Minimum deposit for jp markets

Yet this is the only time they mention credit card as a withdrawing method.

Real forex bonuses

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

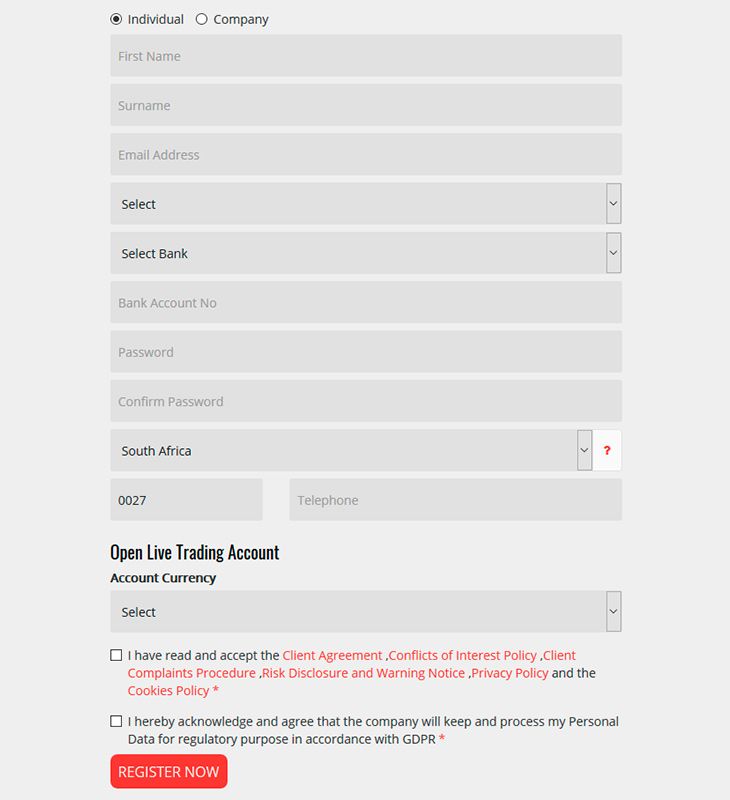

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

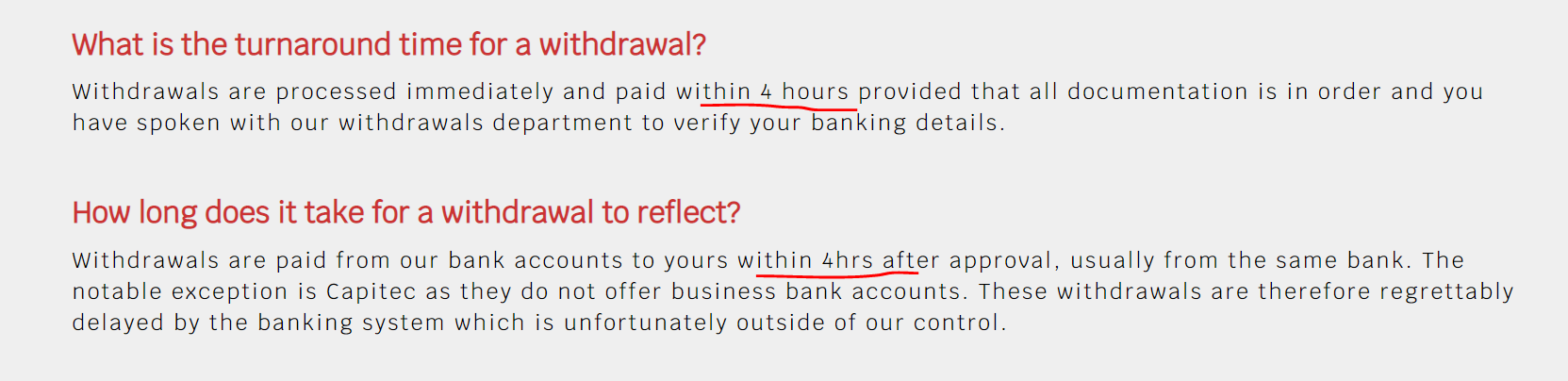

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Minimum deposit for jp markets

JP markets does not have a strict minimum deposit – our clients are welcome to invest whatever they are comfortable with. We do however recommend starting with around R3 000, particularly if you require training.

