Loan to start forex trading

Forex trading loans can come from forex traders, investors/individuals, corporations, financial bodies, forex banks and the government.

Real forex bonuses

These loan parties provides a medium to increase the overall money supply in an economy, expand forex business operations and opens up financial competitions. The interest and fees generated from forex trading loans are seen as primary sources of revenue and income for the above listed loan participants. Forex trading loans can also be seen as revolving or term loans. Revolving forex trading loans are those loans that can be spent, repaid and spent again while term forex trading loans are those loans that are paid off in equal proportion and on monthly instalments over a specific period of time known as a term.

Forex trading loans

Just like in other businesses, one can get a loan as a forex trader, even though they are different from the usual kind of loans one may be used to, and it is not accessible to all. As a matter of fact, new traders in most cases (if not all) do not have access to forex trading loans for some reasons. What is a forex trading loan and who can get it?

A trader is said to have a forex trading loan if he or she gets some securities from another party to pay back in a later date. The payment is meant to be the exact amount of commodity borrowed, and some interest as agreed with both parties at the onset of the deal.

This is not so much different from what is seen in the case of bank loans (for example); where one can borrow money based on some terms and conditions, and pays back after an agreed period of time together with an agreed interest. Forex loan may be for a pre-defined one time amount or can be accessible as an open ended line of credit up to a particular boundary.

The terms surrounding a forex trading loan is based on the agreement of each party involved (the lender and the borrower) in the forex transaction before any money, currency or commodity changes hand. If the lender needs a collateral to be deposited, then it is stated in the loan agreement leaflets. Forex trading loans are made up of maximum amount of interest required and the length of time specified for the repayment of the amount of money loaned.

Forex trading loans can come from forex traders, investors/individuals, corporations, financial bodies, forex banks and the government. These loan parties provides a medium to increase the overall money supply in an economy, expand forex business operations and opens up financial competitions. The interest and fees generated from forex trading loans are seen as primary sources of revenue and income for the above listed loan participants.

TYPES OF FOREX TRADING LOANS

1. SECURED AND UNSECURED FOREX TRADING LOANS

Forex trading loans can be secured or unsecured. Secured forex trading loans can be defined as loans that can be backed up or safeguarded by collaterals. Examples are mortgages and car loans. Unsecured forex trading loans are those forex loans which are not backed up or safeguarded with collateral. These unsecured forex trading loans actually have a greater amount of interest rates attached to them. This increased interest rate of unsecured loans is due to the fact that they are riskier for the lenders. In a secured loan, the lender can have a possession of the collected collateral in case of a default in repayment by the borrower and this makes this type of forex loan less risky.

2. REVOLVING AND TERM LOANS

Forex trading loans can also be seen as revolving or term loans. Revolving forex trading loans are those loans that can be spent, repaid and spent again while term forex trading loans are those loans that are paid off in equal proportion and on monthly instalments over a specific period of time known as a term.

HOW INTEREST RATES AFFECT FOREX TRADING LOANS

Interest rates have a high effect of forex trading loans. Forex trading loans which have high interest rates stands to have an increased monthly payment or take a long time to pay off than forex trading loans with low interest rates. For example, if a forex trader borrows 4,000 dollars on the basis of an instalment or term loan with a 3.5 percent interest rate, he/she will be faced with a monthly payment of 58.33 for the next 5 years.

In conclusion, in forex trading loans, the higher the interest rates, the higher the amount to be paid while the lower the interest rate, the lower the amount to be paid.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

Get loan for forex trading: social funding offering financial help to forex investors

Trading in forex market offers a big opportunity for those who would want to make money in this trillion dollar market. If you want a loan to start forex trading, there are a few social funding options you can consider. This article gives you information on where you can find a loan to trade in forex market.

There are many kinds of loan facilities you can get but one area that has not been explored is lending people money to trade in forex. Lenders consider forex trading to be a high-risk market and they try to keep off from this kind of lending. However, through a social funding platform, you can become a member and be able to access loan facilities to start trading in forex.

Forex trading is a lucrative business and people are making a lot of money through this trade. What you need to do is understand the market, read more about trading strategies and market analysis then start trading. It is important to use the free demo accounts provided by many brokers to practice on how to trade. This will give you a hint on how you are likely to fair when you start the real thing.

