Crypto currency trading online

Etoro, a multi-asset and social trading brokerage, has registered offices in israel, the UK and cyprus.

Real forex bonuses

The brokerage has a worldwide reach and is regulated in all the markets. Cryptopia limited, a well-known name in the market, offers free wallet and a spot trading platform with a lot of features for trading cryptocurrencies like bitcoin, ethereum, litecoin, dogecoin, cannabiscoin (CANN), electroneum (ETN), verge (XVG), digibyte (DGB), and many more (totals 1644 markets in CRYPTOPIA). The trading fee on cryptopia is 0.20% of the total BTC or crypto currency traded.

Fxdailyreport.Com

The prices of cryptocurrencies have zoomed this year and many investors have started focusing on these digital assets. Investors have a couple of options to trade in cryptocurrencies. The first option is to use the cryptocurrency exchanges which allow traders to swap fiat currency such as dollar and euro for the digital currency, or digital currency for digital currency. Another option is to use the online forex brokers’ platforms for trading cryptocurrency cfds or pairs such as USD/BTC, EUR/BTC, etc. The aim of this post is to list out the top 10 cryptocurrency trading platforms.

Best cryptocurrency trading platforms 2021

Etoro, a multi-asset and social trading brokerage, has registered offices in israel, the UK and cyprus. The brokerage has a worldwide reach and is regulated in all the markets.

Retailfx came into existence in 2006 in tel aviv. Etoro openbook was set up in 2010 with the copy trading feature as a social investment platform, enabling traders to follow, view, and replicate the trades of top investors in the network.

Etoro boasts of more than four million active users and allows individuals to trade in forex, stock cfds, and cryptocurrencies.

IQ option may not be most well-known or the biggest platform, but it is growing very fast. The platform offers trading in all of the popular assets and up to 25 percent leverage. In addition, IQ option provides a multi-chart layout, historical quotes, and technical analysis across multiple platforms, including desktop, mobile, and tablet. The brokerage also offers excellent support which includes volatility alerts, stock screeners, calendars, newsletters, and market updates.

Founded in 2007, instaforex has more than 7,000,000 clients and is a well-established investment firm. Instaforex provides support services in more than 27 languages and the platform can be used by newbies and professional traders. The online forex trading platform provider makes available 7 asset classes, 16 platforms, and more than 300 instruments for trading. Clients can trade forex, commodities, precious metals, equity indices, individual stocks, energies, and cryptocurrencies. Instaforex has its registered office in russia and is regulated by RAFMM; and cysec, cyprus.

The hong kong-based cryptocurrency exchange binance charges very low fees of just 0.1 percent per trade. This platform does not only support several coins but also provides services in multiple languages, including chinese, english, korean, japanese, russian, french, and spanish. Binance primarily focuses on the china market and chinese coins. To fund the development of the exchange, it created the binance token (BNB) during the initial coin offering (ICO) event.

Coinmama, an exchange located in israel, specializes in enabling the purchase of bitcoin using credit/debit cards. The services offered by this bitcoin exchange are available in many countries around the world. The buying limit set by the exchange is higher compared to other exchanges. Bitcoins can be purchased for cash and on payments through the western union. However, the fee charged by the exchange is slightly on the higher side.

The bitcoin exchange cex.Io allows users to buy the cryptocurrency for low fees using credit cards. Purchases can also be made for free through bank transfers. The services offered by this exchange are available in many countries around the world, except a few specified by the platform provider. On the basis of verification, cex.Io offers four account levels with different buying limits. This bitcoin exchange operates as a registered company in all of the districts in which it is present.

Cex.Io combines crypto to crypto exchanges, fiat to bitcoin exchange, and a mining pool. The company also offers trades in mining contracts or bitcoin mining equipment rights for a specified period of time. In addition, the exchange offers USD/BTC and EUR/BTC pairs along with several crypto/crypto pairs.

Coinbase is the best option for first-time cryptocurrency buyers. The exchange’s interface is very user-friendly and this makes it easy for anyone to buy bitcoin, ethereum, or litecoin. Most cryptocurrencies have to be bought with bitcoin. Therefore, coinbase provides a good entry point for buying bitcoin or other cryptocurrencies. Coinbase allows clients from canada, the UK, the USA, europe, australia, and singapore to buy bitcoin, litecoin, and ether using either a bank account or credit card. A fee of 3.99 percent is charged when buying using a credit card and 1.49 percent when buying through bank transfer.

In forex trading, avatrade is by far the most recognized online currency trading platform provider. The regulated forex broker is dedicated to providing customized trading solutions to its clients irrespective of their prior knowledge or experience.

It is easy to open an account on the avatrade’s platform and you can be up and trading in a matter of minutes. The greatest advantage of working with avatrade is that the broker provides a large amount of educational material, especially to those who are not very conversant with trading. The online forex broker offers more than 250 trading instruments, including fiat currency, cryptocurrency, bonds, and cfds.

Yobit.Net was founded in russia and introduced through a forum in 2015. It caters to russian, english, and chinese traders. The bitcoin exchange accepts payments only in the fiat currency USD. In order to purchase bitcoins, the client should transfer funds in USD to his/her the account. Yobit.Net offers a wide range of cryptocurrencies such as BTC, ETH, DASH, XBY, and DOGE, among others. Trading on this platform is very easy, even for those who are new to cryptocurrencies.

Cryptopia limited, a well-known name in the market, offers free wallet and a spot trading platform with a lot of features for trading cryptocurrencies like bitcoin, ethereum, litecoin, dogecoin, cannabiscoin (CANN), electroneum (ETN), verge (XVG), digibyte (DGB), and many more (totals 1644 markets in CRYPTOPIA). The trading fee on cryptopia is 0.20% of the total BTC or crypto currency traded.

Kucoin is one of best multi-cryptocurrency exchange and trading platform with service centers based in hongkong. Kucoin exchange offers pairs for trading such as raiblocks (XRB/BTC), red pulse (RPX/BTC), canya (CAN/BTC), BTC/ETH, NEO/BTC, BTC/LTC, UTRUST (UTK/BTC), ethlend (LEND/BTC), bitcoin cash (BCH/BTC), etc (more than 69 BTC pairs). Kucoin charges a flat fee of 0.1% per trade, it also provides users with a mobile app available for android and ios.

Top 10 online cryptocurrency trading brokers

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

Pepperstone has won numerous industry awards for innovation and excellence in CFD brokerage. Pepperstone is an australian-based online ECN forex broker with some of the industries lowest spreads.

- Award winning CFD broker

- No deposit or withdrawal fees

- Fee-free funding options

- Razor spreads from 0.0 pips

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Pepperstone has won numerous industry awards for innovation and excellence in CFD brokerage. Pepperstone is an australian-based online ECN forex broker with some of the industries lowest spreads.

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

How to get started in cryptocurrency trading

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

What is cryptocurrency?

Today, the most famous cryptocurrency is bitcoin. Its inventor attempted to build a “peer-to-peer electronic cash system”. Many have tried this system many times before. However, the main difference between bitcoin and the previous efforts, like digicash, was that it was to be entirely decentralized. Since no overarching entity is controlling the currency, the notion of “trust” would be eliminated from the system.

To combat “double spending”, the major problem in all the digital cash systems at that point, satoshi nakamoto, bitcoin’s inventor, proposed the blockchain technology. The blockchain technology is a revolutionary technology that records all the transactions made with this currency.

For any single balance, transaction, or change to the network to take place, there needs to be a consensus amongst those who validate the network – the miners. Since the invention of bitcoin, many programmers have attempted to use the model and change it to provide what they consider a more functional form of digital cash.

The other kinds of cryptocurrencies include monero, new economy movement, litecoin, and ether. Many of these cryptocurrency efforts tailor their currency for an individual and particular purpose. Some of the most common purposes are speed, privacy, and price.

