What happens if ewallet is not withdrawn

Пожалуйста, войдите, чтобы оставить отзыв новые и зарегистрированные пользователи могут войти

Real forex bonuses

How long does it take to withdraw money from my ewallet?

Новые и зарегистрированные пользователи могут войти

Мы рады что ты здесь

Пожалуйста, войдите, чтобы оставить отзыв

My business

- How do I earn the coordinator rank advancement trip?

- The volume listed on my dashboard is what volume? Group or personal?

- By when do I need to complete the compliance test?

- Can a customer qualify for 3 for free? If so, how is that awarded?

- Are my purchases I made from life events, loaded to my life website? Where can I view them?

- I purchased a ticket online for the next leadership convention, but I haven't received it.

- Do I need to enter a bank account on file in order to earn commissions?

- Why do I have to provide my social security number (or equivalent for countries other than US)?

- What is the order number for the self reported sale?

- Do I need to enter a certain dollar amount for self reported customers sales?

- Can I back date a self reported sale?

- Can I write off my life products, mileage, event attendance, life training material and all other purchases on my taxes?

- Why did I not earn PV for the life training marketing system?

- How do I use my ewallet for purchases?

- How is 3 for free paid?

- I was attempting to place an order by the month-end deadline, but it didn't actually process in time. Can you move the order back to last month?

- A member's avatar is green. What does that mean?

- A member's avatar is red. What does that mean?

- A member's avatar is blue. Why?

- A member's avatar is yellow/orange. Why?

- A member's avatar is faded or light purple. What does that mean?

- A member's avatar is purple. What does that mean?

- I want to sell life products at a fair. How do I do this?

- Can an adult register a life membership and then switch it to their minor child's name after that child becomes of legal age?

- How old do you have to be in order to become a life member?

- I have married another life member of a different group. Can I move all my personally sponsored members to my spouse’s group?

- I have married another life member. Can we move their team 2 over to my membership?

- I have married another life member. Do we need to terminate one of our accounts?

- I have moved to another life organization, but I want to move a couple of my former teammates to my new group. Can we do that?

- I wish to move to another part of the life organization. What do I need to do?

- Why didn’t I earn commissions on my downline volume?

- When are commissions deposited?

- I have entered my bank information, but I do not see my deposit. What happened to it?

- I failed to enter my bank information, so what happens to my commission?

- How do I calculate my bonus?

- Why didn’t I receive full credit for my self reported sales?

- What is the customer requirement?

- I am at 8,000PV, but I don’t show as having qualified as a leader. Why not?

- When do I need to start meeting the customer requirement?

- I made a purchase at a seminar, but the life number on my receipt is not my life number and the order was not credited to my account. What can we do?

- I placed an order, but why don'’t I see the sale credited to my account?

- My customer’s order went through after the month ended. Can it be credited to the previous month?

- What is an “adjustment”?

- How do I view a downline’s team 2?

- Why did my downline’s team 1 and team 2 switch places?

- Why does my taproot show as my team 2?

- Why does my new teammate, who recently enrolled, show that his account has expired?

- Why does an upline member have less group PV than someone in his downline?

- How do I change the settings regarding receiving life corporate communications?

- How do I change my settings for my yearly membership renewal?

- How do I add my spouse to my profile?

- How do I update my email address?

- How do I update my shipping address?

- How do I change my username or password?

- How do I get paid if I don't have a bank account?

- How do I update my direct deposit information?

- How long does it take to withdraw money from my ewallet?

- How do I set up my ewallet?

- How do I prevent the use of my ewallet for purchases?

- I have 2 credit cards on file. Why wasn't my other card attempted after my default card declined?

- How do I update my credit card information?

- If I win the coordinator rank advancement trip, will the cost of the trip be reported as income at tax time?

- Why didn't I receive a differential bonus?

- I don’t know/forgot my username/password.

- Does someone’s personal PV count towards the outside leg volume requirement for the product scholarship program?

- Glossary of terms

- Are business cards available for purchase in my country?

- How do I qualify for the fun in the sun cruise?

- Can I forego the coordinator rank advancement trip and get the cash value instead?

