Tickmill south africa

- An opening introduction to tickmill by our CEO duncan anderson

- Presentations from tickmill representatives

- Networking opportunities with traders from the region

- Exclusive promotions with prizes from a total $6,000 prize pool

Real forex bonuses

Tickmill’s educational tour begins in south africa

In line with our mission to provide meaningful forex education to traders around the world, tickmill embarked on a global educational tour with the first stop in johannesburg, south africa.

The first tour kick-started in johannesburg on september 30 th with the renowned mentor kenny simon, founder of the geometric trading institute. Mr. Simon gave forex enthusiasts the opportunity to master the secrets of trading and maximise their potential.

The event was a huge success, as it exceeded expectations in terms of turnout, while all attendees responded with great feedback to the highly informative training sessions.

Highlights from the seminar included:

- An opening introduction to tickmill by our CEO duncan anderson

- Presentations from tickmill representatives

- Networking opportunities with traders from the region

- Exclusive promotions with prizes from a total $6,000 prize pool

Tickmill thanks all those who attended the event and looks forward to hosting more seminars and workshops as we continue our tour in europe, africa, middle east and asia.

Losses can exceed the initial deposit.

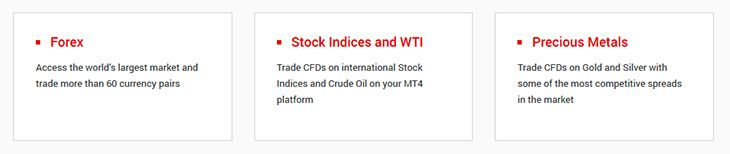

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

Tickmill is a broker firm that offers clients cfds (contracts for difference) for trades in cryptocurrency, forex, stock indices, bonds and precious metals. Its base is in seychelles, with two agencies regulate it, the FCA (financial conduct authority) and FSA (seychelles financial services authority), and it has a global client base.

Who is behind tickmill?

The company has its retail business connecting to armada markets. Founded in august 2014 by the current shareholders of the company, it started with retail broker services.

The company started CFD trade, IB (introducing broker) program and VIP accounts from 2015.

What trading does it offer?

Tickmill is an ECN (electronic communication network) and NDD (no dealing desk) broker. They give trade services in various financial items, and they are active in the middle east, africa and asia.

You can begin to trade on the platform with minimum deposits of $25. This is not bad, considering that it comes from a FCA-licensed broker. You can also trade in the following commodities on the platform aside from forex (64 currency pairs) – stock indices, precious metals, cryptocurrencies and bonds.

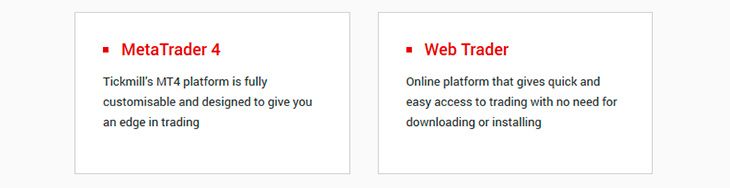

Trading platforms on the site

Similar to many forex brokers, the main platform that the site supports is MT4, which is available for windows and mac pcs, as well as ios and android devices, and web versions.

Most investors prefer using MT4 as a fore trading platform, due to its interface being user-friendly, its advanced charting package, the highly developed back-test environment, a variety of technical indicators, and the support for eas (expert advisers).

You can get VPS service with them as well, and this allows traders to install the EA applications that they want and run them permanently without needing their pcs to stay on.

Tickmill also provides myfxbook services, which provide clients with innovative trade choices, all through the autotrade platform, a copy-trading platform.

Copy trading platforms

This is a form of trade allowing for traders within financial markets to copy positions from a selected investor. This usually happens within the situation of social trading networks.

This is different from mirror trades, which allows traders to copy specified strategies, as well as other traders’ funds to their own account. The trader that is copying the position can retain the power to disconnect any copied trades and manage them as a new position.

All this leads to the development of a new variety of investment portfolio, one that experts from the industry term people-based portfolios.

A point to note: variable vs. Fixed spreads

There are two kinds of spreads in the forex market scene – floating/variable spreads, and fixed. For the case of fixed spreads, these give the trader more assurance when trading because their rates do not change as much and they tend to have wider pips than variable spreads.

Fixed spreads give about two or three pips, while variable spreads can vary from zero pips to whatever the broker and market conditions dictate.

In recent times, the popularity of variable spreads is increasing, due to the high rates of returns they offer when favorable major events occur. However, the forex trade platforms now put caps on variable spreads to minimize losses for traders.

