Jp markets demo

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

Real forex bonuses

You are now being redirected to IC markets (BS) ltd, a company regulated by the bahamas regulator SCB.

Заявление на открытие демо-счета

Global markets at your fingertips

Unfortunately, IC markets do not accept traders from the united states unless they are “eligible contract participants” (“ecps”), as defined in section 1a(18) of the commodity exchange act. If you qualify as an ECP, you may continue to register as a client of IC markets provided you upload the ECP eligibility declaration form duly completed and signed on secure client area upon registration.

Начните торговать на форекс

На платформе ctrader уже сейчас

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of belgium. For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of latvia . For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

Residents of europe that wish to open an account under cysec license, please proceed to www.Icmarkets.Eu

You are now being redirected to internation capital markets pty ltd, a company regulated by the australian regulator ASIC.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to raw trading ltd, a company regulated by the seychelles regulator FSA.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to IC markets (BS) ltd, a company regulated by the bahamas regulator SCB.

Please confirm that you want to be redirected by clicking accept.

We are very sorry, our ASIC licensed entity can accept residents of australia only. We're redirecting you to our SC licensed entity where you can choose to continue your application.

The website you are visiting now is operated by IC markets global, an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Based on your country selection you might want to visit instead www.Icmarkets.Eu

If you want to proceed with onboarding with IC markets global please confirm that, this decision was made independently at your own exclusive initiative and that no solicitation or recommendation ha been made by IC markets or any other entity within the group.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018.

JP markets demo account

JP markets does not offer the option to open a demo account.

Trading can be a very intimidating task for beginners without prior knowledge, skill, or experience in trading and through the provision of demo accounts, brokers provide a comprehensive and risk free environment for beginner traders.

A demo account is often referred to as a practice account due to it providing traders with the ability and freedom to explore the broker’s offering without running the risk of incurring losses through the provision of virtual money with which to practice trading.

Beginner traders can use demo accounts to familiarize themselves with a live trading environment, where they can build up their trading skills by actively participating in trades and develop their own trading strategies.

Demo accounts are not merely intended only for beginners, but it provides more advanced traders the opportunity to explore what JP markets has to offer.

JP markets demo account features

Demo accounts serve the purpose of mimicking a live trading environment without traders risking their actual capital. Trading is conducted by using virtual money while simultaneously having access to all the financial instruments as with a live trading account.

Demo accounts allow traders to explore the broker’s offer and the trading platforms that they offer and brokers who do not offer this are at a slight disadvantage when compared to the various other brokers who do offer this along with similar trading conditions.

Pros and cons

| PROS | CONS |

| 1. Competitive trading conditions offered | 1. Demo account not provided |

What is the difference between a demo and live trading account?

A demo account provides the trader with a practice account that can be used to practice trading in a risk free environment.

Demo accounts are often suited for beginners who need to build up experience with trading as well as advanced traders who would like to test their trading strategies and explore the offering of a broker before registering a live account.

Does JP markets offer a demo account?

Can I convert my demo account to a live trading account with JP markets?

JP markets does not offer the option of opening a demo account, thus traders who choose this broker will only be able to open a live account, either a STP or ECN account which will be tailored to the trader’s needs.

JP markets zo maakt u demo-account aan – stap voor stap

JP markets biedt niet de mogelijkheid om een demo-account te gebruiken.

Handelen kan een zeer intimiderende taak zijn voor beginners zonder voorkennis, vaardigheid of ervaring met handelen en door het aanbieden van demo-accounts, bieden makelaars een uitgebreide en risicovrije omgeving voor beginnende handelaren.

Een demo-account wordt vaak een oefenaccount genoemd omdat het handelaren de mogelijkheid en vrijheid biedt om het aanbod van de broker te verkennen zonder het risico te lopen verlies te lijden door gebruik te maken van virtueel geld waarmee ze kunnen handelen.

Beginnende handelaren kunnen demo-accounts gebruiken om vertrouwd te raken met een live handelsomgeving, waar ze hun handelsvaardigheden kunnen opbouwen door actief deel te nemen aan transacties en hun eigen handelsstrategieën kunnen ontwikkelen.