How much does JP markets charge for training?

Our clients enjoy complimentary access to some of the best forex training and mentorship at no charge, provided they have live, funded accounts with JP markets – there are different levels of access available depending on the value of your investment. We offer classes at selected offices across south africa, or online and video courses should you prefer to learn at your own pace.

Have a look at our training calendar on our website or email learn@jpmarkets.Co.Za to book, or to enquire about our self-study options.

What documents are required to open an account?

As a licensed financial services provider, we are obligated to comply with the financial intelligence centre act (also known as FICA). This act is the government’s response to the global fight against money laundering and fraud. To comply with the act, we must identify, verify and update clients’ information, which includes their proof of residence or proof of address. In short – these efforts ensure a safer financial system for all of us. As most of our business is conducted online and we do not transact with our clients face-to-face, we are subject to stricter laws than other entities. We therefore require the following in order to validate your account:

- A certified copy of your ID.

- Confirmation of residential address. Examples include the following:

- A utility bill reflecting the name and residential address of the person;

- A recent lease or rental agreement reflecting the name and residential address of the person;

- Municipal rates and taxes invoice reflecting the name and residential address of the person;

- Mortgage statement from another institution reflecting the name and residential address of the person;

- Fixed -line telephone account reflecting the name and residential address of the person;

- Valid television licence reflecting the name and residential address of the person;

- A statement of account issued by a retail store that reflects the residential address of the person.

- We will also require confirmation of your bank details in order to process any withdrawals.

I don’t receive any mail in my name – what can I submit as proof of address?

You can request a cohabitation form from us, and ask the homeowner to complete and submit along with their supporting documentation. Alternatively you could approach your ward councilor or local police station for an affidavit confirming your residential address.

I just tried to login and it says invalid login/password/no connection.

Open your MT4 client terminal.

Click on open an account.

Click on scan and let the whole scanning of the servers finish.

Once scanning finishes, click on jpmarkets-live (for live) or jpmarkets-practice (for demo).

Input login and password and you should be able to connect.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

How do I fund my trading account?

JP markets differs from its competitors because we are authorized and licensed to accept local deposits from clients. We have bank accounts with absa, FNB, standard bank and nedbank, as well as multiple payment gateways. It’s as easy as doing an EFT or cash deposit, or a simple card transaction on our website with your preferred intermediary. Please click here for more details: jpmarkets.Co.Za/bank-details.

Can I fund my account using bitcoins?

Yes you can, but only via skrill – fund your skrill wallet using bitcoin and use this intermediary to fund your JP markets trading account.

What reference must I use when I make a deposit?

Please use your MT4 account number as reference number when making a deposit. Should your MT4 number not be active, please use your full name and surname. You can also forward your proof of payment to finance@jpmarkets.Co.Za with your MT4 number in the subject line.

What is the turnaround time for my deposit to be allocated and reflect in my account?

Deposits are allocated almost instantaneously but because this is done manually, we try to adhere to a maximum TAT of 1 hour during business hours. Please be aware that this window may be slightly longer around news events etc.

My deposit has not reflected on my account – what is the problem?

Please ensure that you have used the correct reference, and that your proof of payment contains the following:

- Sending bank, and recipient bank, details.

- Date of transaction.

- Amount.

- Beneficiary reference.

Kindly note that due to high incidences of fraud, we cannot allocate bigger amounts until they have reflected in our bank account. It is for this reason also that all cheques deposits are subject to a 10-day clearance period.

I just downloaded MT4, why can’t I place any trades?

Sometimes upon downloading, not all symbols are displayed automatically. To enable this, you need to do the following:

– right click on your ‘market watch’ list. – select ‘show all’

Please make sure that you trade the instruments that has a dash (-) next to it.

I forgot my password for the client portal.

To reset your password, go to JP markets home.

