Tickmill cent account

Perfectly suits those who are just starting on their way to success on forex cent account is a trading account on which the balance is displayed in cents, and transactions are carried out in cents as well.

Real forex bonuses

It means that if you deposit $10, you will have 1000 cents in your account. Trading on the cent account is low-risk. Therefore, it is an excellent choice for forex novices. Moreover, this type of account can be an attractive option for experienced traders who want to check new strategies. The cent account allows people to trade smaller lot sizes and open an account with a lower initial deposit than any other account. To open the cent account at FBS, you need to make an initial deposit of $1 only – less than you pay for a cup of coffee!

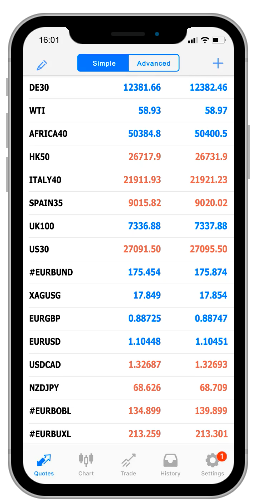

The cent account supports the following trading instruments: 35 currency pairs, 4 metals, 6 CFD, 33 stocks. At FBS, the cent account is available on metatrader4 . If you want to test the account first, feel free to try a demo version!

Open the cent account at FBS and reach new heights in trading!

Cent account

Perfectly suits those who are just starting on their way to success on forex

Trading conditions

initial deposit $1 spread floating spread from 1 pip commission $0 leverage up to 1:1000 maximum open positions and pending orders 200 order volume from 0,01 to 1000 cent lots

(with step 0,01) market execution from 0,3 sec, STP

Cent account

Cent account is a trading account on which the balance is displayed in cents, and transactions are carried out in cents as well. It means that if you deposit $10, you will have 1000 cents in your account. Trading on the cent account is low-risk. Therefore, it is an excellent choice for forex novices. Moreover, this type of account can be an attractive option for experienced traders who want to check new strategies. The cent account allows people to trade smaller lot sizes and open an account with a lower initial deposit than any other account. To open the cent account at FBS, you need to make an initial deposit of $1 only – less than you pay for a cup of coffee!

The cent account supports the following trading instruments: 35 currency pairs, 4 metals, 6 CFD, 33 stocks. At FBS, the cent account is available on metatrader4 . If you want to test the account first, feel free to try a demo version!

Open the cent account at FBS and reach new heights in trading!

Also, all account types except ECN support swap-free trading.

Share with friends:

Instant opening

Frequently asked questions

How to open an FBS account?

Click the ‘open account’ button on our website and proceed to the personal area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the withdrawal page on the website or the finances section of the FBS personal area and access withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account . You may want to test the environment with virtual money with a demo account. Once you are ready, enter the real market and trade to succeed.

How to activate level up bonus?

Open level up bonus account in web or mobile version of FBS personal area and get up to $140 free to your account.

Cent account forex brokers

What is cent account?

In very simple words, cent accounts are trading accounts that measure balance in cents instead of dollars. This specification is an attractive tool for beginning or those individuals that don’t want to risk large fund amounts while trading.

That means, that forex brokers who offer cent account feature enables engaging into the real trade without large fund requirement, as all calculations and measures will be shown by the cents.

- Cent accounts are handled the same manner as a standard account with the only difference of the nominal amount. As an example, once the trader deposit 10$, the displayed balance on the account will be 1,000 which presents trading funds through cents.

The cent account type is widely used by the beginner traders, as well those traders that would like to practice or test the particular trading strategy on real trading not demo account or to see trading conditions of the real account. Also, usually the minimum deposit is quite small for cent accounts and may require only 100$ as a start, which is a great opportunity to start trading the forex market and currency pairs.

Yet, in a low-risk trading environment, you should always consider the demanding minimum transaction volume and checked carefully at the broker’s offering, as conditions may vary.

Who are best forex cent brokers?

Eventually, forex brokers featuring cent accounts are not too many among the market offering, therefore the listing below can help to choose the best forex company available at your region, which brings cent trading opportunity and start trading trough cents’.

However, the crucial point of the broker’s regulatory status remains the same, as the unscrupulous brokers may easily fake trading conditions and remain you with the loss, even that the balance was an initially small deposit. So always stay alert, make good research and learn more information also available below.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Cent account forex brokers

| broker | country | regulation | leverage | platforms | review |

| cyprus, UK, mauritius | cysec, FCA, FSC, FSCA | 1:1000 | MT4, MT5, web | review website | |

