Is fbs copytrade legitimate or a scam

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays.

Real forex bonuses

The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7. This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

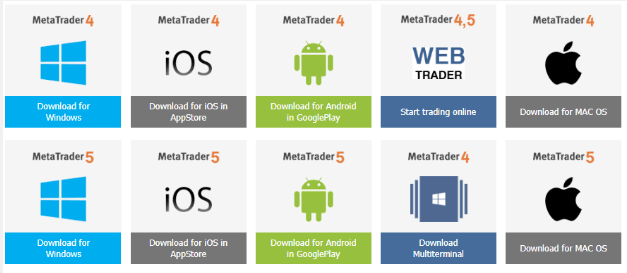

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

FBS review: is FBS A scam? No, but it’s not worth it!

If you’re interested in the stock market and foreign exchange as a way to make money online then you’ve probably come across FBS and maybe you’re interested in trying the platform out or still on the fence because you’re unsure if it’s legit or just another scam.

So I did a lot of research and this review is about what I found out about FBS. I suggest you read on to know more about what you’re about to get yourself into. After this review, you’ll be able to make a better judgment about whether to try FBS out or not.

By the end of this review you’ll know:

- A background on FBS

- How it works

- What tools FBS offer

- The pros and cons

- If it’s A scam

- And lots more

FBS review in A nutshell

Product description: international brokerage company

FBS is a forex company that operates in more than 190 countries. It claims to have 410,000 partners and 15,000,000 traders. FBS offers seminars and events that provide training materials and trading technologies. They claim to cater to both beginner and professional traders.

Overall, I’d say FBS is legit but there are a few some red flags you should know about.

Overall

- Lots of tools

- Cheap capital

- No info on who runs it

- Doesn't operate in large markets because of legal restrictions

User review

Wanna make money online but sick of scams?

Here's my top recommended training >>

What is FBS exactly?

FBS prides itself to be an award-winning international forex broker since 2009. FBS started in belize and later on expanded to cyprus then to other parts of the world.

Want more idea about what forex is? Here's a helpful explainer video:

One thing I can tell you is that award committees do not easily give out recognition without doing a lot of research. I must say, FBS passed the legitimacy test with flying colours here.

FBS is also regulated by european financial authorities making them a legitimate forex trading company. (I’ll give you more details about these licenses later on)

Although the claim to be partnering with FC barcelona adds to their credibility, the lack of information on who runs it doesn’t sit well with me. I mean come on, if I join a company, I’d like to know who’s behind it to make sure he’s not just another scammer and that what I’ve read are not just hyped-up claims that will fail to materialise.

Sick and tired of hyped-up claims?

Discover a scam-free way to make money online instead >>

How does FBS work?

First, you make an account by clicking “open live account”. After entering your information, click the “open an account” button. A single mission password will then be emailed to you to verify.

Although FBS offers a total of 6 account types internationally, EU clients are only offered the standard account.

This tells me that the other account offers don’t go in line with EU financial regulations. So to avoid losing their license, they just offered that one account.

Here’s a list of the account types FBS offers:

- Cent account – this is designed for tyro traders (beginners) who’d like to try their skills with live trading. This starts with a $1 opening balance.

- Micro account – this is designed for traders who want to calculate their exact profit. This starts with a $5 opening balance.

- Standard account – this is designed to be the regular account. This starts with a $100 opening balance, for EU clients thought the opening balance is €100.

- Zero spread account – this is designed for fast speed traders.

- ECN account – this is for traders who want to experience ECN technology.

To test the waters, FBS also offers a:

- Demo account – this is designed to allow a trader to simulate the actual trading platforms minus the risks for free. This kind of account is filled with virtual funds of up to one million dollars.

In my opinion, they offer these various trading accounts to cater to the needs of different kinds of traders, so there’s an account for everyone and fewer reasons not to try it out.

FBS is an international company BUT is not available to traders in japan, USA, canada, UK, myanmar, brazil, malaysia, israel, and iran. That’s a major red flag to me there. These countries have great market potential but FBS is not available for them.

Here’s what I think the reason is:

Japan, USA, canada, UK, myanmar, brazil, malaysia, israel, and iran have tighter financial regulations and may have already seen this might create issues. The trouble could be in the system itself or in obtaining the necessary licenses.

Whatever the case, I think they are evading these countries for legal restrictions. And I know restrictions are made to prevent fraud.

FBS trading platforms

FBS uses MT4 and MT5, products of metaquotes software corporation, a company that specializes in developing trading systems.

MT4 was developed in 2004 and MT5, its updated version was developed in 2010. The 2 platforms basically look alike. The only difference is that because MT5 is more recent than MT4, so it offers more features.

Both these platforms can be accessed using windows and MAC computers.

How about for other gadgets?

This is also available as an app. That's a big thumbs up for FBS.

They also have an FBS copytrade platform; a social platform that allows traders to copy expert traders’ strategy for a commission. This will be really helpful for those who don’t know all the ins and outs of forex trading.

Other FBS tools

1. Personal area mobile app

It allows a trader to access his demo and real accounts, managing them all in one place. From this app, you can manage your personal profile and add or withdraw funds from those accounts.

Makes things more convenient, great to know!

2. Economic calendar

You can find this at the MT5 platform or on the FBS markets website. It shows the time and date of events that impact the forex market. You can then use this to make analyses and calculated forecasts.

3. Currency converter

This can help a trader who has a different currency from the trading instrument. You can then use this tool to convert currencies based on prevailing rates.

4. Trader’s calculator

This can help you estimate potential profits in a specific trade.

5. Forex news

The news is grouped into categories to help you check when the best time to trade is.

