Withdraw ewallet

Budget stores complex

stand no:8,buteko street

town centre, mufulira telephone numbers: +260 211 366 800

Real forex bonuses

branch code: 260937

Withdraw ewallet

FNB offers a network of branches for all your face to face banking requirements

Postal address

first national bank zambia limited

PO box 36187

lusaka, zambia

Physical address

stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 253 057 / 250 602

email: fnb@fnbzambia.Co.Zm

Stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250 090

branch code: 260001

Society house

first floor, shop number G040

plot 3 & 3a cairo road,

central business district

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260050

Shakes investment limited building

plot number 16808

lumumba road

lusaka, zambia

Telephone numbers: +(260) 211 366 900

fax number: +(260) 211 845 453

branch code: 260002

Plot no. 617

shop number 4 musenga house

kwacha road

PO box 11262

chingola, zambia

Telephone numbers: +260 211 366 800

branch code: 260322

Kaonde house

plot no. 921

independence avenue

solwezi, zambia

Telephone numbers: +260 211 366 800

branch code: 262823

Union house

plot 493/494

zambia way and oxford street

kitwe, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 657 145

branch code: 260212

Centro mall premier banking

Unit 63 corner bishop & kabulonga roads

centro mall, kabulonga

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250602

Neighbours city estate

plot number 50

buteko avenue

ndola, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 610009

branch code: 260103

Plot 7A livingstone road

PO box 670159

mazabuka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 213 239 023

branch code: 263613

Plot 414 independence road

mkushi, zambia

Telephone numbers: +260 211 366 800

branch code: 262319

Plot 9471/2/3, makeni mall

kafue road, lusaka

PO box 38911,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 369 398

branch code: 260016

Stand no.3539 jacaranda mall

corner of mushili & kabwe road

PO box 73642

ndola, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

PHI shopping mall

plot no. 38147

bennie mwiinga road

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road, lusaka

PO box 36187,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 366 875

branch code: 260014

Plot no.87A shop no.2

buntungwa street

kabwe, zambia

Telephone numbers: +260 211 366 800

branch code: 260937

Plot no.ME 46

along livingstone

PO. Box 630819

choma, zambia

Telephone numbers: +260 211 366 800

branch code: 261238

Plot no. 646

corner of pererinyatwa road

& umodzi highway

PO. Box 510080

chipata, zambia

Telephone numbers: +260 211 366 800

branch code: 261121

Plot no.4 wada chovu building

zaone avenue, PO box 90953

luanshya, zambia

Telephone numbers: +260 211 366 800

branch code: 260741

Mukuba mall premier branch

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Telephone numbers: +260 211 366 800

branch code: 260243

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Telephone numbers: +260 211 366 800

branch code: 260544

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Telephone numbers: +260 211 366 800

branch code: 260247

Plot 150/27/4586

chilumbulu road

chilenje

Telephone numbers: +260 211 366 800

branch code: 260046

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

Telephone numbers: +260 211 366 800

branch code: 260046

Stand no. 795

kalumbila high street

kalumbila town

Telephone numbers: +260 211 366 800

Find an ATM

Our atms (automated teller machines) are situated within the FNB zambia branches

Stand number 22768

acacia office park

thabo mbeki and great east roads

lusaka

telephone number: +260 211 366 800

Union house

plot 493/494

zambia way & oxford street

kitwe

telephone number: 260 212 657 100

Shakes investment limited building

plot number 16808

lumumba road

lusaka

telephone number: +260 211 366 900

Plot 7A

livingstone road

mazabuka

telephone number: +260 213 239 000

Neighbours city estate

plot number 50

butek

telephone numbers: +260 212 610 006/ 610 007

Makeni mall

plot 9471/2/3

kafue road

lusaka

telephone number: +260 211 369379

Plot 414 independence road

mkushi

telephone numbers: +260 971254871

mobile number: +260 977 995 476

Jacaranda mall

stand no.3539

corner of mushili & kabwe road

ndola

telephone number: +260 212 626 000

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road,

lusaka

telephone number: +260 211 366 863

Musenga house

plot no. 617, shop number 4

kwacha road

chingola

telephone number: +260 212657130

Plot no. ME 46

along livingstone road.

Choma

mobile number: +260 969417613

Plot no. 646

corner of pererinyatwa road

& umodzi highway

chipata

telephone number: +260 216222003

Plot no. 921

kaonde house

independence avenue

solwezi

telephone number: +260 212626013

PHI shopping mall

stand 38147

bennie mwiinga road,

lusaka

telephone number: +260 211366919

Plot no. 87A shop no. 2

buntungwa street

kabwe

mobile number: (+260) 965 085 195

Wada chovu building

shop no. 4

along zaone avenue

mobile number: +260 965 841097

Kabulonga shopping mall,

lusaka

zambia

Phase V ATM lobby,

stand number 2374

arcades shopping centre,

great east road.