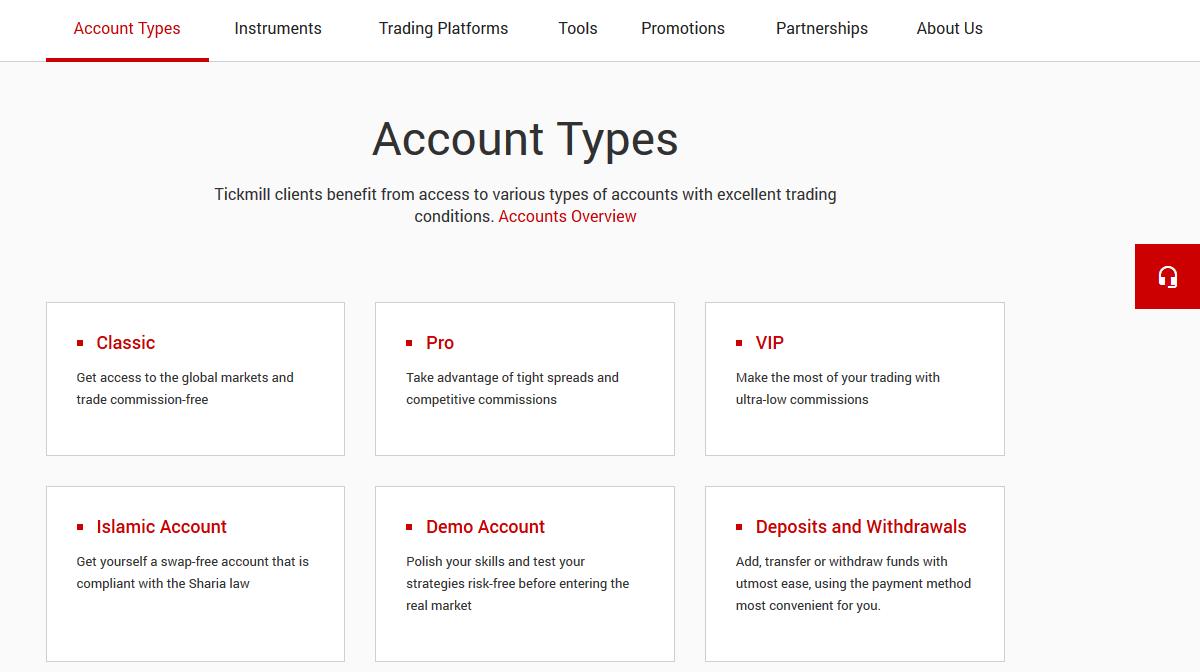

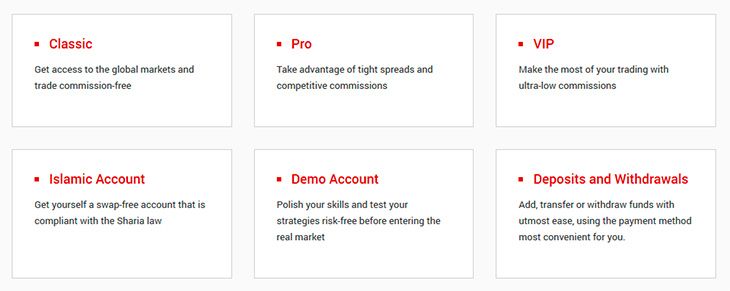

Account types present on the site

1. The site offers users two basic account types, all which use metatrader 4 platform, while giving market execution that has speeds of 0.3 seconds. There is also an advantage of 1:500, variable spreads, and micro-tradable lots.

The classic account is commission-free

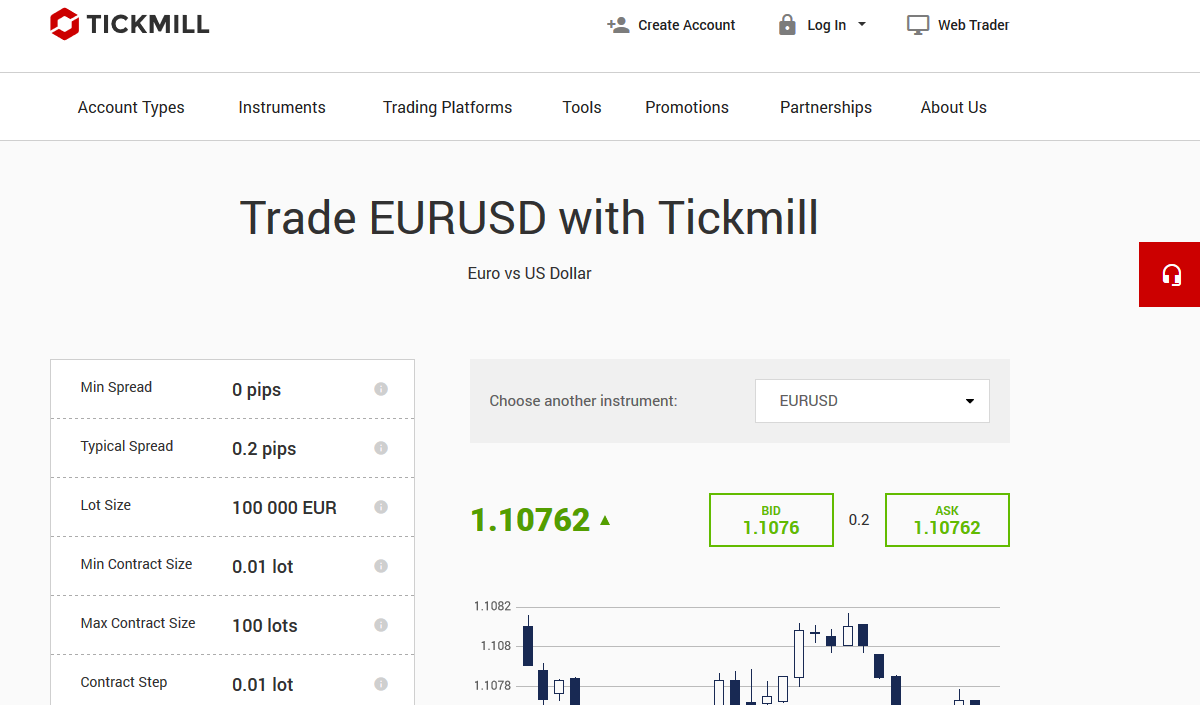

The pro ECN account has small commission fees and tight spreads compared to the classic account. It also charges $2 per side per 100K or 1 standard lot, and the amount added to the lower prevailing spreads that have a usual spread of 0.2 pips for EUR/USD.

2. There are VIP accounts as well, and this caters to clients with account balances greater than $50,000. It offers lower commission fees and custom approaches as well. The charges can be up to $1.6 per side for each lot, while the spreads are likely lower than the PRO account. This makes this account option beneficial for very active traders, since the deposit requirements are higher.

3. You can get personal multi-account manager (PAMM) accounts; while the MAM accounts give professional money managers the opportunity to trade on behalf of their clients, in addition to execute blocking trades on multiple accounts through a master account. The minimum deposit on MAM accounts is $5,000.

4. Islamic accounts comply with sharia law, and are available to clients that do not want to earn interest on their money for religious reasons.