Demo-accounts zijn niet alleen bedoeld voor beginners, maar het biedt meer gevorderde handelaren de mogelijkheid om te ontdekken wat JP markets te bieden heeft.

Misschien bent u ook geïnteresseerd in de JP MARKETS vergoedingen en spreads

JP markets demo-accountfuncties

Demo-accounts dienen om een live handelsomgeving na te bootsen zonder dat handelaren hun werkelijke kapitaal op het spel zetten. Handelen wordt uitgevoerd door virtueel geld te gebruiken en tegelijkertijd toegang te hebben tot alle financiële instrumenten zoals bij een live handelsaccount.

Demo-accounts stellen handelaren in staat om het aanbod van de makelaar en de handelsplatforms die zij aanbieden te verkennen en makelaars die dit niet aanbieden, hebben een klein nadeel in vergelijking met de verschillende andere makelaars die dit wel aanbieden in combinatie met vergelijkbare handelsvoorwaarden.

Misschien bent u ook geïnteresseerd in de JP MARKETS inschrijfbonus

Voor- en nadelen

| ✔️VOORDELEN | ❌NADELEN |

| 1. Er worden concurrerende handelsvoorwaarden aangeboden | 1. Demo-account niet voorzien |

Veelgestelde vragen

Wat is het verschil tussen een demo en een live handelsaccount?

Een demo-account biedt de handelaar een oefenaccount dat kan worden gebruikt om te oefenen met handelen in een risicovrije omgeving.

Demo-accounts zijn vaak geschikt voor beginners die ervaring moeten opdoen met handelen en voor gevorderde handelaren die hun handelsstrategieën willen testen en het aanbod van een broker willen verkennen voordat ze een live-account registreren.

Biedt JP markets een demo-account?

Kan ik mijn demo-account omzetten naar een live handelsaccount bij JP markets?

JP markets biedt niet de mogelijkheid van een demo-account, dus handelaren die voor deze makelaar kiezen, kunnen alleen een live-rekening openen, een STP- of ECN-rekening die is afgestemd op de behoeften van de handelaar.

Welke live handelsaccounts biedt JP markets aan?

- STP-account – minimale storting van ZAR 3.000/USD 175,63, leverage tot 1:500, geen commissies in rekening gebracht op transacties die worden uitgevoerd, spreads die doorgaans beginnen vanaf 2 pips op EUR/USD

- ECN-account – minimale storting van ZAR 3.000/USD 175,63, leverage tot 1:500, $ 10 commissies per lot, krappe spreads.

- VIP-account – dit account is alleen geschikt voor professionele handelaren en biedt extra voordelen, zoals verlaagde commissies naast krappere spreads. Bovendien zijn VIP-accounts onderworpen aan strikte criteria.

Wat zijn de beschikbare stortingsvaluta’s voor een live handelsaccount?