What are cryptocurrencies used for?

Since cryptocurrency is such a new technology, it may be that people have not used it yet for its eventual use. Still, today people utilize it for many various purposes. These purposes include, but aren’t limited to the following: trading, remittances, payment for goods and services, investment, gambling, private monetary transactions, and as a hedge against national currencies which are suffering from rapid devaluation (greece, venezuela for example).

As the whole cryptocurrency space begins to expand, it’s likely that we will see some additional applications joining the list of purposes for the crypto currency. There are already young services such as steemit, which aims to revolutionize the way people pay for content on social media, in addition to services like musicoin which attempts to find a more equitable way to pay artists without the need for a middleman.

What is the difference between bitcoin and ethereum?

All cryptocurrencies have their own characteristics. However, recently one coin has come to challenge bitcoin more than ever before. Ethereum is the new player on the market. The reasons that it is a challenge to bitcoin are easy to understand.

Ethereum emerged as an effort to try to correct some of the main criticisms made towards bitcoin – especially regarding security.

What ethereum has accomplished to do was to provide transactions that are safer, more flexible contracts that are compatible with any wallet, with short block times for negotiating (where the confirmations are easier). Also, ethereum is available more than bitcoin. Whereas more than two-thirds of bitcoin has already been mined, access to ethereum is still widely available. Another main difference between these two cryptocurrencies is that ethereum allows for different developers to raise funds for their projects. It can, therefore, be in itself a kickstarter for some projects.

One of the main advantages to ethereum is that it’s a more secure, easy to use, flexible, and transact coin. In addition to this advantage, it has brought innovations in terms of entrepreneurship and investment. And this is posing a serious challenge to bitcoin’s market cap.

What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

You can invest in cryptocurrency in two ways. First, cryptocurrency can be bought and sold at a cryptocurrency exchange and stored in a digital wallet. The second method would be to invest in crypto as a CFD with regulated cryptocurrency brokers. With CFD cryptocurrency trading, the digital currency is treated as a speculative investment and traded as a contract for difference (or CFD), through brokers.

Platforms that allow traders to buy and sell cryptocurrencies are cryptocurrency exchanges. Dues to the fact that it is a very recent – and booming – market, the majority of these platforms are relatively new. But, of course, one of the essential questions that people ask is how to know if a particular platform is safe or not.

The only way that you can find out is to check if the exchange provides transparent data of the coins that are in cold storage. What this means is, whether it has the reserves that it requires to provide liquidity to its activities. You can find check this easily by checking whether an exchange is regulated or not.

Trade cryptocurrency online using CFD services

If you are interested in trading because of the opportunity to profit from the incredible volatility of cryptocurrency, your best option is to use an online trading platform that allows CFD services. Currently, there are very few CFD platforms that allow this kind of trade, so to see available options refer to our recommendations above.

CFD brokers are a great option if you want to trade cryptocurrencies with the option to accept multiple forms of payment. If you want to buy cryptocurrency with paypal, you can, and these forums also accept major credit cards and wire transfers as well. Furthermore, if you choose to trade through a forex or CFD platform, you will pay the lowest commissions possible. That is in comparison to other investment alternatives. CFD and forex companies use an exchange rate that is an aggregate of different crypto exchanges.

Trading cryptocurrencies – getting started with cfds (contracts for differences)

Cryptocurrency cfds allow you to trade digital coins without actually owning any. Crypto cfds were generated to give traders exposure to the cryptocurrency market without the need for ownership.

Contracts for differences, also known as “cfds,” represent a contract between trader and exchange. Cfds declare that the difference between the price on entry and the price on exit will be a trader’s profit or loss. Basically, cfds are an agreement held between two parties that simulate an actual asset.

How to make money trading crypto

There are several ways to make money cryptocurrency trading. The most popular is trading bitcoin against the US dollar, known in market terms as the BTC/USD pair. The first method is to find a top cryptocurrency broker and to invest in a digital currency in the same way that you would do with a physical currency – by buying low and selling high. Since cryptocurrency is highly volatile, you should be able to identify the dip with studying and market research.

Read on to learn how to find the best cryptocurrency brokers. Be sure to review the platforms we suggest above, all are fully-registered and come highly recommended. For additional information regarding trading cryptocurrency as a CFD, check out our guide on “the basics of cfds“. It’s important that you remember that leverage works both ways and it will magnify the gains and losses.

How to choose the best cryptocurrency trading broker online

Because there’s so much competition in the market as well as having countless cryptocurrency brokers to choose from, it can be difficult to know which option will be best for you. Here are a few key points we suggest keeping in mind when deciding how to best invest:

Regulation

Each country has its own regulatory body. The regulatory body develops rules, services and programs to protect the integrity of the market. The regulators protect traders, and investors as well as the cryptocurrency brokers themselves. Their main obligation is to help members meet regulatory responsibilities. Due to potential safety concerns regarding deposit, you should exclusively open accounts with regulated firms.

Customer service

Cryptocurrency trading takes place 24 hrs a day, so customer support should be available at all times. Ideally, you will want to speak with a live support person rather than a time-consuming auto-attendant. Give a call to the customer service centre to get an idea of the type of customer service provided. Check on wait times and find out the representative’s ability to answer questions regarding spreads and leverage, trade volume, and company details.

Account types

Your ideal cryptocurrency trading broker should be able to offer either multiple account options or an element of customizability. Look for cryptocurrency brokers that offer competitive spreads and easy deposits/withdrawals.

Currency pairs

Cryptocurrency brokers can provide a selection of cryptocurrency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

Platform type

The trading platform is the investor’s portal to the markets. With that in mind, look for a platform that’s easy to use, straightforward and offers an advanced collection of analytical and technical and tools. These features will help to enhance your trading experience.

Here at topbrokers.Trade, we take pride in providing the best possible trading brokers comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrencies, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Best cryptocurrency brokers

Luke jacobi

Contributor, benzinga

Many people believe that cryptocurrencies are the future of finance. When you’re ready to leap into crypto, choosing a broker to trade or invest in cryptocurrencies is one of the most important steps to your success in the crypto market.

Get started now with benzinga’s picks for the best cryptocurrency brokers and choose the right one for you.

Best crypto brokers and trading platforms:

- Best for social trading: etoro

- Best for ease-of-use: gemini

- Best for new investors: coinbase

- Best for gold investments: itrustcapital

- Best for high-volume forex traders: cryptorocket

- Best for accessibility: altrady

- Best for multiple exchanges: voyager

- Best for security: kraken

Best crypto brokers

Since different brokers have different strengths, you need to figure out what kind of broker best suits your cryptocurrency interests. Some brokers provide a social trading platform where you copy other cryptocurrency traders’ trades in your own account. Others can offer the ability to make transactions in a broader selection of altcoins.

Choosing the best crypto broker depends largely on addressing your needs as an investor or trader. The following list crypto brokers been selected for different reasons to meet the needs of differing cryptocurrency trading and investing styles.

Commissions

Account minimum

1. Best for social trading: etoro

Etoro fundamentally changed the way many people trade and invest with its social trading platform. Social trading involves mirroring another trader or investor’s transactions in a special social trading account. While you make the same amount proportionally as the trader you’re copying, you also take the same percentage of losses the trader takes in their account.

In addition to its regular crypto trading platform, etoro offers an advanced cryptocurrency exchange platform called etorox. This platform is designed for algorithmic traders and institutional grade investors. It offers traders access to tight-dealing spreads, and its algox application programming interface (API) can be used to create custom automated trading tools.

Commissions

Account minimum

2. Best for ease-of-use: gemini

Stay on top of market trends, build your crypto portfolio and execute your trading strategy with gemini’s easy-to-use tools. The gemini app is available on all the major app stores, and it puts the industry’s best crypto exchange and wallet in your hands.