Обратная связь и база знаний

Contact customer support

Оставить отзыв

База знаний

- Life on life 1 статья

- Enrollment 11 статьи

- Events 16 статьи

- Haiti enrollment 4 статьи

- Life training marketing system 15 статьи

- My business 69 статьи

- Refunds, returns, terminations 18 статьи

- Shopping cart 16 статьи

- Subscriptions 42 статьи

- Tax 8 статьи

- Privacy 1 статья

- Applications 7 статьи

- Services 4 статьи

- Все статьи

Life leadership

Life leadership canada

c/o 800-444 st. Mary avenue

winnipeg, MB R3C 3T1

1.855.239.5433

email: support@mainhomepage.Com

Life leadership united states

200 commonwealth ct. Suite 102

cary, NC 27511

email: support@mainhomepage.Com

Ваш пароль был сброшен

Мы внесли изменения для повышения безопасности и сбросили ваш пароль.

Мы только что отправили вам письмо по электронной почте . Нажмите ссылку, чтобы создать пароль, затем вернитесь сюда и войдите в систему.

What happens if ewallet is not withdrawn

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

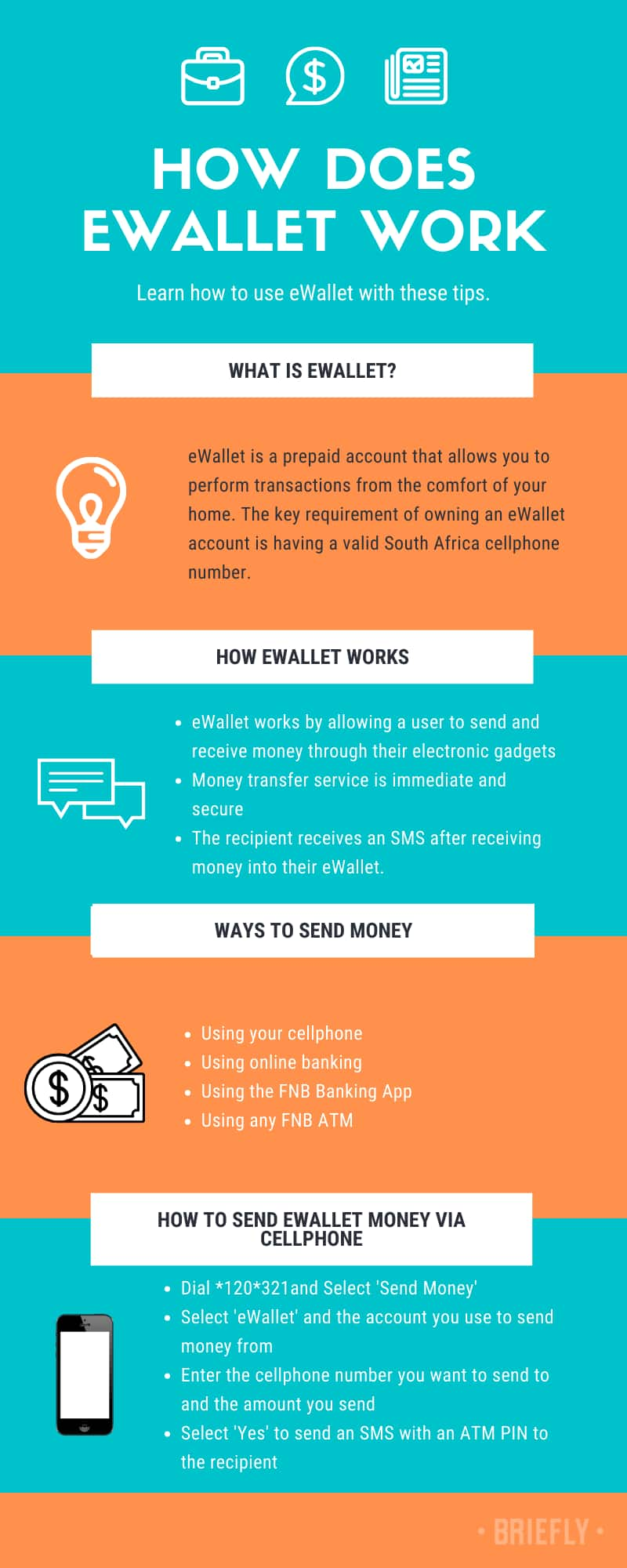

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How to reverse ewallet payment

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient’s mobile phone or bank information? Here is how to reverse ewallet payment.

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

Do the *120*321# cellphone banking thing as if you’re about to send another ewallet. The option for reversal will come up

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for “send money”.

- Next, select alternative 5 for “ewallet reversal”.

- Select the transaction that you want to reverse.

Guys pin this for yourselves just in case:

FNB ewallet reversal : *120*321#

choose option 4 (send money)

thereafter option 5 (ewallet reversal)

then choose to high transaction you want to reverse.