| UK, australia | FCA, ASIC | 1:500 | MT4, MT5, web, mirror trader | review | |

| cyprus | cysec | 1:1000 | MT4, MT5, ctrader | review | |

| cyprus | cysec | 1:400 | MT4, MT5, ctrader | review | |

| BVI | FSC, finacom | 1:500 | MT4 | review | |

| belize | IFSC | 1:1000 | MT4 | review | |

| russia | cysec | 1:1000 | MT4, MT5, web | review | |

| vanuatu | N/A | 1:500 | MT4 | review | |

| SVG | N/A | 1:500 | MT4 | review | |

| vanuatu | VFSC | 1:1000 | MT4 | review | |

| vanuatu | VFSC | 1:1000 | MT5 | review | |

| vanuatu | VFSC | 1:400 | MT4 | review | |

| st. Vincent & grenadines | FSA (SVG) | 1:400 | MT4 | review | |

| SVG | N/A | 1:1000 | MT4, MT5 | review | |

| vanuatu | VFSC | 1:500 | MT4, web | review | |

| seychelles | N/A | 1:500 | MT4 | review | |

| SVG | N/A | 1:100 | MT4 | review | |

| UAE | N/A | 1:1000 | MT4, web | review |

In cent forex accounts all deposits, profit and loss are measured in cents, instead of dollars. Say that you deposit $100 into your cent account. Then what will be displayed as a balance will be 10,000, because that's the amount in cents. Note that even a small deposit looks quite large now.

We recommend cent accounts for traders who use capital-demanding strategies, such as the martingale or grid trading.

Related news

Social trading network copyfx no longer offers cent accounts to traders

Cyprus-based forex broker roboforex has made significant changes to the conditions of the copyfx system it operates, the company announced earlier this week. The copyfx system, which is available to both investors and traders, has stopped offering cent accounts to traders. Read more

Social trading network copyfx no longer offers cent accounts to traders

Cyprus-based forex broker roboforex has made significant changes to the conditions of the copyfx system it operates, the company announced earlier this week. The copyfx system, which is available to both investors and traders, has stopped offering cent accounts to traders. Read more

Russian broker aforex introduces cent forex accounts

The russian broker announces the introduction of cent accounts in order to boost automatic trading acknowledging the wish of its clients. Cent account, one in which $175 are listed as 17 500, is such that allows to trade with, obviously, cents. Read more

Happy birthday FXTM!

Forex time succeeded to establish itself as a recognizable name for just two years. FXTM celebrates its second birthday this august. For these two years the broker has experienced nice growth and has more or less established itself in a highly competitive market. Read more

FBS launches fixed spread and cent forex accounts

FBS, a online forex broker, member of the russian self-regulatory organisation CRFIN, has announced the launch of two new account types: cent accounts and fixed spread accounts. Read more

LAST COMMENTED

MOST READ

BROKER LISTS

CRYPTOCURRENCY EXCHANGES

- Bitcoin exchanges in malaysia

- New zealand bitcoin exchanges

- Bitcoin exchanges accepting bank transfers

- Ripple (XRP) exchanges

- Bitcoin exchanges in australia

- Singapore bitcoin exchanges

- US bitcoin exchanges

- UK bitcoin exchanges

- Bitcoin exchanges in canada

- Bitcoin exchanges in south africa

- Bitcoin exchanges in the netherlands

- Buy bitcoin with credit card

Forex industry news

Latest forex brokers

- Capitalcom investment review: beware of capitalcominvestment.Com! CONSOB scam warning!

- Vigofx review - is vigofx.Com scam or good forex broker?

- Caratcapital review: beware of caratcapital.Com! Cysecscam warning!

- Marketseu review: beware of marketseu.Com! Cysec scam warning!

- Fxglobaltraders review: beware of fxglobaltraders.Com! FINMA scam warning!

- Reliabletrade review: beware of reliable-trade.Com! Cysec scam warning!

- DMA direct review: beware of dmadirectab.Com! CONSOB and FI scam warnings!

- Monetafx review - is monetafx.Com scam or good forex broker?

- Pumabroker review: beware of pumabroker.Com! CNMV scam warning!

- Waves-trade review - is waves-trade.Com scam or good forex broker?

- Home

- News

- Forex brokers

- Binary brokers

- Bitcoin exchanges

- Coins

- Promotions

- Arbitrage

- Contact us

- Compare

Forex trading carries a high level of risk and may not be suitable for all investors. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. All information on forexbrokerz.Com is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

All textual content on forexbrokerz.Com is copyrighted and protected under intellectual property law. You may not reproduce, distribute, publish or broadcast any piece of the website without indicating us as a source. Forexbrokerz.Com does not claim copyright over the imagery used on the website, including brokers' logos, stock images and illustrations.

Forexbrokerz website uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy.

Tickmill review - is tickmill.Co.Uk scam or good forex broker?

With clients in over 200 countries and an average monthly trading volume of over 120 billion USD tickmill is one of the biggest players in the world of forex. And there is a good reason for this - tickmill is an electronic communication network (ECN) and no-dealing desk (NDD) broker offering premium services and exceptional trading conditions with a choice of several account types and leverage as high as 1:500 for its international clients and all who cover the standards for being professional traders. And all of that comes on the powerful metatradre4 platform.