Gemini’s app is easy to use. You can track asset prices and real-time market prices and set price alerts so you can act fast on price movements for individual assets. You can also schedule recurring buys on bitcoin and other cryptocurrencies.

Invest with peace of mind with gemini’s solid cybersecurity and custody solutions. Create a free account and make your 1st buy in as little as 3 minutes.

Commissions

Account minimum

3. Best for new investors: coinbase

Coinbase is 1 of the largest and oldest cryptocurrency exchanges. It currently services 35 million customers worldwide. Coinbase has extensive educational resources and an intuitive interface ideal for new traders and investors.

The exchange also provides clients with a hosted wallet and offers global customer support. Coinbase is an excellent choice for those new to the cryptocurrency market who do not wish to use social trading services.

Pricing

Account minimum

4. Best for gold investments: itrustcapital

Itrustcapital is 1 of the few cryptocurrency brokers that lets you trade and hold physical gold in your individual retirement account (IRA). You can also trade bitcoin (BTC), ethereum (ETH), litecoin (LTC) and bitcoin cash (BTH) in your IRA. Itrustcapital provides you with a personal wallet by curv for your crypto transactions.

While itrustcapital has no minimum trade or account size, the company charges account holders a flat fee of $29.95 per month. This amount includes all IRA fees, asset custody charges and access to its trading platform, although all cryptocurrency trades carry an additional 1% transaction charge based on the trade size.

If you’re planning for your retirement and want to add physical gold to your cryptocurrency portfolio as an inflation hedge, then itrustcapital is a solid choice.

5. Best for high volume forex traders: cryptorocket

Cryptorocket offers straight through processing (STP) to its trading clients. This means you deal directly with the crypto and forex markets and not through intermediaries or market makers. This broker model is ideal for high volume forex traders who tend to be sensitive to dealing spreads.

In addition to the 35 crypto pairs offered, you can trade 55 fiat currency pairs, 64 major stocks and 11 indices. If you are based in a jurisdiction with relatively lax retail forex trading regulatory oversight, you may even be able to take advantage of cryptorocket’s 500:1 maximum leverage ratio for forex trades.

Cryptorocket also supports the popular 3rd-party metatrader4 trading platform.

6. Best for accessibility: altrady

Altrady is built by crypto traders for crypto traders. It makes cryptocurrency trading accessible for beginner, intermediate and advanced traders.

You can get the tools that professional crypto traders use without the expensive price tag. Altrady’s platform is intuitive and easy-to-use. Its crypto trading software platform adapts to your needs.

It combines 10 connected exchanges. It also offers immediate price alerts, portfolio manager, break-even calculator, and customizable trading pages by allowing traders to manipulate widgets to create preferred layout in order to trade comfortably, limit ladder order, gain quick access to market tabs, and integrated market scanners.

Commissions

Account minimum

7. Best for multiple exchanges: voyager

Voyager connects to more than a dozen of the most trusted and secure crypto exchanges so you have access to the largest crypto trading market available anywhere. Voyager gives you faster, more reliable execution, plus:

- Access to multiple exchanges: voyager partnered with over a dozen of the most trusted and secure crypto exchanges and liquidity providers. Voyager’s exchange connectivity offers you competitive prices on your trades and faster, more reliable execution.

- Commission-free trading: voyager operates commission free to save you money. You save money on trades through its extensive crypto market and best execution technology. Voyager achieves price improvement on over 90% of customer orders.

Start trading at a better price today! Download the voyager app today.

Pricing

Account minimum

8. Best for security: kraken

Kraken takes a comprehensive approach to protecting your investments and builds in a number of sophisticated methods to prevent money or information theft.

- Financial stability with full reserves

- Healthy banking relationships

- The highest standards of legal compliance

Crypto advantages vs. Disadvantages

Trading and investing in cryptocurrencies often carry a considerable degree of risk, as you may have observed given the volatility of bitcoin and some other digital currencies. Despite the disadvantages currently associated with cryptos versus fiat currencies (like lower liquidity and minimal payment options), the advantages of holding cryptocurrencies will increase as they become a more common form of payment.

Here’s a quick shot of crypto advantages and disadvantages.

Advantages

- Security. Technology advances typically lead to increased intrusion into your privacy. In contrast, all identities and transactions are strictly secured in the digital currency environment. While most cryptocurrency transactions are very secure, you still could be vulnerable to cybercriminal actions, like hacking.

- Low transaction fees. Because of the elimination of intermediaries like financial institutions, cryptocurrency transaction fees are generally quite low.

- Decentralized. The lack of a central exchange or authority overseeing cryptocurrencies is one of their defining characteristics. Many people consider this among the biggest advantages of cryptocurrencies and blockchain technology.

- High potential returns. You only have to look at a long-term bitcoin price chart to get an idea of the returns you can make investing wisely in digital currencies. The crypto world is still developing and expanding, so investing in the right digital currency now could translate into considerable returns in the future.

Disadvantages

- Acceptance. Because digital currencies have not yet become mainstream, most businesses will not accept them as payment for goods or services. This situation will eventually change as public perception makes digital currencies more acceptable as forms of payment. For example, paypal has recently allowed customers to hold bitcoin balances and has plans to allow payments using that cryptocurrency by early 2021.

- Volatility. The market volatility observed in some digital currencies can lead to large gains or large losses. Trading and investing in crypto is not for everyone, especially those with a low pain threshold or aversion to risk.

- Taxes. The internal revenue service (IRS) states on its official website that “virtual currency transactions are taxable by law just like transactions in any other property.” that IRS web page also links to a guide about how existing general tax principles apply to transactions made using digital currencies.

- Illegal activities. Due to the fact that digital currency transactions generally provide identity security, many people operating outside the law are thought to use digital currency for illegal activities. These activities could include money laundering, “dark web” transactions, and drug and human trafficking.

Cryptocurrency vocabulary

Like many other financial markets, the cryptocurrency market has evolved its own jargon. Some of the key terms used by market operators are defined below.

- Block. A collection of transactions permanently recorded on a digital ledger that occur regularly in every time period on a blockchain.

- Blockchain. A constantly growing list of blocks in a peer-to-peer network that records transactions.

- Cryptocurrency exchanges. Also called digital currency exchanges, these generally consist of online businesses that allow customers to exchange cryptocurrencies for fiat currencies or other cryptocurrencies.

- Cryptocurrency wallet. A secure digital account used to send, receive and store digital currencies. Crypto wallets can either be cold wallets that are used for storing cryptos in an offline environment or hosted wallets that are hosted by 3rd parties. Hosted wallets store your private keys and provide security for your digital currency balances.

- Distributed ledger. A network of decentralized nodes or computers that connect to a network where transaction data is stored. Distributed ledgers do not have to involve cryptocurrencies and can be either private or permissioned.

- Fork. Also known as a “chain split,” a fork is a split that creates an alternate version of a blockchain that then leaves 2 blockchains running simultaneously. For example, bitcoin and bitcoin cash came about due to a fork in the original bitcoin blockchain. Another type of fork is known as a “project” or “software fork.” this occurs when cryptocurrency developers take the source code of an existing altcoin project and create a new project. For example, litecoin is a project fork of bitcoin.

- ICO. An initial coin offering (ICO) occurs when a new digital currency or token is sold, typically at a discount, to its first set of investors. An ICO lets issuing cryptocurrency companies raise funds from the public to support their coin’s development and maintenance.

- Mining. A computationally-intensive process performed within a cryptocurrency network where blocks are added to the blockchain by verifying transactions on its distributed ledger. Miners are rewarded with digital coins as compensation for their successful computational efforts.

Are you ready for the future?

Digital currency and the blockchain appear to be the future of finance. Despite their current typical volatility and lack of widespread acceptance as a payment method, cryptocurrencies seem destined to become increasingly used for online payments. They could therefore make an interesting long-term investment, especially if you have a strong appetite for risk.