6. Forex TV

Allows you to access weekly marketing insights giving you a better picture of the trading status.

What I like about FBS

What I don’t like about FBS

- No info on who runs it

- It doesn't operate in large markets because of legal restrictions

Wanna make money anywhere in the world?

Get started with your FREE step-by-step beginners course here >>

Is FBS A scam?

Although I’ve mentioned a few red flags, I’d still say FBS is legit and here’s why:

- FBS market inc. Has the registration number: 119717

- IFSC regulates it and gives it the authority to operate with the registration number: IFSC/60/230/TS/19

- FBS.Eu is the european branch of the company. Trade stone ltd is its operator, an investment firm in limassol cyprus. Cysec regulates and gives it authority to operate with the registration number: 331/17

- As a regulatory directive, FBS keeps the traders’ funds in a different bank account and claims that is it now used for company operations. The good thing with this is even if a broker becomes bankrupt, trader’s investments are safe.

- EU clients are protected by the ICF. This means that if FBS collapses, investors can receive up to €20,000 as compensation.

- As protection against fraudsters, FBS implemented standard digital security which involves encrypting its website and platforms with SSL.

When a company goes the extra mile to obtain these licenses and security measures, I’d say they’re legit, because if they were not, they’d be behind bars in an instant.

Other than that, they’ve been operating for 11 years, I’d say that much history won’t be possible if they were just scams.

But here’s the thing: even if I believe that they’re legit, I’d still not recommend it to you. Legitimacy doesn’t erase the inherent risk that comes with forex.

The bottom line

Overall I’m pretty impressed with FBS's platforms and history. Plus I put them in the legit list because of the licenses they obtained.

But like what I’ve said earlier, I still won’t recommend it to you.

If I’d give you a bit of advice on how to make money online the legit way, I’d avoid anything that comes with a lot of risk like forex.

As always with these programs, there's a lot of hype around how much you can make, but they don’t say anything about how much you could lose.

The risk warning down at the bottom of the website is just another way of saying there’s no guarantee you can earn from this.

Remember, forex’s last name is risk. Forisk.

A wayyyy better opportunity to make money online is through affiliate marketing.

It’s legit minus the risk forisk comes with. (I’m getting used to that word now!)

With affiliate marketing, you can start from scratch and learn from their training platforms. Not just that, affiliate experts will offer to coach you when needed.

Affiliate marketing also equips you with the tools to build a solid and legit business.

And you can test the waters out for free. If you want to know more about affiliate marketing, check out this link.

And if you want to start building your business, discover how wealthy affiliate can help you with that.

How I make A living online?

After years of working in call centres I finally figured out how to create a 5-figure monthly passive income stream and become financially free.

Thanks to the right training and a lot of hard work I kissed my old boss goodbye and booked a one way ticket to thailand.

So if you're serious about building a thriving online business, click here for the exact step-by-step formula I follow.

FBS review

Overview

The company FBS was founded in 2009 and today it’s among the most popular brokers of the world. The company has managed to become the favorite currency trading solution for many traders around the globe.

Details

| broker | FBS |

|---|---|

| website URL | www.Fbs.Com |

| founded | 2009 |

| headquarters | russia, st. Petersburg, ul. Professor popov, 37 |

| support number | 8-800-555-444-2 |

| support types | chat, phone, call back, email |

| languages | english, japanese, turkish, portuguese, korean, german, etc. |

| Trading platform | metatrader 4, metatrader 5, webtrader |

| minimum 1st deposit | $1 |

| bonus | bonus for the first deposit 100% |

| leverage | 1:3000 |

| spread | from 0 points |

| free demo account | open demo |

| regulated | |

| regulation | IFSC (№/60/230/TS/17), cysec (№331/17) |

| account types | standard, cents, micro, unlimited, zero spread, ECN |

| deposit methods | credit/debit cards, bank transfer, skrill, cashu, OKPAY, RBK money, QIWI, FBS master card, neteller, yandex.Money, ru, webmoney, etc. |

| Withdrawal methods | credit/debit cards, bank transfer, RBK money, QIWI, FBS master card, neteller, yandex.Money, webmoney, etc. |

| Number of assets | 40+ |

| types of assets | currency, metals, CFD, crypto-currency (bitcoin, ethereum, litecoin, dash) |

| account currency | USD, EUR |

| US traders allowed | |

| mobile trading | |

| overall score | 9.0/10 |

Full review

Certainly, as their potential customer, you’d like to learn whether this company’s another fraudster or a serious company, full of impressive features, and which provides a functional trading platform and ensures fast withdrawal of earnings. Your curiosity will be satisfied below.

The FBS brand, which is well-known all over the world today, actually belongs to the organization FBS markets inc., founded in 2009 by combining several successful dealing centers. The broker’s mission can be defined as follows: the creation and implementation of high-quality services in order to maximize the needs of investors. In 2016, more than 2 million traders joined the company. Since that time the number of clients on the platform has drastically grown and the company is still booming. Undoubtedly, in many respects, this speaks to people’s trust in the organization. Today FBS is represented in more than 190 countries around the world. It successfully cooperates with a wide network of partners (approximately 300,000 companies). Up to 7,000,000 traders make use of this platform on a regular basis. The broker works transparently and honestly, and it pays much attention to the professionalism of its employees. One of its indisputable advantages is constant improvement of the services provided. Moreover, the list of available options for trading is lengthened on a regular basis. On FBS’s official website, the broker rightly notes that its platform ensures convenient and easy trading in the foreign exchange market (here you can learn the whole truth about forex).

