Forex withdrawal limit

Note: the revised charges and limits will be applicable on forex prepaid card with effect from april 15, 2017.

Real forex bonuses

The charges are subject to change at bank’s discretion and as per FEMA guidelines. Fee for uncapped ATM withdrawals: 1% of withdrawal amount all fees and charges mentioned above are exclusive of taxes. Goods and service tax - 18% with effect from march 1st, 2020.

Additional fees for ATM transactions may be levied by the bank owning the overseas ATM used note: the forex prepaid card charges & limits may vary from time to time. For latest charges, please visit www.Icicibank.Com/travelcard. The above charges are applicable with effect from april 15, 2017.

Schedule of charges fees & limits

| sr. No | currency | daily limit for ATM cash withdrawal | ATM cash withdrawal fee | ATM balance enquiry fee | international SMS alert charges (monthly) |

|---|---|---|---|---|---|

| 1 | US dollar | USD 2,000 | USD 2.00 | USD 0.50 | USD 1.00 |

| 2 | pound sterling | GBP 1,000 | GBP 1.50 | GBP 0.50 | GBP 1.00 |

| 3 | euro | EUR 1,500 | EUR 1.50 | EUR 0.50 | EUR 1.00 |

| 4 | canadian dollar | CAD 2,000 | CAD 2.00 | CAD 0.50 | CAD 1.50 |

| 5 | australian dollar | AUD 2,000 | AUD 2.00 | AUD 0.50 | AUD 1.50 |

| 6 | singapore dollar | SGD 2,500 | SGD 3.00 | SGD 1.00 | SGD 1.50 |

| 7 | arab emirates dirham | AED 2,000 | AED 7.00 | AED 2.00 | AED 4.00 |

| 8 | swiss franc | CHF 2,000 | CHF 2.50 | CHF 0.50 | CHF 1.00 |

| 9 | japanese yen | JPY 2,00,000 | JPY 250 | JPY 60 | JPY 125 |

| 10 | swedish krona | SEK 15,000 | SEK 15.00 | SEK 4.00 | SEK 10.00 |

| 11 | south african rand | ZAR 25,000 | ZAR 25.00 | ZAR 5.00 | ZAR 15.00 |

| 12 | saudi arabian riyal | SAR 7,500 | SAR 7.50 | SAR 2.00 | SAR 4.00 |

| 13 | thai baht | THB 70,000 | THB 65.00 | THB 16.00 | THB 35.00 |

| 14 | new zealand dollar | NZD 2,500 | NZD 2.50 | NZD 0.60 | NZD 1.50 |

| 15 | hong kong dollar | HKD 15,000 | HKD 15.00 | HKD 4.00 | HKD 10.00 |

| joining fee: INR 150/-, reload fee: INR 100/-; inactivity fees: USD 5.00 or equivalent for every 180 days of inactivity | |||||

Note: the revised charges and limits will be applicable on forex prepaid card with effect from april 15, 2017. The charges are subject to change at bank’s discretion and as per FEMA guidelines.

“transaction fee: point of sale (POS)/online – NIL; cross currency fee: 3.5% + GST

Wallet to wallet transfer fee: 2.5% of transfer amount (from the destination wallet) cash advance/ cash@POS transactions fee: 0.5% of transaction amount. It is a facility through which ICICI bank forex prepaid card holders can withdraw cash by swiping their card at merchant outlets

Lost card replacement fee: international location – USD 20.00, indian location – USD 3.00

Fee for uncapped ATM withdrawals: 1% of withdrawal amount all fees and charges mentioned above are exclusive of taxes. Goods and service tax - 18% with effect from march 1st, 2020.

Additional fees for ATM transactions may be levied by the bank owning the overseas ATM used note: the forex prepaid card charges & limits may vary from time to time. For latest charges, please visit www.Icicibank.Com/travelcard. The above charges are applicable with effect from april 15, 2017.

Inactivity fees: the card will attract an inactivity fees of USD 5 every 180 days, if the card remains inactive for the last 6 months. Inactive means, the card is not used for reload, refund, ATM withdrawal, merchant transaction or e-commerce transaction.”

Funding and withdrawals

It is simple and straightforward to deposit and withdraw funds to and from your OANDA trading account. Funds can be deposited using debit card (backed by mastercard, visa or discover), bank transfer, check (USD) and automated clearing house (ACH). You can withdraw funds using debit card and bank wire transfer.

Funding

To initiate your first deposit into your OANDA trading account, simply log in to 'manage funds' using your OANDA account details.

Debit card

We accept debit cards backed by mastercard, visa and discover. There is a USD$20,000 maximum limit per calendar month.

Bank wire transfer

It takes one to three business days to deposit funds via domestic wire transfer and up to five business days for international wire transfers. There is no minimum or maximum deposit limit. You may be charged a service fee by your bank and intermediary bank for transferring funds into your OANDA trading account.

Check (USD)

To deposit funds, checks must be drawn in USD and from a US bank. We don’t charge a fee when you deposit funds via check. It typically takes between 4 and 6 business days for funds to be deposited into your account.

