Jp markets minimum withdrawal

Also, it is imperative to clarify that orders may get closed before it reaches the TP or SL levels due to account reaching a stop out level.

Real forex bonuses

Spreads are variable based on market conditions. However, JP markets offers some of the most competitive spreads in the market. On average you can get EUR/USD for about 2 pips, under normal market conditions.

Jp markets minimum withdrawal

JP markets does not have a strict minimum deposit – our clients are welcome to invest whatever they are comfortable with. We do however recommend starting with around R3 000, particularly if you require training.

How much does JP markets charge for training?

Our clients enjoy complimentary access to some of the best forex training and mentorship at no charge, provided they have live, funded accounts with JP markets – there are different levels of access available depending on the value of your investment. We offer classes at selected offices across south africa, or online and video courses should you prefer to learn at your own pace.

Have a look at our training calendar on our website or email learn@jpmarkets.Co.Za to book, or to enquire about our self-study options.

What documents are required to open an account?

As a licensed financial services provider, we are obligated to comply with the financial intelligence centre act (also known as FICA). This act is the government’s response to the global fight against money laundering and fraud. To comply with the act, we must identify, verify and update clients’ information, which includes their proof of residence or proof of address. In short – these efforts ensure a safer financial system for all of us. As most of our business is conducted online and we do not transact with our clients face-to-face, we are subject to stricter laws than other entities. We therefore require the following in order to validate your account:

- A certified copy of your ID.

- Confirmation of residential address. Examples include the following:

- A utility bill reflecting the name and residential address of the person;

- A recent lease or rental agreement reflecting the name and residential address of the person;

- Municipal rates and taxes invoice reflecting the name and residential address of the person;

- Mortgage statement from another institution reflecting the name and residential address of the person;

- Fixed -line telephone account reflecting the name and residential address of the person;

- Valid television licence reflecting the name and residential address of the person;

- A statement of account issued by a retail store that reflects the residential address of the person.

- We will also require confirmation of your bank details in order to process any withdrawals.

I don’t receive any mail in my name – what can I submit as proof of address?

You can request a cohabitation form from us, and ask the homeowner to complete and submit along with their supporting documentation. Alternatively you could approach your ward councilor or local police station for an affidavit confirming your residential address.

I just tried to login and it says invalid login/password/no connection.

Open your MT4 client terminal.

Click on open an account.

Click on scan and let the whole scanning of the servers finish.

Once scanning finishes, click on jpmarkets-live (for live) or jpmarkets-practice (for demo).

Input login and password and you should be able to connect.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

How do I fund my trading account?

JP markets differs from its competitors because we are authorized and licensed to accept local deposits from clients. We have bank accounts with absa, FNB, standard bank and nedbank, as well as multiple payment gateways. It’s as easy as doing an EFT or cash deposit, or a simple card transaction on our website with your preferred intermediary. Please click here for more details: jpmarkets.Co.Za/bank-details.

Can I fund my account using bitcoins?

Yes you can, but only via skrill – fund your skrill wallet using bitcoin and use this intermediary to fund your JP markets trading account.

What reference must I use when I make a deposit?

Please use your MT4 account number as reference number when making a deposit. Should your MT4 number not be active, please use your full name and surname. You can also forward your proof of payment to finance@jpmarkets.Co.Za with your MT4 number in the subject line.

What is the turnaround time for my deposit to be allocated and reflect in my account?

Deposits are allocated almost instantaneously but because this is done manually, we try to adhere to a maximum TAT of 1 hour during business hours. Please be aware that this window may be slightly longer around news events etc.

My deposit has not reflected on my account – what is the problem?

Please ensure that you have used the correct reference, and that your proof of payment contains the following:

- Sending bank, and recipient bank, details.

- Date of transaction.

- Amount.

- Beneficiary reference.

Kindly note that due to high incidences of fraud, we cannot allocate bigger amounts until they have reflected in our bank account. It is for this reason also that all cheques deposits are subject to a 10-day clearance period.

I just downloaded MT4, why can’t I place any trades?

Sometimes upon downloading, not all symbols are displayed automatically. To enable this, you need to do the following:

– right click on your ‘market watch’ list. – select ‘show all’

Please make sure that you trade the instruments that has a dash (-) next to it.

I forgot my password for the client portal.

To reset your password, go to JP markets home.

– enter your email address and select ‘reset’

You will receive email instructions to reset your password.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

I forgot my password for my trading platform.

Log into your client portal via our website and click ‘my accounts’ then click on the account number (in blue) to access your trading account.

Click on ‘change password’

Enter the new password in both blocks and submit – you should now be able to access your trading account with your new password.

How do I request a withdrawal?

Withdrawing funds from your JP markets account is easy and quick. Withdrawal are processed monday to friday from 9am to 5pm, GMT +2 (south african standard time), with all others being acted on within 24 hours.

For security reasons, we will call you to verify the request- if you are expecting a withdrawal, please answer any 087 / 010 / 021 calls to avoid further delays.