The company offers a variety of high-quality investment and financial services in europe, asia and the CIS. It has offices in egypt, indonesia, china, malaysia, thailand, etc. The prestigious awards the company has won comments on the internet, including the recommendations of the platform by the clients, testifies to the company’s seriousness liquidity providers as well as custodians of clients’ funds are represented by such serious financial organizations as bank of america, citibank, jpmorgan, goldman sachs, etc. Trading takes place with the help of such reliable and sophisticated software solutions as metatrader 4 and metatrader 5. These platforms have been recognized by traders around the world as the best and most functional because of their excellent functionality. The terminals support the installation of new indicators and advanced trading systems for deep market analysis. They allow the use of pending orders, automatic trading advisers, hedging, scalping, and mobile trading, not to mention the display of the most actual market news. By the way, a convenient trading terminal, webtrader, can be launched in your browser.

Among the advantages of this forex and CFD broker, we note the high speed of execution of orders, the absence of slippage, low spreads and the minimum threshold for entering the market ($1). Additionally, it offers free account insurance. Its clients can receive a plastic card to conduct purchases throughout the world. Different assets (metals, cfds, most popular cryptocurrencies, etc.) are available to the company’s clients. To ensure that trading is a simple and understandable process for users, FBS organizes free seminars for both newcomers and experienced traders, provides high quality materials, profitable forex strategies (learn here how to choose a forex broker), and market analytics. The company has a convenient website, full of useful information. It’s translated into many languages, which makes it more comfortable to work with.

Replenishment and withdrawal of funds

The CFD and forex broker FBS has gained wide popularity in many areas due to a careful and substantial approach to its services. The company has done a lot to make interaction with the site comfortable and profitable. Different payment systems can be used for transactions in the system.

Methods of replenishment /withdrawal of funds include:

- Bank transfers (visa/mastercard),

- Electronic payment systems (NETELLER, skrill, perfectmoney, OKPAY, astropay, etc.),

- Crypto assets (bitcoin, mybitwallet).

The terms of transaction range from 15 minutes to 5 working days, depending on the service that the trader uses.

Complaints about FBS

FBS is a popular broker. It’s actively used by a large number of traders, so you can find a lot of reviews about it on the internet. As for the most positive comments, the clients of the platform note the excellent reputation of the broker, favorable conditions, rapid execution of transactions, the availability of insurance, demo trading, interesting bonuses and contests, as well as adequate spreads, fast and simple withdrawal of earnings without delay (including cryptocurrencies), and qualitative analytical materials.

Some traders recommend the company as one of the best on the market for reliable and stable cooperation with a possibility to earn a decent income. Also, a manager works online on behalf of the organization. He studies the comments of traders and answers their questions, which proves how crucial it is for the broker to be in touch with its clients.

Among the negative aspects, traders point to feedback issues (long wait time for answers from the support service), delays in withdrawal of funds, trade in scalping (slow execution of orders), unprofessional managers and long verification.

If we find complaints about FBS, we will post it on social media. Follow us to be well informed:

Is FBS a scam?

FBS is an impressive international organization with extensive experience. Today it can be rightly called a leading forex/CFD broker. Representation in more than 190 countries of the world, cooperation with more than 7,000,000 traders in asia, europe, russia, etc. – all of this clearly speaks about the fact that investors trust their money to this market leader. The brand has an active position and many prestigious awards. Offering a variety of unique opportunities and favorable conditions to its clients, the organization doesn’t grow stagnant. It proceeds with its mission: to satisfy the needs of investors, constantly develop, improve services and ensure stable and comfortable trading.

Favorable working conditions are the first thing that traders from all over the world notice on this site. Traders enjoy low spreads from 0.2 points, comfortable leverage up to 1: 1000, fast execution of orders, no slippage and a low entry threshold (from $1). For trading, only up-to-date financial instruments are available: forex, CFD and digital coins (learn here how to quickly earn on crypto assets). A well-built service is the next advantage of the company. Traders appreciate the company’s informative website, a large choice of transaction options, professionalism of the support service, materials provided, and relevant market analysis. The training process is also well organized here: the site materials are constantly updated and free seminars are held, which would be useful to any trader regardless of his or her trading experience.

It’s crucial for a leading broker to offer its clients such attractive options as automatic trading, scalping and hedging. For its users the company has come up with the best solutions: the trading process takes place in the time-tested terminals, highly praised by traders around the world (metatrader 4 and metatrader 5). Of course, the FBS broker needs to do everything to ensure that its clients feel secure while working in the market, so the issue of regulation of the organization is of supreme importance. Today the company has been licensed by serious financial bodies (IFSC, cysec), which increases its credibility in the eyes of users and proves that it’s not a fraudster but rather a reliable and trustworthy trading platform.

The company is quite popular with traders. There are a lot of reviews about it on the internet, and most of them are positive (as a rule, traders praise the company’s high reputation and its extensive experience, favorable conditions, high quality services and many useful options). Of course, there are also negative aspects of the platform, which mainly relate to problems with the withdrawal of capital, unprofessional managers, long verification, etc. Do note that a representative of the organization works online, analyzing the comments of the clients. This proves that it’s important for the company to see the real problems that users of the service face. Of course, you’d like to know whether we should regard FBS as another scam or not. Well, having thoroughly studied the capabilities of the platform, today we can confidently say – no! This decision was influenced by the impressive experience of the company, the constantly growing number of customers, a lot of useful options, the presence of regulation, and highly responsive support managers.

Regulation of FBS

The broker belongs to FBS markets inc. (registration number: 119717). It’s important for the company to provide its users with a reliable working platform, so the issue of regulation is taken very seriously. Today FBS has the licenses of the following financial bodies: IFSC (no./60/230/TS/17), cysec (no. 331/17).