Automated clearing house (ACH)

For ACH deposits, there is a maximum limit of USD50,000 per deposit. It can take up to six days for funds to be processed into your account. There is no fee or minimum limit for ACH deposits. We do not accept payments from third parties. Please ensure that the name on the originating account matches the name on your OANDA account.

Third-party deposits: to receive funds from a third party, you will first need to set up a joint account with that party. Select the “instantly add” option to expedite deposits via wire transfer and ACH.

Withdrawals

You can withdraw funds from your OANDA account via debit card and bank wire transfer. Funds can be withdrawn by logging in to ‘manage funds’ using your OANDA trade account details. Remember: withdrawals are subject to our hierarchy rule. If you have deposited funds using multiple methods, you must exhaust the total deposit amounts first by debit card, and then followed by bank wire transfer.

Debit card

It takes up to three business days for funds to be processed into your account. The total amount you can withdraw into your debit card(s) cannot be more than the amount you originally deposited using your debit card(s). Any funds remaining in your account after the original amount has been withdrawn can be taken out using an alternative method, such as a bank wire transfer.

Bank wire transfer

To withdraw funds via bank transfer, your bank account must be in the same name as your OANDA trading account. It takes between one and two business days to withdraw funds via bank wire transfer within the US and up to five business days for international withdrawals. You must confirm that you are the owner of the bank account to which you wish to withdraw funds. You can do this in the form of a wire transfer deposit from the bank account (not all bank transfers can provide required bank details to confirm account ownership), or by submitting documentation. If you send funds via ACH, the fee attached to your withdrawal request will be removed during processing and funds will be sent at no charge.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Frequently asked questions

Withdrawing funds by debit card?

The total amount you can withdraw to your debit card(s) cannot be more than the total amount you deposited using those cards. Any funds remaining in your account after you have withdrawn the full amount you had originally deposited by debit card (e.G. Trading profits) may instead be withdrawn by an alternative method, such as a bank wire transfer.

It takes between one and three business days for you to get your money back (USD only). We do our best to process your request as quickly as possible, but please consider that the following may also affect processing times:

- Withdrawals to debit cards are only processed after all your debit card deposits have cleared. This on average takes around 1-3 business days from the date of your deposit

- Your debit card provider may take additional time to complete your withdrawal

There are no fees for debit card withdrawals.

Withdrawing funds by bank transfer?

If you had deposited funds via check, you could submit a bank transfer withdrawal request for the original amount. We will waive all applicable withdrawal fees. Funds can be withdrawn using the same method and to the same account from which they were deposited. If the bank account from which you deposited funds is no longer active, you can withdraw to an alternate bank account which is currently active. You will need to create a bank account profile for your new bank account. In the account management portal, click on manage funds and then click on bank accounts. Click on ‘+ add bank account’ to add a new bank account to your OANDA account.

Click on ‘OANDA trade accounts’ and select the account from which you wish to withdraw. Click ‘withdraw’ and select bank transfers as the withdrawal method, and then select the bank account to which you would like to withdraw funds. Enter the amount and select 'continue'. You may be charged a fee for withdrawing funds. Find out more about our fees and charges.

Funds can be withdrawn up to the value of the balance of your account, minus the amount of margin used. When requesting a withdrawal, you should ensure that there are sufficient funds remaining in your OANDA account to prevent margin calls on your existing trades.

Note: the above information reflects typical processing times for OANDA and its financial institution or card processing provider to complete your withdrawal. Your financial institution or debit card provider may take additional time to complete your withdrawal.

Forex brokers with best money withdrawal options in 2021

The best and most exciting thing about forex trading is, of course, to withdraw your profit from the forex broker. Say you have been trading, made a considerable amount of profit and now you want to spend your profit. In order to be able to do it, first you have to get your money back from the broker. To withdraw money from your forex account is very straightforward in general but does require you to take few steps.

Forex brokers with best money withdrawal options

Forex.Com

Forex.Com is owned and operated by an industry giant; GAIN capital holdings who has been around for more than 20 years. Forex.Com is registered and regulated by CFTC, NFA and CIMA. The broker accepts clients from the US. Investors can deposit and withdraw funds by credit card, bank card and wire transfer. Digital wallets are going to be available soon.

Money withdrawal options: credit card, bank card, wire transfer

XM

XM puts more than ten methods of deposit and withdrawal under disposal of its clients. In addition to international bank transfer and credit card which has become industry standards as deposit and withdrawal methods, XM clients can use various other methods. Those methods include neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort and western union. One important detail which makes XM even more favorable is that the broker covers international wire transfer commission of its own part which considerably reduces the withdrawal cost.

Money withdrawal options: wire transfer, credit card, neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort, western union

Fxpro

Regulated by FCA,cysec and SCB, fxpro is headquarted in london and one of the most prominent forex brokers in the industry. Traders who open an account at fxpro can withdraw and deposit funds through credit card, international bank transfer (SWIFT), paypal, skrill, neteller and china unionpay.

