Fxopen review

Fxopen has been in the FX trading business since 2005, which makes it a fairly established company in the current crop of FX brokers.

Real forex bonuses

The entire project began in egypt during 2003 as a research and educational center for technical analysis, but gradually, the founders moved into the brokerage business by setting up a full-fledged forex brokerage company. Fxopen is also well-known for their introduction of sharia-compliant accounts, where are directly aimed at muslim traders who are required to follow all islamic rules of trading such as the elimination of SWAP and other interest-based fees. Discover a broker you can trust by reading our in-depth and honest reviews, created by industry experts. Since 2015, we’ve reviewed over 200 forex brokers.

Fxopen review

This broker was not featured in our 2021 broker review audit. This is because, in the past 12 months, it has failed to pass our initial screening process and is not recommended by our team of experts. As such some of the information found here may be out of date.

We review all brokers to a strict and unique methodology, to ensure that we only promote high quality brands that you can trust. This methodology considers over 200 criteria points, covering the categories of safety, fees, platforms, products, payments and customer support. All brokers are then given a score out of 100. We update this methodology and our recommended reviews yearly, so that you’re only given up to date information.

If a broker has a score less than 80, like this one, we won’t recommend it to you. So that we don’t waste your time, we don’t update these reviews either. We know you don’t want to read a long review of an untrustworthy broker. Instead, you can use the tool below to find a high-scoring broker that accepts clients from your country.

Brokers available in ukraine

Discover a broker you can trust by reading our in-depth and honest reviews, created by industry experts. Since 2015, we’ve reviewed over 200 forex brokers.

Fxopen has been in the FX trading business since 2005, which makes it a fairly established company in the current crop of FX brokers. The entire project began in egypt during 2003 as a research and educational center for technical analysis, but gradually, the founders moved into the brokerage business by setting up a full-fledged forex brokerage company. Fxopen is also well-known for their introduction of sharia-compliant accounts, where are directly aimed at muslim traders who are required to follow all islamic rules of trading such as the elimination of SWAP and other interest-based fees.

Fxopen is proactive in keeping up with the times and has evolved into a competitive broker that has designed its services to suit all types of investors. One of the primary attractions of fxopen is their ability to offer FX trading products for a small initial deposit of just $1, which should help traders to test the market with a small capital before taking the plunge and investing huge money.

Fxopen was successful in opening up the FX market to a ton of new traders, who were previously unable to enter the world of FX trading due to high deposit requirements. Fxopen should be attributed towards bringing FX trading to the masses, even though some companies had already started offering micro accounts for amounts as small as $50. However, fxopen rewrote the rulebook by providing a trading account for a minuscule amount of just $1, which was indeed considered revolutionary at that time.

Does A small deposit mean that fxopen is not regulated?

For a large part of the company’s FX operations, the broker was not regulated by any agency, which saw it facing criticisms and consumer complaints from a majority of their clients. The lack of regulatory oversight does prevent companies from being completely honest with their traders. However, the company soon realized that they had to move into a different region and become a part of a regulatory organization if they are to survive in the highly competitive financial market. In 2011, fxopen switched its operations to new zealand, and at present, fxopen regulation is taken care of ASIC.

ASIC regulated forex brokers are highly regarded for their reliability and security, which should offer a sense of confidence and peace of mind while trading with fxopen. Regrettably, fxopen does not provide its services to US traders, which prevents US citizens from taking advantage of the forex markets using a small initial deposit. CFTC rules of 1:50 maximum leverage also prevent traders from opening any sizeable position using a negligible equity such as $1. Therefore, it doesn’t make sense for fxopen to offer micro accounts in the US, but they could have set up a dedicated brokerage in the US for standard accounts, as a CFTC and NFA regulation would have added further credibility for the company’s FX operations.

Account options, the maximum fxopen leverage, spreads, & other costs of trading

Fxopen has three different types of account that are classified according to the type of deposit and trading features. The micro account is the smallest account option that allows clients to start trading using an initial deposit of $1. The micro account is a market maker account, which attracts the highest spreads, re-quotes, and slippages. Although the micro account is ideal for small traders, the overall trading conditions are not favorable for long-term trading. The high fxopen leverage of 1:500 also puts a strain on the trader, as lower equity and higher leverage are always considered to be the downfall of a trader.

The other two types of accounts are known as the STP and the ECN accounts, which are available for deposits higher than $300. Once again, the company displays its dedication to its clients by offering a full ECN account for a small initial deposit. Some forex brokers offer access to their ECN accounts only for deposits higher than $1000 or even $5000. Regarding the trading conditions, STP and ECN accounts have similar features, with the exception being the fxopen spreads and commissions per trade. While ECN accounts are associated with commissions per trades, STP accounts have higher spreads. Perhaps one of the major drawbacks of fxopen is the spread on major currency pairs, as the broker is known to display spreads ranging from 3 to 7 pips for the majors such as EUR/USD and USD/JPY, which is certainly higher than the industry norms. All overnight trades attract a SWAP unless the trader has opted for an islamic account, which eliminates the concept of interests on margin or other fees.

Does fxopen have A proprietary trading platform?

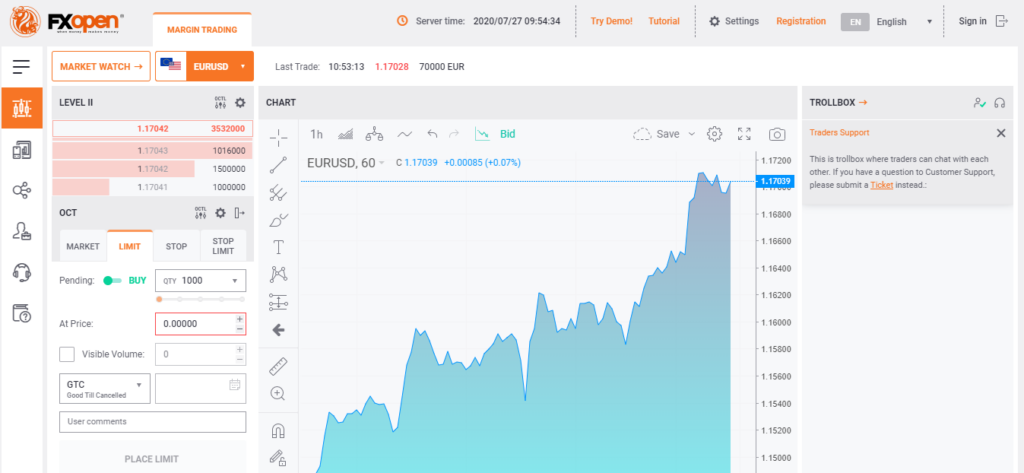

Traders have access to the MT4 terminal as the standard fxopen platform for all types of ECN, STP, and micro trading. The broker hasn’t bothered to develop a proprietary trading interface, which is not necessarily a bad thing, considering that the MT4 is the most widely used trading software in the world. Fxopen mobile traders can also log into their trading accounts using the MT4 app designed for android and ios. Fxopen uses a bridge technology for trade execution, which is developed by the company for their ECN accounts. ECN accounts are by far the best regarding trade execution and server speeds. However, the micro and STP accounts are slower in comparison.

