Tickmill welcome bonus withdrawal

The site contains links to websites controlled or offered by third parties.

Real forex bonuses

Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately. Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to funding@tickmill.Com and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill welcome bonus withdrawal

The bonus amount itself (30 USD of tickmill’s welcome account) cannot be withdrawn .

You can only withdraw profit from the ‘welcome account’ by meeting the following requirements.

Profit amount reaching 30 USD

The available profit withdrawal amount is from 30 – 100 USD.

The profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

Complete online registration & verification

Other than the welcome account, you also need to register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.).

Also, you need to provide the necessary identification documents required to validate the client area account;

Deposit at least 100 USD

Once you opened a live MT4 trading account inside the client area, you need to deposit a minimum of $100 (or equivalent in other currencies).

After a deposit is made to a live MT4 account, please contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

Restricted trading strategies on tickmill MT4 (welcome account)

While trading in tickmill’s 30 USD welcome account, you must make sure that you are not violating any of their T&C.

Here are 3 main restricted trading strategies on the welcome account.

- Use of expert advisors (eas)

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse

For more information or inquiries regarding to the promotion, please contact support team from tickmill official website.

Posted by FXBONUS.Info

Please check tickmill official website or contact the customer support with regard to the latest information and more accurate details.

Tickmill official website is here.

Please click "introduction of tickmill", if you want to know the details and the company information of tickmill.

Rules (terms and conditions) of tickmill $30 welcome bonus promotion

Conditions of trading, fund withdrawal and other rules of tickmill's 30 USD no deposit bonus.

Get $30 welcome bonus from tickmill today! Why?

- Accessible

available to all new clients - Free

no need to deposit funds - Risk-free

no risk of losing your money - Profitable

profits earned can be withdrawn

How to get the $30 welcome bonus

Follow the simple steps below to get yourself a free welcome bonus!

1. Go to the official website

2. Go to the promotion page

Go to “promotions” and “$30 welcome account”.

3. Signup

Signup for free and $30 will be all yours!

Full terms and conditions of tickmill $30 welcome account

Here are the terms and conditions of tickmill’s no deposit bonus promotion.

Read through and make sure to understand them all before participating in the promotion.

- The “welcome account” campaign is held by tickmill ltd and tmill UK limited (tickmill).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill.

- The welcome account is not available in north korea, iran, USA, indonesia, nigeria, lesotho, pakistan, bangladesh, ghana, egypt and kenya.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 90 days from the day of opening. Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved.

- Login details will be sent automatically to the email address provided in the registration form.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- After a deposit is made to a live MT4 account, the client should contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 account holder has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

Already used tickmill’s 30 USD bonus but want to continue risk-free?

Whether you’re new to trading foreign exchange products or contracts for difference or already an experienced trader, tickmill’s risk-free demo account is an ideal way to get started at tickmill.

This demo account allows you to practice trading in a simulated environment.

Thus, all trading is hypothetical and not live trading but allows you to practice your trading strategies and get familiar with tickmill’s trading platform with no risk to your capital.

Benefit from learning how to use tickmill’s quality trade executions, tight spreads, personalized customer service and the flexibility of the tickmill MT4 trading platform.

- Tight dealing spreads on all products

- A robust technical analysis package with the ability to create custom indicators

- Support for hedging activities

- The ability to program and automate specific trading strategies using a built-in language, metaquotes language 4

- Visually track your positions and trade directly from the charts

- Trade with a well-capitalized, respected industry leader

Experience the exciting world of currency trading with a free practice account.

Register below for unlimited access to the tickmill metatrader4 platform, along with real-time executable quotes in many currency pairs.

Test your strategies with no risk and no obligation.

Most popular trading platform – tickmill MT4 (metatrader4)

Tickmill metatrader4 is the most popular forex trading platform available today.

Tickmill MT4 platform truly bridges the gap between the institutional and retail FX world.

Tickmill MT4 platform allows you to connect directly to the interbank market, with STP execution to leading FX banks allowing for pricing and execution free of manipulation and interference.

Tickmil enriches the traditional MT4 platform with their proprietary resources and services.

- Expert advisors (EA) automated scripting

- Market and pending orders

- Email alerts

- Large number of technical indicators and line studies. Metatrader 4 client terminal

- Support of various timeframe’s (from minutes up to months)

- Multi language program interface

- Getting real-time news from the financial markets

- Signals of systems and trading history

- Printing charts and completed trading transaction statements

Tickmill VPS for eas (exert advisers) users

Tickmill takes into account the growing need for automated trading systems for the retail market, and its lag behind more mainstream development (operating systems, personal media, etc).

Tickmill VPS hosting package give clients real-time access to their individual accounts.

This gives you the ability to view, manage and trade in real-time through tickmill and host live expert advisors.

On windows based VPS servers, if a user attempts to use too many resources, the VPS could crash and the user would be forced to upgrade to a more expensive package.