Licensed in the UK by the financial conduct authority (FCA) and throughout the european union with its cyprus securities and exchange commission (cysec) license and its registrations with the federal financial supervisory authority (bafin) in germany, CONSOB in italy, ACPR in france, and CNMV in spain, tickmill abides by the highest regulatory standards.

Still, as many traders view those standards as overly restrictive, especially when it comes to leverage (in the EU and the UK the maximum leverage allowed for retail traders is 1:30), just like most other major brokers, tickmill operates a subsidiary registered in the seychelles as well, where the regulatory requirements are more relaxed and the broker can offer retail clients much higher leverage and various promotions like a rebate program, trading contests and bonuses.

The company. Security of funds

In the UK tickmill is represented by tickmill UK ltd, which as we noted is licensed and authorized by the local financial conduct authority with a FCA register number 717270.

FCA is one of the most reputable financial watchdogs in the world, overseeing over 59 000 financial service companies. And because the UK is still de facto part of the EU all FCA brokers have to abide by the european markets in financial instruments directive (mifid), which establishes the market rules throughout the union.

According to those rules all FCA brokers have to maintain operational capital of at least 730 000 EUR, readily available to cover all outstanding payments towards clients. Also, FCA brokers have to store all capital, deposited by clients in segregated from their own, protected from creditors trust accounts, to report all trading transactions, to allow regular external audits, to provide traders with a negative balance protection and to participate in the financial services compensation scheme, which in practice guarantees the first 85 000 GBP in your trading account, even if a broker happens to be insolvent.

After january 1st 2021, when the brexit transition period will be over and the UK will finally divorce EU, FCA confirmed that it will retain all EU regulatory requirements, which are currently in place, without relaxing any of them.

Throughout the european union tickmill is represented by tickmill europe ltd, which is duly licensed and authorized by the cyprus securities and exchange commission (cysec) as a cyprus investment firm (CIF) with a license number 278/15.

Along with FCA in the UK and the australian securities and investments commission (ASIC), cysec is one of the three most popular regulators in the forex industry. Its requirements also follow the mifid guidelines and the only difference compared to the FCA requirements, is the amount covered by the local compensation scheme. With cysec as a member of the cyprus investor compensation fund (ICF), tickmill europe guarantees all traders' funds for up to 20 000 EUR.

Tickmill europe is also registered with a number of other european regulators - the federal financial supervisory authority (bafin) in germany, commissione nazionale per le societa e la borsa (CONSOB) in italy, autorite de controle prudential (ACPR) in france, and comision nacional del mercado de valores (CNMV) in spain and abides by the european data protection laws and the general data protection regulation (GDPR).

One of the two international subsidiaries of tickmill - tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA).

As we noted the FSA regulatory requirements are not that strict as those in europe and the UK and that allows the seychelles brokers to be more flexible and to offer various benefits to traders, including higher leverage levels.

The seychelles subsidiary of tickmill for example offers everyone leverage as high as 1:500, while in europe and the UK the leverage for retail traders is caped at 1:30.

Similarly to FCA and cysec FSA has some fiscal requirements - brokers have to register a local company with a share capital of at least 50 000 USD, with at least 2 shareholders and 2 directors, where a single person can be both a shareholder and director.

Unlike cysec and FCA brokers however, seychelles brokers can use their capital for various purposes and not only to cover payments towards clients, which gives them more financial flexibility.

Also, FSA brokers do not have to separate their clients money from the their own funds in segregated account – something which brokers in europe and the UK are obliged to do.

For their clients in asia tickmill has registered tickmill asia ltd., which is licensed and authorized by the labuan financial services authority - the regulatory authority of the international business and financial district of labuan in malaysia.

Trading accounts

| account type | minimum deposit | minimum trade size | maximum leverage | spreads |

| PRO account | $100 | 0.01 lot | 1:500 | from 0.1 pips + $4/lot |

| classic account | $100 | 0.01 lot | 1:500 | from 1,6 pips |

| VIP account | $50 000 | 0.01 lot | 1:500 | 0 pips + $2/lot |

With all of their subsidiaries tickmill offers three account types – pro classic and VIP with an option for an islamic or a swap free account as well. The corresponding accounts with all tickmill subsidiaries offer the same trading conditions with the exception of the leverage, which, as we already noted, is restricted on some markets like europe and the UK.

With all account types tickmill offers a selection of 62 currency pairs, many of which minor and exotic, as well as cfds on gold, silver, 14 major indices like S&P 500 stock index, nikkei 225 stock index and FTSE 100 stock index, brent, WTI crude oil and several types of german government bonds. The maximum leverage for all retail traders is capped at 1:30, but if you can prove that you are a professional trader this restriction will not apply. So if you are a professional trader with tickmill UK you will be offered leverage as high as 1:500, while with tickmill EU – leverage of up to 1:300. The execution is said to be within just 0,15 sec, which is also very attractive.

