Real forex traders

He uses and teaches the ichimoku kinko hyo system (a system we highly recommend you to look into, see our strategy here), and has numerous videos you can watch on his youtube channel.Real forex bonuses

Kim krompass trades mostly the 15min timeframe, in the NY or london sessions.

17 successful forex traders you can emulate in 2021

Successful forex traders are hard to find. As a trader, I have always tried to find the genuinely successful ones. Those with a real track record, that you can trust and follow. Not just traders with another seminar, book or a course to sell.

After years or research, hundreds of hours of reading, I have compiled a list of 17 forex traders that have at one point shown positive results. They disclose their systems, and you can emulate their strategies to take your performance to another level.

I have gone through twitter feeds, forums, paid courses, webinars, hundreds of hours of videos, and here it is.

Here’s my list of 17 profitable forex traders you can emulate

These traders will not provide you with the holy grail, but their strategies and insights are definitely worth a look.

Why do so many traders fail and why are so few profitable?

Most of your success in trading will come from discipline and psychology. Strategy plays quite a secondary role. Failure to understand that leads most aspiring traders to concentrate on finding the right strategy rather than adopting the right mindset.

Several academic studies, along with broker disclosures, have shown that only between 3 and 5% of traders are profitable. And probably only 1% are consistently so.

There is an interesting article on thebalance.Com that goes into the reasons why so few traders are actually profitable. Failure to manage risk, greed, trying to beat the market, …

Some of the traders listed below publish their strategies. Some of them make a business out of it. And some of them give it out in forums or on their website. It’s up to you to choose what you prefer.

If it were up to me, my number one choice would definitely be jarratt davis. Probably the most credible, with an all-weather system designed for most market conditions.

In each case, I have indicated what is known of their strategies or where it can be found. That makes it easier for you to get inspiration from it.

But don’t forget. Successful forex trading is not only about the strategy itself.

It is mostly about the mindset and the approach to trading and risk management.

If you want to be a successful trader, you will have to work hard on the psychological aspects.

There’s an interesting article on forexfactory about the common characteristics of successful forex traders. Take a few minutes to read it.

Before we dive in my shortlist, you can also check this list of successful traders and hedge fund managers.

I call it the great big success page. It features links to their net worth, etc…

Anyway, here it goes for my list of 17 successful traders whose success you can emulate in 2019.

Jarratt davis provides the best forex teaching course you can get

Jarratt’s davis’s course mixes fundamental analysis and price action in a combined methodology and one of the very best forex courses. His team at financial source is outstanding and taught by real pro traders.

Jarratt davis is quite a celebrity in the trading world. Barclays named him second best forex trader in the world for the period 2008-2013.

His team at financial source now teaches a very disciplined and systematic form of trading.

Mixing fundamental analysis with technical indicators, and the use of news events.

With arno venter, he also has a fantastic news forex trading course. Check it out, this is really some of the best material you can get. And it comes from professional traders who know how it’s done in banks.

It will teach you how to trade forex with fundamental analysis. Here’s where you can read about it :

It teaches most of his skills to aspiring traders.

Several of his students give testimonials of the success they have achieved.

Some of them with yearly performances (verified by myfxbook) of 50 to 100% yearly.

Jarratt davis is definitely the real thing.

I have tested many of his videos and course materials and they are prime educational content.

His website contains tons of free material that you can use to improve your skills.

Here’s a video on how to get started with fundamental analysis.

Trading tips and weekly videos are provided free. They will give you a good idea of how serious the program is, along with readily actionable strategies.

You can also listen to the interview jarratt gave on the trading heroes podcast. It has loads of useful info also.

If you are serious about getting into forex trading this is definitely the number one choice I would go with.

Jarratt has also written a book about trading a currency fund for those of you who could be interested.

How to trade forex with an audio sqawk ? Just like pro traders and hedge funds

Most forex traders at banks and hedge funds all use sqawk service, providing them with a real-time market news feed. This service gives them a clear edge over regular traders.

News trading means trading market announcements. You can make huge gains doing that.

If you’re in the market right at that time when the news breaks, well … that can be quite rewarding.

At financial source, jarratt davis’s team have a course to teach you how to trade from an audio sqawk. You can try it out and see if that improves your trading.

Kim krompass and the 15min forex price action trading Strategy

Her forex course teaches you to trade around 10 forex pairs in the new york session after taking a look at what happened in the asian session. All based on price action, a step-by-step method, trading long or short on trending pairs.

I got to know of kim krompass through her interview on the trading heroes podcast.

She is a pure forex price action trader, and often trades live for her group of traders. She usually trades from the new york open.

Kim krompass advocates a solid approach to risk and a very serious take on discipline and timing.

I took a closer look at the method she teaches.

Following her tweets and regular trade calls …

And I found that a good number of traders were reporting successful trading improvements and gains.

Her website and course contain a lot of free material. You can start by checking out some of these trade reviews to get an idea of how her strategy works.

Here’s a video on price action trading techniques you can take to the bank :

Kim krompass trades mostly the 15min timeframe, in the NY or london sessions.

She follows around 10 forex pairs. Risk level is 0,5% on every trade. She consistently aims for 3x her risk as upside on every trade.

Her trade plan works with a very simple methodology.

It boils down to three simple questions for each pair that she follows:

- What did price do overnight?

- Where is price now?

- What does price need to do in order for me to execute a trade?

Our recommendation is to get a feel for what kim krompass is doing by following her twitter account for a while.

Austin netzley will teach you to trade while having a full-time job

Austin has built 4 successful businesses and provides a blueprint of 10 simple steps to true wealth (6 figures in the next 6 months). His method is taught in a book which is 27 times #1 NY times bestseller.

Austin netzley made a fortune and retired at age 27 when he created an automated stock trading system that enabled him to achieve financial independence.

You can listen to his story in the interview he made with hugh kimura of trading heroes here.

What is interesting is how he came up with such a system in order to keep trading while holding on to a 9 to 5 job.

Austin’s book is titled make money, live wealthy. In it, 75 successful entrepreneurs share their 10 simple steps to true wealth. It summarizes most of his valuable learnings on true wealth and the mindset needed to achieve it.