Fxopen offers access to a VPS server for traders looking for lower latency and super-fast execution speeds, which are available for high-volume traders. Other traders can avail this service for a $30 monthly fee.

Fxopen also supports a wide variety of payment options, and all deposits and withdrawals are made instantly. The withdrawals do take some time for verification, but fxopen is one of the best forex brokers when it comes to initiating fast withdrawals. Although users can make payments through bank transfers, credit card payments, or through electronic payment systems, fxopen charges a fee for each transaction. Fxopen clients should check with the fxopen representatives regarding the fees and cost of a transaction before making a deposit or withdrawal.

Fxopen is the perfect broker for investors with a small initial capital, or for institutional traders who are looking for a reliable and secure forex broker. Traders can also test their trading skills using an fxopen demo account, but the ability to make a small deposit is certainly a good way to test the markets without risking too much. Apart from a few complaints about the inefficiency of their customer service department, fxopen is certainly a high-quality broker that is perfect for traders from different backgrounds.

Fxopen – forex broker rating and review 2021

| https://www.Fxopen.Co.Uk/ | |

| status | |

| regulation | FCA, ASIC, the financial commission |

| trading software | metatrader 4, metatrader 5, webtrader |

| headquartered | london, sidney, charlestown (nevis) |

Fxopen is a forex and cryptocurrency broker, founded in 2005 by a group of traders. With over a decade of experience, the company has gained an excellent reputation of a major forex brokerage company that continues to expand rapidly. Today, the broker is present over the globe with entities registered locally in london, perth and in saint kitts and nevis. The broker is regulated in all jurisdictions it operates from, including the financial conduct authority (FCA) in the UK and australian securities and investments commission (ASIC). Fxopen is also an approved member of the financial commission - an independent organization which specializes in regulating disputes between brokers and traders working on the forex market.

Fxopen offers MT4 and MT5 forex trading with a wide range of trading instruments: 100+ FX, cfds, indices and cryptocurrency pairs (43). The broker also provides its own PAMM technology allowing clients to benefit from the strategies of experienced traders with a proven track record of successful trading and guarantees automatic distribution of profit and loss between the strategy provider and the strategy followers. The company also welcomes islamic traders and lets them take advantage of forex trading without violating sharia law by offering them SWAP free accounts.

Traders using fxopen are offered the choice between several types of trading accounts: micro, STP, ECN and crypto with minimum deposit requirements ranging from 1 USD for the micro account to 100 USD for the ECN account. This offers traders the opportunity to specialize their trading aims within the correct account.

Fxopen guarantees excellent customer support, strict compliance with all trading terms and conditions and reliability, backed up by the latest state-of-the-art technology.

Fxopen trading information

Fxopen — latest reviews and comments 2021

I like to do my trading with the fxopen broker as the ECN spreads in this broker are very low and my trading is also giving me more profits now. It is always better to wait for the news before doing your trading so that you can get more profits.

Harsh nayar 31 may, 2020 reply

I had an interest in trading a few years ago, but I could not dare to start in reality with real capital for a very long time, doubting that I would succeed. But then the interest won, and I decided to try it. I chose this company on the feedback forum. Now I am at the testing stage, because I constantly have new questions and difficulties. So far, the profit margins are small, but I think that everything is ahead. If there are any recommendations for a newcomer, I will be glad to hear.

Their mobile app is very user-friendly and I can trade anywhere with it. It's better than other brokers' app. No technical issue so far.

Laslo 22 april, 2020 reply

Who said you can't have trading platforms, and trading analysis tools too? In fact, at excentral, we believe you can't really have one without the other, which is why all your fundamental and technical analysis tools are available for free (even with no registration needed). So get your trading started the right way, by checking all the upcoming economic events and releases, double-checking your calculations and seeing what charts, indicators and analysts are anticipating. Did we mention it's free?

I'm a beginner with forex trading and need support to operate all the time. So, for me, their chat online is very useful. It is slow sometimes, but at the end of the day I have some level of support for my operations. It is easy.

I have no experience in trading, but I have learned the basics and just recently I made a withdrawal and it came through to my bank account. Learn forex it's not easy but once you get to know the basics of trading I don't see why you should fail.

With fxopen I finally understood what distinguishes the normal brokerage from a cheater. Now I understand that constant slippages on every stop loss is not normal. Now I know that slippages can really happen but only when the markets get wild, not on every trade. I also finally understood that regulations really matter. I think that FCA and other authorities really keep their eye on what broker is doing. I can't explain otherwise the fact that I always suspected my other broker in quotes manipulations and I've never had similar suspicions about fxopen. Highly recommend the company!

Samuel 24 march, 2020 reply

I am trading with fxopen for the last 4 years and am very happy with the broker. I recommend fxopen to all novice traders because forex trading is not easy, but this company has made it easy for me, something I really appreciate.

I don't think there can be a good broker with no regulator's supervision. Brokerage services bring lots of money to thier owners so there is no single reason why part of these money can't be spent to obtain all the necessary licenses and pay all the fees. I chose fxopen because from the very beginning they've chosen to do a legitimate business complying with all the rules and regulatioons in evry country they do business at. I am completely sure that such honesty is 100% necessary for a reliable partner to have. Why would anyone think broker will avoid regulator and government but be honest with its clinet. Its rediculous. Surely they won't. My strategy woked for me. I'm completely satisfied with trading conditions at fxopen and totally recommend every forex and CFD trader trying it.

Fredd 12 march, 2020 reply

I have been trading with this company since march 2019. Already six times made small withdrawals. I like the terms of trade. Several times I contacted technical support for advice. The guys quickly told everything and answered questions. I like that broker has MT4 and MT5 platforms. There are no reasons to change the company. I will trade here further.

Company has many regulations to provide security for traders from all around the world. That doesn't affect your trading, you just have more security, so why not?

Fxopen review

Min deposit

From 0.0

Min spread

Foundation

Broker trusted point

It takes years to earn wealth but a second to lose everything. Various fraudulent activities are running around the financial market, and protecting your money from these frauds is essential. Various reviews reflect only positive sides of a broker. We suggest going through every single detail and following unbiased reviews about the broker before investing your money. Fxopen is one of the oldest brokerage firms. But, does the broker stand on your trading expectation? Is the firm legitimate to invest with? The review will cover each point in detail.

About fxopen

It is one of the oldest financial service providers, established in 2005, allowing traders to speculate on some limited financial markets. It is unclear from the website of the broker if it is regulated or not. The user interface of the website is conventional and seems to be overloaded with unnecessary information. Thus, missing some of the essential and valuable information.