Where we will be in 20 years is anyone’s guess, but cryptocurrencies and blockchain technology show growing promise as forces to be reckoned with in the financial world. Get started today with 1 of our recommended crypto brokers.

Try gemini

Gemini builds crypto products to help you buy, sell, and store your bitcoin and cryptocurrency. You can buy bitcoin and crypto instantly and access all the tools you need to understand the crypto market and start investing, all through one clear, attractive interface. Gemini crypto platform offers excellent account management options. You can manage your account at a glance, view your account balance 24-hour changes and percent changes. Get started with gemini now.

Beginner’s basics for trading cryptocurrency online

Cryptocurrency trading has grabbed the attention of a new generation of investors due to how easy it is to get involved in this emerging asset class. On some crypto exchanges, users can gain access to the crypto markets in a matter of minutes. The past decade has shown the crypto asset market has huge potential for providing high returns.

Having said that, this is still a new and extremely volatile market, which means beginners must be particularly cautious with their cryptocurrency trading. This guide will cover the fundamentals for trading and equip you with the right knowledge to start investing.

What’s on this page

What you need to start trading crypto

To get started with cryptocurrency trading, you only need a couple of things.

- Sign up on one of the many available crypto exchanges online. Here is a link to our recommended exchanges.

- Once you have an exchange account, you may also want to download a digital wallet to access your coins locally. Check out our curated list of recommended digital wallets. Exchanges have been a notorious target for hackers over the years, so it’s best to keep your cryptocurrency in your own control. This is an extremely important aspect of owning cryptocurrency assets, check out this article to learn more about keeping your funds safe.

To trade larger amounts of money on crypto exchanges, you will most likely need to upload your personal information for identity verification purposes. This would include things like your driver’s license, social security number, phone number, and address.

Our recommended exchange for buying cryptocurrency

Coinbase

- User-friendly

- Great customer service

- Low services fees

- Diverse and consistently updated choice of coins

What to consider when picking an exchange

Beginner traders often look at fees as the most important attribute to consider when comparing various exchanges, but in reality, looking at regulatory compliance and security comes before anything else.

An exchange that is not compliant with local financial regulations should be viewed under a skeptical lens because this may mean there is no one to turn to in a situation where all of the exchange’s funds are lost in a hack or software malfunction.

Regulated exchanges are also usually able to offer better insurance guarantees for their customers.

Figuring out which exchanges offer the highest level of security may seem difficult at first. After all, not everyone is an expert at understanding the most important aspects of exchange security.

Our tip: the simplest way to determine the level of security offered by an exchange is to take a look at how long the exchange has existed and how many times it has been hacked. While a lack of hacks over an exchange’s history may not mean it definitely won’t get hacked in the future, this can be a useful indicator in determining the level of security offered by an exchange.

How trading crypto is different than traditional stocks

Those who have traded traditional stocks in the past need to be aware that crypto trading is quite different from trading legacy financial assets.

For one, there are still no well-established methods for valuing crypto assets. There are no earnings reports to look over, so it can be difficult to figure out whether a particular cryptocurrency is overvalued. In other words, trading is entirely up to supply and demand.

Another key difference is that cryptocurrency transactions are irreversible, which means security must be taken much more seriously. If someone is able to access your exchange account and send your cryptocurrency holdings to their own wallet, there will be effectively nothing the exchange can do to help you get your money back.

Only invest what you can lose

This is the golden rule of investing – invest only what you can afford to lose.

Since cryptocurrency is still very much an emerging asset class, it has proven to be extremely volatile. Due to this high level of volatility, it’s important for traders to only use money they are willing to lose on exchanges.

Fiat to cryptocurrency trading

While cryptocurrencies like bitcoin have been an innovative advancement in payments technology, traditional fiat currencies (such as the US dollar, euro or japanese yen) are still difficult to move around the world. Plus, since cryptocurrency transactions are irreversible, exchanges need to be cautious with accepting fiat in exchange for crypto assets.

Trading cash for cryptocurrency is much more difficult than trading crypto to crypto; however, stablecoins like tether have made the fiat side of crypto trading much more efficient for traders. That said, most beginners are going to start with funds in their bank accounts that they wish to trade, which means it may take a couple of days to get money onto an exchange.

Crypto to crypto trading

Crypto to crypto trading is much easier than dealing with fiat, but it should be noted that the altcoin market can be extremely volatile. While bitcoin has been called volatile for moving 10 or 15 percent in a single day, these sorts of daily moves are nothing compared to the movements of many of the altcoins.

The lack of payment friction involved with crypto to crypto trading makes it attractive to beginners, but it’s important to remember to look at the level of liquidity found in some of altcoin markets. For some of the altcoins, a few thousand dollars is all it takes to move the price in one direction or the other. If you’re going to trade the altcoins, be prepared for extreme levels of volatility.

Why you’ll want a “hot” wallet for trading

A hot wallet allows you to be more active with your cryptocurrency holdings because it is connected to the internet and available for trading at all times. A cold wallet, on the other hand, is mainly used for long-term storage and extra security because the funds are held offline.

Most traders leave their active funds directly on their exchange of choice as it allows them to quickly react to the latest market movements; however, it’s also important to remember that you don’t have control over your own funds when your cryptocurrency is on an exchange, which could potentially lead to a loss of funds if the exchange is hacked.

Basic tips for trading crypto

Focus on the big picture

By focusing on the big picture rather than the latest price fluctuations, you can avoid acting irrationally and selling at a loss. Again, these markets are extremely volatile, so a sharp drop in the value of your cryptocurrency holdings should be expected from time to time. To avoid making a rash decision and selling into a price decline, make sure that you’re taking a long-term point of view with your trading strategy.

Remember that bitcoin leads, altcoins follow

One of the most well-known phenomenons in the crypto market is that the altcoins are highly correlated with bitcoin. When bitcoin moves, the altcoins tend to move in the same direction. The only real difference is that the altcoins are more volatile, so their moves are more pronounced than bitcoin’s. For example, if bitcoin is up 5% in 24 hours, then some of the major altcoins may be up 15% to 20% during that same period of time.

Diversification is important

If you’re going to get involved in the cryptocurrency markets, remember not to put all your eggs in one basket. Betting on the future price of a cryptocurrency of your choice is still a rather speculative endeavor. Remember, this is a high-risk, high-reward investment.

Don’t get too greedy

If you look at the various cryptocurrency forums online, you will notice that they’re filled with stories of making huge profits in the crypto market; however, it’s important to remember that you haven’t actually made a profit until you sell your cryptocurrency holdings. Plenty of people were bragging about their new found wealth in late 2017, but many of these traders also ended up losing money because they became too greedy and expected for the market to simply keep rising indefinitely. Even if you’re making a long-term bet, you need to remember to take profits from time to time.

Set up a stop loss

A stop-loss order will allow you to limit your losses in a situation where the price of a particular cryptocurrency begins to fall sharply. Use these types of orders to prevent yourself from being the last person holding the bag in a dying cryptocurrency.

The relative strength index (RSI)

The relative strength index (RSI) tracks the recent price movements of a particular asset to calculate whether the market is overbought or oversold. This can be an extremely useful technical indicator because you always want to sell when the market is too hot and buy once things have cooled down. An RSI of 70% means the asset is considered overbought and an RSI below 30% means the asset is oversold.

Arthur crowson

Arthur crowson is an award-winning writer and editor who hails from the pacific northwest. His career began in traditional news media but he transitioned to online media in the mid-2000s and has written extensively about the online poker boom and the rise of cryptocurrency.