PRO account comes with spreads starting from 0,1 pip and a small trading commission of just 2 USD per standard lot per side, which when calculated in to the equation yields actual spreads starting from 0,5 pips, which sounds great. With a pro account you can trade with micro lots, the initial deposit requirement is just 100 USD and the account can be opened in USD, euro, british pounds and polish zloty.

The margin call and the stop out are set at 100% and 50% for all retail clients and 100% and 30% for all professional clients respectively.

The classic account comes with spreads starting from 1,6 pips and no trading commission. As with the PRO account you can also trade with micro lots, your minimum deposit requirement is 100 USD and the base account currencies could be USD, EUR, GBP and PLN.

The account is suitable for beginner and professional traders alike as it offers ultra-fast order execution and no dialing desk (NDD) trading environment.

The margin call and the stop out are the same as with the PRO account - 100% and 50% for retail clients and 100% and 30% for professional clients respectively.

The VIP account is created especially for high volume traders, who are looking for competitive trading conditions and other benefits.

The spreads with a VIP account start at virtually zero pips, and you have a symbolic trading commission of just 1 USD per standard lot per side, which when added to your trading costs gives actual spreads starting from just 0,2 pips. Besides, that commission is only applied if you trade forex pairs and precious metals like silver and gold. With cfds on stock indices, oil and bonds you will not pay any trading commission.

The VIP account is also available in USD, EUR, GBP and PLN, and the margin call and the stop - out are also set at 100% and 50% for retail clients and 100% and 30% for professional clients.

The islamic accounts are especially created to service the muslim trading community, as muslims are forbidden to give or receive interest. So with an islamic or a swap free account, as it is also called, you can keep your positions open over night without paying for that. The service is usually compensated with slightly higher spreads, but in the case of tickmill you have a small fee charged if you have a position open for more than three consecutive trading days.

Tickmill seychelles and tickmill asia

As we already noted the international subsidiaries of tickmill offer the same trading accounts as the european subsidiaries of the broker - pro classic and VIP, with one notable exception – all traders, retail and professional alike are allowed to use leverage as high as 1:500.

Also, with tickmill seychelles and tickmill asia you can open trading accounts only in USD, EUR and GBP and your margin call and stop out are 100% and 30% respectively. The execution model is also NDD though.

Maximum leverage

As we already mentioned, depending on whether you are trading with tickmill UK and tickmill EU, or you have chosen one of their international subsidiaries of the broker, the maximum leverage you will be offered will be different.

Tickmill UK and tickmill EU

In an effort to limit the loses many retail traders used to suffer, back in august 2018 the european securities and markets authority (ESMA) - the securities and markets regulator of the european union - restricted the maximum leverage brokers are allowed to offer retail traders.

Henceforth, retail traders in europe are authorized to trade main currency pairs with a leverage of no more than 1:30, and gold and certain other cfds like non- major currency pairs, and the main stock market indices at levels not exceeding 1:20. The leverage on commodities other than gold and non- major market indices is capped at 1:10, while for individual stocks the limit is set at 1: 5. For crypto cfds, the authorized leverage is only 1:2.

As we note however, if you cover the criteria for being a professional trader, you will be offered a much higher leverage – up to 1:500 for traders in the UK and 1:300 for traders in the 27 EU member states.

To qualify for a professional trader you should meet at least two of the following three criteria: 1) you should have executed transactions of a significant size with an average frequency of 10 trades per quarter over the previous four quarters; 2) the size of your portfolio, including cash deposits and financial instruments, should exceed 500 000 EUR; 3) you should have worked in the financial sector for at least one year on a position, requiring knowledge about leveraged products such as cfds.

Tickmill seychelles and tickmill asia

The leverage restrictions on the european market, which followed similar moves by the financial authorities in the U.S. And canada (the maximum leverage allowed in the U.S. Is 1:50, while in canada – 1:75) forced many major brokers to open international subsidiaries, where such restrictions do not apply. Thus, with their seychelles and asia subsidiaries tickmill are able to offer all clients leverage as high as 1:500.

Minimum initial deposit

The minimum deposit requirements for all tickmill accounts are the same, no matter with which of their subsidiaries you trade.

You can open a pro or a classic account with just 100 USD, while for a VIP account you should maintain a trading balance of no less than 50 000 USD.

Myfxbook copy trading with tickmill

With its international subsidiaries tickmill offers its clients the opportunity to join a well known copy trading platform – myfxbook. To join it you should have a demo or a live account, which should be linked to myfxbook autotrade on the myfxbook website. Than you simply go to the autotrade section, click 'manage' and choose the trading system you want to follow. Trades will be copied instantaneously and you can adjust your trading risk by changing the multiplier value, which will show you immediately the hypothetical return and risk you could be exposed to, based on the data gathered so far. A multiplier value of 1 means you are getting the same risk ratio as the trader you follow.

Similarly, if you are an experienced trader with a proven track record, you can offer your trading strategies and join myfxbook, where your trades can be copied by over 90 000 followers. Besides, you can earn as much as 0.5 pips per a winning trade.