It tells his story and the lessons he has learnt in wealth building.

If you want a starting place, check out austin netzley’s podcast, in which he has interviewed around 75 successful entrepreneurs. You will find a ton of extremely valuable info.

The main topic austin netzley talks about are :

- How to get out of debt

- How to have the finances so that you can stop worrying about money

- Ways to make 6-figures per year

- How can you create a passive income from investing on the side

- What are the steps to develop an unstoppable mindset

- Try to do something you’re passionate about with your career

- Ultimately, how to find personal freedom

Carl burgette (chaostrader63) can teach you forex strategies using the ichimoku system

Chaostrader63 (aka carl burgette) has made a name for himself trading the ichimoku system live. He is very didactic and his site fxatoneglance teaches this elaborate trading system.

Carl burgette, aka chaostrader63, is an outstanding trader.

He uses and teaches the ichimoku kinko hyo system (a system we highly recommend you to look into, see our strategy here), and has numerous videos you can watch on his youtube channel.

Here’s a great video he made on ichimoku basics for beginners.

His website fxatoneglance is full of free resources (forex pair reviews, technical analysis, webinars on ichimoku).

It also has a lifetime membership for a reasonable lump sum, it has extra features that you can unlock. We highly recommend following this inspired trader.

How sam seiden teaches profitable supply and demand trading strategies

Supply and demand is one of the purest forms of trading, trying to identify the key price levels where buyers or sellers can be found and anticipating that. Sam seiden is a master of supply and demand.

His approach to trading is explained in an award winning article he wrote for fxstreet.Com.

His strategy and the basics of supply and demand are explained in this video.

Bear in mind that sam seiden’s strategy doesn’t work as a standalone.

However if you already have a good knowledge of price action then you can turn it into a very profitable system.

For those of you wondering if sam seiden’s strategy works, a number of testimonials seem to indicate it does, read here.

Walter vannelli, a bank dealer turned independent trader

Well-known from his twitter feed, you can follow a lot of walter vannelli’s trades real-time. He gives an inside view on how banks really trade and offers 1 to 1 mentoring for motivated traders.

If you read his feed, you will find that his approach is always rigorous and very often his analyses come spot on.

He gave an interview on the traders lifestyle podcast where he goes into a bit of the detail of his strategy and daily routine.

Walter vannelli doesn’t have a website or a course, but he offers private mentoring, if you’re interested you should send him an email at walterfx.Info@gmail.Com.

Why is al brooks called the price action god

Al brooks’ experience and bestselling books on price action are legendary. No one masters these concepts better, with a rigorous methodology he applies to his emini trading (a stock market index future based on the S&P).

His system and strategies are pure price action reading of the market.

His course is available on his website, it consists of more than 100 hours of video arranged in 52 modules. Al brooks is also the author of four bestselling books on price action.

The brooks trading course has three options, with lifetime availability and fully online :

- Price action: price action fundamentals (57 hours plus of video) + how to trade price action (38 hours plus of video)

- Forex price action: price action fundamentals (57 hours plus of video) + how to trade forex price action (35 hours plus of video)

- Brooks trading course (combo of 1 & 2)

Here’s an extract from his price action trading course :

I have tested this course and it is amazingly detailed, al brooks provides a complete system to read the market. Along with the videos, the course includes an online how to trade manual, a tradestation rebate and intraday market updates.

If you want a taste of his strategies, al brooks gives out a free 26,000 word manual on how to trade price action.

Clearly one of top recommendations.

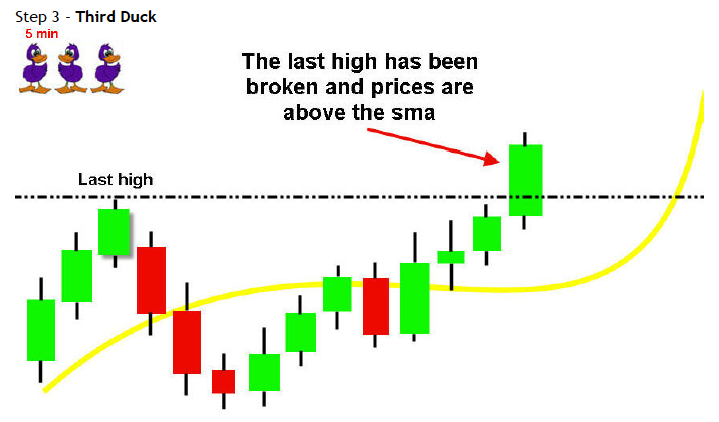

Try the three ducks trading system for an easy no-nonsense strategy

If you’re looking for a simple trading strategy, this simple system created by « captain currency » is a no nonsense system using moving averages.

The discussion thread around this strategy at babypips is one of the most active among all their forum threads.

There is also a pdf of the system available, and if you want to see how the system works check out my 3 duck’s strategy video.

This is a strategy you can very easily implement using a free charting platform such as tradingview, if you need one I also have a full tradingview beginner’s guide.

Here is a recap of the three ducks steps, on the EUR/USD 4 hour chart:

- On the 4 hour chart, current price should be above the 60 SMA

- On the 1 hour chart, price should also be above the 60 SMA

- On the 5min chart, the last high has been broken and prices are above the 60 SMA

Dan zanger, the man who turned $10,775 into $18 million

Dan zanger holds a world record for his trading one-year stock market portfolio appreciation, gaining over 29,000%. In under two years, he turned $10,775 into $18 million.

On his website chartpattern, dan zanger discloses a good part of the principles that led him to his incredible feat. Basically he trades stocks that have explosive moves up on great volumes.

Dan zanger actually holds two records, because he is also famous for making $42 million in 23 months. Not bad for a former swimming pool contractor.

You can subscribe to his newsletter (a free trial is available) where he selects

Now let’s take a look at several very successful french forex traders

Karen peloille, THE ichimoku expert, will teach you real profitable trading

Karen peloille is one of the world’s leading experts on the ichimoku kinko hyo system. She has trained hundreds of pro traders in banks and institutions and written a very authoritative book.

She is a reputed trader, quite low-key, but known for being consistently profitable (she claimed in one interview to never have a losing month).

