How to transfer money from demo account to real account

For novice traders, a demo trading account can supply a valuable insight into the world of forex trading and can give beginners the confidence that they need to start trading for real.

Real forex bonuses

When used correctly, a demo account can be a useful training tool that will give them the necessary basic knowledge and skills that they need to get up and running. A demonstration account can be set up free of charge and only requires the potential investor to enter a few basic personal details. Access to this account enables the trader to get to grips with the trading platform without putting any of their finances at risk and allows the investor to see how to trade in real time, viewing the impact of fluctuations in price upon their account. Even more experienced traders can benefit from using a demo account as they offer a great opportunity to try out a new trading strategy in real time in a genuine trading environment and actual market conditions without taking any financial risk. Most of the best forex brokers on the market offer potential investors the option of opening a demo account in order to try out their trading platform and features before taking the final step of opening a live account and depositing funds. While a demonstration account is a great way to get a taster of the experience of choosing a specific broker, there are some downsides to using one. In this article, we look at the advantages and disadvantages of opening a forex demo account and outline how best to make the transition from a demonstration account to a live trading account.

How to transfer from a demo account to a live one

Most of the best forex brokers on the market offer potential investors the option of opening a demo account in order to try out their trading platform and features before taking the final step of opening a live account and depositing funds. While a demonstration account is a great way to get a taster of the experience of choosing a specific broker, there are some downsides to using one. In this article, we look at the advantages and disadvantages of opening a forex demo account and outline how best to make the transition from a demonstration account to a live trading account.

What are the advantages and disadvantages of using a demo forex account?

For novice traders, a demo trading account can supply a valuable insight into the world of forex trading and can give beginners the confidence that they need to start trading for real. When used correctly, a demo account can be a useful training tool that will give them the necessary basic knowledge and skills that they need to get up and running. A demonstration account can be set up free of charge and only requires the potential investor to enter a few basic personal details. Access to this account enables the trader to get to grips with the trading platform without putting any of their finances at risk and allows the investor to see how to trade in real time, viewing the impact of fluctuations in price upon their account. Even more experienced traders can benefit from using a demo account as they offer a great opportunity to try out a new trading strategy in real time in a genuine trading environment and actual market conditions without taking any financial risk.

Nevertheless, there are some disadvantages to using a demo account. One of the major issues with demonstration accounts is that they cannot train an investor in the best way to manage their money. Most practice accounts come pre-filled with up to $100,000 of virtual money and this is hardly a realistic basis on which to begin. Most novices begin their foray into real-world forex trading with a micro or mini account which will involve depositing much smaller sums of money than this. These enormous virtual sums encourage investors to try their hand at much riskier trades than they should and this can become a habit that is hard to break after transferring to a live account and which can cost the novice investor dearly. The use of virtual money also protects the investor from the knowledge that they are risking their own hard-earned money when they make a trading decision. Therefore, a demo account cannot ever recreate the pressure of real-life forex trades and actually impairs the novice’s understanding of underlying risks.

How to transition to a live account

Transitioning from a demo account to a live trading account can be a steep learning curve, and a novice trader cannot expect to be incredibly successful immediately. It is not unusual for potential investors to have great success when using their demo account only to fail to make a profit as soon as they transition to a live account, and this is because the pressure has increased with real money on the line. One of the keys to transitioning successfully from a demonstration to a live account is to resist the urge to trade quickly and to take your time. Money management is essential at this stage, and every investor should set a maximum daily trading amount for themselves in order to not overstretch their finances.

Objective thinking is very important, and it is vital not to let emotions get in the way. A clear head is the best way to successful forex trading, so developing a defined trading strategy and plan before leaping in is the best way to avoid spectacular losses. Limiting early trades to small values and only opening a micro account that allows low deposits is the best way to start. Wise investors will use a demo account for around three months to hone their strategies before moving onto a live account. This is an adequate amount of time to see consistent virtual profit and to develop all of the necessary skills that will be so vital to a trader’s success in the real-world markets. Here are some key points to remember when transitioning:

Accept that losses are inevitable at some point – use losses as a learning curve.

Never risk money that you cannot afford.

Remember to take all of your trades into account across the course of the day rather than focusing on a single trade. If you are maintaining a risk reward of 1:2 or greater, you are being successful.

Spend enough time practising with your demo account to develop clear strategies before committing any funds to your live account.

Pre-plan your strategy to avoid making emotional decisions.

If you follow these guidelines, you will find the transition from a demo account to a live one less stressful and more profitable.

Post by konstantin rabin of top rated forex brokers

About author

Konstantin has been in the FX industry since 2008. Until early 2015 he was working in marketing for one of the leading brokers and after that, moved into developing his own site dedicated to promotions in the retail FX sector - forexbonuslab. Currently konstantin focuses on writing the reviews about traders' education, platforms and brokers.

How to switch from a demo account to a live trading account

Switching from a demo to a live account is a relatively straightforward process. Depending on your broker, it could be as simple as clicking on a webpage a couple of times to fund an account, and start trading live. Ultimately, most brokers are trying to get you to trade live, and the demo is the first part of the process in taking a new client on.

One of the biggest things that should be noted is that trading a live account is much different than a demo account, at least from a psychological standpoint. After all, now you are starting to lose money and that is much more painful than being wrong on a trade. If you’re wrong in a demo account, your pride is at stake. If you are wrong in a live account, your pride AND your money are on the line.

Documentation

When it comes to opening a live account, you will need to provide a certain amount of documentation. In general, you are typically offered a live account only after you can prove your identity, your residency, and any other legal documents necessary for the regulatory entity that the broker needs to deal with. Overall, you are looking at some type of government identification, and some type of utility bill from the address you are living at. Beyond that, there will be some legal documentation to sign that will be provided by the firm’s attorneys.

There is probably going to be some code of conduct agreement, as well as even more if there is such thing as a social trading platform. This obviously will differ from broker to broker, but in general these are the “hoops” that you will jump through.

Funding

Funding will vary from broker to broker, but most of them will accept bank wires, checks, and various types of electronic payment such as paypal, skrill, and many others. It is the funding part that the proof of identity is so important to the brokers, as there are stringent anti-laundering laws internationally that brokerage accounts used to be used against. Funding can take as little as a few minutes, or as much as a couple of days depending on the broker and the form used.

The psychology

The psychology of going live is a bit of a mix. Initially, it’s an exciting time to be a trader because suddenly it becomes “real.” however, fear becomes a serious problem as well. Suddenly, losing matters, and you will notice that you are much less comfortable trading than you are when it is all paper trading. The psychological part of trading is without a doubt the most difficult, but it is also the most important. It is your psychology that will get you through the rough times, and keep you grounded during the high times. I cannot stress this enough: your success lies within the realm of psychology, and of course money management as well.