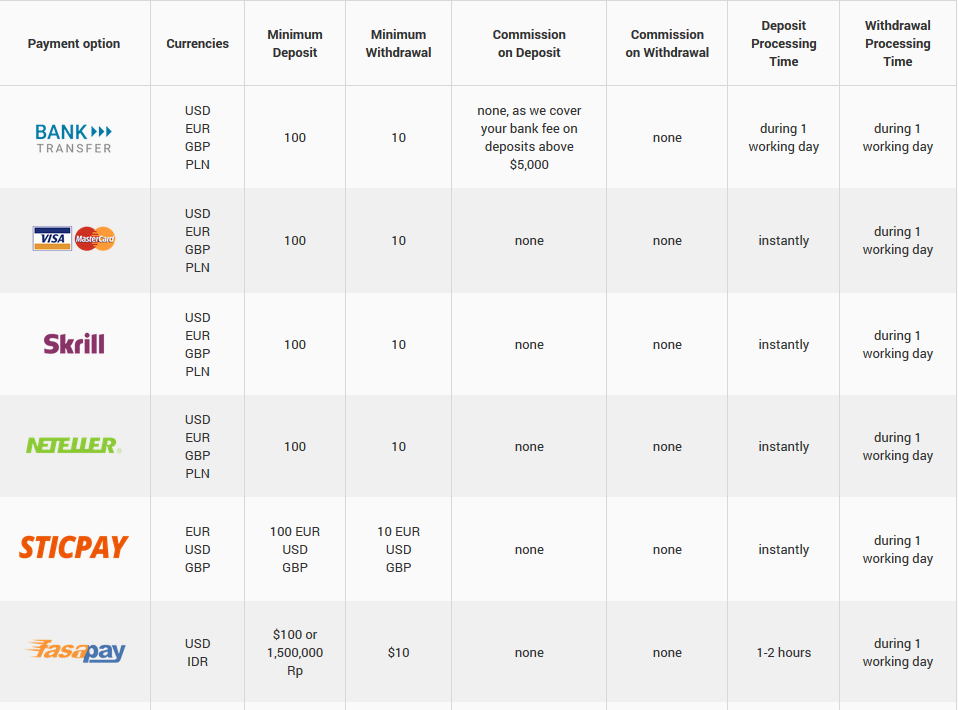

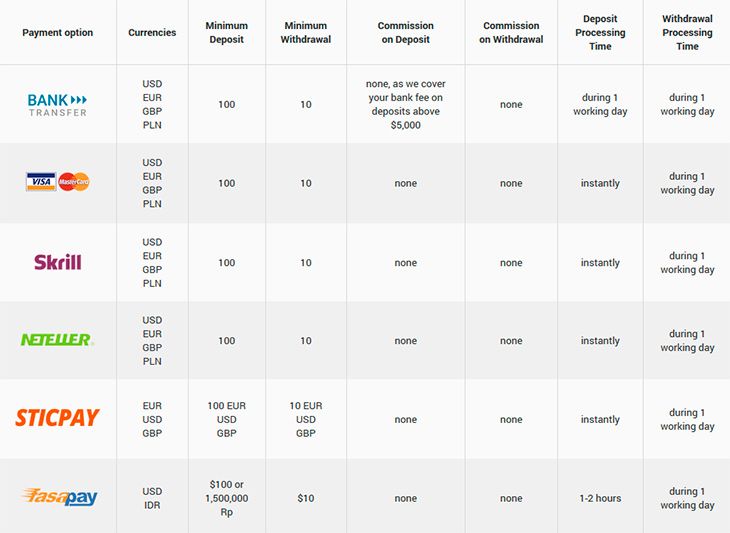

Deposit and withdrawal options

There are no fees for withdrawals and deposits. All deposits that begin from $5,000 go through procedures of bank wire transfer, and they are additional to the company’s zero fees policy. The company also takes care of your transaction fees for up to $100 or equivalent amounts (if using different currency) through their support team.

Depending on the country you live in, you can explore several deposit and withdrawal options:

Barclays bank (bank transfer) – there is no commission on deposits, and it covers four currencies: the EUR, USD, GBP and PLN. The minimum deposit is 25 and withdrawal is 10.

Skrill – four currencies are on the site, same as the ones in the bank transfer option. The conditions are similar to bank transfers though the deposit processing time is instant in most cases.

Mastercard and visa – the same as skrill option.

Neteller – same conditions as above.

Unionpay – only available for seychelles clients, and FSA regulates it. The currency on the platform is the yuan. Minimum deposit is 150 CNY while the withdrawal minimum is 50 CNY. There is instant processing of deposits.

Fasapay – this is only available for seychelles clients, and the FSA regulates it. It accepts USD and IDR (rupees), while the minimum deposit is $25 or 25,000 IRP. The withdrawal minimum is $10 or 10,000 IRP. Processing time for deposits is between one and two hours.

Dotpay – the currency is the PLN (polish zloty). Deposit minimum is 100 PLN while withdrawal amount is 50 PLN.

Nganluong.Vn – like the previous two options, it is only available for seychelles clients. The currency is the VND (vietnamese dong), deposits being at least 500,000 VND and withdrawals being at least 200,000 VND.

For all these methods, the processing of transactions is fast, regardless of whether it is deposits or withdrawals.

The platform does not accept payments made through third parties, while for withdrawal payments they will always use the payment method you used for depositing money.

Commission and bonuses

Maximum advantage rates are 1:500. This might be high, relative to other brokers that the FCA regulates.

It comes with an ECN trading environment, in addition to competitive pricing structures

Has low initial deposit and high leverage levels (compared to other sites)

MT4 platform is available

Has low commission rates in both VIP and PRO accounts

It allows for agency execution

It has few trading platforms and options to explore

The research part is light on content

The cfds available are not many

Conclusion

The VIP accounts on the platform require a minimum of $50,000 for the trader to get deep discounts. This is comparable to other platforms in the forex sector, which may charge slightly more or less. However, tickmill goes further and offers discounts to all VIP holders that have active accounts.

The PRO account seems like the VIP account, the only difference being in costs of commission, but it remains a good choice. The classic account may not offer you much in terms of competitive pricing, so the PRO account is better in this case.