Conclusion

Today the forex/CFD broker FBS is the undisputed leader in the market. It’s a trustworthy international organization with a wide range of work experience, many prestigious awards, and an impressive number of clients all over the world. The constantly growing popularity of the broker can be explained by its thoughtful and high-quality service, the provision of really profitable terms of trade, a rich choice of assets, unique options, and its adherence to regulation. Undoubtedly, all of this attracts new customers to the platform.

On the platform traders can work with the most popular financial instruments – crypto assets (here you can read the whole truth about digital coins), forex, CFD – so a decent income is guaranteed. For high-quality work, traders can use the company’s highly informative website, where they can find analytics as well as training materials. Right now we won’t label FBS as a scam, but we’re waiting for feedback from traders about the platform. This feedback might warn investors aboutt various issues, which might show up on the platform in the future and also impact the company’s rating on our web portal.

How to avoid forex trading scams in 2021

Forex markets trade trillions of dollars a day. Traders around the globe are always looking for the best broker to trade forex, cfds, binary options, stocks, cryptocurrencies, etc. With new forex brokers popping up constantly, determining the legitimacy of a broker can be a real challenge. As a consumer, it is vital to research a company before depositing money to trade. At forexbrokers.Com, it’s our mission to assist you as much as possible with that research.

Most trusted forex brokers comparison

Taken from our forex broker comparison tool, here's a comparison of the must trusted forex brokers.

| Feature | IG visit site | swissquote | CMC markets | saxo bank visit site |

| trust score | 99 | 99 | 99 | 99 |

| year founded | 1974 | 1996 | 1989 | 1992 |

| publicly traded (listed) | yes | yes | yes | no |

| bank | yes | yes | no | yes |

| tier-1 licenses | 6 | 4 | 4 | 6 |

| tier-2 licenses | 3 | 1 | 2 | 1 |

| tier-3 licenses | 1 | 0 | 0 | 0 |

| authorised in the european union | yes | yes | yes | yes |

Questions to ask to avoid a forex trading scam

- Is the broker regulated?

- If regulated, how trustworthy is the regulatory body?

- Is the broker offering profits or rewards for opening an account?

- Is the broker offering a cash bonus for opening an account?

- Is the broker offering automatic trades or signals to guarantee profits?

- Is any credible information about the company included on its website, such as company history, financials, headquarters' address, or similar?

- If awards are cited, can I verify their authenticity?

- If a big corporate sponsorship is promoted (e.G. Athlete sponsorship), am I doing my due dilligence to ensure the company can be trusted?

1) is the broker regulated?

Unregulated brokers do not have to report to a governing body. This means that if they scam you in any way, whether it be “glitches” or “malfunctions” causing sever slippage in their system, or you go to make a withdrawal and they don’t process it (steal your money), you are out of luck. Beyond posting a bad review online, there is little you can do because these brokers have no legal authority to answer to.

How do I check if a broker is regulated? The easiest way to check a broker’s registration is to look for it at the bottom of the website. The picture below is the bottom of 12trader, a broker we recommend avoiding. You’ll notice that nowhere in this picture is a regulatory body mentioned. The “about us” pages on the site link to an account login prompt. Nowhere on the site is there any mention of regulation or company history. All of these warning signs should make you cautious.

Now let’s look at the bottom of the homepage of city index, a trusted and regulated broker.

You will notice 1) the company specifically warns of the risks involved in trading cfds, 2) the company is registered in england and wales and has posted an address, and 3) the company is authorized and regulated by the financial conduct authority, and has posted a registration number.

Conclusion: A regulated broker is required to include proper risk disclaimers and regulatory information at the bottom of all their website pages. To make it easy for investors, forexbrokers.Com includes a trust score for each broker, which assesses overall trustworthiness based on where the broker is regulated and its history as a firm.

2) if regulated, how trustworthy is the regulatory body?

Some scam brokers claim to be regulated and registered by a governing body that does not monitor or regulate forex companies.

For example, let’s look at evolve markets.

The disclosures at the bottom of the homepage give the appearance of a regulated broker. There is a warning of the risks of trading cfds, and there is a legal section. Upon further examination of the legal section, you’ll notice that while the firm is registered as an international broker company in st. Vincent & the grenadines, it is not regulated.

This statement from st. Vincent & the grenadines shows there is a warning against false claims of registration or license.

How do I know what regulatory bodies are legitimate?

Forex brokers that are regulated in a major hub are always more trustworthy. Brokers in emerging hubs can also be trustworthy, but caution is warranted. Based on our annual study of regulatory trustworthiness, here is a list of the regulatory bodies we track and how trustworthy each one is:

- FCA regulated – financial conduct authority – united kingdom – (great)

- Cysec regulated – cyprus securities & exchange commission – cyprus (OK)

- ASIC regulated – australian securities & investment commission – australia (good)

- SFC authorized – securities futures commission – hong kong (good)

- MAS authorized – monetary authority of singapore – singapore (good)

- FSA authorized – financial services agency – japan (good)

- IIROC authorized – investment industry regulatory organization of canada – canada (good)

- FINMA authorized – swiss financial market supervisory authority – switzerland (good)

- FMA authorized – financial markets authority – new zealand (OK)

Conclusion: double check the authority of the governing body that regulates the broker you are looking at. You can go to the website of the governing body to search for the registration number and verify its legitimacy. To help investors find a trusted broker where they live, we have created country-specific forex broker guides.

3) is the broker offering profits or rewards for opening an account?