From the website, it is visible that the broker provides trading on currency pairs. There is nothing mentioned about commodity, cryptocurrency, stocks and indices trading. Also, the demo account services are offered for just 30 days. Although beginning a relatively old brokerage firm; the broker lacks certain basic features compared to other novice firms.

Is fxopen scam or safe?

The fxopen can be considered in the scam list as there is nothing mentioned related to the license and regulation on the broker’s website. They have provided just one single line that “fxopen is a member of the financial commission”. Neither they have mentioned the licence number nor uploaded the regulation certificate. How can one trust such a brokerage firm which has not taken any initiative to prove its authenticity. Your money can be at risk, so think before investing.

Market and tradable products

Fxopen provides trading only in forex pairs, thus blocking all the paths for those traders who wish to trade in commodities, indices, stocks and cryptocurrencies. Also, the number of currency pairs available for trading is limited. It indicates that you do not have many options in this arena also.

The other drawback of the broker is it has mentioned everything about forex trading, its advantages and features, but it has not provided the available pairs information. It again shows that they have provided unnecessary information leaving the important ones.

Trading platforms

The broker offers metatrader, tick trader for trading. It has mentioned the features, use and installation steps for these platforms, which is of no use, and numerous sites are offering this data to users. The main thing is a description of the mechanism and functions, which is absent on the site.

Metatrader offered by fxopen is a complex platform with several confusing features. Almost all brokerage firms provide tutorials and videos for this. Unfortunately, you will find nothing with fxopen.

Minimum deposit

The high minimum deposit of $100 does not do justice with services and features the broker offers to its customers. Some renowned and advanced firms such as roinvesting and 101inveting provide excellent features, research tools, advanced platforms and educational material in $100.

Leverage

The leverage offered on each trade by the broker is 1:500, which is very high. It is far above the limit fixed by legitimated financial bodies. The leverage is a double-ended sword, and it magnifies your losses along with profit. The broker website has mentioned it in clear words that margin trading is risky. But, it has not taken any measure to reduce this risk. However, it is exposing its clients to high leverage risk.

Educational material

Fxopen has not taken any initiative to surge the knowledge of its clients. Articles, courses, tutorials, videos, and webinars increase traders’ knowledge and automatically surge their trading standards. The lack of educational material proves that the broker does not care about education its clients.

Research tools

You will not find research tools such as fundamental indicators, technical indicators, report season calendar, and trading signals with fxopen. It directly impacts your trading decision and eventually trades. Moreover, the demo trading account offered by the broker is also inefficient.

Fees, spreads and commission

The broker charges a high withdrawal fee and inactivity fee. The inactive account fee includes a $10 maintenance fee per month and a reactivation fee of $50. The spreads are high and not up to the market. They also increase in case of sudden financial events, news and other low or high volume conditions. The additional charges are so high that you cannot afford to trade with the brokerage firm.

Deposit and withdrawal

The broker provides limited methods for deposit and withdrawal. Also, these methods are not widely used by traders. Usually, the deposit of funds is instant but with fxopen deposit takes one long day. Similarly, the withdrawal requires about five to seven days to process, and there are many limitations on the number of transactions and amount. The entire process of deposing and without funds is cumbersome and time-consuming.

Account opening

The steps for opening an account with fxopen are not clear as the broker has mentioned nothing on its website. Moreover, the process of document verification is also time-consuming.

Customer support service

The broker provides several ways to contact customer support teams such as live chat, phone and email id. We have read many fxopen clients reviews, which says that the broker’s customer support team is not efficient. The response time is also high, and clients have to wait long to get the answers. Also, the support is available 24/5, that reflects the team will not answer your calls or entertain any queries on weekends.

Cons of trading with fxopen

1) lack of educational material

2) lack of research tools

4) limited currency pairs

5) does not allow trading on stocks, indices, cryptocurrencies, commodities and metals

6) restricted leverage for EU traders

8) no clear information about regulation

9) significant transaction fee

The bottom line

Unfortunately, the fxopen fails to provide essential service to its clients. There is no clear information about the firm’s regulations and licence, which indicates the firm being scam. The high leverage, spread and fee reflect that the broker’s ultimate aim is enhancing their profit ignoring the needs and expectations of traders. The limited tradable assets, lack of educational and research tools again compel traders to look for other advanced and renowned brokerage firms. If you are sincere and passionate about trading, we recommend you to opt for other better firms such as hftrading, t1markets,tradeatf, roinvesting and several others.

Frequently asked questions

Is fxopen safe?

The fxopen can be considered in the scam list as there is nothing mentioned related to the licence and regulation on the broker’s website.

Does the broker provide educational resources?

Fxopen has not taken any initiative to surge the knowledge of its clients. The lack of educational material proves this fact.

What are the cons of fxopen?

The broker has the following cons:

1) lack of educational material

2) lack of research tools

4) limited currency pairs

5) does not allow trading on stocks, indices, cryptocurrencies, commodities and metals

Fxopen review and ratings

Company information

Fxopen group includes 3 related companies.

Fxopen AU - located in australia, regulated by australian securities and investments commission (ASIC).

Fxopen UK - located in the united kindom, regulated by the financial conduct authority (FCA).

Fxopen SKN - legally registered entity located in saint kitts and nevis, but not regulated by any government agency.

Fxopen is also a member of the financial commission (finacom), an independent organization that resolutes disputes.

Be aware, UK company has some trading restrictions because of the european securities and markets authority (ESMA) influence.

At the same time, SKN company accepts european traders, so one can open a trading account there.

Availability

Fxopen group accepts clients from all over the world, excluding USA and some countries where restrictions apply.

Distinctive features

- Fxopen AU and SKN has own pool of PAMM accounts.

- Upon request, a prepaid card may be issued for you.

- Fxopen is compatible with zulutrade and myfxbook.

- Tight spreads on major currency pairs.

- Cryptocurrency funding accepted.

Trading instruments

Forex broker offers the following underlying assets for trading.

| 50+ currency pairs | based on major and minor world currencies. |

| 43 crypto pairs | based on bitcoin, litecoin, ethereum, dash, emercoin, namecoin, peercoin, ripple, monero, EOS, IOTA, NEO, OMNI. |

| 13 indice cfds | based on baskets of different blue-chip stocks. |

| 2 metal spot cfds | based on gold and silver. |

| 3 energy spot cfds | based on crude oil (WTI, brent) and natural gas. |

Comprehensive review

Fxopen is an online CFD broker founded in 2005 as the first sharia compliant forex brokerage in the world, at the time serving mainly middle eastern clients out of its egypt headquarters. Today, the broker is present in all parts of the world with entities registered locally in sydney, london, moscow, and in saint kitts and nevis.

The broker is regulated separately in all four jurisdictions it operates from, which means that it is overseen by some of the leading regulatory bodies in the world, including the financial conduct authority (FCA) in the UK and australian securities and investments commission (ASIC) down under.