– enter your email address and select ‘reset’

You will receive email instructions to reset your password.

Should this fail please contact us via support@jpmarkets.Co.Za, the live chat feature on our website, or telephonically at (+27) 021 276 0230.

I forgot my password for my trading platform.

Log into your client portal via our website and click ‘my accounts’ then click on the account number (in blue) to access your trading account.

Click on ‘change password’

Enter the new password in both blocks and submit – you should now be able to access your trading account with your new password.

How do I request a withdrawal?

Withdrawing funds from your JP markets account is easy and quick. Withdrawal are processed monday to friday from 9am to 5pm, GMT +2 (south african standard time), with all others being acted on within 24 hours.

For security reasons, we will call you to verify the request- if you are expecting a withdrawal, please answer any 087 / 010 / 021 calls to avoid further delays.

Please log in to your member area at secure.Jpmarkets.Co.Za and do an internal transfer from your trading account to your landing account.

Click on ‘transfers’ on the top grey bar and select ‘internal transfers’ from the bar on the right hand side.

The ‘from’ account is your trading account and the ‘to’ account is your landing account.

Enter the amount (in your trading currency) that you would like to withdraw. We will process the conversion on our side and click on submit, and it will go to our finance department for verification.

Ensure all documentation is in order before submitting your request, or it will be declined. We require clear, scanned copies of the following in order to process a withdrawal – ID, proof of address and bank statement confirming your INDIVIDUAL bank details – we are not allowed to process third party payments as per FSB regulations.

More information relating to withdrawals is available on our website.

What is the turnaround time for a withdrawal?

Withdrawals are processed immediately and paid within 4 hours provided that all documentation is in order and you have spoken with our withdrawals department to verify your banking details.

How long does it take for a withdrawal to reflect?

Withdrawals are paid from our bank accounts to yours within 4hrs after approval, usually from the same bank. The notable exception is capitec as they do not offer business bank accounts. These withdrawals are therefore regrettably delayed by the banking system which is unfortunately outside of our control.

Can I withdraw a bonus?

Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

How much is a spread?

Spreads are variable based on market conditions. However, JP markets offers some of the most competitive spreads in the market. On average you can get EUR/USD for about 2 pips, under normal market conditions.

Does JP markets have control over the spread/platform?

No, JP markets has no control over the platform, spreads or clients’ accounts. Unlike some other brokers, our liquidity comes directly from the biggest banks in the world such as JP morgan. UBS and morgan stanley to mention just a few. As a result, the spread is determined by the market conditions. The platform is a 3rd party company – we basically connect our best pricing into MT4. As a result, clients receive market pricing and the most stable and fair pricing.

How much is a swap?

Swaps are dependent on the pairs but can be checked by right clicking in your market watch, and selecting ‘symbols and properties’.

Pending order expiration

When setting a pending order(buy/sell limit OR buy/sell stop), you specify price and can also specify expiry.

In the MT4 platform you can either uncheck or check the expiry box. When unchecked, the pending order will be GTC (good till cancelled), thus the pending order will not expire unless you close it manually. If the expiry box is checked, you will be prompted for a time, take note that the default time is to expire at the close of the next hour.

In the mobile MT4 platform, you will also be asked for expiration either GTC or an expiry time/date. The default is also to expire at the close of the next hour.

Even if you specify a stop loss, the price specified as stop loss is not guaranteed as you may get a worst price due to market conditions as stop orders are always executed as market orders.

Also, it is imperative to clarify that orders may get closed before it reaches the TP or SL levels due to account reaching a stop out level.

Does JP markets give signals to clients?

JP markets does not give signals to clients. However, we do provide world class information and education around specific pairs and symbols and what is happening in the markets. These are sometimes received up to 3 times a day via SMS and email to ensure you get the best available information to make the most informed trading decision. Remember, your success is our success.

Does JP markets buy mandela coins?

JP markets does not accept mandela coins as a preferred method of payment as it is not authorized by the FSB. Clients can cash this in at their bank and then fund their account via the usual channels.

How do I become an introducing broker (IB)?