One big problem that people have when they want to trade in forex is the capital. If you do not have money, it means you cannot trade. However, with the forex trading loans, you can be able to starting trading in this market and get a share of this trillion-dollar market. The good thing about forex trading is that it has been made easy for traders.

You do not have to invest a lot of money in this market. With a couple of tens of dollars, you can trade. All you need is identify the best brokers such as etoro and then register. After registration, you can start practicing with a demo account as you look for the money. Once you have got the money, you can now begin trading.

When trading in forex market, you should understand that there are substantial gains and risks involved. You can earn as well as lose your money. Try to follow the market analysis and move with the trend. There are a lot of resources offering information pertaining to successful forex trading. You can access that information online and learn more about trading in this market.

When you are trading, avoid using a large proportion of your amount. If you have $100 dollars, you can trade with $20 dollars in order to minimize the risks. You can only use a large amount in case you are sure about a particular trade. Nonetheless, it is easy to make money with this trading. Even better, you do not have to trade yourself; you can copy other traders who are succeeding in the trade.

With the copy trader strategy offered by forex brokers, it is helping many people even the inexperienced ones to start making money. If you want to get a forex trading loan , there are a few resources that are offering such opportunities and you can tap the resource and begin your forex trades. You can borrow as little as $50 and use it to begin your trading experience.

Where can I get a loan to trade forex?

6 tips to save using the most popular food delivery apps

Getting a loan for trading forex is not difficult—the challenge is learning how to manage it. Another term for loans on forex is called margin. The money you invest in your position is used as collateral for the loan. The forex market is the largest, most liquid market in the world; it is also one of the least volatile markets as price movements rarely move more than 1 percent over any given day. That said, the forex market is also largely unregulated. Brokers, therefore, have the right to provide almost limitless margin.

Margin cap

Most online trading houses set a cap at 200 to 1, however, 500 to 1 ratios are not uncommon. In laymen terms, a 200 to 1 margin means that the brokerage is willing to lend you $200 for every $1 invested. If you have $5 in your account, you have the buying power equivalent of $1000. It isn't hard to find a brokerage willing to give you a loan. Almost all forex brokerages will provide you with a margin due to the liquidity in the market. The challenge is understanding how to best manage your margin.

Mitigate losses

With the opportunity to make more money comes the opportunity to lose more money. Using margin loans requires a strict trading plan. The use of stop limits to guard against automatic liquidation of your account is essential in order to mitigate the risk of losing your entire investment on one big swing in the market. It is not unusual for first time traders to be "blown out" on the first trade. Identify a range the currency is trading within. Set your stop limit order safely outside of these ranges.

Starter margin

In general, when you set up an account with an online broker, you will have the option to choose your loan (margin) amount. Start off with a small amount, say 10 or 20 to 1. If you're still profitable with this strategy after 3 months, reward yourself with an increase in margin to 40 to 1. Understand that the speed in which you can make or lose money is directly related to the amount of your margin account.

17 simple ways to raise $5,000 to fund forex trading account

How would you raise $5,000 to fund forex trading account? Live trading account, I mean?

For many, $5,000 could be 6 months salary, or 1 year’s salary. It really depends on which part of the world you live in. Now, even though $5,000 may be hard to get, it is not impossible.

Almost all forex websites you visit tell you about how to trade etc..But no-one really talks about the fact that in order to trade, you need cash and actually how to get the money required to start forex trading live.

I guess everyone assumes that anybody who wants to trade forex has adequate money to start with, right?

Actually, there are people interested in trading forex but really have no money at all.

Well, because that’s how the world works…some people have it, some people just don’t.

If something is hard to get…

If something is hard to get,what do you do?

You see, dreaming does not bring results. Taking action does.

When you are hungry, you do not dream about food or wish that food will fly to your mouth. It never happens. Not in this life.

Your hungry stomach will make you stand up, take a walk to the kitchen to cook something, or open the refrigerator to see if there is any food in it, or jump in the car and drive to mcdonalds or KFC or whatever.

When your stomach demands food it is near impossible to ignore it.

Let me construct the sequence of events that happens when you are hungry:

- Step 1: you feel hungry (situation)

- Step 2: your mind tells you where to find food (solution)

- Step 3: you leave whatever you are doing at the moment and you go and find food (taking action)

- Step 4: food in your hand, into your mount, into your stomach (mission accomplished!)

As a forex trader needing cash to fund a live forex trading account, you situation would be like this:

Situation: need to find $5,000 to fund forex trading account

Solution: what ways or options can I raise $5,000?