Money management

As mentioned previously, money management is a huge part of your success or failure. The reality is that random trading can be profitable if you use the proper money management, and the psychology that is necessary. This is why so many traders can use the same system as another and come out with completely different results. It comes down to being able to keep your losses small, and let your winners run. I know that it is a cliché thing to say, but it is true, and that’s why you hear so much about it.

How to use a demo account?

It’s not enough that you trade a demo account, you test the broker, and his capabilities, but more importantly, you need to test yourself in the process. The best attitude in trading is to seek the faults always within yourself instead of blaming anyone or anything for adverse consequences. In a similar vein, it is better use demo trading to test your compatibility and your competence with a broker’s software before making speculations about others, and what they offer.

Remember that we can never decide what the market is going to do. It will go its own way, that’s certain, and for sure. But we have complete control over what we decide with respect to the future. In that demo trading must first focus on how realistic your plans about trading and your general performance are. Can you really do as well as you always hope to do in this market? Many come to forex with unrealistic assumptions about themselves and the market, and become disappointed when those conjectures do not fit with reality. The good news is that with demo trading we can try and test all these aspects of trading, and in time gain a fair and even unbiased view of what is right or wrong about our conceptions.

In practical terms, we must make sure that we do not see demo trading as a kind of game where anything is fair game just because there’s no risk in our trading decisions. In fact, there’s a great risk in that by behaving illogically in demo-trading you will acquire meaningless expectations about real trading, which can only lead to severe distress in your account in time. Trade exactly like how you’d trade in real market conditions. Of course, it’s altogether a different matter to simulate emotions, but if you can master the technical aspect in demo trading, the odds are good that mini-account trading will take care of the emotional side of the issue as well.

Keep notes, acquire a routine, and do not use the whole capital allotted to your account in imaginary cash. You should only trade with as much money as you’d like to commit in a real market environment. Otherwise, time is wasted, and no real understanding of trading is acquired.

You can test your forex analysis and strategies while demo trading. You can check out the claims of the broker. How much of what he’s telling you is reliable? You can also define and limit your expectations, and dreams by actually testing your plans and seeing how well they fit with reality. There are so many things to do while demo trading, only your imagination, and time constrain your ability to try and test your vision of a forex career.

More on the first step: using a forex demo account for technical analysis.

About author

Yohay elam – founder, writer and editor I have been into forex trading for over 5 years, and I share the experience that I have and the knowledge that I’ve accumulated. After taking a short course about forex. Like many forex traders, I’ve earned a significant share of my knowledge the hard way. Macroeconomics, the impact of news on the ever-moving currency markets and trading psychology have always fascinated me. Before founding forex crunch, I’ve worked as a programmer in various hi-tech companies. I have a B. Sc. In computer science from ben gurion university. Given this background, forex software has a relatively bigger share in the posts. Yohay's google profile

How to seamlessly transition from demo trading to real money

- By justin bennett

- / march 24, 2017

This week’s question comes from cooper, who asks:

I like to maintain a demo account as well as my live account. When I can’t pull the trigger on a trade, I go to my demo and enter it there. Gets it out of my system and I can watch it (and hopefully learn from it). However, my demo account is growing, and my live account is dropping… FAST! I did have my first profitable month (month to month) in february, and that was after switching to 4h and daily time frames and focusing on price action/support & resistance. I just can’t seem to make sense of how the trades that I’m entering are different. Obviously, I should be taking the trades I’m sending to the demo, but I just can’t get my brain to let me enter those trades. How would you recommend making that connection?

Usually, I like to keep the questions in these Q&A segments concise. But because today’s topic is a bit more complex than usual, I thought it appropriate to share the full story.

I also believe the situation above is something we’ve all dealt with at one time or another. Making the switch from demo trading to a real money account is a big step and is often not without challenges.

One of two dilemmas tends to arise when making the transition from a demo account to a real money account.

- You did well on demo but as soon as you switched to a real money account your performance suffered

- You run both demo and live accounts, but only your demo account is growing

Both situations tell me the same thing…

Get instant access to the same "new york close" forex charts used by justin bennett!

Your emotions are getting in the way. There’s something about the loss of real money that’s tripping you up, which is why your demo account is doing better than your live account.

The good news is there are a few potential solutions. None of the topics we’re about to discuss are quick fixes, but with the right amount of discipline, your dilemma can be resolved.

By the way, throughout this post, you will see me use “live” and “real money” interchangeably. Both refer to the use of your money versus trading fake money in a demo account.

1. You aren't using risk capital

First things first, if you aren’t using risk capital, your trading is going to suffer. There’s no way around this one.

Put simply, it’s money you can afford to lose. It’s money you set aside that isn’t needed to pay for living costs.

So if you plan on trading your rent money, you may want to rethink your approach. The same goes for any money you need for food, utilities or any other costs required to live your life.

Also included in this list is cash from credit cards. I realize some cards let you take out cash advances. And although U.S. Brokers are now prohibited from allowing credit card funded accounts, I know it’s still available in other countries.

All of the above leads to one inevitable outcome…

Your emotions are likely to get the best of you. You can’t possibly risk money in the forex market that you need for rent or food and not feel the pressure from it.

Trading forex successfully is hard enough as it is. By adding the stress of risking money you can’t afford to lose, you’re making it even harder.

2. The amount at risk is above your comfort level

How much can you risk on one trade without getting anxious or frustrated?

That’s a question you need to answer before every trade. And responding with a fixed percentage such as 2% of your account balance isn’t going to cut it.

As I’ve mentioned in previous posts, you need to know how much money is at risk, not just a percentage.

But more than that, you need to be 100% comfortable with losing every penny of that amount.

After all, it’s usually the money that triggers the emotional reaction. A percentage such as 2% has no meaning without placing a dollar amount next to it.

Here’s a little trick that could help…

Before taking your next trade, try writing the amount you plan on risking. So if you’re risking 2% of your account and that happens to be $50, write the following on a piece of paper, a whiteboard, an ipad or anywhere that’s clearly visible.

I am prepared to lose $50 or 2% of my account to see if this idea has merit.

Now, think about the statement you just wrote. Read it out loud if you have to. Do whatever you need to do for this amount to sink in both consciously and subconsciously.

While you read it, convince yourself that you stand to lose the entire $50.