Money withdrawal options: wire transfer, credit card, paypal, skrill, neteller, unionpay

Hotforex

Established in 2010 and headquartered in cyprus, hotforex is an award winning forex broker that offers a wide range of account types and trading instruments. The broker is pursuing a policy of providing the most convenient and advantageous trading conditions for the traders. You can deposit money in hotforex using credit or debit cards and bank wire transfers. Apart from that hotforex also accepts skrill, neteller, fasapay, sofort, mybitwallet, ideal and webmoney.

Money withdrawal options: wire transfer, credit card, skrill, neteller, fasapay, sofort, ideal, webmoney, bitcoin

Exness

Exness was founded in 2008 in russia and has grown into one of the most popular forex brokers in europe since then. The company is regulated by cysec in cyprus and FCA in UK. Having a wide array of payment methods, transacting money on this brokerage platform is pretty easy and quick.

Money withdrawal options: wire transfer, credit card, skrill, neteller, webmoney, perfect money, sticpay, jeton wallet

Choose the withdrawal option

When it comes to withdraw your profit from forex brokers, the methods are not scarce including credit card, wire transfer, paypal, neteller, skrill, western union, bitcoin to name a few.

I usually go with wire transfer when withdrawing my profit. Nevertheless it comes with some caveats. Wire transfer is recommended if only you are going to withdraw an amount over a thousand. Otherwise the bank transfer fees are going to eat up your hard earned profit. Bear in mind that when you choose to get your money back through wire transfer, you are going to get double charged (once by the bank in where your forex broker is located and again by your local bank). The fees could range from $50 to $100 in total. The certain amount completely depends on the bank the broker is working with and your local bank. International wire transfer fees charged by some US banks are explained in this article.

My second favorite option to withdraw funds from forex account is credit card. Again there are some caveats. Some forex brokers don’t allow you to withdraw more than what you deposited with the same credit card. When you deposit $1000 to your forex account using credit card, you can only withdraw an amount up to $1000 by the same card. So you will have to choose another withdrawal method to transfer your profit.

Though I haven’t used so far, other popular methods are digital wallets like neteller, skrill, paypal. Forex brokers don’t charge extra fees to withdraw money by digital wallets however those services apply their own fees when you want to transfer money from the wallet to your bank account.

Submit your withdrawal request

After you decided the best transfer option for you, you have to submit your withdrawal request. Forex brokers used to demand clients to print out a withdrawal form then fill, sign and forward it to the broker by mail or e-mail.

However nowadays you don’t have to go through this cumbersome process. Majority of the forex brokers provide clients with a username and password for the client portal where they can submit their money withdrawal request in just seconds.

Just log in to the client portal, navigate to the money withdrawal section, fill the online form and click the submit button. Congratulations!

An important caveat is that some forex brokers do not require clients to verify their account till to the point they wish to withdraw funds from their account. If this is the case for the broker that you are trading with, you will need to verify your forex trading account by loading proof documents for ID and address. However, you will have always the chance to verify your account upon registration in case you do not want to worry about the last minute rush.

Wait until your fund is transferred to your bank account / credit card / digital wallet

It ranges between one to three business days depending on the forex broker and withdrawal option you used. Wire transfer and credit card transfers could take up to three business days. Though I remember several times that I received the funds same day when I used wire transfer as the transfer option. The commission and fees are not fixed for wire transfer. Since there are three banks involved at a wire transfer transaction, it is hard to know the exact amount that is going to be charged as commission. However, based on my experience, I can say that it should range between $30 and $100.

Digital wallets such as skrill and neteller has a different commission and time schedule. First time you incur any commission is the moment you withdraw funds from your trading account. The rate changes between %3 and %2 of the amount you like to withdraw. It takes fews days between the time that money leaves your trading account and arrives at your digital wallet. Second time you will get charged is the moment you transfer the money from your skrill account to your bank account. That is another %3 – %2 commission.

Wire transfer is my preferred withdrawal and deposit method. I use digital wallets only if wire transfer is not among the methods offered by the forex broker. Credit card is fast and more reasonable than any other withdrawal and deposit method. Nevertheless, I shall kindly point out that in the case you choosed credit card as a withdrawal method, you can only withdraw the amount you deposited by the same credit card. Therefore, you will have to use another method in order to be able to withdraw your profit.

Fxdailyreport.Com

To answer this question, you need to understand how the trading market works. Forex brokers (dealing centers or dcs) are such licensed companies that provide traders with professional services for access to trade in the international currency market. The success of work on forex depends on the right choice of a dealing center.

Therefore, you should give a preference to a reliable and experienced broker with a variety of trading instruments. The company should have a long history of completed foreign exchange transactions. But how to choose the best forex broker for withdrawal?

How to choose the best forex broker for withdrawal?

Choosing a broker for trading on exchanges should begin with collecting information about successful transactions and openness in working with clients. A reliable broker has its portfolio of deals, a large number of reviews from customers.

The simplest way is to check the published lists of traders, which are continually changing and updated. The trader with the most reviews will offer some of the safest working conditions. We also recommend paying attention to how the process of registering and depositing money with a particular broker is going.