The requirements to join myfxbook and to offer your trading system to other traders, are to have a live metatrader 4 account with at least three months history; your drawdown should not exceed 50%; your returns for the past three months should be at least 10% or higher than your drawdown; your average pip per trade for that past three months should be at least 3; your average trade time should be over 5 minutes; you should not be using any martingale or grid techniques; for the past three months of trading your account balance should be at least 1000 USD; and you should have executed at least 100 trades in three months.

Trading platforms

Tickmill supports the metatrader4 (MT4) platform, available for mac and windows PC, android & ios devices and as a web-based version.

MT4 is a powerful platform that has been holding the title of the most popular forex trading terminal ever since 2005 and continues to be preferred by most investors and brokerages. It has a user-friendly interface, and offers all a trader needs: advanced charting package, a number of technical indicators, extensive back-testing environment and a variety of expert advisors (eas).

What is more, tickmill has partnered with myfxbook to offer its clients advanced automatic trading options via the autotrade platform.

VPS service is also available with tickmill, so that traders can install their favorite EA applications and have them running around the clock without requiring their PC to be on. VPS is porvided by one of the largest forex VPS providers – beeksfx.

Promotions

If you succeed to become the most successful trader of the month you will get a 1000 USD price. This promotion is also available only with the international subsidiaries of the broker. When deciding on the winner, tickmill takes into account not only your profits, but also your money and risk management skills.

Tickmill's NFP machine

If you follow the US labor market you can win up to 500 USD every week a non- farm payroll report is released. During every NFP week tickmill chooses one trading instrument and challenges all traders to guess its price on the metatradre4 platform at 16:00 – exactly 30 minutes after the NFP release.

A perfect match will be awarded with 500 USD, directly added to your trading account. If no one guesses the exact figure, the trader with the closest prediction will get 200 USD. You just have to place your prediction and provide your trading account number along with your full name from monday 0:00 till friday 15:00 on a NFP week. The promotion is available only with the international subsidiaries of the broker.

30 USD welcome account

New clients have the opportunity to start trading at tickmill with free trading funds, without having to make any deposit. The welcome account is very easy to open and the profits earned will be yours to keep. Take a note, however, that existing clients are not eligible to apply for a 30 USD welcome account. The 30 USD welcome account is also available only with the international subsidiaries of tickmill.

The rebate promotion allows you to earn cash rebates on your trades. The only requirement is to open a live account with 100 USD with one of the international subsidiaries of the broker and than you can earn cash rebates of between 0,25 USD and 0,75 USD per standard lot traded, depending on which tier you reach.

If you have traded between 1 and 1000 lots for the month your rebate will be 0,25 USD per lot. If you have traded between 1001 lots and 3000 lots, your rebate will be 0,50 USD per lot, while if you have traded 3001 lots and above the rebate will be 0,75 USD per lot. The accumulated funds will be added to your trading account every month.

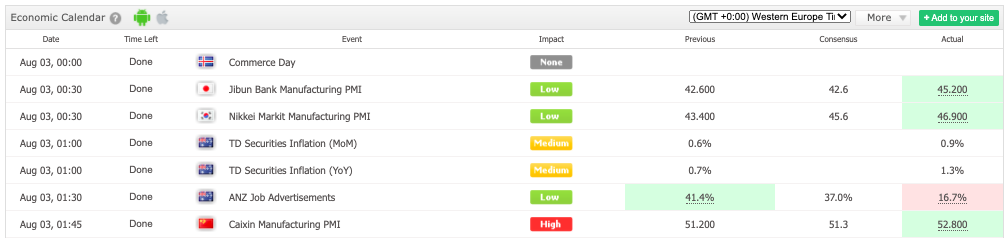

Autochartist

Tickmill offers a free autochartist to all its clients, who have opened a live account. Autochartist is one of the most versatile technical analysis tools, which will help you make informed trading decisions and filter the market information you need. Along with the autochartist app, tickmill also offers its clients an economic calendar, forex calculator and as we already note – a virtual private server (VPS).

Education

Tickmill organizes regular trading seminars, the latest of which were held in ukraine, vietnam, qatar, columbia, malaysia and nigeria. And there are also regular webinars on various topics, including weekly live market and trade analysis.

Finally, from the tickmill website you can also download various e-books including knowing your trading costs and an in- depth look at risk management and trading the majors: insights and strategies. Video tutorials and infographics are also available for free.

Awards

Tickmill has scores of awards, the most recent of which for being the best commodities broker from rankia markets experience expo 2020, best trading experience from forex brokers award 2020, best forex execution broker from CFI.Co awards 2019, best trading platform provider from fxdailyinfo.Com broker awards 2019, best CFD broker asia, from international business magazine 2019, best forex CFD provider from online personal wealth awards 2019, most transparent broker from forex awards 2019, best forex execution broker from UK forex awards 2018, best forex CFD broker from jordan forex expo awards 2018, top CFD broker from fxdailyinfo.Com broker awards 2018, best forex trading conditions from UK forex awards 2017 and most trusted broker in europe from the global brands magazine 2017.