After about 20 to 30 seconds, you’ll know if you’re risking too much. If you are, that $50 is going to look and sound like far too much money to risk on the next trade idea.

If that happens, try cutting the amount in half to $25. Keep cutting by half until you get to a figure that doesn’t intimidate you.

That’s when you’ll know you’ve found an acceptable level of risk.

By the way, the trick of cutting your risk in half also works wonders if you’re suffering from a losing streak.

Just keep cutting your risk in half until you get your confidence back. Once you get it back, you can begin to normalize your risk per trade.

3. You aren't planning your trades

There’s a difference between a trading plan and a trade plan.

As I mentioned in a past Q&A post, think of your trading plan as a way to win the war. Your trade plan, on the other hand, is how you intend to win the battle.

Your trading plan should include things like the strategies you utilize, the time frames you trade and your minimum risk to reward ratio, among other things.

Your trade plan will be specific to the setup at hand. It should include things like your stop loss and take profit values as well as other key levels that could become a factor.

It all goes back to money and emotions. If you don’t have a well thought out plan before putting money at risk, you’re more likely to be influenced by emotions.

We all know the forex market (or any market for that matter) doesn’t always behave. So you have to account for every possible outcome.

For instance, the questions below are just a few you should be asking.

- What’s my reason for entering? (strategy, momentum, risk to reward, etc.)

- What are my stop loss and take profit levels?

- How much am I risking and am I comfortable losing the entire amount?

- Is there any news coming up that could affect my trade?

These are all things you need to account for before you put money at risk. Because once money is on the line, it becomes much harder to differentiate the facts from your emotions.

4. Your demo account balance is unrealistic

This one is tricky. You see, many traders think that the balance of a demo account is inconsequential.

After all, it’s just fake money, right?

Plus it’s fun to experiment with a $50,000 account or maybe even a $100,000 account.

But if you plan on opening a live account with $500 or perhaps already have one with that amount, you’re doing yourself a disservice.

Let’s say you have a real account with $500. You also have a demo account with $50,000.

You did fairly well on demo, but you just can’t figure out why your live account isn’t growing.

One thought is that the profit from your $50,000 demo account is more meaningful to you than your live account.

What does that have to do with performance?

If you’re risking 2% of the account balance on each trade, the profit from the larger account is $2,000 for a 2R trade.

Compare that to your $500 account where a 2R trade is just $20.

Which outcome is more likely to persuade you to relax a bit and not overtrade or over leverage your account?

I think we can all agree it’s the $2,000 profit.

You’re at a far greater risk of overtrading and overleveraging a small account than you are a larger one.

If this sounds familiar then you have two options:

- Save up until you have the funds to put on meaningful trades

- Convince yourself that learning the process of good trading is more important than the profits

You may want to consider doing both. But I will say that number two above is paramount.

Too many traders come into this business obsessed over making a lot of money. The problem is they ignore learning the process first. That process involves things like learning support and resistance, trend analysis, favorable risk to reward ratios, etc.

A lawyer doesn’t get to make a lot of money without first going to law school.

The same concept applies to trading forex or any other market.

Overtrading and overleveraging are perhaps the two greatest sins in the forex market. They’re also the least forgiving.

You do either one, and you’re likely to struggle. You do both, and I can all but guarantee that you’ll end up with a blown account.

It's all about the money

The only thing that separates a demo account from a live account is the money. That’s it. Everything else is the same.

And what does money tend to do?

It triggers emotional responses.

Learn to troubleshoot this problem like you would any other dilemma. Eliminate the irrelevant and think through the problem.

One way to do this is to ask yourself the question “why?” up to five times. The idea is that by the time you get to the fifth why you’ll find the root cause.

I trade well on demo, but my performance suffers as soon as I switch to real money. (the problem)

- Why? I cut profitable trades too early and let losses run in my live account.

- Why? I’m afraid of taking too many losses, and I don’t want to give profits back.

- Why? I can’t afford to lose the money in my account.

- Why? I’m in a financial situation that requires the money in my account.

The method above is called the 5 whys. It’s an interrogative technique used to explore cause-and-effect relationships.

Note that it only took four series of asking why to get to the root cause above. That’s okay as long as you get there.

The idea is that by the time you’ve asked why up to five times, you’ll arrive at the root cause.

Once you have this information, you can address the problem head on.

Final words

If you find that your demo trading is more successful than your real money account, be sure you’re only using risk capital. If the money in your account isn’t disposable income, you shouldn’t be placing at risk in the forex market.

Are you 100% comfortable with the amount of money you’re risking per trade?

If not, you should take a step back and reevaluate your risk threshold. Because if you go over this amount and the market moves against you in the slightest way, you’re going to be tempted to close the trade prematurely.

Plan your trade and trade your plan. It’s sage advice from some of the best traders out there.

To trade based on logic rather than emotions, you need to have a plan before risking any capital. If you don’t have a plan of attack before jumping into the market, your emotions will eat you alive.

The best defense against emotional trading is to keep risk small and always have a plan.

Send me weekly updates about daily price action's Q&A

Your turn: ask justin anything

I’d love for this new weekly Q&A to be successful and provide an invaluable repository of answers to common forex questions.

To do that, I need your help.

Here’s what you can do to get involved and have your question answered in next week’s post:

- Ask questions. Post them in the comments below or tweet them to me @justinbennettfx

- Help me answer questions. If I missed something or if you have something to add, don’t hesitate to leave a comment below.

Leave a comment:

19 comments

If you are scared of losing real money, start with a $50.00 account and start the gearing at .01 and gradually increase it as your confidence increases.

Nice suggestion, andre. Thanks for sharing.

You talk like you live in my account , mentor .

I love your post.

My question is how do I stop letting my losing trades run-I can be positive in 15-20 trades and then I get a big loss and give back everything.

Second I am afraid to let my winning trades run. I trade in small lots 0.02. Usually on 15min. TF.- hour TF. Please help.

Fay, trading from the higher time frames (4-hour and daily) usually helps most traders. I’d start there if I were you.

Hi justin, your comments are always welcome. Most the time they hit the nail on the head. In this case, I would say the key word is discipline. Having a trading plan is easy; executing it, is a different story and there is where discipline comes in. One must resist the urge to put on a trade that does not fit the trading plan, otherwise you end up with a loss. I have been there. Also, you suggestion of risking 2% of capital per trade is a good one and I am trying to stick to it. Thanks for your blog/comments

You’re welcome, fabio. Discipline is certainly key as you say. All of the planning in the world won’t do you any good without having the discipline to stick to it.