Lusaka

zambia

Down town shopping mall,

kafue road,

lusaka

zambia

Stand no. 22845, shop no. 28A,

crossroads shopping mall

leopards hill road

lusaka,

zambia

Plot number 3, independence avenue

city centre

kitwe

Stand no. 272

buteko drive

kalulushi

House no. 33 ndola road

fairview

mufulira

Stand no. KWE/71

kwacha east

kitwe

Stand no. 3680

kabala

kitwe

Plot 643 parklands shopping centre

corner kuomboka/freedom way

kitwe.

Inos holding 93

president avenue

town centre

ndola

Plot no. F/31096

chilengwa road

masaiti area

ndola

Plot no. 10709

kabwe road

ndola

Plot 012

corner president avenue & T3 highway

kafubu mall

ndola

Plot lub/3276/1

chibesa kunda road

ndola

Stand no. 437

cairo road

ndola

SGC filling station

ndola

Stand no. CH/108 hard K shopping complex

chifubu market

ndola

Plot no. 1320,

along great north road

mkushi

Farm no. 3168

farm centre

mkushi farm block

mkushi

SGC filling station

independence avenue

mitech area

solwezi

Industrial park

kalumbila mineral areas

kalumbila,

solwezi

Plot no. 53, 14th street

luanshya town centre

luanshya

Plot no. 2057

corner of gizenda road and chindo road

lusaka

Plot no. 9/65/4586

muramba road

chilenje south

lusaka.

At the real meat stand

lusaka

Oryx filling station

chongwe

Kobil filling station ATM

Corner of ben bella & lumumba road,

lusaka

Plot no. 12/70 - 45/86

kasama road

chilenje south

lusaka

Plot no.5065

mungwi road

lusaka.

Shop no. 18B

manda hill shopping mall

manchinchi road

lusaka

Odys filling station ATM

Plot no. 298

lumumba road

matero

lusaka

Radian stores

along chinika road

lusaka

Shop no. 465

maunda road

kabwata main market

lusaka

Vuma filling station ATM

Plot no. 6076

kafue road

lusaka

Engen filling station ATM

Engen filling station

los angeles road

long acres

lusaka

University of zambia main campus

lusaka

Plot no. 609

foxdale court

zambezi road

lusaka

Plot no. 8674, shop no.1A

corner jambo/almalik drive

riverside

kitwe

36 kabengele avenue

kitwe

Stand no. 100

katilungu road, chimwemwe

kitwe

Plot no. 396A

starbuck food centre

midway road, kamenza

chililabombwe

Konkola hypermarket limited,

mazabuka

Mazabuka sugar farms ATM

Edwina ceri coventry, 52690

lubombo

mazabuka

Intercity bus terminus

lusaka

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Plot 150/27/4586

chilumbulu road

chilenje

mobile: 0964-619518

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

telephone numbers: +260 211 366 800

Withdraw ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

Choose the best ewallet app in 2020

Whether you want to improve your consumer experience online or just enjoy yourself by playing your favorite casino games without any fuss, ewallets must be your default payment processing option.

It doesn’t matter where you live & it doesn’t matter why you do it, having an ewallet account in 2020 is virtually mandatory. Just ask the hundreds of millions of customers who use an ewallet application on a day-to-day basis.

Don’t worry if you aren’t familiar with this awesome payment method or you are on an information overload after searching for the best digital wallet for you. We’re here to help by providing you with only the best options out there. Follow our ewallet reviews 2020.

What is an ewallet?

An ewallet or a digital wallet is nothing more than a web application developed by a payment processing company that greatly facilitates the communication between a buyer and a seller.

It’s an online account where you can manage your money just as you would with a normal wallet. You take some cash with you or you grab your credit/debit card, depending on the situation, you place it in your wallet, and start spending. The same applies to a digital wallet. After you’ve created your account following some simple steps - in most cases, just typing your name, e-mail address, and password - you can top-up your ewallet by adding funds via a variety of sources likebank transfer, credit/debit card, or even the trending prepaid vouchers like paysafecard or neosurf.

After that, the (online) world is yours for the taking. You can spend your ewallet money on virtually anything, from food, clothes, appliances, and electronics to various services like online courses, hosting & domain registrations, IT troubleshooting, you name it. The possibilities are endless!

Why use an ewallet

Convenience

Firstly, convenience and unmatched user-friendly choices you can make. To start using a digital wallet, all you have to do is create an account by typing in your name, e-mail address, and password. After you verified your e-mail, you can add funds and start spending.

When you first use an ewallet app, there will be some limitations. To unlock and use it at its full potential, you will need to go through the verification process, necessary given today’s know-your-customer (KYC) and anti-money laundering (AML) legislation. It won’t take long though; once you provided the payment processing company with your ID and proof of residence, you will set up your own limits, no other third parties involved.

Security

Secondly, by just using a digital wallet, you will greatly minimize the risk of compromising your financial data. Since you will not type down your private financial data like credit/debit card information every time you buy something, your bank funds will be safe.