Please log in to your member area at secure.Jpmarkets.Co.Za and do an internal transfer from your trading account to your landing account.

Click on ‘transfers’ on the top grey bar and select ‘internal transfers’ from the bar on the right hand side.

The ‘from’ account is your trading account and the ‘to’ account is your landing account.

Enter the amount (in your trading currency) that you would like to withdraw. We will process the conversion on our side and click on submit, and it will go to our finance department for verification.

Ensure all documentation is in order before submitting your request, or it will be declined. We require clear, scanned copies of the following in order to process a withdrawal – ID, proof of address and bank statement confirming your INDIVIDUAL bank details – we are not allowed to process third party payments as per FSB regulations.

More information relating to withdrawals is available on our website.

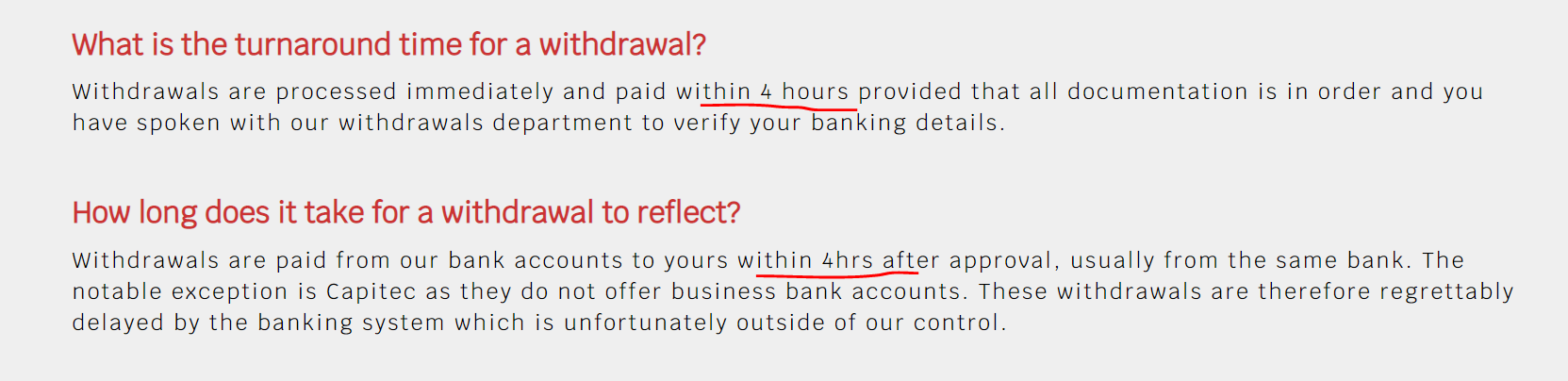

What is the turnaround time for a withdrawal?

Withdrawals are processed immediately and paid within 4 hours provided that all documentation is in order and you have spoken with our withdrawals department to verify your banking details.

How long does it take for a withdrawal to reflect?

Withdrawals are paid from our bank accounts to yours within 4hrs after approval, usually from the same bank. The notable exception is capitec as they do not offer business bank accounts. These withdrawals are therefore regrettably delayed by the banking system which is unfortunately outside of our control.

Can I withdraw a bonus?

Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

How much is a spread?

Spreads are variable based on market conditions. However, JP markets offers some of the most competitive spreads in the market. On average you can get EUR/USD for about 2 pips, under normal market conditions.

Does JP markets have control over the spread/platform?

No, JP markets has no control over the platform, spreads or clients’ accounts. Unlike some other brokers, our liquidity comes directly from the biggest banks in the world such as JP morgan. UBS and morgan stanley to mention just a few. As a result, the spread is determined by the market conditions. The platform is a 3rd party company – we basically connect our best pricing into MT4. As a result, clients receive market pricing and the most stable and fair pricing.

How much is a swap?

Swaps are dependent on the pairs but can be checked by right clicking in your market watch, and selecting ‘symbols and properties’.

Pending order expiration

When setting a pending order(buy/sell limit OR buy/sell stop), you specify price and can also specify expiry.

In the MT4 platform you can either uncheck or check the expiry box. When unchecked, the pending order will be GTC (good till cancelled), thus the pending order will not expire unless you close it manually. If the expiry box is checked, you will be prompted for a time, take note that the default time is to expire at the close of the next hour.

In the mobile MT4 platform, you will also be asked for expiration either GTC or an expiry time/date. The default is also to expire at the close of the next hour.

Even if you specify a stop loss, the price specified as stop loss is not guaranteed as you may get a worst price due to market conditions as stop orders are always executed as market orders.

Also, it is imperative to clarify that orders may get closed before it reaches the TP or SL levels due to account reaching a stop out level.

Does JP markets give signals to clients?

JP markets does not give signals to clients. However, we do provide world class information and education around specific pairs and symbols and what is happening in the markets. These are sometimes received up to 3 times a day via SMS and email to ensure you get the best available information to make the most informed trading decision. Remember, your success is our success.