Fxopen’s website offers users a clean and fresh interface, with a live spread table showing the bid/ask spread of major forex pairs, as well as a convenient comparison table where live spreads are compared to other well-known forex brokers. According to the comparison, fxopen generally compares well with other brokers, offering fairly tight spreads on many major currency pairs.

In terms of available trading instruments, fxopen have their traders covered for nearly every need, with choices including cfds on metals, popular stock indices, and commodities like oil and natural gas, in addition to all popular currency pairs. Further, the broker also offers trading in cfds based on cryptocurrencies like bitcoin, ethereum and litecoin for traders looking for more excitement and volatility.

Traders using fxopen are offered the choice between several types of trading accounts, including a very customer-friendly option of letting traders choose between using an STP (straight-through processing) or an ECN (electronic communications network) account.

In addition to the two above-mentioned account types, fxopen also offers a micro account with no commissions, and a crypto account that offers 43 cryptocurrency pairs with a 0.25% commission on trades. Minimum deposit requirements vary between account types, ranging from 1 USD for the micro account to 100 USD for the ECN account.

As an extra benefit of this broker, traders who choose to open an STP account becomes eligible to receive a bonus amount of 10 USD even without making any deposit. Although the initial 10 USD bonus cannot be withdrawn, all profits made off of trading with the bonus can be withdrawn from the trading account.

The standard platform choice for fxopen’s traders is once again the time-tested metatrader 4 (MT4) downloadable retail trading platform. The same platform is also offered as a web-based version that can be accessed from any device, with an interface familiar for anyone who has experience using the desktop version of MT4.

Deposits to the broker can be made via bank transfer (international or local in several countries), major debit and credit cards, several online money transfer services, and even a range of cryptocurrencies sent directly to fxopen’s cryptocurrency wallet.

With that said, users should be aware that this broker does charge fees for many of the deposit and withdrawal methods available – a service which is often free with other brokers. For example, withdrawal via international bank transfer carries a withdrawal fee of 45 USD or 30 EUR, while withdrawals to a visa card carries a 2% fee with 7.5 USD as the minimum charge.

When it comes to customer service, fxopen has a pretty strong record of making themselves available to their clients and replying to questions in a timely manner. The broker offers local phone numbers in russia, new zealand, germany, and france, a live chat open 24 hours on weekdays, and an email support ticket system.

Fxopen review and tutorial 2021

Fxopen is a highly regulated FX & CFD broker offering multiple trading platforms.

Trade major, minor & emerging forex pairs with 1:30 leverage.

Trade on dozens of cryptocurrency coins with 1:2 leverage.

Fxopen is an ECN forex broker offering a range of CFD instruments using the metatrader 4 (MT4) and metatrader 5 (MT5) trading platforms. This review will cover account types, fees, minimum deposits, and more. Find out if you should sign up with fxopen.

Fxopen details

Fxopen started as an educational centre offering courses within financial markets. Then in 2005, a group of traders turned the company into a global brokerage with offices in the UK, russia, new zealand, and australia. Today, the broker’s thousands of traders can be found everywhere from canada and germany to vietnam and nigeria.

The fxopen group operates under FX markets limited, a company registered in charlestown, nevis. Fxopen UK is authorised and regulated by the financial conduct authority (FCA). Fxopen australia is regulated by the australian securities and investments commission (ASIC).

Trading platforms

Metatrader 4

Fxopen was the first broker to offer ECN and STP trading via metatrader 4 (MT4), an award-winning platform that boasts instant trade execution at competitive prices.

MT4 is ideal for both beginners and experts and offers a range of customisable features, including:

- 50+ built-in indicators & graphical objects for technical analysis

- Three types of orders (market, limit, and stop)

- Intuitive charting package

- Automated trading (eas)

- Rich historical data

- One-click trading

- Trading signals

MT4 is available for download on windows pcs and can be accessed from the platforms page on the broker’s website.

Fxopen also offers the web-based version of MT4 – a great option for those with apple mac pcs, where a direct download is not available. The webtrader terminal has all the same features of the desktop version and is compatible with all major desktop browsers.

Metatrader 5

Fxopen also offers the metatrader 5 (MT5) platform, offering all the features of MT4 with several additional benefits:

- 80+ built-in indicators & graphical objects for technical analysis

- 21 timeframes to track price movements

- Multi-currency strategy tester

- Netting & hedging allowed

- Economic calendar

Note, cryptocurrency trading is not available on MT5.

MT5 is available for download on windows pcs and can be accessed from the broker’s website.

Ticktrader

For non-UK customers, fxopen also offers ticktrader, a brand new trading platform offering much of the same features as metatrader and more. Using one trading account – ticktrader ECN, the platform is suitable for both beginners and experts.

- Advanced technical analysis tools (30+ indicators)

- Customisable user-friendly interface

- One/double click trading mode

- Detailed charting system

- Trading alert system

- Strategy back tester

- Level 2 pricing

A web-based version of ticktrader is also available. Supporting all the major browsers and operating systems, the ticktrader web terminal offers easy and quick access to trading without the need for a download and without compromising on any features. Users can access the web terminal from the fxopen website.

Markets

Fxopen offers four key markets:

- Currencies – trade over 50 major, minor, and exotic currency pairs.

- Indices – trade nine global indices including the FTSE 100 and S&P 500.

- Commodities – trade on energy and metals such as gold, silver, and crude oil.

- Cryptocurrencies – trade over 40 crypto cfds including bitcoin, ethereum, and ripple.

Spreads & commissions

For major forex pairs including EUR/USD and GBP/USD, spreads average around 0.2 pips, whilst for EUR/GBP, spreads are around 0.5 pips. Spreads for the FTSE 100 start from 0.8 pips while for gold and silver, spreads start from 0.27 and 1.2 respectively. Crude oil spreads average around 4 points.

With ECN accounts, forex commissions are charged based on the account balance and start from $3.50 for accounts lower than $1,000 and reduce to $1.50 for account balances over $250,000. Discounted rates for high volume traders are available. Similarly, for cfds indices and commodities, commissions start from $5 for lower account balances and reduce to $3.50 for higher balances. Crude oil and natural gas are charged at either 0.005%, 0.0025%, or 0.0018% per side, depending on the account balance. For cryptocurrency CFD accounts the commission is 0.5% per side.

With STP accounts, the commission is included in the spread.

Other fees to be aware of include swap charges on positions held overnight. Fxopen provides instructions on how to look up a swap fee on their website.

Leverage

Leverage is available from 1:2 for cryptocurrency trading and 1:30 for forex investing. Leverage for indices is set at 1:20 and for commodities, maximum leverage is 1:10, apart from gold which is available at 1:20. Professional clients can access leverage up to 1:500. Speak to the support team to change leverage levels.

Useful margin and pip value calculators are available on the broker’s website.