Taking action: this is when you start doing what it takes to get $5,000.

Mission accomplished: you finally get $5,000 and fund your forex trading account.

OK, how would you actually get $5,000?

Now, think of it this way…$5,000 in itself is quite a big number, or isn’t? It isn’t a huge amount when you break it down into smaller parts.

- Five thousand one dollars.

- Or five hundred $10 dollars

- Or one hundred $50

- Or 200 hundred $25

You get what I’m trying to say here?

In here are 17 actionable ways where I hope can give you some ideas on how to raise $5,000 to trade forex.

1: mow lawns for for 200 neighbors for $25

Do you have a ride-on mower?

Or just an ordinary push lawn mower?

Do you know 200 neighbors where you can ask to mow their laws for $25? Or what about 100 neighbors but you mow their lawns twice, maybe 1 or 2 months apart?

I’d happily pay anyone to mow my law for $25! You wan’t to know why? Because I’d rather sit in front of the computer than mow the lawn.

If I’m like that, imagine there are millions of people in the world today, who are so into technology, facebook, twitter, instagram, youtube…TV, you name it and they just can’t find the time to mow their own lawns. This situation is especially true in developed countries.

Mowing lawns in the past used to be something I enjoyed doing…now, its not. I hate mowing. Its my missus that actually “kicks my arse” to get out and mow the lawn.

If that is how I view mowing lawns, imagine that there are many more like me and and the’d be happy to pay you to mow their lawn…even if they have their own lawn mowers, just ask them.

Or what if you don’t have a lawn mower but your neighbor has a lawn mower and you realize that his lawn is getting tall.

You go up to his door, knock on the door and say ” hello mr neighbour, I noticed you need to mow the lawn but I can do it for you for $25.” (CLICK NUMBERED BUTTONS BELOW TO CONTINUE TO #2)

How to start forex trading

You can perform a forex trade 24 hours a day and five days a week. However, choosing the right account could help you get closer to earning a profit. Here is a guide on how to get started with forex trading.

What is forex trading?

Forex trading is a high-risk investment, and you could lose more amount than your deposit.

Look for a broker

You need to have a forex account with a broker as they will give you a platform that you could use to trade on.

Here is an example of two brokers and their bid and ask exchange rates for the EUR/USD:

| Broker | bid exchange rate | ask exchange rate | spread |

|---|---|---|---|

| A | 1.12310 | 1.12321 | 1 pip |

| B | 1.12310 | 1.12331 | 2 pips |

Going for the broker with the lowest spread implies that the exchange rate must only make a smaller movement before you can earn a profit, for example:

- To earn a profit with broker A, the exchange rate must move by 1.1 pip or more in your favour.

- To earn a profit with broker B, the exchange rate must move by 2.1 pips or more in your favour.

Even though most forex brokers combine the costs in the spread that they give you, some could charge you for the following:

- Inactivity fee: when you stop trading for a period, such as one or two years, your broker could charge you until you begin using your account again, for example, £12 per month.

- Adding/withdrawing charge: brokers charge if you add money to your account or withdraw from your account. This is ordinarily a set fee, such as £5 for every £200.

- Overnight trading: for leaving a trade overnight, some forex brokers charge you for interest. For example, 1.5% of the price of any open trades.

Open an account

After you pick a forex broker, you must complete an online registration form with them.

You will need to provide them with the following information:

- Full name

- Address

- Email address

- Mobile phone number

Your broker will then send a link via text message or email to validate your details.

You may also have to confirm your account by giving your driving licence or passport number. The name on your forex account must match the name on your ID.

If your selected broker owns demo account, make use of it to so that you can be familiar with their forex trading system before you begin using your own money.

Make a trade

You can trade in forex monday to friday, 24 hours a day, which means you can trade on currency pairs more frequently compared to other markets, such as commodities or indices.

Performing a trade is also called opening a position, and if you earn a profit or loss is based on the performance of the base currency as compared to the counter currency that you trade with.

The first currency is the base currency in one pair, the counter currency, on the other hand, is the second, for example, EUR/USD has a euro base currency, and a US dollar counter currency.

The exchange rate is the amount of the counter currency that you can purchase with the base currency. As an example, if the EUR/USD had an exchange rate of 1.12 you can earn $1.12 for every euro.