In addition, problems inherent in the windows server operating system can cause crashes and have limitations of its own.

Specifically spyware, malware and viruses can be major issues.

Tickmill goes many steps further and currently provides the only VPS of its kind that is completely built on unix/linux and is 100% web based.

As a result, there are no limitations on the operating system.

In fact, the user can log in directly to his or her account from any browser anywhere in the world.

The tickmill VPS also uses special state-of-the-art technology whereby there are no limitations on RAM and disk space when compared to all of the other providers.

Most importantly, up time is nearly 100% — a claim that most other hosting services cannot make.

In sum, a VPS is a necessity for those traders who want to protect their account from dropped connections and power outages.

Contact tickmill’s 24/5 support for any inquiries

Tickmill provides individual investors with access to all major capital market sectors.

Tickmill focuss on providing retail clients with professional tools to profit from multiple markets, not just forex.

Tickmill provides extensive customer service and trading facilities such as the followings.

- 24 hour customer service.

- Multi-lingual dealing and trading support.

- Communicate with customer service representatives through phone, live chat, and email.

- Multiple execution options such as online and phone.

- Advanced online trading platform providing real-time tradable prices and charts.

- Service that allows tickmill clients to view real time prices, charts and account information from their mobile phone.

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

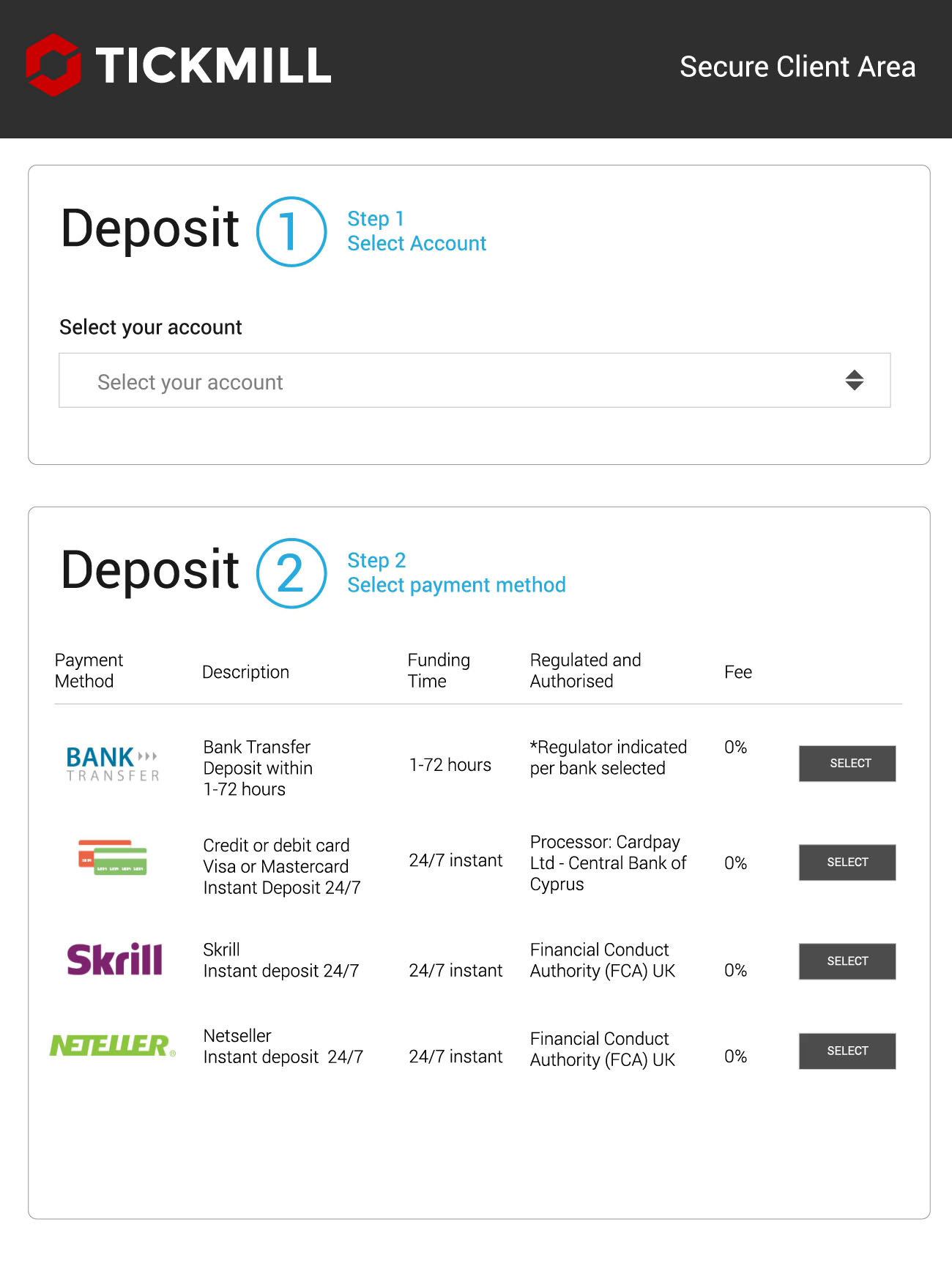

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill withdrawal bonus

When you want to be able to have a top-class experience regarding what is considered to be one of the most optimal trading platforms within the industry of trading that will be will an opportunity that is free of risk, this can become your reality when you get the thirty dollars welcome account that is offered by tickmill at no cost to you. It is absolutely free. However, it is to be noted that when you use the tickmill trading platform as a new trader, there is no provision of access to a tickmill withdrawal bonus.