Instead, you will use your digital wallet’s e-mail/username and password to pay for goods & services. You will only give away your credit/debit card information in a secure environment, guaranteed by the payment processing company & only when you want to add funds in your ewallet.

Variety

Last but not least, the digital wallet payment option is just as popular as the credit/debit card method. What does that mean?

You can pay for most goods & services online by just typing in your ewallet’s e-mail/username and password. You can also play your favorite online casino games with real money without sharing your private financial data… fast & easy.

Moreover, since most ewallets give their client the option to order a physical prepaid card, you can also shop offline, at your local supermarket, general store, kiosk, or gas station. As long as the vendor accepts VISA/mastercard, your prepaid card will be always accepted.

Which ewallet is best

It all depends on what you want to achieve with it.

Do you just want to spend your ewallet money on general goods & services? Then we got the perfect option for you! Do you want to use it more specifically for igaming/online gambling? We’ve got you covered! Are you located in a certain region with specific legislation for online payments? That’s right, we’ve got options for you also.

Top-rated ewallet for general use

Paypal

Paypal is the most popular ewallet on the internet. With almost 280 million active accounts from over 200 markets around the world, it is as used as the VISA/mastercard option online.

Best ewallets for online casinos & gambling

Skrill

Skrill may not be as popular as paypal but it is definitely the top ewallet for online gambling, widely used by millions of players & accepted on most online casino platforms.

Neteller

Neteller began processing payments for online casinos 19 years ago, in 2000 and has the most experience of any gambling-friendly ewallets. You can’t go wrong with neteller!

Region-based ewallets

Yandex money

Yandex is the largest tech company and search engine in all russia. It’s no wonder the corporation extended its services by creating a unique ewallet, targeted for russians & not only.

Myneosurf

Whether you are based in europe or in australia, myneosurf may be the ewallet for you, especially if you use the popular neosurf vouchers constantly. Start using it today!

Webmoney

Originally targeted for russia, webmoney quickly extended its services to europe and the USA. Your money is guaranteed by a company based in your region, working with webmoney.

Cross-platform ready

You can use your chosen ewallet in whatever way you like.

If you are a PC guy or girl, the most popular digital wallets offer you a user-friendly & intuitive interface. You’ll learn how they work and what can you do to pay for online goods & services in no time, on the go. Plus you’ll always have the support by your side, ready to solve any problem you may run into.

If you are a gadget-friendly user, all popular digital wallets offer high mobility with their optimized app for both android & ios platforms. Their interfaces are simple and accessible at a single touch or swipe so you can spend your ewallet money as fast as you like. Google & apple approved!

Is my ewallet app safe & secure?

Our chosen top ewallets are as safe & secure as any other widely-used payment processing method.

Furthermore, you don’t need to worry about some malicious actor peeking at your every move. Since you only use the credit/debit card details or bank transfer information inside your digital wallet, in a secure environment, your private financial data is safer than ever. Not even the company behind the ewallet can actually access your private data.

Authorized

The ewallets are authorized by the official financial institutions where they are based. Thus, you are always protected from any highly unlikely illegal attempt from the payment processing company to steal your money.

Audited

All popular ewallets are regularly audited by tech security companies. Moreover, all encrypt their customers’ data using the state-of-the-art encryption technologies around, to avoid any possible leaks.

To fully secure your ewallet account, most offer the popular and bulletproof two-factor authentication. Even though the hacker might know the ewallet’s password, he can’t guess the one-time 2FA PIN code.

Online casino ewallets in 2020

All popular online casinos have at least one ewallet as both a deposit & a cashout option. While it may not be paypal - the company behind paypal is very picky with the online gambling industry - you can certainly assume other options like skrill & neteller are there by default.

The process of depositing is as simple as it can get: just enter your login credentials, click one more button, and you can safely play your favorite casino games.

If you hit jackpot, cashing out is even simpler: you only have to select the ewallet option and igaming company will send your winnings your way, in no time, faster than any bank transfer & card withdrawal.

Frequently asked questions (FAQ)

Before you read our top ewallet reviews, be sure to check out this general FAQ section that will answer all the questions you may have about this unique payment method.

How can I add funds and top-up my ewallet account?

It depends on the ewallet. All have the bank transfer & credit/debit card options, but, if you need something different, you’ll have to check our reviews. Many, for example, have the internet banking system, while specific ewallets have specific deposit methods - myneosurf gives you the option to add funds using the neosurf vouchers.

Can I withdraw my ewallet money?

Of course, you can. You can always transfer your ewallet money directly to your bank account using the bank transfer & credit/debit card options. You can also use your prepaid ewallet card to withdraw cash via any VISA/mastercard-willing ATM.

What other features does an ewallet provide?

Besides the physical prepaid card, many ewallets also give the user the option to create a virtual card that works just like a physical one. In addition, if you are a high-roller, check our ewallets that offer VIP programs, based on your transaction volume and spending habits.

Can I use an ewallet to buy bitcoin?