Karen peloille has trained numerous traders in dealing rooms around the world.

She does not have a website and has nothing to sell, however her strategies are available in her excellent book (available in english).

You can also follow her twitter feed, regularly updated with her vision of different currency pairs and the market.

Khalid el bouzidi, one of the very few consistently profitable forex traders

Khalid el bouzidi is another awesome ichimoku trader, who has repeatedly demonstrated his skills on numerous forums. He has written two books (sorry, only in french) which are well worth reading.

Khalid el bouzidi also has a youtube channel called ichimoku academy.

Robby, the amazing ichimoku scalper, for more advanced traders

This french ichimoku scalper has tremendous results. He has often traded live with an excellent track record. However, his system is quite elaborate (using 3 ichimoku timeframes and H2 bollinger bands), but not suitable for beginner’s.

His results are impressive and can be verified as he often trades live or shares screen captures of his trading sessions. He has named his strategy the chinkoullinger, a contraction of chikou span and bollinger band.

Here is an amazing video where he scalps LIVE using the ichimoku system. Green arrows signal winning trades. Just watch his win ratio, amazing.

He trades on three timeframes :

- 15min for trade entries and exits

- H1 for confirmation

- H4 for overall trend

Robby uses an H2 bollinger bands indicator in quite a unique way. He loads the indicator on his other timeframes. Then he gets in when 15min chikou span breaks the H2 BB or pulls back on it. He always gets in in the direction of the trend to ride the acceleration.

To see his system in action, you can check his youtube channel (robby scalping, it is in french unfortunately). His system is fantastic but quite elaborate.

If you want to use his setup on tradingview, you can find it here. He also provides occasional ideas and trade comments on his twitter feed.

Benoist rousseau, the expert DAX scalper

Benoist rousseau is a french trader who specializes in index and futures trading, well known for successfully scalping the german DAX and nasdaq index on a daily basis.

He has shown consistently profitable results as he is open and transparent on his performance, which he regularly advertises on his website.

Rousseau has quite a large following and if you do speak french we encourage you to spend some time on his website and check out his youtube channel.

Successful traders found on forex factory

Apart from the established names mentioned above, I have come across quite a number of traders in the forex factory forums that could be worth mentioning.

The FF forums do contain a lot of junk, however, if you put in the time and effort, you can come across a number of interesting individuals, with genuine approaches and seemingly successful strategies, judging by other traders comments, but please note I had no way to verify these trader’s track records.

In any case, the richness of these forum threads will teach you a lot. The exchange of ideas, the chart representations, the trades and journals described, all are a fabulous trading school.

Here are these mostly short term traders.

Magnumfreak , the 1 minute trader

Magnumfreak made a name for himself as an outstanding 1 minute trader. His profile and threads can be found on the forex factory forum.

Here is the recap of his first 1 minute strategy, as disclosed by magnumfreak

His latest challenge, started early 2020 is t trade an account from 670$ to 1 million$. It is described here.

Magnumfreak disclosed one of his trading strategies in a thread called “freakish results”

He is definitely a trader worth following, however he consistently insists on the necessity for each trader to do his own due diligence without blindly copying a system.

Eclayf , creator of “the dance” trading strategy

Eclayf is another celebrity on forex factory. He is the creator of the dance strategy. Quite inspired by magnumfreak and turveyd, two other FF traders, he created this 15 min strategy.

Everything about this strategy « the dance » is inside the thread, you can even download a PDF of eclayf’s journey in trading and his full strategy.

Mongolian , “make money everyday” with a 1min strategy

Mongolian is a price action trader whose goal is to capture as many 12 pip moves as he can. He draws key levels and uses pivot points.

His full 1 minute strategy can be found in the thread here, he is very transparent in the methodology.

Davit, the pivot trader

Another very reputed trader at FF is davit. He trades a pivot trading strategy that can be found here.

Another great way to learn about great traders is to dive in the market wizards

The traders listed in this post are not the big names in trading, but if you want to know more about the big league traders, you have to read jack D. Schwager’s books from the market wizards series.

Bonus tip: copy the best traders

If you don’t have time or the energy to trade your own strategy, another valid option is to go for social trading. Using some platforms such as etoro, you can achieve some good returns by following the best traders, using the copy trading functionality. That option is 100% passive and can be a good choice.

If you’re interested, you can read my post where I explain how you can copy the best traders.

Do you know a forex trader that has a verified track record, a strategy that could be emulated and that you think could be added to this list ?

If you do, share it with us in the comment box below.

Disclaimer: some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase

Trade major US tech stocks this earnings season

Why are traders choosing FOREX.Com?

Global market leader

Connecting traders to the currency markets since 2001

Professional accounts

Discover the FOREX.Com

pro service

Innovative & award-winning

Our new mobile app offers one-swipe trading and lightning fast execution

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex trading platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader trading platforms" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Top stories

Gamestop caught the fascination of traders and the public alike.

BP swings to a large loss in 2020 as the.

EUR/USD looks to GDP data for fresh impetus. WTI.

Ready to learn about forex?

/media/forex/images/global/homepage/newtrader.Svg" alt="new trader" />

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

/media/forex/images/global/homepage/createplan-latest.Svg" alt="new trader" />

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

/media/forex/images/global/homepage/strategies-latest.Svg" alt="have some experience" />

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

*based on active metatrader servers per broker, apr 2019. **based on CFD spreads and financing competitor comparison on 28/08/19.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Forex easy trades

Watch every day live professional traders analysing forex easy trades and trading successfully.

Learn & develop forex trading skill with professional traders in real time.

Why should you join our fast growing trader community?

Real-time intra-day trade analysis with full description

Flex strategy

Price based flex strategy with built-in main four key indicators:

1) market trend, 2) momentum, 3) price direction alerts, 4) fib levels

these indicators help traders to indientify good trade setups and trades successfully.

Flex chart templates

Four flex templates including trade analysis tool, are browser based so traders do not need indicators, a high spec PC and many monitors whether a trader has one or multiple monitors, they can easily use these templates and watch all major pairs easily.