IF you get a $30 free trading bonus from tickmill, no deposit bonus can be withdrawn. A trader can withdraw only the profit that he made without a bonus amount. You can easily transfer profit from $30 to $100. Money needs to be transferred from a welcome account to a new live account by email or chat support request.

To take advantage of the free offer, it is certainly understood that you must engage in the opening of an account with the tickmill trading platform. The good news is that this free welcome offer is provided as a terrific opportunity for all traders. Therefore, this means that there are no limitations placed on who may participate in this awesome free offer that surely prevents a great level of risk for those who would like to try their hand at trading on the tickmill platform.

Tickmill is rather generous by grating the starting point of thirty dollars for free to welcome new traders to the platform. Therefore, it is noted that the funds associated with this endeavor are provided in US dollars. This money will allow traders to commence engaging in the conducting of trades via the forex market, which is done online.

While this welcome package from the tickmill platform is highly alluring, it is to be noted that each person who wishes to try this package for the sake of conducting trades on forex via this platform with no risk involved can only open this type of account one time. This means that they cannot have access to more than one such free welcome account of thirty dollars in US funds with this trading platform.

The good news is that the truth is presented right at the onset that there are no risks to those who get the thirty-dollar welcome package from this platform for free. This means that there are no snares to trap you slyly, and unexpectedly that can sometimes happen with some platforms that may not demonstrate high integrity levels toward traders. There are no extra costs with this platform when you engage in using this type of welcome package. It is also nice to realize that there are no hidden commission costs that are tagged onto this type of welcome package offered via this trading platform.

When someone is coming to the platform as a new investor, the person will need to commence with a welcome account on the tickmill platform. Then the person will be granted credentials for the sake of being able to login into the designated MT4 account.

The person can then commence engaging in the conducting of trades on the forex market by using the provision of the free funds in USD without the need to engage in the risk of using his or her own finances. If the person is successful in making a positive profit via the conducting of trade, the person is thus permitted to make a withdrawal of the profit in the amount of thirty to one hundred US dollars in such cases that the new trader complies with meeting the essential criteria for this type of transaction on this trading platform.

Therefore, if this trading platform by tickmill that is offering this amazing promotion gains your interest and curiosity, you will likely want to then make your way over to the promotion page hosted on the official website of tickmill. Once you arrive at the site, you will want to find FSA SC, then promotions, and the $30 welcome account.

It will then be needful to fill out the application form provided directly on the page of the promotion for the welcome account. When your application has been granted approval by the tickmill trading platform, your welcome account will be formulated, and t. Details that will enable you to log onto the trading platform will be delivered to the email address that you provide. Do note that these credentials are deemed only as valid for the sake of being able to provide access to the welcome account and do not provide you with any leverage of access to the client area of this trading platform.

You will then be able to enjoy commencing in the conducting of trades with this welcome account. You will need to be sure to engage in downloading the MT4, which refers to the metatrader4. Or you may decide to engage in accessing the platform via the web directly through the official website of tickmill. Another plus is the fact that you can engage in downloading applications for mobile devices as well, such as for ios devices and android devices.

When you are making efforts to conduct trades via the usage of the welcome account provided by tickmill with the provision of thirty US dollars at no cost to you, it is important to realize that there are some things to keep in mind. It is forbidden for you to engage in expert advisors’ usage when you are using a welcome account. Also, it is not permitted for you to apply a strategy that entails arbitrage trading when you use this type of trading account. This means that you are not allowed to engage in the hedging of trading positions at an internal level, such as using other designated accounts that you may have tickmill is holding that. It is also forbidden to engage in the usage of other accounts that are under the holding power of other brokers for trading purposes. It is also strictly prohibited to apply the usage of failures that are noted in the quote flow for the sake of obtaining a guaranteed profit.

Tickmill withdrawal bonus

When you want to be able to have a top-class experience regarding what is considered to be one of the most optimal trading platforms within the industry of trading that will be will an opportunity that is free of risk, this can become your reality when you get the thirty dollars welcome account that is offered by tickmill at no cost to you. It is absolutely free. However, it is to be noted that when you use the tickmill trading platform as a new trader, there is no provision of access to a tickmill withdrawal bonus.