If the rate increases to 1.13 ($1.13 for one euro), this means that the euro’s value has increased against the US dollar as you can receive more of the counter currency for the base currency.

Forex trading tools

If you would want to manage your trades without watching them regularly, there are a few trading tools you could make use of:

- Limit order: you pick the exchange rate your trade closes at. This allows you take a profit when the rate reaches a level you have set.

- Stop loss: you pick the exchange rate your trade closes at. However, this does not guarantee further losses as brokers cannot always close the trade at an exact rate.

- Guaranteed stop loss: you pay a fee to the broker, and they will close your trade at the same exchange rate you choose.

- Ybuy limit: your broker will open a trade when the exchange rate reaches your chosen value. If the rate is not reached, the broker never actions your trade.

- Margin call: if your losses come near your margin, your broker will ask you to add more money. If you do not, your broker will then close your trades to stop further losses.

Close your trade

Before you close your trade, also known as closing your position, you can review if you are earning a profit or a loss by studying the active trades on the platform of your chosen broker.

If you are ready, choose the trade you want to close from your active trades tab and click on the close trade button.

You are then required to verify if you want to close your trade. Then you are shown how much profit or loss you have earned.

Should you take a loan to trade forex?

1. The forex just like every financial concept or investment as much as experience is needed, capital is quite fundamental. Many traders are lost to how to generate this capital as this is supposedly supposed to be their risk capital (an amount of money they wouldn’t losing heavily). Some have options in investing their savings, others even actively use their direct income. If we are not doubting the profitability of the market and the ability of the forex market to reward diligent traders, do you think it is best of tactical options to take a loan to finance the beginning of your forex trading journey

It would be unwise to invest/trade loaned capital. To be honest not much capital is needed to start your forex trading journey, if you visit other pages of this forum you can actually find postings of several brokers that give you a sign up bonus for trading, the only catch it you can only withdraw the profit you make.

The common saying in investing/trading, "dont risk money you cant afford to lose". Any trader looking to start trading should do so with a demo or small deposit. If you cant grow a small account or paper money account, whats to say you can grow the $10k (or other) loaned amount? It is best to start off small, learn and grow. To say that someone is not doubting the profitability of the market is kinda negated when mentioning STARTING journey.

My advice to any new or inexperienced trader: start off small, preferably a demo account . Dont think so much of profiting, but actually surviving the markets. Learn money managements, because its the only thing you can truly control. If you start off with a micro lot account and risk less than 2% per trade. At least if you wipe out it wont be over night. The longer your in the game you will start discovering your strategy, what works and what dosent. Another thing is to not rely to much on indicators. Price action, support & resistance and fundamentals should be your focus. If your new then dont make the common mistakes everyone makes, dont risk to much, survive to fight another day, learn & apply (take notes of what works), dont revenge trade (losing trades is part of the game, dont try to recover by opening another trade without analysis), also make some budies on line and reflect upon each others trading ideas (always ask why).

Ive been trading for more than five years, im not to active on forums lol i just sign up generally to have access to certain things. If you or anyone wants to add me on skype for some strategies, need help finding bonus deposit broker or need a trading buddy.

Forex investment loan

Forex investment loan is the a dept provided by an entity to another entity at an interest rate for forex investment , and by a note which specifies, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and date of repayment. Forex investment loan is mainly from banks and big organizations to an individual or to an organization, loan contracts come in different kinds of forms and with varied terms, banks credit unions and other people lend money for significant, though the little loan are mainly available for chosen group of people regardless of type, every loan and its conditions for repayment is governed by the federal guidelines to protect consumers from bad practices like excessive rate.

Generally we have different kinds of loan, and this types includes

Here we are only going to consider the business loan, this loan is grated to business people to help them start of expand a business, this is the type of loan that is applicable by a forex trader as it enables him to invest more on the trade, and pay back the specific amount that may have been required by the lender after a specific period of time, this means that even without having a capital in your account you can still start your business and make your money, one good thing about forex business is that you can still make your money after a short period of time and still pay back the loan you obtained. Business loans can be obtained from banks or credit organizations.

OBTAINING LOAN FROM FOREX BANK

A loan from forex bank can help you realize your dream, it could be anything from taking your dream trip to buying the car you’ve been dreaming about for a long time, and you can take the opportunity to renovate your home adding new things, and also you can settle expensive older loans and credit card dept and thus reduce your monthly expenses.