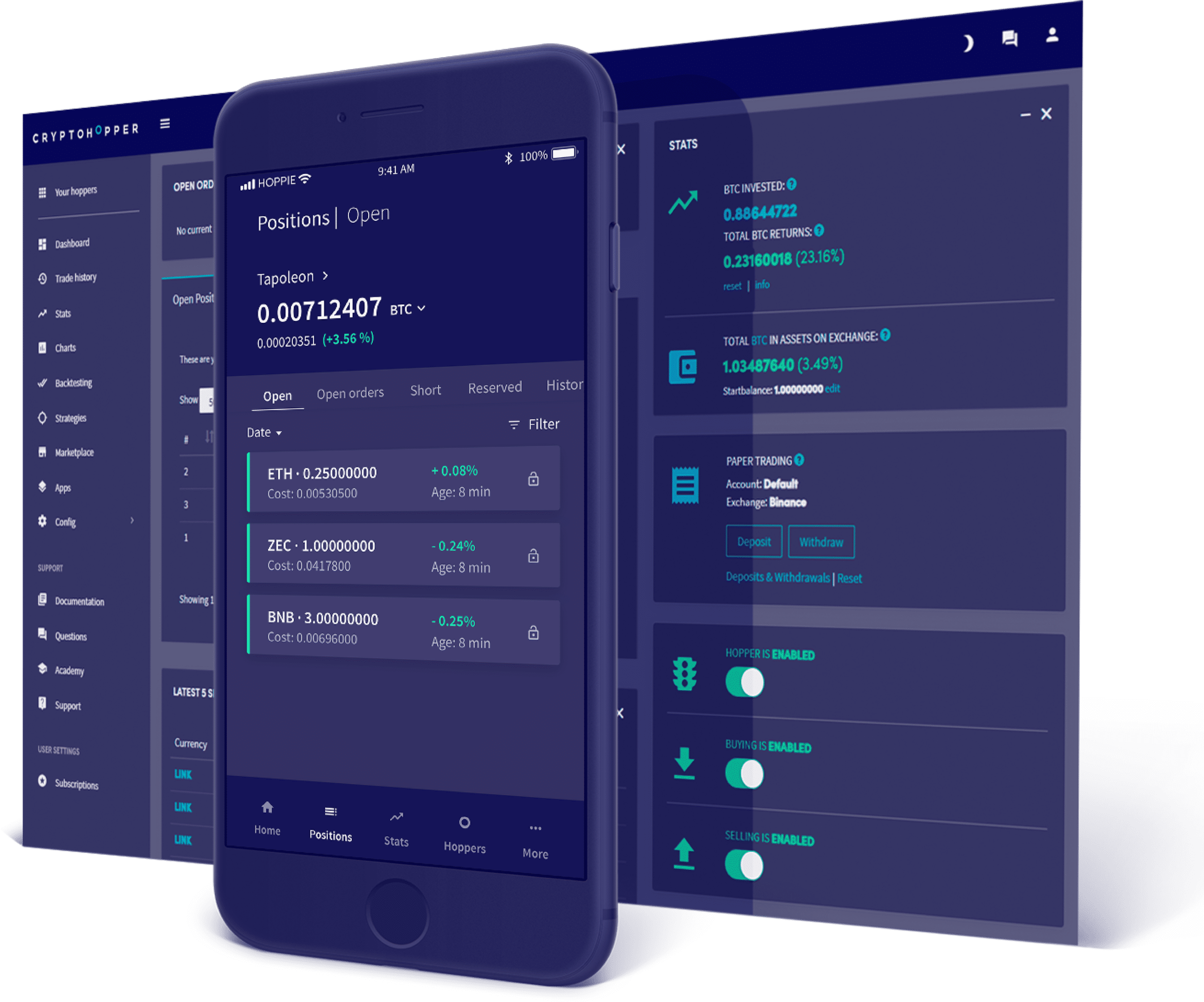

World class automated crypto trading bot

Copy traders, manage all your exchange accounts, use market-making and exchange/market arbitrage and simulate or backtest your trading.

Fast automated trading, and portfolio management for bitcoin, ethereum, litecoin, and 100+ other cryptocurrencies on the world’s top crypto exchanges.

Automate

your trading

And take your emotion out of the equation

Invest in all cryptocurrencies that your exchange offers. At the same time, you’ll also gain access to an expert suite of tools like our trailing features that help you buy/sell better than before.

Trades opened on cryptohopper

Manage all your exchange accounts in one place

Connect your exchange.

Your exchange is where your funds are located. With cryptohopper you can manage all your exchange accounts and trade from one place.

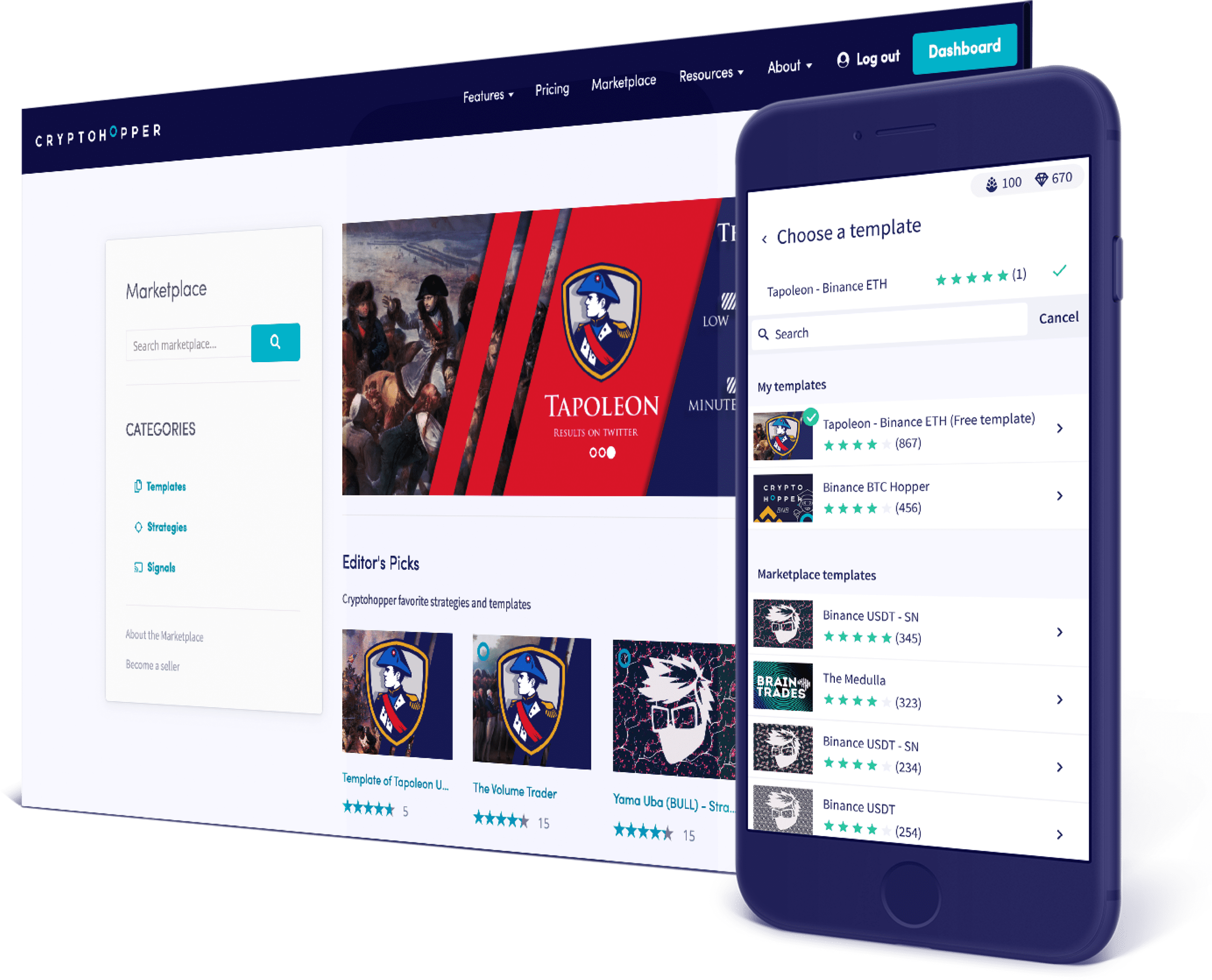

Signals. Templates. Strategies

Social trading platform

(check out the marketplace!)