Thanks justin. Great lesson. I’m new to daily price action & I’m getting a lot out of it. Trading profitably has been so very difficult. It’s really hard work (mentally I mean). Cheers.

That’s great to hear, graeme. Becoming a profitable trader is one of the toughest journeys in life. But that’s also what makes it so rewarding.

Fantastic article justin, thanks! Discipline is the key.

You’re welcome, cooper. Let me know how things work out for you. Cheers.

Sound and proper advise, all the above will be applied in full. Thank you

You’re welcome, thami. Pleased to hear that.

I have a problem about where to place a stop loss order. What is the best position to place a stop loss order in order to prevent stop outs.

Hello justin, how do i manage to handle a winning trade by not being paranoid on taking profits too soon. I see charts going towards the direction as analysed but i take profits too soon before reaching predicted target.

Hi. Am new here. Fantastic insights. My issue is that I start the day gaining on trades only to loose them back before the end of the day resulting in overall huge losses. How can I stop that? Glad for your advise. Thanks

Welcome! Great to have you. The simple answer is to stop overtrading and use the daily time frame.

What is your daily time frame sir

Disclaimer: any advice or information on this website is general advice only - it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by daily price action, its employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, cfd's, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

Metatrader: demo account vs real account

When you decide to invest your money on the markets, you need to choose a broker and try its trading platform to determine if it suits you, if it’s user-friendly, whether the proposed products are the ones you want to invest in, etc. So you will first open a demo account before opening a live account and deposit funds.

Metatrader, provided by metaquotes software corp, is one of the most well-known trading platforms. The metatrader4 (MT4) platform dominates the FOREX market, while metatrader5 (MT5) offers access to other markets depending on the broker you’re using (FOREX, CFD, futures, equity markets…).

To better understand the main differences between the MT4 and MT5 platforms, I recommend you read our previous article: metatrader 4 vs 5 – which one? (2015 review) to know which platform suits you best.

Metatrader: demo account vs real account

Slippage, re-quotes and latency time in execution

At the execution level, you might think that you shouldn’t see any differences between a real account and a demo account. Yet, you can often observe differences in terms of liquidity, slippage or latency depending on the broker you’re using, because a demo account cannot completely simulate the supply/demand aspect.

- Market liquidity is the term for buying or selling an asset without triggering major changes in the asset’s price.

- Slippage is the difference between the required price and the price at which the trade is actually triggered (entry price or exit price with any kind of order: limit orders, market orders, stop-loss or take-profit orders…).

- The spread is your broker’s fee. It’s the difference between the buying price and the selling price, the ask and the bid price, hence the name of bid-ask spread.

The available market liquidity can differ depending on the market you are investing in, and the current market conditions that can increase volatility: is there a market-moving statistic/event? Is a central bank going to talk about its rate decision? Is a war being declared? Is there a natural disaster happening?

This liquidity’s depth cannot totally be simulated in a demo account if a lot of traders suddenly want to buy USD and sell EUR for example. These market condition changes also affect the latency time, slippage and the spread.

A broker may execute stop-loss orders more accurately with a demo account, whereas you will deal with considerable slippage with a real account, because of liquidity and markets conditions. The same goes for the spread, which might widen in periods of limited liquidity or during very volatile events (such as brexit), whereas you often have static spreads with demo accounts.

The main challenge: yourself

The biggest difference lies in the psychological aspect.

With a real account, you will not have the same decision process, the same capital or the same reactions to profits (or losses) as with a demo account. Your money management will also be affected by your mental state and whether or not you respect your trading plan.

Your emotions will make all the difference between the performance of a demo account – because it’s not your money – and the performance of a real account. This time you have decided to move to a real money account!

Some tips to achieve the same performance on a real account

You must try to minimize harmful emotions to avoid polluting your trading.

You must try wherever possible to trade step by step using the resources of your broker, such as using different lot sizes: first micro-lots, and then mini lots, then 1 complete lot…

This is better to avoid trading products that you don’t really know because the volatility, the spreads, the margins etc. Might be different than what you are use to. Once again, you should use the information available from your broker on margins, spreads and commissions.

Try to avoid trading in market conditions you don’t know, such as trading news, which causes high volatility and lower liquidity. It is also better not to trade on friday or on sunday night.

It is necessary to have a solid trading plan you have back-tested and most importantly that you will follow. It has to be implemented with good money management:

- Know how to estimate the expected profit (place a limit order at least 2 times higher than the stop-loss),

- Define the associated risk (stop-loss should not exceed more than 3% of your total capital)

- Assess the level of investment required to take a position, taking into account the leverage effect. You should always have a risk/reward ratio before entering the position, typically 2x or higher.

You can improve your chances of success in trading by being more patient. Read our previous article: the power of patience in trading: why it will help you achieve lifelong goals.

Fxdailyreport.Com

Forex trading is probably the only market where prospective traders can test strategies and systems without risking their money. In other markets like the stock market, investors have no room for error.

So, they must learn everything before getting started. With forex, you can learn on the job, but with fake money. This is done using a practice account, popularly known as a forex demo account.

So, what exactly is a forex demo account?

Generally, a forex demo account is a trial account funded with a specific amount of virtual currency. Some best forex brokers offer a specified amount, mostly $50,000 while others have a list of options, which range from as low as $1,000 to as high as $100,000. This means that traders can choose the level of account to use for practice depending on the amount they plan to invest in a real forex account.

On the other hand, a real account is not pre-funded by the broker. It comes with a zero balance, which means that the trader must make a deposit in order to start trading. But that is not the only difference.

The differences between a real account and a demo forex account

There are several reasons why differences occur between a real account and a forex demo account. One of the key factors contributing to this is that brokers are required to pay a certain fee to access data feed from the live market, which they can then provide to traders trading on a real forex account. As such, this can cause the differences below to occur.

Delay in order filling

When you are trading via a forex demo account, orders are filled automatically. There are no delays or no-fills. Every order placed is executed immediately because it does not matter whether there is another person on the other end of your request to fill it.

On the other hand, the situation is quite different when it comes to a real forex account. Here, brokers fill trader requests by submitting them to their liquidity providers, which include banks and large institutional investors. If there is no one at the end of your order ready to fill it at your requested rate (especially non-market orders), then the chances are that you will experience a delay before your order is taken.

Slippage in price

Because orders are filled depending on the prevailing prices in the live market, sometimes slippage will occur. Market slippage is a situation where the price of the asset jumps the preset trading conditions like stop-loss after a price gap or a massive instant change in the price of the asset.

