 4

Metatrader 4 is the first and most popular trading platform developed by metaquotes software. Metatrader 4 is user-friendly, customisable, and designed to let you trade with ease on desktop or mobile trading (including ios and android). This platform is the favourite among many forex traders around the world because of its sophisticated level of trading analysis tools, customisable interface, charting functionality, and access to expert advisors through the accompanied metatrader marketplace.

Along with the advanced trading conditions from tickmill, you can enjoy many features from using the metatrader 4 trading platform:

- Fast order execution on a range of cfds including forex, stock indices, commodities, and bonds

- Expert advisor trading facilities and advanced trading signals (run on tickmill VPS) suitable for scalping

- Provision of fundamental and technical analysis tools including over 50 indicators and customisable charting

Metatrader 4 webtrader

The metatrader 4 webtrader platform allows you to access the markets online directly through your web browser. The webtrader trading platform through tickmill makes trading more accessible as the metatrader system is available directly in your browser. Equipped with all the same functions as the original, the webtrader version has enhanced security with data encryption. However, the trade execution time is a little more lagged.

The metatrader 4 webtrader trading platform offers:

- Access to one-click trading through all modern browsers

- Real-time quotes on customisable price charts

- Over 30 indicators to use across 9 different time frames

- Trading history and encrypted data transmission

Other platform

Myfxbook copy trading

If you prefer to copy the trades of other successful traders, then myfxbook is available within your metatrader 4 trading account.

Myfxbook works by providing you with tools to find and follow other traders in their social network. You can then use filters which will allow you to replicate their trades within the conditions you set. Social trading is popular for those that don’t have the experience or time to invest in trading themselves, instead, you can leave the work to other traders.

Third-party tools

Tickmill clients can access third-party technical analysis tool autochartist. This is one of the most comprehensive forex trading tools that can add some value to your trading. Authochartist uses advanced technology to analyze past market trends and identify real-time trading opportunities across a wide selection of CFD instruments.

Some of the best tools included in the autochartist market analysis pack include:

- Automated trade alerts

- Volatility analysis for SL and TP optimization

- Fibonacci patterns

- Market reports delivered 3 times per day

- Historical performance statistics

- The key support and resistance levels

- Customizable searches to only get the data you need

Autochartist is offered free of charge to all tickmill live account holders. This tool is offered as an MT4 plugin as well as a standalone web application.

Financial products

A range of trading instruments including forex, stocks indices and oil, precious metals, and bonds are available.

Tickmill does lack some diversity in the cfds on offer. For example, you cannot trade popular cfds such as cryptocurrencies, stocks, etfs or soft commodities (such as crops and livestock) through tickmill. This can limit your ability to spread your risk through investment diversity.

Forex

The forex market is the most popular financial market because of its volatile price movements and 24/5 availability for trading. When trading forex, you are simultaneously buying and selling currencies for profit. Tickmill offers you access to over 60 currency pairs, allowing you to trade popular currencies such as USD, EUR, and GBP. Spreads start from 0.0 pips, and the average trade execution speed is 0.20 seconds.

At tickmill, trading minor and exotic forex pairs is also available with no requotes and ultra-fast execution speed of 20ms.

Stock indices and oil

Stock indices allow you to track a group of stocks to buy and sell them as an aggregate, rather than picking single stocks. Where stocks show the performance of a company, stock indices are useful to determine the economic health of sectors, industries, or countries. Tickmill offers 14 stock indices with no commission fees.

Trading WTI oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Trading oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Precious metals

Gold and silver metal commodities against the USD are available through tickmill. These trading instruments are relatively uniform across the world and are typically safer assets during periods of market uncertainty. With the metatrader 4 trading platform, you can trade gold and silver from 0.0 pips spreads, no commissions, and an average trade execution speed of 0.20 seconds. Much like the forex market, you can trade precious metals 24/5.

The tickmill range of precious metals is small. Other popular metals such as copper, palladium, platinum are not available.