Luckily, you can. Skrill & neteller - which are part of the same company, paysafe group - offer any customer the possibility to buy & sell bitcoin, plus several other cryptocurrencies like bitcoin cash, litecoin ether, XRP, stellar, or EOS. No additional verification required!

What are the fees for any given ewallet?

Depends from ewallet to ewallet. Check our reviews for more specific information related to your chosen payment processing option.

Summary

Forget about complicated bank transfers and risky card usage on the internet.

Using an ewallet in 2020 is probably the best decision you can make financial-wise. It doesn’t matter its actual usage, once you use a digital wallet, you’ll never look back. Convenience, accessibility, and ease of money transfer at their best!

Cryptocurrencies are gaining more and more acceptance as a means of transferring funds on the internet. But are they an appropriate payment solution for online casinos? Here we look at some of the pros and cons of digitalizing your gambling bankroll.

Tuesday, february 2nd, 2021, 11:58:37 AM

With the recent record-breaking increases showing no signs of slowing, more people are considering investing in the crypto than ever before. If you’re one of them, here are 5 questions you should ask yourself before taking the plunge.

Tuesday, january 12th, 2021, 10:11:18 PM

The covid-19 pandemic is changing the way we live and do business. Fintech has suffered along with every other sector of the economy. But thanks to changing needs in the financial sector, fintech companies are better positioned than most to weather the storm

Wednesday, october 21st, 2020, 10:34:37 AM

The global pandemic has forced us to conduct more of our lives online, including our financial transactions. Fintech is coming into its own. Here we compare how these new services compare with traditional banks and the potential for synergy between the two.

Thursday, october 8th, 2020, 8:21:13 AM

Despite the hits to the global economy caused by the pandemic, 2020 has seen massive gains for bitcoin. But will there be more, and will they last? Here we look at some of the factors that will determine this and give our predictions for the future of BTC.