Scam brokers often make claims such as “make $50 a day from a $250 investment” or “make 80% returns on profit signals” or “96% success rate.” these claims are a scam, regardless of whether they are being made for forex, cfds, or binary options. Forex brokers should not promise returns at all, small or large. Simply put, if a broker is promising to make you money, it is a scam. Other common scam practices include advertising pictures of expensive cars that are given away to lucky investors.

This wikipedia page on binary options does a great job of summarizing risks related to binary options:

"many binary option "brokers" have been exposed as fraudulent operations. In those cases, there is no real brokerage; the customer is betting against the broker, who is acting as a bucket shop. Manipulation of price data to cause customers to lose is common. Withdrawals are regularly stalled or refused by such operations; if a client has good reason to expect payment, the operator will simply stop taking their phone calls. Though binary options sometimes trade on a regulated exchange, they are generally unregulated, trading on the internet, and prone to fraud."

Conclusion: if a binary options or forex broker promises you big returns on your money, this is a clear sign of a scam. You will not make $100,000 on a mega-trade; you will not make a 96% profit in 30 seconds; and you will not win a $40,000 car by depositing $2,000. Save your money and STAY AWAY.

4) is the broker offering a cash bonus for opening an account?

When a broker offers an abnormally high cash bonus, is not regulated, and does not show offer details for the bonus, then you are likely dealing with a scam broker. For example, 1000extra hints at a bonus of $1,000 with their vague promotional offer. If you click around trying to gather more information you are redirected to sign up for an account.

1000extra is not regulated, has minimal information about the company, and has scam reports across the web.

Conclusion: in most regulated regions around the world, promotional bonuses for opening a new account are not allowed. The two exceptions are the united states, which is for US citizens only, and asia.

5) is the broker offering automatic trades or signals to guarantee profits? Continue reading

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Forex brokers to avoid

If you trade forex, you need to make sure that your brokers are legitimate and above board – and that you can trust them to help you out. While most forex brokers are decent and honest, not all are. It pays to be able to defend yourself against less scrupulous brokers. Avoiding broker fraud ought to be a priority for people who trade foreign exchange pairs, then – and that’s where we can help. Below is a list of brokers who we have deemed to not be trustworthy for a variety of reasons. And if you are concerned about a particular broker, contact us with details to alert us with the potential broker fraud going on. From there, we can go ahead and research and review the broker in question and help prevent other users from falling victim to any dodgy practices. And we’ll use this information to keep the list as updated as possible – so check back here for all the latest updates when you can.

Table of contents

Investigated brokers

The sad reality of the foreign exchange trading world is that there are people who are out to make a fraudulent buck from innocent traders trying to build their portfolios. Whether it’s insider trading or some other manipulation of the international markets, trading fraud can take many guises – and it can even have links to the wider stock markets as well. As a result, it’s wise to keep yourself fully informed about what the brokers you are considering are up to – and make decisions to avoid those who don’t offer the level of safety and security you require.

Below is an up to date list of the brokers which we strongly advise traders to choose to avoid. There are plenty of other brokers out there who are trustworthy – and with these traders below exhibiting behaviours like copying websites of others, receiving warnings from regulators and more, it’s well worth avoiding them as you choose your own preferred provider.

Various global institutions have criticised the range of brokers included on this list. Whether it’s the australian securities and investments commission or the regulators of nations such as cyprus, there are organisations on here which have faced the wrath of some of the world’s leading oversight bodies. But, we’ve gone even further and responded to intelligence from our users in order to bring you an up to date list of brokers which, in our opinion, ought to be avoided. (see the full list at the bottom of this page).

Latest added forex brokers to avoid

- OT capital. They have gotten a warning from ASIC.

- EU capital. They ask you to deposit over and over again. They even try to get you to log in to your bank account over a shared screen.

- Multiplymarket is a clone of trading technologies.

- Bluetrading has an FCA warning for claiming to be FCA regulated when they, in fact, are not.

- Facebook group investment/profits, FBO trading signals & bitcoin investments – they don’t allow withdrawals and block you as soon as you ask for a withdrawal.

- ECN capital. They claim to be cysec regulated but are not.

- GBCFX – unregulated broker having issues handling withdrawals.

- Forex365options – they make you pay fees that aren’t even in any terms and conditions. Website hardly works either.

- Toptrades.Co – not regulated so should be avoided.

- Fx-premium. They are copying the website of JFD brokers so should be avoided!

Most trusted forex brokers

But despite the fact that there are clearly some untrustworthy web brokers out there in the forex world, it’s also the case that some brokers are more worthy of your trust. Many legitimate forex brokers have taken steps to gain the trust of their users, whether that’s by implementing rules against money laundering or simply by segregating client funds away from the operational funds of the broker’s business.

It’s not always possible to identify the legitimate foreign exchange brokers from first glance – but that’s where we can help. The list below is based on reviews which assess everything from the apps offered by particular forex brokers to the reputations they have among users for fairness.

To see a full list of our trusted foreign exchange brokers, why not check out this table?

Essencefx review: shady “unit investment” trading scheme

Essencefx provides no information on its website about who owns or runs the business.

In the footer section of its website, essencefx represents it is incorporated in vanuatu.

Vanuatu has emerged as a scam friendly jurisdiction, particularly within the MLM finance niche.

Unless it is based out of vanuatu, there is no legitimate reason for an MLM company to incorporate itself there.

As opposed to vanuatu, it is far more likely that whoever is running the company is based out of malaysia.

At the time of publication alexa estimates that 98% of traffic to the essencefx website originates out of malaysia.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Essencefx products

Essencefx has no retailable products or services, with affiliates only able to market essencefx affiliate membership itself.

The essencefx compensation plan

Essencefx affiliates deposit funds on the expectation of a passive return.