IF you get a $30 free trading bonus from tickmill, no deposit bonus can be withdrawn. A trader can withdraw only the profit that he made without a bonus amount. You can easily transfer profit from $30 to $100. Money needs to be transferred from a welcome account to a new live account by email or chat support request.

To take advantage of the free offer, it is certainly understood that you must engage in the opening of an account with the tickmill trading platform. The good news is that this free welcome offer is provided as a terrific opportunity for all traders. Therefore, this means that there are no limitations placed on who may participate in this awesome free offer that surely prevents a great level of risk for those who would like to try their hand at trading on the tickmill platform.

Tickmill is rather generous by grating the starting point of thirty dollars for free to welcome new traders to the platform. Therefore, it is noted that the funds associated with this endeavor are provided in US dollars. This money will allow traders to commence engaging in the conducting of trades via the forex market, which is done online.

While this welcome package from the tickmill platform is highly alluring, it is to be noted that each person who wishes to try this package for the sake of conducting trades on forex via this platform with no risk involved can only open this type of account one time. This means that they cannot have access to more than one such free welcome account of thirty dollars in US funds with this trading platform.

The good news is that the truth is presented right at the onset that there are no risks to those who get the thirty-dollar welcome package from this platform for free. This means that there are no snares to trap you slyly, and unexpectedly that can sometimes happen with some platforms that may not demonstrate high integrity levels toward traders. There are no extra costs with this platform when you engage in using this type of welcome package. It is also nice to realize that there are no hidden commission costs that are tagged onto this type of welcome package offered via this trading platform.

When someone is coming to the platform as a new investor, the person will need to commence with a welcome account on the tickmill platform. Then the person will be granted credentials for the sake of being able to login into the designated MT4 account.

The person can then commence engaging in the conducting of trades on the forex market by using the provision of the free funds in USD without the need to engage in the risk of using his or her own finances. If the person is successful in making a positive profit via the conducting of trade, the person is thus permitted to make a withdrawal of the profit in the amount of thirty to one hundred US dollars in such cases that the new trader complies with meeting the essential criteria for this type of transaction on this trading platform.

Therefore, if this trading platform by tickmill that is offering this amazing promotion gains your interest and curiosity, you will likely want to then make your way over to the promotion page hosted on the official website of tickmill. Once you arrive at the site, you will want to find FSA SC, then promotions, and the $30 welcome account.

It will then be needful to fill out the application form provided directly on the page of the promotion for the welcome account. When your application has been granted approval by the tickmill trading platform, your welcome account will be formulated, and t. Details that will enable you to log onto the trading platform will be delivered to the email address that you provide. Do note that these credentials are deemed only as valid for the sake of being able to provide access to the welcome account and do not provide you with any leverage of access to the client area of this trading platform.

You will then be able to enjoy commencing in the conducting of trades with this welcome account. You will need to be sure to engage in downloading the MT4, which refers to the metatrader4. Or you may decide to engage in accessing the platform via the web directly through the official website of tickmill. Another plus is the fact that you can engage in downloading applications for mobile devices as well, such as for ios devices and android devices.

When you are making efforts to conduct trades via the usage of the welcome account provided by tickmill with the provision of thirty US dollars at no cost to you, it is important to realize that there are some things to keep in mind. It is forbidden for you to engage in expert advisors’ usage when you are using a welcome account. Also, it is not permitted for you to apply a strategy that entails arbitrage trading when you use this type of trading account. This means that you are not allowed to engage in the hedging of trading positions at an internal level, such as using other designated accounts that you may have tickmill is holding that. It is also forbidden to engage in the usage of other accounts that are under the holding power of other brokers for trading purposes. It is also strictly prohibited to apply the usage of failures that are noted in the quote flow for the sake of obtaining a guaranteed profit.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FCA, FSA, CYSEC

Cryptocurrencies: YES

Minimum deposit: $100

Maximum leverage: 1:500

Spreads: low

My score: 7.9

First thing I can say about tickmill forex broker is that it is one of the fastest growing brokers in the world. Thanks to the company’s aggressive growth policy, tickmill succeeded in reaching thousands of forex traders from a wide range of different countries in a very short period of time. The website has more than a million visitors a month. In this tickmill review, you will find information on tickmill spreads, regulations, account types, deposit and withdrawal methods. Are you wondering is tickmill scam or legit? I would definitely recommend reading this review before opening an account with tickmill.

Tickmill regulation and investor protection

One of the most crucial issues in the forex system is regulation. Because when you have problems with your broker, the regulators help you to solve the problems. Think about; you wanted to withdraw but the broker could not let this. In this situation, the regulator moves in and protects your rights. We can duplicate samples like this. Let’s see what tickmill offers us.

There are two different companies behind the tickmill brand name. One of them is tmill UK limited and the other is tickmill limited. Tmill UK limited regulated by FCA (register number: 717270) in the UK FCA while tickmill limited regulated by FSA in seychelles.