Does JP markets buy mandela coins?

JP markets does not accept mandela coins as a preferred method of payment as it is not authorized by the FSB. Clients can cash this in at their bank and then fund their account via the usual channels.

How do I become an introducing broker (IB)?

You can sign up directly on our website under our partners tab. You can also call on at our head office on 021 276 0230 or email support@jpmarkets.Co.Za.

We pay the best commissions in the industry and you can withdraw your rebates at any time. You can also track your rebates on your MT4 account which you can trade with or withdraw at any time. We also have a dedicated team of IB professionals that help you with your business from building a website, hosting seminars, online marketing, designing banners to mention a few. These individuals are focused to take all these tasks away from you to ensure you can focus on sales.

Our goal for all our partners is to help them grow so that one day they too can open their own brokerage, if that is their aim. Our sister company, JP technology, can assist with all the requirements to start your own brokerage.

We can also tailor make a structure to suit your individual requirements. Your success is our success!

What different account types does JP markets offer?

We understand that traders are different, and therefore their requirements are different, based on their trading style. As a result, we offer different types of accounts structured to suit you as a trader. We have ZAR, USD and GBP based accounts, as well as accounts which charge you commission or an account which charge you spread as a cost. All these accounts have direct market access and your order flows directly into the market, thereby ensuring you receive the best possible market price from the forex market with no manipulation of prices, slippages or lagging of any sort. We do not differentiate between micro or mini accounts – you are free to trade all available pairs without restriction.

What is the difference between ECN and standard accounts?

An ECN account stands for electronic communication network. It means that your orders are executed directly in the market. The difference between the two is that on an ECN account, you will see a commission charged per transaction whereas on a standard account you will be charged on spread. Both accounts work out to similar in cost so it is all dependent on what you as a trader prefer.

How much is the commission on an ECN account?

The commission charged is $ 10 per lot. We do offer a lower commission on our VIP accounts.

Why was my stop loss / take profit not hit?

System brief the way pending orders work in financial markets is as follows:

If a client has placed a buy limit or a buy stop order, the orders will get executed if the ask price reaches the specified level.

If a client has placed a sell limit or a sell stop order, the orders will get executed if the bid price reaches the specified level.

If a client has placed a buy order, both SL (stop loss) and TP (take profit) levels will be executed if the bid price reaches the specified levels.

If a client has placed a sell order, both SL (stop loss) and TP (take profit) levels will be executed if the ask price reaches the specified levels.

- By default, MT4 platform only displays bid price line. Enable the ask price line on the charts.

- All the highs and lows of all symbols are made from the bid prices.

Clients make their trading decisions based only on the bid price line which is what they see ontheir charts and then think that their stop loss and take profit levels were wrongly executed.

Clients place trades only using the pricing information on the charts which is not the right way asthe charts are made not from the tradable prices but from pricing library.

Clients should place trades using the prices displayed on the market watch as those are theprices JP markets is willing to buy and sell.

How a chart looks with only bid price line

How chart looks with both bid and ask price lines

How does JP markets make money if you are offering free courses and your clients are “profitable”?

JP markets makes revenue when clients trade. Therefore the more that clients trade, the more revenue that is made. It is for this reason we ensure that our clients receive all the knowledge and tools available to be able to make their own educated trading decisions.

Who regulates JP markets?

JP markets is an authorized FSP 46855. We are regulated by the financial services board and the responsible acts such as FIC act, SARB and FICA act.

How much money can I make if I deposit X amount?

Your profits all depend on the type of trader you are. There are no limitations or restrictions on what you can make in the forex market. Some people have managed to make 10 000 % in one day but what is important is to manage your risk.

I want to start trading but I don’t know how?

We can teach you through our online courses, PDF forex book or any of our free classes we host. Contact us at learn@jpmarkets.Co.Za to find out more.

Do I have to pay JP markets for their services other than my investment?

No, there are no fees you have to pay.

Can JP markets trade on my behalf?

No, we do not trade clients’ funds on their behalf, and we do not recommend that you give your login credentials to anyone to trade on your behalf. We can however teach you how to trade the markets on your own. Alternatively you could link your account to that of a master trader – check out our social trading facility here copytrader.Jpmarkets.Co.Za. You can compare the trading history of the available traders and pick the one whose trading strategy is most closely aligned with your investment goals.

Does JP markets make any deductions for taxes on the money I make/withdraw?

No, we do not make any deductions – your tax considerations are completely between you and SARS. However, it should be noted that any profit that you make from trading forex will be classed as contributing to your gross income in the income tax act, and thus would be taxed as income, based on the income tax tables for an individual. Consequently, any expense that you incur in the production of the income can be deducted. Please speak to your tax consultant to be completely clear about the tax implications.

Is my money safe?

Your funds are completely safe. Funds are kept in client to client segregated accounts which gets monitored and audited daily by a third party registered auditor every single day. Therefore, your funds are separate and completely safe and secured. In addition, we also have fidelity and professional indemnity insurance to give our clients that extra piece of mind.