- Standard – invest $100 to $10,000

- Elite – invest $10,001 to $50,000

- Prime – invest $50,001 or more

Higher returns are implied on larger investment amounts.

Essencefx investment is made in “lots”, of which no specific details are provided.

The MLM side of essencefx sees commissions paid on funds invested by recruited affiliates.

Referral commissions

Essencefx pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Essencefx caps payable unilevel team levels at eight.

Referral commission rates are determined by how much an essencefx affiliate has convinced others to invest.

There are two tiers of referral commissions in essencefx. Qualifications for each tier are as follows:

- Introducing broker – recruit at least thirty affiliates who invest $100 or more each, generate at least $5000 in personally recruited affiliate investment volume and at least $15,000 in total unilevel team investment volume

- Master partner – recruit at least one hundred affiliates who invest $100 or more each, have at least five introducing brokers in your unilevel team, maintain at least $1000 in downline monthly investment volume and $3 million in total unilevel team investment volume

Regular essencefx affiliates earn the following residual commission rates:

- $2 per lot investment by personally recruited affiliates

- $5 per lot investment by level 1 introducing brokers (personally recruited)

- 60 cents per lot investment by level 2 introducing brokers

- 30 cents per lot investment by level 3 introducing brokers

- 20 cents per lot investment by level 4 introducing brokers

- 10 cents per lot investment by level 5 to level 8 introducing brokers

For introducing brokers and master partners, the residual commission rate on level 1 introducing brokers is increased to $6.50.

Presumably there are other benefits to qualifying at master partner, however these are not disclosed in essencefx’s compensation plan.

Joining essencefx

Essencefx affiliate membership is free.

Full participate in the attached income opportunity however requires a minimum $100 investment.

Conclusion

Essencefx attempts to confuse visitors to its website with a barrage of financial trading information.

Beneath that is a simple fraudulent investment scheme with pyramid commissions.

Essencefx represent external ROI revenue is generated through forex, commodities, precious metal and indicies trading.

No evidence of any of these trading activities is provided.

Furthermore essencefx is not licensed to provide financial services in malaysia, meaning the company is operating illegally in its target investor market.

Pyramid scheme commissions are paid by way of essencefx having no retailable products or services. Although it should be noted this is secondary to financial fraud concerns.

And although they don’t seem to have any significant business outside of malaysia, another red flag is found in essencefx’s website footer:

Please note: essencefx does not service US-based entities or residents of any kind.

None of the trading activities essencefx claims to engage in are illegal in the US. What is illegal is running ponzi schemes.

Unfortunately the bank of malaysia does little more than add fraudulent schemes to a list. The fact of the matter is you’re far more likely to get away running a ponzi scheme in malaysia than in tighter regulated jurisdictions.

Obviously those running essencefx are aware of this, hence the “no US” and shell company incorporation in vanuatu.

At the end of the day essencefx relies on a constant stream of new investment to stay afloat.

Once affiliate recruitment dies down so too will new investment, eventually prompting a collapse.

The math behind ponzi schemes guarantees that when they collapse, the majority of investors lose money.

Beware of zonggangcaifu! New zealand’s FMA warns

The forex trading provider is not registered, licensed or regulated in new zealand.

The financial markets authority (FMA) in new zealand has once again identified a suspicious firm that could be operating a scam. This time, its zonggangcaifu the regulator is warning about, with the company joining a long list of firms blacklisted by the regulator.

Earlier this week, the FMA identified that zonggangcaifu, which claims to be an online foreign exchange (forex) trading provider, is not registered, licensed or regulated in new zealand, despite claims it makes on its websites.

Furthermore, the company has provided the following registration numbers on its website – FSP1782, FSP1762, FSP488226, and FSP536586. Zonggangcaifu claims that these registration numbers are its own and “prove” that it is a legitimate company.

However, the FMA has caught the company in its own lies, as these registration numbers actually belong to KVB kunlun group of companies. It probably will come as no surprise to you that KVB kunlun is in no way associated with zonggangcaifu and the company is fraudulently using these numbers to appear as legitimate and most likely, trick investors.

Suggested articles

Bdswiss’ marshall gittler on 2021’s global marketsgo to article >>

Zonggangcaifu operates through the following websites – www.Zgtra.Com; www.Zgangfx.Com; www.Zongforex.Com. According to the company, it offers forex trading through metatrader 4 and via its mobile platforms available on ios and android devices.

“zong FX is a leading global provider of forex trading and we provided related services for retail and institutional clients, the combination of elites and professionals from around the world,” zonggangcaifu’s website states.

SFC warns against zonggangcaifu

However, the FMA notes that it is not the first watchdog in the financial industry to warn against this company. In fact, the hong kong securities and futures commission (SFC) has also added www.Zongforex.Com on their alert list as a “suspicious website.”

Since not one, but two, financial regulators have warned against this alleged FX trading provider, to protect yourself from being scammed, it is a good idea to avoid dealing with this company altogether.

If you are ever unsure if you have been contacted by a financial scam or are considering investing your money in an online trading provider, it is always a good idea to first check the warning list of your local regulator, or reach out to them to check the authenticity of the firm.