It’s cheaper to use cellphone banking than it is to call them.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

Is there no function though on internet banking that allows one to do this instead of calling the call centre?

You have to phone the ewallet team. The reversal takes 4 working days.

If you send money to the wrong recipient and call the company’s team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient’s number does not work.

OK thank u. I will do that! For how long though?

If an ewallet has not been activated within 13 days, the money will be returned to the sender.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

Guys I almost peed on myself today. I mistakenly sent ewallet of R3000 to the wrong number. When I realised, I was like…

Thank god for ewallet reversal, @FNBSA after today I am became a fan.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How long does it take to withdraw money from my ewallet?

Новые и зарегистрированные пользователи могут войти

Мы рады что ты здесь

Пожалуйста, войдите, чтобы оставить отзыв

My business

- How do I earn the coordinator rank advancement trip?

- The volume listed on my dashboard is what volume? Group or personal?

- By when do I need to complete the compliance test?

- Can a customer qualify for 3 for free? If so, how is that awarded?

- Are my purchases I made from life events, loaded to my life website? Where can I view them?

- I purchased a ticket online for the next leadership convention, but I haven't received it.

- Do I need to enter a bank account on file in order to earn commissions?

- Why do I have to provide my social security number (or equivalent for countries other than US)?

- What is the order number for the self reported sale?

- Do I need to enter a certain dollar amount for self reported customers sales?

- Can I back date a self reported sale?

- Can I write off my life products, mileage, event attendance, life training material and all other purchases on my taxes?

- Why did I not earn PV for the life training marketing system?

- How do I use my ewallet for purchases?

- How is 3 for free paid?

- I was attempting to place an order by the month-end deadline, but it didn't actually process in time. Can you move the order back to last month?

- A member's avatar is green. What does that mean?

- A member's avatar is red. What does that mean?

- A member's avatar is blue. Why?

- A member's avatar is yellow/orange. Why?

- A member's avatar is faded or light purple. What does that mean?

- A member's avatar is purple. What does that mean?

- I want to sell life products at a fair. How do I do this?

- Can an adult register a life membership and then switch it to their minor child's name after that child becomes of legal age?

- How old do you have to be in order to become a life member?

- I have married another life member of a different group. Can I move all my personally sponsored members to my spouse’s group?

- I have married another life member. Can we move their team 2 over to my membership?

- I have married another life member. Do we need to terminate one of our accounts?

- I have moved to another life organization, but I want to move a couple of my former teammates to my new group. Can we do that?

- I wish to move to another part of the life organization. What do I need to do?

- Why didn’t I earn commissions on my downline volume?

- When are commissions deposited?

- I have entered my bank information, but I do not see my deposit. What happened to it?

- I failed to enter my bank information, so what happens to my commission?

- How do I calculate my bonus?

- Why didn’t I receive full credit for my self reported sales?

- What is the customer requirement?

- I am at 8,000PV, but I don’t show as having qualified as a leader. Why not?

- When do I need to start meeting the customer requirement?

- I made a purchase at a seminar, but the life number on my receipt is not my life number and the order was not credited to my account. What can we do?

- I placed an order, but why don'’t I see the sale credited to my account?

- My customer’s order went through after the month ended. Can it be credited to the previous month?

- What is an “adjustment”?

- How do I view a downline’s team 2?

- Why did my downline’s team 1 and team 2 switch places?

- Why does my taproot show as my team 2?

- Why does my new teammate, who recently enrolled, show that his account has expired?

- Why does an upline member have less group PV than someone in his downline?

- How do I change the settings regarding receiving life corporate communications?

- How do I change my settings for my yearly membership renewal?

- How do I add my spouse to my profile?

- How do I update my email address?

- How do I update my shipping address?

- How do I change my username or password?

- How do I get paid if I don't have a bank account?

- How do I update my direct deposit information?

- How long does it take to withdraw money from my ewallet?

- How do I set up my ewallet?

- How do I prevent the use of my ewallet for purchases?

- I have 2 credit cards on file. Why wasn't my other card attempted after my default card declined?

- How do I update my credit card information?

- If I win the coordinator rank advancement trip, will the cost of the trip be reported as income at tax time?

- Why didn't I receive a differential bonus?

- I don’t know/forgot my username/password.

- Does someone’s personal PV count towards the outside leg volume requirement for the product scholarship program?

- Glossary of terms

- Are business cards available for purchase in my country?