You can sign up directly on our website under our partners tab. You can also call on at our head office on 021 276 0230 or email support@jpmarkets.Co.Za.

We pay the best commissions in the industry and you can withdraw your rebates at any time. You can also track your rebates on your MT4 account which you can trade with or withdraw at any time. We also have a dedicated team of IB professionals that help you with your business from building a website, hosting seminars, online marketing, designing banners to mention a few. These individuals are focused to take all these tasks away from you to ensure you can focus on sales.

Our goal for all our partners is to help them grow so that one day they too can open their own brokerage, if that is their aim. Our sister company, JP technology, can assist with all the requirements to start your own brokerage.

We can also tailor make a structure to suit your individual requirements. Your success is our success!

What different account types does JP markets offer?

We understand that traders are different, and therefore their requirements are different, based on their trading style. As a result, we offer different types of accounts structured to suit you as a trader. We have ZAR, USD and GBP based accounts, as well as accounts which charge you commission or an account which charge you spread as a cost. All these accounts have direct market access and your order flows directly into the market, thereby ensuring you receive the best possible market price from the forex market with no manipulation of prices, slippages or lagging of any sort. We do not differentiate between micro or mini accounts – you are free to trade all available pairs without restriction.

What is the difference between ECN and standard accounts?

An ECN account stands for electronic communication network. It means that your orders are executed directly in the market. The difference between the two is that on an ECN account, you will see a commission charged per transaction whereas on a standard account you will be charged on spread. Both accounts work out to similar in cost so it is all dependent on what you as a trader prefer.

How much is the commission on an ECN account?

The commission charged is $ 10 per lot. We do offer a lower commission on our VIP accounts.

Why was my stop loss / take profit not hit?

System brief the way pending orders work in financial markets is as follows:

If a client has placed a buy limit or a buy stop order, the orders will get executed if the ask price reaches the specified level.

If a client has placed a sell limit or a sell stop order, the orders will get executed if the bid price reaches the specified level.

If a client has placed a buy order, both SL (stop loss) and TP (take profit) levels will be executed if the bid price reaches the specified levels.

If a client has placed a sell order, both SL (stop loss) and TP (take profit) levels will be executed if the ask price reaches the specified levels.

- By default, MT4 platform only displays bid price line. Enable the ask price line on the charts.

- All the highs and lows of all symbols are made from the bid prices.

Clients make their trading decisions based only on the bid price line which is what they see ontheir charts and then think that their stop loss and take profit levels were wrongly executed.

Clients place trades only using the pricing information on the charts which is not the right way asthe charts are made not from the tradable prices but from pricing library.

Clients should place trades using the prices displayed on the market watch as those are theprices JP markets is willing to buy and sell.

How a chart looks with only bid price line

How chart looks with both bid and ask price lines

How does JP markets make money if you are offering free courses and your clients are “profitable”?

JP markets makes revenue when clients trade. Therefore the more that clients trade, the more revenue that is made. It is for this reason we ensure that our clients receive all the knowledge and tools available to be able to make their own educated trading decisions.

Who regulates JP markets?

JP markets is an authorized FSP 46855. We are regulated by the financial services board and the responsible acts such as FIC act, SARB and FICA act.

How much money can I make if I deposit X amount?

Your profits all depend on the type of trader you are. There are no limitations or restrictions on what you can make in the forex market. Some people have managed to make 10 000 % in one day but what is important is to manage your risk.

I want to start trading but I don’t know how?

We can teach you through our online courses, PDF forex book or any of our free classes we host. Contact us at learn@jpmarkets.Co.Za to find out more.

Do I have to pay JP markets for their services other than my investment?

No, there are no fees you have to pay.

Can JP markets trade on my behalf?

No, we do not trade clients’ funds on their behalf, and we do not recommend that you give your login credentials to anyone to trade on your behalf. We can however teach you how to trade the markets on your own. Alternatively you could link your account to that of a master trader – check out our social trading facility here copytrader.Jpmarkets.Co.Za. You can compare the trading history of the available traders and pick the one whose trading strategy is most closely aligned with your investment goals.