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

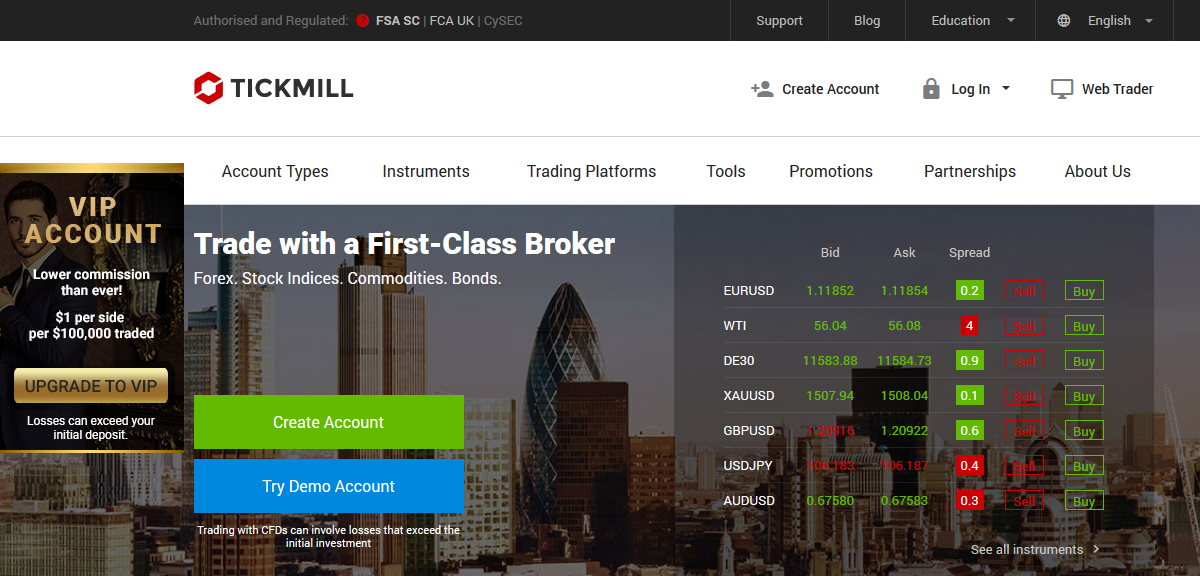

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

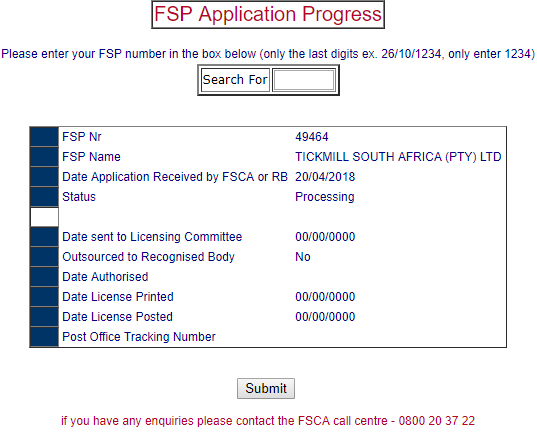

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

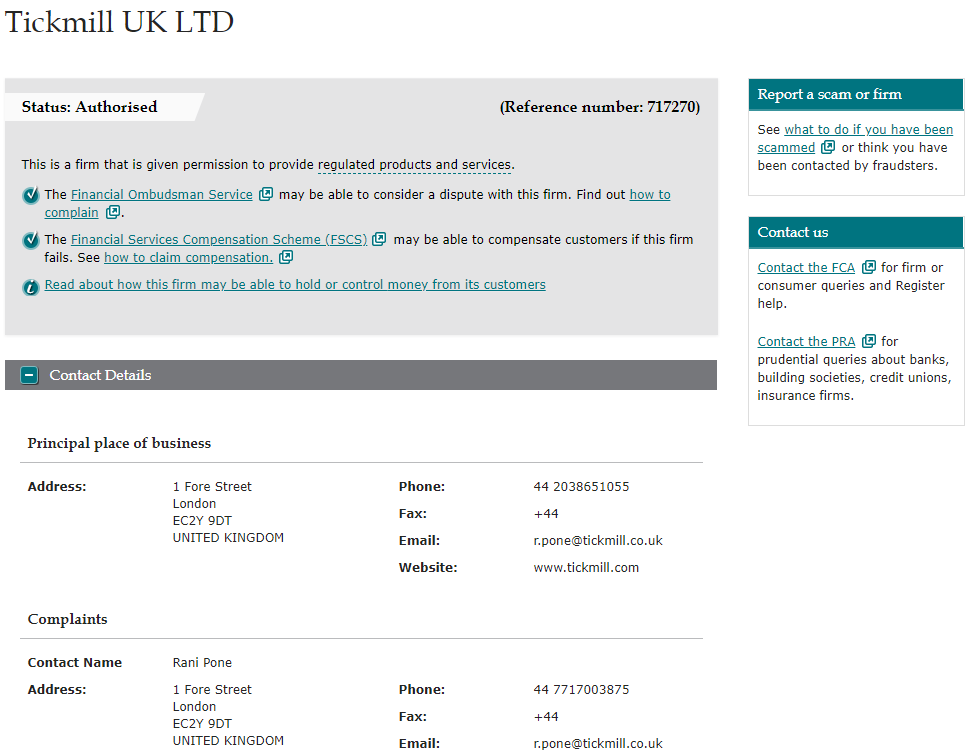

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

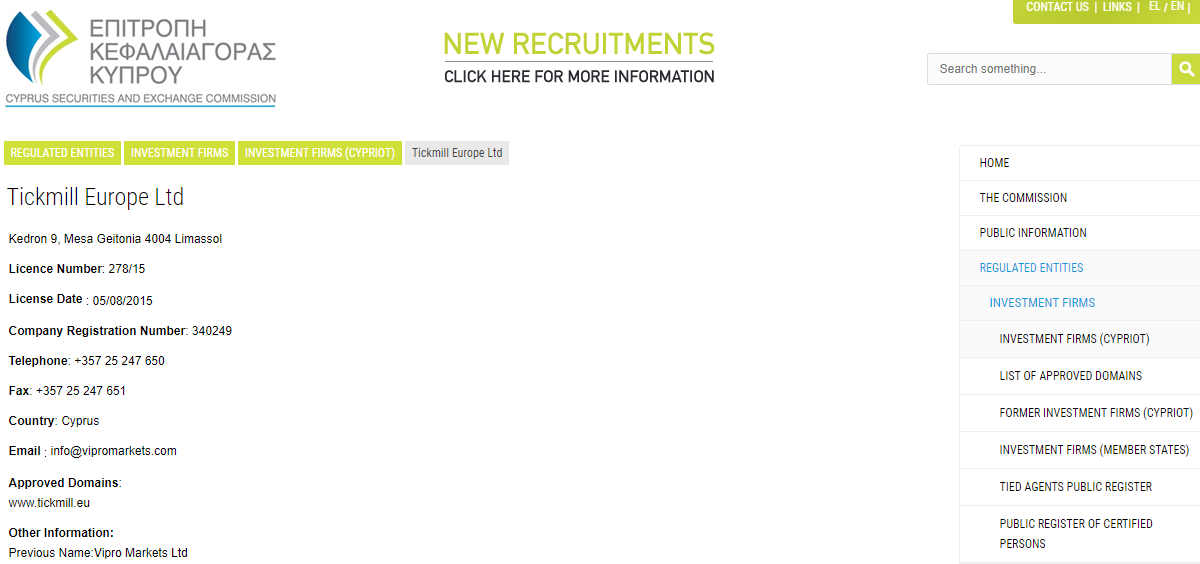

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

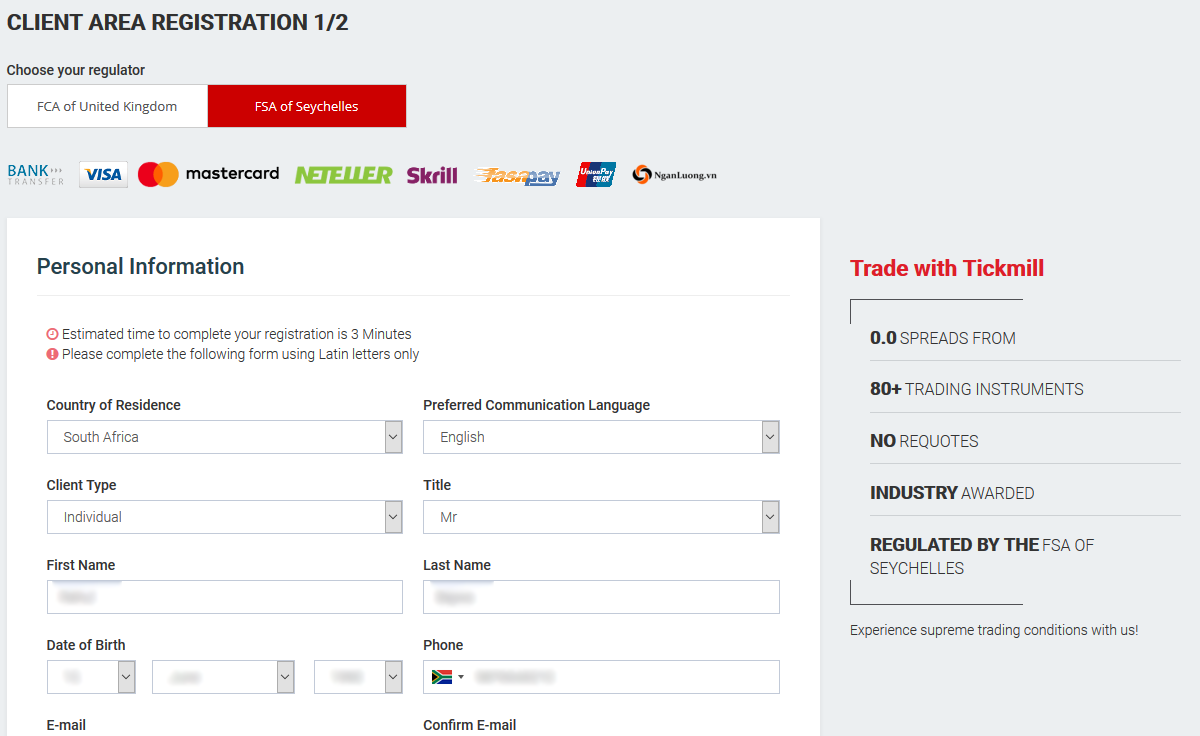

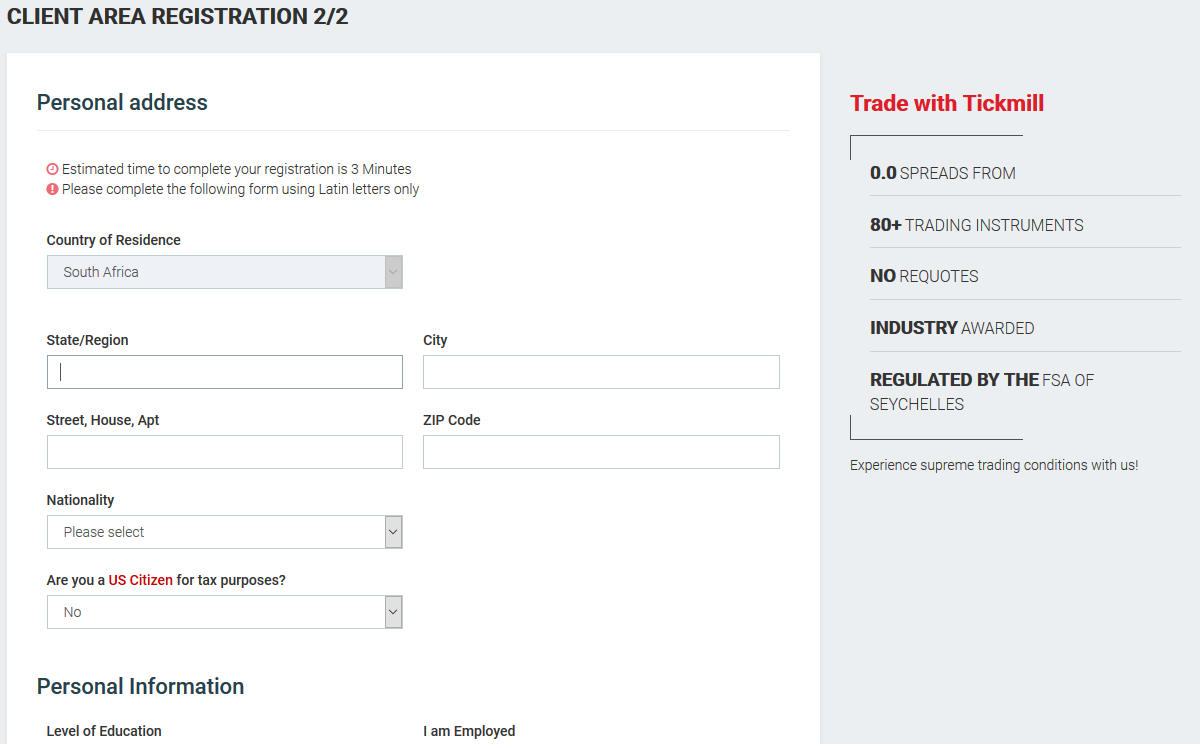

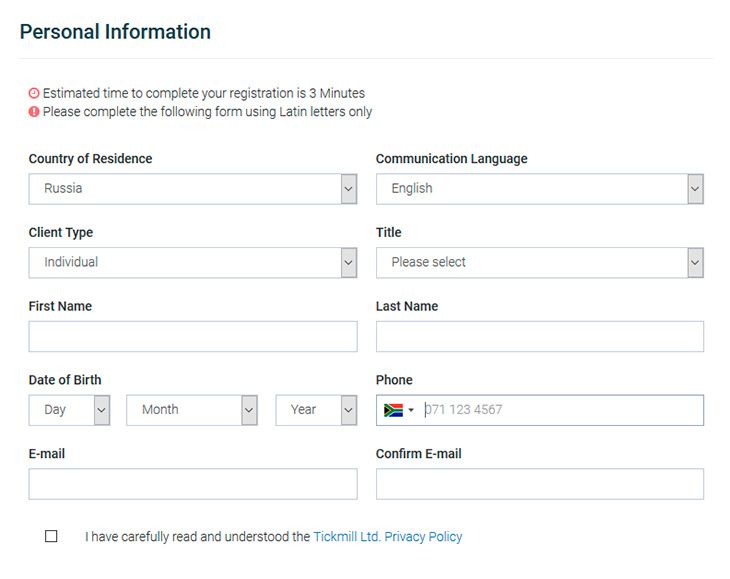

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

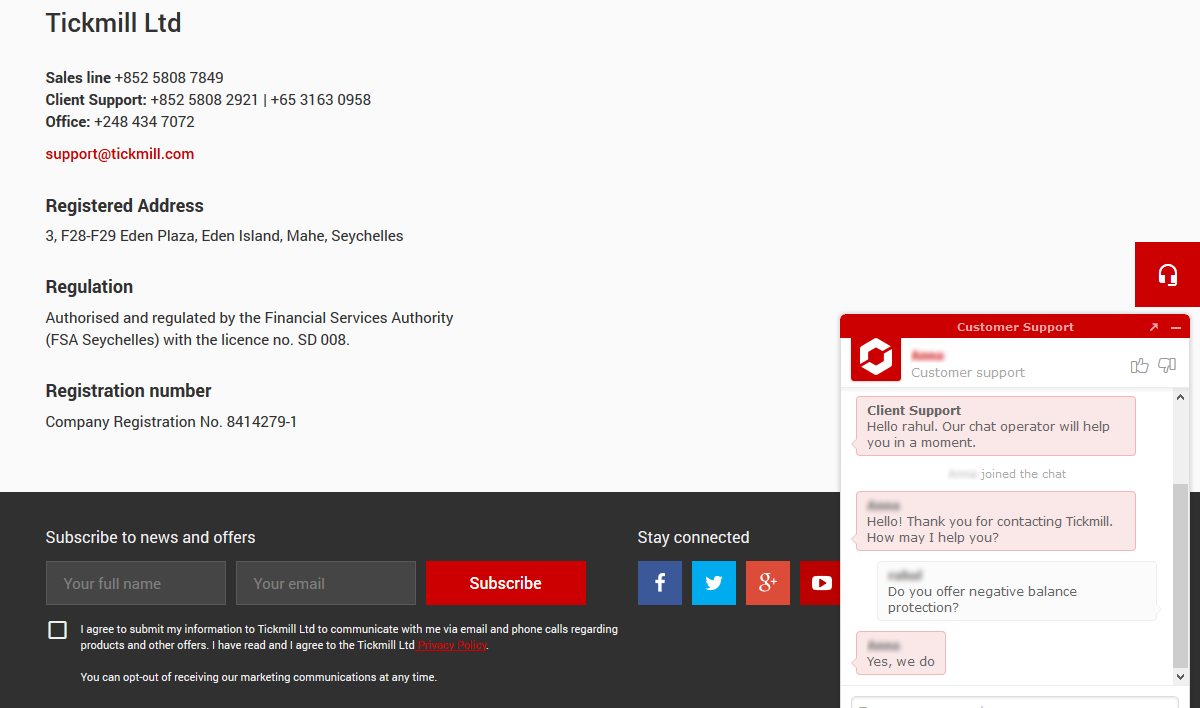

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Tickmill’s educational tour begins in south africa

In line with our mission to provide meaningful forex education to traders around the world, tickmill embarked on a global educational tour with the first stop in johannesburg, south africa.

The first tour kick-started in johannesburg on september 30 th with the renowned mentor kenny simon, founder of the geometric trading institute. Mr. Simon gave forex enthusiasts the opportunity to master the secrets of trading and maximise their potential.