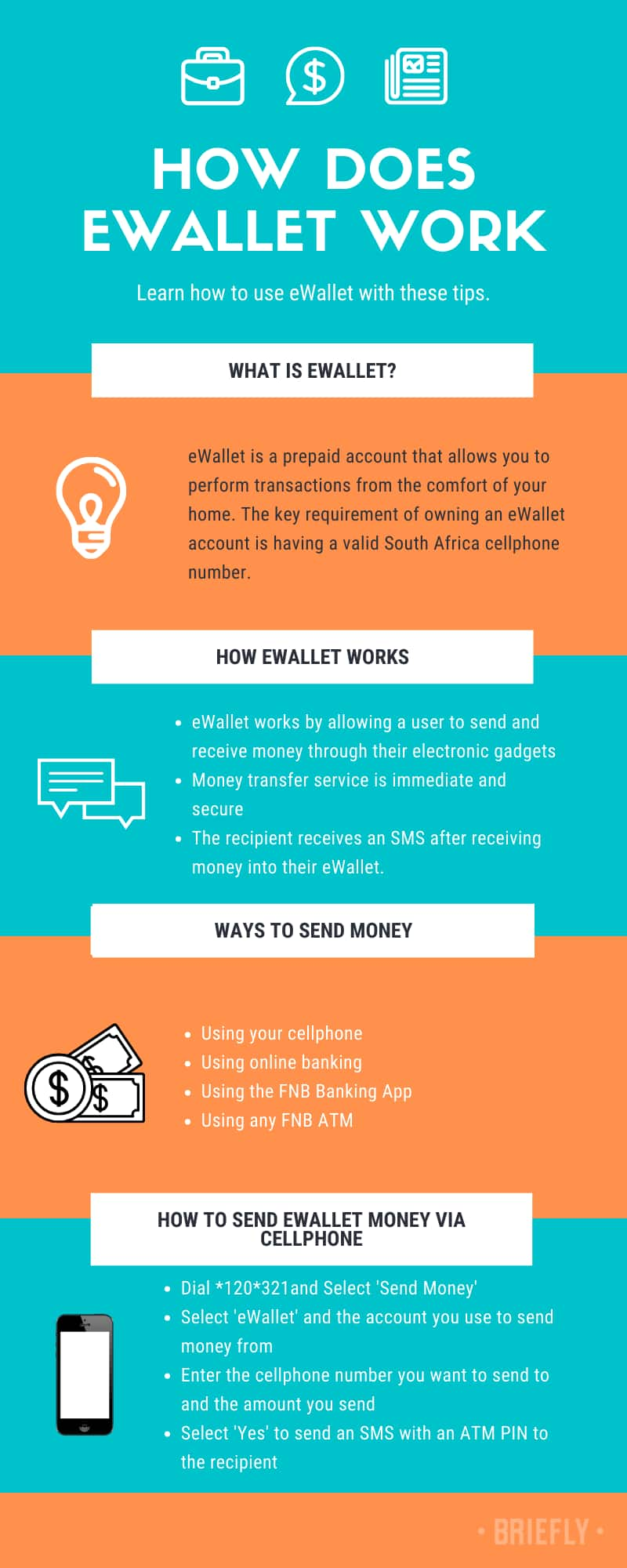

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

Withdraw ewallet

FNB offers a network of branches for all your face to face banking requirements

Postal address

first national bank zambia limited

PO box 36187

lusaka, zambia

Physical address

stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 253 057 / 250 602

email: fnb@fnbzambia.Co.Zm

Stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250 090

branch code: 260001

Society house

first floor, shop number G040

plot 3 & 3a cairo road,

central business district

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260050

Shakes investment limited building

plot number 16808

lumumba road

lusaka, zambia

Telephone numbers: +(260) 211 366 900

fax number: +(260) 211 845 453

branch code: 260002

Plot no. 617

shop number 4 musenga house

kwacha road

PO box 11262

chingola, zambia

Telephone numbers: +260 211 366 800

branch code: 260322

Kaonde house

plot no. 921

independence avenue

solwezi, zambia

Telephone numbers: +260 211 366 800

branch code: 262823

Union house

plot 493/494

zambia way and oxford street

kitwe, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 657 145

branch code: 260212

Centro mall premier banking

Unit 63 corner bishop & kabulonga roads

centro mall, kabulonga

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250602

Neighbours city estate

plot number 50

buteko avenue

ndola, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 610009

branch code: 260103

Plot 7A livingstone road

PO box 670159

mazabuka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 213 239 023

branch code: 263613

Plot 414 independence road

mkushi, zambia

Telephone numbers: +260 211 366 800

branch code: 262319

Plot 9471/2/3, makeni mall

kafue road, lusaka

PO box 38911,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 369 398

branch code: 260016

Stand no.3539 jacaranda mall

corner of mushili & kabwe road

PO box 73642

ndola, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

PHI shopping mall

plot no. 38147

bennie mwiinga road

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road, lusaka

PO box 36187,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 366 875

branch code: 260014

Plot no.87A shop no.2

buntungwa street

kabwe, zambia

Telephone numbers: +260 211 366 800

branch code: 260937

Plot no.ME 46

along livingstone

PO. Box 630819

choma, zambia

Telephone numbers: +260 211 366 800

branch code: 261238

Plot no. 646

corner of pererinyatwa road

& umodzi highway

PO. Box 510080

chipata, zambia

Telephone numbers: +260 211 366 800

branch code: 261121

Plot no.4 wada chovu building

zaone avenue, PO box 90953

luanshya, zambia

Telephone numbers: +260 211 366 800

branch code: 260741

Mukuba mall premier branch

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Telephone numbers: +260 211 366 800

branch code: 260243

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Telephone numbers: +260 211 366 800

branch code: 260544

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Telephone numbers: +260 211 366 800

branch code: 260247

Plot 150/27/4586

chilumbulu road

chilenje

Telephone numbers: +260 211 366 800

branch code: 260046

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

Telephone numbers: +260 211 366 800

branch code: 260046

Stand no. 795

kalumbila high street

kalumbila town

Telephone numbers: +260 211 366 800

Find an ATM

Our atms (automated teller machines) are situated within the FNB zambia branches

Stand number 22768

acacia office park

thabo mbeki and great east roads

lusaka

telephone number: +260 211 366 800

Union house

plot 493/494

zambia way & oxford street

kitwe

telephone number: 260 212 657 100

Shakes investment limited building

plot number 16808

lumumba road

lusaka

telephone number: +260 211 366 900

Plot 7A

livingstone road

mazabuka

telephone number: +260 213 239 000

Neighbours city estate

plot number 50

butek

telephone numbers: +260 212 610 006/ 610 007

Makeni mall

plot 9471/2/3

kafue road

lusaka

telephone number: +260 211 369379

Plot 414 independence road

mkushi

telephone numbers: +260 971254871

mobile number: +260 977 995 476

Jacaranda mall

stand no.3539

corner of mushili & kabwe road

ndola

telephone number: +260 212 626 000

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road,

lusaka

telephone number: +260 211 366 863

Musenga house

plot no. 617, shop number 4

kwacha road

chingola

telephone number: +260 212657130

Plot no. ME 46

along livingstone road.

Choma

mobile number: +260 969417613

Plot no. 646

corner of pererinyatwa road

& umodzi highway

chipata

telephone number: +260 216222003

Plot no. 921

kaonde house

independence avenue

solwezi

telephone number: +260 212626013

PHI shopping mall

stand 38147

bennie mwiinga road,

lusaka

telephone number: +260 211366919

Plot no. 87A shop no. 2

buntungwa street

kabwe

mobile number: (+260) 965 085 195

Wada chovu building

shop no. 4

along zaone avenue

mobile number: +260 965 841097

Kabulonga shopping mall,

lusaka

zambia

Phase V ATM lobby,

stand number 2374

arcades shopping centre,

great east road.