Potential trade alerts

Potential trade alerts including market trend & momentum information with a screenshot and past trade analysis which helps traders to identify high probability trades easily and plan trades accordingly or execute the trade instantly.

Live trade analysis

Trade analysts continuously analyse 12 major currency pairs and broadcast these analyses as soon as they find any good trade setups. These analyses are based on price action intra-day trading style, which is very easy for any trader to understand and validate instantly.

Forex squawk & news alert

Traders find all upcoming news details in the system including news alerts - 30 and 1 minute prior to the news release. Traders also receive information through a forex squawk including news updates and any new upcoming trade opportunities.

Online support

We provide live support to all our members through online chat and audio commentary. Our objective is to help traders to become successful, so any trader can ask questions in regards to the flex trading system and analyses.

Order desk

Pips-based trade execution order desk (with market and limit orders.) contains real time live market data feed which helps traders to test the flex strategy. Once they gain confidence then they can open a position on the real platform.

MT4 trade copier

Traders have the option to copy live trades from the flex virtual trading desk into MT4 platform through our MT4 trade copier plugin. Traders can also manage all MT4 trades from the flex virtual trading desk. Configuration and use is quick and simple.

Performance / trade history

Trading system records trades so that traders can view their current and past trading performances with screenshots and help them analyse their previous trades and improve their trading skills effectively.

Past trade analysis results

Here traders can view the results of all the past trade analyses made so they can practice virtually and understand how professional analysts analyse the forex market. This feature help traders to further develop their skills and understand live trade analyses effectively.

Daily analyses training videos

We provide detailed flex strategy training videos so traders can learn and understand how to use the system and strategy to trade successfully. These training videos cover all basic and advance trading material.

One on one forex education

We also provide private one to one forex training and coaching to individuals per request and help them live through the profxtrainer. Within this training we also cover forex trading, money & risk managment, investment & portfolio management.

Professional forex traders reveal their secrets to successful trading

Expert forex traders give insightful tips to becoming a successful forex dealer.

Is forex or currency trading worth the risk? This is one of the most popular questions a lot of individuals ask when considering trading forex. They do so because currency trading is among the top lucrative jobs in finance around the world.

Data obtained from salary.Com revealed that the average foreign exchange trader’s salary at the entry level in the world’s biggest economy was $76,458 as of july 27, 2020. However, the range typically falls between $42,048 and $97,964 for the rest of the world.

It should be noted that currency trading is among the top lucrative jobs. Bank forex traders only make up 5% of the total number of currency traders around the world, with other retail forex speculators accounting for the remaining 95%. But even at that, these few bank traders account for 92% of all forex volumes globally.

So, how can one become a good forex trader?

Michael chukwuka, a currency trader at a leading nigerian bank who spoke to nairametrics, shared insight on what it takes to be a forex dealer at a bank. He said:

“in my years of being a banker and a forex trader, I would say it has been an interesting one for me. But what I tell a lot of people who have exclaimed ‘oh wow!! I hear you guys make a lot of money trading,’ is that well, true there is a lot of money to be made in any business venture you go in and also so much money to be lost. This all depends on the will power to learn, understand, and have the will power to be guided properly with a goal in mind not just I want to be a forex trader.”

Micheal also stressed that currency trading is not for the faint-hearted. In other words, you must be emotionally strong and have proper risk management in place. He continued by saying:

“trading in the banking space is a whole different ball game than trading for your own self. The same techniques are used from price action trading, trend trading strategy, position trading, forex scalping strategy and a whole lot more, but you first of all need to know in-depth what you are about to start and be willing to go down the tunnel because you would make losses which most times scare people and they give up. In the same vein, you can make so much profit as you see everywhere today on the internet, but mind you, the losses are real too.”

He rounded up by advising that as a matter of importance, those who want to learn forex must have proper risk management in place. He said:

“we would keep this short, but I would advise you to learn the first basic steps to guide a forex trader on the right path. A few of these tips can be read about to get a full understanding of what it entails as it guides you along the path of being a forex trader. Knowledge is power, set aside funds, set aside time, start small, time those trades, cut losses with limit orders, be realistic about profits (this isn’t a ponzi scheme).”

Lukman otunuga, a senior research analyst at forextime (FXTM), spoke to nairametrics from his london office, on why discipline is paramount in trading forex. He said:

“when going head-on with the largest and most liquid market in the world, one needs to have faith in their trading strategy. Discipline is critical and sticking to the game plan is the real test, especially when things do not go your way. Aim for positive risk/reward setups as trading is a numbers game. Most importantly, respect the volatile and unpredictable nature of the markets.”

Opeoluwa dapo-thomas, an independent oil trader, in a phone chat interview with nairametrics, laid emphasis on the importance of having a good strategy when trading forex. He said:

“what makes professional traders stand out is their stance on risk management. Every trader has a strategy and a plan. Executing these plans is one thing, managing it is another kettle of fish. With proper risk management, professional traders try not to over-leverage while trading and still target decent returns.

“for example, 30-40% returns in a year from trading out do return on most risk-free investments and portfolio benchmarks. New FX traders ignore proper risk management and target 200-300% returns which most times ends up disastrous for their accounts.”

Finally, it’s very important to note that the present world can boast of less than 5% successful forex traders. Therefore, to be among these elite class of traders, you must have a very good strategy, proper risk management plans, be highly disciplined, have the ability to make snap judgment calls, and great knowledge of currency markets.

10 forex trading tips for newbies from real-life traders

In most of the posts I write, I usually pull from my expertise and personal experiences to help both budding and experienced traders in their trading. But this time, I’d like to do something different.

A few years ago, one of our lovely moderators had interviewed some of the most respected and experienced traders in the babypips.Com community.

I thought I’d go through their answers again in hopes of re-learning a thing or two from them. After all, the learning never stops here at babypips.Com!

I have compiled some of the best ones below. Take a look:

1. Don’t give up.

“I have several pieces of fairly good advice, but if I can choose only one this would be it: learning to trade is not a sprint, it’s a multi-year marathon. Don’t give up.”

– o990l6mh

2. Go for consistency

“I would urge newbies to learn the power of compounding modest, but CONSISTENT, daily profits — and, then, letting those profits grow exponentially to build wealth.