Bonds

Tickmill offers 4 types of government bonds (also known as treasury cfds) which are agreements between borrowers and lenders that you can trade over the counter. These bonds are futures (cash) contracts. Tickmill provides access to german bonds from 0.0 pips spread and no commissions.

Customer service

Hours of support

Tickmill provides extensive trading services and customer support with the head office in london, united kingdom. You can contact the CFD broker through the client support number or office number during 7:00 to 16:00 GMT monday to friday. Tickmill also provides a support email with a response time within 24 hours on business days. A livechat is also available through their website tickmill.Com, one can choose from 14 different languages.

Education and research

Tickmill provides a range of educational resources to help you improve your trading experience with tickmill. Some of these tools are available for download and some require registration. These tools can help you improve your trading strategies.

- Ebooks – topics include introduction to fibonacci analysis, know your trading costs, risk management, trading forex

- Videos – forex trading, market analysis, trading psychology, trading strategies, social trading, stocks, MT4

- Webinars – hosted by forex experts, these webinars are in a range of languages including english, german, polish, portuguese, turkish

- Seminars – these seem to have stopped at least for 2020 but are allow you to hear from forex experts online

- Infographics – these are visual graphics that visualise data, charts and statistics on trading topics

Minimum deposit – funding

Tickmill has a zero fees policy for deposits and withdrawals. This means there are no costs from the brokers’ end for using when transferring funds. If your wire transfer and your deposit are greater than $5000, tickmill will refund any fees up to $100 with if you can provide a bank statement.

To open an account with tickmill, you will require a minimum deposit of $100. To access a VIP account, your balance will need to be $50,000 to open your position. Tickmill accepts 4 different deposit currencies EUR, GBP, USD and PLN. Deposits made in unsupported currencies will be converted incurring a conversion fee to the previously mentioned currencies.

Tickmill offers a range of deposit and withdrawal methods, and there is a minimum withdrawal requirement of $25. Fund transfer will be instant or up to 1 working day:

- Bank transfer

- Visa and mastercard

- Skrill

- Neteller

- Dotpay

- Paysafecard

- Sofort

- Rapid transfer

- Paypal

- Unionpay

- Fasapay

- Qiwi

Tickmill doesn’t have any official inactivity fees however tickmill may apply charges if they believe you are not actively using your account.

Regulation and risk management

Global regulation

Tickmill has regulation in several countries including:

- Tickmill UK ltd: financial conduct authority (FCA) for the UK (register number 717270)

- Tickmill ltd: seychelles financial services authority (FSA) for seychelles (licence number SD008)

- Tickmill europe ltd: cyprus securities and exchange commission (cysec) for cyprus (licence number 278/15)

- Tickmill asia ltd: labuan financial services authority (LFSA) for labuan (licence number MB/18/0028)

- Tickmill south africa (pty) ltd: financial sector conduct authority (FSCA) for south africa (licence number FSP 49464)

Tickmill asia applies for clients in malaysia, all clients outside tickmill subsidiaries that have FCA, cysec, LFSA and FSCA regulation will have FSA regulation. While tickmill policies for FSA will be in line with other regulators, you need to remember that FSA is an offshore regulator. So if you have any complaints, you may not have the protection you need to settle disputes in case of scams.

If you are australian or from dubai, then you may note that tickmill does not have ASIC or DFSA regulation. We don’t advise using regulators outside your country. So tickmill may not be a suitable broker for your situation.

Risk management features

If an account falls below a zero balance, tickmill will cover the debt by providing negative balance protection. This means that tickmill will cover any losses below a zero balance on your account in the event of trading losses or excessive slippage. The forex broker also uses a risk department to monitor traders’ risk appetite and may notify the client of excessive risk-taking or even reduce the leverage.

Tickmill provides a degree of risk management to improving trading conditions. The range of educational resources and research-based features helps you to improve your trading ability on a demo account before testing your skills with a live account. These tools are a form of risk management as they ensure you understand the nature of trading before getting started.

Furthermore, tickmill allows the maximum leverage depending on the relevant regulatory entity. For retail clients trading forex, leverage is capped at 1:30 whereas professional clients can access leverage up to 1:500. Tickmill also provides a simple and transparent calculation of the required margin for clients to visualize the risk of trades.