Lusaka

zambia

Down town shopping mall,

kafue road,

lusaka

zambia

Stand no. 22845, shop no. 28A,

crossroads shopping mall

leopards hill road

lusaka,

zambia

Plot number 3, independence avenue

city centre

kitwe

Stand no. 272

buteko drive

kalulushi

House no. 33 ndola road

fairview

mufulira

Stand no. KWE/71

kwacha east

kitwe

Stand no. 3680

kabala

kitwe

Plot 643 parklands shopping centre

corner kuomboka/freedom way

kitwe.

Inos holding 93

president avenue

town centre

ndola

Plot no. F/31096

chilengwa road

masaiti area

ndola

Plot no. 10709

kabwe road

ndola

Plot 012

corner president avenue & T3 highway

kafubu mall

ndola

Plot lub/3276/1

chibesa kunda road

ndola

Stand no. 437

cairo road

ndola

SGC filling station

ndola

Stand no. CH/108 hard K shopping complex

chifubu market

ndola

Plot no. 1320,

along great north road

mkushi

Farm no. 3168

farm centre

mkushi farm block

mkushi

SGC filling station

independence avenue

mitech area

solwezi

Industrial park

kalumbila mineral areas

kalumbila,

solwezi

Plot no. 53, 14th street

luanshya town centre

luanshya

Plot no. 2057

corner of gizenda road and chindo road

lusaka

Plot no. 9/65/4586

muramba road

chilenje south

lusaka.

At the real meat stand

lusaka

Oryx filling station

chongwe

Kobil filling station ATM

Corner of ben bella & lumumba road,

lusaka

Plot no. 12/70 - 45/86

kasama road

chilenje south

lusaka

Plot no.5065

mungwi road

lusaka.

Shop no. 18B

manda hill shopping mall

manchinchi road

lusaka

Odys filling station ATM

Plot no. 298

lumumba road

matero

lusaka

Radian stores

along chinika road

lusaka

Shop no. 465

maunda road

kabwata main market

lusaka

Vuma filling station ATM

Plot no. 6076

kafue road

lusaka

Engen filling station ATM

Engen filling station

los angeles road

long acres

lusaka

University of zambia main campus

lusaka

Plot no. 609

foxdale court

zambezi road

lusaka

Plot no. 8674, shop no.1A

corner jambo/almalik drive

riverside

kitwe

36 kabengele avenue

kitwe

Stand no. 100

katilungu road, chimwemwe

kitwe

Plot no. 396A

starbuck food centre

midway road, kamenza

chililabombwe

Konkola hypermarket limited,

mazabuka

Mazabuka sugar farms ATM

Edwina ceri coventry, 52690

lubombo

mazabuka

Intercity bus terminus

lusaka

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Plot 150/27/4586

chilumbulu road

chilenje

mobile: 0964-619518

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

telephone numbers: +260 211 366 800

How can I withdraw money from my fiat wallet?

Articles in this section

Articles in this section

Our fiat wallet feature allows you to sell cryptocurrencies to your fiat wallet and withdraw money at any time. You can also deposit money to your fiat wallet and have it available at any time to purchase cryptocurrencies. This allows you to react quickly to the market regardless of the processing times of the payment methods.

Available fiat wallets

The following fiat wallets are available at the moment:

- Euro (EUR)

- US dollar (USD)

- Swiss franc (CHF)

- British pound (GBP)

- Turkish lira (TRY)

Withdrawals

To withdraw money from your fiat wallet follow these steps:

- On the dashboard, under fiat wallets , click on the desired fiat wallet

- Click on withdraw

- Select the payout account. If you haven’t done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and click on go to summary

- On the summary page, check if everything is correct and click confirm

- You will receive a confirmation email, click the confirm transaction button in this email

If everything went right, you will be redirected to the success-screen on the bitpanda website.

- Tap the trade button

- Tap on withdraw

- Choose the fiat wallet you wish to withdraw from

- Select the payment provider you wish to use

- If you haven't done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and tap on continue

- On the summary page, check if everything is correct and tap withdraw now

- You will receive a confirmation email, tap the confirm transaction button in this email

If everything went right, you will be redirected to a success-screen in the app.

- Tap the trade button

- Tap on withdraw

- Choose the fiat wallet you wish to withdraw from

- Select the payment provider you wish to use

- If you haven't done it yet, you will need to create a new payout account for the payment provider you have selected

- Enter the amount you wish to withdraw and tap on continue

- On the summary page, check if everything is correct and tap withdraw now

- You will receive a confirmation email, tap the confirm transaction button in this email

If everything went right, you will be redirected to a success-screen in the app.