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

JP markets minimum deposit

The JP markets minimum deposit amount that JP markets requires is ZAR3,000.

The minimum deposit amount of ZAR3,000 when registering a live account is equivalent to USD 170,38 at the current exchange rate between south african rand and the US dollar on the day that this article was written.

JP markets is a south african-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as JP markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

JP markets does not charge any fees when deposits are made into the trader’s account, and traders can deposit the minimum deposit amount by using any of the following methods:

- Bank transfer (ABSA, FNB, nedbank)

- Credit/debit cards

- Skrill

- I-pay

- Payfast

- Transfers from atms, and

- Snapscan, and

- Mpesa

JP markets supports a variety of deposit currencies in which traders can fund their accounts including:

- USD

- GBP

- ZAR

- KWD

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by taking down the banking details provided to transfer funds via EFT, or traders can follow these steps for other payments:

- Navigate to the JP markets website and log into the client portal.

- Select the deposit option, the payment method and amount.

- Follow the instructions and additional prompts to deposit the minimum amount.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Small variety of deposit methods supported |

| 2. Only a few deposit currencies supported |

What is the minimum deposit for JP markets?

Interactive brokers does not have a specified minimum deposit.

Professional accounts, however, have certain minimum deposits depending on the account that the professional trader opens.

How do I make a deposit and withdrawal with JP markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Bank wire transfer

- US automated clearing house (ACH) transfer initiated at interactive brokers

- Cheques

- Direct debit/electronic money transfer

- Canadian electronic funds transfer, or EFT

- Single euro payment area (SEPA)

- BACS/GIRO/ACH

Does JP markets charge withdrawal fees?

The first withdrawal is free, thereafter traders will be charged per withdrawal depending on the size of the withdrawal and the method of payment.

JP markets review

JP markets is among the many forex markets that are increasing in popularity. It gives its clients a single type of account with variable spreads, as well as additional benefits. However, the site does not allow the use of (EA) automated strategies, scalping and hedging.

Who is behind JP markets?

Established in 2016, JP markets is a forex broker that has its base in south africa, and happens to be the leading african and south african forex broker, with services expanding into other countries such as bangladesh, swaziland, kenya and pakistan.

The company operates under approval from the financial services board (FSB), south africa, FSP 46855. This gives the technology and platform allowing african-based clients to trade successfully in forex markets around the world.

JP markets focuses on assisting clients at a localized level through customer service as well as tools that can assist in succeeding on that front. The company prides itself on being the only brokerage worldwide that gives interest on trading accounts (this is subject to a specific minimum balance), as well as other industry firsts and benefits to various clients.

The founder is a south african entrepreneur, justin paulsen. He has extensive knowledge on the financial sector, having obtained a degree in economics and finance from the university of cape town. He has also worked with several brokers and forex agencies before setting up the company.

Trading services offered

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform.

You may wonder why the base is in south africa. One reason is that many investors view south africa as a country with great potential, since it is among the most developed countries on the continent. The regulator, FSA, has enforcing powers that allow it to deal with breaches in forex brokerage, while it also runs the office of the omud for financial services providers, which is a customer complaints service.

Regulation within the country is not among the best in the world, though there is some level of reliability in the sector. If you are a local broker with a trading license, you need to keep all your client funds in recognized banks in the country within segregated accounts.

Advantages of MT4 trade platform

As the industry standard platform, MT4 lends itself to various traders as an easier alternative, thanks to the richness of its features. It places itself among the leading platform in online trading due to its foreign exchange agency model implementation, unconventional organization of trading, as well as competitive assessments.

You can use algorithmic traders as well as expert advisors (eas), which automate your exchange and make the process easier for you. MT4 allows you to see the marketplace you are dealing with, all within real time, highly accurate and impeccably judge all your exits and entrances.

Accounts available on the platform

Clients have a single account type to choose, and this account comes with no commission fees imposition, fixed spreads, STP (straight through processing) market execution and leverage that reaches a maximum of 1:500. You can get PAMM services as well.

Straight through processing

This service means that the forex broker will send the customer’s order directly to larger brokers or banks without the order passing through a dealing desk. That implies that there are no delays in the process and the processing of transactions is faster.

It has several advantages, which include:

STP brokers make their money through addition of small commissions, which are markups to the spreads

The losses of the client are not the profits of the broker

When the trader loses or wins, the exact markup will go to the broker, so this eliminates conflict of interest

A related aspect to STP is NDD (no dealing desk), which gives brokers access to the inter-bank forex markets. In addition, this eliminates conflict of interest, filling orders and re-quotes.

Deposit and withdrawal options

The platform does not offer a wide range of deposit options. The bank option is ned bank, with the deposit details. Keep in mind that the south african reserve bank (SARB) will always convert international payments to their base rate. Other options include bitcoin, credit and debit cards, neteller and skrill.

You need an initial deposit minimum of R3500, and this is a reasonable amount especially when you compare it to other south african brokers. In addition, allocations of payments can take a maximum of 24 hours on business days (from monday to friday).