- Forex broker license

The presence of a broker license allows you to judge his conscientiousness and honesty in his approach to trading. A licensed broker is more likely to complete all transactions and also carries them with benefits not only for himself but also for the client.

But to obtain a license from well-known world communities or government agencies, a broker needs to try hard and earn a positive reputation. If you see that an unknown office located on a distant island issued the permit – you should avoid working with this broker.

- Forex brokers rating

On the internet, you can find several independent from each other ratings of popular brokers. You can sort them by the number and quality of reviews, working hours, and other essential parameters. We recommend you to pay attention to the number of completed transactions, the regularity in payments to customers, and not to leverage or the promised interest.

Top 10 forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

In general, do your first steps in trading with the help of brokers with caution, trading on small amounts. Hence the preference in favor of traders with work experience and safe conditions.

- How do brokers earn?

Usually, brokerage support in the foreign exchange market is not free. And dealing companies, like traders, have some financial interests. How do they earn? Providing comprehensive support for trader transactions, such agents get income that makes up the difference between the purchase/sale prices of traded currency pairs (spreads).

Or they receive direct payment from the trader for each trade transaction conducted. Depending on the chosen scheme of work, a brokerage company can only get commissions or have additional sources of income.

- Reliable forex brokers

How to find a dealing center to which you can safely entrust your trading operations? One of the surest ways is to choose a broker on the recommendation of traders already working with them. Numerous ratings will also help ease the choice.

They publish information on the most successful and reliable forex brokers regularly. Besides, remember about such vital points as the transparency of the information provided on the dealing company activities. Check the legal documents and the availability of client support, working 24/7.

Three categories of brokers

In the modern foreign exchange market, there are three leading categories of brokers.

- Classical (most expensive) intermediaries work in the full-service format. They provide clients with a full range of services – from receiving orders to legal support of accounts.

- Discount dealing centers (discount broker) put the orders to the forex market. As payment for their work, they receive a monetary reward in the form of a percentage commission.

- Electronic or online brokers specialize in online transactions and have been extremely popular lately.

Withdrawal process in different brokers

How to withdraw money from your trading account? Every trader should ask himself this question when signing a service agreement. Let us talk about the withdrawal process on forex.

Why does a trader come to the forex currency market? Generally, not for fun, but profit. For this purpose, you study the basics of technical analysis, try various trading strategies, and read a lot of information. Finally, you achieved the result – profit. And the most critical question arises – how to get your hard-earned money?

How to withdraw money on forex?

The problem is that many traders choose brokers to trade without getting known how to get your earnings back. Many brokers have enormous commissions, and it may be that you did not even know about them. Let’s talk in more detail about how to withdraw money from a forex broker trading account.

What to do before opening a real account

Before you open a real deposit with a chosen forex broker, you should inquire about what conditions the broker withdraws the earned profit.

As a rule, money is available for withdrawal only after passing the verification procedure.

At the same time, verification can have several levels, on each of which you will need scans or photos of identity documents. Naturally, during registration, to avoid further problems, you should indicate your real last name and first name.

It is highly advisable to do the verification procedure before depositing funds. The requirements of a forex broker regarding the quality and quantity of necessary documents can seem needlessly strict to you. In this case, nothing stops you from changing your company before starting a financial relationship with it.

As a rule, there are no difficulties with verification. Most forex brokers request a standard set of documents: a passport scan and the confirmation of the address of your residence. After completing the verification, you only have to choose a suitable withdrawal method.

Most companies have a bonus program. Carefully read the terms of granting this bonus. Some bonuses limit the withdrawal of profits or even make it impossible without losing the reward.

Most popular ways of withdrawal

The methods for withdrawing profits, as well as the timing of this procedure, are different for each forex broker. For example, big companies withdraw money only to a bank account. Naturally, everything goes officially, including the income tax for individuals.

Dealing centers and brokers do not limit their services only in this way but offer many more ways to get your profits – from electronic payment systems to cryptocurrency. That is why you should choose a broker that uses the withdrawal method most convenient to you.

- Electronic payment systems

Most companies allow you to withdraw profits on electronic wallets of the most common payment systems. The leaders are paypal, skrill, and neteller. When choosing a payment system, be sure to check how much money you will lose when withdrawing profits. For example, neteller has a commission of 1% (no more than 11.41 USD or 10 EUR) and a fee of 1.39% of the withdrawal amount.

At the same time, pay attention to the timing. The withdrawal may take from several business hours to several business days – this will be indicated on the broker’s website and in the contract.

- Withdrawal to a bank account

This method is not so popular among ordinary traders. The commission charged in this case is slightly higher than when withdrawing funds to the same card using the chain trading account – electronic payment system – bank card. It is especially true if the country of residence of the trader and the broker’s country are different. In some cases, for citizens of other states, this method is generally not available.

The timing of the withdrawal of money also decreases the popularity of this method. Unlike electronic payment systems, it can take from 1 to 7 banking days. Nevertheless, many traders with a substantial profit (several thousand dollars) use this system. For such traders, it is not the waiting time that matters, but its maximum reliability.