Does JP markets make any deductions for taxes on the money I make/withdraw?

No, we do not make any deductions – your tax considerations are completely between you and SARS. However, it should be noted that any profit that you make from trading forex will be classed as contributing to your gross income in the income tax act, and thus would be taxed as income, based on the income tax tables for an individual. Consequently, any expense that you incur in the production of the income can be deducted. Please speak to your tax consultant to be completely clear about the tax implications.

Is my money safe?

Your funds are completely safe. Funds are kept in client to client segregated accounts which gets monitored and audited daily by a third party registered auditor every single day. Therefore, your funds are separate and completely safe and secured. In addition, we also have fidelity and professional indemnity insurance to give our clients that extra piece of mind.

FP markets minimum deposit guide (2021)

If you have read our FP markets review, you will know that they make a range of account types available.

Within these account types, one of the key factors you have to consider is the minimum deposit and how it applies to your trading style.

That is why we have conducted a thorough review of the FP markets minimum deposit and how it is applied over a range of different funding methods and account types.

This should help you as a trader to select the best deposit method and account type depending on the minimum amount available.

Table of contents

74-89% of retail CFD accounts lose money

FP markets base currency

First of all, it is important to note that FP markets makes a wide selection of base currencies available. These include EUR, USD, GBP, AUD, CAD, SGD, CHF, HKD, JPY, and NZD.

This is an extensive range that caters well for almost every trader no matter where you are located.

FP markets funding and deposit methods

As you would expect from a top forex broker, FP markets offers a very good selection of deposit methods for you to choose from. Let’s take a more detailed look at each deposit method available.

Wire transfer

The FP markets minimum deposit using a wire transfer is 100 australian dollars or the equivalent in your chosen account currency. Typically, if you choose to fund this amount with a local bank, then no fees will be applied. This could change if you are funding from an overseas bank.

The processing time for this FP markets deposit type is usually one business day.

Credit/debit card

Credit and debit card funding options are available with FP markets through both visa and mastercard. The minimum deposit in this case again stands at 100AUD.

No fees are applied if you are funding a metatrader account. In the case of IRESS accounts though, a 1.6% domestic funding fee, and 3.18% international funding fee applies. This funding process is typically instant in the case of metatrader accounts, and takes up to one business day with IRESS accounts.

Ewallets

Ewallet deposit and withdrawals are well facilitated by FP markets. Both neteller and skrill are employed to take care of this with a 100 AUD minimum deposit in place.

Funding in this manner is typically fee-free from the broker side, and again, deposits for the funding of metatrader accounts are typically instant, while the funding of IRESS accounts takes up to one business day to complete.

Other methods

There are several other funding methods available for your FP markets account. These will depend on your location. POLI, BPAY, and fasapay are widely available.

If you are based in asia then online pay as well as the services paytrust88, and ngan luong are accessible.

The same general rules apply in regard to the deposit processing time. The FP markets minimum deposits here are not stated but will typically vary.

FP markets minimum deposits

As per the others forex trading low minimum deposit brokers, as well as depending on the funding method, the minimum deposit which applies to you will depend on the account type you are using.

Let’s take a more in-depth look at the minimum amount on each account type.

Standard account (metatrader)

The FP markets standard account with metatrader is a commission-free forex account. In this case, the minimum deposit is 100 AUD or equivalent amount in your trading currency.

Raw account (metatrader)

The FP markets raw account operated through metatrader is again a forex account, on this occasion with very low spreads but they do apply a commission charge. The minimum deposit here is again 100 AUD or equivalent.

Standard account (IRESS)

The FP markets standard account through IRESS is used by many traders who wish to trade equities through the proprietary FP markets trading platform. Here, a monthly fee is charged based on the profits you have made, and a minimum commission of 10 AUD is applied.

The FP markets minimum deposit for this account type is 1000 AUD or equivalent currency.

Platinum account (IRESS)

Again this account type is used by traders wishing to trade equities through the FP markets proprietary platform. As with the standard IRESS account, a monthly profit-based fee is charged along with a minimum commission of 9 AUD.