Clients of the UK broker are protected by financial services compensation scheme-FSCS as well as FCA. If the forex broker goes bankrupt, the investors’ money is under the FSCS guarantee. The institution pays investor’s money up to £50,000. This shows your money is in safe if the broker goes bankrupt.

In addition, vipro markets, which operates in cyprus with CYSEC-licenced, joined the tickmill group in 2017. Before joining the tickmill group, this company also had more than 500,000 visitors per month. If a broker wants to have a cysec license, it must keep at least €1,000,000 to prove to clients that they can make a payment. I think it is a reassuring feature for prospective clients who are suspected of not taking their money.

In order to keep your money safe, you must trade with a broker who has a license. Watchdogs allow the brokers to act in accordance with the rules. They periodically inspect the brokers and if the brokers do not obey the rules, they may cancel the licenses.

The tickmill forex broker has grown rapidly in a short period of time and currently serves forex and CFD trading in asia, the middle east and africa.

Tickmill spreads and account types

Tickmill offers customers 4 different account types as follows:

| account type | minimum deposit | maximum leverage | spreads (& commission) | swap free |

|---|---|---|---|---|

| classic | $100 | 1:500 | from 1.6 pips | yes |

| pro | $100 | 1:500 | 0.2 pips + $4 / lot (round turn) | yes |

| VIP | $50.000 | 1:500 | 0.0 pips + $3.2 / lot (round turn) | yes |

In all of these 4 account types, you can trade on 85 trading instruments and use USD, EUR, GBP, PLN as base currency of the account. The maximum leverage in the accounts is 1:500.

Classic account is more suitable for newbie investors. Minimum deposit for classic account is $100. It can be called an average deposit. There is no commission, but spreads start from 1.6 pips on EURUSD. If I compare it with fxpro, I can say that spreads are higher in the classic account in tickmill. However, the pro account that we can see as ECN account is quite advantageous compared to other brokers’ ecns.

In the pro account, the minimum deposit is same with classic account and it is $100. You only pay a commission of $ 2 per lot and $ 4 per round turn. I can easily say that this commision is quite low. If we compare with other brokers, tickmill offers better commission fee. For example FXPRO offers $ 3 per lot and $ 4.5 per round turn.

The most advantageous of all is the VIP account. You only pay a commission of $ 1.6 per lot. However, the minimum deposit for this account is $ 50,000. Tickmill also offers personal multi account manager. With the MAM program, professional money managers are assigned to act on behalf of their clients. In this way, a money manager can perform block trades on all accounts with his master account effectively.

If you are an investor with islamic belief and do not want to earn or pay interest, you can apply for a swap free account for all these account types. Tickmill offers the same terms and conditions as their regular account types to its clients who want to use islamic accounts. The only difference is that there are no swaps. Tickmill may ask you to document your belief. It also has the right to reject your application.

Trading products

Tickmill offers to trade cfds on currency pairs, precious metals, crude oil, stock indices, bonds and cryptocurrencies. The broker includes only BTC on cryptos. This is a disadvantage for tickmill. And also, +60 pairs of forex pairs available.

Trading platforms

You can trade with tickmill on desktop or tablet, browser or on-the-go with your smartphone. Metatrader 4 and web trader are available. MT4 is considered to be the world’s most popular forex trading platform because it is easy to use, offers a variety of graphics and indicators, a variety of expert advisors (eas) and most importantly supports the MQL language.

- Cfds on forex, stock indices, WTI, commodities, bonds and cryptocurrencies

- EA trading facilities

- Micro lots available

- No partial fills

Promotions

Tickmill offers three promotions to its clients. One of them is ‘trader of the month’ : each month, tickmill selects the best and highest performance among its talented clients and rewards it with a $ 1,000 award. They take into account not only good profits, but also money and risk management skills when selecting the winner. I would say that this promotion enables competition among clients. Available to clients of tickmill ltd (FSA SC regulated) only.

The second one is ‘tickmill’s NFP machine’. This promotion is also available to clients of tickmill ltd (FSA SC regulated) only. During every NFP week, they choose one instrument and challenge you to guess its price in their MT4 platform at 16:00, exactly 30 minutes after the NFP release. A perfect hit will bring you $500 to your trading account. If no one breaks the bank by an exact figure, the trader with the closest prediction will cash in a $200 prize.

And the last one is ‘$30 welcome account’. Available to clients of tickmill ltd (FSA SC regulated) only. If you open a new account tickmill gives you $30 welcome bonus.

All promotions have terms and conditions.

Deposit and withdrawal methods.

Tickmill has a wide range of funding and withdrawal methods. These are wire transfer, credit/debit card, skrill, neteller, fasapay and unionpay. I can say that this is enough but unfortunately, there is no BTC. Also, you do not pay any fees thanks to the zero fees policy of the company. Tickmill offers deposit and withdrawal methods as follows:

I did not have any problems with withdrawing and depositing money during my transactions. When depositing money I preferred to deposit with a credit card. When withdrawing money, they deposit the money in the same day.