Withdraw ewallet

Offline stores and service providers can now become a dominating force online " ewallet has built the most amazing future for retail and service providers. An in-sync system by using your everyday ewallet as a selling tool get started today by registering for a merchant account first, after approval by admin, this then allows you to instantly upload and publish your offline products for sale to an online shop within minutes, more impressive is that the items that are sold online or offline are in sync amazing innovation from ewallet all online and offline orders can be tracked in the same wallet you are selling from and getting paid too one wallet does it all

Protect your client's purchases

If the goods are not received or are not as what was described in the sale the user can open a dispute and open an investigation and have the funds returned including crypto this is a FIRST for CRYPTO CURRENCIES "ABILITY TO REFUND " EWALLET PATENT PENDING " please visit resolution center

IPN service

The platform will send POST notification to the user's server with the details of the completed transaction

Low risks

The purchase is paid from the balance account - not directly through a third-party gateway

Popular methods for deposit and withdrawing money

Built-in methods are suitable for most countries

Automatic deposits

Users will instantly receive money to their account balance after the deposit is successful, except for methods of bank transfers and large crypto transactions

Manual withdrawals

Requests for withdrawal of funds are handled by the administrator in manual mode

Operation limits

The administrator can set the minimum and maximum limit for each currency

Verification requirement

Set a minimum level of verification to use the deposit method and withdraw of funds method

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

30 best ewallets

There is no doubt that the electronic wallet market in 2019 is as huge as it is elaborate. For the most people using online platforms this is a convenient way to make transactions in a safe, controlled and easy way, without bringing forward the cash or the credit card, all the time. What is ewallet? The e-wallet concept must be able to keep money in a digital ewallet account, to give you the options to transfer money between the e-wallet (digital wallet) and your bank account or the credit card. The payment lanscape has been much improved by these apps and it also benefits from top online technologies.They bring cutting edge procedures regarding money transfer and security, so there are a lot of pros for using these apps. Plus, almost everybody is working with best online wallet these days. So, sooner or later we all have to understand that this is, so far, the best manner for transferring money, besides the old-fashioned cash and the already classic bank or card transfer.

It is good that we have so many options to choose from. This means we can expect ess fee amounts and faster service. There are many types of ewallet.

We have chosen, among so many, 30 top of the top ewallet apps , which have already been consacrated and have proven their worth and utility. These are the apps that are setting the trends on all markets, and here they are, presented for you:

Adyen

This app has spread globally, and allows to connect all types of cards (visa, mastercard etc.). It is considered an innovative payment processor, as cool and as stylish as there can be. It is great for international merchants, but too expensive for low-volume merchants.

Airtel money

It reaches globally but it is somehow restricted to just making recharges and online money transfers, as well as bill payment and online shopping. It doesn’t allow, however, cash withdrawal. If you have more queries then, you can make contact to airtel payment bank customer care number by clicking here !

Alliedwallet

It accepts all major credit and debit cards and almost every international currency. They have been established since 2002 and, are currently working in over 190 countries, thus having one of the best custumer support features.

Apple pay

Apple pay app is the oldest e-wallet app on the market and it accepts a large number of locations and card types. The connection is made simply, via phone with apple pay limit. Do you have questions - how to use apple pay? Or how to set up apple pay? Or how does apple pay work? Or how to pay with apple pay? Click here ! To get apply pay support in order to set up apple pay.

Brinks

It’s a mastercard app that lets you load money on the phone and manage your money on the go. It can perfectly work to send and receive money, as well as make online payments.

Cardfree

This is an integrated commerce system which includes gifts,loyalty, offers, order ahead, databases, complex data analytics. It is also ahead of its many competitiors as it offers the possibility to integrate with other mobile digital wallets on the market.

Chase pay

It is an all-in-one app that combines shopping apps, coupon, food, gas, reward and wallet and payment apps, all in just one that lets you do all that from your phone. They continually develop and add new features that simplify the entire process.

Citi masterpass

This was created to simplify your life to a great extent. It ensures faster checkout with a simple click. It stores all your credit, debit, prepaid, or loyalty cards and all your personal details in one very safe place. You can send, receive money and make online payments with just a click.

Coinbase

This app is dedicated to cryptocurrency transactions. It is one of the most popular in this area. You can sell, purchase, and securely store bitcoin, ethereum and litecoin. They also have a coinbase pro feature that brings an intuitive interface that gives options like real-time order books, charting tools and data exporting. It grants you access to real-time market data.

Due

This is a global app and it offers lots of features for individuals, freelancers or companies, just to mention a few: time tracking, bill payment, invoicing, cost splitting and a unique transaction fee of for all payments.

Ecopayz

It’s easy to create an digital ewallet account here without even having a bank account or credit check. This app is in the top due to its system of bonuses and gold VIP rewards, together with all the other benefits they offer.

Epayments

This is a cost-effective platform, with very low fees. They have also developed a mobile wallet app for all around the world. The platform is divided in two major directions: personal accounts for individuals and business accounts. It works both with visa and mastercard as well as with cryptocurrency.

Famacash

It’s a platform that provides you an online wallet for storing coupons, loyalty cards, sensitive account numbers for all debit and credit cards. It notifies you regarding all promotions and deals from stores and brands.

Gatehub

This is a digital payment platform that allows you to manage your cryptocurrency. You can trade popular coins like bitcoin and ethereum, but not limited to them, and exchange them to other coins or even to US dollars or euros.

Gyft

This e-wallet allows you to manage all the gift cards and coupons and vouchers and to store them on one device, so you can make the most of them, as these things usually get easily lost.