- Forex brokers cards

The trend of issuing payment cards by brokers gains popularity. Each company names them different, but they are the same – an international mastercard. This method has many advantages. Using a mastercard, you can withdraw cash at any ATM, pay in stores, make purchases on ebay or amazon.

However, the most significant benefit is different. Brokers open their cards in the offshore zone. And the law of their native state doesn’t regulate them.. Therefore, if your profit from forex trading has reached a grandiose size, this method will be most profitable.

But there are some drawbacks. The issuance of such a card is not free, and the broker also charges a card maintenance fee. Therefore, if your profit is not too big, there is no reason for using it.

Conclusion

As you see, choosing the best forex broker for withdrawal is a quite complicated task. First of all, you should determine your needs and the most convenient withdrawal method for you. And only then you can start looking for a broker.

You have come to the foreign exchange market with serious intentions to make money. So the question of money withdrawal should interest you first of all. After all, the goal of a trader is earning, and not to deposit money on a forex broker account.

Withdrawal without commission

Withdraw funds from your account

with no commissions twice a month!

You have an opportunity to benefit from the company’s unique program and withdraw funds from your account without any commissions. This service works on the permanent basis and allows traders to withdraw funds from their accounts without paying any commission on the first and the third tuesday of each calendar month.

Don’t miss the next following date of free funds withdrawal!

The rules of "free funds withdrawal" program

- Within the framework of the program, a client has an opportunity to withdraw funds from their members area twice a month without paying any commissions.

- A client can take advantage of the program on the first and the third tuesday of each calendar month, all through the day.

- On the above-mentioned days of the week, a client can withdraw funds without any commissions via any available payment system only once a day.

- Roboforex reserves the right to deny its clients this service at its own discretion with no reason given.

More than 20 methods to withdraw funds

Security of client's funds

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

THE SECRETS OF HOTFOREX WITHDRAWAL SYSTEM

BRKV - it is never an easy job for traders to select a nice broker to work with because it has a significant impact on their trading success. In order to help you save your precious time but still have a good result while finding a brokerage, we will review hotforex broker (especially hotforex withdrawal system) in this article, one of the top tier brokerage in the forex world.

The conditions for hotforex withdrawal

Withdrawal conditions

Withdrawals are available from mywallet only. To withdraw funds from your trading account, you can proceed with an internal transfer to mywallet. Go to hotforex.Com/deposit-withdraw/withdrawal-options hotforex will not be responsible for any errors made by the account holder. In order to complete the withdrawal request, you must fill out all fields just like the picture below.

Then, pay attention to each hotforex withdrawal option's condition as below:

| Withdrawal options | accepted currency | minimum amount | fees | time |

| VISA | USD, EUR | $5 | none | 2 - 10 days |

| mastercard | USD, EUR | $5 | none | 2 - 10 days |

| maestro | USD, EUR | $5 | none | 2 - 10 days |

| american express | USD, EUR | $5 | none | 2 - 10 days |

| HF mastercard | USD, EUR | $5 | none | instantly |

| neteller | USD, EUR | $5 | none | instantly |

| skrill | USD, EUR | $5 | none | instantly |

| bank transfer | any | $150 | depends | 2 - 10 days |

Other notes

- In the first 6 months, you have to withdrawal the same way you deposit. If you deposit via your VISA card, you have to withdraw money back to that VISA card. If you use multiple deposit methods, the amount you can withdraw is based on the ratio between the amounts you deposited. For example, if you deposit $50 via VISA and $100 via skrill, you can withdraw only a third of your balance to your VISA card. The rest has to be withdrawn to your skrill account.

- The fees charged for your withdrawal are regulated by the payment gateway vendor. None of that money will be transfered to hotforex.

- You have to indentify your information if you want to make withdrawals.

About hotforex

Hotforex is a forex trading services broker that has aligned with many liquidity providers to accommodate any kind of trader. They give access to a wide variety of instruments like currencies, indices… the famous MT4 trading platform is used in their services, you can download it to do your trades or you can try any operating system that enables web-based to work. The company’s spreads are very tight, and it is a rule to attract more clients, furthermore, you can look for higher leverage compare to other intermediaries, applied to all accounts from hotforex micro account to hotforex VIP account. One important thing to take note is that hotforex has very special customer service. The support team can work in many languages and there is always staffs to help you. We must admit that this is one of the most significant client support brokerage.

Exclusive features of trading with hotforex

The reason we should collaborate with hotforex lies on their unique traits that we have listed below for you:

- Having been formed in 2010 in mauritius, hotforex has undergone about 10 years of operation.

- The cysec regulations and FSCA licenses are applied to hotforex. Plus, it is regulated by DFSA, FCA, and FSA.

- Many accounts in global banks will hold your money if you work with hotforex. So, safety is guaranteed.

- With over 140 asset selections in 20 markets to choose from: metals, energies, cfds or dealing forex pairs.

- Access to the MT4 platform through any operating system with web-based support.