1) modest profits: don’t take huge risks swinging for the fences;

2) consistent profits: this means accurately following a trading method which has a high win-ratio; and

3) compound profits: let your profits accumulate in your account; and, as your account grows, increase the size of your trades in proportion to the size of your account.”

– clint

3. No shortcuts and no excuses!

“there are no shortcuts if a person is really willing to do whatever it takes to make it happen. They can become the trader of their dreams. That’s what I’m shooting for.

Why not? There’s no excuse not to become a great trader so many free websites like babypips.Com with excellent educational threads for traders to take advantage of.”

– wendy pablico

4. Proper risk management is key

“recognize that learning a trading setup is not the end of the road, it is just the very start. You must learn how to manage that position with proper risk, with a clear target, and with the trust that you must trade it every time for success.”

– scott cisco

5. Know thyself

“my one piece of advice I have for newbie traders is to find out who you are as a trader! There is no quicker path to losses and frustration than to trade who you are NOT. Discover who you are as a trader and trade YOU.”

– lydia idem finkley

6. Plan your trade and trade your plan

“plan your trades well before they happen, meaning it should have an entry, stop-loss and take-profit. Make sure you stick to your plan through thick and thin, meaning, of course, win or lose…stick to the plan!

Your entry can be S&R levels, smas or emas, bounces or breach, fibonacci levels, pivot levels, anything for that matter, but your entry is a prerequisite to knowing your stop-loss and profit target.

Without knowing these 3 key elements, there would be no guaranteed success, but of course, one could get lucky a few times, but if you want to stay in this business for the long haul, I would strongly advise to know these points before entering a trade.

All of the above means do not enter a trade on impulse, or based on your hunch or gut feeling that it will go your way.”

– butch belano

7. Start small

“my advice to newbies: keep it small. Too many newbies start with way too much money. I say keep your account size small while you learn.”

– casey stubbs

8. Leave room for error

Experience with trading on a live account is no less important than acquiring knowledge of technical indicators and no less important than knowing what moves the markets fundamentally. So, giving yourself enough margin for error means that the margin call will be further away.”

– yohay elam

9. Follow your system

“write out your trading system. Whether on a word document or excel sheet, write out your rules, trade requirements, goals, and details of your specific trades. Additionally, have this document open at all times.

You need to have a plan and follow it consistently. I believe that having it in your face the whole time helps you not sneak in that “different” trade.”

– rafael rosa

10. Respect the market

“never be afraid to admit you’re wrong. As much as you think you know, the market always knows more. Always respect your risk & never compromise your defensive circuit-breakers. They’re there for a reason & designed to check you out of your position if changing circumstances invalidate the trade.”

– tess

There you have it, folks! I hope you’ve picked up a nugget or two from tehse traders.

What about you? Do you have any forex trading tips you’d like to share with your fellow traders?

Insights for forex traders for december 2020 by saul lokier

Real talks with real forex traders

At the5ers, we get to speak to many of our traders about their strategies, systems, and emotions through our portfolio analyst resource.

We hear about the traders’ challenges and successes!

From these talks, we get to learn a lot of important insights regarding trading performance that might be helpful for all of you!

Here are some key insights from last month:

“I usually trade consolidation breakouts, but I struggle letting my trade run in my favor; I find myself closing for small profits as market retraces”

Insight: after breakouts, it is very normal for the market to retrace back to the breaking level before continuing in the previous direction. These are called swap zones, where resistance becomes support or supply becomes a demand. Be conscious of that pullback being normal market behavior, expect it so you don’t close your trades early when it happens.

“I do great on my demo accounts, but I can’t perform the same on real accounts”.

Insight: I hear you. I know this from a lot of traders, myself included years ago. Once real money is on the line we start trading differently. It is a normal and natural process we all need to go through. Expect to lose money at first, but make sure you learn from those losses. Think of that first lost money as learning fees, the same money you would commit to learning any other skill. Once trading real, start with very small positions, get used to them, and slowly increase your position size.

“I started trading supply and demand areas, but I am getting a lot of losses.”

Insight : snd is only a way of reading and understanding the market, it isn’t a strategy itself. You need to build your own strategy around snd concepts using parameters that suit your lifestyle and trading style. Let’s start adding some filters and better definitions of how you define tradeable areas.

We trade forex – come trade with us!

Instant funding on live trading account – click here

“I recognize that I start revenge trading and over trading when increasing lot sizes”

Insight: first, it is impressive you recognize the fact that increasing lot size is actually the cause for bad performance such as over-trading. Now you are aware of that, let’s approach it.

Risk tolerance is like a muscle we need to build and make stronger. We can’t jump from a micro-lot on a small account to managing 10 lot positions from one day to another. Even if you are trading a larger account, keep your lot size small and increase it slowly over time. You will soon get used to the big numbers and positions and will be able to trade larger positions.

“sometimes I face a contradiction between my strategy giving me a signal and my intuition ”

Insight: tough one, but you need to go with your strategy. Otherwise, you will never know its real stats and performance since you manually interfere in it. If you are getting a lot of these dilemmas, you might be doubting your strategy which is not good. We need to add to your trading plan how to handle these situations, maybe with special trade management for these specific trades.

Thank you saul for the call this morning.

I found your advice to be very helpful which I plan to implement in my trading immediately.

Insights for forex traders final words

Some trading challenges are very common across many traders. Some of them are more sophisticated but some have a relatively simple solution.

We are happy to see the improvement in the equity curve of the traders who have attended a portfolio analyst meeting.

If you are a 5ers trader, you can also schedule an appointment with one of our portfolio analysts to share your challenges and get some feedback. Just go to your dashboard and save your spot.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our newsletter.

Real forex traders

To invest with yellow traders, all you need to do is fill any of the investment forms.

Invest

Make your payment into our designated accounts and upload your proof of payment through the details that would be emailed to you.

Earn monthly

Let us do the hard work of trading your investment. While you relax and earn the ROI monthly.

Our investment services

Individual investment

This investment trading package enables investors to hold investment packages with yellow traders for 3 or 6 months respectively with ROI of maximum 20%.