Join the social trading revolution. Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace. You don't need to be an expert to trade like one.

Easy. Effective. Worldclass

Use expert tools

without coding skills

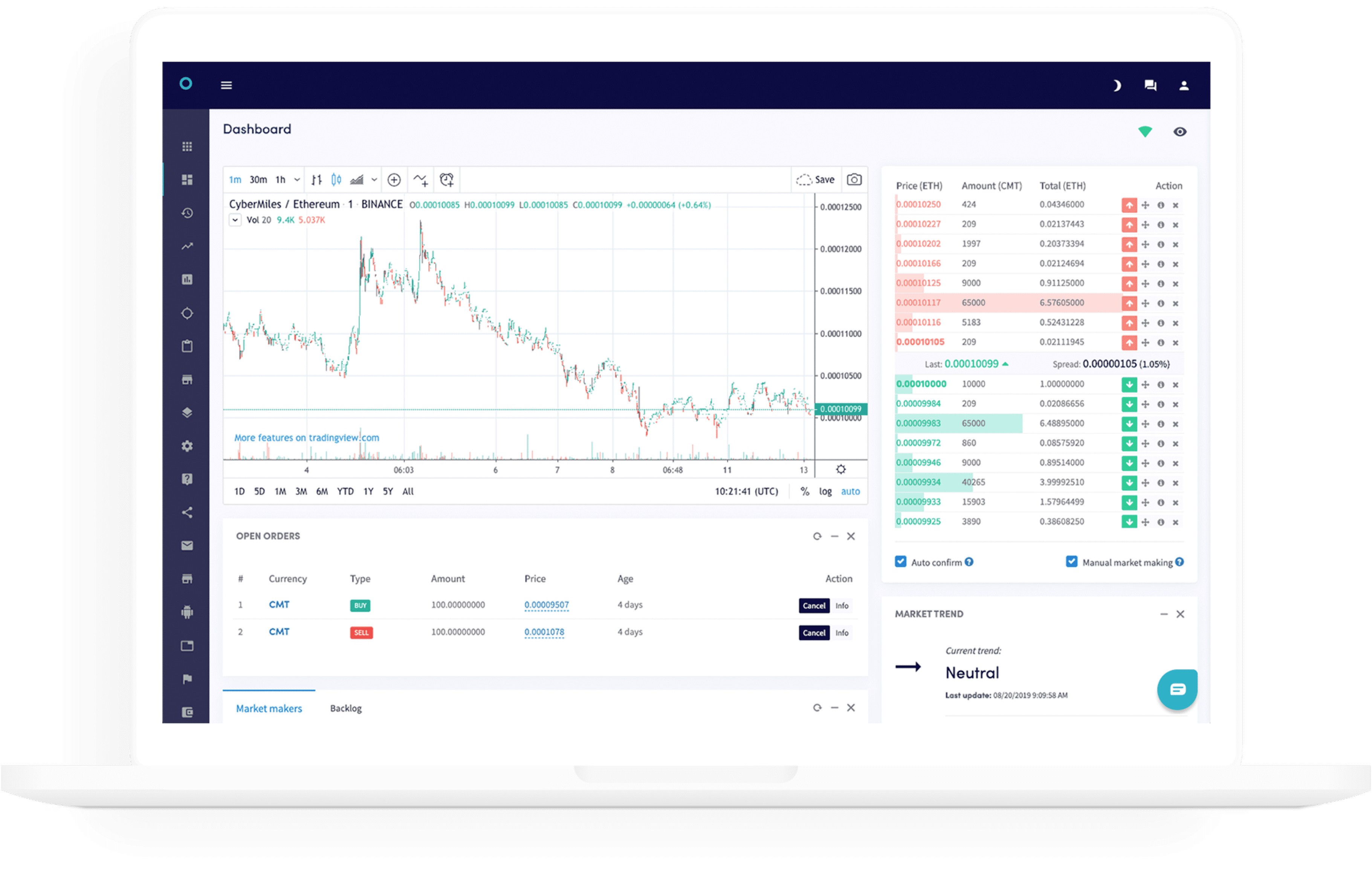

Market-making

Market makers are the best friend of every exchange or crypto project. Now you can trade easily on the spread as well, and make the markets. A win-win for everybody. Read more

Exchange/market arbitrage

Want to benefit from price differences of exchanges and/or between pairs? Our arbitrage tool is your new best friend. Read more

Strategy designer

Create your own technical analysis to get the best buy and sell signals from your strategy. Popular indicators and candle patterns are: RSI, EMA, parabolic sar, CCI, hammer, hanged man, but we have many more. Your hopper will scan the markets 24/7 searching for opportunities for you. Read more

Simulate your trading without fear (or money.)

Practice daring new strategies risk-free while mastering cryptohopper’s tools. Even backtest your bot and your strategies, so you can keep tweaking until it is effective.

What succesful cryptocurrency traders say about cryptohopper

Average score from the google play store (21 nov. 2019)

Meyer family | 11 nov 2019

"I'm very satisfied with cryptohopper and highly recommend it for day trading. It took me a while to get a strategy that worked for me, but it appears to have been well worth it. I recommend paper trading and backtesting extensively before using any real money. Once you master the initial learning curve, you will feel much more secure and confident that you can weather any trend or market. It will also be a valuable asset during the next alt-season and halvening events. Thank you cryptohopper team!"

Roshywall gurgel | 7 nov 2019

"great app. I don't understand cryptocurrencies very well but from what I saw in the demo you can profit. I will definitely buy the basic version to upgrade and profit."

"good service, powerful features, effective, affordable. Highly recommend. ��"

Soflow will | 24 oct 2019

"very easy to use and incredibly affordable. Get the free trail to test it and learn the ropes, then upgrade. I upgraded twice after one week and i still use both subscriptions. Awesome selection of options. Unlimited strategies, lots of free built-ins. Spend time to learn the fundamentals of technical analysis - you'll be glad you did. Crypto hopper will soon become your best friend. And weapon of choice!"

Chika moronu | 23 oct 2019

"took a while to get used to the settings, but once I got the hang of it, the app has been great"

Damion la bagh | 21 sep 2019

"the cryptohopper experience is simply amazing. Great instructions to help you on your way and s great community. The website is beautifully designed with full functionality. The app on the other hand is nice but it's not as full featured. It has the things you need to monitor your hoppers and basically interact but doesn't have the nice graphs, charts or settings to create new strategies like the website does. So one is still dependant on a laptop or computer to get everything set up 1st before"

Cryptocurrency trading: how to start?

Cryptocurrency trading: how to trade cryptocurrency? Follow this guide and find out how cryptocurrency trading works and how to start.

Last updated: january 05, 2021

Bitdegree.Org fact-checking standards

To ensure the highest level of accuracy & most up-to-date information, bitdegree.Org is regularly audited & fact-checked by following strict editorial guidelines. Clear linking rules are abided to meet reference reputability standards.

All the content on bitdegree.Org meets these criteria:

1. Only authoritative sources like academic associations or journals are used for research references while creating the content.

2. The real context behind every covered topic must always be revealed to the reader.

3. If there's a disagreement of interest behind a referenced study, the reader must always be informed.

Feel free to contact us if you believe that content is outdated, incomplete, or questionable.

So, you’ve finally decided to start your cryptocurrency trading career, and you’re already thinking about how you’re going to spend your millions. There’s no doubt that cryptocurrency is an exciting market for investors, but unfortunately, success doesn’t happen as easy as that.