- A great amount of accounts gives out advantages for traders: auto, hfcopy, premium, micro, fix, and VIP.

- Several accounts with special zero spread for special requirements: zero accounts and “swap-free islamic” account. Besides, HL markets client has a unique PAMM account.

- A bunch of deposit/withdrawal methods is assisted.

- Hotforex support service works 24 hours every trading day and they can use 27 languages.

Hotforex spreads & leverage

Spreads of hotforex is tight compared to other intermediaries in the forex world. It also provides the fixed spread account for automated traders and scalpers which has the spread just the same as the spread of interbank. The leverage is another thing to take into account. It depends on what account you are using. For instance, the rate of micro account is 1:500, 1:400 for premium and 1:300 for VIP. Traders in the EU region have the biggest leverage at 1:30.

Hotforex premium trader features

Here are some exclusive trading features that you can only find on hotforex platform:

- TRADE TERMINAL: professional trading matching and analysis tool.

- MINI TERMINAL: designed for traders who want to focus on a specific market which will display profit-taking orders in pips, calculate the size of trading lots compared to a certain amount, in addition mini terminal allows you to place orders quickly through the small windows below, without necessarily opening the trading terminal.

- CONNECT: it provides message boards and calendar of economic events and information related to deposit, training materials, or webinar registration provided by hotforex.

- SENTIMENT TRADER: market sentiment data taken directly from FX blue labs helps traders see how many people are trading a currency pair.

- SESSION MAP: gives you a quick overview of the market through time zones, and also displays an overview of price movements during the current or previous session.

- ALARM MANAGER: A personal trading assistant that informs you of various information from account issues, prices, trading psychology to technical indicators .

- EXCEL RTD: put real-time account, coupon and price data into excel.

- MARKET MANAGER: provides full control of the logo tracking list and all account and order activity; all this information is provided through a very compact window but can summarize the entire price movement.

- CORRELATION MATRIX (correlation matrix): provides market information across different time periods, helping to determine the strong or weak low or highest correlation quickly.

- CORRELATION TRADER: allows correlation between two symbols, two price charts when placed side by side, along with the current open position and profit for each symbol.

- TICK CHART TRADER: displays a variety of stick chart types updated as the selling or buying prices change. The tool also allows super-fast entry using single clicks or keyboard shortcuts.

Customer support

Experienced client support can help you out with up to 27 languages and it is available 24 hours all trading days through email, skype, phone or live chat. The site is created to bring you many educational materials so that you can learn more about the forex market and actually begin your career.

Conclusion

For the past few years, hotforex has become one of the best forex brokers and it is agreed by many traders. It is because of the competing spreads and leverage, dealing platform for all operating systems, adaptive fees for EA enthusiasts and scalpers, and very good client support team. Therefore, we believe hotforex can meet all your demands and help you in your trading forex road.

Mario draghi

Hey, I’m mario draghi. I’m a writer currently resided in thailand. For my forex experience, I have been working with brokers and trading for 5 years. Hope that you'll enjoy my articles about all forex-related matters.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

Funding and withdrawals

It is simple and straightforward to deposit and withdraw funds to and from your OANDA trading account. Funds can be deposited using debit card (backed by mastercard, visa or discover), bank transfer, check (USD) and automated clearing house (ACH). You can withdraw funds using debit card and bank wire transfer.

Funding

To initiate your first deposit into your OANDA trading account, simply log in to 'manage funds' using your OANDA account details.

Debit card

We accept debit cards backed by mastercard, visa and discover. There is a USD$20,000 maximum limit per calendar month.

Bank wire transfer

It takes one to three business days to deposit funds via domestic wire transfer and up to five business days for international wire transfers. There is no minimum or maximum deposit limit. You may be charged a service fee by your bank and intermediary bank for transferring funds into your OANDA trading account.

Check (USD)

To deposit funds, checks must be drawn in USD and from a US bank. We don’t charge a fee when you deposit funds via check. It typically takes between 4 and 6 business days for funds to be deposited into your account.

Automated clearing house (ACH)

For ACH deposits, there is a maximum limit of USD50,000 per deposit. It can take up to six days for funds to be processed into your account. There is no fee or minimum limit for ACH deposits. We do not accept payments from third parties. Please ensure that the name on the originating account matches the name on your OANDA account.

Third-party deposits: to receive funds from a third party, you will first need to set up a joint account with that party. Select the “instantly add” option to expedite deposits via wire transfer and ACH.

Withdrawals

You can withdraw funds from your OANDA account via debit card and bank wire transfer. Funds can be withdrawn by logging in to ‘manage funds’ using your OANDA trade account details. Remember: withdrawals are subject to our hierarchy rule. If you have deposited funds using multiple methods, you must exhaust the total deposit amounts first by debit card, and then followed by bank wire transfer.

Debit card

It takes up to three business days for funds to be processed into your account. The total amount you can withdraw into your debit card(s) cannot be more than the amount you originally deposited using your debit card(s). Any funds remaining in your account after the original amount has been withdrawn can be taken out using an alternative method, such as a bank wire transfer.