An interesting aspect to JP markets is the allowance for sending withdrawal requests through whatsapp, which is unseen on other platforms. The withdrawals are easy and fast to process (the process takes about 24 hours), and you can do the process on official working days from 9am to 5pm.

The platform uses secure and safe ways to send you your money, while all transactions undergo rigorous processing to ensure your money stays safe.

The option is through local bank transfer, as the site does not allow e-wallets or any other mediums of withdrawal. The time it takes to receive funds depends on the bank you use. For instance, standard bank, ABSA, nedbank and FNB allow you to get your money within the same day, while other banks could take up to two days.

As with any other withdrawal process, you need to have proof of documentation before you submit your withdrawal request. This includes scanned copies of your ID, bank statements and proof of address, all confirming your details as per regulations from the FSB.

Keep in mind that all withdrawals that you make through credit cards have an extra fee of R50. For the case of bank transfers, there are no charges for withdrawals, but you are liable for any fees that the individual bank charges in the transaction, including the use of intermediaries.

Commissions, leverages and spreads

The maximum amount of leverage you can get is 1:500, which many investors consider high, even with other brokers offering higher or similar rates.

Note that with higher leverage comes higher risks of losses, and this is the reason many jurisdictions set caps on leverage rates.

Any promotional bonuses?

There are a few promotions that the company offers, which include:

30% welcome on deposit bonus, and this is valid for 60 days

Currently, the minimum amount that qualifies you for any bonus is R3000. There is also not much information regarding bonuses.

The platform does not charge you extra commission fees, which may be a good thing. However, we do not like the spreads, as we find them too wide to be competitive – they are 2.4 pips on average for USD/EUR.

Even though fixed spreads are wider than floating ones generally, many other brokers will offer you a better deal.

Pros of the JP markets platform

The FSB regulates its activities

MT4 is available on the site

Same day deposits and withdrawals are possible

You can trade in rand, other than USD or EUR

There is a limited choice of trading platforms

The spreads are too wide

You cannot use eas, hedging or scalping techniques on the platform

Final thoughts

JP markets is a CFD south african broker and forex company that the FSA regulates actively. They support the MT4 platform, making them easy to use for many traders. However, the spreads are higher than the average, and this unfortunately places many restrictions on trade.

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

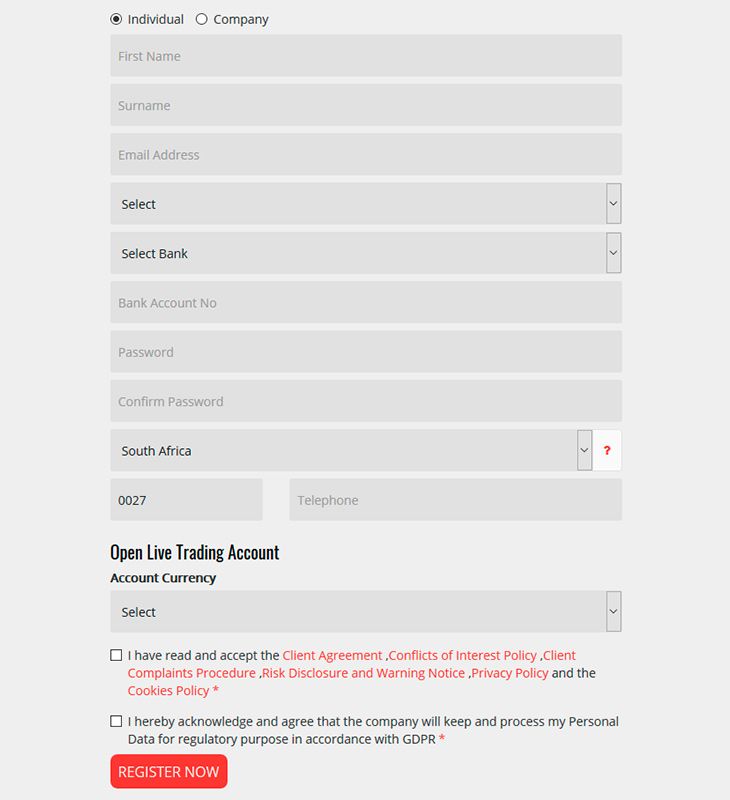

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

IC markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

IC markets has one of the finest websites we’ve had the pleasure to browse through. Every type of information is laid out, and all important details are displayed within reach. Do our impressions expand to IC markets’ services? Find out below.

IC markets holds a license from ASIC. The aim of this establishment is to promote a safe and secure environment for traders. What’s more are the segregated bank accounts that guarantee the safety of trader’s funds. Unlike cysec or the FCA, ASIC does not arrange for a reimbursement fund. The leverage here can go above 1:30, since this domain is outside the jurisdiction of ESMA.

The leverage reaches the outstanding 1:500, which might be risky for rookies. However, traders are free to choose their leverage level. The spread fluctuates between 0.0-0.1 pips for the EUR/USD currency pair for the true ECN account, and 1.1 pips for the standard account.