Misschien bent u ook geïnteresseerd in de JP MARKETS minimum storting

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

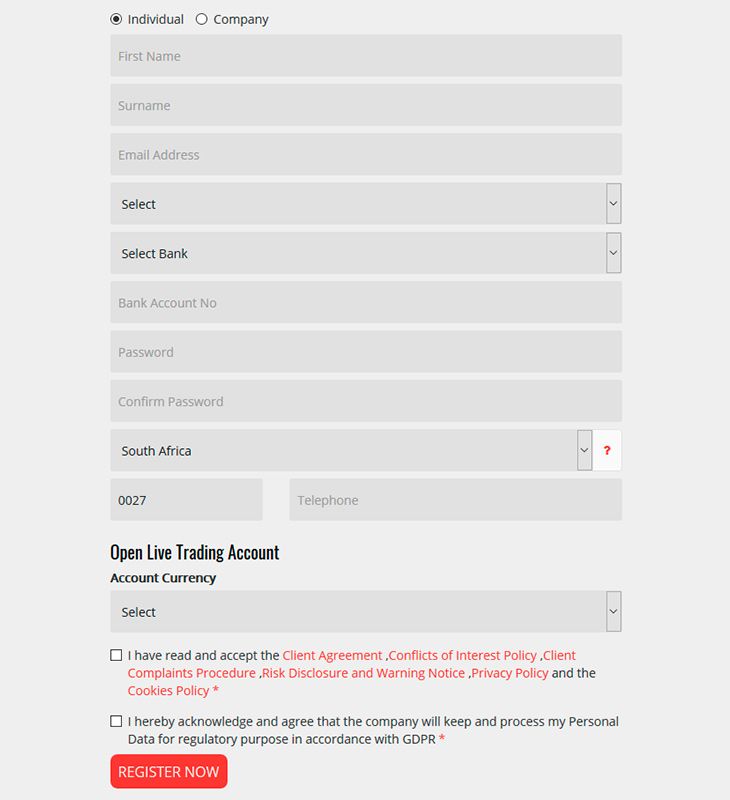

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

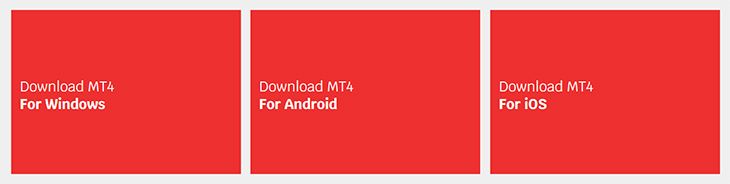

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

JP markets demo account

JP markets does not offer the option to open a demo account.

Trading can be a very intimidating task for beginners without prior knowledge, skill, or experience in trading and through the provision of demo accounts, brokers provide a comprehensive and risk free environment for beginner traders.

A demo account is often referred to as a practice account due to it providing traders with the ability and freedom to explore the broker’s offering without running the risk of incurring losses through the provision of virtual money with which to practice trading.

Beginner traders can use demo accounts to familiarize themselves with a live trading environment, where they can build up their trading skills by actively participating in trades and develop their own trading strategies.

Demo accounts are not merely intended only for beginners, but it provides more advanced traders the opportunity to explore what JP markets has to offer.

JP markets demo account features

Demo accounts serve the purpose of mimicking a live trading environment without traders risking their actual capital. Trading is conducted by using virtual money while simultaneously having access to all the financial instruments as with a live trading account.

Demo accounts allow traders to explore the broker’s offer and the trading platforms that they offer and brokers who do not offer this are at a slight disadvantage when compared to the various other brokers who do offer this along with similar trading conditions.

Pros and cons

| PROS | CONS |

| 1. Competitive trading conditions offered | 1. Demo account not provided |

What is the difference between a demo and live trading account?

A demo account provides the trader with a practice account that can be used to practice trading in a risk free environment.

Demo accounts are often suited for beginners who need to build up experience with trading as well as advanced traders who would like to test their trading strategies and explore the offering of a broker before registering a live account.

Does JP markets offer a demo account?

Can I convert my demo account to a live trading account with JP markets?

JP markets does not offer the option of opening a demo account, thus traders who choose this broker will only be able to open a live account, either a STP or ECN account which will be tailored to the trader’s needs.

Metatrader 5 (MT5) trading platform

Metatrader 5 (MT5) for windows windows

Metatrader MT4/MT5 webtrader

Metatrader 5 (MT5) for mac mac

Metatrader 5 (MT5) for ios ios

Metatrader 5 (MT5) for android android

MT5 forex trading platform

MT5 forex

trading platform

Fast, flexible and informed

Fast, flexible and informed

Metatrader 5 (MT5) is the all-in-one trading platform for forex, indices, share cfds and commodities.

Metatrader 5 is a technologically advanced multi-asset platform specifically designed for trading forex and cfds. The FP markets MT5 platform for windows offers traders access to a first-rate trading experience in forex, shares, metals, commodities, indices and cryptocurrencies.

Following the success of metatrader 4, its developer metaquotes created metatrader 5 to cater for a more enhanced trading experience. The platform provides a wider range of market analysis tools and offers access to additional exchange markets. There is no need to use multiple applications as metatrader 5 is a complete suite.

The platform includes all the necessary tools required to conduct fundamental and technical analysis, along with the option of developing custom indicators. Metatrader 5 has distinct features that accommodate for algorithmic trading and copy trading, making it suitable for traders using expert advisors (eas).

In addition to its functionality, metatrader 5 provides a high level of flexibility. FP markets offers versions for alternate operating systems including mac OS and webtrader, which is a web platform that is accessible through all popular internet browsers. You can also access your trading account via portable devices using FP markets mobile versions for ios (iphone and ipad) and android.