Final thoughts

Tickmill is a fast-growing broker. A few years ago, nobody knew tickmill. But now all investors on the forex market know tickmill. If this growth continues fast, I can not imagine what will happen in a few years. They have a good designed website and you can find all information about trading.

FCA license and FSCS registration are two of the broker’s strongest features. The broker has cysec license too. There is no doubt that tickmill is a reliable broker. Tickmill offers enough account types to its clients. The classic account has advantages about minimum deposit and spreads. The pro account also offers a highly advantageous and competitive spread. If you are going to use a pro account, I recommend you open an account at tickmill. Finally, tickmill is a reputable broker who has various product portfolio and effective trading conditions.

Tickmill minimum deposit & withdrawal methods

The british broker tickmill is a company originally established in estonia, which is now regulated by the FCA thanks to its branches in great britain and the seychelles. At tickmill, more than 60 forex pairs and cfds can be traded via the popular metatrader 4 or the in-house webtrader, with three different account models at favorable conditions. The STP broker offers access to the markets with a minimum deposit of 100 euro or US-dollars at tickmill. Since the provider is still little known in germany, we will show you how tickmill deposits and withdrawals are handled and what fees traders have to expect for transactions.

Facts about the payment methods and conditions of tickmill:

- A minimum deposit of 100 euro / US dollar

- Payment execution by visa or mastercard, bank transfer, IMMEDIATELY, skrill, neteller, paysafecard, dotpay

- Account management in EUR, USD, GBP and PLN

- No deposit and withdrawal fees

Why payment methods are so important

Traders who are just taking their first steps in forex and CFD trading, possibly having found their way in through a demo account, usually focus on the educational offerings and later on the conditions of a broker. Once they are satisfied with the demo, the transition to a real money account with the same provider is easy. But experienced users know that all too often less attention is paid to payment methods.

Accordingly, dissatisfaction with payment methods, in particular, is one of the most frequent reasons for switching brokers. Some online brokers charge double-digit fees, which significantly reduces the trader’s return, and delay payouts due to unnecessarily long processing times. However, high minimum deposits of four-digit amounts are also a shortcoming, as they make it difficult, especially for beginners, to gain access to trading at all.

- The payment methods offered depend on the broker

- Ewallets are becoming increasingly common

- Deposit and withdrawal methods are usually the same

- Payments via third parties are not accepted

Fortunately, an insight into customer wishes and the competitive pressure among the numerous online brokers on the market ensures that the range of payment methods is also becoming increasingly comprehensive and customer-friendly. Thanks to above all too common ewallets, payments can be made faster and more cost-effectively. However, all providers have certain restrictions in common, such as those relating to payments via third parties. An overview presents the common payment methods, their advantages, and limitations.

Credit cards remain one of the most popular options

If you use a credit or debit card to capitalize on your trading account, most brokers will allow you to deposit and withdraw larger amounts free of charge – usually up to 10,000 euros. Another advantage is the immediate crediting so that trading can begin immediately. And traders do not have to worry about the security of their own data. A glance at the data protection information shows that brokers know and apply the importance of secure data transmission and modern encryption technologies.

In addition, credit cards, formerly a rather exclusive means of payment with their own, quite high annual fees, are now offered very cheaply or even free of charge, especially by direct banks, and are thus accessible to the average customer. Additional costs for the card alone are a thing of the past. What traders should consider is that it is not unusual for brokers to insist on a scan of the credit card for card payments.

The customer does not always have the option of blackening some digits of the card number! In addition, with card payments, the maximum amount deposited is often the payout limit for this option. And not all providers offer free card payments, whether for deposits or withdrawals. Therefore, there are sometimes good reasons against capitalizing the merchant account by credit card.

Bank transfers are secure and much faster

A very secure and mostly free alternative to payment by credit card is the conventional bank transfer, especially in the single euro payment area. SEPA bank transfers are executed within one working day. As long as they are done from your own home banking, there are no costs involved, and most brokers also offer free of charge payment by bank transfer. Furthermore, bank transfer can be tracked very well. However, the secure and inexpensive payment method is anything but fast, because the processing time by the bank is joined by the processing by the broker.

It can take at least two and up to seven working days for the trader to receive the credit on his trading account. Nothing for the hurried! And for international transfers to a broker outside the EU it can take even longer. There may also be costs associated with bank transfers, for example, if the transaction is ordered on paper or by telephone. International bank transfers are subject to interbank commissions, and if the currency of the transaction is not the same as the currency of the trading account, exchange rate costs are added.

Online payment methods

Electronic payment options are becoming increasingly popular – the pioneer is paypal, once the in-house payment solution of the ebay platform, now an independent financial service provider with a banking license. Imitators with almost as large a customer base are skrill and neteller, providers who enable the international transfer of even large amounts at good conditions. Links to the current account are the basis for fast payment options such as trustly or sofort. And international ewallets are joined by regional solutions such as the german giropay.