In all seriousness, cryptocurrency trading can be risky business. Yes, it’s true — some people have made lots of money. However, some people have lost lots of money too.

For those of you who are interested in learning about cryptocurrency trading, I’m here to help you get started. This beginners guide is going to show you everything you need to know.

First, I am going to give you some background information on when cryptocurrency trading began. Next, I will help you understand the difference between short-term and long-term cryptocurrency trading, and both of their advantages and disadvantages.

After that, we will tell you the important things that you need to be careful of before you start trading.

Finally, I will show you how to trade! This will include a step-by-step guide with some useful images.

By the end of reading this beginner guide, you will have all the information need to go and trade on your own. So, what are you waiting for, let’s go and learn about the early days of crypto trading!

Cool fact: in december 2017, for the first ever time, more than $50 billion of cryptocurrency was traded in just one day!

Table of contents

- 1. Cryptocurrency trading

- 2. Short-term trading

- 2.1. Advantages

- 2.2. Disadvantages

- 3. Long-term trading

- 3.1. Advantages

- 3.2. Disadvantages

- 4. What to be careful of?

- 4.1. FUD

- 4.2. Persuasion

- 5. How to start trading

- 5.1. Open an account at coinbase

- 6. Conclusion

Cryptocurrency trading

As you must already know, bitcoin became the first ever cryptocurrency when it was released in 2009. However, with only one coin available, you couldn’t trade it with any other cryptocurrency.

Latest coinbase coupon found:

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

Your discount is activated!

It wasn’t until a few years later when more and more cryptocurrencies were created that people started trading them. The idea is really simple. You trade one cryptocurrency for another, with the hope that the coin you buy increases in value.

This concept is the same as the real-world stock exchange.

When people trade, they need to use a cryptocurrency exchange. This is so buyers and sellers can be matched. For example, if you are holding bitcoin and want to sell it for ethereum, an exchange will help you find an ethereum seller to trade with.

Exchanges will charge you a fee for doing this, which normally costs around 0.1% for each trade. Cryptocurrency trading is now really popular, with billions of dollar’s worth of coins being bought and sold every day.

The “lucky” ones have made a serious amount of money doing this, and there are lots of people that are now trading cryptocurrency as a full-time job.

However, experienced traders use lots of different tools to help them pick the right coins at the right time. This can include software that helps investors analyze previous pricing trends etc.

Nevertheless, everyone must start somewhere! As long as you are not trading more than you can afford to lose, there is no harm in giving it a try.

Now, I will now explain what short-term trading is, along with its advantages and disadvantages.

Short-term trading

Short-term trading is where you buy a cryptocurrency but only plan to hold on to it for a short amount of time. This can be anything from minutes, hours, days, weeks or even a few months!

You might buy a certain cryptocurrency because you think it will rise in price in the short term. In which case, you would then sell it for a quick profit if you thought the price was going to drop again!

Let’s look at some of the advantages of short-term trading.

Advantages

The main advantage of short-term cryptocurrency trading is that it offers a really good opportunity to make high percentage gains. Unlike fiat currency markets, where prices usually don’t move by more than 1% each day, cryptocurrency prices can almost double overnight!

Now that cryptocurrencies have become so popular, there are now more than 1,500 different cryptocurrencies to trade. Which means one thing — more opportunities to make huge profits. Not only that, though, but there are large trading volumes for lots of coins.

Large trading volumes are important as it means you will always find a buyer or seller! It simply means that a high amount of currency is flowing in and out of that cryptocurrency.

Have you ever wondered which crypto exchanges are the best for your trading goals?

Disadvantages

As the cryptocurrency markets are so volatile, the prices can change very quickly. This means that if you want to perform short-term crypto trading, you will need to spend a lot of time analyzing the markets.

It’s super important to keep in control of your emotions — one thing you will learn when short-term trading is that you don’t always win. It can be very stressful when prices move differently to how you had hoped.

So, learning to accept losses is a big part of cryptocurrency trading. Nobody makes profits 100% of the time!

Short term cryptocurrency traders look for small gains in small price movements, so you will need to have quite a good analysis ability. This means being able to read trading charts and graphs. Which, if you are a beginner, can take a little while to learn.

Another disadvantage of short-term trading is that, for you to see good returns, you must make quite a large investment. Which is something that most of you beginners might not feel comfortable with.

The most liked findings

Looking for more in-depth information on related topics? We have gathered similar articles for you to spare your time. Take a look!

GDAX VS coinbase: what's the better alternative?

Complete GDAX VS coinbase comparison: learn the main difference between coinbase and GDAX!

Bytecoin price prediction: 2021 and beyond

What to expect when it comes to bytecoin price prediction for 2021? Thoroughly explained in one guide.

Ethereum price prediction: 2021

The complete ethereum price prediction 2021: find out how high will ethereum price rise and more in this detailed ethereum price prediction 2021.

Long-term trading

Have you ever heard the word “HODL”? Well, if not, then we’ll assume you’re completely new to the crypto space! No, it’s not a word you’ll find in the dictionary, but you’ll certainly find it in crypto forums and community chat groups!

“HODL” is a slang word meaning to hold a cryptocurrency long term rather than selling it. Its actual meaning is “hold on for dear life”. Usually, long-term crypto trading means to hold a coin for one year or more.

The idea is that, although there will always be volatility, the price should increase in a large amount over the long term.

A great example of this would be the lucky investors who bought bitcoin in 2011 when it was just $0.35. If they held on to it until late 2017, they could have sold their coins for almost $20,000 each! That’s over 57,000X your initial investment!

Advantages

One of the main advantages of long-term cryptocurrency trading is that it’s easy and requires a little amount of time. You don’t need to understand complex trading charts or graphs as you’re simply looking to hold your coin for the long term.

Unlike short-term trading, where you need to constantly spend time checking the prices of cryptocurrencies, you can do it in your spare time. It’s simple, once you have bought your coin, you don’t need to do anything other than wait!

Another good advantage of long-term cryptocurrency trading is that you don’t need lots of money to get started. You can buy small amounts whenever you have some spare money, and let it grow over a long period of time.

This also allows you to avoid the stresses of market volatility, as you don’t need to worry about short-term movements in price.

Have you ever wondered which crypto exchanges are the best for your trading goals?

Disadvantages

One disadvantage of long-term cryptocurrency trading is that you might miss a good opportunity to make quick short-term gains.

Sometimes coins rise in value really quickly, only to fall straight back down. Short term traders will notice this and can make a quick profit.

Another disadvantage is that because you aren’t spending time analyzing the market (as much as a short-term trader), you could miss some bad news. If there is bad news released that could affect the price of your cryptocurrency (such as regulations), the price could fall and never rise again.

So, just make sure you are keeping on top of cryptocurrency news to avoid this from happening.

Now that you know some of the advantages and disadvantages of both short and long term cryptocurrency trading, let’s have a look at some of the things you need to be careful of before you start.

What to be careful of?

The most important thing to remember before you start trading is that there is a chance you could lose your entire investment.

The cryptocurrency markets are very volatile, and although some people have made lots of money, lots of people have lost money too. You should never trade with any amount that you can’t afford to lose.

How you deal with your losses will determine your success as a trader. Here’s some important advice — never try to earn your losses back by investing larger amounts. This is investing with emotions, and often causes people to lose a lot of money.

FUD

A popular term that is used in both real-world and crypto trading is FUD. This stands for fear uncertainty and disinformation.

FUD is when people or organizations try to get people to not invest in an asset by telling them they will lose all their money (or something similar). They normally say things like “it’s a scam” or it’s “going to crash”.

You should always do your own research before jumping to any conclusions. Use google to find out if the information you hear is correct.

Persuasion

One final thing to consider before you start trading is that you should never be influenced by other people’s opinions. Remember, you aren’t the only person who wants to profit from cryptocurrency trading.