IC markets offers a very satisfactory trading asset choice that even avid traders will appreciate: forex pairs, indices, commodities, stocks, bonds, futures, crypto.

The broker is available in a colorful bundle of languages: english, chinese, thai, indonesian, korean, german, french, portuguese, spanish, vietnamese, russian, arabic, czech, malay and italian.

IC MARKETS LOGIN

This is by far one of the largest choices of trading platforms we have ever encountered: MT4, MT5, ctrader, zulutrade. The only other broker that can boast of the same accomplishment is roboforex. Having such a choice opens up many opportunities for all sorts of traders.

METATRADER 4

As one of the leading platforms in the world, even surpassing its successor at times, metatrader4 offers its full services to the traders who have chosen IC markets as their broker. Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for expert advisors and VPS’s hosted by IC markets. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash. There is the inclusion of myfxbook auto trade which can be linked to your MT4. By utilizing this, clients will be able to monitor and duplicate the trading patterns and strategies of more established traders.

Furthermore, IC markets allows for PAMM (percentage allocation money management) accounts to be utilized. The essence of this is that inexperienced traders, or those without the time, can allocate a sum of their money to a qualified trader they chose before hand. From there on these adept traders will trade with their and your money with the sole purpose of generating as much profit as possible.

Moreover, IC markets have included 20 advanced trading tools such as the correlation trader that serves to compare the differences in markets in real-time, and 19 more! Simply put, at IC markets the metatrader 4 platform has been optimize to its full potential, more than any other broker we’ve reviewed before.

The leverage reaches its maximum potential at 1:500, while the EUR/USD spread is 0.0-0.1 pips for the true ECN account, and 1.1 pips for the standard account.

However, there is a commission attached to the true ECN account type (meta trader). The commission is $7 ($3.5 per side) per 100 000 units (1 lot). Thus raising the 0.0-0.1 pips true ECN account spread to an actual cost of trading of 0.7-0.8 pips.

Metatrader 4 is available on iphone/ipads, android devices, as a webtrader, and can be downloaded as a standalone desktop software.

METATRADER 5

Offering more in pure quantity than MT4, MT5 has still a hard time replacing its predecessor mostly due to the fact that MT4 is universal, and essentially used by every online broker.

Nevertheless, MT5 allows for full expert advisor support, has a built in economic calendar, more pending orders are available, has increased time frames and much more. Virtual private servers can be utilized, as well all the tools and features that were mentioned for the MT4: 20 advanced trading tools, PAMM, myfxbook auto trade.

The EUR/USD spread is 0.0-0.1 pips for the true ECN account, and 1.1 pips for the standard account. The leverage reaches its maximum potential at 1:500.

The commission of $7 ($3.5 per side) per lot attached to the true ECN account type (meta trader) raises the 0.0-0.1 pips true ECN account spread to an actual cost of trading of 0.7-0.8 pips.

Metatrader 5 is available on iphone/ipads, android devices, as a webtrader, and can be downloaded as a standalone desktop software.

Ctrader handles with ease and possesses a much better visual style than both MT4/5. The interface is highly customizable, giving users a much needed aesthetic touch of their own.

One of the main features of ctrader is the ability for traders to access provider’s liquidity making room for better pricing and lower spreads. There is also automated trading, PAMM and VPS.

The unique feature of ctrader comes in the shape of a supplementary component called calgo. Users can write their own trading algorithms using a set of C# instruments, and can have bots to do trading in their place. However, ctrader does not come with the foregoing advanced tools.

The EUR/USD spread is 0.0-0.1 pips for the true ECN account, and 1.1 pips for the standard account. The leverage reaches its maximum potential at 1:500.

The commission differs slightly from the one imposed on MT4/MT5 users. The fee of $6 ($3 per side) per standard lot attached to the true ECN account type (meta trader) raises the 0.0-0.1 pips true ECN account spread to an actual cost of trading of 0.6-0.7 pips.

Ctrader is available on iphone/ipads, android devices, as a webtrader. There is no desktop software version.

Zulutrader is essentially an online platform for copying the strategies of more advanced traders, and in so doing traders can build their own trading portfolios. With hundreds of different signal providers, zulutrade has introduced a sorting feature that will make things easier when the time for choosing and expert has come. At their end, signal providers get compensated by 0.5 pips when a lot is traded using their strategy, i.E they are motivated to provide good strategies.

Zulutrade can be reached on iphones/ipads, android devices, on any web browser, and can be downloaded as a standalone desktop software.

IC MARKETS MINIMUM DEPOSIT

The minimum deposit is $200, nothing out of the ordinary.

The payments methods are varied: credit/debit cards, paypal, neteller, neteller VIP, skrill, union pay, wire transfer, bpay, fasapay, broker to broker, poli, thai internet banking, rapidpay, klarna, bitcoin wallet, vietnamese internet banking.

IC markets allows traders to open accounts in these base currencies: AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF, RMB, BTC.