Within this account type, an FP markets minimum deposit amount of 25,000 AUD or equivalent is required.

Premier account (IRESS)

The FP markets premier IRESS account is their top-tier account for those wishing to trade equities. The platform is the FP markets proprietary trading platform and there are no platform fees charged at this level. There is also no minimum commission in place.

The FP markets minimum deposit for this account type is 50,000 australian dollars or your equivalent base currency.

Related guides:

FP markets deposit bonus

At present, there are no FP markets trading bonus or no deposit bonus on offer.

Previously the broker had offered a 20% deposit bonus and a $30 no deposit bonus. These are no longer available. This is likely in line with regulatory requirements around the world which are becoming more stringent.

74-89% of retail CFD accounts lose money

IC markets minimum deposit guide (2021)

Trading with IC markets there is every chance that you have already taken a look at our IC markets review.

This will provide you with much of the information you need in order to get started.

Here we are going to get our feet wet a little more with information around the specific areas of IC markets minimum deposit amounts, and IC markets funding methods.

This should present you with all the options you need when depositing and beginning to trade with the broker.

Table of contents

74-89 % of retail CFD accounts lose money

IC markets base currency

As a major broker, IC markets makes a variety of base currencies available for you to trade with. These base currencies do not change regardless of which regulatory authority you are under, or where you are based. This can be something of a positive for many traders who like to choose their base currency.

The options available include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and canadian dollar. If you choose to use a different currency to deposit then you may well be liable to incur a conversion fee.

IC markets funding and deposit methods

As you would expect, there are a range of common funding methods to be found as a trader with IC markets. Here we will take a closer look at the conditions surrounding each method.

Wire transfer

Like almost all top forex brokers, wire transfer deposits and withdrawals are made available by IC markets. These deposits accept all of the base currencies mentioned above with the only exception being if you are located within europe. If this is the case, then you can choose between deposits in euro, GBP, or USD only.

There are no fees from the broker side for wire transfers, though you will want to check with your bank to verify their policy as fees could apply from that side. There is a typical processing time of between 2-5 days for wire transfer deposits.

No IC markets minimum deposit amount applies here.

Credit/debit card

Both credit and debit card deposits are available around the world with IC markets. Mastercard and visa, in particular, are always available. Every base currency is facilitated with the exception of HKD and if you are located again in europe, you must choose between a deposit in euro, GBP, or USD.

With the credit and debit card deposits, again there are no fees attached from the broker end and the deposit is instant so you can trade with your funds right away. Once again, no specific minimum deposit applies here.

Ewallets

Ewallets are an increasingly popular deposit method among top forex brokers. With IC markets these methods are available around the world with the exception of within europe. Even so, UK traders can still use ewallets although only neteller is available to UK traders.

Traders in other places can avail of paypal, neteller, neteller VIP (not available in the UK), and skrill. When it comes to base currencies, all are supported by paypal deposits, all except HKD, CHF, and NZD are supported by neteller, and neteller VIP supports AUD, GBP, EUR, CAD, SGD, and JPY. Skrill as a funding method supports 6 currencies in AUD, USD, JPY, EUR, GBP, and SGD.

There are no fees to be concerned about with these deposit methods and the funds are usually available right away. Again, there is no minimum deposit from IC markets to be concerned about.

Cryptocurrencies

The next IC markets deposit method you may be wondering about is cryptocurrency.

The only crypto which you can use in funding your account is bitcoin, but there are no fees attached to this other than the minimal fees from your own BTC wallet which can be directly used to deposit.

The processing time for this method depends on the crypto network traffic but usually completes within 2-hours.

Other methods

Naturally, there are other methods available for you to deposit with IC markets.

These are largely fee-free and depending on your location. The exception here is when you use china unionpay cards. This facilitates a CNY deposit, but there is a 3.5% fee attached.

Other deposit methods from within europe include klarna and rapidpay which both allow for EUR or USD deposit.

Outside europe, bpay and poli can be used for AUD deposits, fasapay for USD deposits, and if you are located in thailand or vietnam, you can avail of their online internet banking services to deposit USD within 30-minutes.