Tickmill FAQ

Is tickmill an ECN broker or market marker

Tickmill is an ECN pricing. Tickmill doesn’t advertise themselves as an ECN broker or STP broker but they offer ECN pricing because they connect you with forex liquidity providers without a dealing desk. This is why spreads are low. As there is no dealing desk, tickmill is not a market maker.

If you are looking for other forex brokers with ECN pricing then see our best ECN brokers. All these brokers offer ECN trading execution using the MT4 trading platform.

What trading platforms does tickmill offer?

Tickmill only offers one trading platform. This is metatrader 4 (MT4). Metatrader 4 is the world most popular platform with brokers and traders so is a solid choice for a trading platform.

Some traders may wish to consider metatrader 5 over metatrader 4 as metatrader 5 allows you to deal with exchange-traded cfds and has superior trading features and speed.

Is tickmill good for beginners?

Tickmill can be a good option for beginners as they have a commission-free account (called the classic account), negative balance protection ensures you account balance never goes below zero, metatrader 4 trading platform and a demo account.

If you are looking for other suitable trading platforms for beginners, see out best trading platforms for beginners.

Is tickmill a good choice for australian traders?

You can certainly use tickmill if you are in australia, however, you will be using seychelles financial services authority (FSA) as your regulator. Compareforexbrokers never recommend using an offshore regulator. If you are trading in australia then we suggest our best brokers australia who all have regulation with the australia securities investments commissions (ASIC).

Overall

With a choice of a classic account which is commission-free and ECN pricing accounts all which allow hedging, scalping and eas, tickmill is a suitable forex broker for traders of all levels of experience. The $2 commission per lot to open your position is some of the best in the market. However, tickmill has a few weaknesses. The broker only offers the metatrader 4 trading platform, which many consider the gold standard for trading platforms however it would be nice to have another trading platform to choose from. Tickmill also limits the range of cfds you can choose from. Overall, tickmill is one of the better brokers, but pepperstone exceeds the broker in most areas.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

5 key facts about tickmill

- Minimum deposit

- $100 - Forex platforms

- metatrader 4 - Trading fees

- low commissions - Regulated by

- cysec

- FCA

- FSCA

- LFSA - Trading account

- classic

- pro - Tradable instruments

- forex

- cfds

- bond CFD

visit tickmill >>

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

So, let's see, what was the most valuable thing of this article: tickmill forex malaysia вђ“ review & penarafan broker forex tickmill malaysia! Akaun forex tickmill, platform, spread, syarat-syarat dagangan, deposit/pengeluaran & lebih banyak! At tickmill deposit malaysia

Contents of the article

- Real forex bonuses

- Tickmill malaysia - tickmill broker review

- Tickmill broker review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- Tickmill malaysia

- Maklumat tentang tickmill, forex broker yang...

- Apakah komen orang tentang tickmill?

- Tickmill deposit malaysia

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Ulasan terhadap broker tickmill

- Ringkasan

- Ulasan

- Maklumat akaun

- Keadaan dagangan

- Butiran syarikat

- Cara simpanan & pengeluaran

- Platform yang disokong untuk tickmill

- Adakah tickmill selamat?

- Persekitaran dagangan

- Jenis akaun

- Spread dan komisyen

- Yuran deposit dan pengeluaran wang

- Tickmill untuk pemula

- Bahan pendidikan

- Bahan analisis

- Platform dagangan

- Gambaran keseluruhan

- Tickmill review

- Tickmill account types

- Pro account

- Classic account

- VIP account

- Islamic account

- Spreads

- Leverage

- Trading platforms

- Financial products

- Forex

- Customer service

- Minimum deposit – funding

- Regulation and risk management

- Global regulation

- Risk management features

- Tickmill FAQ

- Is tickmill an ECN broker or market marker

- What trading platforms does tickmill offer?

- Is tickmill good for beginners?

- Is tickmill a good choice for australian traders?

- Overall

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.