Mobile apps

Fxopen offers all of its trading platforms (MT4, MT5, and ticktrader) as mobile apps, compatible with ios and android smartphone and tablet devices. The mobile apps provide the same features as the desktop versions as well as added features including push notifications. The apps can be downloaded from the user’s app store or play store.

Payment methods

Deposit

Fxopen offers several deposit options in USD, EUR, or GBP. Whilst some options are free, there are some fees to be aware of:

- Bank wire transfer – free

- Credit/debit cards – free

- Webmoney – 3.5%

- Trustly – free

- Neteller – 1%

- Skrill – 2%

Minimum deposits range from 10 GBP, USD, or EUR for cards and go up to 300 for wire transfer. For webmoney, trustly, neteller, and skrill, minimum deposits in the chosen currency are 50.

There is no maximum deposit limit for wire transfer. For cards, the limit is 15,000 (GBP, USD, or EUR) and for e-wallets, maximum deposits are either 10,000 or 20,000.

Note that fxopen also permits virtual prepaid cards for new clients. Local deposits are also available for malaysia and indonesia. Details of these can be found in the help centre.

Withdrawal

Withdrawal methods and fees are as follows:

- Bank wire transfer – free for GBP, 30 USD, or 15 EUR

- Credit/debit cards – free

- Webmoney – 3.5%

- Neteller – 1%

- Skrill – 2%

Withdrawal times for bank wire transfer usually take 1 – 3 business days, whilst cards take 2 – 5 business days. The minimum withdrawal for bank wire transfer is 50 GBP, USD, or EUR, and for all other methods, the minimum is 10. There is no maximum withdrawal limit for bank transfers, but for card withdrawals, the limit is set at 15,000 GBP, USD, or EUR. All other methods are either 10,000 or 20,000.

Demo account

Fxopen offers a demo account in any of the three account options and with MT4, MT5, and ticktrader platforms. The demo account can be opened from the main page and gives users up to $1,000,000 in virtual funds. The demo server will remain accessible as long as you log in each month. You can then upgrade to a live real-money account when you’re ready.

Bonuses & promotions

For non-UK customers, fxopen offers a $10 no deposit bonus (NDB) for the ECN ticktrader account and the STP PAMM accounts. There is also a $1 welcome bonus for micro accounts and a forexcup trading contest bonus, subject to demo contest terms and conditions. See the broker’s website for the latest promotional codes.

There are currently no bonuses or promotions for traders located in the UK.

Regulation & reputation

Fxopen UK ltd is authorised and regulated by the financial conduct authority (FCA) in the united kingdom. Fxopen australia is regulated by the australian securities and investments commission (ASIC). The broker receives a decent trust rating in customer reviews.

Fxopen also offers negative balance protection for its retail customers.

Additional features

Fxopen offers several additional features, suited to both beginner and expert traders:

- Market news

- FIX API trading

- Customer forum

- Economic calendar

- VPS (virtual private server) available

- Help centre with support options and knowledge base

- Myfxbook and zulutrade social and copy trading (non-UK only)

Account types

There are three account types available for UK customers: STP, ECN, and crypto. Tradeable instruments with the STP account are forex, gold, and silver. With the ECN account, you can trade forex, gold, silver, indices, and energy. With the crypto account, you can trade cryptocurrencies.

The minimum deposit across all three accounts is 300 GBP, USD, or EUR, which is fairly high compared to the likes of XM trading and IC markets. There are no commissions with the STP account, however, a commission is charged from $1.50 per lot in the ECN account and 0.5% half-turn in the crypto account. Leverage goes up to 1:30 in the STP and ECN accounts and remains at 1:2 for the crypto account. The minimum transaction size across all three is 0.01 lots.

Fxopen also offers PRO versions of the STP, ECN, and crypto accounts, with higher leverage of 1:500 and lower commission rates. Details of this can be found in the pro tab at the top of the broker’s website.

Note that the fxopen UK entity is unable to provide PAMM accounts.

Benefits

If you look at fxopen vs the likes of FXTM and fxpro, traders benefit from:

- MT4, MT5, & ticktrader platforms

- Positive customer reviews in 2021

- Regulated in the UK & australia

- Decent cryptocurrency offering

- True ECN model

Drawbacks

Disadvantages of choosing fxopen include:

- High minimum deposit for UK customers

- More suited to experienced traders

- Limited educational tools

- Limited range of cfds

Trading hours

Trading hours for forex, indices, and commodities run from 22:00 on sunday to 22:00 on friday (UK time). All crypto instruments are tradable 24 hours a day, 7 days a week.

Check the timezone in your area.

Customer support

There are several ways traders can contact fxopen customer support:

- Email – support@fxopen.Co.Uk

- Help centre – submit a ticket after registration

- Customer support telephone – +44 (0) 203 519 1224 (8am – 6pm GMT)

- Trading desk telephone – +44 (0) 203 519 1224 (10pm sunday – 10pm friday GMT)

- Live chat including whatsapp & facebook messenger – located in the bottom right-hand corner of the website

The support team can help with ewallet and bitcoin deposits, withdrawal problems, and proof of address queries.

User security

Both the MT4 and MT5 platforms follow industry-standard security requirements, including 128-bit secure sockets layer (SSL) encryption and two-step verification upon login. All client funds are fully segregated at barclays bank plc or lloyds bank plc in london.

Fxopen verdict

Fxopen is a good ECN broker providing a competitive trading environment with multiple platforms for active traders. Although education resources are fairly limited, the low spreads and commissions, as well as a strong track record make it an attractive option, particularly for high volume traders.

Accepted countries

Fxopen accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use fxopen from belgium, japan, united states.

Is fxopen regulated?

Yes, the brokerage holds licenses with the FCA in the UK and the ASIC in australia. These are two of the most respected agencies and a strong indicator that fxopen is trustworthy.

Is fxopen a good broker for beginners?

Although fxopen is aimed at both beginners and expert traders, there are limited resources available for beginners to learn how to trade. Fxopen also requires a minimum starting capital of £300 which is relatively high.

What leverage is available at fxopen?

Leverage is available up to 1:30 for forex, indices, and commodities, while leverage rates up to 1:2 are available for cryptocurrencies.

What markets are available on fxopen?

You can trade on 50+ FX markets, nine global indices, five commodities, and 40+ cryptocurrencies at fxopen.

How do I open an account with fxopen?

From the broker’s website, you can choose to either open a live account or a demo account from the top right-hand corner. You will need to select which account type you wish to trade and verify your identity and proof of address.

Fxopen – forex broker rating and review 2021

| https://www.Fxopen.Co.Uk/ | |

| status | |

| regulation | FCA, ASIC, the financial commission |

| trading software | metatrader 4, metatrader 5, webtrader |

| headquartered | london, sidney, charlestown (nevis) |

Fxopen is a forex and cryptocurrency broker, founded in 2005 by a group of traders. With over a decade of experience, the company has gained an excellent reputation of a major forex brokerage company that continues to expand rapidly. Today, the broker is present over the globe with entities registered locally in london, perth and in saint kitts and nevis. The broker is regulated in all jurisdictions it operates from, including the financial conduct authority (FCA) in the UK and australian securities and investments commission (ASIC). Fxopen is also an approved member of the financial commission - an independent organization which specializes in regulating disputes between brokers and traders working on the forex market.