Wire transfer and bpay and broker to broker process payments between 2-5 days. Bpay takes from 12-48 hours. All other methods should process you funds immediately.

There are no deposit fees. This is always a blast to come across, same as with FXDD and exness.

IC MARKETS WITHDRAWAL TIME AND FEES

The methods of withdrawal are the same as the ones used for account funding: credit/debit cards, paypal, neteller, neteller VIP, skrill, union pay, wire transfer, bpay, fasapay, broker to broker, poli, thai internet banking, rapidpay, klarna, bitcoin wallet, vietnamese internet banking

However, each withdrawal method is predetermined by the way you deposited.

If a withdrawal is submitted before 12:00 AEST/AEDT it will be processed on the same day as the request. The process time differs from the arrival time of your money. Once processed by the broker, the money will be send to you from the appropriate payment system. This can take from 2-5 working days.

The broker does not charge any fees on withdrawals, save for international wire transfer’s fee of approximately AUD $20.

The minimum withdrawal amount at IC markets is $1.

BOTTOM LINE

IC markets creates a bang, and the shock waves keep on traversing… the ASIC license guarantees fund and client security, and even without a compensation scheme the segregated bank accounts most definitely reassure traders of their money’s safety. All platforms have been pushed to their limits, especially the MT4/MT5, by which we mean that the sheer number of tools and add-ons is astounding. Payment methods are varied and responsive. All this results in a formidable broker that should not be missed.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FSC in BVI

Cryptocurrencies: YES

Minimum deposit: $1

Maximum leverage: 1:1000

Spreads: medium

My score: 5.2

Forex4you is a broker who has been in the forex industry since 2007 and offers online trading for investors. It is a brand of E-global trade & finance group, inc. I can say that forex4you mainly serve asian countries. As far as I can see, the vast majority of investors in this broker are russia, ukraine and southeast asian countries. The awards won by the company are also directed towards asian countries such as the “south east asia 2017 IAIR award”.

Besides these, the company launched the social trading service named “share4you” in 2013. Share4you is a social trading service where you can see and follow the trades of other investors. You can even look at the past trading success of these investors. With the tools in the site, you can follow the trades of investor X and make measurements like how much you would earn in 1 month or 6 months. The number of investors using this service is quite high.

What account types are offered by forex4you and what are the spreads and advantages of these account types? Is it worth opening an account with forex4you? What are the deposit and withdrawal methods? Are there any chronic problems and user complaints about withdrawals? In this forex4you review you will find all these questions! Do not open an account without reading this review!

Regulation

I can say that forex4you is very weak in terms of regulation. Because it is regulated by only one regulator. It is regulated by FSC in british virgin islands.

This regulator is not a very reputable institution among forex traders. There are many requirements required by reliable and reputable regulators such as FCA, ASIC, cysec. For example; these regulators require that brokers keep a minimum net capital in their bank accounts at a certain amount. They also protect clients’ funds by creating some compensation schemes. Thus, even if the broker you have opened accounts in bankruptcy, you can get your money back. Since the brokers that provide the required conditions already have a strong financial structure, there are not many cases that will distress the customers.

But FSC in british virgin island has none of these powerful features. Therefore, the customers of FSC-regulated brokers are not as guaranteed as the customers of other reliable brokers.

Account types & spreads at forex4you

There are fixed spread option and variable spread option for account types offered by forex4you. But I can not say that there are enough options in terms of account types.

| Account type | minimum deposit | maximum leverage | spreads |

|---|---|---|---|

| cent | $1 | 1:1000 | fixed spread from 1.5 pips |

| classic | $1 | 1:1000 | fixed spread from 2 pips |

| cent NDD | $1 | 1:1000 | floating spread from 0.1 pip + commission 10$ cents per lot |

| classic NDD | $1 | 1:1000 | floating spread from 0.1 pip + commission 8$ per lot |

| pro STP | $1 | 1:200 | floating spread from 0 pips + commission 10$ per lot |

There is no fixed spread option for the cent and classic account types offered with the no dealing desk model. As a result, you may encounter a problem widening spreads during important news moments. In addition, spreads and commissions are quite high and far from competitiveness. Minimum deposit is $ 1 in all account types, but this amount may vary depending on your payment method.

The maximum leverage is 1: 200 for the prostp account type while the maximum leverage is 1: 1000 for the other account types. You can determine the leverage between 1:10 and 1: 1000. If you are a beginner trader do not forget that the very high leverage include high risk.

Deposit & withdrawal methods at forex4you

Deposits and withdrawal methods offered by forex4you is limited, but I can say enough for a standard forex trader. Because there is wire transfer and credit card method. You can also use neteller, skrill and webmoney from popular e-wallet systems. However, the method variety could be more. Also I can say that fees charged by the broker are higher than its competitors. You can review the payment methods in detail in the table below.

Engaging with your clients simplified.