Corporate investment

Our corporate investment plan which is globally licensed and regulated accrues dividends and returns on investment for up to 9 months at 20% ROI.

Junior traders

Yellow traders paying close attention to the income stability of our children’s future creates a plan that enables sustainable financial plan of 3 and 6 months’ of 10% maximum ROI as low as N50,000

Frequently asked questions

As of august 1st 2020, corporate investment is opened. Kindly fill the corporate registration form to invest.

Yes, your funds are secured and we even guarantee the safety of your funds further by signing a memorandum of understanding (MOU) with you stating clearly that your capital will be refunded if anything changes.

Our reviews

I never blv yt is real not until I got my first alert hoping to get another

Truely this investment is a place to stay for ever long live investors and long live yellow trader thanks and god will continue to increase your business and investors

Response from yellow traders

Thank you so much for this review.

Take the risk it’s worth it

Go ask about me I don’t believe in things like this especially when I hear invest your money….. ( invest what?) but I took the bold step by investing in yellowtraders ��now I’m preaching to my friends to stop buying big phones and come join the moving train…… and I pray for yellowtraders they we grow stronger and better in jesus name

Response from yellow traders

Thank you so much for this review. We are glad you are enjoying our service

Best forex brokers – top 10 brokers 2021 in ukraine

How should you compare forex brokers, and find the best one for you? In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options – everything that makes a broker tick, and impacts your success as a trader.

The “best” forex broker will often be a matter of individual preference for the forex trader. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements.

But we can help you choose…

Below are a list of comparison factors, some will be more important to you than others but all are worth considering. Details on all these elements for each brand can be found in the individual reviews.

Forex brokers in ukraine

How to find the best forex broker

The main criteria for finding the best forex brokers in ukraine 2021 are these – we will expand on each area later on in the article:

- Trading conditions/fees – this is the most important part of your global forex broker appraisal. There is no way around that. One forex broker may charge you 10 times less for the same trade than another. Take note of “hidden” fees, such as withdrawals fees, or inactivity fees.

- Market coverage – you need to be able to trade the fx pair or product of your choice/preference.

- Accessibility and affordability – beginner forex traders and small-timers need love too. You should never be forced into making a minimum deposit that you cannot afford to lose. Minimum deposits range from $10 to $1000 (or the £ / € equivalent). It might be worth investing more for a platform that suits you better, so stay open minded.

- Trading platforms – the forex trading platform and the tools it features are your primary weapons in your personal war for profits. Pick the one that suits you best. Remember many platforms are configurable, so they can be tailored to suit you. Personal preference will play a large part here, as many trading platforms offer very similar services, but look and feel very different. Is a mobile platform your priority, or a desktop web trading platform?

- Mobile trading apps – being able to trade on the go may be important. Some mobile apps are superior to others. Ideally the mobile platform will function just as the web based version.

- Deposits and withdrawals – you have to move funds to and from the broker, quickly and preferably cheaply. The deposit/withdrawal methods supported by the forex broker determine whether or not you can accomplish that. Financing an account may also require a specific payment method.

- Reputation – people talk. It is well worth listening to what traders say about a forex broker they have already tried.

- Regulation – when push comes to shove, legal recourse is your first, last and only hope to settle the problems you might have with your forex broker. A proper regulatory framework is preventive in nature. It aims to keep such problems from popping up in the first place.

- Customer support – you need someone to talk to when you run into problems with your deposits, actual trading, or – god forbid – withdrawals. Competent support is a must. From opening an account, to help with the platform, customer support can be important.

- Company background and history – knowing the past exploits of your forex broker can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet for example. You want peace of mind that your trading funds are segregated, and held safely and securely.

- Education – it never hurts to improve your understanding of how the forex markets work and how you can make the most of the opportunities they present. Some brokers offer extensive educational tools.

- Account opening / registration – is it a simple process to open an account? Do clients need to be verified? These processes are not always the same and might be worth considering if opening a trading account has been problematic in the past.

Broker costs

The services that forex brokers provide are not free. You pay for them through spreads, commissions and rollover fees. Low trading fees are a huge draw.

The fee structures differ from one forex broker to another, and even from one account type to another. There are two widely used basic setups.

- The broker charges a spread only. All other fees – with the exception of the rollover rate – are included in the spread.

- Besides the spread, a commission is charged as well. This commission is based on the amount you trade.

Spreads

Of these two forex broker fee arrangements, the second one is arguably the more transparent. That said, the commission/spread combination may not be the cheaper choice in every instance.

The spread can be fixed or variable. Fixed spreads are always constant. ECN broker may even deliver zero spreads. Variable spreads change, depending on the traded asset, volatility and available liquidity.

A currency market and spread go hand in hand.

Daily spreads may only differ slightly among brokers, but active traders (or even hyper active traders) are trading so frequently that small differences can mount up and need to be calculated to compare trading costs.

The lowest spreads suit frequent traders.

Some brokers focus on fixed spreads. There are indeed 1 pip fixed spread forex brokers out there too.

Forex brokers with low spreads are certainly popular. Do take commission and rollover/swap into account as well with such brokers though.

What is the rollover rate?

Forex positions kept open overnight incur an extra fee. This fee results from the extension of the open position at the end of the day, without settling. The rollover rate results from the difference between the interest rates of the two currencies. The first of the pair is the base currency, while the second is the quote currency.

Forex pairs traded

While most forex brokers offer impressive-looking selections of currency pairs, not all of them cover minors and exotics. Does the broker offer the markets or currency pairs you want to trade?

If you are trading major pairs (see below), then all brokers will cater for you.

If you want to trade thai bahts or swedish krone as the base currencies you will need to double check the asset lists and tradable currencies.

Majors

The aussie dollar ans swiss franc, while considered ‘minor’ pairs, are often traded in high volume. You can read more about those here: aud/usd or usd/chf

That said, there are brokers out there that will truly go out of their way to cater to their traders’ needs. Some will even add international exotics and currency markets on request.

Such flexibility is obviously a major asset, positively impacting the overall quality of the service.

What about crypto?

Cryptocurrency pairs are quite ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are both popular.

The massive volatility associated with these products makes scalping a viable strategy for profitable trading.