IC markets minimum deposits

Having had a look at all of the funding methods available, we can see that no minimum deposit particularly applies to any funding method you wish to use.

Now let us take a closer look at whether any minimum deposit in IC markets is needed based on the IC market account types.

In fact we can see that no minimum is required, although a 200 USD deposit is recommended so that you can get the most out of the services offered by the broker. This does not change regardless of where you are based.

So, IC markets minimum deposit is officially 0$. In fact, IC markets is one of our forex trading no minimum deposit option.

Metatrader standard account

The IC markets standard account type makes the well-known and respected MT4 and MT5 trading platforms available for you. This account type features no commission and low spreads which start from 1 pip.

This account type also features micro lot trading if you require it. The IC markets standard account minimum deposit is 0$.

Metatrader true ECN account

The IC markets metatrader true ECN account as referred to in the name makes ECN execution of trades available through both metatrader platforms. This account has spreads that begin from 0 pips although a commission is charged within trading on this account type. That commission amounts to $7 per round trade on a lot.

Again, the IC markets true ENC minimum deposit requirement is 0$.

Ctrader true ECN account

The final account type we will examine is the ctrader true ECN account. This account type has many similarities with the metatrader ECN account and again facilitates ECN-executed trades with a spread starting from 0 pips and commission applied. The commission here is slightly lower at $6 per round turn on a currency lot.

Again micro-trading is catered for and no minimum deposit applies.

Related guides:

IC markets deposit bonus

When it comes to IC markets bonus types that are offered, unfortunately, the broker does not offer any type of trading or no deposit bonus.

This may change in the future with the possibilities open outside the strict european regulations, but at the moment this is not the case.

74-89 % of retail CFD accounts lose money

JP markets minimum deposit

The JP markets minimum deposit amount that JP markets requires is ZAR3,000.

The minimum deposit amount of ZAR3,000 when registering a live account is equivalent to USD 170,38 at the current exchange rate between south african rand and the US dollar on the day that this article was written.

JP markets is a south african-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as JP markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

JP markets does not charge any fees when deposits are made into the trader’s account, and traders can deposit the minimum deposit amount by using any of the following methods:

- Bank transfer (ABSA, FNB, nedbank)

- Credit/debit cards

- Skrill

- I-pay

- Payfast

- Transfers from atms, and

- Snapscan, and

- Mpesa

JP markets supports a variety of deposit currencies in which traders can fund their accounts including:

- USD

- GBP

- ZAR

- KWD

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by taking down the banking details provided to transfer funds via EFT, or traders can follow these steps for other payments:

- Navigate to the JP markets website and log into the client portal.

- Select the deposit option, the payment method and amount.

- Follow the instructions and additional prompts to deposit the minimum amount.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Small variety of deposit methods supported |

| 2. Only a few deposit currencies supported |

What is the minimum deposit for JP markets?

Interactive brokers does not have a specified minimum deposit.

Professional accounts, however, have certain minimum deposits depending on the account that the professional trader opens.

How do I make a deposit and withdrawal with JP markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Bank wire transfer

- US automated clearing house (ACH) transfer initiated at interactive brokers

- Cheques

- Direct debit/electronic money transfer

- Canadian electronic funds transfer, or EFT

- Single euro payment area (SEPA)

- BACS/GIRO/ACH

Does JP markets charge withdrawal fees?

The first withdrawal is free, thereafter traders will be charged per withdrawal depending on the size of the withdrawal and the method of payment.

Minimum deposit for jp markets

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

JP markets review

General information

Company information

Account information

Review

Forex trading is becoming increasingly popular in south africa, so it’s no surprise that forex brokerages are popping up in the country left and right. The good news is that there are very strict regulations in south africa so it is possible to find a broker that will keep your money segregated and protected. The FSB, financial services board monitors the actions of the brokerages in south africa and offers regulation for JP markets. According to its website, JP markets has offices in kenya, pakistan and bangladesh, though we haven’t visited them to ascertain the reliability of these claims.