WAY OF APPLYING FOR LOAN

Meeting a branch of credit organizations.

Printing and mailing an application

But you must meet the requirement of any organization before your application will be granted.

You can start your forex business even without a enough capital ,but jus by investing you loaned money

Also loaning from forex bank is cheaper, and more secured

You can still make profit and repay the loan.

Loaning to trade in a business like forex trade is very risky; you may end up losing all the money.

It may be difficult for bank to grand you loan for forex business, considering the risk involved.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to start a forex trading business from home

If you are looking to set up your own forex trading business from home, you have come to the right place.

This post will tell you how you can make money by trading currency pairs. If you are a beginner, you must be aware that it involves some amount of risk, but you can learn to do it in an interesting manner and earn an income.

In the forex market, currencies worth US$5 trillion are traded on a daily basis. This means there is an opportunity for you to earn a lot of profits through your forex trading business without the need to invest too much of your hard-earned money. One of the biggest advantages is that you need not meet any formal requirements for starting a forex trading business.

The advantages of forex trading are as follows:

• unlike the stock market, the forex market operates round the clock.

• it is not possible for anyone to manipulate the forex market.

• the forex enables margin trading. This means that you can buy currencies worth thousands of dollars though you may have only less than US$100 with you. This is not possible in stock trading.

As such, all that you need to have with you are a little money, some amount of patience, a personal computer, and a reliable internet connection in order to become a currency trader. Here is how you can start your forex trading from home:

#1: learn the basics of currency trading

It is not easy to learn forex trading on your own through video tutorials. It is, therefore, recommended that you work with an expert to understand the nuances of trading. In addition, you should attend seminars/webinars and read a little bit to in order to sharpen your skills. Reading books on economics and business also helps you to broaden your insight, especially with respect to fundamental analysis. Additionally, you must master technical analysis as well.

#2: organize the trading capital

Fortunately, you are not required to have a large amount of money to start currency trading. This is because of the margin trading feature offered by brokers. You just need about US$10 to set up an account on the broker platform or you can use no-deposit bonus to start trading. However, it is a good idea to start with at least US$1,000 as it will ensure a little bit of buffer if you happen to incur losses.

#3: choose a reliable forex broker

Forex brokers make available online platforms to help you access the forex market and trade. You should go through the terms of trading before choosing any of the brokers. It is important that you work with the right forex broker in order to achieve your financial goals.

You should, therefore, compare the features offered by a few brokers prior to deciding to work with one. Some of the factors to be considered are trading options, terms and conditions, and user reviews. Then choose a broker that best fits your needs. You may also consult with an expert trader for this purpose.

#4: start by opening a demo account

After choosing the forex broker, open a demo account on the broker’s platform. The virtual account may be offered only for a certain specified amount of time period. However, it will give you an idea as to how you can use the trading platform offered by the broker. It will also be helpful in getting prepared for using the real platform. This means that you will not be using real money without testing the broker’s platform through the demo account.

#5: practice well

You cannot learn forex trading on the go. It is important to train yourself extensively so that you are in a position to buy and sell at the right time. You should trade on the demo platform for a few weeks so that the chances of you incurring losses are considerably reduced.

A demo account helps you to learn to implement various trading strategies successfully and develop a trading style of your own.

#6: start trading with real money

Open a live trading account with the forex broker after you have practiced enough and gained the confidence to go live. Actually, you should be able to convert the demo account into a live account. You may have to just deposit the minimum amount specified by the broker.

Some trading strategies will fetch you huge profits, some others will not work for you. The secret to increasing profits is repeating what works for you and avoiding what does not.

6 key terms you need to know before you start forex trading

Every trader must learn these terms and ideas before beginning forex trading

1. Pip

In forex trading, a PIP or pip is short for ‘percentage in point’ and is a measure for exchange rate movement. The pip is a unit – a numeric value that ultimately measures profit and loss. A single pip is equal to 0.0001.

Forex traders will often quote the movements, profits or losses in pips. For example, stating something like “I made 30 pips on that last trade” or “the AUD/USD has just gained 30 pips in the last hour”.

MXT global’s currency prices are displayed to the fifth decimal place (fractional pips) for improved precision. Our spreads can be too small to be seen with only four decimal places.

To find out more about pips, please see the following topics:

• what is a fractional pip?

• how do you calculate the per pip value?

• how is the pip change or movement calculated?