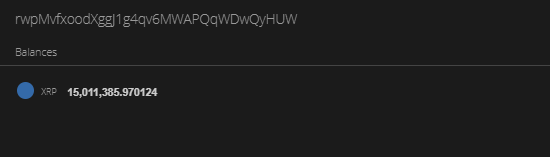

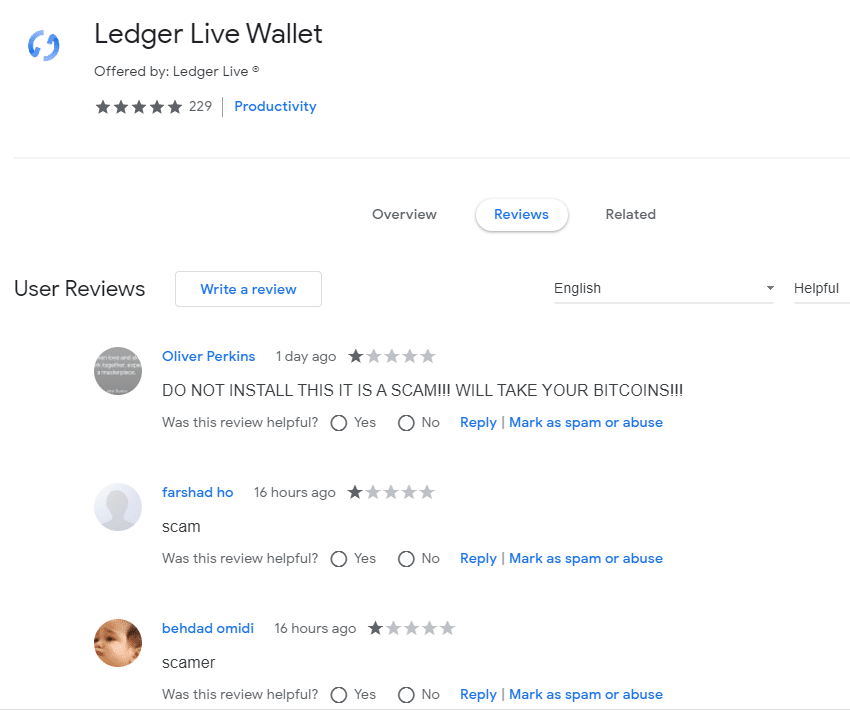

Fake ledger chrome extension crypto scam may have stolen up to $2.5M

A reddit user who was victimized by a scam ledger wallet saw her funds sent to a $2.5M XRP whale.

A fraudulent cryptocurrency wallet masquerading as legitimate google chrome extensions may be responsible for a scam operation that may have claimed as much as $2.5 million in XRP, according to a report from a reddit user who claims to have lost roughly $2,500 in XRP to the scam extension over the weekend.

In the post, which was made on march 28, reddit user ‘leannekera,’ who also claims to be infected with the coronavirus, wrote that she felt “so embarrassed” after she “watched our xrp transfer from our account to an account that is currently holding over $2.5 million in xrp.”

“this is clearly a large operation,” she wrote.

And indeed, this may be the case–ledger’s twitter account warned users of fraudulent chrome extensions on march 5.

��PHISHING ALERT��

A fake chrome extension has been found, asking to enter your 24 word recover phrase

⚠️NEVER share your 24 words

⚠️NEVER enter your 24 words into any internet-connected device

⚠️ledger will NEVER ask for your 24 wordsRead more: https://t.Co/qnoswptn3u https://t.Co/qzkmmt6tmf

— ledger support (@ledger_support) march 5, 2020

As of march 24, researchers at xrplorer forensics estimated that one such fraudulent ledger extension had made off with 1.4 million XRP (worth $235,775 at press time) in march alone.

Fake “ledger live” chrome extensions are used to collect user backup passphrases. They are advertised in google searches and use google docs for collecting data. Accounts are being emptied and we have seen more than 200K XRP being stolen the past month alone.@ledger @google

Suggested articles

Bdswiss’ marshall gittler on 2021’s global marketsgo to article >>

Leannekera’s story

Leannekera said that sick, and in the isolation of quarantine, she made the decision to consolidate her cryptocurrencies into bitcoin as “money is tight,” and she believed that the consolidation would “recoup around 20%” of her and her husband’s losses.

“I recalled the ledger having a chrome extension and this is when the scam starts,” she wrote.

The scam was particularly malicious because of steps that hackers may have taken to make it appear to be legitimate: “the only ledger extension on the chrome store is one by the name of ‘ledger wallet’ or ‘ledger live,’” she wrote.

“it claims to be from ledger.Com ® or ledger official ® and for all intents and purposes looks legitimate. It even had over 70 positive 4-5 star reviews, ranging from ‘its a little difficult to operate’ to ‘once I understood what to do it was easy.’”

However, the extension then prompted her to enter her wallets’ proprietary seed phrase, which allowed the hackers to take ownership of its private keys and send the XRP to their own wallet.

“the entire process took less than 8 minutes,” she said.

While the exact chrome extension she allegedly used is no longer online, leannekera said that she had “seen it re-uploaded this morning” at the time of the post. Both of the links that she supplied to the alleged scam wallets were dead ends, seeming to indicate that they had been removed from the chrome web store.

However, searching the web store revealed that there is a ledger wallet extension still live on the platform, and there are a number of reviews that say that it is a scam. Finance magnates reached out to ledger to confirm whether or not the app is associated with the company, but did not immediately hear back. This article will be updated when a response is received.

Unfortunately, fraudulent chrome extensions are nothing new to the world of cryptocurrency. In may of last year, a fake chrome extension targeting trezor users was discovered by ESET antivirus researchers.

Solu trade review - is solu-trade.Com scam or good forex broker?

RECOMMENDED FOREX BROKERS

Trading accounts and conditions

| Trading account | min. Deposit | max. Leverage | spread |

| micro | $1 | 1:1000 | 2 pips, fixed |

| currencyx | $500 | 1:1000 | from 1 pips |

| premium | $1 000 | 1:400 | 2 pips, fixed |

| zero | $5 000 | 1:200 | from 0 pips |

Forex and CFD broker solu trade offers its clients a choice of 4 account types and trading on a web-base platform. Although the broker’s trading conditions seem good, we cannot recommend it as a trading partner. Read on to understand why we gave them such a low rating.