Payment methods

The payment methods with tickmill differ slightly depending on which of their subsidiaries you are trading with. What is common with all of tickmill's subsidiaries, however, is that no commissions are charged nether on deposits nor on withdraws with the single exception, when you make a wire transfer deposit of less than 5000 USD. Wire transfer deposits and withdraws starting from 5000 USD or equivalent, which are made in one transaction, are include in the tickmill zero fees policy.

With tickmill UK you can chose to pay with a wire transfer, VISA, mastercard, skrill, neteller, dotpay, paysafe card, SOFORT, rapid transfer and pay pal. Payments are accepted in USD , EUR , GBP and PLN.

With the cyprus subsidiary of the broker the payment methods are more limited – you can chose only among wire transfer, VISA, mastercard, skrill, neteller and dotpay. Payments are accepted in USD , EUR , GBP and PLN as well.

Tickmill tickmill seychelles and tickmill asia

With the international subsidiaries of the broker, along with the standard payment options like bank wire, VISA, mastercard, skrill and neteller, you can also choose to pay with stic pay, fasa pay, china union pay, nganluong.Vn, QIWI, and web money. Here payments are accepted in USD, EUR, GBP, indonesian rupiah , chinese yuan, vietnamese dong and russian ruble.

Conclusion

Tickmill is a reputable UK-based forex and CFD broker with strong regulation and attractive trading conditions. We especially like its ECN offerings. To sum things up:

| Pros | cons |

| FCA regulation | no choice of trading platforms |

| ECN trading environment available with competitive pricing | |

| attractive spreads on pro accounts | |

| MT4 available |

Latest news about tickmill

- Tickmill jumps the bitcoin bandwagon oct 10 2017 10:25:33

- Tickmill adds 4 german government bonds to trading portfolio jul 19 2017 08:42:05

- $30 no deposit forex bonus by tickmill jun 08 2017 07:59:43

- Tickmill expands to europe with a UK forex license nov 10 2016 13:37:21

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

Tickmill review

Tickmill

Leverage: 1:30

Regulation: FCA, FSA, cysec

Min. Deposit: 100 US$

Platforms: MT4, webtrader

Found in: 2014

Tickmill licenses

- Tickmill UK ltd - authorized by FCA (UK) registration no. 717270

- Tickmill ltd seychelles - authorized by FSA (seychelles) registration no. SD008

- Tickmill europe ltd (ex vipro markets ltd) - authorized by cysec (cyprus) registration no. 278/15

- Tickmill asia ltd - authorized by labuan FSA registration no. MB/18/0028

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- What is tickmill?

- Awards

- Is tickmill safe or a scam?

- Leverage

- Accounts

- Fees

- Market instruments

- Deposits and withdrawals

- Trading platform

- Customer support

- Education

- Conclusion

What is tickmill?

Tickmill is a new player among the brokers and online trading world since the company established in 2014 with its headquarter in london, UK as well as offices in seychelles. Tickmill strives to innovate a unique trading experience to its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Indeed, the broker develops rapidly and their yearly achievements are quite impressive. Recently tickmill management responsibilities expanded, since additional part to “tickmill family” been added in the name of a tickmill europe ltd (ex vipro markets ltd).

| Pros | cons |

|---|---|

| fully regulated broker | conditions vary according to regulation and entity |

| globally recognized and multiple awarded broker | no 24/7 support |

| standard and pro trading conditions | |

| good costs and commissions | |

| excellent support, learning and research tools |

10 points summary

| �� headquarters | UK |

| ��️ regulation | FCA, FSA, cysec |

| �� instruments | 62 currency pairs, cryptocurrencies, bonds, cfds and precious metals, stock indices |

| �� platforms | mt4, webtrader |

| �� EUR/USD spread | 0.3 pips |

| �� demo account | available |

| �� base currencies | USD, GBP, EUR |

| �� minimum deposit | 100 USD |

| �� education | professional education center with trading blog |

| ☎ customer support | 24/5 |

Awards

Tickmill as a new company has grown rapidly throughout only a few years so that the broker has been recognized by industry publications already, which is definitely great for the building of a successful portfolio.

Along with that tickmill constantly runs a range of fascinating promotions, which helps to boost trading and enhancing even beginning traders’ possibilities.

Is tickmill safe or a scam?

When it comes to defining whether tickmill or any other broker is a legit and safe broker, we definitely check on the registration where the broker operates and applicable regulatory obligations that oversee the forex trading industry.

| Pros | cons |

|---|---|

| regulated broker with good record | additional offshore entity |

| FCA license and overseeing | |

| negative balance protection | |

| global expand and cysec license with european cross border authorization |

Is tickmill legit?

Tickmill is a multiply regulated broker is various jurisdictions, thus considered a safe broker to trade with. Tickmill trading name of a tickmill UK ltd and tickmill ltd seychelles regulated as a securities dealer.