Some traders are in the forex game specifically to trade the crypto volatility. Such operators obviously need a forex broker that features as many crypto pairs as possible.

Micro accounts

Not everyone trades forex on a massive scale. In fact, many forex traders are small-timers. Such forex clients appreciate forex brokers’ micro accounts, some of which have the US dollar as their base currency.

Some forex micro accounts do not even have a set minimum deposit requirement. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings.

Note however that the spreads/commissions on such micro accounts tend to be quite adverse.

It is however, a cheaper introduction to a complex market (similar to cfd accounts) – and trading for real beats a demo account for genuine experience learning how to trade.

Trading platforms

Forex trading platforms are more or less customisable trading environments for online trading.

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Some may include sentiment indicators or event calendars.

Metatrader 4 or 5

Integration with popular software packages like metatrader 4 or 5 (MT4 or MT5) might be crucial for some traders. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure.

Trading view

Tradingview is also a popular choice. Some forex brokers allow their traders to trade directly on the world’s top social trading network.

Proprietary solutions are often interesting, though in some cases less than optimal. For traders who base their strategies on the use of eas and VPS, a proprietary platform that does not support such features, is useless.

While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and eas.

Make sure you understand any and all restrictions in this regard, before you sign up.

If you want scalping, see if your broker is a forex broker for scalping.

For those who want to trade on the go, a mobile trading app is obviously important. While all forex brokers feature such apps these days, some mobile platforms are very simplistic.

They lack all the advanced analysis and market research features, and as such, are hardly useful.

Tools & features

From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience.

Again, the availability of these as a deciding factor on opening account will be down to the individual.

Level 2 (or level II) data is one such tool, where preference might be given to a brand delivering it.

Deposits and withdrawals

There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. Such disparities mostly result from the internal procedures observed by different brokers.

At one given broker, it can take as much as 5 times longer to fund an account than at another. The incurred costs differ quite a bit as well.

Otherwise, the payment process largely hinges on the accepted money transfer methods.

It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark.

Education

Some traders may rely on their broker to help learn to trade. From guides, to classes and webinars, educational resources vary from brand to brand.

A broker however, is not always the best source for impartial trading advice. Consider checking other sources too – such as our trading education page!

Payment methods

The most common methods are bank wire, VISA and mastercard. The majority brokers tend to accept skrill and neteller too.

Forex brokers with paypal are much rarer. The same goes for forex brokers accepting bitcoin.

We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency.

Proper forex brokers always provide a local-specific payment solution to their target countries.

Customer feedback

Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums.

You have to take this type of feedback with a grain of salt, to say the least.

First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased.

Secondly: not all of this feedback is factually correct. Furthermore, there is no way to actually fact-check/verify this data. Even sites like trustpilot are blighted with fake posts or scam messages. There is no quality control or verification of posts.

That said, it is still relevant. If there’s a forex broker about which no one has ever said anything good, chances are it might have issues. To the trained eye, genuine trader reviews are relatively easy to spot.

The utter lack of community feedback is red flag as well. People always have something to say about their forex broker or trading account. Therefore, something is definitely amiss if there is no information available in this regard.

Regulation

Regulation should be an important consideration if trading on the forex market. Whether the regulator is inside, or outside, of europe is going to have serious consequences on your trading.

ESMA (the european securities and markets authority) have imposed strict rules on forex firms regulated in europe. This includes the following regulators:

ESMA have jurisdiction over all regulators within the EEA

The rules include caps or limits on leverage, and varies on financial products. Forex leverage is capped at 1:30 (or x30). Outside of europe, leverage can reach 1:500 (x500).

Traders in europe can apply for professional status. This removes their regulatory protection, and allows brokers to offer higher levels of leverage (among other things).

Outside of europe, the largest regulators of trading accounts and brokers are:

These cover the bulk of countries outside europe. Forex brokers catering for india, hong kong, qatar etc are likely to have regulation in one of the above, rather than every country they support.

Some brands are regulated across the globe (one is even regulated in 5 continents). Some bodies issue licenses, and others have a register of legal firms.

So to reiterate, an ASIC forex broker can offer higher leverage to a trader in europe.

Offshore regulation – such as licensing provided by vanuatu, belize and other island nations – is not trust-inspiring. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections.

Regulators such as ESMA (european securities and markets authority) generally frown upon bonuses.

Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. Those same ESMA rules are also why some brands are duty bound to display warnings about CFD trading creating a “risk of losing all your money“.

Security

Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security.

Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed.

A worthy consideration. Some regulators will set a higher benchmark than others – and being registered is not the same as being regulated.

Account security also differs among brokers. Some may offer the additional layer of protection of 2FA (two-factor authentication) to ensure only you have access to the account.

Demo accounts

Try before you buy. Most credible brokers are willing to let you see their platforms risk free. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances.

Try as many as you need to before making a choice – and remember having multiple accounts is fine (even recommended).

FX leverage

For european forex traders this can have a big impact. Forex leverage is capped at 1:30 by the majority of brokers regulated in europe. Assets such as gold, oil or stocks are capped separately.

In australia however, traders can utilise leverage of 1:500. That makes a huge difference to deposit and margin requirements. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish.

Just note that higher leverage increases potential losses, just as it does potential profits.

Company history

A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers. It will also likely blacklist them.

This practice creates a sort of online trail, an operational history of sorts, highlighting the past sins of currently “reputable” forex brokers.

What’s interesting about this history is how little exposure it receives. You actually have to scour the archives of regulators to happen upon such relevant bits of information.

Bonus

From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Regulatory pressure has changed all that.

Bonuses are now few and far between. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice.

Also always check the terms and conditions and make sure they will not cause you to over-trade. Many have time limits or turnover requirements.

Additional account details

When comparing brokers, there are also other elements that may affect your decision. These will not affect all traders, but might be vital to some.

Order execution types

Once you click the “open trade” or “enter” button in your trading interface, you start a rather intricate process. Your broker uses a number of different methods to execute your trades.

Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Some brokers only support certain order execution methods. For instance, your broker may act as a market maker and not use an ECN for trade execution.

If you are looking for this method specifically, you will need to seek out an ECN forex broker.