Metatrader 5 (MT5) platform features:

Metatrader 5 (MT5) platform

features:

Trade forex, indices, commodities, shares & cryptocurrencies

Spreads from 0.0 pips & leverage up to 500:1

Depth of market display and technical indicators

6 pending stop order types, including buy stop limit and sell stop limit

Improved strategy tester for algorithmic trading and expert advisors (eas)

In-built market of trading systems & apps

Trading functions and alerts with e-mail and push notifications on mobile devices

Improve precision in forex and CFD trading through trading robots for scalpers

Exchange trading allowed

Forex signals and copy trading

21 time frames and 8 order types

System requirements: MT5 is available on windows 7 or higher. It is also supported on mac OSX.

System requirements:

MT5 is available on windows 7 or higher.

It is also supported on mac OSX.

What can you trade on MT5?

What can you

trade on MT5?

14 to trade on

global exchanges

view full list

Bitcoin, ethereum, ripple,

bitcoin cash, litecoin

view full list

14 to trade on

global exchanges

view full list

Bitcoin, ethereum, ripple,

bitcoin cash, litecoin

view full list

What makes FP markets MT5 superior?

What makes

FP markets MT5

superior?

Tighter spreads

from 0.0 pips

FP markets consistently

offer some of the tightest

spreads in the industry.

Trade from 0.0 pips on the

major currency pairs.

FP markets consistently offer some of the tightest spreads in the industry. Trade from 0.0 pips on the major currency pairs.

Access institutional-grade

liquidity with no price

manipulation, no dealing

desk & no requotes.

Access institutional-grade liquidity with no price manipulation, no dealing desk & no requotes.

Award-winning low

latency trade execution

under 40* milliseconds.

Delivered from our equinix

NY4 facility server cluster.

Award-winning low latency trade execution under 40* milliseconds. Delivered from our equinix NY4 facility server cluster.

FP markets provide conditions for scalping and eas with no minimal distance between the spread.

FP markets provide

conditions for scalping and

eas with no minimal distance between the spread.

Metatrader 5 platform for forex

trading and technical analysis

Metatrader 5

platform for forex

trading and

technical analysis

The MT5 platform is a multi-asset trading platform offering forex and CFD trading across a wide range of asset classes and financial markets. Its features and functionality make it the trading platform of choice among experienced traders, particularly those who use technical analysis to conduct market analysis.

FP markets provides the ideal environment for scalping and expert advisors (eas) courtesy of zero restrictions, raw pricing and fast trade execution. Those using the MT5 platform are able to make full use of these trading conditions due to the advanced capabilities of the trading platform. The key features and functionality of MT5 include:

Multi-asset trading platform: unlike MT4 which was specifically designed for forex trading, MT5 is a multi-asset trading platform which allows users to trade a variety of asset classes including exchange instruments and futures. You can also manage multiple MT5 accounts simultaneously.

Powerful technical analysis tools: metatrader 5 provides an extensive range of technical indicators and trading tools that can be used to conduct technical analysis. Access 80+ technical indicators and in excess of 40 analytical objects through a customisable interface. Traders who place a premium on speed can activate the one click trading option.

Algorithmic and automated trading: this is an area where the MT5 platform excels as it has sophisticated automated trading capabilities. Metatrader 5 has been specifically designed for the use of expert advisors (eas) but takes algorithmic trading to another level. It does this by giving traders the ability to create and customise their own trading robots and indicators. This is beneficial to traders that wish to run different trading strategies across alternate asset classes and those who wish to capitalise on trading opportunities 24 hours a day.

Real-time market news & analysis: being informed of the latest market news and relevant macroeconomic releases are considered important to modern day traders. The MT5 platform includes an in-built economic calendar which features financial news as it is released. Access to real-time news can help traders identify trading opportunities and recognise volatility levels.

Multi-device capabilities: traders no longer have to install additional applications to use all the features that the MT5 platform has. FP markets offers specific versions for a variety of devices including mac OS, ios (iphone and ipad) and android.