Since the data feed for a forex demo account is simulated, traders do not experience slippage in their open positions, which makes it easier to execute certain trading strategies as compared to when trading via a real forex account.

Wider spreads

Most brokers that provide their services as market makers do not charge a described commission on trades. Instead, they take a percentage of the spread on every trade completed. This bumps up the spread offered on currency pairs like the EUR/USD, and USD/JPY by a few pips, which are then used to cover service costs.

And in the case of true ECN brokers or STP forex brokers where liquidity is sourced directly from a pool of big banks and institutional investors, they offer floating spreads, which means that they can change at any time. This is different when trading on a demo forex account because spreads don’t change, which makes it easier to execute various trading strategies with a higher degree of success.

Proof of identity and address

Trading via a practice demo account is simple, has no strict requirements, and is designed to get traders excited about opening a real account. However, the moment you start preparing to fund your account, you realize that there are a few more steps to cover.

Several brokers are very strict when it comes to funding your account. All brokers are strict when it comes to making withdrawals. As such, before you start using a real forex account, brokers will ask you to add and verify your identity and physical address.

This is mainly done for the security of your funds to ensure that when the time comes for the broker to process your withdrawals, they are sent to the actual account holder and not some masquerading to be you.

Emotional pressure

This is one of the most perspective-changing factors that traders experience after transitioning from a forex demo account to a real account. Psychologically, there is no pressure when trading using a demo account. This changes once you begin using a real account.

The main reason behind this paradigm shift in emotions is that with a real account, there is the risk of losing everything. So, it is easy to get scared and close positions early when the market is going against you. There is a flip side to this too. If the market is going your way, there is the risk of getting greedy and waiting before you close your open positions until things begin to go against you.

Then what follows shortly is panic, and before you know it, you have ditched the strategies that you practiced for weeks or months in a demo account. This is usually the beginning of the end, but it can also be turned around by taking a short break to calm down and refocus.

Final thoughts

In summary, a practice account can be an important starting point for a new trader. It is a risk-free account, which means that traders can practice different strategies without worrying about how much they could lose. This is where expert traders recommend that you make all the mistakes you can so that when you transition to a real account, there is barely any to make.

However, as we have discussed, there are some key differences between a real account and a forex demo account that could hamper your successful transition to real money trading. It is good to take note of them so that your are not surprised when slippage occurs or when your order is not filled in time.

Forex trading big

Reap big in currency trading

From forex demo account to real account: when?

The forex market is a highly volatile market which experiences constant currency price fluctuations. Because of this, many newbies are always being advised to start with a forex demo account before investing their money and trading it on a real/live account.

This is a sound advice which no one should ever take for granted. Nevertheless, despite everyone hearing all about using a practice account, no one ever tells you when to switch to a live account. My answer to when a trader should permanently switch to a live account is NEVER!

I do not mean you should never switch to a live account, I simply mean always keep your demo account running even after you switch to the live account.

As to the best time to start using a real/live account, it should be when you are ready. There are a few points that determine when a trader is finally ready to invest money and profitably manage their account.

This article outlines the steps necessary to take before shifting from a demo forex account to a live forex account.

To determine when you are ready, you have to ask yourself some important questions and honestly and critically analyze your responses.

Have you chosen the right broker?

Your broker is critical to your forex trading success. Do not open a live account until you are satisfied with your choice of broker. To choose a broker, check whether the brokerage firm is licensed and adheres to the guidelines on this site found here how to choose the best forex broker.

Check also that they are under a regulatory body. Search on online forums on what others are saying about your broker. Do they have past, continuing, or pending legal suits against them?

Are there customer complaints against them? Which country are they registered in and how effective is the legal system in that country?

Here is a review of some of the best brokers in the market: top brokers.

Are you familiar with all the trading platform’s features?

You have been trading on a forex demo account, but are you familiar with all the features of that particular trading platform?

The basic features you have to be well versed in using include the price charts, stop loss, take profit, and trailing stop loss. Check on every other feature available on your demo account and ask questions from customer support.

The live account will include some additional features which you will have to learn how to use. That will be much easier if you already know what everything does on the demo platform.

Have you defined your trading strategy?

Having a trading strategy is the single most important determinant on whether your trades will be making losses or they will be profitable.

No two traders are the same and it takes time for each trader to develop a strategy that works for them. Use your demo account to define and refine your forex trading strategy.

Have you chosen A currency pair?

Currencies are traded in pairs. You sell one currency to buy another. It is preferable and advisable for a trader to master one currency pair at a time.

Try and master all the unique characteristics of one chosen currency pair using your demo account.

If it does not go well with your preferred trading style, then try another and another until you find a currency pair that you can work well with. Only then should you consider moving to a real account.

Have you decided on A risk management strategy?

99% of all your trades may be 100% profitable but if you do not have a proper and effective risk management strategy in place, that remaining 1% of your trades will wipe out your whole account.

Use your practice account to develop a good risk management strategy and stick to it throughout your trades.

Have you learnt how to generate trade signals?

Trade signals will help you in determining trade entry and exit points. There are many services that will supply you with trade signal but these services charge very high subscription fees.

Instead of paying $500 per month to receive trade signals that may or may not be profitable for your trades, learn to use your demo account and market analysis to generate your own trade signals.

Once you are capable of generating accurate signals then you can consider switching to a live account.

Have you decided on optimal leverage levels?

Leverage can make you king, but they can also cripple you. Leverage helps you make quick big gains within a very short period of time and using very little start-up capital.

How you use leverage will determine whether you will be a long term player in the fx exchange or whether your life as a forex trader will die a quick death. Choose your leverage levels very carefully.

Use your demo account to freely play around with different leverage levels until you learn to make the best decisions on the amount of leverage that works best in each trading situation.

Have you learnt to keep you emotions in check?

A forex trader’s number one enemy is the human emotions that we all possess. The two main culprits are greed and fear.

Greed will make you lose focus, make many mistakes, forget your trading strategy, forget to use money management strategies, and take on too much leverage. Trading on greed is a sure way to quick demise.

You are bound to lose all your forex investments within a very short period of time if you allow greed to dictate how you trade. Fear on the other hand will cause inertia and panic.

You will make minimal profits which will be eaten up by the spreads and you will eventually give up on currency trading online. Any kind of business or investment is about taking risk and in forex trading you cannot be successful without taking calculated risks.

If you are interested in becoming a forex trader, do not directly invest your money without learning the trade.

Use a forex demo account to perfect how you trade. Once you have traded for a while, typically between 3 and 9 months on the demo account, use the above checklist to see if you are ready for a live account.