• how do you calculate profit/loss in pips?

2. Spread

A spread is the pip difference between the bid and the ask price of an underlying asset. As it is essentially the cost of making a trade, it is important for forex traders to know what spreads are. To find the spread we minus the bid (sell) price from the ask (buy) price.

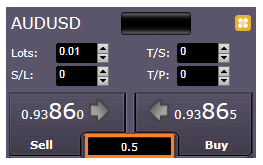

From the example taken from the trade terminal below, the AUD/USD is currently priced at 0.93860/0.93865 (sell/buy).

Buy price – sell price = spread

0.93865 – 0.93860 = 0.00005 or 0.5 pips

The MT4 trade terminal will show the spread quoted in pips between the two prices. Spreads are always variable and as we source our feeds from as many as 70 different institutions, we can provide lower spreads. To compare the spreads between different currency pairs and other forex providers, please see here.

3. Leverage

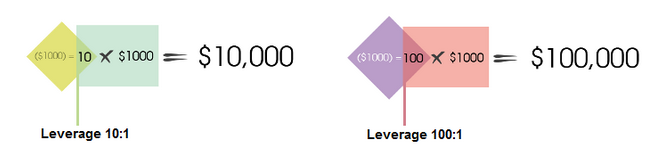

Leverage is the ratio at which defines the loan amount, “margin”, that traders are allowed to use to gain access to larger sums of trading capital. Leverage can heighten both profits and losses and should be used wisely. Due to the nature of leverage, forex providers like MXT global have strict leverage restrictions in place to assist traders in minimising risk.

Let’s look at a numerical example:

Say two traders have $5,000 USD and they both wish to use $1,000 on one trade as margin. Trader A has an account leverage of 10: 1 and trader B has an account leverage of 100:1.

The exposure they both have differs due to the difference of their account leverage ratios.

4. Margins

In forex trading, a margin is required to trade. A margin can be considered as the minimum collateral or deposit. This margin allows you effectively take a ‘loan’ – access to a larger amount of capital.

How do you calculate the margin per trade?

An account leverage ratio is used to determine how much margin will be required.

Overall lot size / leverage amount = margin required

example with 2 lots at leverage of 400:1

200,000 / 400 = $500 margin required

A margin call is a notification you will receive when there are not enough funds in your trading account support open trades. Essentially, when your floating losses are greater than the minimum margin required. MXT global’s margin call level is at 80%.

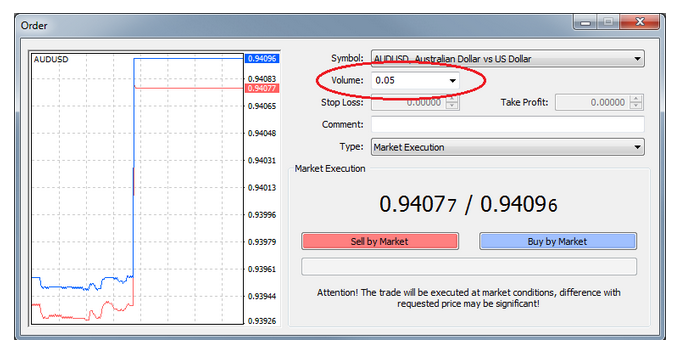

5. Volume

Looking at the your MT4 terminal, you will see the term ‘volume’ appear.

Volume in the order window refers to the volume to buy/sell.

Volume refers to number of lots whereby 1 lot = 100,000 units

Volume in on the volume bar in the charts refers to the tick volumes. It counts how many times the price has changed in that period.

6. Slippage

When you’re trading, sometimes you’ll notice a slight difference between the price you expect and the execution price (the price when the trade is executed). When this happens, it’s known as slippage. It’s a common thing to experience as a trader and it can work either positively or negatively. The main reasons for slippage are market volatility and execution speeds.

The price of the AUD/USD was 0.9010. After analysing the market, you speculate that it’s on an upward trend and long a one standard lot trade at the now current price of AUD/USD 0.9050, expecting to execute at the same price of 0.9050.

The market follows the trend but goes past your execution price and up to 0.9060 very quickly – within a second. Because your expected price of 0.9050 is not available in the market, you’re offered the next best available price. For the sake of the example, that price is 0.9045.

In this case, you would experience positive slippage:

0.9050 – 0.9045 = 0.0005, or +5 pips.