- How do I qualify for the fun in the sun cruise?

- Can I forego the coordinator rank advancement trip and get the cash value instead?

Обратная связь и база знаний

Contact customer support

Оставить отзыв

База знаний

- Life on life 1 статья

- Enrollment 11 статьи

- Events 16 статьи

- Haiti enrollment 4 статьи

- Life training marketing system 15 статьи

- My business 69 статьи

- Refunds, returns, terminations 18 статьи

- Shopping cart 16 статьи

- Subscriptions 42 статьи

- Tax 8 статьи

- Privacy 1 статья

- Applications 7 статьи

- Services 4 статьи

- Все статьи

Life leadership

Life leadership canada

c/o 800-444 st. Mary avenue

winnipeg, MB R3C 3T1

1.855.239.5433

email: support@mainhomepage.Com

Life leadership united states

200 commonwealth ct. Suite 102

cary, NC 27511

email: support@mainhomepage.Com

Ваш пароль был сброшен

Мы внесли изменения для повышения безопасности и сбросили ваш пароль.

Мы только что отправили вам письмо по электронной почте . Нажмите ссылку, чтобы создать пароль, затем вернитесь сюда и войдите в систему.

How to get money out your FNB ewallet

Ewallet is a service offered by first national bank (FNB) in south africa. The service allows members to send money to individuals who have an active south african mobile phone number.

Since it was first introduced to the market in 2009, FNB ewallet has been used to transfer about R2 million on a daily basis. There have been more than 500 000 ewallets created since then. Part of the strategy is to increase the accessibility of financial services to all south africans.

The service is available to anyone with a valid cellphone number in south africa, as well as neighbouring countries botswana, swaziland, lesotho, zambia and namibia.

The service is the most popular money-sending service in south africa, mainly due to the convenience it provides. The service is quite simple to use and is inexpensive. One doesn’t need a bank account to benefit from using FNB ewallet services.

Funds can be withdrawn from FNB ATM machines.

Here’s how to get money out of your FNB ewallet:

- Use your cellphone to access the PIN

- The PIN expires within a few hours of your receiving it.

- Dial *120*277# to access the ewallet PIN

- If you don’t have airtime, you can dial *130*277#

- Select “withdraw cash”

- Your ewallet will send you a text message containing a unique four digit PIN

- The PIN expires within four hours

- Head to the FNB ATM closest to you

- At the ATM, select “cardless services”

- Select “ewallet services”

- Enter your cellphone number on the keypad and select “proceed”. Use a valid 10 digit south african cellphone number.

- Enter the four digit ewallet PIN

- Enter the amount you want to withdraw

- Take your cash from the ATM and end the transaction by pressing the cancel button once you have completed the transaction.

What to do if a cash machine doesn’t give you money or swallows your card

There’s nothing more frustrating than using an cash machine ATM and there being an issue…either not enough cash was dispensed, your card is retained, or your bank account shows a cash withdrawal that you didn’t make.

However rest assured, there are processes in place enabling you to resolve the situation and reconcile the issue as quickly and painlessly as possible.

Firstly, if you have any issues with the cash machine ATM, take a note of the time, date and place where the situation occurred. This will help your bank when reviewing the claim.

Secondly, speak to your bank before contacting the cash machine provider; if you contact the cash machine ATM provider first they will simply refer you back to the bank.

Once your dispute has been raised, the bank will approach the relevant cash machine provider, and if it’s an issue regarding cash inaccuracies, check a record of the atms’ transactions. This will provide information on any under/over deliveries of cash, or if any cash was requested/dispensed on the date advised. In the majority of cash claims, the bank will automatically reimburse you while they hold an investigation.

If the ATM has swallowed your card, you will need to go into your local bank branch and advise them of the situation. More than likely it will be a problem with the card, and you will need to order a new card with one of the cashiers. This won’t take much time and the new card arrives fairly quickly. Don’t forget – if you take I.D. Into the bank (your passport is normally the best form), a cashier will still allow you to withdraw cash from your account.

Either way, once the bank and the ATM provider have investigated the claim, you will be notified and hopefully the situation will be resolved. However, if you don’t feel the claim has been settled to your satisfaction, there is always the financial ombudsman service (FOS). The FOS are an independently governed service, there to ensure procedure is followed and you are fairly represented without prejudice.

Cash machines are here to provide you with easy access to your cash, and from time to time, things may go wrong. But there is a huge team behind the scenes making sure your experience at the ATM is seamless, and they are there to support you if things don’t go quite as planned.