Bank wire transfer

To withdraw funds via bank transfer, your bank account must be in the same name as your OANDA trading account. It takes between one and two business days to withdraw funds via bank wire transfer within the US and up to five business days for international withdrawals. You must confirm that you are the owner of the bank account to which you wish to withdraw funds. You can do this in the form of a wire transfer deposit from the bank account (not all bank transfers can provide required bank details to confirm account ownership), or by submitting documentation. If you send funds via ACH, the fee attached to your withdrawal request will be removed during processing and funds will be sent at no charge.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Frequently asked questions

Withdrawing funds by debit card?

The total amount you can withdraw to your debit card(s) cannot be more than the total amount you deposited using those cards. Any funds remaining in your account after you have withdrawn the full amount you had originally deposited by debit card (e.G. Trading profits) may instead be withdrawn by an alternative method, such as a bank wire transfer.

It takes between one and three business days for you to get your money back (USD only). We do our best to process your request as quickly as possible, but please consider that the following may also affect processing times:

- Withdrawals to debit cards are only processed after all your debit card deposits have cleared. This on average takes around 1-3 business days from the date of your deposit

- Your debit card provider may take additional time to complete your withdrawal

There are no fees for debit card withdrawals.

Withdrawing funds by bank transfer?

If you had deposited funds via check, you could submit a bank transfer withdrawal request for the original amount. We will waive all applicable withdrawal fees. Funds can be withdrawn using the same method and to the same account from which they were deposited. If the bank account from which you deposited funds is no longer active, you can withdraw to an alternate bank account which is currently active. You will need to create a bank account profile for your new bank account. In the account management portal, click on manage funds and then click on bank accounts. Click on ‘+ add bank account’ to add a new bank account to your OANDA account.

Click on ‘OANDA trade accounts’ and select the account from which you wish to withdraw. Click ‘withdraw’ and select bank transfers as the withdrawal method, and then select the bank account to which you would like to withdraw funds. Enter the amount and select 'continue'. You may be charged a fee for withdrawing funds. Find out more about our fees and charges.

Funds can be withdrawn up to the value of the balance of your account, minus the amount of margin used. When requesting a withdrawal, you should ensure that there are sufficient funds remaining in your OANDA account to prevent margin calls on your existing trades.

Note: the above information reflects typical processing times for OANDA and its financial institution or card processing provider to complete your withdrawal. Your financial institution or debit card provider may take additional time to complete your withdrawal.

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period of XM bank wire transfer withdrawal was 5 days in my last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders safe, XM takes all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use to trade, become familiar with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

Forex withdrawal limit

I will call in short word as forex card withdrawal limit for folks who are looking for forex card withdrawal limit review. Forex withdrawals via most electronic payment systems are typically processed by our back office staff during 1 day.

forex com mobile apps download on iphone or android forex com

forex com mobile apps download on iphone or android forex comSome forex brokers offer their customers special debit cards which let traders make fast easy and secure deposits and withdrawals from their accounts.

Forex withdrawal limit! . What concerns me most however is whether or not there are maximum leverage amounts and withdrawal limits what i mean by maximum leverage amount is not by how much your account can be leveraged such as 1001 or 2001 but the actual maximum dollar amount. Paxforex reserves the right to identify payee. If withdrawal request was sent after 1800 gmt3 of the current day then itll be transferred to the next working day.

Online forex broker. Funds withdrawals are available only to account holders. Shop for cheap price axis bank forex card maximum withdrawal limit price low and options of axis bank forex card maximum withdrawal limit from variety stores in usa.

Open account log in. Tightest spread broker with neteller fundingwithdrawal 10 replies ecn broker that allows withdrawal not only into bank acc. Bank wire transfers may take 1 3 business days.

Bank wire transfers may take 1 3 business days. Today if you do not! Want to disappoint check price before the price uphdfc forex ! Card withdrawal limit you will not regret if check price buying hdfc forex card withdrawal limit. Forex trading involves significant risk of loss and is not suitable for all investors.

Withdrawals are not executed on weekends and holidays. Over 190 countries of presence. 25 replies i am looking for ea to put buy stops buy limits sell limits and sell stops.

All withdrawal requests are processed daily from 900 to 1800 server time gmt3. Over 13 000 000 traders more than 370 000 partners. Money transfer to third parties is forbidden.

Reviews forex card withdrawal limit is best in online store.