Key ring

This is another e-wallet specialized in managing loyalty and gift cards, coupons and vouchers, which allows customers to centralize them, as well as to share shopping lists, to search promotions and deals with various stores. However this best wallet app does not allow you to manage your debit or credit cards.

Moven

It is an app that operates only on mobile devices. It allows customers to store all their payment information as well as to operate online payments in a very secure manner.

Obopay

A global mobile payment supplier, provides streamline for the entire transaction process. It brings international solutions and specific data for each industry at a time.

Passkit

It is focused towards amplifying customer engagement through its geolocation feature. This is the main objective here, to help companies increase customer engagement, to ease transactions via wide digital payment network.

Paycloud

This platform allows you to store data regarding loyalty and reward cards on your mobile device. It allows local brands and stores within your area to deliver you special promotions and offers.

Papaya

It offers a safe alternative to cash and actual credit cards. It allows customers to shop, send and receive money instantly everywhere in the world.

Paypal

Does this wallet app need any introduction? I guess this is the first name that comes to everybody’s minds when thinking about online payments. They have based their popularity and fame step by step, in the entire world. And these days almost everybody in the online space works with them, at least as one of the options. It updates constantly with latest technologies and it also offers mobile card readers and POS systems.

Payoneer

This is also one of the big ewallet apps, used at a very large scale world wide. This is a great funds transfer solution, especially for freelancers in all the industries around the globe, working with foreign partners.

Paytoo

It acts like an electronic bank account and you can use your mobile feature for bill payment, share funds, money transfer. This app allows you to make direct deposits ans secure the money, manage gift cards etc.

Puut wallet

This platform gives you the opportunity to store all your payment information as well as some personal data of your choice, through its very secure system. It also enables you to make all the usual online money transfers.

Samsungpay

This app lets customers purchase online and make payments just with a tap. This is one of the most used e-wallets on the market. It also offers the option to link several cards to the smartphone, and make payments from all these interconnected cards.

Sequent

It connects all your cards to your mobile allowing you to make payments, securely digitize all the credit or debit cards, also the transit, loyality or even ID cards.

Stocard

It is a free app that allows you to store card information on your mobile device. This app is dedicated to loyalty and reward cards.

Stripe

It is a platform that enables you to make credit card processing and transfer funds. It is mainly focused on business clients, for companies of all sizes.

Tabbedout

This app is dedicated to bars and restaurants. Their clients can view the menu and make payments through their phone. It also helps them solve the issues regarding splitting of the bills, when larger groups are involved.

Zelle

This is a payment app that allows you to make transactions directly from your bank to everybody else. It enables same-day transfers to individual and businesses that have accounts at the participating banks. And this bank network is increasing constantly, by including the most popular players on the market. Up to this point, it allows you to connect only one bank account, so it must be wisely chosen upon registration.

In final words, there are many more famous ewallet apps like paytm, amazon pay, google pay, phonepe, mobikwik, BHIM axis pay and etcetera. Each country has different famous ewallets and each e-wallet provides special offers (discounts) which attracts you to install it in your smartphone and use it for great savings. In all the cases, e-wallet system (payment method) is perfect but, the biggest con of using such app is extreme worth shopping which you must need to control yourself for worth money spend.

So, let's see, what was the most valuable thing of this article: ewallet. Send money anywhere, anytime. Ewallet allows FNB customers to send money to anyone with a valid zambia cellphone number on any network. Money is transferred instantly and can be used to buy prepaid airtime, send money to another cellphone or draw cash from any FNB ATM. At withdraw ewallet

Contents of the article

- Real forex bonuses

- Withdraw ewallet

- Find an ATM

- Withdraw ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- Choose the best ewallet app in 2020

- What is an ewallet?

- Why use an ewallet

- Which ewallet is best

- Cross-platform ready

- Is my ewallet app safe & secure?

- Online casino ewallets in 2020

- Frequently asked questions (FAQ)

- How can I add funds and top-up my ewallet account?

- Can I withdraw my ewallet money?

- What other features does an ewallet provide?

- Can I use an ewallet to buy bitcoin?

- What are the fees for any given ewallet?

- Summary

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- Withdraw ewallet

- Find an ATM

- How can I withdraw money from my fiat wallet?

- Available fiat wallets

- Withdrawals

- Withdraw ewallet

- Popular methods for deposit and withdrawing money

- Built-in methods are suitable for most countries

- Automatic deposits

- Manual withdrawals

- Operation limits

- Verification requirement

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- 30 best ewallets

- Adyen

- Airtel money

- Alliedwallet

- Apple pay

- Brinks

- Cardfree

- Chase pay

- Citi masterpass

- Coinbase

- Due

- Ecopayz

- Epayments

- Famacash

- Gatehub

- Gyft

- Key ring

- Moven

- Obopay

- Passkit

- Paycloud

- Papaya

- Paypal

- Payoneer

- Paytoo

- Puut wallet

- Samsungpay

- Sequent

- Stocard

- Stripe

- Tabbedout

- Zelle

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.