The event was a huge success, as it exceeded expectations in terms of turnout, while all attendees responded with great feedback to the highly informative training sessions.

Highlights from the seminar included:

- An opening introduction to tickmill by our CEO duncan anderson

- Presentations from tickmill representatives

- Networking opportunities with traders from the region

- Exclusive promotions with prizes from a total $6,000 prize pool

Tickmill thanks all those who attended the event and looks forward to hosting more seminars and workshops as we continue our tour in europe, africa, middle east and asia.

Losses can exceed the initial deposit.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

User review

Tickmill.Com is a provider of premium financial instruments and trading services featuring fast execution, low spreads, 100% transparency, no requotes, and the latest technology. Tickmill ltd which has extensive experience in the industry owns and operates tickmill.Com.

• licensed and regulated

• dedicated client support

• spreads that start from 0 pips

• 84 trading instruments

• negative balance protection

• no cryptocurrency trading

South african traders and investors prefer tickmill.Com for the following reasons:

- Licensed and regulated

- Dedicated client support

- Spreads that start from 0 pips

- 84 trading instruments

- Negative balance protection

- Industry awards

- Segregated accounts

- Allows expert advisors (eas) and algorithmic trading

Is tickmill reliable forex broker?

Although the forex broker is not licensed in SA, south african traders can definitely trust it because it has received licenses from the following financial regulatory bodies:

- Tickmill ltd is licensed by seychelles financial services authority (FSA)

- Tickmill UK ltd is licensed by the financial conduct authority (FCA)

- Tickmill europe ltd is licensed by the cyprus securities and exchange commission (cysec)

Moreover, tickmill UK limited is part of the financial services compensation scheme (FSCA), an independent fund for clients. Its objective is to compensate clients if the firm shuts down or stops offering trading services.