Risk management: is an important concept in the financial services industry and an essential part of any trading plan. Metatrader 5 offers a growing range of risk management tools including an increased amount of pending order types. Multiple stop order options combined with an advanced depth of market (DOM) feature allow traders to implement a variety of risk management strategies.

Powerful trade analysis tools

Powerful trade

analysis tools

Access the most comprehensive analytical tools, with over 80 technical indicators and 44 analytical objects.

Up to 100 charts of currency and stock quotes at a time. For the most demanding traders, additional indicators are available on the MQL5 code base and “market”.

Trade 24 hours a day

with customised robots

Sophisticated automated trading capabilities for inexhaustible monitoring of charts, price quotes and trading strategies.

Engage in efficient financial trading 24-hours a day.

Look for hundreds of precise forex trading signals on the MQL5 “showcase,” to influence your trading decisions which you can use on both demo and live accounts.

The MQL5 programming language allows you to create customised trading robots and indicators, based on your trading style. The marketplace has 2,500+ readymade algorithmic applications to choose from.

Real-time market

news & analysis

Real-time market

news & analysis

Latest market news, macroeconomic releases and detailed insights with an in-built economic calendar to assist with financial news and fundamental analysis, FP markets understands the needs of today’s traders and delivers a high-functioning and secure trade terminal in the form of metatrader 5 for seamless trade execution and risk management.

Trade forex, share cfds, indices, commodities & cryptocurrencies on the

Trade forex, share cfds,

indices, commodities

& cryptocurrencies on the

Tight raw spreads

from 0.0 pips

Only $100

initial deposit

Why trade with the FP markets

MT5 platform for online trading?

Why trade with the

FP markets MT5

platform for online

trading?

Multi-asset trading from a single platform

open new positions and close existing ones with just a single click

Multi-device compatibility

MT5 is accessible on different devices, including windows, ios and android, without compromising on features

Forex signals and copy trading

trading signals allow real-time copying of trading operations from one account to another

Superior technical and fundamental analysis

advanced charting tools and indicators with numerous customisation options. In-built economic calendar and financial news source

Robust risk management

advanced market depth. Two types of stop orders and one trailing stop

How to download metatrader 5?

How to download

metatrader 5?

You can download and install metatrader 5 in a few simple steps.

Choose metatrader 5 in the 'select platform' menu

Log in to client portal using credentials provided in email

Download the appropriate version for your operating system

Install, log in, and start trading

Watch the video below for a step-by-step guide.

How to trade on MT5?

With metatrader 5 you can access the biggest financial markets from a single platform. That includes the NASDAQ and NYSE in the united states along with the australian stock exchange (ASX). One of the benefits of trading on MT5 with FP markets is the option of learning how to trade using a demo account before upgrading to a live account. This is a great way for inexperienced traders to understand the basics of trading forex along with learning how to use the trading platform and its features. Follow the link for further information on how to trade on MT5?

What is better MT4 or MT5?

The answer to this will vary on your trading style and preferred instruments. MT4 was specifically built for trading forex while MT5 is a multi-asset trading platform that is better suited to more experienced traders. It offers an expanded range of pending order options, charting tools and indicators. Traders using MT5 can also write and alter scripts making it more efficient for those using algorithmic trading and hedging strategies. Many traders prefer the simplicity of MT4, which is in fact the more popular platform of the two. For a detailed comparison, click here.

Start trading on FP markets’ MT5 today

Start trading on

FP markets’ MT5

today

Following 4 simple steps

Following 4

simple steps

The file it has

downloaded

The file it has downloaded

MT5 following the

onscreen instructions

Using your demo

or real account

Open an account now

By supplying your email you agree to FP markets privacy policy and receive future marketing materials from FP markets. You can unsubscribe at any time.

Yes, keep me up to date

With complimentary newsletter subscription & education materials

By supplying your email you agree to FP markets privacy policy and receive future marketing materials from FP markets. You can unsubscribe at any time.

Quick start & resources

Markets

Tools & platforms

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

Trading info

- Iress account types

- MT4/5 account types

- Pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

About us

Regulation & licence

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

- Iress account types

- MT4/5 account types

- FP markets pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

* the average order execution time between the trade being received, processed and confirmed as executed by us is 38 milliseconds. As observed from our bridge provider between 01-01-2021 to 31-01-2021. FP markets was rated by investment trends as the best for quality of trade execution 2019

** terms and conditions apply.

DISCLAIMER: this material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for difference (cfds) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading cfds you do not own or have any rights to the cfds underlying assets.