Do not deposit any money into a live account unless you are satisfied that you are ready.

Gmail money transfer: A complete guide to transfer money with email

Google rolled out an online gmail money transfer feature for UK and US users for free. Google has google wallet to transfer money and this gmail money transfer coming in handy for most of the users who don’t want to use google wallet. Google wallet is a free and fast online money transfer tool to handle money online right with your smartphone and web app. Google integrated this google wallet with your gmail account to transfer money quickly. With this simple gmail money transfer feature, anybody can send or receive money online with your gmail account, no need to have a google wallet account.

So google simplified this banking mechanism to few buttons on your gmail account and anybody can send money online just with a gmail, A debit card or bank account added to the gmail account.

The benefit of transferring money online

Well, transfer money online is easy, secure as a bank transfer, and you can do the entire process right from your smartphone or personal computer. There are online money transfer services available, and they charge a fraction of the amount as a service fee. However, online money transfer service through gmail service is free at this point. You can send money to any email account including other email providers for free with google’s money transfer feature.

How to send money online with gmail?

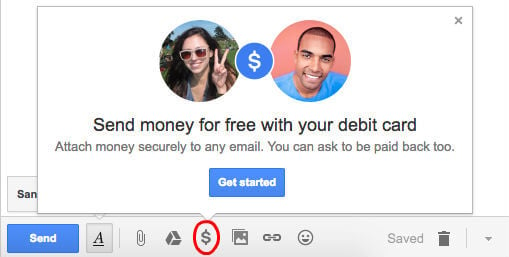

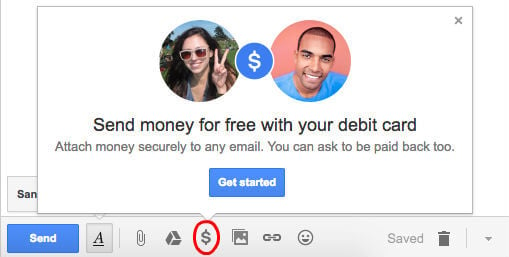

Those who are interests to know how to perform an email money transfer, we described all the steps here with screenshots. First, you have to log in to your gmail account to start. After you click on the compose button to start an email, you can see a $ symbol (£ for UK users) next to google drive icon. You can fill out the recipient email address in an address area and then the subject required.

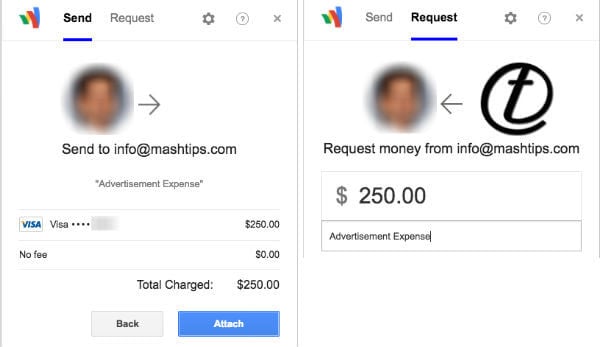

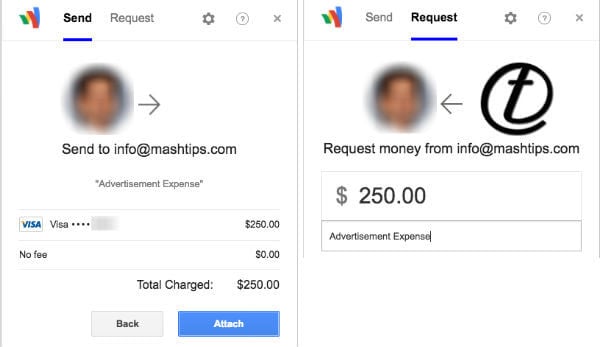

Once you click on the dollar sign, then the new pop-up window will appear with google wallet icon. In this window, you can tap on send tab to send money, or you have the choice to request money from somebody else with the request tab.

On both tabs, you have to fill out the details for the amount requested or planning to send, and you can add a memo to the recipient at this point. Those who don’t have a google wallet account or wallet account balance, google will ask you to add a valid debit card (credit cards are not supported) or bank checking account to transfer the money. Once you give the debit card information or bank checking or savings account information, then click on attach button.

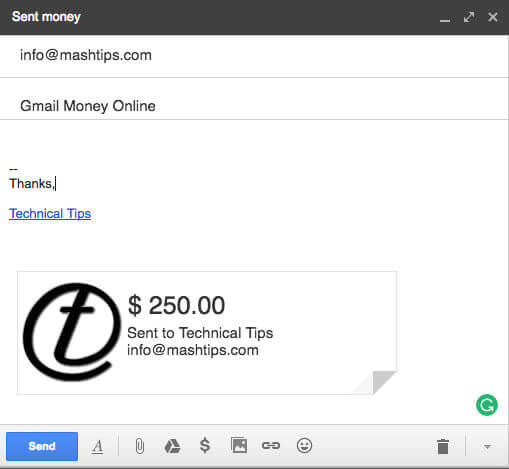

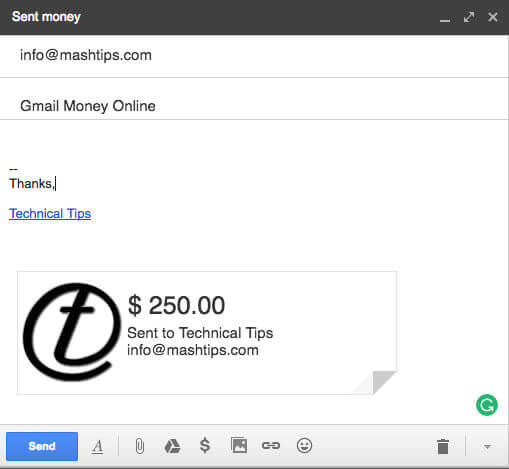

Now you are ready to transfer money online with email. You can see an attachment with the amount, and the recipient email address on the gmail window. You can compose the required message and the subject in the text area and click on the send button to send money online from gmail.

How to receive money online with gmail?

It is easy to claim the email transferred money. You don’t need to have a gmail account to claim the money, you can use any email account to receive the money, and the sender can email money to any of your email accounts. However, we demonstrated this money transfer online feature with gmail account for the sake of screenshots.