Be wary of the youtubers you watch and listen to. They will often be paid by cryptocurrency projects to promote their coin. This could increase the price in the short term but could end up decreasing in the long term. So, always do your own research first.

If you have read our guide so far, you should now have a good understanding of what cryptocurrency trading is, the difference between short-term and long-term trading, and the things you need to be careful of.

Guess what? It’s now time to learn how to trade crypto!

How to start trading

As you are looking to trade cryptocurrencies, the first thing we need to do is get you some coins! The easiest way to do this is with bitcoin, as almost every exchange accepts it.

If you decide to buy ethereum instead, then you can still follow the guide below. However, wherever bitcoin is mentioned, swap it for ethereum.

If at this point you already have bitcoin, you can skip to the next part of the guide!

The quickest way to buy bitcoin is to use your debit or credit card with coinbase. Coinbase are an exchange broker and will sell you bitcoin at a really good rate. Although there is a 4% charge to use your card, it is worth it as you get your coins straight away.

- Can be managed from mobile device

- Very secure

- Supports more than 1,100 cryptocurrencies

- Super secure

- Protection against physical damage

- Supports more than 1500 coins and tokens

Open an account at coinbase

Go to the coinbase website by clicking this link. You will need to choose a username and a strong password. You will also need to confirm your email address and mobile number.

Verify your account at coinbase

Before you can buy bitcoin at coinbase, you will need to verify your identity. Follow our step-by-step guide below.

- Click on buy/sell at the top of the screen.

- You now need to add a payment method. Click on add payment method.

- You will then be asked if you want to add a bank account or a debit/credit card. In this example, we will add a debit/credit card as it is the quickest way to deposit.

- As coinbase takes security very seriously, you will now need to verify your identity. Click on upload ID.

- You can upload either a passport, driver’s license or a government-issued ID card. Click on the one that you wish to upload.

- Next, you will be asked how you want to upload your ID. You can choose a webcam, mobile camera or a file upload.

- Once you have uploaded your ID, you will get the below confirmation.

If the picture quality if not clear enough, you will be requested to upload it again. Add your payment method in coinbase

- You will now need to enter the billing address for your debit/credit card.

- Now you will need to enter your debit/credit card details. Don’t worry — coinbase never gets to see your card details as the numbers are encrypted.

- Congratulations, you have now verified your identity and added a payment method! Now, let’s go and buy some bitcoin.

Buying bitcoin at coinbase

- Click on buy/sell again at the top of the page. This time you will be able to see the four coins that you can buy. Click on bitcoin.

- Scroll down and enter the amount (in fiat) you want to spend on bitcoin. In our example, we are buying 150 EUR worth. The amount of bitcoin will update when you enter your amount.

- Finally, click on buy bitcoin instantly, confirm the payment card that you added previously, and click on confirm. That’s it, it’s as easy as that — you now own bitcoin!

Now that you have some bitcoin, we need to open an account at binance. They are one of the most popular crypto exchanges for cryptocurrency trading and have more than 100 different coins available!

Open an account at binance

- Visit the binance website by clicking this link.

- Click on register and follow the prompts. Binance is as basic as coinbase — you need to enter your email address, mobile number and choose a username and password.

- Now that you have a binance account, we need to deposit the bitcoin that you just bought from coinbase.

Deposit funds into binance

- Go back to your coinbase account and click on accounts at the top of the page. Then click on send.

- You will then be asked to enter the address that you want to send your coins to. As you want to send them to your binance wallet, we need to go back to binance and get your binance wallet address.

- Go back to binance. Move your mouse over funds and click on deposits.

- Click on select deposit coin, type in BTC and then click on bitcoin.

- You will now see your binance deposit address for bitcoin. Copy it.

- Now, go back to your coinbase account. Enter the amount of bitcoin you want to send and then paste the binance wallet address. Finally, click on send. Your binance account should be funded within 15 minutes.

How to trade cryptocurrency at binance

Now that your binance account is funded with bitcoin, we are going to show you how cryptocurrency trading works. In our example, we are going to trade bitcoin for NEO, but you can replace NEO with the coin you wish to trade with!

- Move your mouse over exchange and click on basic.

- On the right of the page, click on BTC and enter NEO (or the coin you want to buy). Then click on NEO/BTC. If the coin you want to trade with isn’t NEO, and instead it was ABC, then you would look for the pair ABC/BTC.

- You are now on the main trading screen for the coins you want to trade — this is where all the fun happens!

- To make a trade, you need to scroll down and look for the buy NEO

- Before choosing how many coins you want to trade, you need to decide if you want to do a limit order or a market orderlimit order: this is where you enter the price that you want to trade at. However, there is no guarantee that you will get your price matched. Market order: this is where you take the current market price that is available at binance. If this is your first time, market order is your best option.

- Now you need to enter the amount of NEO (or your chosen coin) that you want to buy. In our example, we are buying 10 NEO. As you will see, we will get the market price, as we chose the market. Finally, to complete your trade, click on buy NEO. That’s it, you’ve just made your first ever cryptocurrency trade!

Just remember, you can change the above guide for the coin you want to buy.

The most trending findings

Browse our collection of the most thorough crypto exchange related articles, guides & tutorials. Always be in the know & make informed decisions!

So, let's see, what was the most valuable thing of this article: fxdailyreport.Com the prices of cryptocurrencies have zoomed this year and many investors have started focusing on these digital assets. Investors have a couple of options to trade in at crypto currency trading online

Contents of the article

- Real forex bonuses

- Fxdailyreport.Com

- Best cryptocurrency trading platforms 2021

- Top 10 online cryptocurrency trading brokers

- How to get started in cryptocurrency trading

- What is cryptocurrency?

- What are cryptocurrencies used for?

- What is the difference between bitcoin and...

- What is the difference between a cryptocurrency...

- Trade cryptocurrency online using CFD services

- Trading cryptocurrencies – getting started with...

- How to make money trading crypto

- How to choose the best cryptocurrency trading...

- Best cryptocurrency brokers

- Best crypto brokers and trading platforms:

- Best crypto brokers

- Commissions

- Account minimum

- 1. Best for social trading: etoro

- 2. Best for ease-of-use: gemini

- 3. Best for new investors: coinbase

- 4. Best for gold investments: itrustcapital

- 5. Best for high volume forex traders:...

- 6. Best for accessibility: altrady

- 7. Best for multiple exchanges: voyager

- 8. Best for security: kraken

- Crypto advantages vs. Disadvantages

- Cryptocurrency vocabulary

- Are you ready for the future?

- Beginner’s basics for trading cryptocurrency...

- What you need to start trading crypto

- Our recommended exchange for buying cryptocurrency

- Coinbase

- What to consider when picking an exchange

- How trading crypto is different than traditional...

- Only invest what you can lose

- Fiat to cryptocurrency trading

- Crypto to crypto trading

- Why you’ll want a “hot” wallet for trading

- Basic tips for trading crypto

- Focus on the big picture

- Remember that bitcoin leads, altcoins follow

- Diversification is important

- Don’t get too greedy

- Set up a stop loss

- The relative strength index (RSI)

- Arthur crowson

- World class automated crypto trading bot

- Manage all your exchange accounts in one place

- Social trading platform

- Use expert tools without coding skills

- Market-making

- Exchange/market arbitrage

- Strategy designer

- Simulate your trading without fear (or money.)

- What succesful cryptocurrency traders say about...

- Cryptocurrency trading: how to start?

- Cryptocurrency trading

- GET UP TO $132

- Short-term trading

- The most liked findings

- GDAX VS coinbase: what's the better alternative?

- Bytecoin price prediction: 2021 and beyond

- Ethereum price prediction: 2021

- Long-term trading

- What to be careful of?

- How to start trading

- The most trending findings

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.