As a forex brokerage, JP markets has somewhat limited options. They work only with the metatrader 4 platform, which may be enough for some traders but will certainly be limiting for traders looking for a more diverse experience. There is no autotrading system immediately available by JP markets, though savvy traders can ostensibly add an EA to their MT4 account.

During our JP markets review we did not see any information about the spreads, commissions or minimum deposits which was a bit troubling to us, as we think that brokers should be totally transparent when expecting people to deposit their hard-earned funds. It seems very risky to open an account with so little information. They claim to have tight spreads but offer no details about what their actual trading conditions are. They do offer a demo account with a default total of $/R 10,000.

JP markets seems to offer many interesting promotions, which is uncommon since most regulated brokers these days are prohibited from offering such incentives. At the time of this JP markets review, the brokerage was offering a social media competition through which winners could win a yacht cruise, as well as a christmas promotion. It is unclear how often new promotions are offered.

During the course of this JP markets review we examined the website thoroughly and read reviews of the broker by independent sources, most of whom had fairly negative things to say about the brokerage. As we haven’t directly deposited funds with JP markets we cannot confirm whether these negative reviews were warranted, but it is certainly cause for concern. We were not able to find even one positive experience in the online forums that discuss brokerage experiences.

Even though JP markets is regulated by the FSB, there were ample red flags to indicate that it’s worth investigating other options if you’re looking for a forex broker in south africa. There are many global brokerages that are regulated in south africa or that accept south african traders even if their regulation is based in another country. These brokerages are likely to provide better service and to have larger, more experienced teams that can respond to your needs. Do your research carefully before depositing any money, and make sure to test the brokerage on a demo account to make sure that the service meets your needs and expectations.

So, let's see, what was the most valuable thing of this article: JP markets: login, minimum deposit, withdrawal time? RECOMMENDED FOREX BROKERS JP markets is solid, at first glance, as african brokers go, but what is most important is that it is at minimum deposit for jp markets

Contents of the article

- Real forex bonuses

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Minimum deposit for jp markets

- How much does JP markets charge for training?

- What documents are required to open an account?

- I don’t receive any mail in my name – what can I...

- I just tried to login and it says invalid...

- How do I fund my trading account?

- Can I fund my account using bitcoins?

- What reference must I use when I make a deposit?

- What is the turnaround time for my deposit to be...

- My deposit has not reflected on my account – what...

- I just downloaded MT4, why can’t I place any...

- I forgot my password for the client portal.

- I forgot my password for my trading platform.

- How do I request a withdrawal?

- What is the turnaround time for a withdrawal?

- How long does it take for a withdrawal to reflect?

- Can I withdraw a bonus?

- How much is a spread?

- Does JP markets have control over the...

- How much is a swap?

- Pending order expiration

- Does JP markets give signals to clients?

- Does JP markets buy mandela coins?

- How do I become an introducing broker (IB)?

- What different account types does JP markets...

- What is the difference between ECN and standard...

- How much is the commission on an ECN account?

- Why was my stop loss / take profit not hit?

- How does JP markets make money if you are...

- Who regulates JP markets?

- How much money can I make if I deposit X amount?

- I want to start trading but I don’t know how?

- Do I have to pay JP markets for their services...

- Can JP markets trade on my behalf?

- Does JP markets make any deductions for taxes on...

- Is my money safe?

- FP markets minimum deposit guide (2021)

- FP markets base currency

- FP markets funding and deposit methods

- FP markets minimum deposits

- Standard account (metatrader)

- Raw account (metatrader)

- Standard account (IRESS)

- Platinum account (IRESS)

- Premier account (IRESS)

- FP markets deposit bonus

- IC markets minimum deposit guide (2021)

- IC markets base currency

- IC markets funding and deposit methods

- IC markets minimum deposits

- IC markets deposit bonus

- JP markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- What is the minimum deposit for JP markets?

- How do I make a deposit and withdrawal with JP...

- Does JP markets charge withdrawal fees?

- Minimum deposit for jp markets

- Forex minimum deposit

- Trading with a small deposit

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- JP markets review

- General information

- Review

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.