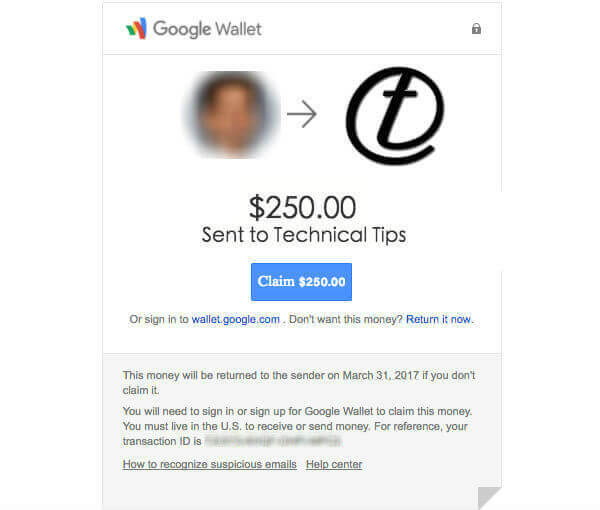

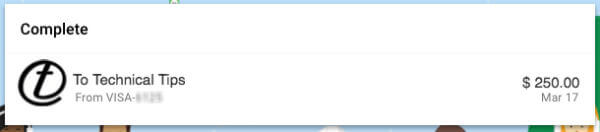

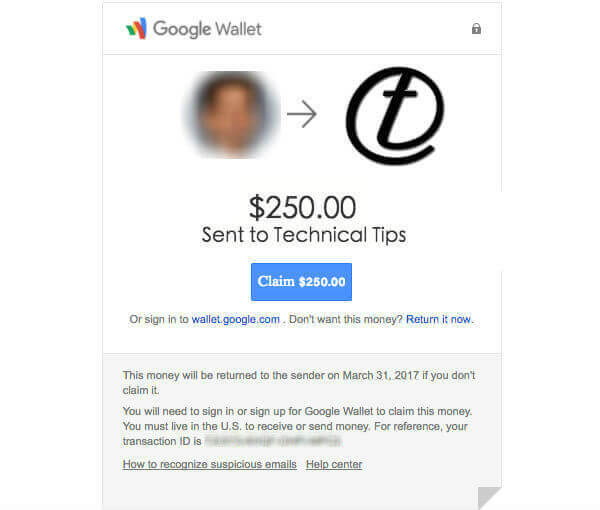

For the recipient email, they can see an email in the inbox just like other emails. Once you open and click on the email body, you can see the window like the screenshot below. On the screen, you can see the transaction ID, the amount received, and the expiry date to claim the money, that seems like 15 days. One this screen, you have to click on the claim button attached to the email to transfer the money to your bank account or debit card.

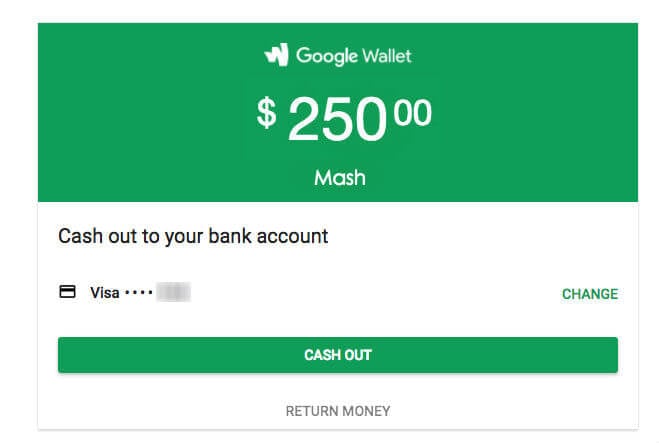

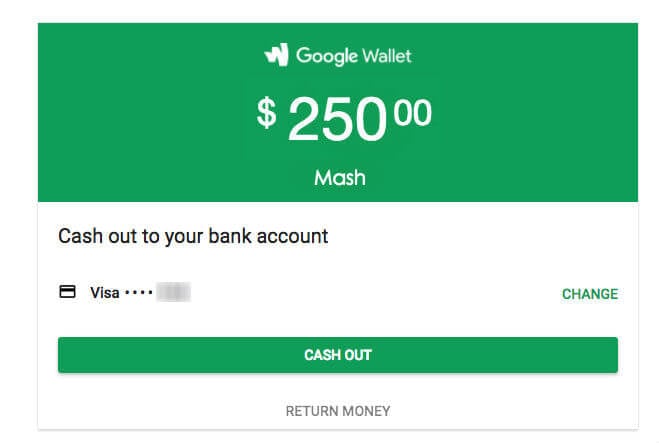

When you claim the money, google will ask you to connect your bank account or debit card number to deposit the money. The next screen lets you cash out the money from the email to the debit card or bank account you provided.

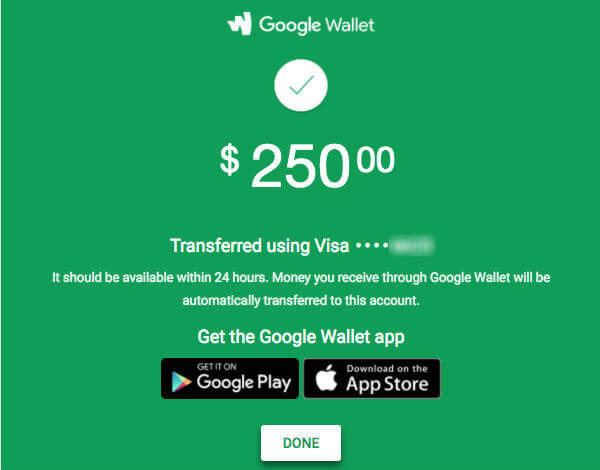

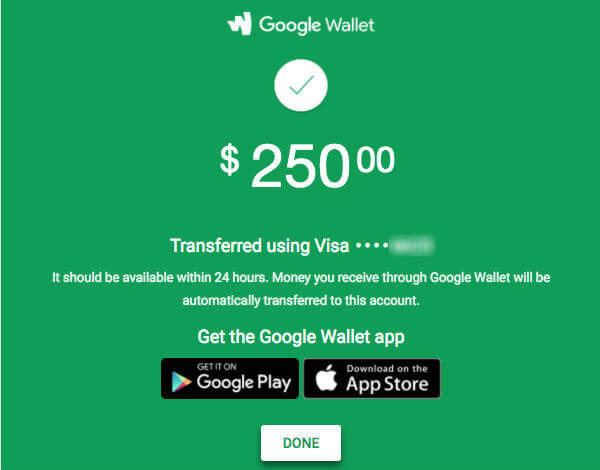

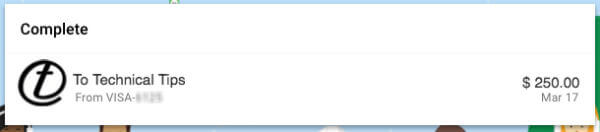

At this point, you have the option to return money if somebody emails the money to you by accident. Once you click on the CASH OUT button, then the next screen will let you know the money transfer status.