The broker authorized and regulated by two major UK financial conduct authority and by the financial services authority of seychelles, hence either entity includes strict regulations. Besides, tickmill now grows to asia region as well and establishes its entity to cover the proposal.

In addition, newly added to the company line tickmill europe ltd (ex vipro markets ltd) is authorized and regulated by the cyprus securities and exchange commission (cysec) and is a member of the investor compensation fund (ICF).

Customer protection

To ensure security and transparency of transactions tickmill keeps clients’ funds in segregated accounts with trusted financial institutions, as per FCA regulations. In addition, clients are covered by the FSCS with investments up to £50,000.

Leverage

Being a UK and european based regulated broker tickmill follows strict guidelines set by the european authority ESMA. A recent update from the european regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

- Clients of tickmill europe may use leverage up to 1:30 for forex products, 1:5 for cfds and 1:10 for commodities.

- International traders since tickmill serves entity through seychelles and other entity as well, so the clients with the opened account under this jurisdiction may enjoy high level of leverage.

Accounts

Tickmill clients can benefit from the various types of accounts with quite competitive trading conditions. Tickmill contends attractive packages and a new way of trading with low market spreads, no requotes, transparency and innovative trading technology. There are 3 main account types in tickmill’s proposal.

| Pros | cons |

|---|---|

| fast account opening | none |

| standard account | |

| commission based pro account | |

| islamic account | |

| account base currencies USD, GBP, EUR |

Account types

There are 3 main account types in tickmill’s proposal, where you can choose either account based on spread only classic account or with commission per trade pro account. The third account is designed for high-volume traders and is named VIP account where conditions are tailored and defined as per agreement.

Additionally, islamic or swap-free account, been added to the broker features recently too. These accounts comply with the sharia law, which has exactly the same trading conditions and terms, but there is no swap or rollover interest on overnight positions, that is against the faith.

How to open account at tickmill

As we already see by the account offering, there are different price modes according to the account type you choose. Besides, fee conditions always vary according to the regulatory rules authority impose and broker obliges to. So be sure to verify specific conditions as well. Here we will check a brief of spreads and commission charges that are defined by the account type.

| Pros | cons |

|---|---|

| options between spread account or commission account via pro account | none |

| low CFD fees and stock fees | |

| good standard account spreads | |

| no hidden costs |

Our find on trading fees

For a better understanding of the tickmill pricing model and spread see the table below, yet as mentioned before according to the type of account trader will enjoy lower costs along with some commission per trade. In the tale we compare standard spread conditions, while pro accounts are based on the commission of 2 per side and interbank spreads from 0 pips.

The overnight fee should be considered as a cost as well, e.G. EURUSD swap for long position is -11.742 while for short is 6.693 US$.

You can also compare tickmill trading fees to another popular broker forex CT.

Comparison between tickmill fees and similar brokers

| asset/ pair | tickmill fees | GO markets fees | XM fees |

|---|---|---|---|

| EUR USD | 0.3 pips | 1.2 pips | 1.6 pips |

| crude oil WTI | 4 | 1.9 | 5 |

| gold | 20 | 1.4 pip | 35 |

| inactivity fee | yes | yes | yes |

| deposit fee | no | no | no |

Trading instruments

Tickmill europe ltd is fully licensed to provide the investment services of agency only execution which deliver high-grade trading instruments 62 currency pairs, cryptocurrencies (opportunity to trade CFD on bitcoin, with margin 20% and 0 commission per side, per 1 CFD).

Stock indices, bonds, cfds and precious metals, with a minimum deposit requirement of only 25$, fluctuating spreads from 0.0 pips, some of the lowest commissions in the industry and no requotes, delays or interventions policy.

Deposits and withdrawals

For the deposit or withdrawal options broker using convenient methods with perform payments with ease and diverse.

Deposit options

Payment options including popular bank transfers, credit/ debit cards, E-wallets neteller, fasapay, unionpay, dotpay, nganluong. Vn (only for clients of the tickmill ltd seychelles) with available currencies USD, EUR, GBP, PLN.

| Pros | cons |

|---|---|

| fast digital deposits | conditions may vary according to entity rules |

| no internal deposit fees or withdrawal fees | |

| multiple account base currencies EUR, USD, GBP |

What is the tickmill minimum deposit?

The minimum allowed deposit is 100$, which is a fantastic opportunity for the trader of even very small size, in reverse 10$ is set for withdrawals which is good as we see in our tickmill review.

Withdrawals

All money manipulation withdrawals, deposits or requests are submitted via your online account area. While tickmill process withdrawals within 1-2 business days as per regulatory obligations.

Moreover, at tickmill a zero fee policy is employed, where no charges or fees applicable to monetary transactions. All deposits from 5,000$ also including zero fee policy and all fees up to 100$ will be covered.