On the other hand, let’s say your trade was executed at 0.9055. You would then experience negative slippage:

0.9050 – 0.9055 = 00.0005, or -5 pips.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Editors’ picks

EUR/USD tumbles to new 2021 low under 1.2050

EUR/USD has slipped below 1.2050, falling to the lowest levels since early december – a new 2021 trough. The common currency is struggling amid a slow vaccination drive in the old continent EZ GDP dropped by 0.7%. US stimulus developments are eyed.

GBP/USD consolidates gains below 1.3700 amid risk-on mood

GBP/USD holds gains below 1.3700, snapping a two-day downtrend. Although market optimism favored the pair’s uptick from the short-term support line, bulls need extra fuel to cross the multi-month top marked the previous day.

USD/JPY: bulls keep pressuring the 105.00 level

Japan’s prime minister suga extended the state of emergency until march 7. Attention gyrates to a US stimulus package, as negotiations loom. USD/JPY is consolidating gains and poised to extend its advance.

Editors’ picks

EUR/USD tumbles to new 2021 low under 1.2050

EUR/USD has slipped below 1.2050, falling to the lowest levels since early december – a new 2021 trough. The common currency is struggling amid a slow vaccination drive in the old continent EZ GDP dropped by 0.7%. US stimulus developments are eyed.

GBP/USD consolidates gains below 1.3700 amid risk-on mood

GBP/USD holds gains below 1.3700, snapping a two-day downtrend. Although market optimism favored the pair’s uptick from the short-term support line, bulls need extra fuel to cross the multi-month top marked the previous day.

USD/JPY: bulls keep pressuring the 105.00 level

Japan’s prime minister suga extended the state of emergency until march 7. Attention gyrates to a US stimulus package, as negotiations loom. USD/JPY is consolidating gains and poised to extend its advance.

XAG/USD eyes deeper correction amid descending triangle breakdown

XAG/USD attempts a bounce but remains below the $28 mark. Silver bears look to extend control after the 4% drop so far. Descending triangle breakdown on the 1H chart points to more losses.

XAU/USD struggles near session lows, around $1850 region

Gold maintained its offered tone through the first half of the european session and was last seen trading near the lower end of its daily range, around the $1850 region.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 forex news events you need to know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news.

Top 10 chart patterns every trader should know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and.

7 ways to avoid forex scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: forex scams are becoming frequent. Michael greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What are the 10 fatal mistakes traders make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Strategy

Money management

Psychology

Note: all information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

So, let's see, what was the most valuable thing of this article: FOREX TRADING LOANS at loan to start forex trading

Contents of the article

- Real forex bonuses

- Forex trading loans

- Get loan for forex trading: social funding...

- Where can I get a loan to trade forex?

- Margin cap

- Mitigate losses

- Starter margin

- 17 simple ways to raise $5,000 to fund forex...

- If something is hard to get…

- OK, how would you actually get $5,000?

- 1: mow lawns for for 200 neighbors for $25

- How to start forex trading

- What is forex trading?

- Look for a broker

- Open an account

- Make a trade

- Forex trading tools

- Close your trade

- Should you take a loan to trade forex?

- Forex investment loan

- How to start a forex trading business from home

- If you are looking to set up your own forex...

- #1: learn the basics of currency trading

- #2: organize the trading capital

- #3: choose a reliable forex broker

- #4: start by opening a demo account

- #5: practice well

- #6: start trading with real money

- 6 key terms you need to know before you start...

- 1. Pip

- 2. Spread

- 3. Leverage

- 4. Margins

- 5. Volume

- 6. Slippage

- Editors’ picks

- EUR/USD tumbles to new 2021 low under 1.2050

- GBP/USD consolidates gains below 1.3700 amid...

- USD/JPY: bulls keep pressuring the 105.00 level

- Editors’ picks

- EUR/USD tumbles to new 2021 low under 1.2050

- GBP/USD consolidates gains below 1.3700 amid...

- USD/JPY: bulls keep pressuring the 105.00 level

- XAG/USD eyes deeper correction amid descending...

- XAU/USD struggles near session lows, around $1850...

- RECOMMENDED LESSONS

- Making money in forex is easy if you know how the...

- 5 forex news events you need to know

- Top 10 chart patterns every trader should know

- 7 ways to avoid forex scams

- What are the 10 fatal mistakes traders make

- Strategy

- Money management

- Psychology

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.