The value date of the instructed amounts is immediately or within one day at the latest with the electronic payment service providers, and the fees charged by brokers on such payments are, if any, rather low. The security measures for online payments are also convincing, and they can even be made by mobile phone. It is therefore not surprising that the list of e-payment providers is also getting longer and longer among the payment methods used by forex and CFD brokers. This is a real alternative for customers, especially since the chosen payment method is then usually also binding for payouts.

With the deposit you commit yourself for the payout

If a trader has decided on a particular payment method at or shortly after opening the trading account, this method usually remains binding. For example, when depositing by credit card, subsequent withdrawals from the trading account must also be made through the credit card account. A combination of different methods is usually not possible – much to the disadvantage of traders, as it is not uncommon for there to be no fees when depositing via a certain method, but there are fees when withdrawing, and vice versa.

Customers would be better served with a flexible combination of different options, but unfortunately, the majority of brokers do not allow this. If you later want to change a payment method once it has been selected, it is necessary to contact customer support and in any case to go through a re-verification process. In addition, the amount of the largest deposited amount usually automatically represents the limit for later withdrawals.

Everything you need to know about the deposits at tickmill can be found in the following table:

| Method: | minimum amount: | processing time: |

| visa/mastercard | 100 USD | within 24 hours |

| bank transfer | 100 USD | within 24 hours |

| IMMEDIATELY | 100 USD | within 24 hours |

| paysafecard | 100 USD | within 24 hours |

| neteller | 100 USD | within 24 hours |

| skrill | 100 USD | within 24 hours |

| rapid | 100 USD | within 24 hours |

| dotpay | 100 PLN | within 24 hours |

Transactions on own account only

The capitalization of the trading account, no matter by what means, can only ever be done in your own name. Payments by and to third parties, via the partner’s mastercard or as a transfer from friends, are not accepted under any circumstances unless explicit escrow accounts can be kept. This applies not only to brokers within the european union but internationally.

This is due to binding regulations that are intended to help curb money laundering and capital flight. Furthermore, business accounts cannot be used for payments – at least not by private traders. Under certain circumstances, brokers may offer this option for their business customers. The reference account through which all payments are made must be in the same name as the trading account with the broker.

Three accounts, small minimum deposit at tickmill

The british STP broker offers its customers a demo account and three different real money accounts, the “classic” and ECN-pro account with a tickmill minimum deposit of only 100 euro. However, accounts can also be managed in USD, GBP, and PLN. This way, especially beginners do not have to invest too much money to get started in trading. Experienced traders receive particularly favorable conditions for trading with the VIP account, but must make an initial deposit of 50,000 USD.

- Two accounts with 100 USD minimum deposit

- Free demo is offered

- VIP account for experienced traders

- Swap-free islamic account

The different account models allow users to choose the offer that best suits their needs. Trading fees are charged in different ways, with the classic account through spreads, with the ECN account through commissions. For both accounts, the minimum transaction size is only 0.01 lot, which means that even small investments can be traded.

How tickmill deposits and withdrawals are possible

The trading account with tickmill is set up by clicking on the “open account” button in the website header. Traders have the choice of trading with the FCA-regulated UK provider or having their account managed by the seychelles branch, which allows them to use higher levels of leverage. The form, which must now be filled out, asks for first and last name, country of residence, e-mail and telephone number, but also for the preferred language of communication. In addition, the trader can decide whether a private or business account should be managed.

With the sending of these first details, the user receives an e-mail with a confirmation link. Afterward a verification is necessary. For this purpose, a copy of an identification document and a proof of address must be uploaded. Verification is necessary because without it no payouts can be made later. The broker usually verifies the documents within 24 hours, often even faster, so that traders can deposit money immediately at tickmill.

First transactions via the trading account

After verification by the broker, the trading account is activated and the client can make deposits and withdrawals at tickmill. Both are done from the personal customer area, after login. Among the offered payment methods you will search in vain at tickmill paypal. Most options can be used for all offered account currencies, i.E. Euro, US dollar, british pound, and polish zloty. An exception is the IMMEDIATE bank transfer by the swedish provider klarna, where only euro or GBP can be transferred. The polish payment solution dotpay can also only be used for zloty.

No fees for payments at tickmill

Fortunately, there are no fees for depositing money at tickmill and no fees for withdrawals. Traders who wish to capitalize their account by bank transfer can take advantage of tickmill’s zero fees policy. This means that the broker will cover the costs of the transaction from a deposit value of 5,000 USD or the equivalent in one of the other possible currencies, up to a maximum of 100 euros / USD.

In order to receive the refund, traders only need to send a copy of their account statement to tickmill support within one calendar month after making a deposit. The amount will then be refunded within a few days. Nevertheless, tickmill also reserves the right to charge fees for deposits or withdrawals – namely when the user is inactive.