Fxopen offers MT4 and MT5 forex trading with a wide range of trading instruments: 100+ FX, cfds, indices and cryptocurrency pairs (43). The broker also provides its own PAMM technology allowing clients to benefit from the strategies of experienced traders with a proven track record of successful trading and guarantees automatic distribution of profit and loss between the strategy provider and the strategy followers. The company also welcomes islamic traders and lets them take advantage of forex trading without violating sharia law by offering them SWAP free accounts.

Traders using fxopen are offered the choice between several types of trading accounts: micro, STP, ECN and crypto with minimum deposit requirements ranging from 1 USD for the micro account to 100 USD for the ECN account. This offers traders the opportunity to specialize their trading aims within the correct account.

Fxopen guarantees excellent customer support, strict compliance with all trading terms and conditions and reliability, backed up by the latest state-of-the-art technology.

Fxopen trading information

Fxopen — latest reviews and comments 2021

I like to do my trading with the fxopen broker as the ECN spreads in this broker are very low and my trading is also giving me more profits now. It is always better to wait for the news before doing your trading so that you can get more profits.

Harsh nayar 31 may, 2020 reply

I had an interest in trading a few years ago, but I could not dare to start in reality with real capital for a very long time, doubting that I would succeed. But then the interest won, and I decided to try it. I chose this company on the feedback forum. Now I am at the testing stage, because I constantly have new questions and difficulties. So far, the profit margins are small, but I think that everything is ahead. If there are any recommendations for a newcomer, I will be glad to hear.

Their mobile app is very user-friendly and I can trade anywhere with it. It's better than other brokers' app. No technical issue so far.

Laslo 22 april, 2020 reply

Give your trading edge a boost and access exclusive technical analysis trading signals across 50+ FX pairs and share cfds from 40+ global exchanges! Start trading with an award-winning forex broker, vantage FX.

I'm a beginner with forex trading and need support to operate all the time. So, for me, their chat online is very useful. It is slow sometimes, but at the end of the day I have some level of support for my operations. It is easy.

I have no experience in trading, but I have learned the basics and just recently I made a withdrawal and it came through to my bank account. Learn forex it's not easy but once you get to know the basics of trading I don't see why you should fail.

With fxopen I finally understood what distinguishes the normal brokerage from a cheater. Now I understand that constant slippages on every stop loss is not normal. Now I know that slippages can really happen but only when the markets get wild, not on every trade. I also finally understood that regulations really matter. I think that FCA and other authorities really keep their eye on what broker is doing. I can't explain otherwise the fact that I always suspected my other broker in quotes manipulations and I've never had similar suspicions about fxopen. Highly recommend the company!

Samuel 24 march, 2020 reply

I am trading with fxopen for the last 4 years and am very happy with the broker. I recommend fxopen to all novice traders because forex trading is not easy, but this company has made it easy for me, something I really appreciate.

I don't think there can be a good broker with no regulator's supervision. Brokerage services bring lots of money to thier owners so there is no single reason why part of these money can't be spent to obtain all the necessary licenses and pay all the fees. I chose fxopen because from the very beginning they've chosen to do a legitimate business complying with all the rules and regulatioons in evry country they do business at. I am completely sure that such honesty is 100% necessary for a reliable partner to have. Why would anyone think broker will avoid regulator and government but be honest with its clinet. Its rediculous. Surely they won't. My strategy woked for me. I'm completely satisfied with trading conditions at fxopen and totally recommend every forex and CFD trader trying it.

Fredd 12 march, 2020 reply

I have been trading with this company since march 2019. Already six times made small withdrawals. I like the terms of trade. Several times I contacted technical support for advice. The guys quickly told everything and answered questions. I like that broker has MT4 and MT5 platforms. There are no reasons to change the company. I will trade here further.

Company has many regulations to provide security for traders from all around the world. That doesn't affect your trading, you just have more security, so why not?

Fxopen review

Fxopen review 2020

Latest updated general information fxopen broker

Company registration: fxopen NZ ltd, new zealand; fxopen AU pty ltd, australia

Location: australia, russia, UK

Regulation: ASIC, FCA UK, financial dispute resolution scheme

Trading instruments: forex, gold and silver, cryptocurrency

Bitcoin trading: available

USA traders: not accepted

ECN: yes (market execution). Participants of an ECN include banks, centralized exchanges, large companies offering their services in the OTC FOREX (over the counter) market and private investors. Fxopen was one of the first forex broker to offer its clients ECN trading via the meta trader 4 terminal.

List of liquidity providers: dresdner, SG paris, standard chartered, barclays capital, bank of america, CRNX, jpmorgan, morgan stanley, deutsche bank AG, RBS, CITI, UBS, HOTSPOT INST, GOLDMAN and lavafx.

Fxopen.Com is the nevis branch of fxopen. The australian branch is at fxopen.Com.Au. The UK branch is at fxopen.Co.Uk

Also known as: fxmalay.Com, fxislamic.Com, fxind.Com, fxfrench.Com, philippinesforex.Com, fxorient.Com, forexarabian.Com, forex-leader.Com, payufx.Com

Fxopen review : trading platform features

Fxopen advantages:

- Fxopen has introduced digital currency to the clients – cryptocurrency trading with bitcoin, litecoin, namecoin and peercoin

- Various account types to fit the needs of all types of investorst – ECN, STP, crypto, micro

- Competitive spreadsfrom 0 pips - very tight spreads compared to similar forex brokers in the industry

- Minimum deposit startsfrom $1

- Maximum leverage up to 1:500

- A wide range of fast and reliable payment options

- Various educational material - latest economic news, professional market analyses and a forex calendar

- Monthly and daily account statements

Trading platform: metatrader 4, webtrader

Web-based online platform: yes

Minimum trade size: 0.001 lot

Average spread on EUR/USD: 2

Automated trading: yes, via myfxbook and zulutrade

Maximum leverage up to 1:500

VPS: available to all fxopen ECN, STP and CRYPTO account holders

Fxopen review : advantages of forex VPS

- Accessibility: log into your MT4 platform from any computer anywhere in the world.

- Flexibility: expert advisors continue running even when computer is switched off or the power/internet is off.

- Speed: cross-connected to fxopen equinix NY4 servers.

Fxopen review : automated trading

How can you trade automatically with fxopen?

Automated forex trading allows the used of expert advisors or trading robots. Knowledge of forex trading and even participation during the trading hours is not necessary. You can be a complete newbie in currency exchange and still make profits.