Tickmill europe ltd is part of the investor compensation fund, which protect clients and compensates them in case the forex broker has to close down.

Moreover, the broker clearly mentions its contact details. The telephone numbers are +852 5808 7849 (sales), +852 5808 2921 and +65 3163 0958 (client support), and +248 434 7072 (office). The email address is [email protected] the registered address is 3, F28-F20 eden plaza, eden island, mahe, seychelles.

Get started with a demo account

If you feel that you lack the skills required for trading, you can get started at tickmill.Com with a demo account. The demo accounts at tickmill.Com work like a live account. The only difference is that clients use virtual funds for trading. If you open a demo account, you must log in regularly as demo accounts left inactive for seven days will expire.

To open a demo account, traders have to fill in their names, phone numbers, and email address. They have to select their country from the drop-down box. They also have read, understand, and agree to the privacy policy. They have to agree to receive communication through email from the forex broker. Finally, they have to click on the blue proceed link.

Your demo account comes with a full-fledged MT4 trading platform, trading instruments such as gold and silver, bonds, 15 stock indices, and 62 pairs of currencies.

Account types

Tickmill.Com offer several types of accounts to suit the trading requirements, goals, skills, and strategies of different types of clients. The following is a brief introduction to each type of account:

- Classic account – you can open a classic account in USD, PLN, GBP, and EUR and deposit a minimum of 100. The spreads start from 1.6 pips and the maximum leverage is 1:500. Classic accounts come with zero commissions and options for swap-free islamic accounts.

- Pro account – traders can open a pro account in USD, EUR, PLN, and GBP. The minimum deposit is 100, the maximum leverage is 1:500, and the spreads start from 0.0 pips. The commission is 2 per side per 100,000 traded. You also have the option of opening an islamic pro account.

- VIP account – VIP accounts support currencies such as GBP, PLN, EUR, and USD. The minimum deposit is 50,000. The spreads start from 0 pips, the max leverage is 1:500, and the commission is 1 per side per 100,000 traded. The option of swap-free islamic account is also available.

- Islamic (swap free) account – an islamic account is a swap free account designed especially for those who obey sharia laws. This type of account is absolutely free from rollover interest or swap from overnight positions.

Trading instruments

Tickmill.Com offers a variety of trading instruments including cfds on stock indices, currency pairs, precious metals, bonds, and crude oil.

- Forex trading – tickmill offers its clients the opportunity to trade 62 currency pairs, including minor, major, and exotic with fast execution and low spreads.

- Bonds – trade german government bonds with no commissions and competitive spreads.

- Stock indices and WT1 – tickmill offers cfds on crude oil and stock indices. Clients can access 15 global stock indices and WT1 with no requotes, no commissions, and no hidden mark ups.

- Precious metals – trade gold and silver at tickmill.Com. The margins vary according to your account leverage.

Trading platforms

You can trade with tickmill on any device of your choice. You can either download the MT4 software for your desktop or mac computer or use the webtrader to trade right in your browser.

Metatrader 4

Tickmill’s MT4 platform is designed in such a way that clients can easily customize it according to their requirements. Here are the key features of this popular trading platform:

- No partial fills

- Micro lots are available

- EA trading facilities

- Cfds on stock indices, forex, bonds, commodities, WT1

Webtrader

The webtrader platform is for traders who prefer to trade without downloading and installing any software. Here are the key features of this platform:

- Real-time quotes in market watch

- 9 chart timeframes

- Basic analytical objects: vertical, horizontal, and trend line, fibonacci lines, and equidistant channel

- Customizable price charts

The webtrader platform gives you easy and quick access to all financial markets. It is secure and enables one-click trading.

Tickmill banking information

All deposits that start from US$500 or its currency equivalent, made in a single transaction, are eligible for zero fees. Tickmill refunds transaction fees up to US$100 or its currency equivalent. To get a refund, customers have to send the FX broker a copy of the confirmation document, including bank statement.

Tickmill is popular for offer safe, easy, and instant payment methods.

- Bank transfer

- Skrill

- Visa & mastercard

- Sticpay

- Neteller

- Fasapay

- Union pay

- Qiwi wallet

- Globepay

Internal transfers between trading accounts are instant provided both accounts are in the same currency. If the currency is different, tickmill requires one banking day to process the transaction.

Here are a few rules regarding deposits and withdrawals:

- Traders have to use a payment method that is in their own name.

- The broker does not charge clients for making deposits and withdrawals. It has nothing to do with the fees charged by banks, credit card companies, electronic wallets, and financial companies.

- Tickmill processes withdrawals through the same method used to make deposits.

- The company processes payments only in GBP, EUR, PLN, and USD. If you deposit in ZAR, it will be converted to one of the above-mentioned currencies.

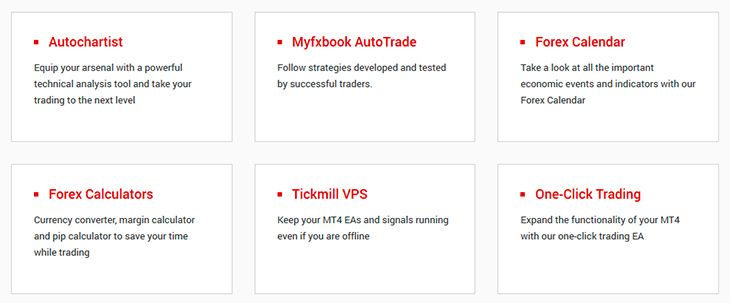

Trading tools

Tickmill offers a set of useful tools to help traders develop their trading strategies:

- Autochartist – the autochartist is a powerful technical analysis tool that can make it easier for you to trade faster. This tool has an advanced recognition engine that enables it to process huge quantities of data to identify key price levels and chart patterns across a variety of CFD and forex instruments.

- Forex calculators – the tickmill toolset includes a currency converter, margin calculator, and pip calculator.

- Myfxbook autotrade – traders can alter their settings so that they can automatically follow successful traders and copy their trades.

- Tickmill VPS – the tickmill VPS comes for beeksfx and clients who opt for its services get 20% discount, 24/7 support through email and live chat, and 100% uptime guarantee.

- Forex calendar – use the forex calendar to check important economic indicators and events.

- One-click trading – traders have the option of expanding the functionality of their MT4 platform by using tickmill’s one-click trading EA.