Consolidated everything an IB needs into a single experience

Ultra low

spreads

250+ trading

instruments

$10 minimum

deposit

Leverage

1:500

Immediate deposits

and withdrawals

24/5 email

support

Instruments

250+ instruments in the platform.

Desktop, tablet, mobile

Desktop, tablet, mobile and web based trading with metatrader 4 and metatrader 5

Automated trading platforms

A range of automated trading platforms and EA compatibility

Spreads offering

Competitive spreads offering

Client funds security

Client funds are held in segregated accounts for increased security

Multilingual languages

Trading website in more than 20 languages

Customer support

Connect through whatsapp

Whatsapp contact to reach customer support

Why trade with veracity markets?

Veracity markets is continuously working hard to become a major player in the online financial field, with a proven track record of positive customer satisfaction. Our key responsibility is to offer top-notch services to all our traders.

Trade anywhere

any time

Successful online trading depends on efficient and powerful trading technology. Veracity markets offers you the best trading platforms to get you into the market quicker and easier. You can access quality information and trading tools to help ensure you make educated trading decisions.

Choose your account type

| standard account |

|---|

| initial deposit : $250 |

| spreads : floating from 1.6 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| pro account |

|---|

| initial deposit : $250 |

| spreads : floating from 2 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisors : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| ECN account |

|---|

| initial deposit : $250 |

| spreads : floating from 0.00 pips |

| commission : $7 lot only FX & metals* |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: not available |

| read full account terms & description here |

| open account |

Access the world's top tradable assets

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum cursus sit amet metus id ultricies.

Become a

just perfect trader

today and receive 100%

on your first deposit

Trade a broad range of markets

Discover hundreds of markets available to trade, with more to be added soon

Forex trading

Over 38 major, minor & exotic pairs

Cryptocurrencies

Trade a broad range of cryptocurrencies

Indices

9 globel indices available

Metals

Trade gold, silver, platinum & copper

Commodities

Oil, gas & agricultural commodities

Shares

Over 150 shares to choose from

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Start your trading with veracity markets in 4 simple steps:

Register

Verify

Trade

Trade

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

So, let's see, what was the most valuable thing of this article: frequently asked questions on JP markets. At jp markets minimum withdrawal

Contents of the article

- Real forex bonuses

- Jp markets minimum withdrawal

- How much does JP markets charge for training?

- What documents are required to open an account?

- I don’t receive any mail in my name – what can I...

- I just tried to login and it says invalid...

- How do I fund my trading account?

- Can I fund my account using bitcoins?

- What reference must I use when I make a deposit?

- What is the turnaround time for my deposit to be...

- My deposit has not reflected on my account – what...

- I just downloaded MT4, why can’t I place any...

- I forgot my password for the client portal.

- I forgot my password for my trading platform.

- How do I request a withdrawal?

- What is the turnaround time for a withdrawal?

- How long does it take for a withdrawal to reflect?

- Can I withdraw a bonus?

- How much is a spread?

- Does JP markets have control over the...

- How much is a swap?

- Pending order expiration

- Does JP markets give signals to clients?

- Does JP markets buy mandela coins?

- How do I become an introducing broker (IB)?

- What different account types does JP markets...

- What is the difference between ECN and standard...

- How much is the commission on an ECN account?

- Why was my stop loss / take profit not hit?

- How does JP markets make money if you are...

- Who regulates JP markets?

- How much money can I make if I deposit X amount?

- I want to start trading but I don’t know how?

- Do I have to pay JP markets for their services...

- Can JP markets trade on my behalf?

- Does JP markets make any deductions for taxes on...

- Is my money safe?

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- JP markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- What is the minimum deposit for JP markets?

- How do I make a deposit and withdrawal with JP...

- Does JP markets charge withdrawal fees?

- JP markets review

- Who is behind JP markets?

- Trading services offered

- Accounts available on the platform

- Deposit and withdrawal options

- Commissions, leverages and spreads

- Pros of the JP markets platform

- Final thoughts

- Leave a reply cancel reply

- ������top broker 2020 SA������

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- IC markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- IC MARKETS LOGIN

- IC MARKETS MINIMUM DEPOSIT

- IC MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Forex brokers lab

- Regulation

- Account types & spreads at forex4you

- Deposit & withdrawal methods at forex4you

- Engaging with your clients simplified.

- Consolidated everything an IB needs into a single...

- Ultra low spreads

- 250+ trading instruments

- $10 minimum deposit

- Leverage 1:500

- Immediate deposits and withdrawals

- 24/5 email support

- Instruments

- Desktop, tablet, mobile

- Automated trading platforms

- Spreads offering

- Client funds security

- Multilingual languages

- Customer support

- Connect through whatsapp

- Why trade with veracity markets?

- Trade anywhere any time

- Choose your account type

- Access the world's top tradable assets

- Become a just perfect trader today...

- Trade a broad range of markets

- Forex trading

- Cryptocurrencies

- Indices

- Metals

- Commodities

- Shares

- Start your trading with veracity markets in 4...

- Register

- Verify

- Trade

- Trade

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.