How to withdraw money savings account withdrawal limits paxforex

Ewallet optimizer ecopayz vip program

Know the best ways to carry money abroad business news

How to deposit and withdraw your fund from skrill in india

Chinese banks quietly lower daily limit on foreign currency cash

Plus500 review 2019 pros and cons uncovered

Axis bank prepaid forex card withdrawal limit forex rates usd to

Forex sach kha forex capital markets ltd

Xm lo! Cal services deposit withdrawal

Skrill withdrawal limits forex

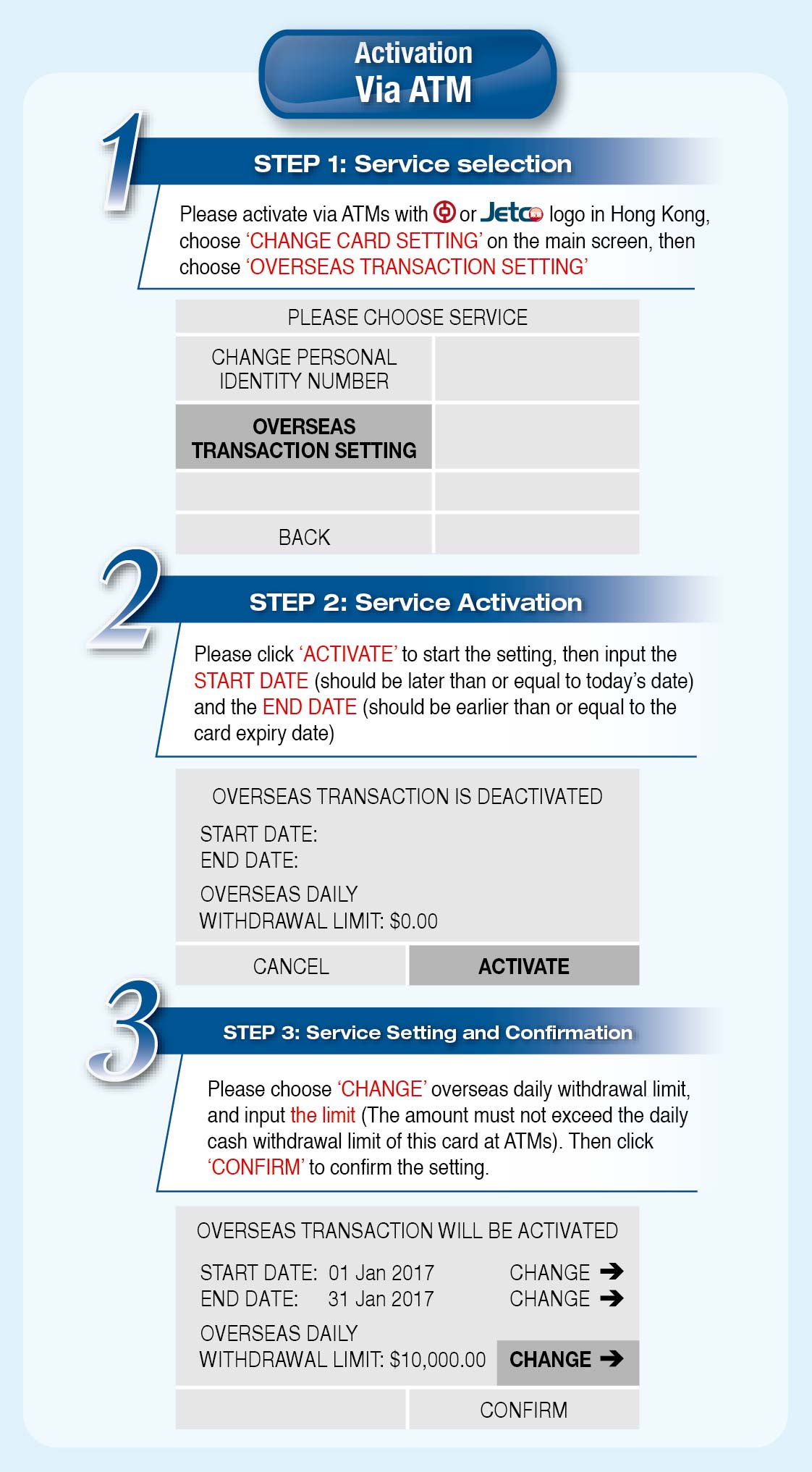

Note of outside hong kong atm cash withdrawals limit setting more

Coinbase eth withdrawal fees

Is olymp trade A scam read this broker review to know more

so, let's see, what was the most valuable thing of this article: find out the schedule of charges of forex prepaid card depending upon different currencies around the world. At forex withdrawal limit

Contents of the article

- Real forex bonuses

- Schedule of charges fees & limits

- Funding and withdrawals

- Funding

- Withdrawals

- Ready to start trading? Open an account in minutes

- Frequently asked questions

- Forex brokers with best money withdrawal options...

- Forex brokers with best money withdrawal options

- Choose the withdrawal option

- Submit your withdrawal request

- Wait until your fund is transferred to your bank...

- Forex brokers with best money withdrawal options

- Fxdailyreport.Com

- How to choose the best forex broker for...

- Withdrawal without commission

- Don’t miss the next following date of free funds...

- Security of client's funds

- THE SECRETS OF HOTFOREX WITHDRAWAL SYSTEM

- The conditions for hotforex...

- About hotforex

- Exclusive features of trading with...

- Hotforex spreads & leverage

- Hotforex premium trader features

- Customer support

- Conclusion

- Funding and withdrawals

- Funding

- Withdrawals

- Ready to start trading? Open an account in minutes

- Frequently asked questions

- XM deposit and withdrawal methods in 2021

- Forex withdrawal limit

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.