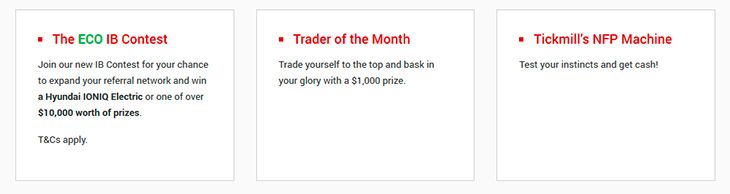

Promotions

Clients can use the special offers at tickmill.Com to boost their trading and grab rewards for their achievements.

The ECO IB contest

The IB contest is tickmill.Com’s IB community’s opportunity to expand their network of referrals and win their share of a $10k prize pool or a hyundai IONIQ electric.

Trader of the month

The trader who is declared to be the trader of the month will receive a prize of $1000 and his/her name will be entered into the wall of fame.

Tickmill’s NFP machine

The forex broker will select a financial instrument during the NFP week and challenge its clients to guess its price on the MT4 platform at 16:00, half an hour after the NFP is released. If traders predict accurately, they will receive a prize of $500. If their prediction is close to the actual figure, they will receive a prize of $200.

$30 welcome account

Tickmill welcomes new clients with a welcome bonus of $30.

Tickmill partnerships

Tickmill presents a number of opportunities for its clients to become its partners and run their business under its secure umbrella.

The following are three major ways to earn some extra cash at tickmill:

- Introducing broker (IB) – you can refer traders to tickmill.Com and earn commission whenever they make trades.

- Multi account manager (MAM) – this platform enables professional money managers to trade for their clients. Mams can use this platform to manage multiple accounts from one place.

- Tickmill prime functions on the mission of providing continuous liquidity and helping market participants worldwide to get the best prices in the asset classes it covers, irrespective of changing market conditions.

Tickmill.Com faqs

Q1: what happens to inactive trading accounts at tickmill.Com?

A: if you fail to log in to your tickmill.Com account for 90 days, the system will automatically archive the account.

Q2: can I close my tickmill.Com account?

A: you can close your account, but tickmill reserves the right to keep your information for a period of seven years.

Q3: can I open a live account and a demo account at the same time?

A: yes, it is possible. You have to install the MT4 trading platform in different folders on your desktop for your live and demo accounts.

Q4: what is the minimum amount I can deposit to my account?

A: you can deposit a minimum of $100 for all accounts. However, the minimum deposit amount for VIP accounts is $50,000.

Q5: does tickmill.Com offer protection from negative balance?

A: you can get a negative balance only if you trade irresponsibly, miscalculate your risks, and use maximum leverage. Tickmill covers negative balance and makes sure that its clients cannot lose more money than they deposited. Moreover, its risk department continuously monitors trading activities and warns trades through email whenever necessary.

Our take on tickmill.Com

Tickmill doesn’t have a south africa license, but is still the number one choice for south african traders and customers because it has obtained licenses from three reputed jurisdictions. Moreover, tickmill has great client support, a wide range of trading instruments and trading tools, and excellent trading conditions.

You can become a trader on tickmill or earn extra cash by becoming a partner. If you are a new trader, we suggest getting started with a demo account as it is the best way to learn trading strategies.

Day of reconciliation in south africa - trading schedule

In observance of the day of reconciliation in south africa on the 16 th of december , we would like to inform you that the trading schedule will be changed as follows:

Instrument

Monday, 16 th december

Traders should note that in the event of low liquidity, spreads might significantly increase from their normal levels.

Should you have any questio ns about these changes, please do not hesitate to contact our client support team.

Please note that trading hours are subject to change by the respective exchanges or liquidity providers.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Day of reconciliation in south africa - trading schedule

In observance of the day of reconciliation in south africa on the 16 th of december , we would like to inform you that the trading schedule will be changed as follows:

Instrument

Monday, 16 th december

Traders should note that in the event of low liquidity, spreads might significantly increase from their normal levels.

Should you have any questio ns about these changes, please do not hesitate to contact our client support team.

Please note that trading hours are subject to change by the respective exchanges or liquidity providers.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill south africa

Read details and apply for tickmill job online.

Partnership account manager vacancy in tickmill

They will be representing tickmill in key B2B and B2C events and providing retention while assisting ibs to expand their network;

Hiring organization / company: tickmill

job location: south africa

Not satisfied with the result for tickmill jobs in south africa? Use our search form bellow and try to seach using different keyword.

If that you are not kidding approximately in search of jobs, you'll agree that it is among the hardest jobs in this day and age. In most cases, you're going to don't have any clue where or what to search for in the job market. The good factor is that you're not alone. There are several folks in the market who are jobless such as you. Finding a job even in a industrial center can be simple if you realize the place to start out. Before you start your job looking procedure, here are tips to help you in finding your dream job.

Job firms are a fantastic and usually overlooked hots pot for locating jobs. Job firms usually provide important training, belongings, and programs for task seekers. These corporations can also be specifically helpful for younger job seekers or those with little working experience. A simple internet test for job firms to your areamust discover the place and how you can get to them.

Many corporations choose to have their positions dispatched by way of temporal companies. The tip objective for that is to economize on consultant advantages like healthcare. Temporally agencies likewise give companies the way in which of screening candidates. Employment products and services can often be a quicker and less daunting job than finding direct employment. An employment company might likewise turn into into a long-lasting process for the people who perform neatly during their running.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what was the most valuable thing of this article: tickmill’s educational tour begins in south africa at tickmill south africa

Contents of the article

- Real forex bonuses

- Tickmill’s educational tour begins in south africa

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill review

- Who is behind tickmill?

- What trading does it offer?

- Trading platforms on the site

- Account types present on the site

- Deposit and withdrawal options

- Commission and bonuses

- Conclusion

- Leave a reply cancel reply

- ������top broker 2020 SA������

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

- Tickmill’s educational tour begins in south africa

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill review

- Is tickmill reliable forex broker?

- Get started with a demo account

- Account types

- Trading instruments

- Trading platforms

- Tickmill banking information

- Trading tools

- Promotions

- Tickmill.Com faqs

- Our take on tickmill.Com

- Day of reconciliation in south africa - trading...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Day of reconciliation in south africa - trading...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill south africa

- Partnership account manager vacancy in tickmill

- Not satisfied with the result for tickmill jobs...

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.