Trading platforms

Like most brokers the broker using as mainstay trusted and well-tried MT4. Trading platform available on desktop or tablet, in web or on the go with a smartphone. As well, though many among the brokers do not allow stop and limit orders placing close to market prices, tickmill allows so, so it is another good point in tickmill’s proposal.

| Pros | cons |

|---|---|

| MT4 and webtrader | no alternative platform or proprietary software |

| copy trade, social trading and technical indicators | |

| no restrictions on strategies | |

| fast execution | |

| available in various languages |

Web platform

Web platform is very useful to any size of the trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop platform

It is fact that every platform is different even you trade metatrader4, as it is a broker decision what to include and propose in its software. Good news that tickmill platforms have been enhanced with the span of useful tools including:

- Autochartist – powerful technical analysis tool with automatic recognition feature

- Myfxbook autotrade – allows following of the strategies developed by the successful trader

- One click trading – trading through eas (by the company statistics about 63% of the executes are placed by algorithms and eas)

- Tickmill VPS – keeps eas and signals active even while the trader is offline

- Forex calendar – plugging market insights and news

- Forex calculators – displays currency converter, margin calculators, etc.

Tickmill striving to reach success trading among their client, hence they do not impose restrictions on profitability and allows all trading strategies including hedging, scalping and arbitrage. Nevertheless, be sure to verify conditions with particular entity regulatory restrictions as those may apply.

Mobile platform

Customer support

Also good to consider customer support, where tickmill shows a professional team available around the clock and supporting international languages accessible via live chat, email, and phone lines in various regions including the UK and international as well.

Yet, customer service isn’t available during the weekends, so you can leave your request via the contact form to be advised.

| Pros | cons |

|---|---|

| 24/5 support | no 24/7 client support |

| relevant answers | |

| live chat, international phone lines and email |

Education

Another good point to note in tickmill proposal and offering is established learning center along with professional trading blog where traders can find recent updates, various educational materials and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars and traders community of minded traders all is a very good level and available for all.

| Pros | cons |

|---|---|

| education programs free trading signals and research tools | none |

| seminars, webinars and video lessons | |

| market outlook and research | |

| trading blog |

Conclusion

Overall, tickmill inviting clients with their attractive features such as a low minimum deposit (only 25$), technical solutions, a great range of instruments and interesting promotional campaigns. Moreover, the company’s strive to achieve targets quickly and effectively while posing tickmill as a high-tech and trustable forex broker, either to start or to gain new apex with.

The fact that the company been established only in 2014 and until now became one of the industry progress which stand in the leaders’ row, definitely means a lot. Also considering the fact, that company recently grow by establishing a branch of tickmill europe ltd, which been done by the purchase of vipro markets ltd.

Thus, tickmill should be strongly considered while choosing the broker with whom a trader or investor will start his journey to the financial markets.

Nevertheless, it is always good to know your opinion about tickmill which you may share in the comment area below.

Global provider of FX and CFD brokerage services tickmill has announced that it has sponsored the kyrenia triathlon team at the IRONMAN austria, one of the most exciting races in the world. Known to be one of the greatest challenges of endurance that triathlon has to offer, IRONMAN austria took place on 7th july 2019.

Tickmill as a relatively new player among the brokers that offers its services 2014 but already showed its significant impact on the trading industry by the number of clients and gains they report. The rapid development of tickmills’ trading environment recently brings the fantastic achievement of a record increase in net profits consolidated for 3.

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Tickmill review and tutorial 2021

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

So, let's see, what was the most valuable thing of this article: cent trading account suits perfectly to those who are just starting their way to success on forex. Trading conditions by FBS broker: initial deposit $1, floating spread from 1 pip, leverage up to 1:1000 at tickmill cent account

Contents of the article

- Real forex bonuses

- Cent account

- Trading conditions

- Cent account

- Instant opening

- Frequently asked questions

- How to open an FBS account?

- How to withdraw the money you earned with FBS?

- How to start trading?

- How to activate level up bonus?

- Cent account forex brokers

- Tickmill 30$ welcome bonus (no deposit required)

- Cent account forex brokers

- Related news

- Social trading network copyfx no longer offers...

- Social trading network copyfx no longer offers...

- Russian broker aforex introduces cent forex...

- Happy birthday FXTM!

- FBS launches fixed spread and cent forex accounts

- LAST COMMENTED

- MOST READ

- BROKER LISTS

- CRYPTOCURRENCY EXCHANGES

- Tickmill review - is tickmill.Co.Uk scam or good...

- The company. Security of funds

- Trading accounts

- Maximum leverage

- Minimum initial deposit

- Myfxbook copy trading with tickmill

- Trading platforms

- Promotions

- Autochartist

- Education

- Awards

- Payment methods

- Conclusion

- Latest news about tickmill

- Tickmill review

- Top 3 forex brokers

- What is tickmill?

- Awards

- Is tickmill safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Deposits and withdrawals

- Trading platforms

- Customer support

- Education

- Conclusion

- Forex minimum deposit

- Trading with a small deposit

- Forex minimum deposit

- Trading with a small deposit

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.