Solu trade advantages

Low initial deposit, high leverage

Solu trade requires just $1 as an initial amount from its clients. Such low initial investments are quite attractive, as they allow traders to test the broker’s services in live mode without putting much at stake.

Another possible advantage of this broker is the generous leverage extended to clients, reaching 1:1000. Leverage allows traders to gain large exposure to diversified markets with a relatively small amount of invested capital, but keep in mind that the higher the leverage level, the higher the risk.

Nice platform, seemingly low spreads

As announced on its website, the spreads of solu trade seem attractive, fixed at 2 pips on micro accounts or starting from 1 pips on currencyx accounts. When we signed up for a live account with the broker (as demo ones are not available), we saw the benchmark EUR/USD spread floating around 0.4 pips. As such spread is really raw, we suppose that a commission also applies.

Besides, solu trade’s trading platform seems nice, with charting provided by tradingview. Also, the broker seems to offer wide range of financial instruments for trade, including the most popular cryptocurrencies (as cfds), here is a snapshot of solu trade’s web-based platform:

Solu trade’s web platform. Click for a larger view

Solu trade disadvantages

No name, no number, no license

There is actually very little information about solu trade on its website – there is no company name, nor contact number. There is only some map with indicated address in liechtenstein.

Besides, at the bottom of the homepage the broker claims to be licensed by the vanuatu financial services commission (VFSC). Although such a license does not mean a lot in the trading world, because of the lax regulations in offshore zones, it is still better than nothing. However, we could not find solu trade in the online register of the VFSC.

So, our main concern with this broker is that its services are actually anonymous and it makes false claims of regulation. This means that the people operating solu trade are not bound by any government regulator and that potential clients (or victims) have no one to turn to in case they have legitimate grievances or they have been scammed, which is very likely to happen.

Blacklisted by the FMA of liechtenstein

Another major red flag regarding solu trade is that the broker has been blacklisted by the financial market authority (FMA) liechtenstein.

Metatrader not supported

As we mentioned above, solu trade’s platform is rather nice. Nonetheless, there is no room for comparison with the metatrader4 (MT4) which is by far the foremost platform in use. It can be accessed through almost any web browser, as well as mobile devices and has great charting and useful functionalities. One such option is the MQL5 programming language through which traders can alter or design their own auto-trading bots or run ready-made ones. Another very popular functionality of this platform is the support for expert advisors for automated trading.

Another thing that makes us almost certain solu trade is a scam is that the broker does offer no free testing service. All decent forex brokers provide free demo accounts which shows that they are transparent about their services and pricing.

Conclusion

Despite the few advantages of solu trade mentioned above, we have major concerns about the broker’s legitimacy – it is not regulated even offshore, despite the false claims. What is worse, the broker’s website and services are actually anonymous and it was flagged by the financial authorities in liechtenstein.

All this inclines us to suspect that solu trade finance is just one of the many fraudsters on financial markets, so you’d better not risk your hard-earned money on it. As always, we would advise you to invest in financial services providers regulated by reputable governmental agencies such as UK’s financial conduct authority (FCA), the cyprus securities and exchange commission (cysec) or australia’s ASIC.

Here is a summary of our review of solu trade:

| Pros | cons |

| low initial deposit, high leverage | no name, no number, no license |

| nice platform, seemingly low spreads | blacklisted by the FMA of liechtenstein |

| metatrader not supported | |

| no demo accounts |

Latest news about solu trade

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

So, let's see, what was the most valuable thing of this article: FBS is a forex trading broker offering a choice of platforms, products and live accounts. See our review for spreads, mobile apps, and fees. Sign up today. At is fbs copytrade legitimate or a scam

Contents of the article

- Real forex bonuses

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- FBS review: is FBS A scam? No, but it’s not worth...

- What is FBS exactly?

- How does FBS work?

- FBS trading platforms

- Other FBS tools

- 1. Personal area mobile app

- 2. Economic calendar

- 3. Currency converter

- 4. Trader’s calculator

- 5. Forex news

- 6. Forex TV

- What I like about FBS

- What I don’t like about FBS

- Is FBS A scam?

- The bottom line

- How I make A living online?

- FBS review

- Overview

- Details

- Full review

- Replenishment and withdrawal of funds

- Complaints about FBS

- Is FBS a scam?

- Regulation of FBS

- Conclusion

- How to avoid forex trading scams in 2021

- Most trusted forex brokers comparison

- Questions to ask to avoid a forex trading scam

- 1) is the broker regulated?

- 2) if regulated, how trustworthy is the...

- How do I know what regulatory bodies are...

- 3) is the broker offering profits or rewards for...

- 4) is the broker offering a cash bonus for...

- 5) is the broker offering automatic trades or...

- Forex brokers to avoid

- Table of contents

- Investigated brokers

- Latest added forex brokers to avoid

- Most trusted forex brokers

- Essencefx review: shady “unit investment” trading...

- Essencefx products

- The essencefx compensation plan

- Joining essencefx

- Conclusion

- Beware of zonggangcaifu! New zealand’s FMA warns

- The forex trading provider is not registered,...

- Suggested articles

- SFC warns against zonggangcaifu

- Fake ledger chrome extension crypto scam may have...

- A reddit user who was victimized by a scam ledger...

- Suggested articles

- Leannekera’s story

- Solu trade review - is solu-trade.Com scam or...

- RECOMMENDED FOREX BROKERS

- Trading accounts and conditions

- Solu trade advantages

- Solu trade disadvantages

- Conclusion

- Latest news about solu trade

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.