FP markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A product disclosure statement for each of the financial products available from FP markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First prudential markets pty ltd (ABN 16 112 600 281, AFS licence no. 286354). FP markets is a group of companies which include, first prudential markets ltd (registration number HE 372179), a company authorised and regulated by the cyprus securities and exchange commission (cysec license number 371/18, registered address: griva digeni, 109, aigeo court, 2nd floor, 3101, limassol, cyprus. FP markets does not accept applications from U.S, japan or new zealand residents or residents from any other country or jurisdiction where such distribution or use would be contrary to those local laws or regulations.

Thank you for visiting FP markets

The website www.Fpmarkets.Com is operated by first prudential markets PTY ltd an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Read T & cs

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by FP markets or any other entity within the group.

JP markets zo maakt u demo-account aan – stap voor stap

JP markets biedt niet de mogelijkheid om een demo-account te gebruiken.

Handelen kan een zeer intimiderende taak zijn voor beginners zonder voorkennis, vaardigheid of ervaring met handelen en door het aanbieden van demo-accounts, bieden makelaars een uitgebreide en risicovrije omgeving voor beginnende handelaren.

Een demo-account wordt vaak een oefenaccount genoemd omdat het handelaren de mogelijkheid en vrijheid biedt om het aanbod van de broker te verkennen zonder het risico te lopen verlies te lijden door gebruik te maken van virtueel geld waarmee ze kunnen handelen.

Beginnende handelaren kunnen demo-accounts gebruiken om vertrouwd te raken met een live handelsomgeving, waar ze hun handelsvaardigheden kunnen opbouwen door actief deel te nemen aan transacties en hun eigen handelsstrategieën kunnen ontwikkelen.

Demo-accounts zijn niet alleen bedoeld voor beginners, maar het biedt meer gevorderde handelaren de mogelijkheid om te ontdekken wat JP markets te bieden heeft.

Misschien bent u ook geïnteresseerd in de JP MARKETS vergoedingen en spreads

JP markets demo-accountfuncties

Demo-accounts dienen om een live handelsomgeving na te bootsen zonder dat handelaren hun werkelijke kapitaal op het spel zetten. Handelen wordt uitgevoerd door virtueel geld te gebruiken en tegelijkertijd toegang te hebben tot alle financiële instrumenten zoals bij een live handelsaccount.

Demo-accounts stellen handelaren in staat om het aanbod van de makelaar en de handelsplatforms die zij aanbieden te verkennen en makelaars die dit niet aanbieden, hebben een klein nadeel in vergelijking met de verschillende andere makelaars die dit wel aanbieden in combinatie met vergelijkbare handelsvoorwaarden.

Misschien bent u ook geïnteresseerd in de JP MARKETS inschrijfbonus

Voor- en nadelen

| ✔️VOORDELEN | ❌NADELEN |

| 1. Er worden concurrerende handelsvoorwaarden aangeboden | 1. Demo-account niet voorzien |

Veelgestelde vragen

Wat is het verschil tussen een demo en een live handelsaccount?

Een demo-account biedt de handelaar een oefenaccount dat kan worden gebruikt om te oefenen met handelen in een risicovrije omgeving.

Demo-accounts zijn vaak geschikt voor beginners die ervaring moeten opdoen met handelen en voor gevorderde handelaren die hun handelsstrategieën willen testen en het aanbod van een broker willen verkennen voordat ze een live-account registreren.

Biedt JP markets een demo-account?

Kan ik mijn demo-account omzetten naar een live handelsaccount bij JP markets?

JP markets biedt niet de mogelijkheid van een demo-account, dus handelaren die voor deze makelaar kiezen, kunnen alleen een live-rekening openen, een STP- of ECN-rekening die is afgestemd op de behoeften van de handelaar.

Welke live handelsaccounts biedt JP markets aan?

- STP-account – minimale storting van ZAR 3.000/USD 175,63, leverage tot 1:500, geen commissies in rekening gebracht op transacties die worden uitgevoerd, spreads die doorgaans beginnen vanaf 2 pips op EUR/USD

- ECN-account – minimale storting van ZAR 3.000/USD 175,63, leverage tot 1:500, $ 10 commissies per lot, krappe spreads.