Tickmill payout: fast and free

It is similarly uncomplicated and fast when traders want to withdraw money from their trading account at tickmill. The tickmill payout is requested from the personal customer area, the processing by the broker usually takes place within one working day. However, traders should take into account that depending on the payment method chosen, further processing times may be required by the payment service provider, so that, for example, if withdrawals are made by bank transfer according to tickmill, withdrawals are only credited after up to seven working days.

Withdrawals are generally made via the same channel as deposits, except for paysafe – where an alternative withdrawal method must be selected. Of course, the account holder must be verified in order for the payout to take place at all, and the transferred amounts must not result in a coverage gap for open positions.

Everything you need to know about withdrawals with this broker can be found in the following table:

| Method: | minimum amount: | time-span: |

| visa/mastercard | 25 USD | within 24 hours |

| bank transfer | 25 USD | within 24 hours |

| IMMEDIATELY | 25 USD | within 24 hours |

| paysafecard | 25 USD | within 24 hours |

| neteller | 25 USD | within 24 hours |

| skrill | 25 USD | within 24 hours |

| rapid | 25 USD | within 24 hours |

| dotpay | 25 PLN | within 24 hours |

Buy-in bonus and competitions at tickmill

Bonus payments are prohibited for forex and CFD brokers within the EU, but anyone trading through tickmill’s seychelles office can look forward to the $30 US no deposit bonus. Clients who open a “welcome account” with the broker will receive a credit for this amount, which can be used for trading, without the need to make their first deposit. Winnings made with the welcome account can be transferred to a real money account up to 100 US dollars later.

Another additional offer is the “trader of the month” contest. For this, tickmill customers do not have to register; instead, the broker selects a particularly successful trader, who wins prize money of 1,000 US dollars. Other competitions include, for example, forecasts on the performance of financial instruments, and attractive cash prizes can also be won here.

Occasionally raffles are added, such as recently especially for german traders the possibility to win a trip for two to london and to meet the managing director of tickmill at dinner. Further additional offers include the demo account, the comprehensive, free educational offer, and also the broker’s trading tools, which are also available to traders at the british branch.

Conclusion: good conditions, free payment methods at tickmill

The british broker tickmill, which is not yet very well known in germany, recently launched a website in german to present its services to german traders. Three account models allow trading with forex and cfds with the FCA-regulated provider with STP/ECN market model. The minimum deposit, initially set at 25 USD, has now been raised to 100 USD, but is still low enough for private investors.

The conditions for forex and CFD trading can be described as good, even if the trading offer for cfds is still quite narrow. All relevant information is presented very transparently on the website. Tickmill offers its customers a sufficient choice of payment methods. In addition, all options can be used without fees from the broker, both for deposits and withdrawals.

For bank transfers of amounts over 5,000 euros or US dollars at deposit, the provider even reimburses possible costs on the part of the bank, provided that the customer documents the payment within one calendar month by submitting a bank statement. Alternatively, the trading account can be capitalized by credit card, but also by using skrill, neteller, paysafe or IMMEDIATELY. Processing is carried out immediately; a value date can be expected within one working day at the latest; payout orders are also processed promptly and free of charge.

Traders must find out for themselves whether fees are incurred by the payment service provider, and how long the processing of payouts takes until they are credited to the reference account. By waiving its own fees, the broker offers extensive freedom of choice when selecting a payment method. Interested users also have the opportunity to test tickmill’s offer through the free demo account, which is unlimited in time, and thus get an idea of the broker’s services for themselves.

Read our other articles about tickmill:

so, let's see, what was the most valuable thing of this article: experience forex trading risk-free with tickmill's $30 welcome account. It’s simple, fast and rewarding! Register now! T&cs apply. At tickmill welcome bonus withdrawal

Contents of the article

- Real forex bonuses

- Welcome account

- A special welcome to the world of...

- Your perfect start with...

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill welcome bonus withdrawal

- Restricted trading strategies on tickmill MT4...

- Posted by FXBONUS.Info

- Rules (terms and conditions) of tickmill $30...

- Conditions of trading, fund withdrawal and other...

- How to get the $30 welcome bonus

- 1. Go to the official website

- 2. Go to the promotion page

- 3. Signup

- Full terms and conditions of tickmill $30 welcome...

- Most popular trading platform – tickmill MT4...

- Tickmill VPS for eas (exert advisers) users

- Contact tickmill’s 24/5 support for any inquiries

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill withdrawal bonus

- Tickmill withdrawal bonus

- Forex brokers lab

- Tickmill regulation and investor protection

- Tickmill spreads and account types

- Deposit and withdrawal methods.

- Final thoughts

- Tickmill minimum deposit & withdrawal methods

- Why payment methods are so important

- Credit cards remain one of the most popular...

- Bank transfers are secure and much faster

- Online payment methods

- With the deposit you commit yourself for the...

- Transactions on own account only

- Three accounts, small minimum deposit at tickmill

- How tickmill deposits and withdrawals are possible

- Tickmill payout: fast and free

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.