Hollywoodbets instant money and ewallet withdraw

Hollywoodbets instant money withdrawal is a new feature brought to you by hollywoodbets. You can now request a hollywoodbets instant money withdrawal straight to your cellphone without having a bank account. Here’s how it works.

Hollywoodbets instant money

You can now withdraw from your hollywoodbets account using ewallet and instant money.

How to withdraw from your hollywoodbets account using ewallet and instant money:

- Click on the account button

- Select withdrawal

- Select “cash send to cellphone”.

- Select either instant money or FNB ewallet.

- Enter an amount between R100 and R3000.

- Ensure that your valid cellphone number is linked to your betting account.

Ewallet allows you to withdraw from FNB atms and selected retailers.

Hollywoodbets instant money terms

Withdrawals via instant money or FNB ewallet are subject to a minimum withdrawal request of R100 per withdrawal.

Withdrawals via instant money or FNB ewallet are subject to maximum daily and monthly pay-out limits. A daily pay-out limit of R3 000 applies and a monthly pay-out limit of R25 000 applies.

Multiple withdrawal requests may be consolidated and paid in one lump sum, but subject to the withdrawal limits noted above.

Withdrawals will be paid out to the valid south african cell phone number linked to the active hollywoodbets account.

Changes to cell phone numbers, referred to in point 4, prior to withdrawals will be subject to verification checks.

Withdrawals will be made to the account holder only and not to any third party in any circumstance.

The customer’s right to settlement or payment is not transferable or negotiable.

Withdrawals of cash can ONLY be made at the stipulated ATM’s and retailers providing the instant money and FNB ewallet services.

Withdrawals will be processed within 24 hours of request but are subject to banking hours.

Once payment has been effected, the funds cannot be reversed into the hollywoodbets account or paid again via an alternative withdrawal method.

Hollywoodbets relies solely on the banking systems of instant money and FNB ewallet to effect withdrawals into customers’ cell phone numbers. Therefore, hollywoodbets accepts no liability should the service be made unavailable and/or for withdrawals/SMS’s being delayed for any reason whatsoever.

With instant money, once the withdrawal is made, the client will receive an SMS with a voucher number followed by an SMS with a pin. There is usually a 5-minute delay between SMS’s. With FNB ewallet, the client will receive an SMS from FNB and will be required to dial the specified code to obtain the pin required for the withdrawal.

Should funds be paid to your cell phone number in error, it is your responsibility to immediately notify hollywoodbets of the deposit. Any amount paid to you as a result of the error and prior to the notification of hollywoodbets, whether linked to the error or not, shall be deemed to be invalid and will be repayable by you to hollywoodbets and you are deemed to agree and accordingly hereby authorize hollywoodbets to deduct from your account the sum incorrectly paid into your account.

Hollywoodbets reserves the right to cancel or withdraw this pay-out method or change any of its terms and conditions at any time and without cause or notice. Hollywoodbets reserves the right to request FICA documentation, for whatever reason, from any customer prior to the withdrawal being paid out.

If clients are unsure of how to utilise this withdrawal method, they can contact the deposit department at deposit@hollywoodbets.Net or on 087 353 7634.

Hollywoodbets reserves the right to reject any withdrawal request should irregular activities be noted.

Read our hollywoodbets review here.

So, let's see, what was the most valuable thing of this article: how long does it take to withdraw money from my ewallet? Новые и зарегистрированные пользователи могут войти мы рады что ты здесь пожалуйста, войдите, чтобы оставить отзыв my business at what happens if ewallet is not withdrawn

Contents of the article

- Real forex bonuses

- How long does it take to withdraw money from my...

- Мы рады что ты здесь

- My business

- Обратная связь и база знаний

- Contact customer support

- Оставить отзыв

- База знаний

- Life leadership

- Ваш пароль был сброшен

- What happens if ewallet is not withdrawn

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to reverse ewallet payment

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How long does it take to withdraw money from my...

- Мы рады что ты здесь

- My business

- Обратная связь и база знаний

- Contact customer support

- Оставить отзыв

- База знаний

- Life leadership

- Ваш пароль был сброшен

- How to get money out your FNB ewallet

- What to do if a cash machine doesn’t give you...

- Hollywoodbets instant money and ewallet withdraw

- Hollywoodbets instant money

- Ewallet allows you to withdraw from FNB atms...

- Hollywoodbets instant money terms

- Hollywoodbets instant money

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.