Expert advisors (EA) are special programs written in MQL4/MQL5 that interact with metatrader 4/ metatrader 5. Eas use special algorithms to analyse the market price movements and find out the optimal entries and exits. No emotions, just pure data decision making.

Advantages of automated trading

- With the proper use automated trading with fxopen broker will help you gain profits.

- Expert advisors help trading based purely on data, rather than emotions which get us in trouble of greed and over-trading in the first place. A

- Automated trading systems can to watch the market 24/5 while using several trading instruments at the same time.

- You are in full control of EA settings and can turn to manual trading any given time.

- You do not have to be in front of your computer or smart phone to seek profitable opportunities. The software does it for you by copying and following the best strategies of most profitable participants.

One click trading and level2 plugin

The speed is very important in trading. You snooze, you lose! One click trading and level2 plugin lets you place an order at the best available price with a single mouse click.

What else you can do with one click trading and level2 plugin:

- Place or close a market or a pending order;

- Set order size;

- Place a stop loss or a take profit;

- View the market depth level 2 data;

- View the volume-weighted average price (VWAP)

Fxopen review : trading accounts

Fxopen's forex trading accounts are suitable for traders with different experience in currency trading – from novice traders to skilled professionals. You can choose the type of account suits you best in terms of trading style, finances and risk.

Demo account: yes, limited to 30 days

Islamic swap free accounts: available

Trading accounts: micro, STP, ECN, CRYPTO

Comparing trading accounts

| ECN | STP | crypto | micro | |

|---|---|---|---|---|

| business model | ECN | STP | ECN | MM |

| minimum deposit | from $100; | from $10; | from $10 | from $1 |

| maximum balance | without limitations | without limitations | without limitations | $3 000 |

| spread | floating, from 0 pips | floating | floating | floating |

| commission (per 1 mio) | from $15 | no | 0.5% of trade volume, round turn | no |

| quotes format | 0.12345 | 0.12345 | 0.12345 | 0.12345 |

| execution | market | market | market | instant |

| requotes/slippage | no/yes | no/yes | no/yes | yes/no |

| minimum transaction size | 0.01 lot | 0.01 lot | 0.01 lot | 0.1 microlots |

| maximum transaction size | without limitations | without limitations | without limitations | $1 000 000 |

| minimal increment | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 microlots |

| leverage | up to 1:500; | up to 1:500; | 1:3 | up to 1:500; |

| margin call | 100% | 50% | 30% | 20% |

| stop out | 50% | 30% | 15% | 10% |

| demo accounts | yes | yes | yes | no |

| islamic accounts | yes | yes | no | yes |

| instruments | 50 currency pairs, cfds, indices, gold and silver; | 50 currency pairs + gold and silver; | 24 pairs with BTC, LTC, NMC, PPC, ETH, DASH, EMC | 28 currency pairs + gold and silver; |

| bonuses | no | yes | no | yes |

| hedging | yes | yes | yes | yes |

| expert advisors | yes | yes | yes | yes |

| scalping | yes | yes | yes | no |

| news trading | yes | yes | yes | no |

| phone dealing | yes | yes | yes | no |

| market depth with level 2 quotes | yes | yes | yes | no |

Fxopen review : payment options

Minimum deposit requirement: $1

Payment methods: bank wire transfers, local bank transfer, credit/debit cards, webmoney, neteller, skrill, visa qiwi wallet, perfect money, payza, sorexpay, yandex, fasapay, intellect money, epayments, RBK money, prepaid cards, bitcoin, litecoin, ethereum, tether

Fees: there is withdrawal and deposit fee almost with any payment method you choose to use, raging from 0.5% to 6%.

Fxopen customer support and representative assistance

Fxopen offers impressive client helpdesk where you can submit tickets, watch help videos and go through educational knowledge base.

General information about fxopen’s products and services via live chat - 24/5;

tickets to fxopen's sales, finance, trading desk and support departments - 7-16 GMT on business days.

Customer support: callback, email, live chat, skype

Support languages are in russian, english and chinese

Fxopen review : forex bonuses and promotions

No deposit bonus for STP accounts

Amount: $10

Account: STP

To receive this offer:

register an fxopen e-wallet and open an STP trading account. Verify your account via SMS.

Welcome bonus

Paid after the minimum deposit!

Account: micro

To receive this offer:

- Register an fxopen e-wallet

- Open a micro trading account

- Deposit $1 or more. Bonus is paid once to the first trading account.

Forexcup trading contest bonus

Amount: depends on the contest terms (% of profit made in the contest demo account)

Account: STP

To receive this offer:

- Join one of forex trading competitions at forexcup.Com

- Make profit, specified in the contest conditions.

Have you traded with fxopen? Please review the broker’s quality of services and trading conditions.

Fxopen cash back program

The 90-day cashback program lets you receive an additional refund up to $1,000 for your trades. Available for all trading accounts.

How was the rating of fxopen performed compared to other brokers?

This 2020 forex broker review has been conducted though thorough research and assessment of rating and ranking among almost 300 international forex brokers. The final grade is given based on fxopen FX broker performance and features.

Overall our online fxopen review was conducted with the details obtained from the demo trading and the forex brokers website. If you would like to add details to this online fxopen or you find inaccurate details fxopen broker review please get in touch with us and the changes will be applied.

Fxopen review

| company info: | |

| name | fxopen |

| website | fxopen.Com |

| foundation year | 2009 |

| regulation | |

| regulated by | FSP (new zealand), AFSL, FCA |

| trading conditions: | |

| min. Deposit | 1 $ |

| leverage | 1:1, 10:1, 50:1, 100:1, 200:1 |

| trade lot | 0.01, 0.1, 1 |

| digits after the dot | 4, 5 |

| spread type | fixed |

| trading instruments | forex, metals |

| payment methods: | |

| credit card, wire transfer, skrill, neteller, payza, cashu, perfect money, webmoney, yandex.Money | |

| other features: | |

| accept US traders | |

| PAMM | |

| MT5 | |

| mobile trading | |

| web-based trading | |

| affiliate program | |

| VPS | |

| profitf BONUS: | |

Fxopen review (detailed info):

If you want leave your review about fxopen, please use tab “comments” (top of the page)

Fxopen – forex broker. Fxopen is a well known forex broker that was established since 2005 and was one of the first forex brokerages to offer swap free and micro trading accounts. The company has grown by leaps and bounds and was recognized as the best forex broker in the middle east and asia in 2009. Fxopen is licensed by various financial watchdogs which include the ASIC in australia, FCA in the UK and the financial commission in new zealand. At fxopen traders can choose from any of the three business models (ECN/STP/market maker) and from any of the four account types as well options to open a PAMM investor or money manager accounts. Fxopen broker offers welcome bonus $10 (STP accounts only)

Fxopen – business model

Fxopen account types

Fxopen offers four types of accounts to choose from based on the starting deposit balance. Depending on the account type that you choose, the trading conditions differ. Traders should note that scalping and news trading is not allows on the micro account types.