As per google, the money will be available in your bank account within 24 hours. The money is transferring through the google wallet service. You don’t need to worry about this wallet account at any point. There is no need to have google wallet account to receive the money online.

Once you click on the done button, you will get a transaction completed window. The money will be available in your bank account within 24 hours.

Is this gmail money transfer secure?

Behind the scene, google is using a highly secured google wallet service to transfer money online. Google claim “google wallet comes with 24/7 fraud monitoring and covers 100% of all verified unauthorized transactions. All your financial information in google wallet is encrypted and stored on google’s protected servers in secure locations.”

You can always file a claim for google wallet service for any unauthorized charges or fraud activity.

Google online money transfer service is available only in US and UK at this point. Hope this email money transfer will extend to other countries. That let us make the international money transfer from an email with just a few clicks.

Transfer money is few clicks away now even without opening your bank account. You can send money online with your gmail account from a computer browser or with a smartphone. Those who want to transfer money online with android phone, use this email money transfer service or google wallet app.

Gmail money transfer: A complete guide to transfer money with email

Google rolled out an online gmail money transfer feature for UK and US users for free. Google has google wallet to transfer money and this gmail money transfer coming in handy for most of the users who don’t want to use google wallet. Google wallet is a free and fast online money transfer tool to handle money online right with your smartphone and web app. Google integrated this google wallet with your gmail account to transfer money quickly. With this simple gmail money transfer feature, anybody can send or receive money online with your gmail account, no need to have a google wallet account.

So google simplified this banking mechanism to few buttons on your gmail account and anybody can send money online just with a gmail, A debit card or bank account added to the gmail account.

The benefit of transferring money online

Well, transfer money online is easy, secure as a bank transfer, and you can do the entire process right from your smartphone or personal computer. There are online money transfer services available, and they charge a fraction of the amount as a service fee. However, online money transfer service through gmail service is free at this point. You can send money to any email account including other email providers for free with google’s money transfer feature.

How to send money online with gmail?

Those who are interests to know how to perform an email money transfer, we described all the steps here with screenshots. First, you have to log in to your gmail account to start. After you click on the compose button to start an email, you can see a $ symbol (£ for UK users) next to google drive icon. You can fill out the recipient email address in an address area and then the subject required.

Once you click on the dollar sign, then the new pop-up window will appear with google wallet icon. In this window, you can tap on send tab to send money, or you have the choice to request money from somebody else with the request tab.

On both tabs, you have to fill out the details for the amount requested or planning to send, and you can add a memo to the recipient at this point. Those who don’t have a google wallet account or wallet account balance, google will ask you to add a valid debit card (credit cards are not supported) or bank checking account to transfer the money. Once you give the debit card information or bank checking or savings account information, then click on attach button.

Now you are ready to transfer money online with email. You can see an attachment with the amount, and the recipient email address on the gmail window. You can compose the required message and the subject in the text area and click on the send button to send money online from gmail.

How to receive money online with gmail?

It is easy to claim the email transferred money. You don’t need to have a gmail account to claim the money, you can use any email account to receive the money, and the sender can email money to any of your email accounts. However, we demonstrated this money transfer online feature with gmail account for the sake of screenshots.

For the recipient email, they can see an email in the inbox just like other emails. Once you open and click on the email body, you can see the window like the screenshot below. On the screen, you can see the transaction ID, the amount received, and the expiry date to claim the money, that seems like 15 days. One this screen, you have to click on the claim button attached to the email to transfer the money to your bank account or debit card.

When you claim the money, google will ask you to connect your bank account or debit card number to deposit the money. The next screen lets you cash out the money from the email to the debit card or bank account you provided.

At this point, you have the option to return money if somebody emails the money to you by accident. Once you click on the CASH OUT button, then the next screen will let you know the money transfer status.

As per google, the money will be available in your bank account within 24 hours. The money is transferring through the google wallet service. You don’t need to worry about this wallet account at any point. There is no need to have google wallet account to receive the money online.

Once you click on the done button, you will get a transaction completed window. The money will be available in your bank account within 24 hours.

Is this gmail money transfer secure?

Behind the scene, google is using a highly secured google wallet service to transfer money online. Google claim “google wallet comes with 24/7 fraud monitoring and covers 100% of all verified unauthorized transactions. All your financial information in google wallet is encrypted and stored on google’s protected servers in secure locations.”

You can always file a claim for google wallet service for any unauthorized charges or fraud activity.

Google online money transfer service is available only in US and UK at this point. Hope this email money transfer will extend to other countries. That let us make the international money transfer from an email with just a few clicks.

Transfer money is few clicks away now even without opening your bank account. You can send money online with your gmail account from a computer browser or with a smartphone. Those who want to transfer money online with android phone, use this email money transfer service or google wallet app.

So, let's see, what was the most valuable thing of this article: traders find it difficult to start trading on a live account successfully. This article explains the best practices when moving to real money trading. At how to transfer money from demo account to real account

Contents of the article

- Real forex bonuses

- How to transfer from a demo account to a live one

- What are the advantages and disadvantages...

- How to transition to a live...

- How to switch from a demo account to a live...

- Documentation

- Funding

- The psychology

- Money management

- How to use a demo account?

- How to seamlessly transition from demo trading to...

- 1. You aren't using risk capital

- 2. The amount at risk is above your comfort level

- 3. You aren't planning your trades

- 4. Your demo account balance is unrealistic

- It's all about the money

- Final words

- Send me weekly updates about daily...

- Your turn: ask justin anything

- Metatrader: demo account vs real account

- Metatrader: demo account vs real...

- Slippage, re-quotes and latency time in...

- The main challenge:...

- Fxdailyreport.Com

- So, what exactly is a forex demo account?

- The differences between a real account and a demo...

- Delay in order filling

- Slippage in price

- Wider spreads

- Proof of identity and address

- Emotional pressure

- Forex trading big

- From forex demo account to real account: when?

- Gmail money transfer: A complete guide to...

- The benefit of transferring money online

- How to send money online with gmail?

- How to receive money online with gmail?

- Is this gmail money transfer secure?

- Gmail money transfer: A complete guide to...

- The benefit of transferring money online

- How to send money online with gmail?

- How to receive money online with gmail?

- Is this gmail money transfer secure?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.