- VIP-account – dit account is alleen geschikt voor professionele handelaren en biedt extra voordelen, zoals verlaagde commissies naast krappere spreads. Bovendien zijn VIP-accounts onderworpen aan strikte criteria.

Wat zijn de beschikbare stortingsvaluta’s voor een live handelsaccount?

Misschien bent u ook geïnteresseerd in de JP MARKETS minimum storting

JP markets - south africa's and africa's biggest forex broker

JP markets is a global forex powerhouse. We set high standards for our services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. We continue to grow everyday thanks to the confidence our clients have in us. We are licensed and regulated by the financial services board, south africa, FSP 46855.

Negative

balance protection

Through the use of an automated transaction monitoring and risk management system, a client’s account will never be allowed to reach negative balance.

Zero fee because

we want you to prosper

We do not charge you any fees for bank deposits or withdrawals made through our payment gateways. We are africa’s best, most reliable & trusted broker.

Quick & sufficient trading platforms

With high performing and innovative technology, our platforms are fast and sufficient for your trading. We do not lag and do not re-quote on orders. What you want you get.

Fast, reliable

deposits & withdrawals

With our almost instant deposit and almost instant funds withdrawal technology. You can enjoy your success almost instantly. No long waiting periods.

State of the art security

for your money

Safety is our top priority. Your monies is always safe with us and are kept in a separate banking account as requested by our regulator. Your money is safe and secure.

Friendly

customer support

Customer support, one of our most prized position – to what makes us different. Call, email or chat with us today. Our consultants are happy to help you with any request.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

So, let's see, what was the most valuable thing of this article: IC markets предоставляет лучшие платформы для торговли на финансовых рынках: metatrader 4, ctrader, multi account manager и другие. At jp markets demo

Contents of the article

- Real forex bonuses

- Заявление на открытие демо-счета

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- JP markets demo account

- JP markets demo account features

- Pros and cons

- What is the difference between a demo and live...

- Does JP markets offer a demo account?

- Can I convert my demo account to a live trading...

- JP markets zo maakt u demo-account aan – stap...

- JP markets demo-accountfuncties

- Voor- en nadelen

- Veelgestelde vragen

- Wat is het verschil tussen een demo en een live...

- Biedt JP markets een demo-account?

- Kan ik mijn demo-account omzetten naar een live...

- Welke live handelsaccounts biedt JP markets aan?

- Wat zijn de beschikbare stortingsvaluta’s voor...

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- JP markets demo account

- JP markets demo account features

- Pros and cons

- What is the difference between a demo and live...

- Does JP markets offer a demo account?

- Can I convert my demo account to a live trading...

- Metatrader 5 (MT5) trading platform

- How to download metatrader 5?

- How to download metatrader 5?

- How to trade on MT5?

- What is better MT4 or MT5?

- Open an account now

- Yes, keep me up to date

- Quick start & resources

- Markets

- Tools & platforms

- Trading info

- About us

- Regulation & licence

- Thank you for visiting FP markets

- JP markets zo maakt u demo-account aan – stap...

- JP markets demo-accountfuncties

- Voor- en nadelen

- Veelgestelde vragen

- Wat is het verschil tussen een demo en een live...

- Biedt JP markets een demo-account?

- Kan ik mijn demo-account omzetten naar een live...

- Welke live handelsaccounts biedt JP markets aan?

- Wat zijn de beschikbare stortingsvaluta’s voor...

- JP markets - south africa's and africa's biggest...

- Negative balance protection

- Zero fee because we want you to prosper

- Quick & sufficient trading platforms

- Fast, reliable deposits & withdrawals

- State of the art security for your money

- Friendly customer support

- Forex brokers lab

- What is JP markets?

- JP markets account types, spreads and leverage

- What is the difference between ECN and STP JP...

- Trading platforms

- Trading products

- What are JP markets fees?

- What is the minimum deposit for JP markets?

- JP markets bonuses and promotions

- JP markets deposit and withdrawal methods

- Is JP markets suspended?

- Customer services

- Conclusion

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.