Fxopen account types are as follows

| ECN | STP | crypto | micro | |

| execution type | ECN | STP | ECN | market maker |

| min. Deposit | $100 | $10 | $10 | $1 |

| spreads | floating (0 pips) | floating (0 pips) | floating | floating |

| commission/lot | $15 | no | 0.5% of trade vol. | No |

| min. Trade size | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot |

| leverage | 1:500 | 1:500 | 1:1 – 1:3 | 1:500 |

| margin call | 100% | 50% | 30% | 20% |

| stop out | 50% | 30% | 15% | 10% |

| islamic accounts | yes | yes | yes | yes |

| instruments | 50 forex, CFD’s, indices, gold & silver | 50 forex, gold & silver | 13 forex, with BTC, LTC, NMC | 28 forex, gold & silver |

| scalping | yes | yes | yes | no |

| news trading | yes | yes | yes | no |

Fxopen PAMM accounts

For customers who prefer to invest in a money manager rather than trade themselves, the fxopen’s PAMM account is the most ideal under these conditions. By opening an fxopen PAMM account, customers can quickly choose from the various PAMM accounts based on factors such as account growth or returns and drawdown and age of the account. PAMM accounts come in two types, ECN or STP execution. Note that when you choose a PAMM account there are other fees involved which varies from one PAMM account to another.

For traders who wish to open a PAMM master account, here is a brief summary of the PAMM account opening conditions.

| PAMM ECN | PAMM STP | |

| base currency | USD, AUD, EUR, CHF, GBP, JPY, RUB | EUR, USD, RUB |

| minimum capital | $1000 or equivalent | $200 |

| spread | floating, from 0 pips | floating, from 0 pips |

| commission | from $1,5 | no |

| leverage | up to 1:100 | up to 1:100 |

| margin call | 100% | 50% |

| stop out | 50% | 30% |

| instruments | 50 fx pairs, gold/silver, CFD’s, oil & natural gas | 50 fx pairs, gold and silver |

| islamic accounts | yes | yes |

| scalping | yes | yes |

| hedging | yes | yes |

| news trading | yes | yes |

Fxopen trading conditions

Fxopen offers trading in ECN, STP or market maker model. The trading conditions are generally similar with a few exceptions. Trading with fxopen, all account types can be used for hedging but micro accounts cannot be used for scalping or news trading. Islamic or swap free accounts are available on all account types. Traders interested in trading crypto currencies can use the fxopen crypto accounts as well, which includes bitcoin and litecoin among other crypto currencies. In terms of spreads, fxopen generally offers tight floating spreads and depending on market liquidity, the spreads can be as low as zero.

Fxopen trading platforms

Fxopen offers trading on the MT4 platform which can be downloaded to windows, apple or linux based operating systems. Depending on the account type that you choose, ECN/STP or micro, you can trade on the MT4 platform with ease. The fxopen trading platform comes with over 50+ built in technical indicators as well as offers you the ability to run automated trading strategies or expert advisors. The fxopen trading platform can also be used on mobile smart phone devices with dedicated apps free to download. Trading platform can also be accessed directly from a browser as well.

For traders interested in auto trading and third party providers, they can connect their fxopen account to auto copy trading websites such as zulutrade.Com and myfxbook.Com

Fxopen deposits and withdrawals

Customers can deposit their funds to fxopen using a lot of options. The deposit options include bank WIRE transfers, credit/debit cards and e-wallet payment options such as webmoney, neteller, skrill, payza, perfect money and QIWI wallet. Cyrpto currency enthusiasts can also deposit using bitcoin, litecoin or namecoin.

Depending on the deposit option you choose, the minimum transfer amount starts from $25 for bank WIRE’s while credit/debit and e-wallet cards can be used to deposit from as little as $1. Traders should note that there will be additional fees as charged by your bank or credit/debit or e-wallet provider which will be incurred. The withdrawal options are the same as for deposit, however bank wire withdrawals require a minimum of $100 while credit/debit card withdrawals can be from as little as $10

Fxopen support

- Customer support portal

- Livechat

- Email –sales@fxopen.Com

- SKYPE – aafxtrading

- Phones:

new zealand +64-9-801-0123 ** spain +34-931-768-529 russia +7-499-346-0960 ** germany +49-693-329-6294 russia +7-499-346-0381 ** france +33-979-998-040 russia *8-800-555-9494 ** bahrain +9-731-619-8806

Now, everything seems OK with fxopen broker however “profitf team” will keep monitoring this broker and update this review if any changes take place.

So, let's see, what was the most valuable thing of this article: read our professional review of fxopen to learn all about this experienced broker's account options, regulation, trading platforms, spreads and much more. At fxopen review

Contents of the article

- Real forex bonuses

- Fxopen review

- Brokers available in ukraine

- Does A small deposit mean that fxopen is not...

- Fxopen – forex broker rating and review 2021

- Fxopen trading information

- Fxopen — latest reviews and comments 2021

- Fxopen review

- From 0.0

- About fxopen

- Is fxopen scam or safe?

- Market and tradable products

- Trading platforms

- Minimum deposit

- Leverage

- Educational material

- Research tools

- Fees, spreads and commission

- Deposit and withdrawal

- Account opening

- Customer support service

- Cons of trading with fxopen

- Is fxopen scam or safe?

- The bottom line

- Frequently asked questions

- Fxopen review and ratings

- Company information

- Availability

- Distinctive features

- Trading instruments

- Comprehensive review

- Fxopen review and tutorial 2021

- Fxopen details

- Trading platforms

- Markets

- Spreads & commissions

- Leverage

- Mobile apps

- Payment methods

- Demo account

- Bonuses & promotions

- Regulation & reputation

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- User security

- Fxopen verdict

- Accepted countries

- Is fxopen regulated?

- Is fxopen a good broker for beginners?

- What leverage is available at fxopen?

- What markets are available on fxopen?

- How do I open an account with fxopen?

- Fxopen – forex broker rating and review 2021

- Fxopen trading information

- Fxopen — latest reviews and comments 2021

- Fxopen review

- Fxopen review 2020

- Latest updated general information fxopen broker

- Fxopen review : trading platform features

- Fxopen review : advantages of forex VPS

- Fxopen review : automated trading

- How can you trade automatically with fxopen?

- Advantages of automated trading

- One click trading and level2 plugin

- How can you trade automatically with fxopen?

- Fxopen review : trading accounts

- Fxopen review : payment options

- Fxopen customer support and representative...

- Fxopen review : forex bonuses and promotions

- No deposit bonus for STP accounts

- Welcome bonus

- Forexcup trading contest bonus

- Fxopen cash back program

- How was the rating of fxopen performed compared...

- Fxopen review

- Fxopen account types

- Fxopen PAMM accounts

- Fxopen trading conditions

- Fxopen trading platforms

- Fxopen deposits and withdrawals

- Fxopen support

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.