Ecns are great for limit orders, as they match buy and sell orders automatically within the network.

Some other options that your forex broker can use are:

- Order to the floor. Mostly used for stocks. This execution type is handled manually, through actual trading floors/regional exchanges. It is therefore extremely slow.

- Order to third market maker. This execution type involves a third party, which is a market maker. This party is the one handling the order.

- Order to market maker. This method is essentially the same as the above one. The market maker handles trade execution. Some market makers pay brokers to send them orders. Thus, your order may not end up with the best market maker.

- Internalization. When using this method, the broker matches the order from its own inventory of assets. This execution method is therefore extremely fast.

Order execution is extremely important when it comes to choosing a forex broker. It also goes hand-in-hand with regulatory requirements.

Broker reporting

Both ESMA and the US’s SEC require brokers to report the quality of the execution their services provide. Regulators aim to make sure that traders get the best possible execution.

Mifid II sets clear guidelines in this regard. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

This may seem tedious, but it is the only way to head off fraud. The prices are compared to the public quotes. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do.

If it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

These examples yet again showcase the importance of a proper regulatory background.

Account types

From cash, margin or PAMM accounts, to bronze, silver, gold and VIP levels, account types can vary. The differences can be reflected in costs, reduced spreads, access to level II data, settlement or different leverage.

Micro accounts might provide lower trade size limits for example.

Retail and professional accounts will be treated very differently by both brokers and regulators for example. An ECN account will give you direct access to the forex contracts markets.

So research what you need, and compare it to what you are getting.

Scams

Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;

- Were you ‘cold called’? Reputable firms will not call you out of the blue (this includes emails, or facebook or instagram channels)

- Are they offering unrealistic profits? Just stop and consider for a minute – if they could make the money they are claiming, why are they cold calling or advertising on social media?

- Are they offering to trade on your behalf or use their own managed or automated trades? Do not give anyone else control of your money.

If you have any doubts, simply move on. There are plenty of legitimate, legal brokers.

With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you.

We have ranked brokers based on our own opinion and offered ratings in our tables, but only you can award ‘5 stars’ to your favourite!

Read who won the daytrading.Com ‘best forex broker 2021‘ on the awards page.

Difference between A broker and A market maker?

A broker is an intermediary. Its primary (and often only) goal is to bring together buyers and sellers. By matching orders, hopefully automatically, without human intervention (STP), a broker fulfils its task. For this service, it collects its due fees.

A market maker on the other hand, actively creates liquidity in the market. It always buys and it always sells, acting as a counterparty to traders. Should your forex broker act as a market maker, it will in effect trade against you.

The conflict of interest in this setup is obvious, but it does happen.

The bottom line

Hopefully, you now understand some of the methods we’ve used to create our forex brokers ranking list.

Picking the right broker is no easy task, but it is imperative that you get it right. While we can point you in the correct general direction, only you know your personal needs. Take them into account, together with our recommendations.

Forex broker reviews

Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Note that some of these forex brokers might not accept trading accounts being opened from your country.

If we can determine that a broker would not accept your location, it is marked in grey in the table.

So, let's see, what was the most valuable thing of this article: if you want to fast track your trading performance, read about these 17 successful forex traders. They have found the key to profitable trading, and you can now emulate their strategies. At real forex traders

Contents of the article

- Real forex bonuses

- 17 successful forex traders you can emulate in...

- Why do so many traders fail and why are so few...

- Jarratt davis provides the best forex teaching...

- How to trade forex with an audio sqawk ?...

- Kim krompass and the 15min forex price...

- Austin netzley will teach you to trade...

- Carl burgette (chaostrader63)...

- How sam seiden teaches...

- Walter vannelli, a bank dealer turned independent...

- Why is al brooks called the price action god

- Try the three ducks trading system for an easy...

- Dan zanger, the man who turned $10,775 into $18...

- Karen peloille, THE ichimoku expert, will teach...

- Khalid el bouzidi, one of the very few...

- Robby, the amazing ichimoku scalper, for more...

- Benoist rousseau, the expert DAX scalper

- Successful traders found on forex factory

- Magnumfreak , the 1 minute trader

- Eclayf , creator of “the dance” trading strategy

- Mongolian , “make money everyday” with a 1min...

- Davit, the pivot trader

- Another great way to learn about great traders is...

- Bonus tip: copy the best traders

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

- Forex easy trades

- Why should you join our fast growing trader...

- Real-time intra-day trade analysis with full...

- Flex strategy

- Flex chart templates

- Potential trade alerts

- Live trade analysis

- Forex squawk & news alert

- Online support

- Order desk

- MT4 trade copier

- Performance / trade history

- Past trade analysis results

- Daily analyses training videos

- One on one forex education

- Real-time intra-day trade analysis with full...

- Professional forex traders reveal their secrets...

- 10 forex trading tips for newbies from real-life...

- 1. Don’t give up.

- 2. Go for consistency

- 3. No shortcuts and no excuses!

- 4. Proper risk management is key

- 5. Know thyself

- 6. Plan your trade and trade your plan

- 7. Start small

- 8. Leave room for error

- 9. Follow your system

- 10. Respect the market

- Insights for forex traders for december 2020 by...

- Real talks with real forex traders

- Here are some key insights from last...

- “I usually trade consolidation breakouts,...

- “I do great on my demo accounts, but I...

- “I started trading supply and demand areas,...

- “I recognize that I start revenge trading...

- “sometimes I face a contradiction...

- Insights for forex traders final words

- Real forex traders

- Our investment services

- Frequently asked questions

- Our reviews

- Best forex brokers – top 10 brokers 2021 in...

- Forex brokers in ukraine

- How to find the best forex broker

- Broker costs

- What is the rollover rate?

- Forex pairs traded

- Micro accounts

- Trading platforms

- Metatrader 4 or 5

- Tools & features

- Deposits and withdrawals

- Education

- Payment methods

- Customer feedback

- Regulation

- Security

- Demo accounts

- FX leverage

- Company history

- Bonus

- Broker costs

- Additional account details

- Scams

- Difference between A broker and A market maker?

- The bottom line

- Forex broker reviews

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.